Iraq New Vehicle and used Vehicle Market Outlook to 2028

Iraq New and Used Vehicle Market: Trends, Segmentation & Forecast 2019–2030

Region:Middle East

Author(s):Harsh Saxena

Product Code:KR1533

August 2025

90

About the Report

Iraq New Vehicle and Used Vehicle Market Overview

- The Iraq New Vehicle and Used Vehicle Market is valued at USD 10 billion, based on a five-year historical analysis. This growth is primarily driven by increasing urbanization, rising disposable incomes, a rebound in demand following the pandemic, and a growing need for both personal and commercial transportation. The market has seen a significant influx of both new and used vehicles, with online marketplaces such as iQ Cars facilitating access and transparency for a diverse range of consumer preferences and needs.

- Key cities dominating the market include Baghdad, Basra, and Erbil. Baghdad, as the capital, serves as a central hub for trade and commerce, resulting in increased vehicle demand. Basra's strategic location as a port city enhances its logistics and transportation needs, while Erbil's economic growth and development projects contribute to its rising vehicle market.

- In 2023, the Iraqi government issued Cabinet Resolution No. 23055, which provides tax exemptions and customs duty reductions for electric vehicles (EVs) and hybrid vehicles. This regulation, issued by the Council of Ministers, aims to promote the adoption of EVs, reduce carbon emissions, and encourage sustainable transportation solutions in Iraq. The incentives include reduced import duties for EVs and support for charging infrastructure development.

Iraq New Vehicle and Used Vehicle Market Segmentation

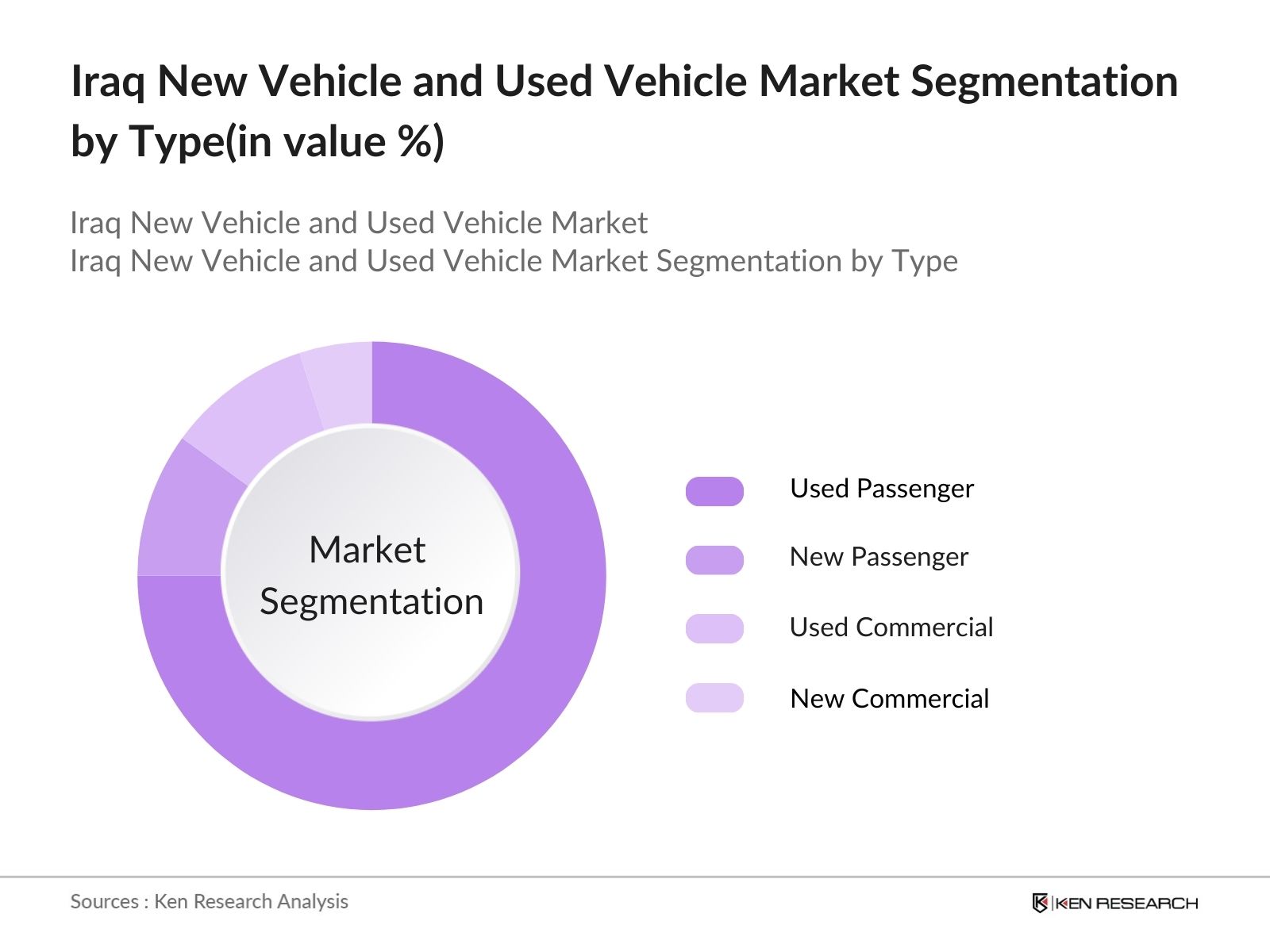

By Type: The market is segmented into various types, including Used Passenger, New Passenger, Used Commercial, and New Commercial Vehicles. Each category caters to different consumer needs, with Used passenger vehicles dominating due to Iraq’s young demographics and preference for affordable mobility, and with new passenger vehicles driven by modern designs, financing availability, and after-sales service; new commercial vehicles supported by logistics and infrastructure activity; Used commercial vehicles serving small businesses and transport operators seeking cost-effective fleet options.

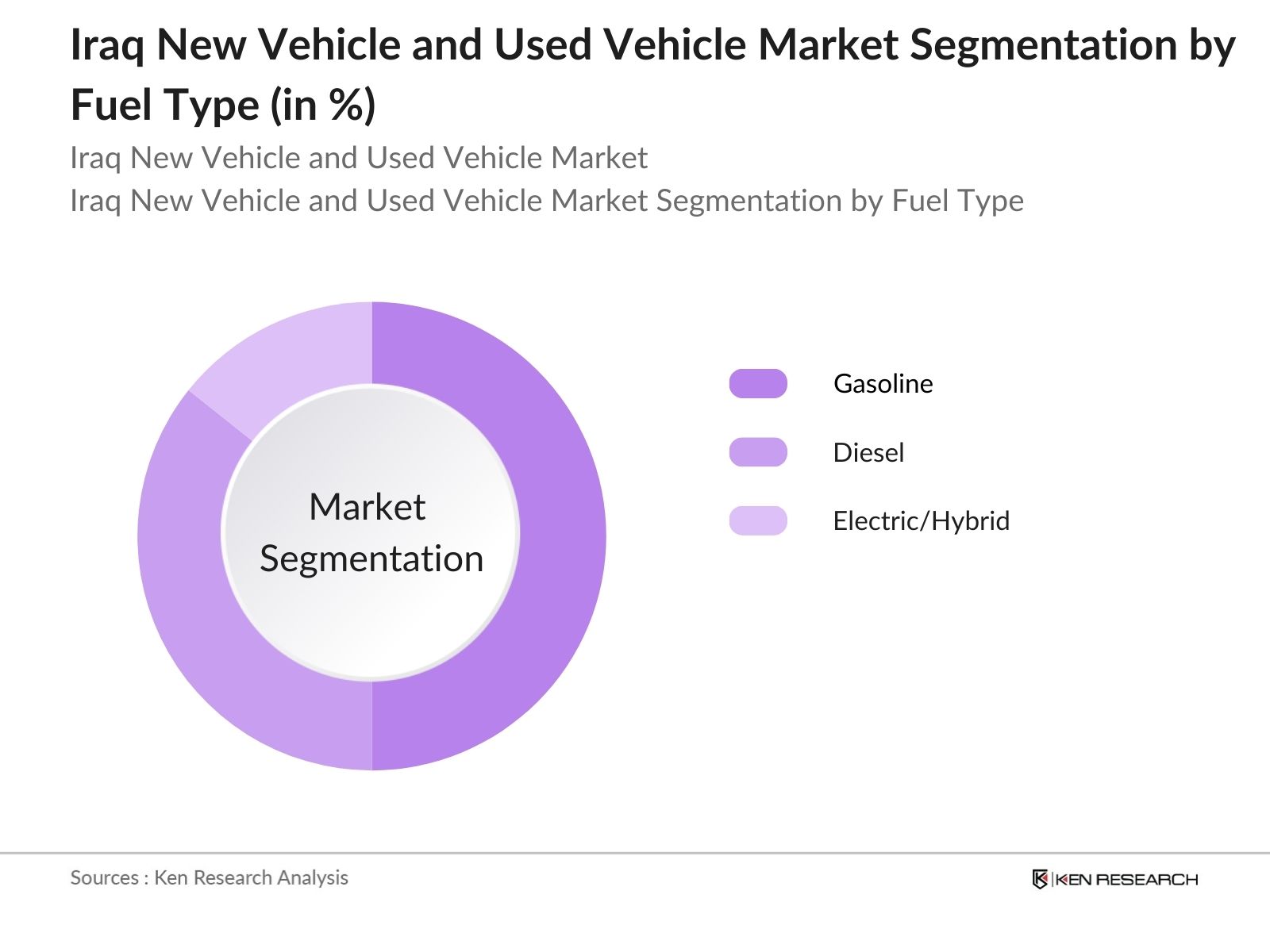

By Fuel Type: The fuel type segmentation includes Gasoline, Diesel, and Electric/Hybrid Vehicles. Gasoline vehicles dominate the market, supported by their affordability, wide availability, and strong refueling infrastructure. Diesel vehicles also contribute significantly, with demand driven by logistics, commercial fleets, and sectors requiring higher fuel efficiency and torque. Electric and hybrid vehicles, while currently holding a smaller share, are expanding rapidly as rising fuel costs, government incentives, and growing environmental awareness encourage adoption among consumers and businesses alike.

Iraq New Vehicle and Used Vehicle Market Competitive Landscape

A dynamic mix of regional and international players characterizes the Iraq New Vehicle and Used Vehicle Market. Leading participants, such as Toyota, Kia, Hyundai, MG, and Suzuki, contribute to innovation, geographic expansion, and service delivery in this space.

| Toyota | 1937 | Toyota City, Japan | – | – | – | – | – | – |

| Kia | 1944 | Seoul, South Korea | – | – | – | – | – | – |

| Hyundai | 1967 | Seoul, South Korea | – | – | – | – | – | – |

| MG | 1924 | Shanghai, China | – | – | – | – | – | – |

| Suzuki | 1909 | Hamamatsu, Japan | – | – | – | – | – | – |

| Company | Establishment Year | Headquarters | Group Size (Large, Medium, Small) | Annual Sales Volume (Units) | Market Share (%) | Revenue (USD Million) | Market Penetration Rate (%) | Customer Retention Rate (%) |

|---|

Iraq New Vehicle and Used Vehicle Market Industry Analysis

Growth Drivers

- Government Push for Local Assembly and Industrial Revival: Iraq’s Ministry of Industry is actively promoting local vehicle manufacturing through CKD/SKD incentives, particularly in Basra and Baghdad industrial zones. This initiative is part of the National Development Plan 2023–2027, which seeks to reduce import dependency and create over 20,000 direct jobs. The government’s strategy positions automotive manufacturing as a key pillar of Iraq’s industrial diversification and economic development agenda.

- Youth-Driven Demand and Urbanization Growth: With over 60% of the population under 25, Iraq is witnessing a surge in first-time car ownership, especially in urban hubs like Baghdad, Erbil, and Basra. Rising urbanization, expected to reach 73% by 2030, along with improving road infrastructure and increasing disposable incomes, is fueling demand for two-wheelers and four-wheelers. This demographic and urban shift is creating a large, youthful consumer base for both new and used vehicles.

- Emerging Investment and Regional Expansion Activity: Iraq is attracting foreign direct investment (FDI) in mobility, from luxury car dealerships like Rolls-Royce in Erbil to tech-enabled platforms such as iQ Cars. Simultaneously, new automotive players are leveraging Iraq’s strategic location as a re-export hub to Turkey and the Levant. These trends signal growing investor confidence, with regional expansions and consolidation activities supporting long-term growth in Iraq’s automotive ecosystem.

Market Challenges

- Regulatory Inconsistencies and Policy Gaps: Iraq’s alignment with GCC import regulations is hindered by inconsistent application of customs exemptions and varied licensing norms across provinces. This regulatory fragmentation creates uncertainty for dealers and importers, complicating vehicle movement and market planning. Additionally, the lack of a finalized EV subsidy or tax benefit framework delays the rollout of electric vehicles. Compared to neighboring countries that offer duty waivers, Iraq’s policy gaps place it at a competitive disadvantage for OEM entry and EV adoption.

- Informal Distribution Channels Limit Market Formalization: A significant portion of vehicle parts and used car transactions in Iraq continues to flow through informal or unregistered distributors. These fragmented channels contribute to inconsistent product quality and weak traceability, hampering the development of a robust after-sales ecosystem. While regional markets have made strides in formalizing B2B distribution platforms, Iraq’s penetration remains limited, restricting the growth of organized sales networks and diminishing consumer confidence in used vehicle purchases.

Iraq New Vehicle and Used Vehicle Market Future Outlook

The future of Iraq's new and used vehicle market appears promising, driven by urbanization and rising incomes. As infrastructure investments continue, the demand for vehicles is expected to grow, particularly in urban areas. Additionally, the shift towards electric vehicles and online sales platforms will likely reshape the market landscape. With increasing disposable income and a burgeoning middle class, the market is poised for expansion, despite challenges such as political instability and financing limitations that need addressing.

Market Opportunities

- Acceleration of Digital Used-Car Platforms in Urban Iraq: Online vehicle platforms like OpenSooq, CarsDir, and IQ Cars now account for ~20% of used car transactions in Iraq, with usage doubling since 2019. Increased mobile internet penetration and urban digital adoption are driving this trend. Automotive players can capitalize by integrating with these platforms and supporting VIN-based inspection tools that improve transparency and consumer trust in online vehicle sales.

- EV Charging Network Expansion and Policy Momentum: Iraq plans to install 500 public EV charging stations by 2029, with a near-term target of 50 stations by 2026 in key cities like Baghdad and Basra. Backed by the Electricity Master Plan, this infrastructure rollout is supported by private partners like Zain Iraq. The initiative paves the way for early EV adoption, presenting growth potential for electric vehicle manufacturers and charging solution providers.

Scope of the Report

| By Type |

Used Passenger New Passenger Used Commercial New Commercial |

| By Fuel Type |

Gasoline Diesel Electric/Hybrid |

| By Sales Channel |

OEM Dealerships Independent Dealers Online Marketplace Auctions |

| By Age of Vehicle |

New Vehicles 0-5 Years Old 5-10 Years Old More than 10 Years Old |

| By Region |

Baghdad Basra Erbil Mosul Sulaymaniyah Others |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Ministry of Trade, Ministry of Interior)

Automobile Manufacturers and Producers

Distributors and Retailers

Automotive Importers

Insurance Companies

Financial Institutions

Logistics and Transportation Companies

Companies

Players Mentioned in the Report:

Toyota

Kia

Hyundai

MG

Suzuki

Chery

Geely

Jeep

Volkswagen

Honda

Table of Contents

1. Executive Summary

1.1 Executive Summary: Iraq New and Used Vehicle Market

2. Market Overview of Iraq New and Used Vehicle Market

2.1 Supply Side Ecosystem

2.2 Business Timeline for Iraq New and Used Vehicle Market

2.3 Value Chain for Iraq New and Used Vehicle Market

3. Market Size and Segmentation of Iraq New and Used Vehicle Market

3.1 Market Size Analysis of Iraq New and Used Vehicle Market, 2020–2024–2030F

3.2 By Vehicle Type and By Fuel Type in Iraq New and Used Vehicle Market, 2024 and 2030F

3.3 By Sales Channel and By Vehicle Age in Iraq New and Used Vehicle Market, 2024 and 2030F

3.4 By Region in Iraq New and Used Vehicle Market, 2024 and 2030F

4. Market Analysis of Iraq New and Used Vehicle Market

4.1 Market Opportunities in Iraq New and Used Car Market

4.2 Emerging Trends in Iraq New and Used Car Market

4.3 Key Challenges in Iraq New and Used Car Market

4.4 Demand Drivers in Iraq New and Used Vehicle Market

4.5 Porter’s 5 Forces in Iraq New and Used Vehicle Market

4.6 Stakeholder Ecosystem in Iraq New and Used Vehicle Market

5. Competition Analysis of Iraq New and Used Vehicle Market

5.1 Competition Landscape of Iraq New and Used Vehicle Market

5.2 Market Share Analysis of Iraq New and Used Vehicle Market

5.3 Cross Comparison of Major Players in Iraq New and Used Vehicle Market

6. Regulatory Framework of Iraq New and Used Vehicle Market

6.1 Compliance Standards of Iraq New and Used Vehicle Market

6.2 Emission Norms of Iraq New and Used Vehicle Market

6.3 Regulatory Bodies of Iraq New and Used Vehicle Market

7. Analyst Recommendation of Iraq New and Used Vehicle Market

7.1 TAM, SAM & SOM Analysis

7.2 Market Entry Strategy: Distribution & Segment Analysis

7.3 Market Expansion: Regional Strategy

7.4 Digital Marketing Strategies

8. Research Methodology

Research Methodology

Phase 1: Approach

Desk Research

- Analysis of government reports on vehicle registrations and imports

- Review of industry publications and market analysis reports specific to the Iraqi automotive sector

- Examination of trade statistics from the Ministry of Trade and international trade organizations

Primary Research

- Interviews with key stakeholders in the automotive industry, including dealers and distributors

- Surveys targeting vehicle owners to understand preferences and purchasing behavior

- Field visits to automotive markets and dealerships to gather firsthand insights

Validation & Triangulation

- Cross-validation of data from multiple sources, including government and industry reports

- Triangulation of findings from primary interviews with secondary research data

- Sanity checks through expert panel discussions with automotive analysts

Phase 2: Market Size Estimation

Top-down Assessment

- Estimation of total vehicle market size based on national economic indicators and population growth

- Segmentation of the market by vehicle type (new vs. used) and fuel type (petrol, diesel, electric)

- Incorporation of government policies affecting vehicle imports and local manufacturing

Bottom-up Modeling

- Collection of sales data from major dealerships and automotive distributors

- Analysis of pricing trends for new and used vehicles across different regions

- Estimation of market share for various vehicle brands and models based on sales volume

Forecasting & Scenario Analysis

- Development of market forecasts using historical sales data and economic growth projections

- Scenario analysis based on potential changes in consumer preferences and regulatory impacts

- Creation of best-case, worst-case, and most-likely scenarios for market growth through 2030

Phase 3: CATI Sample Composition

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| New Vehicle Buyers | 80 | First-time buyers, Middle-income families |

| Used Vehicle Owners | 70 | Current vehicle owners, Budget-conscious consumers |

| Automotive Dealers | 50 | Dealership owners, Sales managers |

| Fleet Managers | 40 | Corporate fleet managers, Logistics coordinators |

| Automotive Service Providers | 40 | Service center managers, Automotive technicians |

Frequently Asked Questions

What is the current value of the Iraq New Vehicle and Used Vehicle Market?

The Iraq New Vehicle and Used Vehicle Market is valued at approximately USD 10 billion, driven by factors such as urbanization, rising disposable incomes, and increased demand for personal and commercial transportation following the pandemic.

Which cities are the main hubs for vehicle demand in Iraq?

Key cities driving vehicle demand in Iraq include Baghdad, Basra, and Erbil. Baghdad serves as the capital and trade center, while Basra's port location enhances logistics needs, and Erbil's economic growth contributes to rising vehicle sales.

What incentives has the Iraqi government introduced for electric vehicles?

The Iraqi government issued Cabinet Resolution No. 23055, providing tax exemptions and customs duty reductions for electric and hybrid vehicles. This initiative aims to promote EV adoption, reduce carbon emissions, and support the development of charging infrastructure.

How is urbanization affecting the vehicle market in Iraq?

Urbanization in Iraq is projected to increase the urban population to 71%, driving demand for personal and commercial vehicles. This growth translates to an estimated 1.5 million potential vehicle buyers annually, enhancing market opportunities for both new and used vehicles.

What role does disposable income play in the vehicle market?

Rising disposable income in Iraq, expected to reach approximately $4,660 per capita, allows more consumers to afford vehicles. As financial stability increases, families are more likely to invest in personal transportation, boosting demand for new and used vehicles.

What challenges does the Iraqi vehicle market face?

The Iraqi vehicle market faces challenges such as political instability, which affects consumer confidence and purchasing power, and limited financing options, with only 23% of the population having access to formal banking services, restricting vehicle purchases.

What opportunities exist for e-commerce in Iraq's vehicle market?

The growth of e-commerce in Iraq, projected to reach $1.5 billion, presents significant opportunities for online vehicle sales platforms. As consumers increasingly prefer digital channels, automotive companies can enhance sales and reach a broader audience.

What types of vehicles are popular in the Iraqi market?

The Iraqi vehicle market features a variety of types, including sedans, SUVs, pickup trucks, motorcycles, and commercial vehicles. SUVs and pickup trucks are particularly popular due to their versatility and suitability for both urban and rural environments.

How does the presence of Chinese brands impact the Iraqi vehicle market?

Chinese brands like MG, Changan, and BYD are gaining popularity in Iraq due to competitive pricing and expanding dealership networks. Their presence caters to budget-conscious consumers and contributes to the overall growth of the vehicle market.

What is the significance of government infrastructure investments for the vehicle market?

The Iraqi government's $10 billion investment in infrastructure development, focusing on road construction and public transport, is expected to enhance connectivity and accessibility. This improvement will encourage vehicle ownership and boost demand for commercial vehicles.

What are the main end-user segments in the Iraqi vehicle market?

The end-user segments in the Iraqi vehicle market include individual consumers, corporate fleets, government agencies, and rental services. Individual consumers dominate the market, driven by rising disposable incomes and a growing preference for personal vehicles.

What trends are shaping the future of the Iraqi vehicle market?

Key trends shaping the future of the Iraqi vehicle market include a shift towards electric vehicles, the rise of online sales platforms, and enhanced vehicle safety features. These trends reflect changing consumer preferences and a growing focus on sustainability.

How does the vehicle market in Iraq compare to other regions?

The Iraqi vehicle market is characterized by unique challenges such as political instability and limited financing options, which differ from more stable regions. However, it also presents significant growth opportunities driven by urbanization and rising incomes.

What is the expected growth outlook for the Iraqi vehicle market?

The future outlook for Iraq's vehicle market appears promising, with expected growth driven by urbanization, rising incomes, and infrastructure investments. Despite challenges like political instability, the market is poised for expansion, particularly in urban areas.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.