KSA Armored Car Market Outlook to 2030

Region:Middle East

Author(s):Mukul

Product Code:KROD729

October 2024

80

About the Report

KSA Armored Car Market Overview

- The KSA Armored Car Market has experienced substantial growth, this is reflected by the global Armored Car Market reached a valuation of USD 22.24 billion in 2023. driven by increased security concerns, expansion of the banking sector, and the growing private security industry. The rising demand for secure transportation of valuables and VIPs has further fueled market growth.

- Key Players in the KSA armored car market include INKAS Armored Vehicle Manufacturing, Streit Group, Centigon Security Group, Armormax, and Alpine Armoring Inc. These companies dominate the market due to their advanced production techniques, extensive supply chains, and robust distribution networks.

- Riyadh leads the KSA armored car market, owing to its status as the financial hub of the country. The city's dominance is attributed to the presence of numerous banks, financial institutions, and high-value assets requiring secure transportation. Additionally, several armored vehicle manufacturers and service providers are based in Riyadh.

- In 2023, INKAS Armored Vehicle Manufacturing reported a substantial increase in revenue, reaching $50 million, with a notable 12% rise in net profit. This success is supported by strategic global partnerships and investments in advanced manufacturing facilities.

KSA Armored Car Market Segmentation

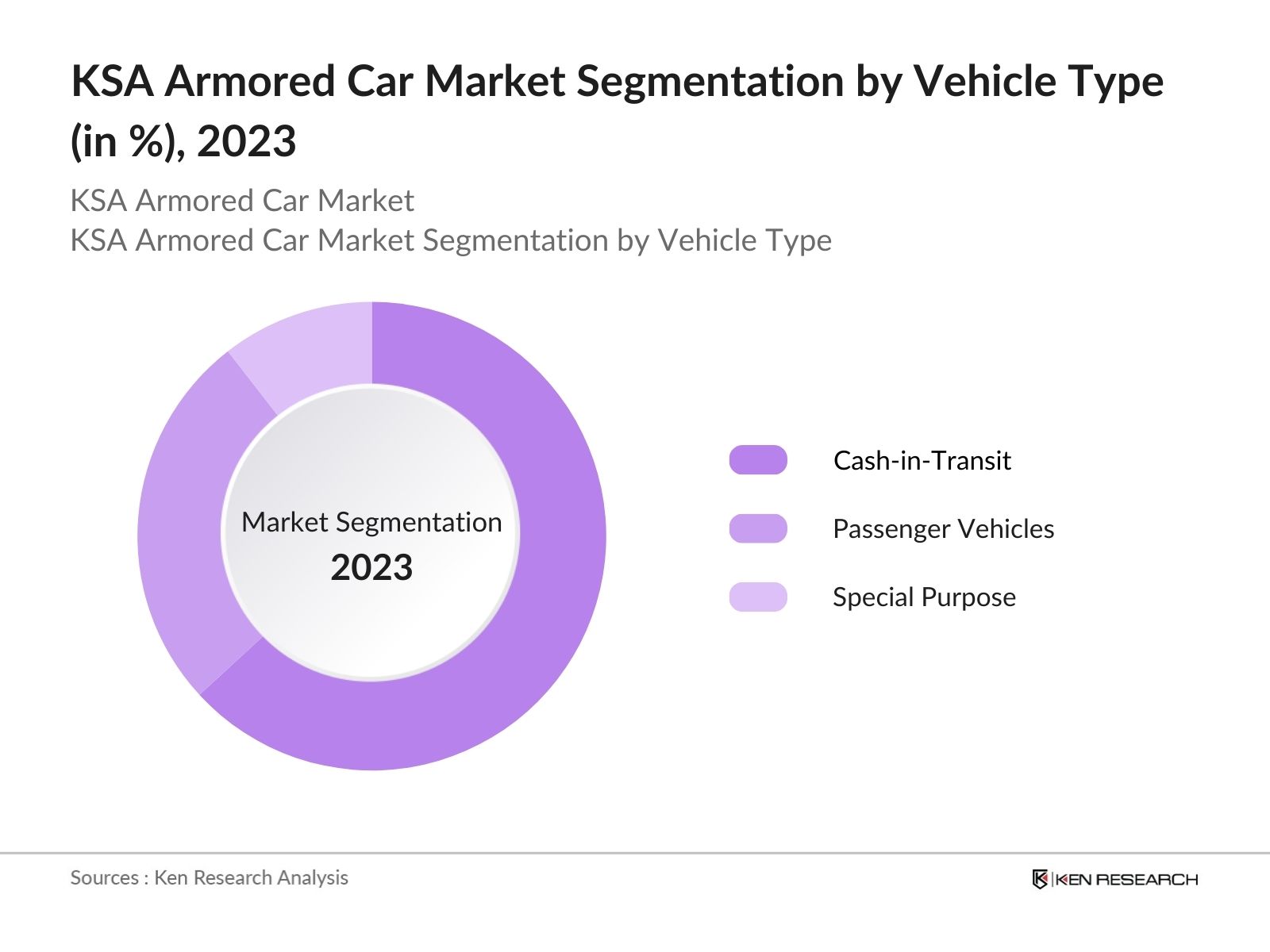

The KSA Armored Car Market can be segmented based on several factors. Like By Vehicle Type, By Armor Level, and By Region.

By Vehicle Type: The KSA Armored Car Market is segmented by vehicle type into: Cash-in-Transit Vehicles, Passenger Vehicles,Special Purpose Vehicles. Cash-in-transit vehicles dominated the market in 2023. This segment's dominance is driven by the increasing demand for secure transportation of cash and valuables, especially with the expansion of retail and banking sectors.

By Armor Level: The KSA Armored Car Market is segmented by armor level into: Level B4, Level B6, Level B7. Level B6 armor dominated the market in 2023. This level offers a balanced combination of security and cost, making it ideal for most civilian and commercial applications.

By Region: The KSA Armored Car Market is segmented by region into: North, South, East, West, East. In 2023, East region dominated the market, mainly due to the concentration of oil and gas industries that require secure transportation for high-value assets and personnel.

KSA Armored Car Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|

INKAS Armored Vehicle Mfg. |

1996 |

Toronto, Canada |

|

Streit Group |

1992 |

Ras Al Khaimah, UAE |

|

Centigon Security Group |

1998 |

Lamballe, France |

|

Armormax |

1993 |

Ogden, USA |

|

Alpine Armoring Inc. |

1985 |

Herndon, USA |

- Centigon Security Group: In 2023, Centigon Security Group introduced a new line of armored SUVs designed for VIP transport, featuring state-of-the-art security systems. This product launch is expected to cater to the growing demand for luxury armored vehicles among high-net-worth individuals in KSA.

- Streit Group: Streit Groups new partnership with a local security firm in 2023 is set to enhance its market presence and provide customized solutions tailored to the needs of the KSA market. This strategic move is expected to boost Streit Groups revenue by SAR 50 million annually.

KSA Armored Car Industry Analysis

KSA Armored Car Market Growth Drivers

-

Increased Security Concerns: The heightened threat of terrorism and organized crime in KSA has driven the demand for armored vehicles. In 2023, the Ministry of Interior reported a 15% increase in high-risk security incidents, necessitating the use of armored cars for safe transportation of valuables and VIPs.

- Expansion of the Banking Sector: The Saudi banking sector has seen significant growth, with the number of bank branches increasing to 2,083 in 2023 from 1,957 in 2022, according to the Saudi Arabian Monetary Authority (SAMA). This expansion has fueled the demand for secure cash-in-transit solutions provided by armored vehicles.

- Oil and Gas Industry Requirements: The oil and gas industry, crucial to KSAs economy, relies heavily on armored vehicles for the secure transportation of personnel and assets. In 2024, Aramco plans to increase its investment in security measures, allocating SAR 1 billion for the enhancement of transportation security, including the procurement of new armored vehicles.

KSA Armored Car Market Challenges

-

High Production and Maintenance Costs: The cost of manufacturing armored vehicles remains a significant challenge. In 2023, the average cost of producing an armored vehicle was SAR 750,000, up from SAR 700,000 in 2022, primarily due to the increased prices of raw materials like steel and ballistic glass.

- Regulatory Compliance and Standards: Meeting the stringent safety and quality standards set by the government poses a challenge for manufacturers. In 2023, the Saudi Standards, Metrology, and Quality Organization (SASO) introduced new regulations requiring enhanced ballistic protection levels, increasing the complexity and cost of production.

KSA Armored Car Market Government Initiatives

-

Localisation of Military Procurement: The Vision 2030 initiative, the Saudi government aims to localizemore than 50%of its military spending by 2030. This includes the procurement of armored vehicles, which is part of a broader strategy to reduce dependency on foreign suppliers and develop local industries. The General Authority of Military Industries (GAMI) oversees these efforts, focusing on increasing domestic production capabilities and creating jobs for Saudi nationals.

- Strategic Partnerships and Joint Ventures: The government is fostering partnerships with international defense companies to facilitate technology transfer and local production of armored vehicles. These strategic collaborations aim to build local expertise and capabilities, aligning with the broader goals of industrial development and localization within the defense sector.

KSA Armored Car Future Market Outlook

The KSA armored car market is expected to grow significantly by 2028, driven by technological advancements and expansion of local manufacturing capabilities.

Future Market Trends

-

Increased Demand for Lightweight Vehicles: Over the next five years, the market will see a growing demand for lightweight armored vehicles. Manufacturers will invest in advanced materials and technologies to produce vehicles that offer high protection levels while improving fuel efficiency and reducing maintenance costs.

- Expansion of Local Manufacturing Capabilities: By 2028, KSA will see a significant increase in local manufacturing of armored vehicles. Government initiatives and strategic partnerships with international firms will drive this growth, reducing dependency on imports and fostering the development of domestic expertise.

Scope of the Report

|

By Vehicle Type |

Cash-in-Transit Vehicles Passenger Vehicles Special Purpose Vehicles |

|

By Armor Level |

Level B4 Level B6 Level B7 |

|

By Region |

North South East West |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

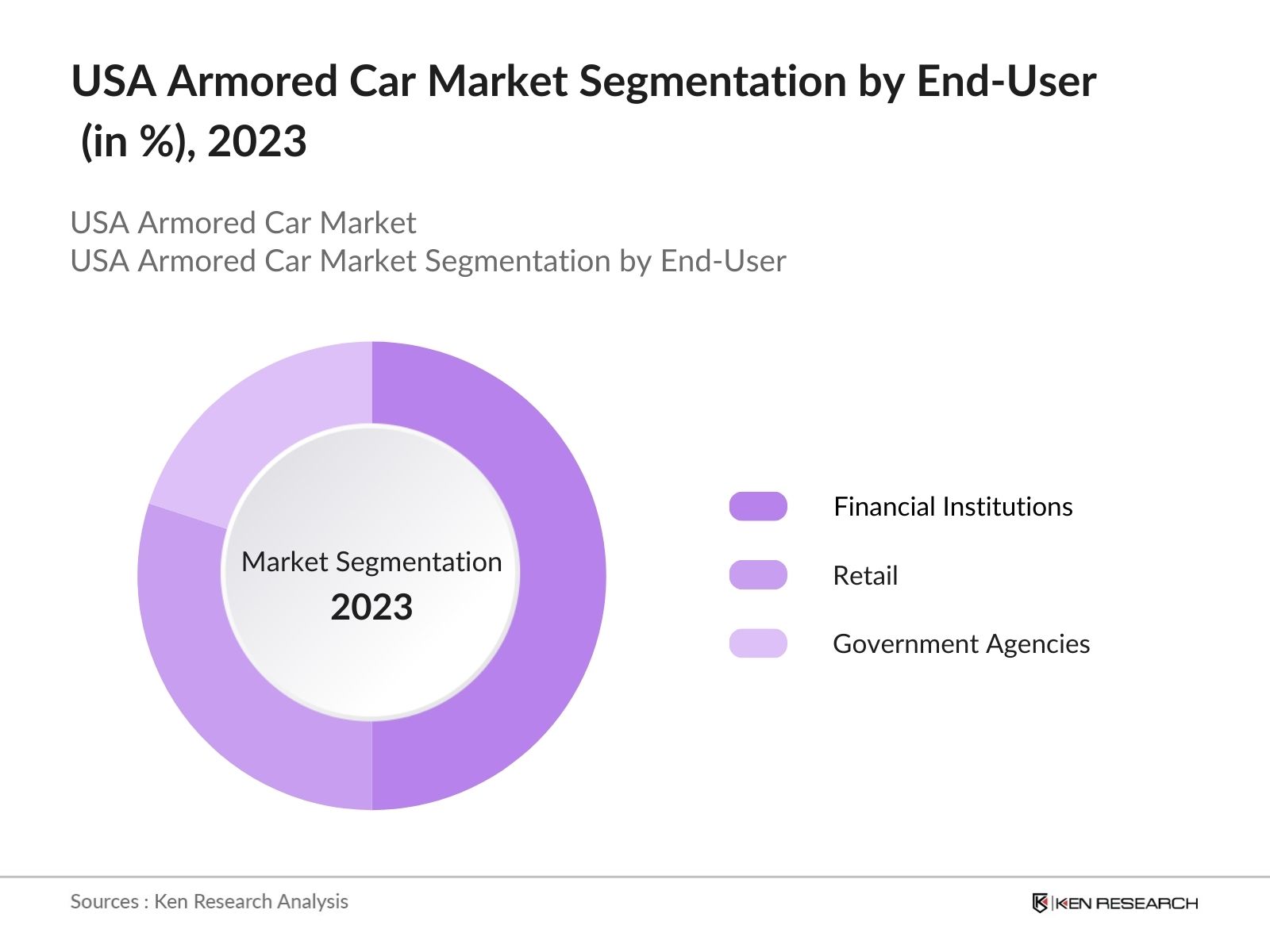

Banks and Financial Institutions

Government Agencies

Private Security Firms

Logistics Companies

High-Net-Worth Individuals

Corporate Enterprises

Oil and Gas Companies

Jewelry Stores

Retail Chains

Armored Car Manufacturers

Defense Contractors

Insurance Companies

Cash Management Companies

VIP Transport Services

High-Value Asset Transporters

Time Period Captured in the Report:

Historical Period:2018-2023

Base Year:2023

Forecast Period:2023-2028

Companies

Players Mentioned in the Report:

INKAS Armored Vehicle Manufacturing

Streit Group

Centigon Security Group

Armormax

Alpine Armoring Inc.

Al-Bahar Group

Shell Special Vehicles LLC

MSPV Armored Cars

Mezcal Security Vehicles

EAGLEi Armored Systems

FMS Tech

Armor International

Alpha Armouring

TAG Group

HESCO Bastion

Table of Contents

1. KSA Armored Car Market Overview

1.1 KSA Armored Car Market Taxonomy

2. KSA Armored Car Market Size (in USD Bn), 2018-2023

3. KSA Armored Car Market Analysis

3.1 KSA Armored Car Market Growth Drivers

3.2 KSA Armored Car Market Challenges and Issues

3.3 KSA Armored Car Market Trends and Development

3.4 KSA Armored Car Market Government Regulation

3.5 KSA Armored Car Market SWOT Analysis

3.6 KSA Armored Car Market Stake Ecosystem

3.7 KSA Armored Car Market Competition Ecosystem

4. KSA Armored Car Market Segmentation, 2023

4.1 KSA Armored Car Market Segmentation by Vehicle Type (in value %), 2023

4.2 KSA Armored Car Market Segmentation by Armor Level (in value %), 2023

4.3 KSA Armored Car Market Segmentation by Region (in value %), 2023

5. KSA Armored Car Market Competition Benchmarking

5.1 KSA Armored Car Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters and advanced analytics)

6. KSA Armored Car Future Market Size (in USD Bn), 2023-2028

7. KSA Armored Car Future Market Segmentation, 2028

7.1 KSA Armored Car Market Segmentation by Vehicle Type (in value %), 2028

7.2 KSA Armored Car Market Segmentation by Armor Level (in value %), 2028

7.3 KSA Armored Car Market Segmentation by Region (in value %), 2028

8. KSA Armored Car Market Analysts Recommendations

8.1 KSA Armored Car Market TAM/SAM/SOM Analysis

8.2 KSA Armored Car Market Customer Cohort Analysis

8.3 KSA Armored Car Market Marketing Initiatives

8.4 KSA Armored Car Market White Space Opportunity Analysis

9. Disclaimer

10. Contact Us

Research Methodology

Step 1: Identifying Key Variables

Ecosystem creation for all major entities and referring to multiple secondary and proprietary databases to perform desk research around the market to collate industry-level information.

Step 2: Market Building

Collating statistics on the KSA Armored Car Market over the years, penetration of marketplaces, and service providers ratio to compute revenue generated for the KSA Armored Car Market. Service quality statistics will also be reviewed to understand revenue generation and ensure accuracy behind the shared data points.

Step 3: Validating and Finalizing

Building market hypotheses and conducting CATIs with industry experts from different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research Output

Our team will approach multiple armored vehicle suppliers and distributors to understand the nature of product segments and sales, consumer preferences, and other parameters, supporting the validation of statistics derived through a bottom-up approach from armored vehicle suppliers and distributors.

Frequently Asked Questions

01. How big is the KSA Armored Car Market?

The KSA Armored Car Market has experienced substantial growth, this is reflected by the global Armored Car Market reached a valuation of USD 22.24 billion in 2023. driven by increased security concerns, expansion of the banking sector, and the growing private security industry. The rising demand for secure transportation of valuables and VIPs has further fueled market growth.

02. What are the growth drivers of the KSA Armored Car Market?

The KSA armored car market is propelled by increased security concerns, expansion of the banking sector, requirements of the oil and gas industry, and the growth of private security services.

03. What are the challenges in the KSA Armored Car Market?

Challenges in the KSA armored car market include high production and maintenance costs, stringent regulatory compliance, rapid technological advancements, and intense market competition from international players.

04. Who are the major players in the KSA Armored Car Market?

Key players in the KSA armored car market include INKAS Armored Vehicle Manufacturing, Streit Group, Centigon Security Group, Armormax, and Alpine Armoring Inc. These companies lead due to their innovative technologies, extensive product range, and strategic partnerships.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.