KSA Advanced Wound Care Market Outlook to 2030

Region:Middle East

Author(s):Vijay Kumar

Product Code:KROD6159

December 2024

86

About the Report

KSA Advanced Wound Care Market Overview

- The Kingdom of KSA advanced wound care market is valued at USD 200 million, based on a five-year historical analysis. The market is driven by a growing population suffering from chronic conditions such as diabetes and obesity, both of which significantly increase the demand for advanced wound care products. The governments healthcare reforms and initiatives under Saudi Vision 2030 have also boosted healthcare infrastructure and accessibility, further propelling the demand for advanced wound care treatments.

- Key cities such as Riyadh, Jeddah, and Dammam lead the market due to their well-established healthcare facilities, higher healthcare budgets, and a concentrated population base. Riyadh, being the capital, is home to a majority of hospitals and specialized healthcare centers, making it a significant hub for advanced wound care. Additionally, Jeddahs strong healthcare network and proximity to international healthcare providers have further bolstered its dominance, while Dammam benefits from advanced medical facilities and regional healthcare initiatives.

- The Saudi Ministry of Health has established strict guidelines for the use of advanced wound care products, ensuring that only SFDA 75 years, as per the Saudi General Authority for Statistics. This growing geriatric demographic is more prone to chronic wounds, including pressure ulcers and venous leg ulcers, due to factors such as limited mobility and longer healing times. As healthcare systems focus on geriatric care, there is a corresponding increase in demand for advanced wound care products to address these challenges.

KSA Advanced Wound Care Market Segmentation

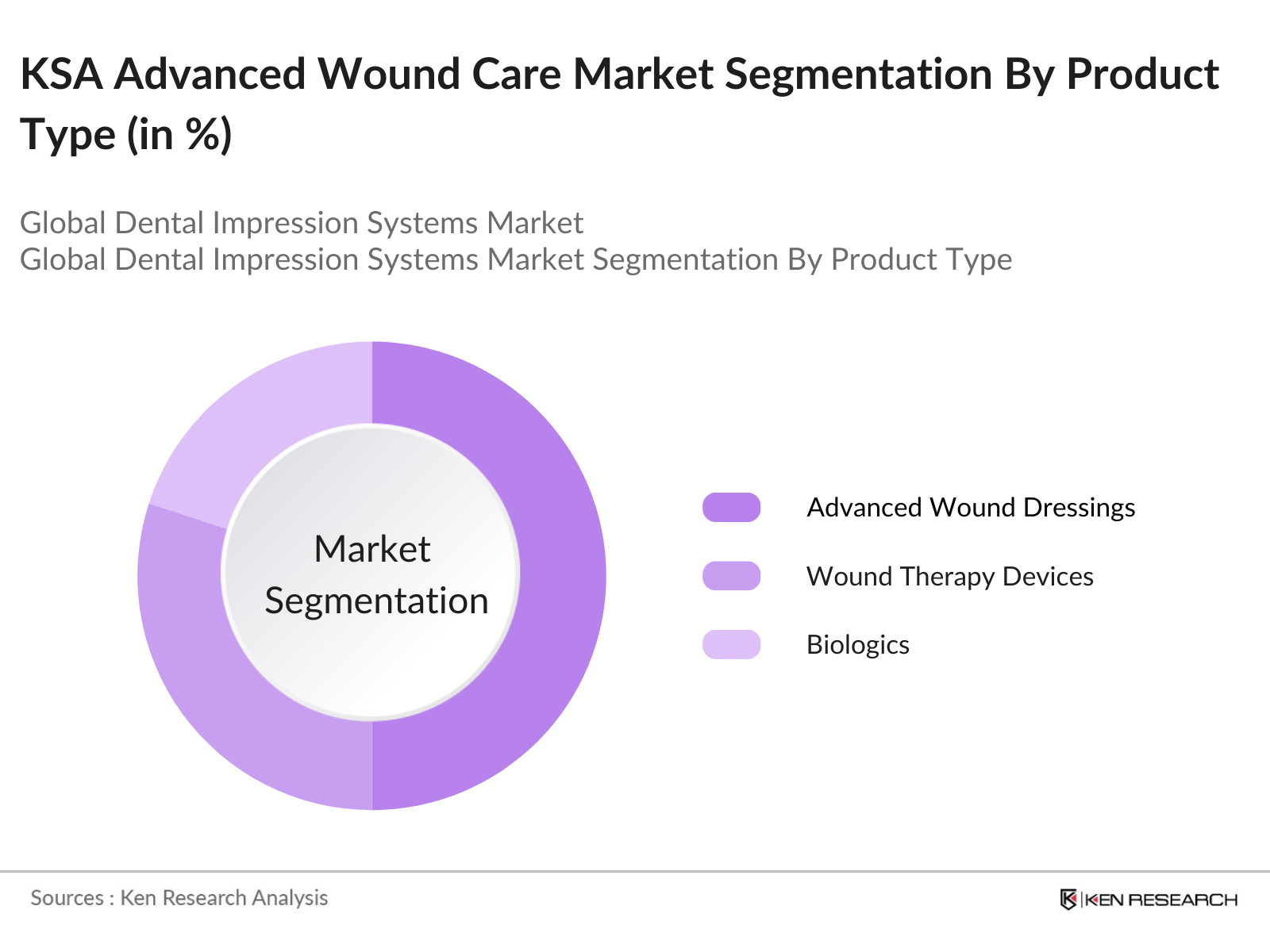

By Product Type: The market is segmented by product type into advanced wound dressings, wound therapy devices, and biologics. Among these, advanced wound dressings hold the largest market share, accounting for around 50% of the total market in 2023. This segment dominates due to the widespread use of hydrocolloid, foam, and alginate dressings, which are effective in managing both chronic and acute wounds.

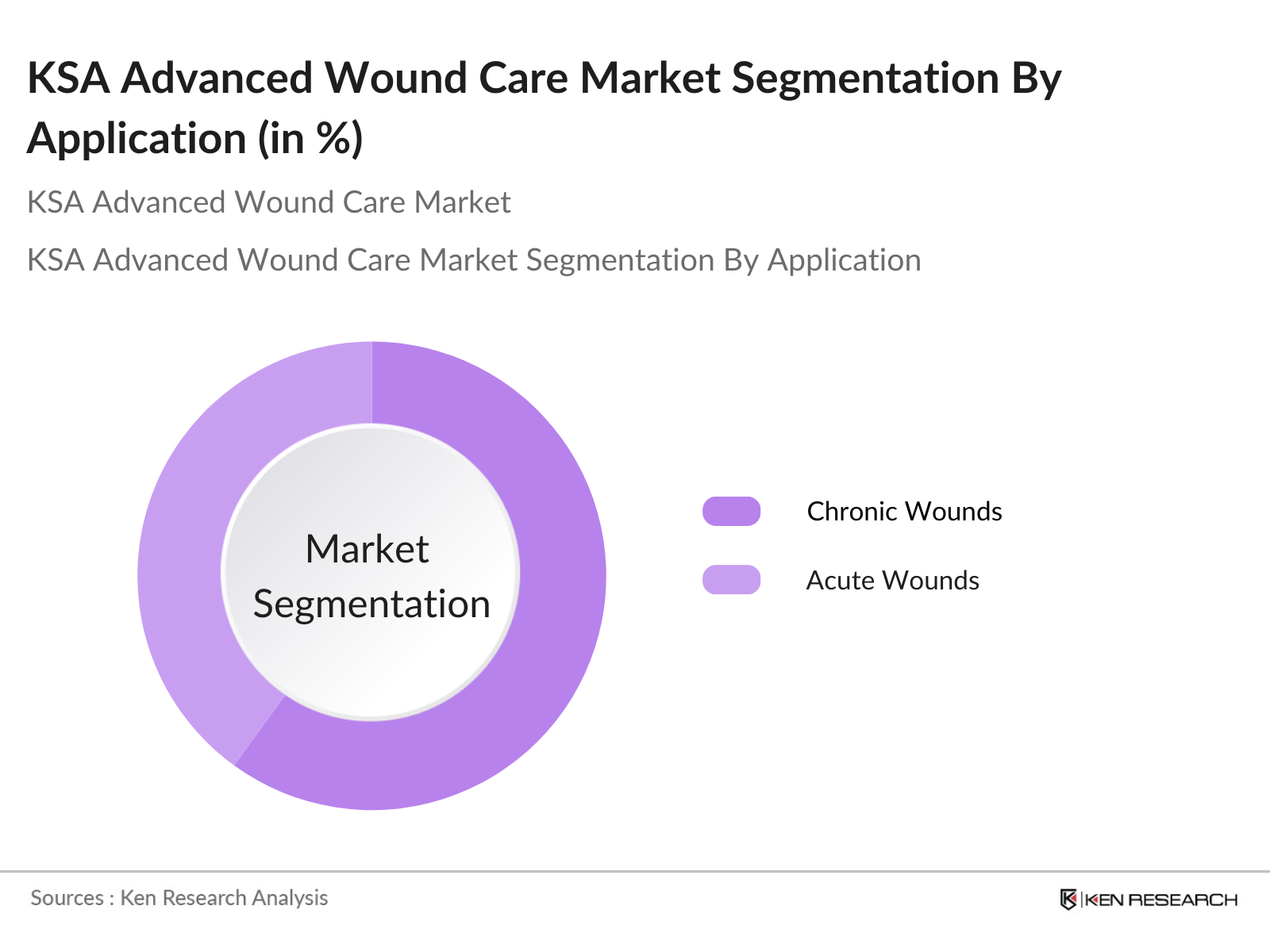

By Application: The market is also segmented by application into chronic wounds and acute wounds. The chronic wounds segment, covering diabetic foot ulcers, pressure ulcers, and venous leg ulcers, holds a dominant share of about 60% in 2023. This dominance is largely due to the high prevalence of diabetes in Saudi Arabia, making diabetic foot ulcers one of the most common and severe chronic wound types.

KSA Advanced Wound Care Market Competitive Landscape

The Saudi Arabia advanced wound care market is competitive, with major players focusing on expanding their product portfolios, enhancing distribution networks, and forming strategic partnerships to maintain market dominance. The landscape is marked by the presence of both global and local companies actively involved in product innovation and research.

KSA Advanced Wound Care Industry Analysis

Growth Drivers

- Rising Diabetic Population: Saudi Arabia faces a significant rise in diabetes cases, with over 4 million adults currently diagnosed, according to the International Diabetes Federation. The prevalence of diabetes leads to an increased number of chronic wounds, particularly diabetic foot ulcers. The country's health infrastructure is under pressure to manage these complications, driving demand for advanced wound care solutions.

- Growing Geriatric Population: The elderly population in Saudi Arabia has grown to over 2.2 million people in 2024, with life expectancy rising to 76 years. An aging population leads to a higher incidence of pressure ulcers and slow-healing wounds, which require advanced wound care products. The rising geriatric demographic represents a significant burden on the healthcare system, further intensified by increased government healthcare investments, totaling $46 billion in 2023, dedicated to elderly care and chronic disease management.

- Increased Awareness of Advanced Wound Care: Public awareness campaigns run by the Saudi Ministry of Health have significantly increased knowledge about advanced wound care solutions. Over 45% of healthcare professionals are now trained in modern wound care techniques, reflecting a push for better patient outcomes. Additionally, the Kingdoms healthcare literacy initiatives have reached over 2 million individuals, promoting the benefits of specialized treatments like antimicrobial dressings and bioactive wound care products.

Market Challenges

- High Treatment Costs: The cost of advanced wound care products and treatments in Saudi Arabia remains high, with an average hospital stay for chronic wounds costing $4,500 per patient. This financial burden limits access, particularly for the uninsured or underinsured population. Healthcare expenditure, although increasing, still struggles to cover these advanced treatments for all citizens, especially as government health insurance programs focus on essential services.

- Lack of Skilled Healthcare Professionals: The shortage of specialized healthcare professionals in Saudi Arabia, particularly in advanced wound care, is significant. With only 1.8 nurses per 1,000 people, many facilities face challenges in providing adequate care for chronic wounds. This shortage directly impacts patient outcomes, as advanced wound care requires specialized training that many healthcare workers have not yet received.

KSA Advanced Wound Care Market Future Outlook

Over the next five years, the Saudi Arabia advanced wound care market is expected to witness steady growth, driven by the increasing prevalence of chronic diseases, a growing elderly population, and continuous technological advancements in wound care solutions. The adoption of telehealth services and AI-driven wound management tools will enhance patient care and treatment outcomes.

Market Opportunities

- Expanding Home Healthcare Solutions: The demand for home healthcare services in Saudi Arabia is growing, with over 150,000 patients receiving home care in 2023. This trend has created opportunities for advanced wound care products that can be administered in home settings, reducing the need for prolonged hospital stays. With the government allocating $500 million to home healthcare services in 2023, the adoption of advanced wound care solutions in this sector is expected to rise significantly.

- Adoption of Telemedicine and Remote Monitoring: Telemedicine in Saudi Arabia grew by 80% in 2023, with over 10 million consultations conducted virtually. Remote monitoring for wound care, particularly for chronic and diabetic wounds, is becoming more common, supported by government healthcare initiatives. The integration of telemedicine services has allowed more efficient monitoring of wound healing processes, reducing the need for in-person hospital visits and improving patient outcomes.

Scope of the Report

|

Product Type |

Dressings Grafts Wound Therapy Devices Bioactives |

|

Wound Type |

Diabetic Foot Ulcers Pressure Ulcers Venous Leg Ulcers Surgical Wounds |

|

End User |

Hospitals Clinics Homecare Long-Term Care Centers |

|

Distribution Channel |

Direct Tenders Retail Pharmacies Online Platforms |

|

Region |

Riyadh Jeddah Dammam Makkah |

Products

Key Target Audience

Hospitals and Clinics

Specialized Wound Care Centers

Home Healthcare Providers

Long-term Care Facilities

Pharmaceutical and Medical Device Companies

Government and Regulatory Bodies (Ministry of Health, SFDA)

Investments and Venture Capitalist Firms

Insurance Providers

Companies

Players Mentioned in the Report

Smith & Nephew

Mlnlycke Health Care AB

ConvaTec Group PLC

3M Healthcare

Baxter International Inc.

Johnson & Johnson

Medline Industries, Inc.

Coloplast A/S

Medtronic PLC

Cardinal Health Inc.

Table of Contents

1. KSA Advanced Wound Care Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. KSA Advanced Wound Care Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. KSA Advanced Wound Care Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Prevalence of Chronic Wounds [Diabetes, Pressure Ulcers, and Venous Leg Ulcers]

3.1.2. Rising Geriatric Population [Age Group-Specific Market Impact]

3.1.3. Technological Advancements in Wound Care Products [Introduction of Active Wound Care, Bioactives, and Smart Bandages]

3.1.4. Growing Awareness About Wound Care Treatments [Patient Education and Healthcare Campaigns]

3.2. Market Challenges

3.2.1. High Cost of Advanced Wound Care Products

3.2.2. Lack of Skilled Healthcare Professionals

3.2.3. Limited Reimbursement Policies [Impact on Adoption of Advanced Therapies]

3.3. Opportunities

3.3.1. Expansion in Home Healthcare [Shift from Hospitals to Home-Based Care]

3.3.2. Increasing Investments in Healthcare Infrastructure [Government Initiatives and Private Sector Investments]

3.3.3. Rise in Telemedicine and Remote Monitoring Solutions

3.4. Trends

3.4.1. Emergence of Artificial Intelligence in Wound Diagnostics

3.4.2. Use of Biologics and Growth Factors for Accelerated Healing

3.4.3. Incorporation of Smart Devices for Remote Wound Monitoring

3.5. Government Regulation

3.5.1. KSA Medical Device Regulatory Framework

3.5.2. Reimbursement Policies for Advanced Wound Care

3.5.3. Import Tariffs and Market Access Challenges

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. KSA Advanced Wound Care Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Dressings (Foam, Hydrocolloids, Alginate, Collagen, Hydrogels)

4.1.2. Wound Therapy Devices (Negative Pressure Wound Therapy, Hyperbaric Oxygen Therapy, Electrical Stimulation)

4.1.3. Active Wound Care (Biologics, Skin Substitutes, Growth Factors)

4.2. By Application (In Value %)

4.2.1. Chronic Wounds (Diabetic Foot Ulcers, Pressure Ulcers, Venous Leg Ulcers)

4.2.2. Acute Wounds (Trauma, Surgical Wounds, Burns)

4.3. By End-User (In Value %)

4.3.1. Hospitals

4.3.2. Specialty Clinics

4.3.3. Home Healthcare

4.4. By Wound Type (In Value %)

4.4.1. Superficial Wounds

4.4.2. Full-Thickness Wounds

4.4.3. Partial-Thickness Wounds

4.5. By Distribution Channel (In Value %)

4.5.1. Direct Tenders

4.5.2. Retail Pharmacies

4.5.3. E-Commerce

5. KSA Advanced Wound Care Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Smith & Nephew Plc

5.1.2. Mlnlycke Health Care

5.1.3. 3M Healthcare

5.1.4. ConvaTec Group Plc

5.1.5. Coloplast A/S

5.1.6. Acelity (A subsidiary of 3M)

5.1.7. Medtronic Plc

5.1.8. B. Braun Melsungen AG

5.1.9. Integra LifeSciences Holdings Corporation

5.1.10. Hartmann Group

5.1.11. Lohmann & Rauscher GmbH & Co. KG

5.1.12. Cardinal Health

5.1.13. Organogenesis Inc.

5.1.14. BSN Medical

5.1.15. Derma Sciences Inc.

5.2. Cross Comparison Parameters

(No. of Employees, Headquarters, Revenue, Market Share, Product Innovation, Mergers & Acquisitions, Regional Presence, Patents Held)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. KSA Advanced Wound Care Market Regulatory Framework

6.1. Medical Device Registration and Compliance

6.2. Quality Standards for Wound Care Products

6.3. Certification Processes and Regulatory Approvals

7. KSA Advanced Wound Care Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. KSA Advanced Wound Care Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By End-User (In Value %)

8.4. By Wound Type (In Value %)

8.5. By Distribution Channel (In Value %)

9. KSA Advanced Wound Care Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first step involved mapping the Saudi Arabia advanced wound care ecosystem, identifying key stakeholders such as manufacturers, distributors, and healthcare providers. Data was gathered through proprietary and secondary databases to identify the variables driving market dynamics.

Step 2: Market Analysis and Construction

In this step, historical data was analyzed to assess market penetration, product demand, and treatment adoption rates. The analysis included evaluation of market trends, product availability, and revenue generation.

Step 3: Hypothesis Validation and Expert Consultation

Key market hypotheses were validated through interviews with industry experts, including wound care specialists and manufacturers. These discussions helped refine market estimates and provided additional insights into market trends and future growth.

Step 4: Research Synthesis and Final Output

The final step included direct consultations with healthcare facilities and distributors to verify the collected data. The information obtained from these consultations was integrated with the results from a bottom-up approach to ensure accurate and comprehensive market analysis.

Frequently Asked Questions

01. How big is the Saudi Arabia advanced wound care market?

The Kingdom of Saudi Arabia (KSA) advanced wound care market is valued at USD 200 million, based on a five-year historical analysis.

02. What are the challenges in the Saudi Arabia advanced wound care market?

The market faces challenges such as high product costs, limited awareness in remote areas, and stringent regulatory approval processes, which can impede market growth and adoption.

03. Who are the major players in the Saudi Arabia advanced wound care market?

Key players include Smith & Nephew, Mlnlycke Health Care, ConvaTec, 3M Healthcare, and Baxter International, known for their diverse product portfolios and strong market presence.

04. What drives growth in the Saudi Arabia advanced wound care market?

The market is driven by rising incidences of diabetes, an aging population, and the increasing adoption of advanced wound management solutions in hospitals and clinics.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.