KSA Agricultural Equipment Market Outlook to 2030

Region:Middle East

Author(s):Sanjna

Product Code:KROD8727

December 2024

128

About the Report

KSA Agricultural Equipment Market Overview

- The KSA Agricultural Equipment market is valued at USD 280 million, based on a comprehensive analysis of the past five years. The market is primarily driven by increasing investments in modern agricultural practices and a strong focus on food security within the Kingdom. Government initiatives, such as Vision 2030, aim to increase local agricultural production, thus driving the demand for advanced equipment such as tractors, irrigation systems, and harvesting machinery.

- Riyadh and Jeddah are dominant regions within the KSA agricultural equipment market due to their strategic positioning, robust infrastructure, and higher concentration of large-scale farming activities. These cities serve as key agricultural hubs, with easy access to both local and international equipment suppliers. The government's focused agricultural expansion programs in these regions, coupled with favorable climatic conditions, have contributed to their dominance in the market.

- The Saudi government enforces strict censorship policies to ensure that gaming content aligns with the cultural and religious values of the country. In 2024, the General Commission for Audiovisual Media (GCAM) reviewed over 300 new game titles, of which 40 were either banned or had content modified. These regulations primarily target violent or morally ambiguous content and ensure that games released in Saudi Arabia adhere to national guidelines. This regulatory framework is aimed at maintaining cultural sensitivity in the entertainment sector.

KSA Agricultural Equipment Market Segmentation

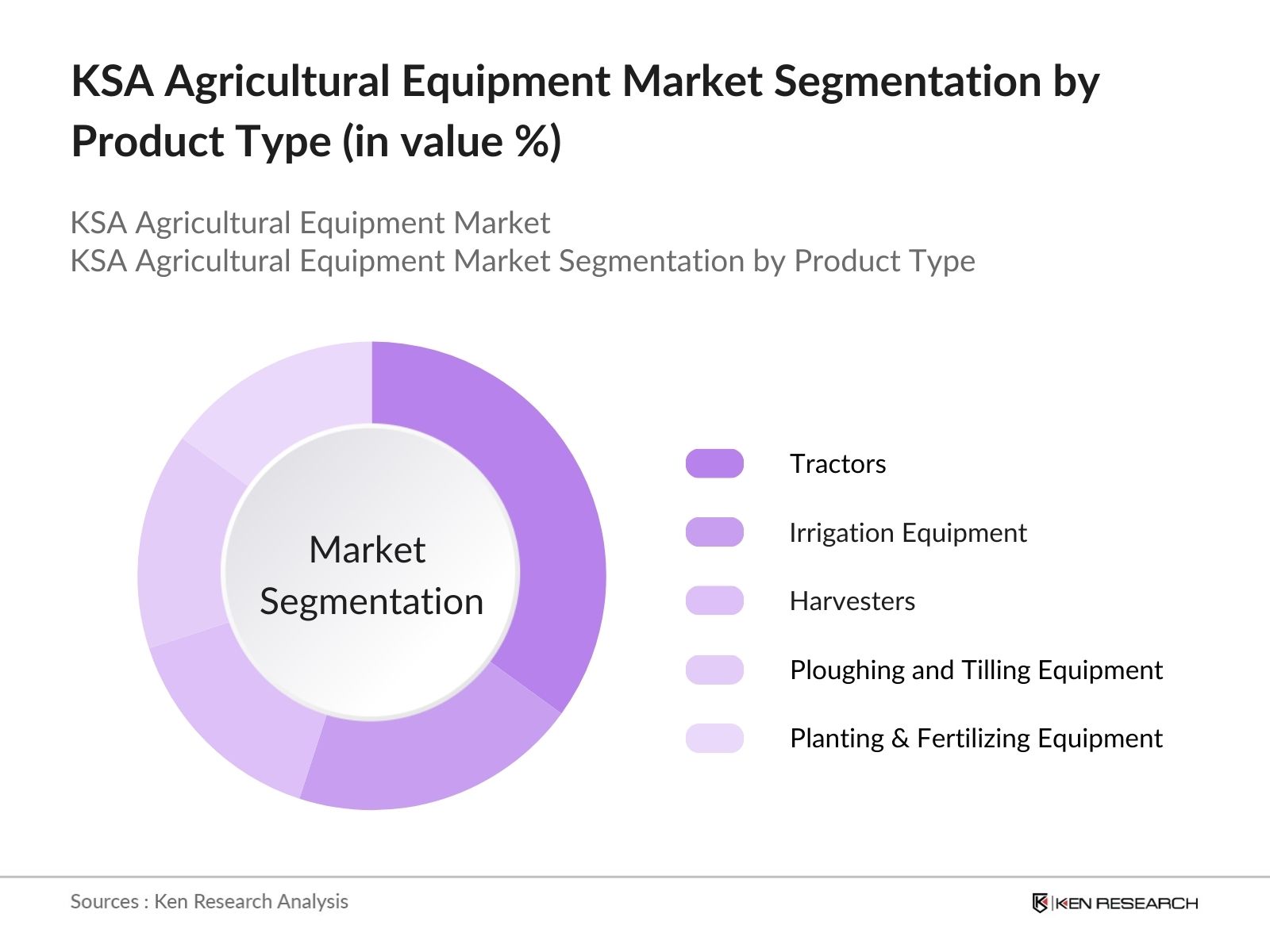

By Equipment Type: The KSA Agricultural Equipment market is segmented by equipment type into tractors, irrigation equipment, harvesters, ploughing and tilling equipment, and planting and fertilizing equipment. Recently, tractors have captured a dominant market share due to their versatility and essential role in various agricultural operations such as plowing, planting, and harvesting. The rising adoption of mechanized farming practices across the Kingdom has led to a surge in tractor sales, especially as farms modernize to improve efficiency.

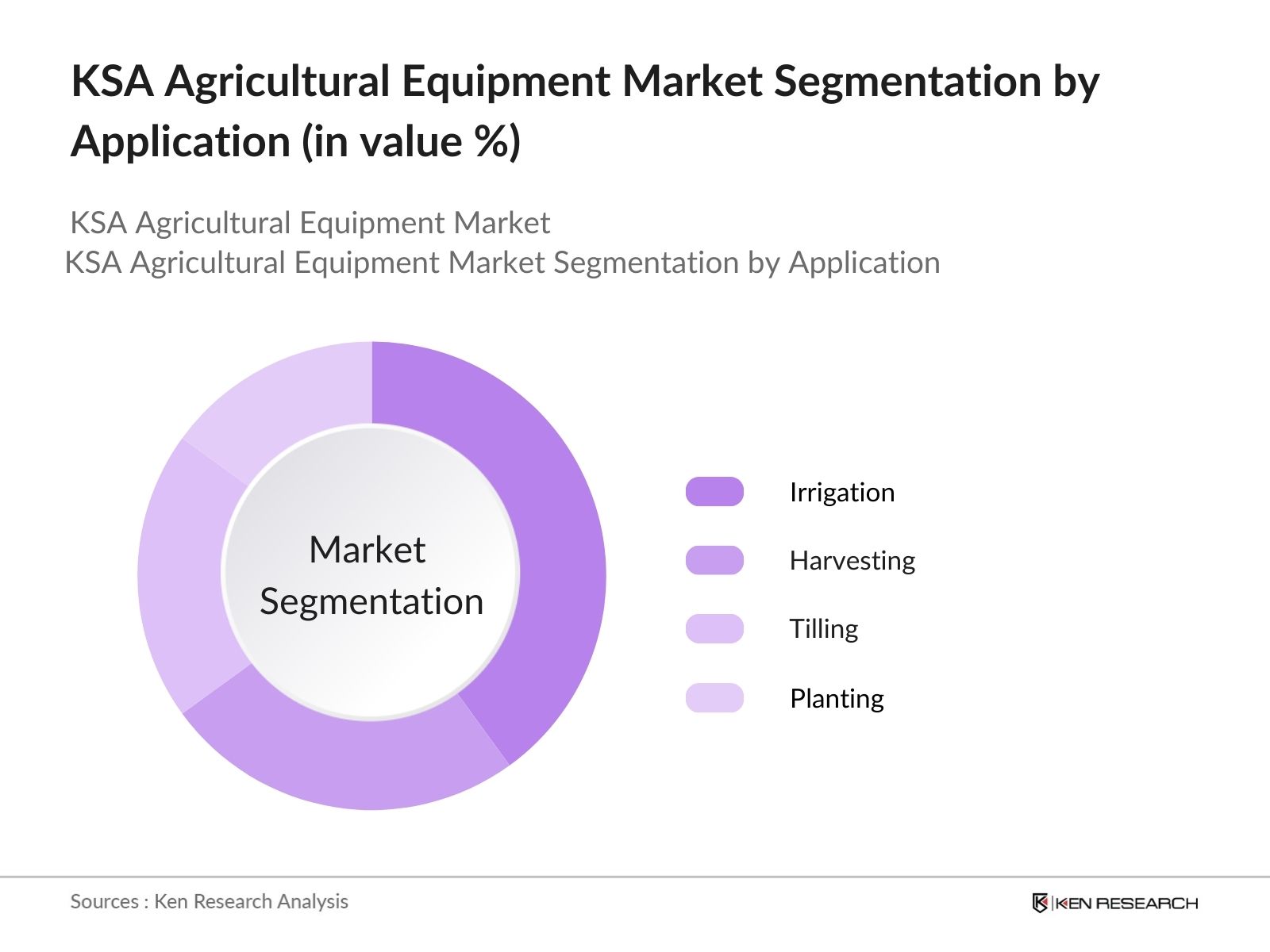

By Application: The market is also segmented by application into irrigation, harvesting, tilling, and planting. Irrigation has emerged as a key segment due to the Kingdom's arid environment and the need for efficient water management systems. The Saudi government has been investing heavily in irrigation technologies to combat water scarcity and ensure sustainable agricultural practices, which has led to the dominance of irrigation equipment in this category.

KSA Agricultural Equipment Market Competitive Landscape

The KSA Agricultural Equipment market is dominated by both global and local players, with companies competing on the basis of technological advancements, product reliability, and after-sales services. Major international brands have a strong foothold in the market due to their extensive product portfolios and superior technology. Local companies are increasingly collaborating with global players to bring advanced machinery into the market.

KSA Agricultural Equipment Market Analysis

Growth Drivers

- Rising Gamer Population: The gamer population in Saudi Arabia has seen a rapid increase due to the young demographic makeup, where more than 67% of the population is under 35 years old. As of 2024, approximately 23 million active gamers are reported in Saudi Arabia, contributing to the virtual gaming market's expansion. The growing digital literacy and access to gaming platforms have driven this surge. With more individuals engaging in gaming across various platforms, the virtual gaming market is set to grow steadily.

- Increasing Internet Penetration: Saudi Arabia has one of the highest internet penetration rates in the Middle East, with over 96% of the population connected to the internet by 2024. This level of connectivity facilitates seamless gaming experiences and has boosted the adoption of online multiplayer games. The country has invested heavily in its digital infrastructure, with approximately 30,000 km of fiber optics laid out to ensure broader internet coverage.

- Government Support and Initiatives: Under Saudi Vision 2030, the government is committed to diversifying the economy and positioning the Kingdom as a regional hub for digital entertainment, including gaming. Initiatives such as the establishment of the Saudi Esports Federation have created a structured ecosystem for competitive gaming, attracting international events like the Gamers8 festival, which drew over 1.5 million attendees in 2023. Government-backed funds, such as the Saudi Fund for Development, are also supporting startups and companies involved in gaming technologies.

Challenges

- High Cost of VR/AR Gaming Systems: The initial investment required for setting up VR/AR gaming systems remains high, despite technological advancements. As of 2024, the average cost of a high-quality VR setup in Saudi Arabia, including the necessary hardware and accessories, is around USD 1,3301,729. This price range is a major deterrent for the mass adoption of VR gaming systems. Furthermore, the lack of local manufacturing and the reliance on imported technology drives prices upward due to import duties and logistics costs.

- Limited Localized Content: While there has been a growth in Arabic-language gaming platforms, only about 10% of the available games in the virtual gaming space are localized for the region. This limits the appeal of many international titles, which may not align with the cultural and religious values of Saudi society. Furthermore, local game developers face challenges in scaling up due to limited funding and skill shortages in specialized areas like game design and development.

KSA Agricultural Equipment Market Future Outlook

KSA Agricultural Equipment market is expected to witness significant growth driven by ongoing government initiatives to modernize agriculture, the increasing need for sustainable farming practices, and the growing adoption of smart farming technologies. The emphasis on achieving food security through enhanced agricultural productivity will further fuel demand for advanced equipment. As technology continues to evolve, equipment integrating IoT, robotics, and AI for precision farming will become more prevalent, contributing to the expansion of the market.

Market Opportunities

- Growth in Esports and Competitive Gaming: Saudi Arabia has emerged as a key player in the global esports arena. With over 1.5 million esports enthusiasts in 2023, the Kingdom is poised to be a hub for competitive gaming in the region. The prize pool for the Gamers8 festival in Riyadh reached USD 12 million in 2023, attracting top international teams and players. This increasing popularity of esports is opening up investment opportunities for infrastructure, sponsorship, and local game development to cater to this growing community.

- Increasing Adoption of Virtual Learning and Training Platforms: Beyond entertainment, virtual gaming systems in Saudi Arabia are increasingly being used for educational and training purposes. In 2024, nearly 600 educational institutions and corporate training centers have integrated VR/AR solutions for immersive learning experiences. This trend is particularly prominent in sectors like healthcare, where VR is used for medical training and simulations.

Scope of the Report

|

Segment |

Subsegments |

|

Equipment Type |

Tractors Harvesters Irrigation Equipment Ploughing and Tilling Equipment Planting and Fertilizing Equipment |

|

Power Output |

Low Power Equipment Medium Power Equipment High Power Equipment |

|

Drive Type |

Two-Wheel Drive Four-Wheel Drive |

|

Application |

Irrigation Harvesting Tilling Planting |

|

Region |

Riyadh Jeddah Dammam Other Regions |

Products

Key Target Audience

Agricultural Equipment Manufacturers

Distributors and Suppliers of Agricultural Machinery

Large-Scale Farm Owners and Agribusinesses

Government and Regulatory Bodies (e.g., Ministry of Environment, Water, and Agriculture)

Investors and Venture Capitalist Firms

Agricultural Cooperatives and Farmer Associations

Technology Providers for Precision Farming

Research and Development Institutes Focused on Agritech

Companies

Players Mentioned in the Report:

John Deere

CNH Industrial

Kubota Corporation

Mahindra & Mahindra Ltd.

CLAAS Group

AGCO Corporation

SDF Group

Yanmar Co., Ltd.

Iseki & Co., Ltd.

New Holland Agriculture

Table of Contents

1. KSA Agricultural Equipment Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. KSA Agricultural Equipment Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. KSA Agricultural Equipment Market Analysis

3.1 Growth Drivers (e.g., Government Support Programs, Agricultural Modernization)

3.1.1 Government Agricultural Policies

3.1.2 Increasing Mechanization of Agriculture

3.1.3 Shift to Sustainable Agriculture

3.2 Market Challenges (e.g., High Cost of Equipment, Water Scarcity Issues)

3.2.1 High Initial Investment

3.2.2 Maintenance and Technical Expertise Shortage

3.3 Opportunities (e.g., Precision Farming, Smart Farming Initiatives)

3.3.1 Growing Adoption of IoT and AI in Agriculture

3.3.2 Rise in Agritech Startups

3.4 Trends (e.g., Use of Drones in Agriculture, Data-driven Farming)

3.4.1 Integration of Drones and Satellite Imaging

3.4.2 Robotics in Agricultural Practices

3.5 Government Regulation (e.g., Import Tariffs, Subsidy Programs)

3.5.1 National Agricultural Development Strategy

3.5.2 Government Subsidies for Equipment Purchase

3.6 SWOT Analysis

3.7 Stake Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competition Ecosystem

4. KSA Agricultural Equipment Market Segmentation

4.1 By Equipment Type (In Value %)

4.1.1 Tractors

4.1.2 Harvesters

4.1.3 Irrigation Equipment

4.1.4 Ploughing and Tilling Equipment

4.1.5 Planting and Fertilizing Equipment

4.2 By Power Output (In Value %)

4.2.1 Low Power Equipment

4.2.2 Medium Power Equipment

4.2.3 High Power Equipment

4.3 By Drive Type (In Value %)

4.3.1 Two-Wheel Drive

4.3.2 Four-Wheel Drive

4.4 By Application (In Value %)

4.4.1 Irrigation

4.4.2 Harvesting

4.4.3 Tilling

4.4.4 Planting

4.5 By Region (In Value %)

4.5.1 Riyadh

4.5.2 Jeddah

4.5.3 Dammam

4.5.4 Other Regions

5. KSA Agricultural Equipment Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 John Deere

5.1.2 CNH Industrial

5.1.3 Kubota Corporation

5.1.4 AGCO Corporation

5.1.5 Mahindra & Mahindra Ltd.

5.1.6 CLAAS Group

5.1.7 Yanmar Co., Ltd.

5.1.8 SDF Group

5.1.9 Iseki & Co., Ltd.

5.1.10 New Holland Agriculture

5.2 Cross Comparison Parameters (No. of Employees, Market Presence, Technology Adoption, Product Portfolio, Revenue, Market Share, Strategic Initiatives, Innovation Index)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Joint Ventures and Collaborations

6. KSA Agricultural Equipment Market Regulatory Framework

6.1 Environmental Regulations

6.2 Compliance Requirements

6.3 Subsidy and Incentive Programs

6.4 Certification Processes

7. KSA Agricultural Equipment Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. KSA Agricultural Equipment Future Market Segmentation

8.1 By Equipment Type (In Value %)

8.2 By Power Output (In Value %)

8.3 By Drive Type (In Value %)

8.4 By Application (In Value %)

8.5 By Region (In Value %)

9. KSA Agricultural Equipment Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Strategies

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial step involved mapping all key stakeholders within the KSA Agricultural Equipment Market. Secondary research from proprietary databases and industry publications was conducted to identify critical variables affecting the market.

Step 2: Market Analysis and Construction

Historical data from 2018 onwards was analyzed to assess trends in market size, product penetration, and equipment adoption rates. This data was cross-verified using multiple sources to ensure reliability.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts were consulted to validate the identified trends and market projections. These experts provided insights into the future market trajectory and the impact of government policies on the markets growth.

Step 4: Research Synthesis and Final Output

After hypothesis validation, data from various stakeholders were synthesized to provide an accurate representation of the market. This phase also included interviews with leading manufacturers to corroborate data and gain deeper insights into market dynamics.

Frequently Asked Questions

01. How big is the KSA Agricultural Equipment Market?

The KSA Agricultural Equipment market is valued at USD 280 million, primarily driven by government investments in agricultural modernization and the increasing adoption of mechanized farming.

02. What are the challenges in the KSA Agricultural Equipment Market?

Challenges in KSA Agricultural Equipment Market include high initial investment costs, water scarcity issues affecting crop productivity, and a lack of skilled labor to operate advanced machinery.

03. Who are the major players in the KSA Agricultural Equipment Market?

Major players in KSA Agricultural Equipment Market include John Deere, CNH Industrial, Kubota Corporation, Mahindra & Mahindra, and CLAAS Group, all of whom have extensive product portfolios and significant market presence in the Kingdom.

04. What are the growth drivers of the KSA Agricultural Equipment Market?

Key drivers in KSA Agricultural Equipment Market include government support through Vision 2030, the push for food security, the rising adoption of precision farming technologies, and the growing focus on sustainable agricultural practices.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.