KSA Autonomous Automobile Market Outlook to 2030

Region:Middle East

Author(s):Naman Rohilla

Product Code:KROD9600

December 2024

87

About the Report

KSA Autonomous Automobile Market Overview

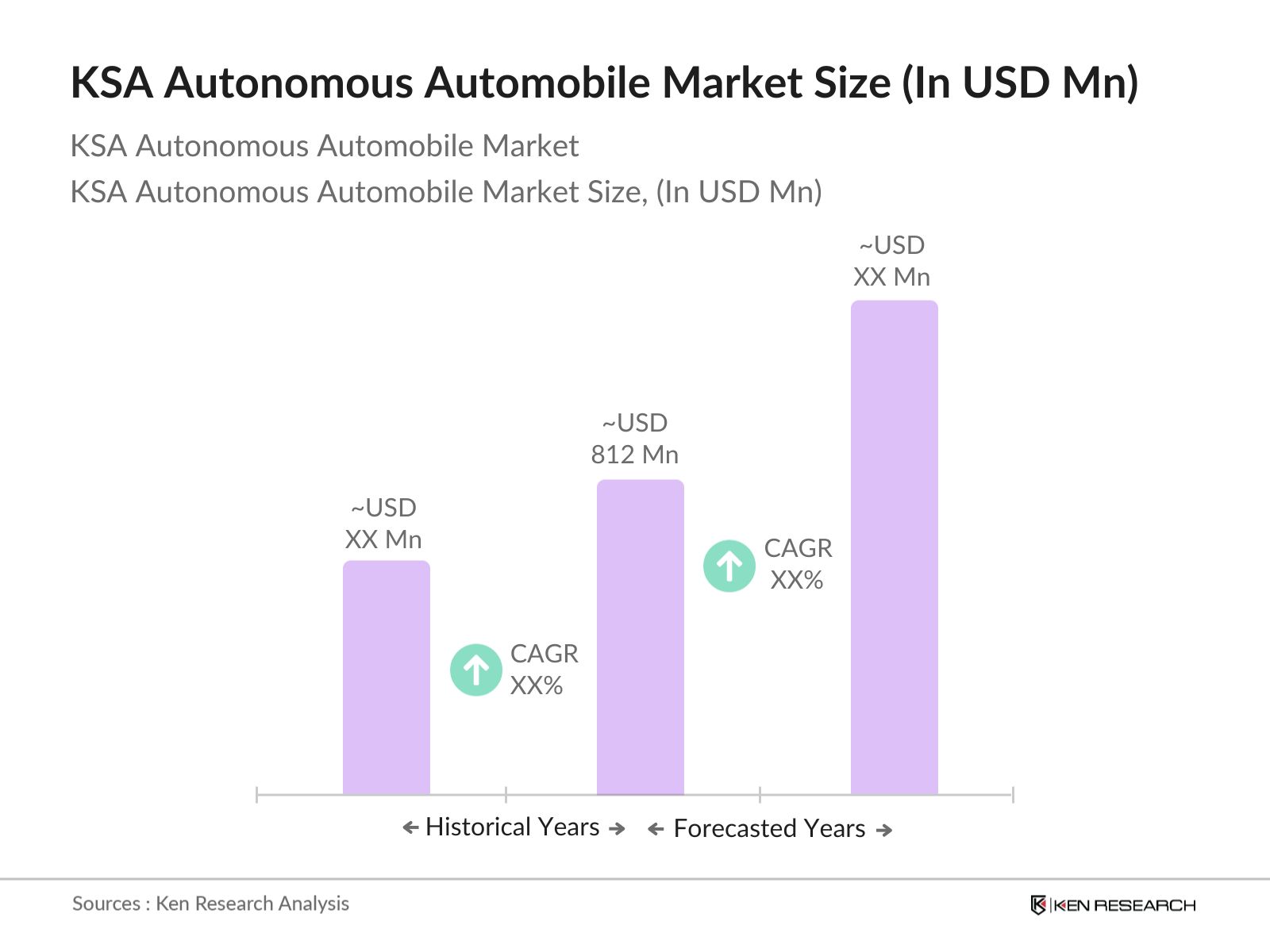

- The KSA Autonomous Automobile Market is valued at USD 812 million, influenced by a strong commitment to advanced mobility technology and infrastructure expansion under Vision 2030. Similar to building a high-tech ecosystem from the ground up, the markets growth is propelled by both technological advancements in AI and autonomous vehicle (AV) systems and the Kingdoms dedication to sustainable transport solutions. The five-year analysis indicates this value reflects a significant increase from previous years as KSA invests heavily in building an autonomous and sustainable urban transport landscape, with autonomous vehicles (AVs) set to play a key role.

- Riyadh and Jeddah are the leading cities in KSAs autonomous automobile market. Riyadh, as the nations capital, attracts most AV projects due to its extensive urban infrastructure and government support for pilot programs and large-scale initiatives. Jeddahs dominance comes from its proximity to the Red Sea, making it a hub for technological and logistical advancements, particularly in autonomous freight and public transport. Both cities benefit from investment influxes and infrastructure tailored to emerging tech, placing them at the forefront of the autonomous automobile landscape in KSA.

- In 2023, Saudi Arabia established comprehensive national autonomous vehicle standards, encompassing stringent safety and performance criteria. This pivotal regulatory framework was developed to steer the growth of the autonomous vehicle market while safeguarding public safety and bolstering consumer trust. The standards delineate specific requirements for vehicle communication systems, sensor accuracy, and emergency handling capabilities, setting a high benchmark for all market entrants.

KSA Autonomous Automobile Market Segmentation

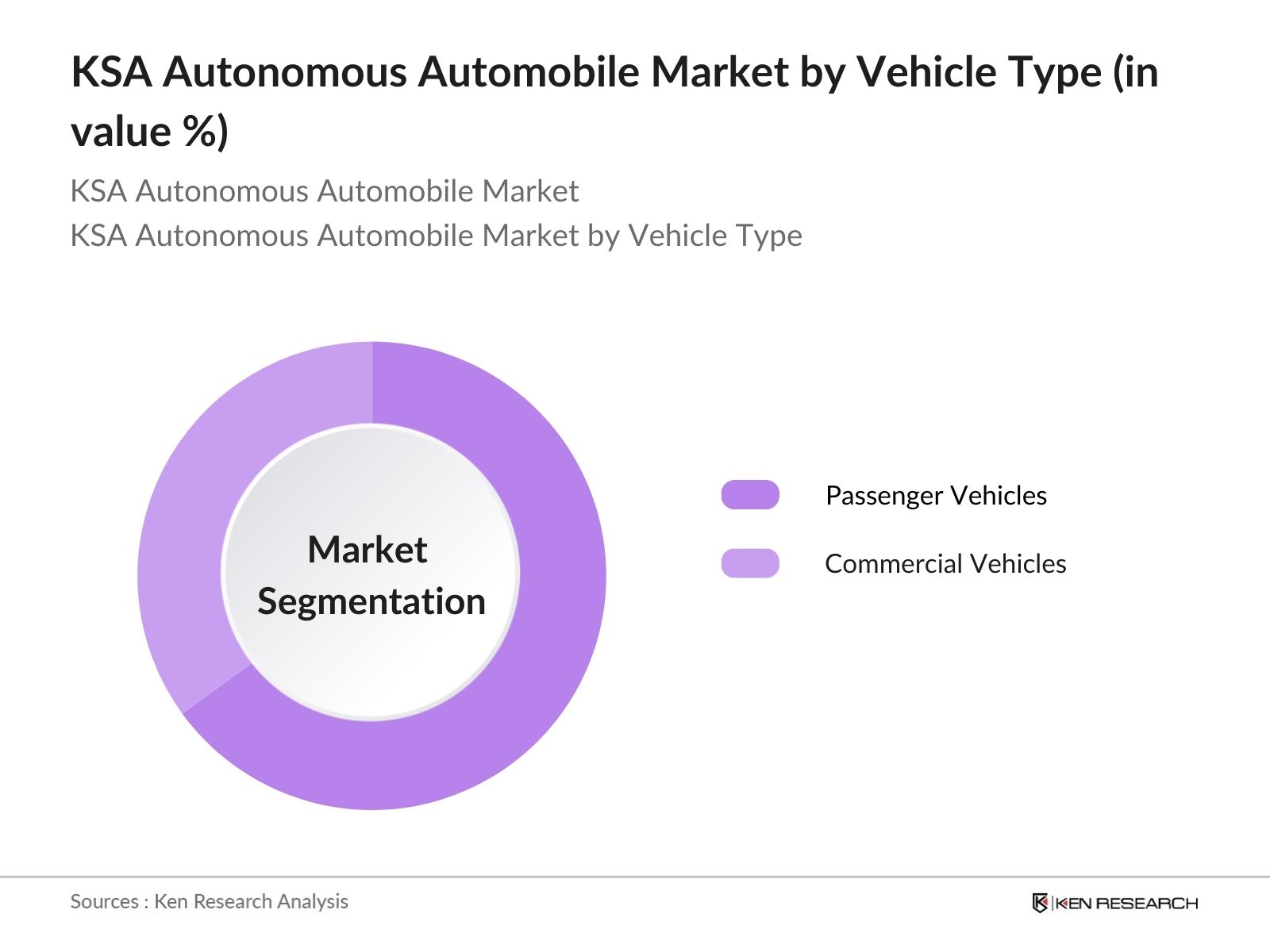

- By Vehicle Type: The market is segmented by vehicle type into passenger vehicles and commercial vehicles. Recently, passenger vehicles hold a dominant share due to rising interest in personal AVs for urban mobility solutions and partnerships with global AV manufacturers. Like setting up tailored public transportation, these vehicles are integrated into urban settings for a more accessible and sustainable transit system.

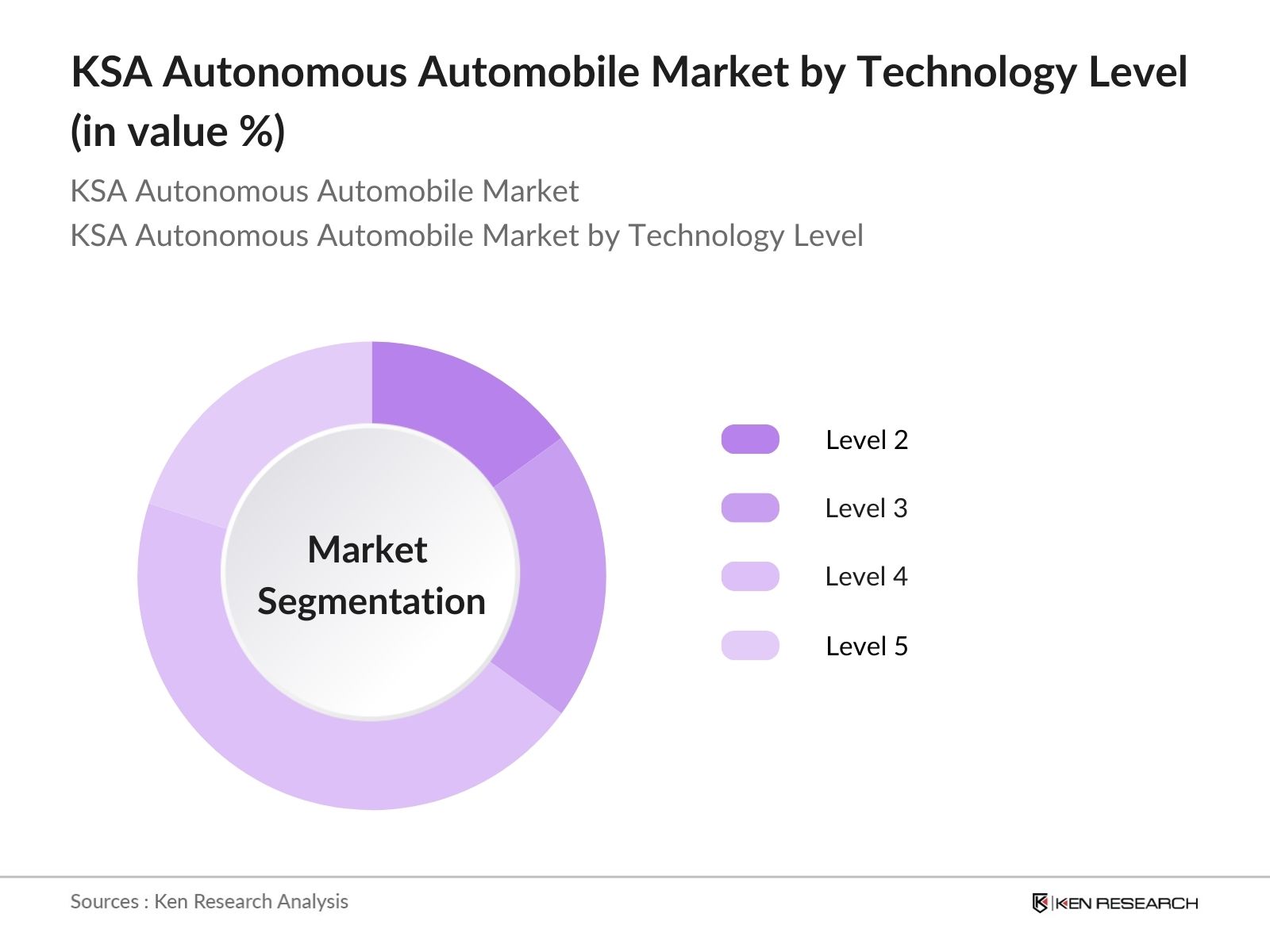

- By Technology Level: The technology level in the market ranges from partial to full automation, segmented into Level 2, Level 3, Level 4, and Level 5 automation. Level 4 currently leads the market, particularly in controlled urban environments where driverless capabilities can be leveraged with minimal manual intervention. This levels dominance resembles the gradual shift from guided experiences to fully independent systems, optimizing for both safety and convenience within urban zones.

KSA Autonomous Automobile Market Competitive Landscape

The KSA Autonomous Automobile Market is led by several prominent players, each contributing unique innovations and strengths. Key companies such as Waymo, Tesla, Baidu, Aptiv, and Cruise collectively drive technological advancements, market reach, and service improvements. This consolidation of key players, akin to anchoring a marketplace with reliable and innovative brands, creates a stable yet competitive environment.

KSA Autonomous Automobile Market Analysis

Market Growth Drivers

- Technological Advancements in Autonomous Vehicles: Technological advancements are pivotal for the KSA autonomous vehicle market. Saudi Arabia has invested significantly in automotive technology, integrating advanced sensors and AI to bolster vehicle autonomy. In 2022, Saudi Arabias spending on technology in the transportation sector exceeded SAR 5 billion, demonstrating a commitment to adopting cutting-edge technologies which support the development of autonomous vehicles.

- Infrastructure Developments: Infrastructure improvements, essential for autonomous vehicle operations, have seen robust government spending, with Saudi Arabia investing SAR 12 billion in 2024 in road and telecom infrastructure suited for autonomous vehicles. This includes upgrades to road sensors and Wi-Fi networks, facilitating better vehicle communication and functionality.

- Demand for Sustainable Transport Solutions: The shift towards sustainable transport solutions in KSA is driven by increasing environmental awareness and oil dependency reduction goals. The government's investment in green transport technologies reached SAR 15 billion in 2022, aiming to integrate autonomous electric vehicles in public transportation networks to reduce carbon emissions and improve urban air quality.

Market Challenges

- Regulatory Compliance: Navigating regulatory compliance is a major challenge. The Saudi Standards, Metrology and Quality Organization (SASO) introduced new standards in 2023 for autonomous vehicles, focusing on safety and interoperability, which requires manufacturers to invest heavily in compliance technologies, adding complexity to market entry.

- Public Trust and Safety Concerns: Public trust remains low, with only 25% of Saudis reporting comfort with autonomous technology in a 2023 survey by the Saudi Ministry of Transport. This underscores the need for extensive safety demonstrations and public education initiatives to build trust in autonomous vehicle reliability and safety.

KSA Autonomous Automobile Market Future Outlook

Over the next five years, the KSA Autonomous Automobile Market is expected to grow considerably, fueled by ongoing technological advancements, policy support, and increasing investments in infrastructure development. As this ecosystem matures, innovations in Level 4 and 5 automation are anticipated to expand market opportunities for public and private transport alike, setting a high standard for autonomous mobility in the region.

Market Opportunities

- Partnerships with Global Tech Firms: Opportunities for local firms to partner with global tech giants are substantial, with initiatives aiming to enhance technical expertise in autonomous vehicle technologies. In 2022, Saudi tech firms secured 5 major partnerships with multinational companies, bringing advanced AI and machine learning capabilities to the local automotive industry.

- Expansion into Public Transport Sector: The Saudi government's plan to expand autonomous vehicles into the public transport sector is supported by a 2023 allocation of SAR 18 billion for public transport enhancements, including the integration of autonomous buses and taxis, which presents significant market opportunities for growth.

Scope of the Report

|

Vehicle Type |

Passenger Vehicles Commercial Vehicles |

|

Technology Level |

Level 2 Level 3 Level 4 Level 5 |

|

Application |

Urban Mobility Industrial Applications Logistics and Freight |

|

Component Type |

Hardware (Sensors, Cameras, LiDAR) Software (AI, Machine Learning, IoT) |

|

Region |

Riyadh Jeddah Dammam Al Khobar |

Products

Key Target Audience

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Saudi Ministry of Transport)

Autonomous Vehicle Manufacturers

AI and Machine Learning Development Firms

Urban Mobility and Infrastructure Planners

Banks and Financial Institutions

Logistics and Freight Companies

Autonomous Technology Start-ups

National Security Agencies (for AV regulation and compliance)

Companies

Players Mentioned in the Report

Waymo

Tesla

Baidu

Aptiv

Cruise

Uber ATG

Aurora Innovation

Mobileye (Intel)

Nuro

Argo AI

Table of Contents

1. KSA Autonomous Automobile Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Industry Structure

1.4. Market Segmentation Overview

2. KSA Autonomous Automobile Market Size (in USD)

2.1. Historical Market Size

2.2. Year-on-Year Market Growth Analysis

2.3. Key Developments and Innovations

3. KSA Autonomous Automobile Market Analysis

3.1. Growth Drivers

3.1.1. Technological Advancements in Autonomous Vehicles

3.1.2. Government Initiatives (Saudi Vision 2030, Smart Cities)

3.1.3. Infrastructure Developments

3.1.4. Demand for Sustainable Transport Solutions

3.2. Market Challenges

3.2.1. Regulatory Compliance (Autonomous Vehicle Standards)

3.2.2. Public Trust and Safety Concerns

3.2.3. High Capital Requirements

3.3. Opportunities

3.3.1. Partnerships with Global Tech Firms

3.3.2. Expansion into Public Transport Sector

3.3.3. Technological Integration (AI, IoT, 5G)

3.4. Trends

3.4.1. Shift Towards Level 4/5 Autonomous Vehicles

3.4.2. Adoption of LiDAR and Radar Technologies

3.4.3. Growth of Electric Autonomous Fleets

3.5. Government Regulation

3.5.1. National Autonomous Vehicle Standards

3.5.2. Safety and Testing Guidelines

3.5.3. Import Regulations and Tariffs

3.5.4. Incentives for Technological Integration

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

4. KSA Autonomous Automobile Market Segmentation

4.1. By Vehicle Type (in Value %)

4.1.1. Passenger Vehicles

4.1.2. Commercial Vehicles

4.2. By Technology Level (in Value %)

4.2.1. Level 2 (Partial Automation)

4.2.2. Level 3 (Conditional Automation)

4.2.3. Level 4 (High Automation)

4.2.4. Level 5 (Full Automation)

4.3. By Application (in Value %)

4.3.1. Urban Mobility

4.3.2. Industrial Applications

4.3.3. Logistics and Freight

4.4. By Component Type (in Value %)

4.4.1. Hardware (Sensors, Cameras, LiDAR)

4.4.2. Software (AI, Machine Learning, IoT Integration)

4.5. By Region (in Value %)

4.5.1. Riyadh

4.5.2. Jeddah

4.5.3. Dammam

4.5.4. Al Khobar

5. KSA Autonomous Automobile Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Waymo

5.1.2. Tesla, Inc.

5.1.3. Baidu Inc.

5.1.4. Aptiv PLC

5.1.5. Cruise LLC

5.1.6. Uber ATG

5.1.7. Aurora Innovation, Inc.

5.1.8. Mobileye (Intel Corporation)

5.1.9. Nuro, Inc.

5.1.10. Argo AI

5.1.11. Zoox (Amazon.com, Inc.)

5.1.12. Motional

5.1.13. Pony.ai

5.1.14. Navya

5.1.15. Neolix

5.2 Cross Comparison Parameters (Employee Count, Headquarters, Founding Year, Revenue, R&D Investment, AI Technology Integration, Patent Ownership, Market Share)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

6. KSA Autonomous Automobile Market Regulatory Framework

6.1. AV Licensing and Compliance Requirements

6.2. Data Protection and Privacy Standards

6.3. Environmental Regulations for AV Manufacturing

6.4. Certification and Testing Requirements

7. KSA Autonomous Automobile Future Market Size

7.1. Projected Market Expansion

7.2. Key Drivers for Future Market Growth

8. KSA Autonomous Automobile Future Market Segmentation

8.1. By Vehicle Type (in Value %)

8.2. By Technology Level (in Value %)

8.3. By Application (in Value %)

8.4. By Component Type (in Value %)

8.5. By Region (in Value %)

9. KSA Autonomous Automobile Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Key Customer Segmentation and Preferences

9.3. Strategic Marketing Initiatives

9.4. White Space Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The research initiates with identifying the ecosystems major stakeholders within the KSA Autonomous Automobile Market. This stage involves extensive desk research utilizing both secondary and proprietary databases to define the markets primary influences and stakeholders.

Step 2: Market Analysis and Construction

Historical data from the past five years are analyzed to determine market size, growth patterns, and the distribution of autonomous vehicles across urban and commercial applications, focusing on performance and reliability statistics to build revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses derived from the data are validated through direct consultations with industry experts. These consultations offer insights into market trends, challenges, and technological advancements, strengthening the research with real-world perspectives.

Step 4: Research Synthesis and Final Output

In this final stage, feedback from autonomous vehicle manufacturers and technology developers is consolidated to refine market projections. This synthesis ensures that the final output accurately reflects the KSA Autonomous Automobile Market's present and near-future trajectory.

Frequently Asked Questions

1. How big is the KSA Autonomous Automobile Market?

The KSA Autonomous Automobile Market is valued at USD 812 million, driven by strategic investments and advances in autonomous technology within the Kingdom.

2. What are the main challenges in the KSA Autonomous Automobile Market?

Key challenges include regulatory compliance, high development costs, and public trust issues, each impacting the rapid adoption of AVs.

3. Who are the major players in the KSA Autonomous Automobile Market?

Leading players include Waymo, Tesla, Baidu, Aptiv, and Cruise, all of whom bring unique capabilities and established technological expertise to the market.

4. What are the growth drivers of the KSA Autonomous Automobile Market?

The market is propelled by government support under Vision 2030, advancements in AI and automation, and increasing demand for sustainable urban mobility solutions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.