KSA Anime Market Outlook to 2030

Region:Middle East

Author(s):Meenakshi Bisht

Product Code:KROD5721

November 2024

83

About the Report

KSA Anime Market Overview

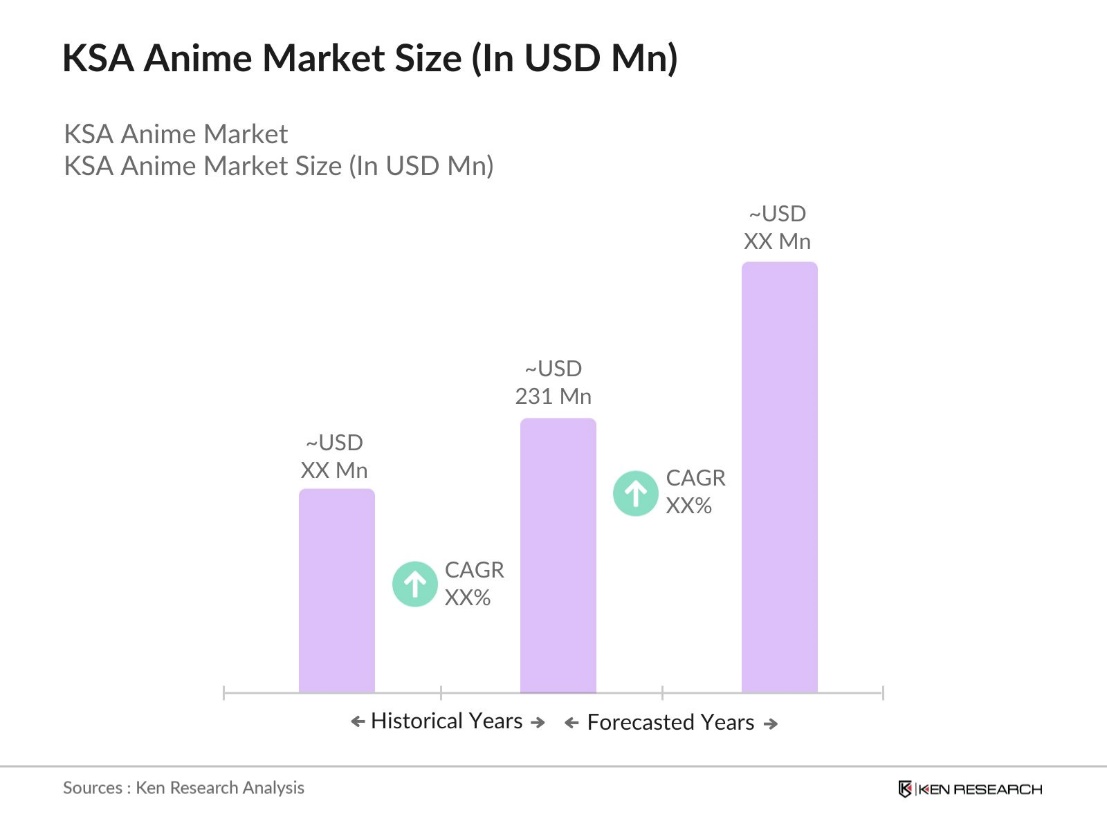

- The KSA Anime market is valued at USD 231 million, driven primarily by a growing youth population and increased internet penetration. With streaming platforms gaining popularity, anime has seen a surge in consumption, fueled by an increase in localized content. This growth is further supported by Saudi Arabias Vision 2030, which emphasizes expanding entertainment and cultural industries.

- The cities of Riyadh and Jeddah dominate the anime market in KSA due to their large urban populations and access to entertainment infrastructure. These regions have seen significant growth in anime conventions, retail sales, and community-driven events. Additionally, a higher concentration of streaming subscriptions and dedicated anime retail stores in these areas highlights their influence in the market.

- KSAs entertainment content laws govern imported and locally produced media, affecting anime distribution. Under the Media Content Act, foreign content must align with cultural values, impacting animes availability. The Ministry of Medias 2023 report indicated that over 40% of globally produced anime titles required revisions to meet local content standards, shaping anime accessibility.

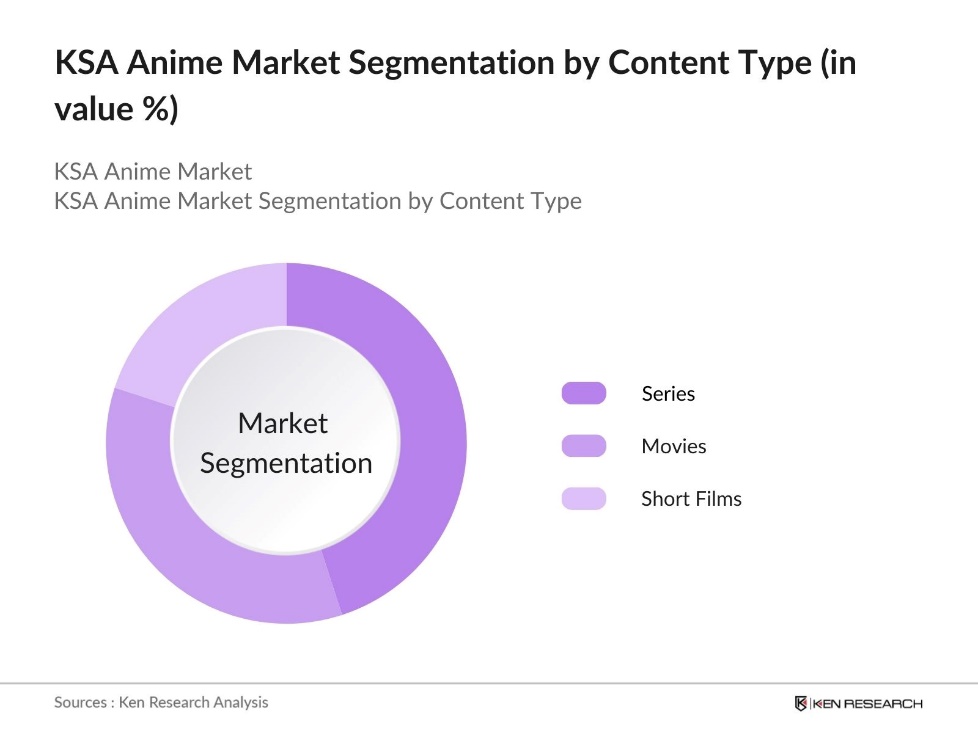

KSA Anime Market Segmentation

By Content Type: The market is segmented by content type into Series, Movies, and Short Films. Recently, Series hold a dominant market share, given their continuous storyline structure, which appeals to viewers looking for sustained engagement. The presence of globally acclaimed anime series available through OTT platforms has further bolstered their popularity among KSA audiences.

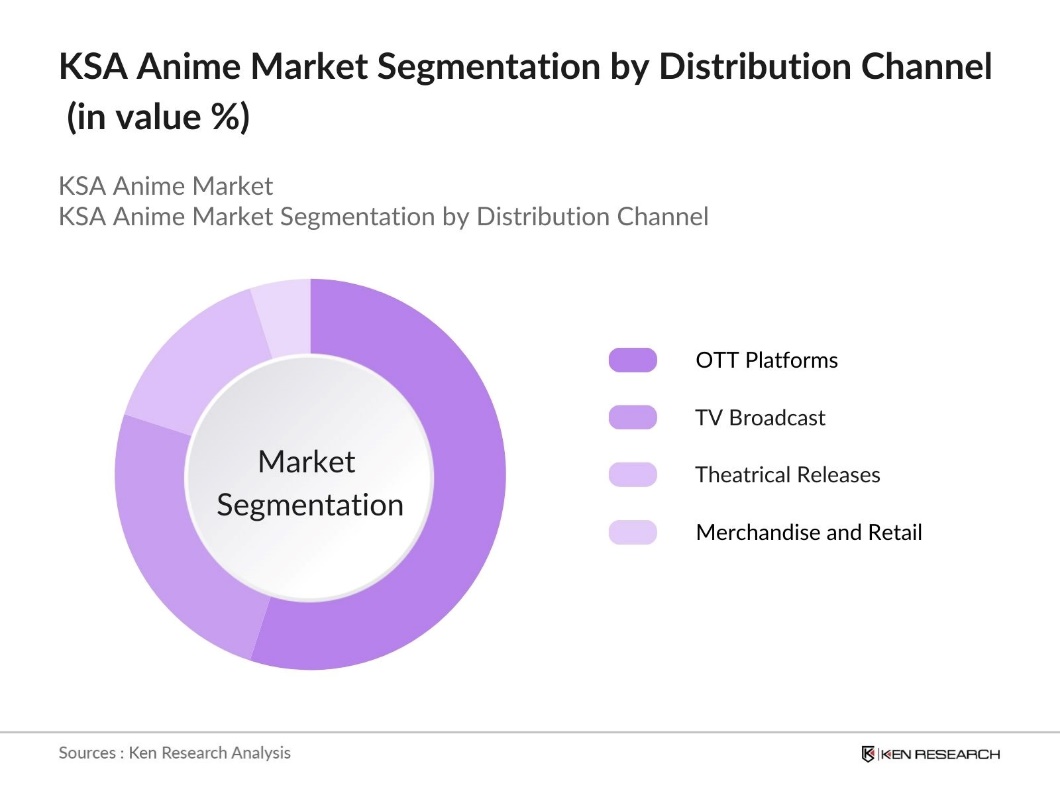

By Distribution Channel: The market is segmented by distribution channel into OTT Platforms, TV Broadcast, Theatrical Releases, and Merchandise and Retail. The OTT Platforms category leads the distribution channels due to the increasing preference for on-demand content. Platforms like Netflix and Crunchyroll offer exclusive anime content, which attracts a diverse viewer base eager for both dubbed and subtitled options.

KSA Anime Market Competitive Landscape

The KSA Anime market is dominated by a few major players, including global streaming giants and Japanese studios. These companies benefit from well-established distribution networks, exclusive content rights, and strategic partnerships with local entities.

KSA Anime Industry Analysis

Growth Drivers

- Increasing Youth Demand: Youth demand for anime content is driven by high internet penetration and a strong social media presence among young Saudis. For instance, a Pew Research Center survey indicates that 95% of U.S. teens (ages 13-17) reported using YouTube, and other platforms like TikTok and Instagram also have high usage rates among this demographic. This vibrant online culture boosts demand for anime content, youth respondents indicated a preference for video streaming as their primary source of entertainment.

- Supportive Government Initiatives: KSA's Vision 2030 actively encourages cultural diversification, including promoting anime and Japanese pop culture. Through initiatives like the Saudi-Japan Vision 2030, the Saudi government has fostered cultural exchange programs, leading to an increase in anime-related events and partnerships. In 2023, the Ministry of Culture announced collaborations with Japan to promote anime, demonstrating governmental support for expanding anime accessibility and integration within KSA.

- Expansion of OTT Platforms: The rise of OTT platforms in KSA has made anime more accessible, enhancing its popularity across varied demographics. Improved internet infrastructure, including extensive 5G coverage, enables smooth streaming, allowing audiences to explore a wide range of anime titles. The convenience and affordability of these platforms support a growing viewership, establishing anime as a key entertainment choice in the country.

Market Challenges

- Content Censorship and Regulations: In KSA, strict media regulations pose challenges for the anime market, as content often requires adaptation to align with local standards. These censorship requirements limit the direct import of anime titles, potentially impacting their availability and reach. As a result, certain anime content may face restricted access, influencing the genres overall growth and limiting the variety of anime offerings accessible to Saudi audiences.

- Limited Localized Content: A shortage of Arabic-dubbed or subtitled anime in KSA limits its accessibility, especially for non-English-speaking viewers. This lack of localized content means that anime primarily caters to English speakers or existing fans familiar with Japanese media. Expanding Arabic-language options would increase animes appeal, enhancing viewer engagement and drawing in a wider audience who may be interested but deterred by language barriers.

KSA Anime Market Future Outlook

Over the next five years, the KSA Anime market is expected to witness substantial growth, driven by cultural shifts, increased localization efforts, and a rising young population with access to digital platforms. Government support for entertainment diversification under Vision 2030, along with the popularity of anime as a global phenomenon, is anticipated to further fuel market expansion.

Market Opportunities

- Localization and Subtitling Services: The growing demand for Arabic subtitles and dubbing in KSA presents substantial potential for the anime market. Localizing anime content could bridge language barriers, making it more accessible to non-English-speaking audiences. This need for localized content encourages partnerships between Japanese studios and local agencies, which can enhance viewer engagement and expand animes reach across the country.

- Collaborative Projects with Japanese Studios: Collaborations between Saudi and Japanese studios offer unique opportunities to expand anime tailored for local audiences. Government-supported initiatives encourage such partnerships, allowing KSA to participate actively in anime production. These joint projects not only provide economic benefits but also create anime series that resonate culturally with Saudi viewers, strengthening KSAs position in the global anime industry.

Scope of the Report

|

By Content Type |

Series Movies Short Films |

|

By Distribution Channel |

OTT Platforms TV Broadcast Theatrical Releases Merchandise and Retail |

|

By Genre |

Action Fantasy Romance Sci-Fi Horror |

|

By Audience Demographics |

Teenagers Young Adults Adults Families |

|

By Merchandise Type |

Apparel Toys and Collectibles Posters and Accessories Manga and Light Novels |

Products

Key Target Audience

OTT and Streaming Platforms

Animation Studios Companies

Retail and Merchandising Companies

Local Event Organizers and Promoters

Advertising Agencies Industry

Anime Fandom Communities

Government and Regulatory Bodies (General Authority for Audiovisual Media, Ministry of Culture)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Netflix, Inc.

Crunchyroll, LLC

Amazon Prime Video

Funimation

Aniplex of America

Bandai Namco Holdings Inc.

Viz Media, LLC

Toei Animation Co., Ltd.

Studio Ghibli

Sunrise Inc.

Table of Contents

1. KSA Anime Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. KSA Anime Market Size (In USB Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. KSA Anime Market Analysis

3.1. Growth Drivers

3.1.1. Cultural Shift and Rising Popularity of Anime

3.1.2. Expansion of OTT Platforms

3.1.3. Increasing Youth Demand

3.1.4. Supportive Government Initiatives

3.2. Market Challenges

3.2.1. Content Censorship and Regulations

3.2.2. Limited Localized Content

3.2.3. High Import Costs

3.3. Opportunities

3.3.1. Localization and Subtitling Services

3.3.2. Collaborative Projects with Japanese Studios

3.3.3. Merchandising and Licensing Opportunities

3.4. Trends

3.4.1. Rise in Anime Conventions and Fandom Events

3.4.2. Integration of Anime in KSA Gaming Culture

3.4.3. Increased Female Audience Participation

3.5. Regulatory Analysis

3.5.1. KSA Entertainment Content Laws

3.5.2. Import and Distribution Regulations

3.5.3. Guidelines for Streaming Services

3.6. SWOT Analysis

3.7. Value Chain Analysis

3.7.1. Content Creation and Production

3.7.2. Licensing and Distribution

3.7.3. Merchandising Channels

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. KSA Anime Market Segmentation

4.1. By Content Type (In Value %)

4.1.1. Series

4.1.2. Movies

4.1.3. Short Films

4.2. By Distribution Channel (In Value %)

4.2.1. OTT Platforms

4.2.2. TV Broadcast

4.2.3. Theatrical Releases

4.2.4. Merchandise and Retail

4.3. By Genre (In Value %)

4.3.1. Action

4.3.2. Fantasy

4.3.3. Romance

4.3.4. Sci-Fi

4.3.5. Horror

4.4. By Audience Demographics (In Value %)

4.4.1. Teenagers

4.4.2. Young Adults

4.4.3. Adults

4.4.4. Families

4.5. By Merchandise Type (In Value %)

4.5.1. Apparel

4.5.2. Toys and Collectibles

4.5.3. Posters and Accessories

4.5.4. Manga and Light Novels

5. KSA Anime Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Netflix, Inc.

5.1.2. Crunchyroll, LLC

5.1.3. Amazon Prime Video

5.1.4. MyAnimeList, Co. Ltd.

5.1.5. Viz Media, LLC

5.1.6. Bandai Namco Holdings Inc.

5.1.7. Aniplex of America Inc.

5.1.8. Funimation Productions, LLC

5.1.9. Toei Animation Co., Ltd.

5.1.10. Madhouse Inc.

5.1.11. Studio Ghibli

5.1.12. Sunrise Inc.

5.1.13. TMS Entertainment Co., Ltd.

5.1.14. Sentai Filmworks

5.1.15. MAPPA Co., Ltd.

5.2. Cross Comparison Parameters (No. of Subscribers, Monthly Active Users, Average Watch Time, Revenue from KSA, Merchandise Sales, Content Localization, Distribution Network, OTT Partnership)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Partnerships and Support

6. KSA Anime Market Regulatory Framework

6.1. Content Production and Distribution Guidelines

6.2. Import Licensing Requirements

6.3. Censorship and Rating Standards

7. KSA Anime Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. KSA Anime Future Market Segmentation

8.1. By Content Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Genre (In Value %)

8.4. By Audience Demographics (In Value %)

8.5. By Merchandise Type (In Value %)

9. KSA Anime Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Marketing and Content Strategy Recommendations

9.3. Collaborative Opportunities with Regional Studios

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This step involves mapping all primary stakeholders within the KSA Anime Market. The aim is to identify critical variables that affect market dynamics, utilizing comprehensive secondary research and proprietary databases.

Step 2: Market Analysis and Construction

In this phase, we assess historical data related to KSA's anime consumption, analyzing revenue sources and determining key content providers. Additionally, the ratio of OTT to traditional media consumption is evaluated.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through direct interviews with KSA-based industry experts, providing valuable operational and financial insights that enhance the reliability of market data.

Step 4: Research Synthesis and Final Output

The final phase entails collaboration with multiple anime distribution and retail companies to confirm market segmentation and consumption patterns. This step ensures a validated analysis with insights from bottom-up approaches.

Frequently Asked Questions

01. How big is the KSA Anime Market?

The KSA Anime market, valued at USD 231 million, is supported by a youth-driven demand, increased internet penetration, and the expansion of OTT platforms, making it one of the fastest-growing entertainment segments in Saudi Arabia.

02. What are the challenges in the KSA Anime Market?

Challenges include regulatory limitations on content, high import costs, and limited locally produced anime content. Additionally, piracy and content licensing restrictions present obstacles for growth.

03. Who are the major players in the KSA Anime Market?

Key players include Netflix, Crunchyroll, Amazon Prime Video, Funimation, and Aniplex. These companies benefit from established digital distribution networks and exclusive anime rights.

04. What are the growth drivers of the KSA Anime Market?

The market is driven by cultural shifts, increased youth interest, and support from Vision 2030 initiatives. OTT platforms and the availability of dubbed/subtitled content have also accelerated market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.