KSA Autonomous & Sensor Technology Market Outlook to 2030

Region:Middle East

Author(s):Naman Rohilla

Product Code:KROD3865

November 2024

89

About the Report

KSA Autonomous & Sensor Technology Market Overview

- The KSA Autonomous & Sensor Technology market is valued at USD 0.23 billion, based on a five-year historical analysis. The market is driven by the country's focus on integrating smart technologies across various sectors, particularly in line with the Vision 2030 initiative. This focus is reinforced by substantial government investments aimed at fostering innovation in autonomous systems and sensor technologies, catering to industries such as transportation, energy, and defence. The rapid adoption of smart infrastructure and autonomous vehicles further fuels market growth.

- The dominance of key cities like Riyadh and Dammam in the KSA Autonomous & Sensor Technology market can be attributed to their role as central hubs for industrialization and infrastructure development. Riyadh, as the capital, houses numerous governmental initiatives and smart city projects, while Dammam leads in the energy sector, benefiting from the integration of sensor-based automation in oil and gas operations. These cities are pivotal in setting the course for market advancements.

- The Saudi government has implemented specific regulations for the testing of autonomous vehicles to ensure safety and compliance with international standards. The Public Transport Authority (PTA) has designated specific zones in Riyadh, Jeddah, and Neom for autonomous vehicle testing, with stringent safety protocols. In 2023, over SAR 1 billion was invested to develop autonomous testing facilities, where companies are required to meet strict guidelines on data privacy, cybersecurity, and operational efficiency. These regulations are critical in fostering innovation while ensuring the safety and security of autonomous vehicles on public roads.

KSA Autonomous & Sensor Technology Market Segmentation

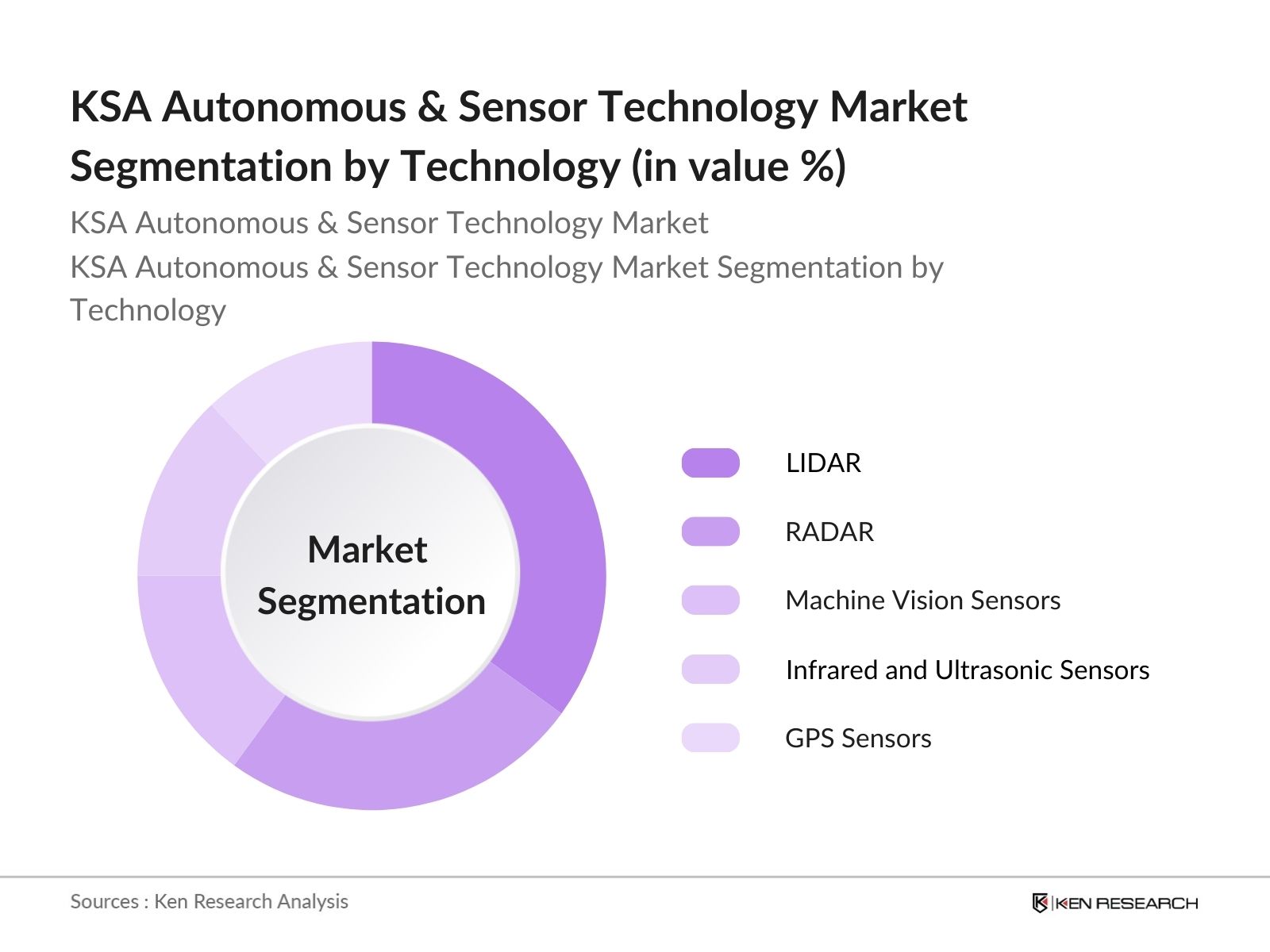

- By Technology: The market is segmented by technology into LIDAR, RADAR, Machine Vision, Infrared Sensors, and GPS Sensors. LIDAR technology dominates this segment due to its extensive use in autonomous vehicle navigation and smart city infrastructure projects. The high precision and accuracy of LIDAR in mapping and object detection make it indispensable for advanced driver assistance systems (ADAS), thus driving its adoption across multiple industries, including automotive and defense sectors.

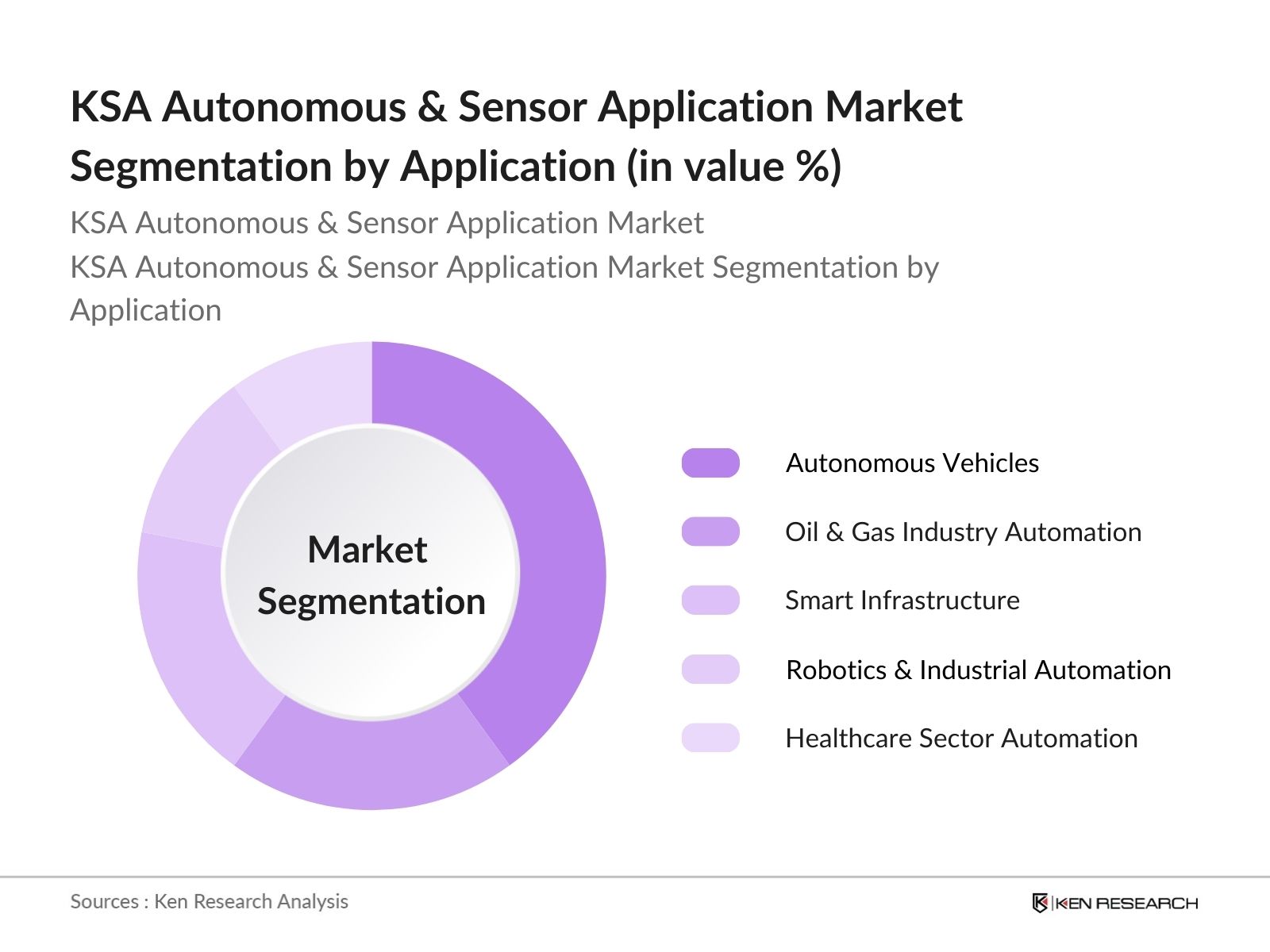

- By Application: The market is segmented by application into Autonomous Vehicles, Oil & Gas Industry Automation, Smart Infrastructure, Robotics & Industrial Automation, and Healthcare Sector Automation. Autonomous vehicles have the largest market share in this segment, driven by growing government investments and partnerships with global tech giants to develop smart transportation systems. The increased focus on creating a sustainable transportation network that leverages autonomous technology has led to a surge in demand for sensors and navigation systems within the automotive industry.

KSA Autonomous & Sensor Technology Market Competitive Landscape

The KSA Autonomous & Sensor Technology market is dominated by several key players, both global and local, contributing to a consolidated market environment. Major companies like TAQNIA and STC Solutions have emerged as significant players in the development and deployment of autonomous systems, particularly in sectors such as transportation and defense. Global technology leaders like Siemens and Huawei also play a crucial role, particularly in sensor technology integration, providing the necessary infrastructure for smart city development and industrial automation.

|

Company |

Establishment Year |

Headquarters |

Key Technology Focus |

No. of Employees |

Revenue |

Partnerships |

R&D Investments |

Key Sectors |

|

Saudi Technology Development (TAQNIA) |

2011 |

Riyadh |

- |

- |

- |

- |

- |

- |

|

STC Solutions |

2002 |

Riyadh |

- |

- |

- |

- |

- |

- |

|

NEOM Tech & Digital |

2019 |

Neom |

- |

- |

- |

- |

- |

- |

|

Siemens AG |

1847 |

Munich |

- |

- |

- |

- |

- |

- |

|

Huawei Technologies |

1987 |

Shenzhen |

- |

- |

- |

- |

- |

- |

KSA Autonomous & Sensor Technology Market Analysis

KSA Autonomous & Sensor Technology Market Growth Drivers

- Integration of Autonomous Systems in National Infrastructure: Saudi Arabia's strategic infrastructure projects are witnessing the integration of autonomous systems, particularly in transportation and logistics. According to the Ministry of Transport, over 1,500 km of autonomous-ready highways are planned for development to support the increasing use of autonomous vehicles. Additionally, autonomous systems are becoming a key component in national security, with the government allocating SAR 1.2 billion to autonomous drone systems for border security. This integration aligns with Saudi Vision 2030, which prioritizes the modernization of infrastructure to support advanced technologies in transportation, energy, and security sectors.

- Advancements in AI and Machine Learning in Sensor Technology: Saudi Arabia has seen significant advancements in AI and machine learning applications within sensor technology, particularly in the oil and gas industry. In 2024, the government invested SAR 5 billion into AI-driven sensor systems to optimize oil extraction processes, with projects supported by national entities such as Aramco. AI-integrated sensors have improved efficiency in oil rigs, resulting in a 15% increase in extraction rates. This progress is part of a broader trend in the country, where AI-based sensors are being used to predict equipment failures and reduce downtime in critical industries.

- Demand from Oil & Gas and Transportation Sectors: The oil and gas industry, a key pillar of Saudi Arabia's economy, is heavily investing in sensor technology to enhance operational efficiency. In 2023, Saudi Aramco announced a SAR 4.5 billion investment in advanced sensor technologies to monitor pipelines and drilling operations. The transportation sector is also adopting sensor technologies, particularly in autonomous logistics. In the same year, the Saudi Railways Organization began trials of sensor-equipped autonomous trains across a 2,000 km network. These investments highlight the growing demand for advanced sensors in key sectors of the economy.

KSA Autonomous & Sensor Technology Market Challenges

- High Initial Investment in Sensor Technology: The high initial cost of sensor technology poses a significant challenge for widespread adoption in the Kingdom. In 2023, sensor installations for autonomous systems in transportation alone required a capital expenditure of SAR 3.8 billion. The oil and gas sector also faces challenges, with sensor deployments in offshore rigs costing up to SAR 1.5 million per installation. These high costs often deter smaller industries from adopting sensor technologies, despite their long-term benefits. Government subsidies, although available, do not fully cover the initial capital outlay required for these advanced systems.

- Technical Integration and Compatibility Issues: A major challenge in the KSA autonomous and sensor technology market is the technical integration of these systems with existing infrastructure. Reports from the Saudi Communications and Information Technology Commission indicate that only 45% of industrial systems in the country are compatible with autonomous sensor technologies, leading to delays in adoption. Compatibility issues are particularly acute in the oil and gas sector, where integrating new sensors with legacy systems has caused operational bottlenecks. Additionally, sensor data management systems are not fully optimized for the vast data generated by autonomous systems.

KSA Autonomous & Sensor Technology Market Future Outlook

Over the next five years, the KSA Autonomous & Sensor Technology market is expected to witness substantial growth, driven by continuous government support and strategic investments in key sectors. The focus on developing smart cities and enhancing the Kingdoms technological capabilities through Vision 2030 will be pivotal in pushing the demand for autonomous systems and advanced sensor technologies. Additionally, innovations in artificial intelligence (AI), machine learning (ML), and IoT are set to revolutionize the operational dynamics across various industries, including transportation, energy, and healthcare.

KSA Autonomous & Sensor Technology Market Opportunities

- Increasing Adoption of Autonomous Vehicles: The adoption of autonomous vehicles in Saudi Arabia is rapidly growing, with the government rolling out plans to deploy over 1,000 autonomous taxis in Riyadh by 2024. The transportation sector is set to benefit immensely, with the autonomous vehicles market receiving SAR 7 billion in government support. The Saudi Public Transport Authority is also working to establish autonomous vehicle testing zones in major cities, ensuring the safe rollout of these vehicles. This rise in autonomous vehicle adoption provides significant opportunities for sensor technology manufacturers and integrators.

- Growth of IoT and Smart Infrastructure: Saudi Arabia is at the forefront of IoT and smart infrastructure development, creating new opportunities for sensor technology. In 2023, the government allocated SAR 10 billion towards the development of IoT-enabled smart cities, with a focus on deploying smart sensors for energy management, security, and public services. The National Smart Infrastructure Project aims to install over 500,000 smart sensors across the countrys urban areas by the end of 2025. These developments provide a lucrative market for both local and international sensor technology providers.

Scope of the Report

|

By Technology |

LIDAR RADAR Machine Vision Infrared Sensors GPS Sensors |

|

By Application |

Autonomous Vehicles Oil & Gas Automation Smart Infrastructure Healthcare |

|

By Component |

Sensors, Software Hardware Connectivity Modules |

|

By End-User |

Automotive & Transportation Energy & Utilities Industrial Manufacturing Defense |

|

By Region |

South East West North |

Products

Key Target Audience

Automotive Manufacturers

Industrial Automation Companies

Telecommunications Providers

Defence & Aerospace Industries

Government and Regulatory Bodies (Saudi Standards, Metrology and Quality Organization)

Investments and Venture Capitalist Firms

Companies

KSA Autonomous & Sensor Technology Market Major Players

Saudi Technology Development and Investment Co. (TAQNIA)

STC Solutions

NEOM Tech & Digital

Siemens AG

Huawei Technologies

Bosch Group

Thales Group

Intel Corporation

NVIDIA Corporation

Honeywell International

ABB Ltd

General Electric

Mitsubishi Electric

Schneider Electric

Microsoft

Table of Contents

1. KSA Autonomous & Sensor Technology Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. KSA Autonomous & Sensor Technology Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. KSA Autonomous & Sensor Technology Market Analysis

3.1 Growth Drivers

3.1.1 Integration of Autonomous Systems in National Infrastructure

3.1.2 Advancements in AI and Machine Learning in Sensor Technology

3.1.3 Government Support for Smart City and Vision 2030 Projects

3.1.4 Demand from Oil & Gas and Transportation Sectors

3.2 Market Challenges

3.2.1 High Initial Investment in Sensor Technology

3.2.2 Technical Integration and Compatibility Issues

3.2.3 Limited Skilled Workforce for High-Tech Installations

3.3 Opportunities

3.3.1 Increasing Adoption of Autonomous Vehicles

3.3.2 Growth of IoT and Smart Infrastructure

3.3.3 Strategic International Partnerships for Technology Transfer

3.3.4 Expansion into Underdeveloped Industrial Sectors

3.4 Trends

3.4.1 Rising Use of LIDAR and RADAR Systems

3.4.2 Integration of Autonomous Systems in the Energy Sector

3.4.3 Shift Towards 5G-Enabled Smart Sensors

3.4.4 Adoption of Predictive Maintenance Sensors in Industry 4.0

3.5 Government Regulation

3.5.1 Saudi Vision 2030: Technological Innovation Goals

3.5.2 Regulations on Autonomous Vehicle Testing

3.5.3 National Cybersecurity and Data Protection Guidelines

3.5.4 Public-Private Partnerships in Autonomous Tech Development

3.6 SWOT Analysis (Strengths, Weaknesses, Opportunities, Threats)

3.7 Stake Ecosystem (Manufacturers, Suppliers, Distributors, End-Users)

3.8 Porters Five Forces (Bargaining Power of Suppliers, Threat of New Entrants, etc.)

3.9 Competition Ecosystem (Global vs. Domestic Players)

4. KSA Autonomous & Sensor Technology Market Segmentation

4.1 By Technology (In Value %)

4.1.1 LIDAR

4.1.2 RADAR

4.1.3 Machine Vision Sensors

4.1.4 Infrared and Ultrasonic Sensors

4.1.5 GPS Sensors

4.2 By Application (In Value %)

4.2.1 Autonomous Vehicles

4.2.2 Oil & Gas Industry Automation

4.2.3 Smart Infrastructure (Smart Cities, Buildings)

4.2.4 Robotics & Industrial Automation

4.2.5 Healthcare Sector Automation

4.3 By Component (In Value %)

4.3.1 Sensors

4.3.2 Software

4.3.3 Hardware

4.3.4 Connectivity Modules

4.4 By End-User (In Value %)

4.4.1 Automotive & Transportation

4.4.2 Energy & Utilities

4.4.3 Industrial Manufacturing

4.4.4 Healthcare

4.4.5 Defense & Aerospace

4.5 By Region (In Value %)

4.5.1 Central Region (Riyadh)

4.5.2 Eastern Region (Dammam, Dhahran)

4.5.3 Western Region (Jeddah, Makkah)

4.5.4 Northern Region

5. KSA Autonomous & Sensor Technology Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Saudi Technology Development and Investment Co. (TAQNIA)

5.1.2. STC Solutions

5.1.3. NEOM Tech & Digital

5.1.4. Siemens AG

5.1.5. Huawei Technologies

5.1.6. Intel Corporation

5.1.7. Bosch Group

5.1.8. ABB Ltd

5.1.9. Thales Group

5.1.10. General Electric

5.1.11. NVIDIA Corporation

5.1.12. Mitsubishi Electric

5.1.13. Honeywell International

5.1.14. Schneider Electric

5.1.15. Microsoft

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, R&D Investments, Market Share, Product Specialization, Revenue, Key Partners)

5.3 Market Share Analysis

5.4 Strategic Initiatives (Collaborations, Product Innovations, Regional Expansions)

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. KSA Autonomous & Sensor Technology Market Regulatory Framework

6.1 National Standards for Autonomous Systems and Sensors

6.2 Certification Processes for Sensor-Based Technology

6.3 Safety and Compliance Regulations for Autonomous Vehicles

6.4 Data Privacy and Cybersecurity Requirements

7. KSA Autonomous & Sensor Technology Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. KSA Autonomous & Sensor Technology Future Market Segmentation

8.1 By Technology (In Value %)

8.2 By Application (In Value %)

8.3 By Component (In Value %)

8.4 By End-User (In Value %)

8.5 By Region (In Value %)

9. KSA Autonomous & Sensor Technology Market Analysts' Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Strategic Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first step involves constructing an ecosystem map that identifies all major stakeholders within the KSA Autonomous & Sensor Technology Market. This is conducted through extensive desk research, gathering data from credible government sources and market reports, to define the key variables that shape market dynamics, including advancements in AI and government policies.

Step 2: Market Analysis and Construction

This phase compiles and analyzes historical data to assess market penetration and service provider ratios within the KSA Autonomous & Sensor Technology Market. Detailed analysis of industry reports is conducted to ensure revenue accuracy and service quality statistics.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be validated through interviews with industry experts and key players in the autonomous technology sector, providing operational and financial insights directly from the industry to ensure reliable data.

Step 4: Research Synthesis and Final Output

This phase involves the synthesis of data collected from primary and secondary sources, followed by cross-verification through bottom-up and top-down approaches. The final analysis is then constructed to offer a comprehensive, validated understanding of the market dynamics.

Frequently Asked Questions

01. How big is the KSA Autonomous & Sensor Technology Market?

The KSA Autonomous & Sensor Technology Market is valued at USD 0.23 billion, driven by investments in smart cities, autonomous vehicles, and government initiatives under Vision 2030.

02. What are the challenges in the KSA Autonomous & Sensor Technology Market?

Challenges in the KSA Autonomous & Sensor Technology Market include high initial investment costs, a lack of skilled professionals for system integration, and the complexity of regulatory frameworks for autonomous technologies.

03. Who are the major players in the KSA Autonomous & Sensor Technology Market?

Key players of the KSA Autonomous & Sensor Technology Market include Saudi Technology Development (TAQNIA), STC Solutions, NEOM Tech & Digital, Siemens AG, and Huawei Technologies.

04. What are the growth drivers of the KSA Autonomous & Sensor Technology Market?

Growth drivers of the KSA Autonomous & Sensor Technology Market include the Saudi Vision 2030 initiative, investments in smart city infrastructure, and advancements in AI and IoT technologies that are transforming various sectors.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.