Iraq Aftermarket services Market Outlook to 2030

Region:Middle East

Author(s):Mukul Soni

Product Code:KROD9637

October 2024

99

About the Report

Iraq Aftermarket services Market Overview

-

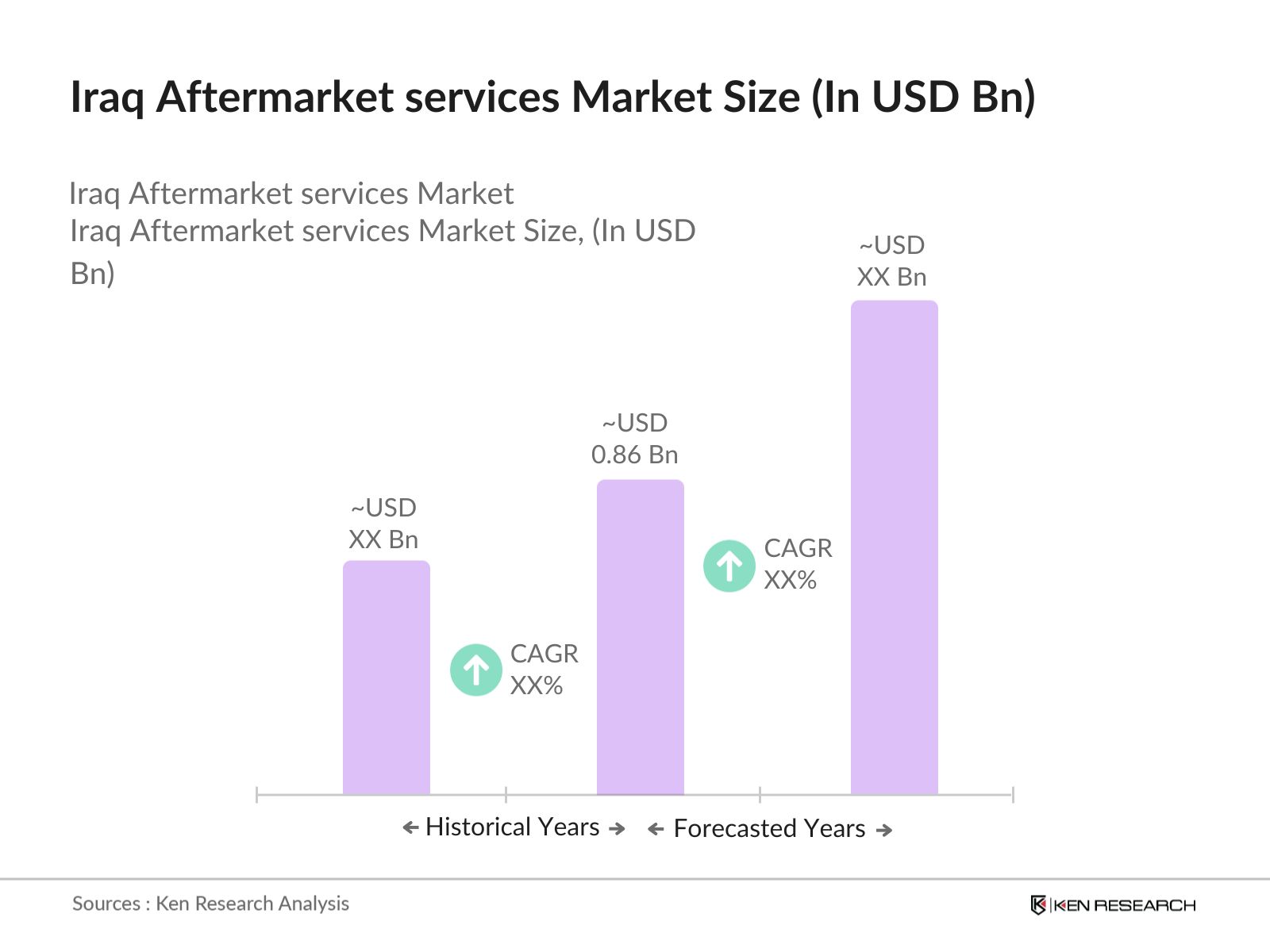

The Iraq aftermarket services market is a growing industry valued at USD 0.86 billion, driven by a significant increase in vehicle ownership, particularly for passenger and light commercial vehicles. With the aging vehicle population, the demand for maintenance and repair services has surged, contributing to the market’s expansion. Additionally, rising investments in road transport infrastructure have fueled growth in the sector, leading to increased demand for aftermarket components and services to support the growing fleet of vehicles across the country.

- Dominant cities in the Iraq aftermarket services market include Baghdad, Basra, and Erbil. These cities dominate due to their strategic importance as economic and transportation hubs. Baghdad, being the capital, has the highest concentration of vehicles and automotive service providers, while Basra's proximity to ports facilitates the import of aftermarket components. Erbil's stable business environment and growing commercial activities have also contributed to its prominence in the market.

- The Iraqi government has introduced mandatory safety certifications for aftermarket parts, aiming to reduce the circulation of counterfeit products. In 2024, the Iraq Standards Organization (ISO) made it compulsory for all imported and locally produced automotive parts to carry safety certifications. This move is designed to ensure consumer safety and improve product reliability, thereby creating opportunities for certified aftermarket providers to dominate the market.

Iraq Aftermarket services Market Segmentation

-

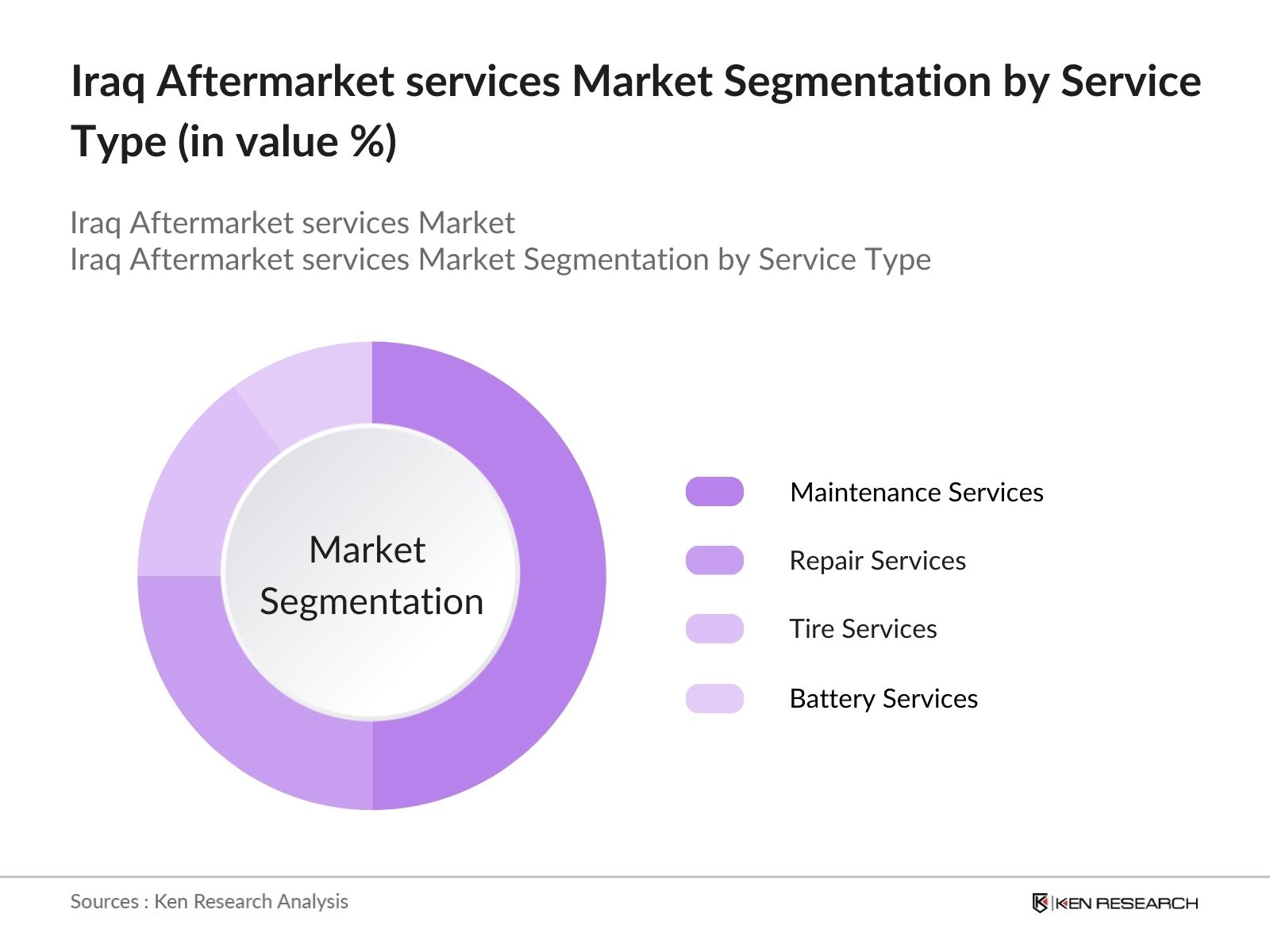

By Service Type: The Iraq aftermarket services market is segmented by service type into maintenance services, repair services, tire services, battery services, and diagnostics. Among these, maintenance services dominate the market due to the high demand for routine checkups and preventive maintenance required by both passenger and commercial vehicles. This segment benefits from the increasing vehicle ownership and the aging vehicle population, which requires regular upkeep to avoid breakdowns and ensure efficiency. Additionally, maintenance services are heavily reliant on the availability of skilled labor, which is more accessible in urban areas, contributing to the growth of this segment.

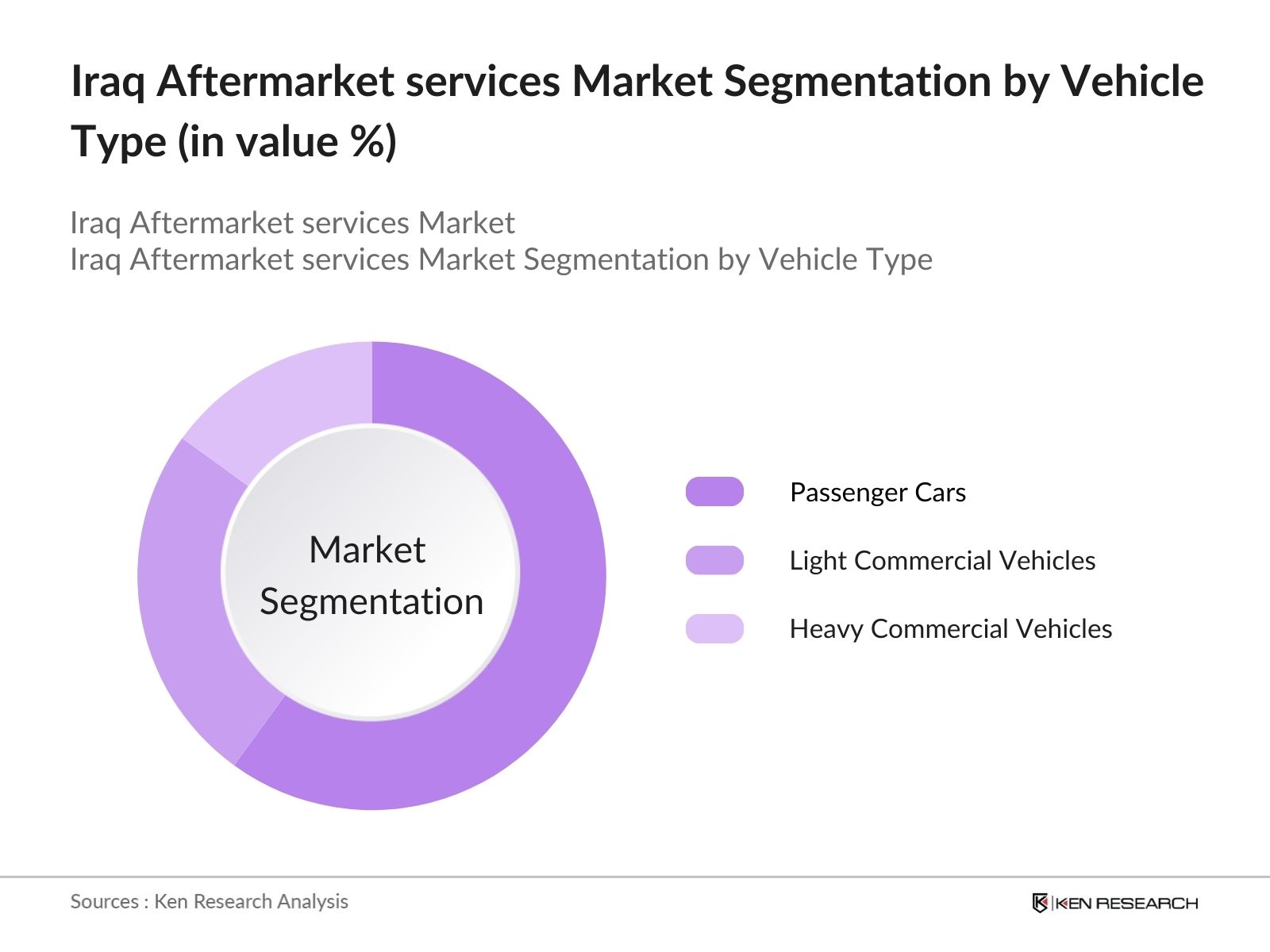

- By Vehicle Type: The Iraq aftermarket services market is also segmented by vehicle type into passenger cars, light commercial vehicles, and heavy commercial vehicles. Passenger cars dominate the market, as they account for a significant portion of the total vehicle fleet in Iraq. This segment is largely driven by urbanization, increasing disposable income, and the growing middle class, which has led to higher car ownership. Moreover, the rising demand for personal mobility, especially in urban centers like Baghdad and Basra, further boosts the aftermarket services needed for passenger cars.

Iraq Aftermarket services Market Competitive Landscape

The Iraq aftermarket services market is characterized by a combination of local and international players. These companies compete on various fronts such as service quality, availability of genuine parts, and the breadth of service offerings. The market is dominated by well-established local service providers with strong networks, while global brands focus on premium service offerings.

|

Company Name |

Established |

Headquarters |

Data Center Locations |

Partnerships |

Revenue from Cloud Services |

Number of Employees |

Cloud Certifications |

Compliance with Local Regulations |

|

Bosch Auto Service |

1921 |

Stuttgart, Germany |

|

|

|

|

|

|

|

Al-Fahd Auto |

2005 |

Baghdad, Iraq |

|

|

|

|

|

|

|

Bridgestone Iraq |

1931 |

Tokyo, Japan |

|

|

|

|

|

|

|

Shell Service Centers |

1907 |

The Hague, Netherlands |

|

|

|

|

|

|

|

Total Auto Care |

1980 |

Baghdad, Iraq |

|

|

|

|

|

|

Iraq Aftermarket services Industry Analysis

Growth Drivers

-

Increasing Vehicle Ownership (Passenger, Commercial Vehicles): Iraq's vehicle ownership has been steadily increasing, driven by economic recovery and growing consumer demand for both passenger and commercial vehicles. According to the World Bank, Iraq had 2.1 million registered passenger vehicles and over 600,000 commercial vehicles by the end of 2023. This increase, fueled by urbanization and government-backed financial reforms, is pushing demand for aftermarket services, such as maintenance, repair, and spare parts. Additionally, the country's improving road infrastructure supports vehicle ownership growth, further expanding the aftermarket services market. This increase in vehicle numbers correlates directly with a higher demand for services.

- Government Reforms on Auto Industry (Subsidies, Regulations): The Iraqi government has implemented several reforms to support its automotive industry, including subsidizing parts and providing tax relief for imported automotive components. These policies are aimed at encouraging vehicle maintenance and repairs by making parts more affordable, thereby stimulating growth in the aftermarket services sector. For example, in 2024, the Iraqi Ministry of Trade reduced import taxes on automotive spare parts by 15%, enhancing accessibility for repair shops. Such measures are directly contributing to the affordability and availability of quality aftermarket services in the country.

- Aging Vehicle Population (Average Vehicle Age): The average vehicle age in Iraq is currently around 14 years, significantly higher than in many neighboring countries. As vehicles age, they require more frequent repairs and maintenance, creating a robust demand for aftermarket services. According to a 2024 report from Iraq’s Ministry of Transport, around 60% of vehicles on the road are over a decade old, necessitating regular servicing and part replacements. This aging fleet will continue to sustain demand for aftermarket parts, boosting the service industry.

Market Restraints

-

Limited Skilled Workforce (Training, Certification Requirements): Iraq faces a shortage of skilled technicians capable of providing quality vehicle maintenance and repair services. According to Iraq’s Ministry of Labor, fewer than 20,000 certified auto technicians were available in 2024, insufficient to meet the growing demand for services. The lack of training institutions and certification programs further hampers the development of a competent workforce, creating challenges for the aftermarket services sector, particularly in offering high-quality services.

- High Dependency on Imported Parts (Supply Chain Constraints): Iraq’s automotive aftermarket heavily depends on imported parts, which account for nearly 85% of the total supply in 2024, according to the Iraq Customs Authority. This reliance exposes the market to supply chain disruptions, especially in times of political instability or logistical challenges. Furthermore, fluctuating foreign exchange rates and high import duties complicate the pricing and availability of genuine parts, making it difficult for local service providers to maintain a steady supply.

Iraq Aftermarket services Market Future Outlook

Over the next five years, the Iraq aftermarket services market is expected to grow steadily, supported by the increasing number of vehicles on the road, government investments in transportation infrastructure, and the expansion of service networks. Additionally, technological advancements, such as telematics and connected car diagnostics, are expected to drive demand for high-tech maintenance and repair services. The growing preference for genuine and high-quality aftermarket parts will further shape the market dynamics, as consumers become more aware of the long-term benefits of using original equipment manufacturer (OEM) parts.

Market Opportunities

-

Expansion of Service Networks (OEM and Independent): Original Equipment Manufacturers (OEMs) and independent service providers are expanding their networks across Iraq, with 35 new service centers opened in 2024 alone, according to Iraq’s Ministry of Industry. This expansion is critical in meeting the increasing demand for vehicle repairs and maintenance, especially in urban centers like Baghdad and Basra. Furthermore, OEMs are partnering with local service providers to offer certified parts and services, creating a more organized and trusted aftermarket ecosystem.

- Increasing Demand for Genuine Parts (Consumer Preferences): There has been a growing consumer preference for genuine spare parts over cheaper alternatives, as vehicle owners become more aware of the risks associated with counterfeit products. According to the Iraq Consumer Protection Agency, demand for certified parts increased by 20% in 2024, especially for critical components like brake pads and filters. This shift toward genuine parts presents an opportunity for authorized dealers and OEMs to capture a larger share of the aftermarket services market by offering quality products and warranties

Scope of the Report

|

By Service Type |

Maintenance Services, Repair Services, Tire Services, Battery Services, Diagnostics |

|

By Vehicle Type |

Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles |

|

By Distribution Channel |

OEM Authorized Dealers, Independent Garages, Online Platforms, Retail Chains |

|

By Component Type |

Engine Components, Electrical Components, Brake Components, Suspension Components, Transmission Components |

|

By Region |

Baghdad, Basra, Erbil, Mosul, Karbala |

Products

Key Target Audience

-

OEMs (Original Equipment Manufacturers)

- Aftermarket Parts Manufacturers

- Independent Auto Repair Shops

- Vehicle Dealership Networks

- Fleet Operators and Transport Companies

- Investors and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Transport, Ministry of Industry)

- E-commerce Platforms

Companies

Players Mentioned in the Report:

-

Bosch Auto Service

- Al-Fahd Auto

- Bridgestone Iraq

- Shell Service Centers

- Total Auto Care

- Al-Kindi Trading Co.

- Eagle Auto Services

- AutoHub Iraq

- Yokohama Tire Iraq

- ACDelco Service Centers

- Euro Auto Repair

- Al-Hamza Auto Solutions

- Al-Rashid Trading Group

- Naptco Automotive

- Al Habbaniyah Auto Spare Parts

Table of Contents

1. Iraq Aftermarket Services Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Iraq Aftermarket Services Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Iraq Aftermarket Services Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Vehicle Ownership (Passenger, Commercial Vehicles)

3.1.2. Government Reforms on Auto Industry (Subsidies, Regulations)

3.1.3. Aging Vehicle Population (Average Vehicle Age)

3.1.4. Rise in Road Transport Sector (Transport Infrastructure)

3.2. Market Challenges

3.2.1. Limited Skilled Workforce (Training, Certification Requirements)

3.2.2. High Dependency on Imported Parts (Supply Chain Constraints)

3.2.3. Unorganized Market (Fragmented Aftermarket Providers)

3.2.4. Political Instability and Its Impact on Supply Chains

3.3. Opportunities

3.3.1. Expansion of Service Networks (OEM and Independent)

3.3.2. Increasing Demand for Genuine Parts (Consumer Preferences)

3.3.3. Growth in Online Aftermarket Sales (E-commerce, Digital Channels)

3.3.4. Rise in Electric Vehicle Maintenance Services (EV Adoption Rates)

3.4. Trends

3.4.1. Shift Toward Preventive Maintenance (Telematics, Predictive Services)

3.4.2. Increased Demand for Extended Warranty Services (Consumer Protection)

3.4.3. Growth in Technological Integration (Diagnostics, Smart Sensors)

3.4.4. Influence of Global Brands in Iraq Aftermarket (Brand Penetration)

3.5. Government Regulation

3.5.1. Policies on Imported Aftermarket Parts (Taxation, Tariffs)

3.5.2. Environmental Regulations (Emission Norms, Vehicle Scrappage Policies)

3.5.3. Safety Standards for Aftermarket Products (Certifications, Compliance)

3.5.4. Local Market Protection Measures (Regulations Supporting Local Vendors)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porter’s Five Forces Analysis

3.9. Competitive Ecosystem

4. Iraq Aftermarket Services Market Segmentation

4.1. By Service Type (In Value %)

4.1.1. Maintenance Services

4.1.2. Repair Services

4.1.3. Tire Services

4.1.4. Battery Services

4.1.5. Diagnostics

4.2. By Vehicle Type (In Value %)

4.2.1. Passenger Cars

4.2.2. Light Commercial Vehicles

4.2.3. Heavy Commercial Vehicles

4.3. By Distribution Channel (In Value %)

4.3.1. OEM Authorized Dealers

4.3.2. Independent Garages

4.3.3. Online Platforms

4.3.4. Retail Chains

4.4. By Component Type (In Value %)

4.4.1. Engine Components

4.4.2. Electrical Components

4.4.3. Brake Components

4.4.4. Suspension Components

4.4.5. Transmission Components

4.5. By Region (In Value %)

4.5.1. Baghdad

4.5.2. Basra

4.5.3. Erbil

4.5.4. Mosul

4.5.5. Karbala

5. Iraq Aftermarket Services Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Bosch Auto Service

5.1.2. Al-Fahd Auto

5.1.3. Naptco Automotive

5.1.4. Bridgestone Iraq

5.1.5. Al-Kindi Trading Co.

5.1.6. Al Habbaniyah Auto Spare Parts

5.1.7. Euro Auto Repair

5.1.8. ACDelco Service Centers

5.1.9. Shell Service Centers

5.1.10. Total Auto Care

5.1.11. Eagle Auto Services

5.1.12. AutoHub Iraq

5.1.13. Yokohama Tire Iraq

5.1.14. Al-Hamza Auto Solutions

5.1.15. Al-Rashid Trading Group

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Branch Network, Market Penetration, Customer Ratings, Partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Iraq Aftermarket Services Market Regulatory Framework

6.1. Safety Regulations on Aftermarket Components

6.2. Environmental Standards for Automotive Services

6.3. Compliance Requirements for Local Workshops

6.4. Certification Processes for Aftermarket Providers

7. Iraq Aftermarket Services Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Iraq Aftermarket Services Future Market Segmentation

8.1. By Service Type (In Value %)

8.2. By Vehicle Type (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Component Type (In Value %)

8.5. By Region (In Value %)

9. Iraq Aftermarket Services Market Analyst's Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping out the key stakeholders and market segments within the Iraq aftermarket services market. Primary and secondary research sources, including government reports, industry publications, and proprietary databases, are utilized to identify variables that drive market trends.

Step 2: Market Analysis and Construction

The second step is focused on collecting historical market data, analyzing service penetration rates, and evaluating the contribution of different market segments. This is followed by a detailed assessment of revenue streams generated from various services, ensuring the data is accurate and reliable.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts from both global and local firms are consulted to validate market trends and insights. Interviews conducted through telephonic and digital means help refine the collected data, ensuring it aligns with real-time market dynamics.

Step 4: Research Synthesis and Final Output

The final stage synthesizes data from interviews, historical analysis, and market observations. This ensures a comprehensive market report that provides actionable insights for stakeholders, from service providers to investors.

Frequently Asked Questions

01. How big is the Iraq Aftermarket Services Market?

The Iraq aftermarket services market is valued at USD 0.86 billion, supported by the country's growing vehicle population and investments in road infrastructure. This growth is being driven by the increasing need for repair, maintenance, and replacement services.

02. What are the challenges in the Iraq Aftermarket Services Market?

The market faces several challenges, including a lack of skilled labor, high dependence on imported parts, and political instability, which affects supply chains and service reliability.

03. Who are the major players in the Iraq Aftermarket Services Market?

Major players in the market include Bosch Auto Service, Al-Fahd Auto, Bridgestone Iraq, Shell Service Centers, and Total Auto Care. These companies lead the market due to their established service networks and strong product offerings.

04. What are the growth drivers of the Iraq Aftermarket Services Market?

Key growth drivers include the increasing number of vehicles, aging vehicle fleets requiring frequent servicing, and consumer demand for high-quality replacement parts. Furthermore, advancements in automotive technology, such as diagnostics and connected services, are driving growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.