KSA Adhesive Industry outlook to 2030

Region:Middle East

Author(s):Dev Chawla

Product Code:KROD9958

June 2025

80

About the Report

KSA Adhesive Industry Market Overview

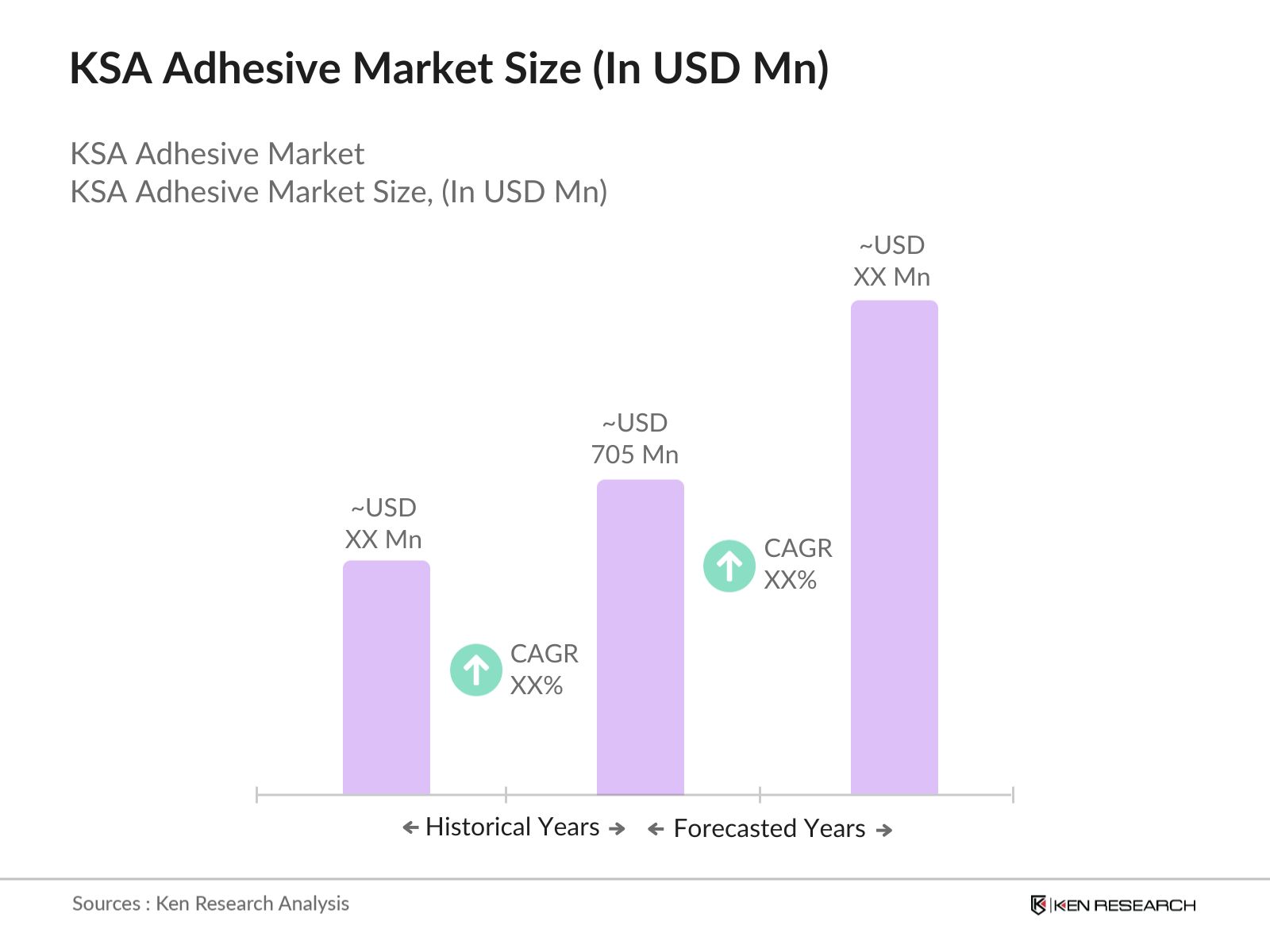

- The KSA Adhesive Market was valued at USD 705 million, based on a five-year historical analysis. This growth is primarily driven by the booming construction sector, increasing automotive production, and rising demand for consumer goods. The expansion of manufacturing capabilities and the introduction of innovative adhesive solutions have further fueled market growth.

- Key cities dominating the market include Riyadh, Jeddah, and Dammam, primarily due to their strategic locations and robust industrial infrastructure. Riyadh, as the capital, serves as a hub for government projects and investments, while Jeddah and Dammam benefit from their proximity to ports, facilitating trade and distribution of adhesive products.

- In 2023, the Saudi government implemented regulations aimed at enhancing the sustainability of the adhesive industry. These regulations mandate the reduction of volatile organic compounds (VOCs) in adhesive formulations, promoting the use of eco-friendly materials and technologies. This initiative is part of the broader Vision 2030 strategy to diversify the economy and reduce environmental impact.

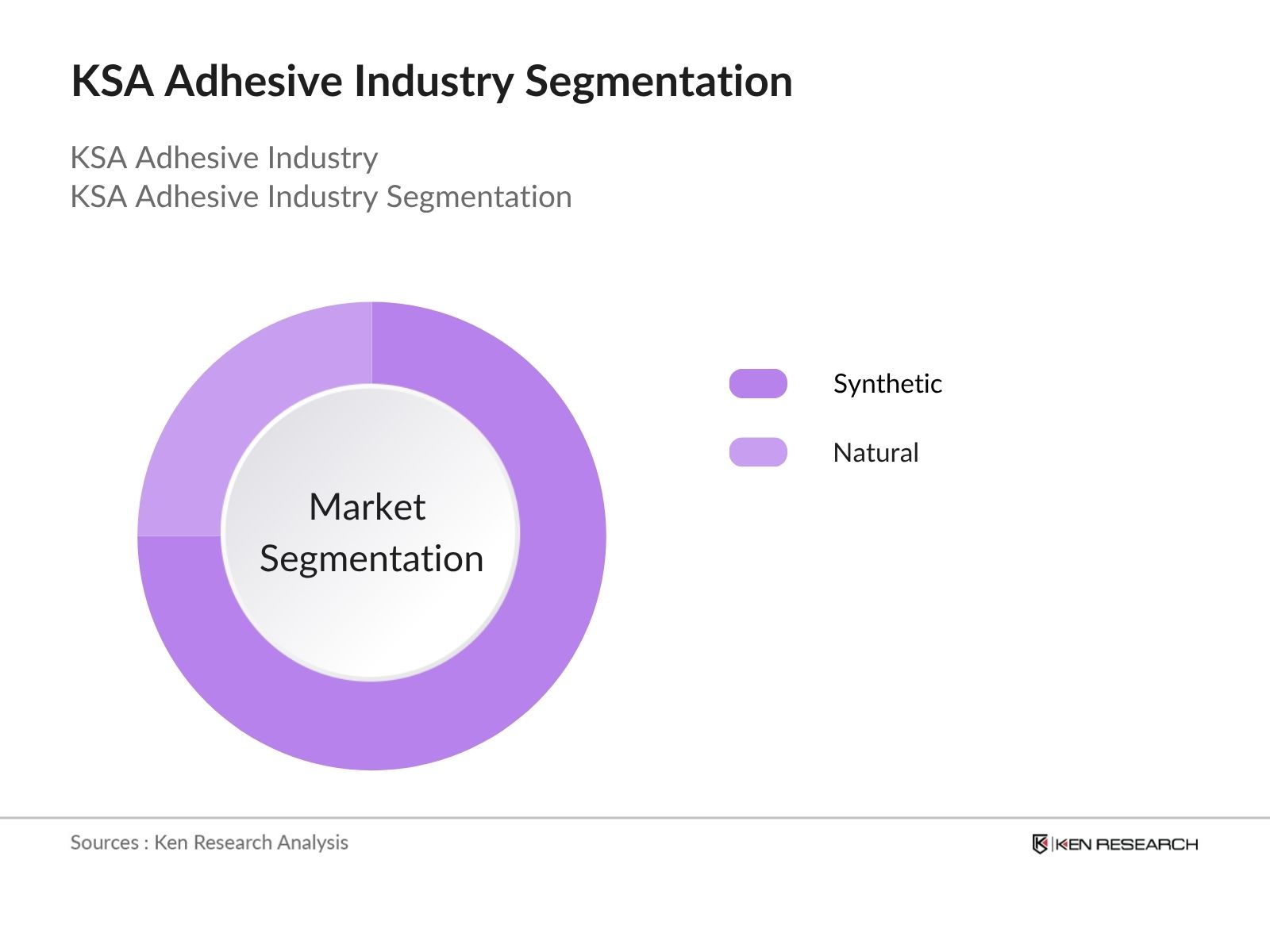

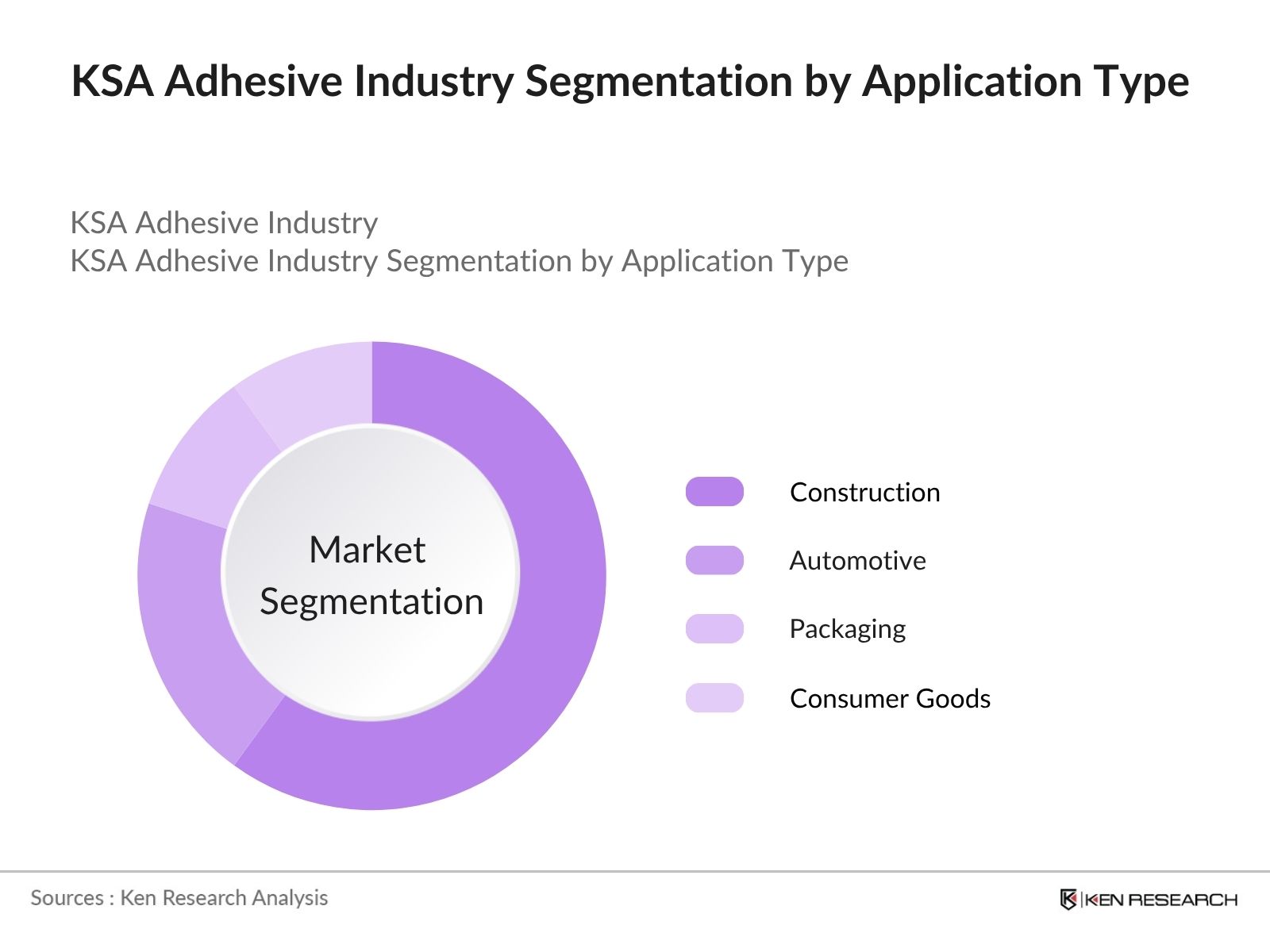

KSA Adhesive Industry market Segmentation

By Source: The adhesive market can be segmented based on the source of raw materials, which includes natural and synthetic adhesives. Among these, synthetic adhesives dominate the market due to their superior performance characteristics, versatility, and cost-effectiveness. The increasing demand for high-performance adhesives in various applications, such as construction and automotive, has led to a significant shift towards synthetic options. Natural adhesives, while gaining traction due to sustainability trends, still hold a smaller market share compared to their synthetic counterparts.

By Application: The adhesive market is also segmented by application, which includes construction, automotive, packaging, and consumer goods. The construction segment is the largest, driven by the rapid growth of infrastructure projects and residential construction in the region. Adhesives used in construction are essential for bonding materials such as wood, concrete, and metal, making them indispensable in modern building practices. The automotive sector follows closely, with adhesives playing a critical role in vehicle assembly and manufacturing.

KSA Adhesive Market Competitive Landscape

The KSA Adhesive Market is characterized by a competitive landscape with several key players, including Henkel AG, Sika AG, and Saudi Adhesive Company. These companies are known for their innovative product offerings and strong distribution networks, which enhance their market presence. The industry is marked by a mix of local and international firms, contributing to a dynamic competitive environment.

KSA Adhesive Market Industry Analysis

Growth Drivers

- Increasing Demand from the Construction Sector: Saudi Arabia’s Vision 2030 is driving over $1 trillion in construction investments, including more than 25 giga projects like NEOM and the Red Sea Project. These large-scale developments focus on sustainability, smart technology, and urban innovation, boosting demand for adhesives in flooring, wall coverings, and insulation. Public-private partnerships and modernization efforts further accelerate construction growth, making the sector a key driver for adhesive market expansion.

- Technological Advancements in Adhesive Formulations: Innovations in adhesive technologies are driving the development of high-performance, eco-friendly products with improved bonding strength and durability. Manufacturers in Saudi Arabia are focusing on advanced polymer-based and bio-based adhesives that meet environmental regulations and industry demands. Continuous R&D and collaborations with research institutions foster customized, sustainable adhesive solutions, supporting diverse sectors like construction, automotive, and packaging while enhancing overall market competitiveness.

- Rising Consumer Awareness Regarding Sustainable Products: There is a growing trend among consumers and businesses in Saudi Arabia towards sustainability, with a significant increase in demand for eco-friendly adhesives. The market for bio-based adhesives is projected to grow at a rate of 10% annually, driven by consumer preferences for products that minimize environmental impact. This shift is prompting manufacturers to invest in sustainable practices, thereby enhancing their market position and contributing to the overall growth of the adhesive industry.

Market Challenges

- Fluctuating Raw Material Prices: The adhesive industry in Saudi Arabia faces challenges due to the volatility of raw material prices, particularly petrochemicals, which constitute a major component of adhesive production costs. This unpredictability can squeeze profit margins, hinder investments in new technologies, and limit the ability to offer competitive pricing, thereby posing a challenge to sustainable market growth.

- Stringent Environmental Regulations: Compliance with increasingly strict environmental regulations is another key challenge for adhesive manufacturers. The government’s focus on reducing volatile organic compounds (VOCs) emissions has led to more rigorous legal frameworks, increasing compliance obligations. This evolving regulatory landscape demands significant investments in reformulation and cleaner production processes, which may reduce operational flexibility and add to cost pressures for manufacturers.

KSA Adhesive Industry market Future Outlook

The KSA adhesive industry is poised for significant growth, driven by ongoing advancements in technology and increasing demand for sustainable products. As the construction and automotive sectors expand, the need for high-performance adhesives will rise. Additionally, the focus on eco-friendly solutions will encourage manufacturers to innovate and adapt. By 2029, the market is expected to witness a transformation, with a greater emphasis on bio-based adhesives and automation in production processes, enhancing efficiency and sustainability across the industry.

Market Opportunities

- Expansion of the Automotive Industry: In 2024, Saudi Arabia produced approximately 826,580 vehicles, reflecting significant growth fueled by government initiatives and investments in local manufacturing. This surge supports rising demand for adhesives used in vehicle assembly, interiors, and lightweight materials. The focus on electric vehicle production and partnerships with global OEMs further drives the need for innovative adhesive solutions tailored to evolving automotive technologies and sustainability goals.

- Growth in the Packaging Sector: The Saudi Arabian packaging industry is expanding rapidly, with production increasing from 44.5 billion units in 2023 to a forecasted 51.5 billion units by 2028. Growth is driven by rising e-commerce, food and beverage demand, and sustainability initiatives. The sector is adopting eco-friendly materials, automation, and smart packaging technologies, creating strong opportunities for adhesive manufacturers to develop specialized, sustainable adhesive solutions for diverse packaging applications.

Scope of the Report

| By Source |

Natural Synthetic |

| By Application |

Construction Automotive Packaging Consumer Goods |

| By Technology |

Water-based Solvent-based Hot Melt Reactive |

| By End-User Industry |

Building & Construction Automotive Woodworking Electronics |

| By Region |

Central Region Eastern Region Western Region Southern Region |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Saudi Standards, Metrology and Quality Organization)

Manufacturers and Producers

Distributors and Retailers

Construction and Building Material Companies

Automotive Manufacturers

Packaging Industry Stakeholders

Chemical Raw Material Suppliers

Companies

Players Mentioned in the Report:

Henkel AG

Sika AG

Saudi Adhesive Company

BASF SE

3M Company

Adhesive Innovations KSA

Gulf Bond Technologies

Saudi Polymer Adhesives

Desert Glue Solutions

Arabian Adhesive Systems

Table of Contents

1. KSA Adhesive Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. KSA Adhesive Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. KSA Adhesive Market Analysis

3.1. Growth Drivers

3.1.1. Increasing demand from the construction sector

3.1.2. Technological advancements in adhesive formulations

3.1.3. Rising consumer awareness regarding sustainable products

3.2. Market Challenges

3.2.1. Fluctuating raw material prices

3.2.2. Stringent environmental regulations

3.2.3. Competition from alternative bonding solutions

3.3. Opportunities

3.3.1. Expansion of the automotive industry

3.3.2. Growth in the packaging sector

3.3.3. Development of bio-based adhesives

3.4. Trends

3.4.1. Shift towards eco-friendly adhesive solutions

3.4.2. Increasing automation in manufacturing processes

3.4.3. Rising demand for high-performance adhesives

3.5. Government Regulation

3.5.1. Compliance with environmental protection laws

3.5.2. Regulations on VOC emissions

3.5.3. Safety standards for adhesive products

3.5.4. Import/export regulations affecting adhesive materials

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porter’s Five Forces

3.9. Competition Ecosystem

4. KSA Adhesive Market Segmentation

4.1. By Source

4.1.1. Natural

4.1.2. Synthetic

4.2. By Application

4.2.1. Construction

4.2.2. Automotive

4.2.3. Packaging

4.2.4. Consumer Goods

4.3. By Technology

4.3.1. Water-based

4.3.2. Solvent-based

4.3.3. Hot Melt

4.3.4. Reactive

4.4. By End-User Industry

4.4.1. Building & Construction

4.4.2. Automotive

4.4.3. Woodworking

4.4.4. Electronics

4.5. By Region

4.5.1. Central

4.5.2. Eastern

4.5.3. Western

4.5.4. Southern

5. KSA Adhesive Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Henkel AG

5.1.2. Sika AG

5.1.3. Saudi Adhesive Company

5.1.4. BASF SE

5.1.5. 3M Company

5.1.6. Adhesive Innovations KSA

5.1.7. Gulf Bond Technologies

5.1.8. Saudi Polymer Adhesives

5.1.9. Desert Glue Solutions

5.1.10. Arabian Adhesive Systems

5.2. Cross Comparison Parameters

5.2.1. Market Share

5.2.2. Product Portfolio Diversity

5.2.3. Geographic Presence

5.2.4. R&D Investment

5.2.5. Customer Base Size

5.2.6. Pricing Strategy

5.2.7. Distribution Channels

5.2.8. Sustainability Initiatives

6. KSA Adhesive Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. KSA Adhesive Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. KSA Adhesive Future Market Segmentation

8.1. By Source

8.1.1. Natural

8.1.2. Synthetic

8.2. By Application

8.2.1. Construction

8.2.2. Automotive

8.2.3. Packaging

8.2.4. Consumer Goods

8.3. By Technology

8.3.1. Water-based

8.3.2. Solvent-based

8.3.3. Hot Melt

8.3.4. Reactive

8.4. By End-User Industry

8.4.1. Building & Construction

8.4.2. Automotive

8.4.3. Woodworking

8.4.4. Electronics

8.5. By Region

8.5.1. Central

8.5.2. Eastern

8.5.3. Western

8.5.4. Southern

9. KSA Adhesive Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the KSA Adhesive Industry market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the KSA Adhesive Industry market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIS) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the KSA Adhesive Industry market.

Frequently Asked Questions

01. How big is the KSA Adhesive market?

The KSA Adhesive Industry market is valued at USD 705 million, driven by factors such as increasing demand, technological advancements, and supportive government initiatives.

02. What are the key challenges in the KSA Adhesive market?

Key challenges in the KSA Adhesive market include intense competition, regulatory complexities, and infrastructure limitations affecting market dynamics.

03. Who are the major players in the KSA Adhesive market?

Major players in the KSA Adhesive market include Henkel AG, Sika AG, Saudi Adhesive Company, BASF SE, 3M Company, among others.

04. What are the growth drivers for the KSA Adhesive market?

The primary growth drivers for the KSA Adhesive market are increasing consumer demand, favorable policies, innovation, and substantial investment inflows.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.