KSA Aerogel Market Outlook to 2030

Region:Middle East

Author(s):Mukul Soni

Product Code:KROD379

July 2024

98

About the Report

KSA Aerogel Market Overview

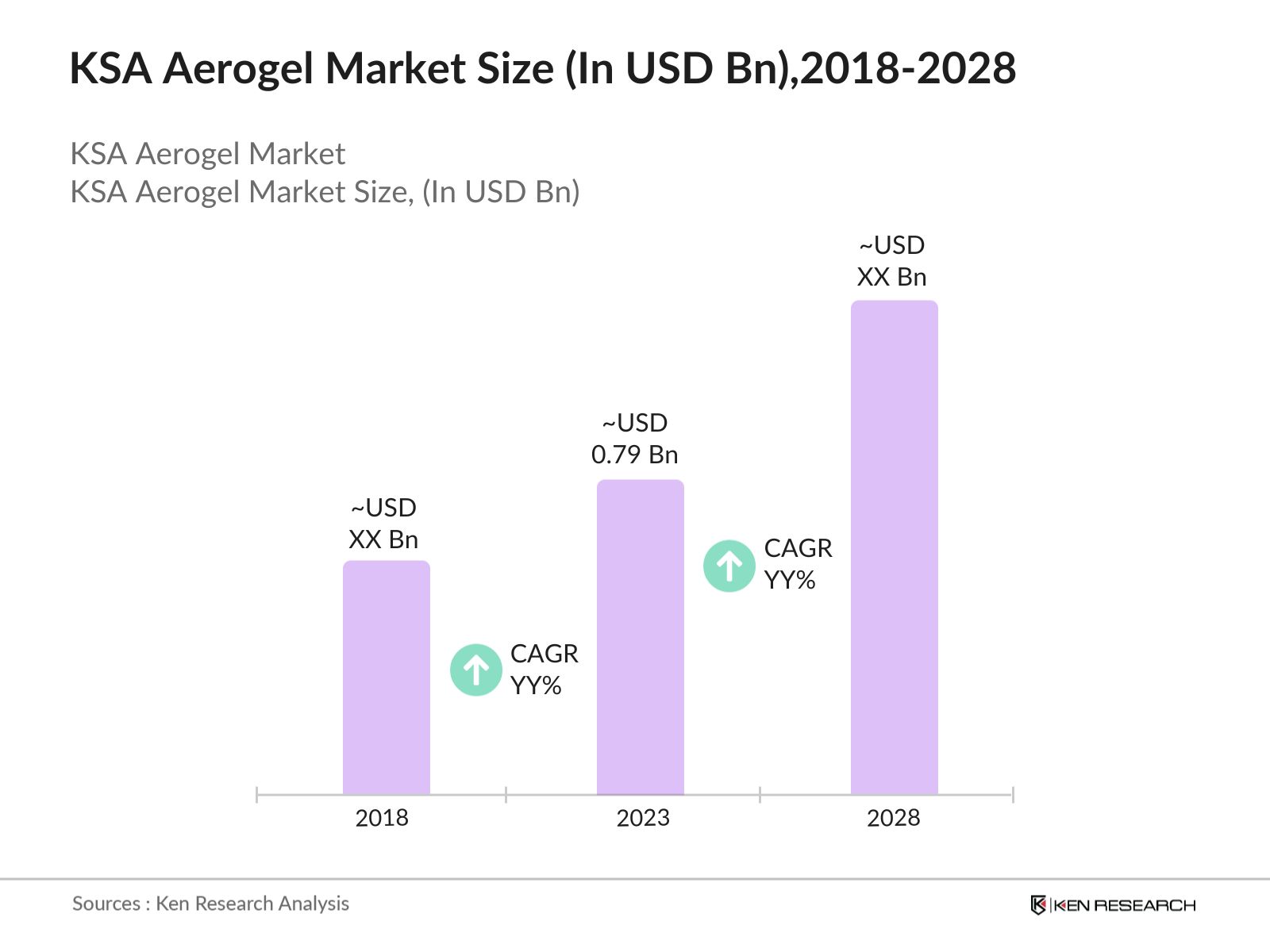

- The KSA Aerogel Market has shown growth from 2018 to 2023. The global aerogel market size was USD 0.79 billion in 2023. The adoption of aerogel in construction, oil & gas, and automotive sectors further propels the market.

- Leading players in the KSA Aerogel market include Aspen Aerogels, Cabot Corporation, and Aerogel Technologies. These companies are at the forefront of adopting innovative technologies and expanding their production capacities.

- In 2023, Aspen Aerogels announced a strategic partnership with Saudi Aramco to enhance its technological capabilities and expand its market reach. This partnership aims to integrate advanced aerogel solutions into Saudi Aramco's operations, potentially increasing their energy efficiency by 15%. This collaboration is expected to set a new standard in the aerogel industry in KSA.

KSA Aerogel Current Market Analysis

- The aerogel market in KSA is experiencing robust growth, with silica aerogels emerging as the leading product segment. This dominance is attributed to the high efficiency of silica aerogels in thermal insulation, which makes them particularly suitable for construction and industrial applications. Silica aerogels can provide superior insulation properties, making them an attractive option for energy-saving projects.

- Thermal insulation products, including silica aerogels, are the top-selling products in KSA's aerogel market. These products are favored due to their superior thermal performance and high market demand in various industries. The ability to provide significant energy savings enhances their appeal. Thermal insulation aerogels are essential in many industrial processes and are sought after for their effectiveness and efficiency.

- The Eastern Province of Saudi Arabia is particularly dominant in the aerogel market, primarily due to the presence of a large number of oil and gas industries. The demand for high-performance insulation materials in this region is driven by the need to enhance energy efficiency in oil extraction and refining processes. In 2023, the Eastern Province accounted for 40% of the total aerogel market share, highlighting its significant contribution to the market.

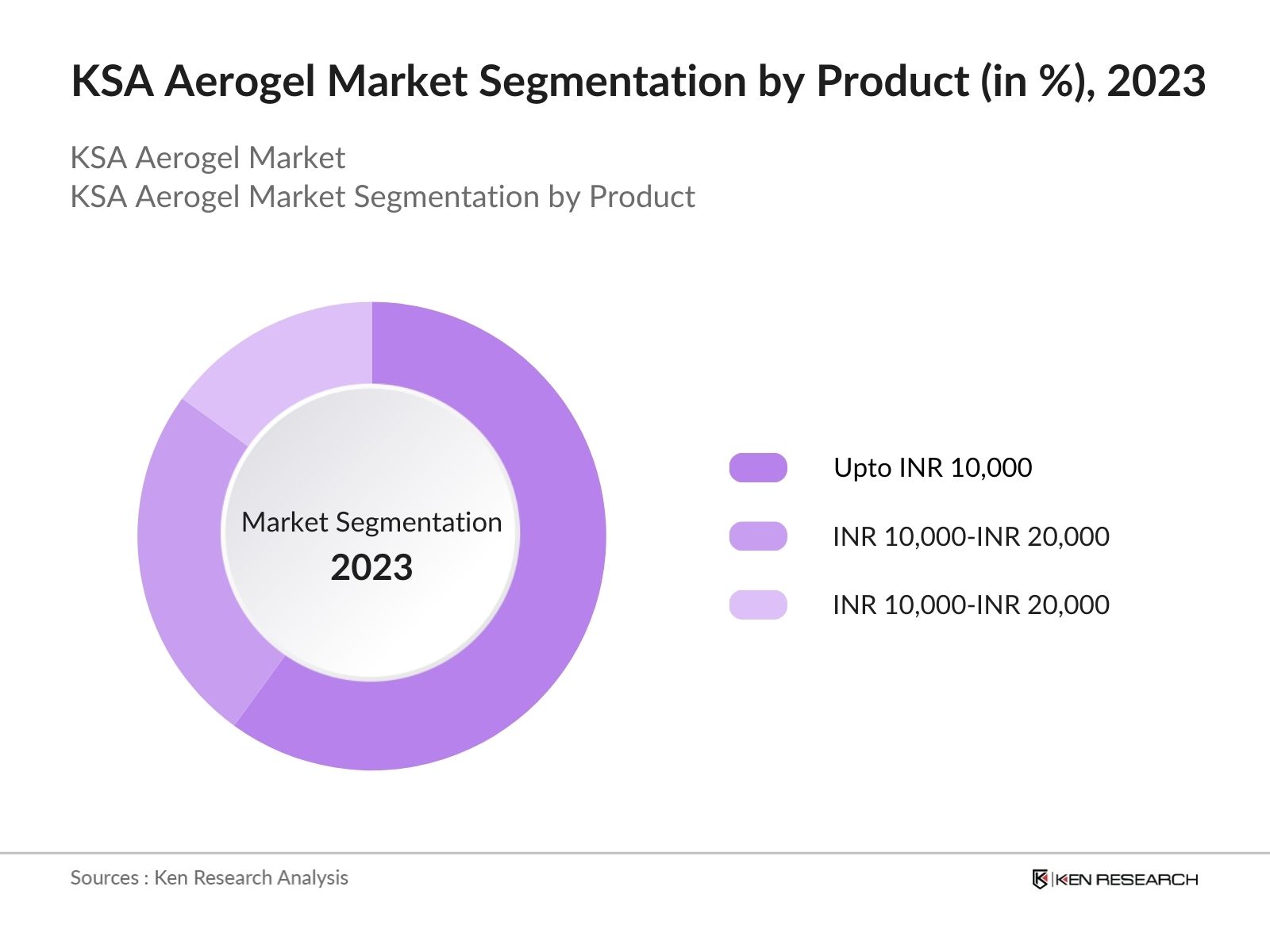

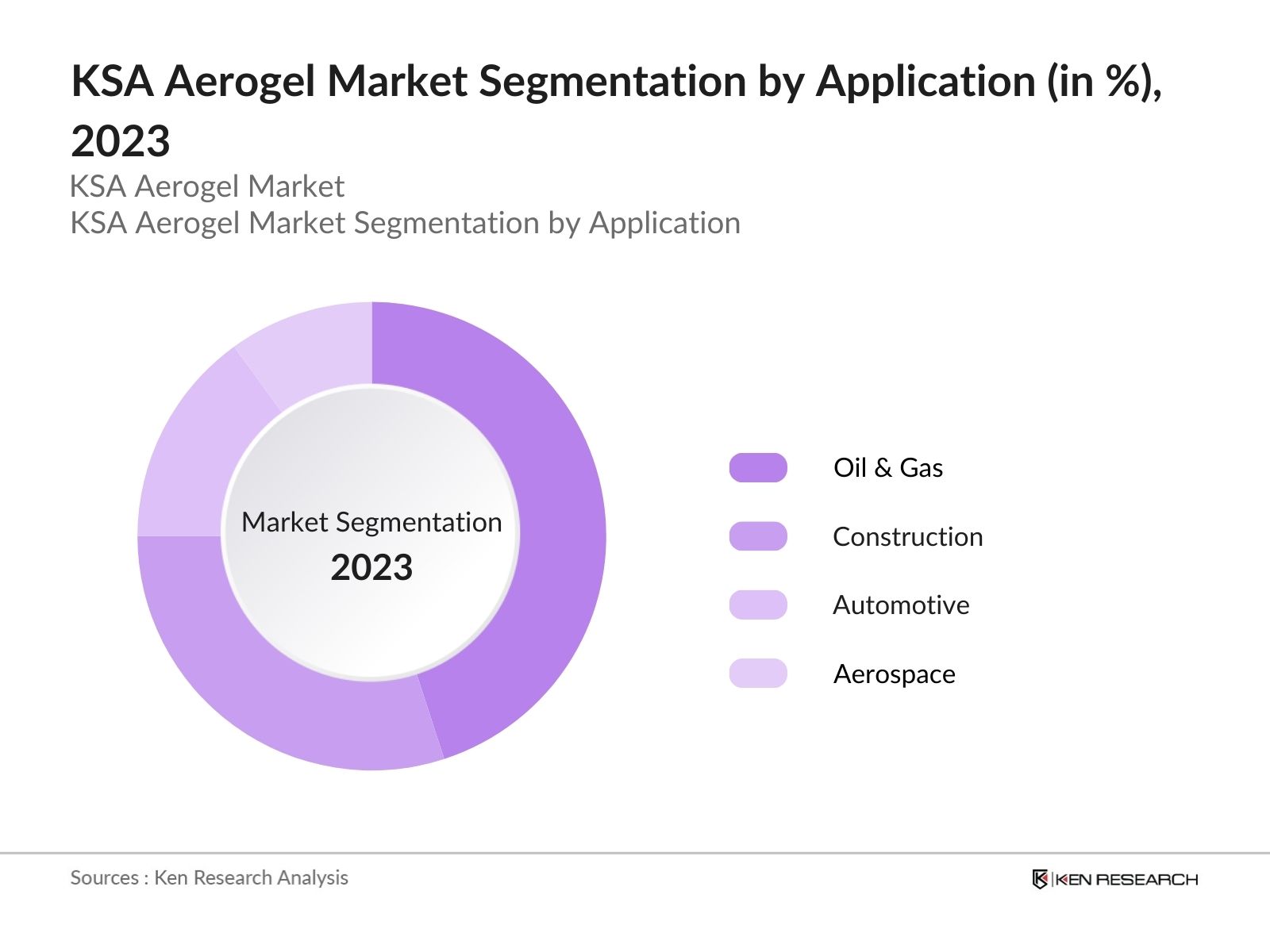

KSA Aerogel Market Segmentation

The KSA Aerogel Market can be segmented by various factors like Product, Application, and Region.

- By Product: The India molding machine market is segmented by product into Silica aerogels dominate due to their efficient thermal insulation properties, ideal for industrial and construction settings. Polymer aerogels offer flexibility and lightweight properties, making them suitable for niche applications. Carbon aerogels are known for their electrical conductivity and are used in specialized applications.

- By Application: The India molding machine market is segmented by application into Thermal insulation thrives in industrial environments, meeting high consumer demand for energy efficiency. Oil & gas applications are popular for their thermal management properties. Automotive applications benefit from advanced aerogel technologies. Construction applications such as building insulation also benefit from the high-performance properties of aerogels.

- By Region: The India molding machine market is segmented by region into Central KSA, including Riyadh, benefits from government initiatives and industrial innovation, with a focus on sustainable development. Eastern KSA, led by Dammam, dominates the market due to high industrialization and strong local demand for advanced insulation materials. Western KSA is growing thanks to investments in construction technology and a favorable industrial climate that supports diverse applications. Southern KSA is emerging in aerogel applications, focusing on sustainable practices and government initiatives to improve energy efficiency and reduce environmental impact.

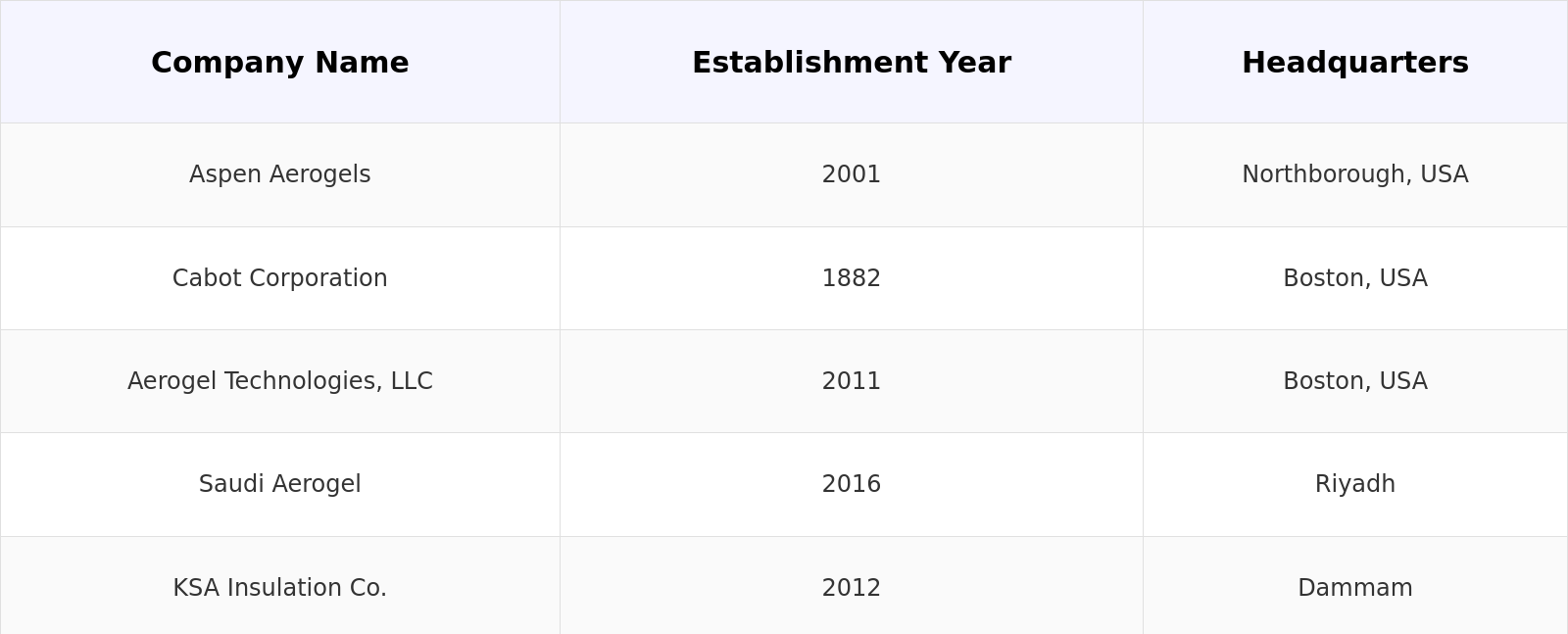

KSA Aerogel Market Competitive Landscape

- Aspen Aerogels: In 2023, Aspen Aerogels reported a 20% increase in production capacity due to the implementation of advanced manufacturing systems. This technological advancement has allowed them to produce a significant volume of aerogels, meeting the growing demand for high-performance insulation materials in industrial areas. Aspen Aerogels' strategic partnership with Saudi Aramco in 2023 aims to further enhance their technological capabilities and expand their market reach.

- Cabot Corporation: In 2022, Cabot Corporation invested USD 10 million in a new research facility dedicated to improving aerogel production technologies. This investment has led to innovations that increase production efficiency by 25%, positioning Cabot Corporation as a key player in the market.

- Aerogel Technologies: The company has gained popularity for its innovative aerogel products designed for industrial applications. In 2023, Aerogel Technologies introduced a new line of high-performance aerogels that saw a 30% increase in sales within the first six months of launch. These products are designed to be highly efficient and durable, allowing industrial consumers to achieve significant energy savings.

KSA Aerogel Industry Analysis

KSA Aerogel Market Growth Drivers

- Increased Demand in Oil and Gas Industry: The KSA aerogel market is experiencing `growth driven by the rising demand for insulation materials in the oil and gas industry. In 2023, Saudi Aramco invested USD 2 billion in advanced insulation technologies to improve energy efficiency in its operations. This investment is expected to drive the demand for aerogels, which offer superior thermal insulation properties, reducing energy consumption in oil extraction and refining processes.

- Construction Industry Expansion: The construction sector in Saudi Arabia is witnessing rapid growth, propelled by the Vision 2030 initiative. In 2024, the government allocated USD 30 billion for the development of new infrastructure projects, including residential, commercial, and industrial buildings. The superior insulation properties of aerogels make them ideal for these projects, driving their demand in the construction industry.

- Aerospace Industry Growth: The aerospace sector in Saudi Arabia is expanding, driven by increasing investments in advanced materials and technologies. In 2024, the government announced a USD 1 billion investment in the development of aerospace technologies. Aerogels, known for their lightweight and superior thermal insulation properties, are being adopted in various aerospace applications, driving market growth.

KSA Aerogel Market Challenges

- High Production Costs: One of the primary challenges facing the KSA aerogel market is the high production cost of aerogels. In 2023, the average production cost of aerogels was around USD 5,000 per cubic meter. This high cost limits their widespread adoption, particularly in cost-sensitive applications, posing a significant challenge for market growth.

- Technological Barriers: The production of aerogels involves complex manufacturing processes, which pose technological barriers to their adoption. In 2023, a report by the Saudi Industrial Development Fund highlighted that only a few companies had the technical expertise and infrastructure to produce high-quality aerogels. These technological barriers restrict market growth and limit the number of suppliers.

- Skilled Labor Shortage: The adoption of aerogel production technologies requires a workforce with specialized skills and knowledge in advanced manufacturing practices and technologies. However, there is a shortage of skilled labor in KSA capable of operating and managing these sophisticated systems.

KSA Aerogel Market Government Initiatives

- Subsidies and Grants (2021): The Saudi government introduced a series of subsidies and grants to promote the establishment of aerogel production facilities as part of its energy efficiency strategy. These financial incentives are designed to reduce the initial setup costs, which can be prohibitively high for many companies. By covering up to 50% of the setup costs, these subsidies make it more feasible for companies to invest in advanced aerogel production systems. These initiatives have resulted in a 20% increase in the number of aerogel production facilities established over the past two years.

- Saudi Energy Efficiency Program (SEEP): SEEP has introduced stringent regulations to promote energy efficiency in buildings and industrial processes. In 2023, the program allocated USD 10 million for the development and adoption of advanced insulation materials, including aerogels. This initiative is expected to boost the demand for aerogels in the construction and industrial sectors.

- National Industrial Development and Logistics Program (NIDLP): NIDLP aims to transform Saudi Arabia into a leading industrial powerhouse. In 2024, the program announced a USD 50 million investment in the development of advanced materials, including aerogels, to enhance the competitiveness of the Saudi industrial sector. This investment is expected to drive innovation and market growth.

KSA Aerogel Market Future Outlook

The KSA Aerogel Market is expected to continue its growth in the coming years. The market is also expected to see a shift towards more organized production, with established players and innovative technologies expanding their reach.

Future Market Trends

- Increased Adoption in Construction: Over the next five years, the adoption of aerogels in the construction sector is expected to increase significantly. With the government's focus on sustainable infrastructure, aerogels will play a crucial role in enhancing the energy efficiency of buildings. By 2028, it is estimated that the demand for aerogels in the construction sector will reach 15,000 tons annually, driven by ongoing and new infrastructure projects.

- Technological Advancements: Technological advancements will continue to drive the development of high-performance aerogels. Innovations in production processes are expected to reduce costs and enhance the properties of aerogels. By 2028, the production cost of aerogels is projected to decrease by 30%, making them more competitive with traditional insulation materials.

Scope of the Report

|

By Product |

Silica Aerogels Polymer Aerogels Carbon Aerogels |

|

By Application |

Oil & Gas Construction Automotive Aerospace |

|

By Region |

North South East West |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

Government agencies (e.g., Saudi Energy Efficiency Center)

Oil and gas companies

Construction firms

Aerospace companies

Insulation material suppliers

Environmental agencies

Energy efficiency consultancies

Industrial manufacturers

Chemical companies

Time Period Captured in the Report

- Historical Period: 2018-2023

- Base Year: 2023

- Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Aspen Aerogels

Cabot Corporation

Aerogel Technologies

Saudi Aerogel

KSA Insulation Co.

Advanced Insulation Solutions

ThermalGuard KSA

EcoAerogels

GreenTech Insulation

Superior Aerogels

Insulation Masters

Ultra Insulation Co.

AeroTherm KSA

Thermal Innovations

Table of Contents

1. KSA Aerogel Market Overview

1.1 KSA Aerogel Market Taxonomy

2. KSA Aerogel Market Size (in USD Bn), 2018-2023

3. KSA Aerogel Market Analysis

3.1 KSA Aerogel Market Growth Drivers

3.2 KSA Aerogel Market Challenges and Issues

3.3 KSA Aerogel Market Trends and Development

3.4 KSA Aerogel Market Government Regulation

3.5 KSA Aerogel Market SWOT Analysis

3.6 KSA Aerogel Market Stake Ecosystem

3.7 KSA Aerogel Market Competition Ecosystem

4. KSA Aerogel Market Segmentation, 2023

4.1 KSA Aerogel Market Segmentation by Product (in %), 2023

4.2 KSA Aerogel Market Segmentation by Application (in %), 2023

4.3 KSA Aerogel Market Segmentation by Region (in %), 2023

5. KSA Aerogel Market Competition Benchmarking

5.1 KSA Aerogel Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial

parameters and advanced analytics)

6. KSA Aerogel Future Market Size (in USD Bn), 2023-2028

7. KSA Aerogel Future Market Segmentation, 2028

7.1 KSA Aerogel Market Segmentation by Product (in %), 2028

7.2 KSA Aerogel Market Segmentation by Application (in %), 2028

7.3 KSA Aerogel Market Segmentation by Region (in %), 2028

8. KSA Aerogel Market Analysts’ Recommendations

8.1 KSA Aerogel Market TAM/SAM/SOM Analysis

8.2 KSA Aerogel Market Customer Cohort Analysis

8.3 KSA Aerogel Market Marketing Initiatives

8.4 KSA Aerogel Market White Space Opportunity Analysis

Disclaimer

Contact UsResearch Methodology

Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around the market to collate industry-level information.

Market Building:

Collating statistics on the KSA Aerogel Market over the years, penetration of marketplaces, and service providers ratio to compute revenue generated for the KSA Aerogel Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Validating and Finalizing:

Building market hypotheses and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Research Output:

Our team will approach multiple Aerogel companies and understand the nature of product segments and sales, consumer preference, and other parameters, which will support us in validating statistics derived through bottom to top approach from Aerogel companies.

Frequently Asked Questions

01 What was the size of the KSA Aerogel market in 2023?

The Global Aerogel market was valued at USD 0.79 billion in 2023, driven by increasing demand for advanced insulation materials and energy-efficient solutions.

02 Who are the leading players in the KSA Aerogel market?

The KSA Aerogel Market leading players include Aspen Aerogels, Cabot Corporation, and Aerogel Technologies, which are at the forefront of adopting innovative technologies and expanding their production capacities.

03 What significant development occurred in the KSA Aerogel market in 2023?

In 2023, Aspen Aerogels announced a strategic partnership with Saudi Aramco to enhance its technological capabilities and expand its market reach. This partnership aims to integrate advanced aerogel solutions into Saudi Aramco's operations, potentially increasing their energy efficiency by 15%.

04 What are the current trends in the KSA Aerogel market?

Current trends include a surge in demand for high-performance insulation materials, particularly in industrial sectors, driven by the need for energy-efficient solutions and advanced technologies.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.