KSA Autonomous Vehicle Market Outlook to 2030

Region:Middle East

Author(s):Naman Rohilla

Product Code:KROD7753

December 2024

89

About the Report

KSA Autonomous Vehicle Market Overview

- The KSA autonomous vehicle market is valued at USD 812 million, driven by the governments strategic initiatives, including Vision 2030, which prioritizes high-tech infrastructure, sustainable transportation, and smart cities. These initiatives have positioned Saudi Arabia as a central hub for autonomous technology development. Moreover, investment from both local and international players, alongside technological advancements in AI and machine learning, has accelerated market expansion. The market is expected to see robust growth due to the government's continued commitment to smart transportation solutions.

- The key regions dominating the KSA autonomous vehicle market include Riyadh and Jeddah, driven by their advanced urban infrastructure and ongoing smart city projects. In particular, the development of NEOM, a mega project focused on advanced technologies, is a growth driver of market activity. Riyadhs position as the capital and an economic center has also contributed to its leadership in adopting autonomous vehicles, while Jeddah's port infrastructure attracts logistics and freight transport solutions integrating autonomous technology.

- Collaborations between the Saudi government and private tech companies are catalyzing AV deployment. In 2023, the Ministry of Transport announced new initiatives to establish national AV testing zones, including partnerships with international automakers and AI firms. These partnerships enable AV pilot programs, particularly in regions like NEOM and KAEC. Government incentives, such as tax breaks and infrastructure grants, are further encouraging private sector investment in autonomous technology. These collaborations are instrumental in advancing AV development, reducing the technological and financial burdens associated with R&D and commercialization.

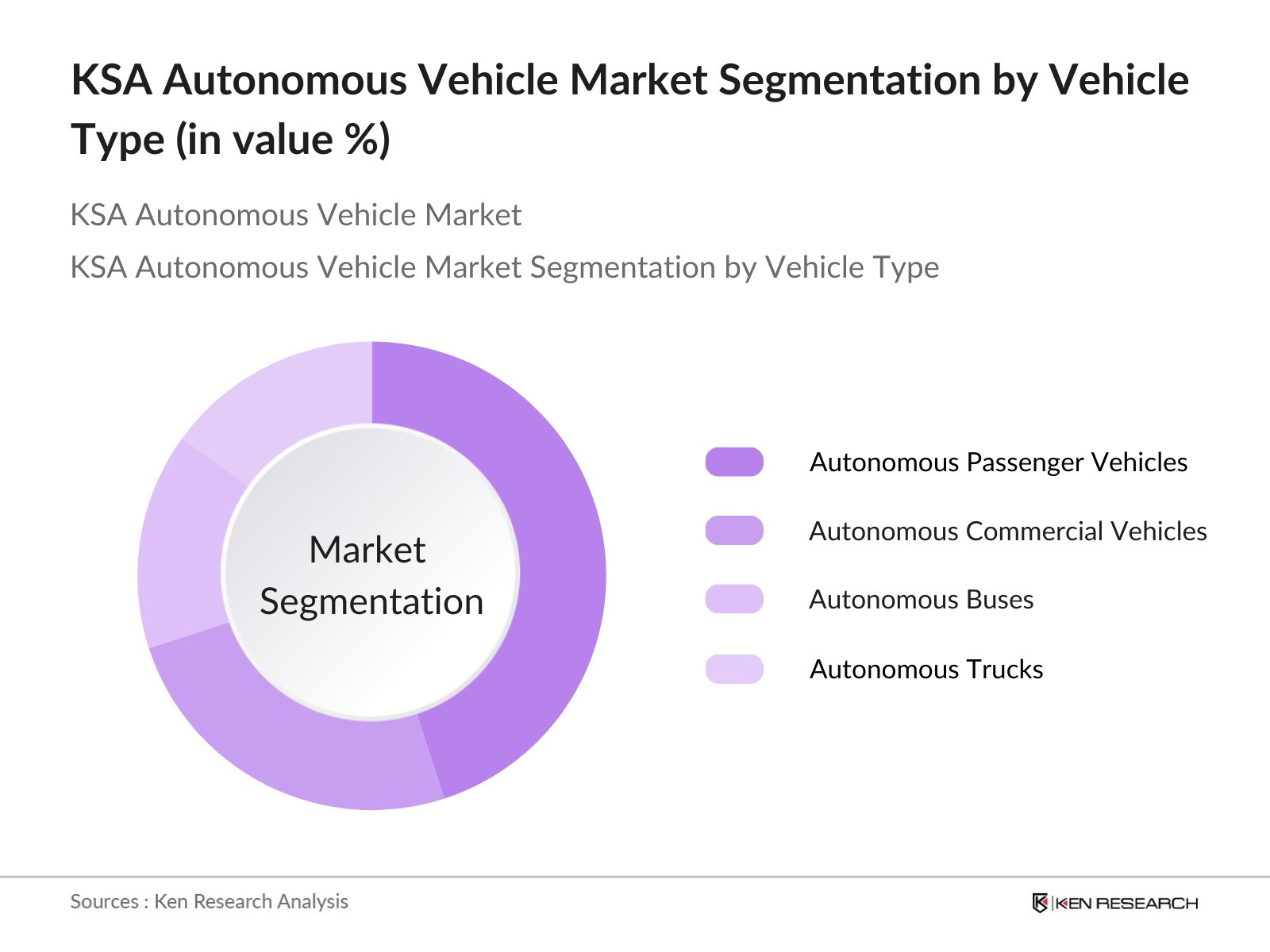

KSA Autonomous Vehicle Market Segmentation

- By Vehicle Type: The KSA autonomous vehicle market is segmented by vehicle type into passenger vehicles, commercial vehicles, autonomous buses, and autonomous trucks. Among these, autonomous passenger vehicles dominate the market, particularly driven by rising consumer interest in autonomous ride-sharing services. The integration of advanced AI-based safety features and government trials of autonomous taxi services are factors propelling the growth of passenger vehicles. Additionally, the adoption of autonomous technologies by leading ride-hailing companies in urban centers such as Riyadh enhances the segment's market position.

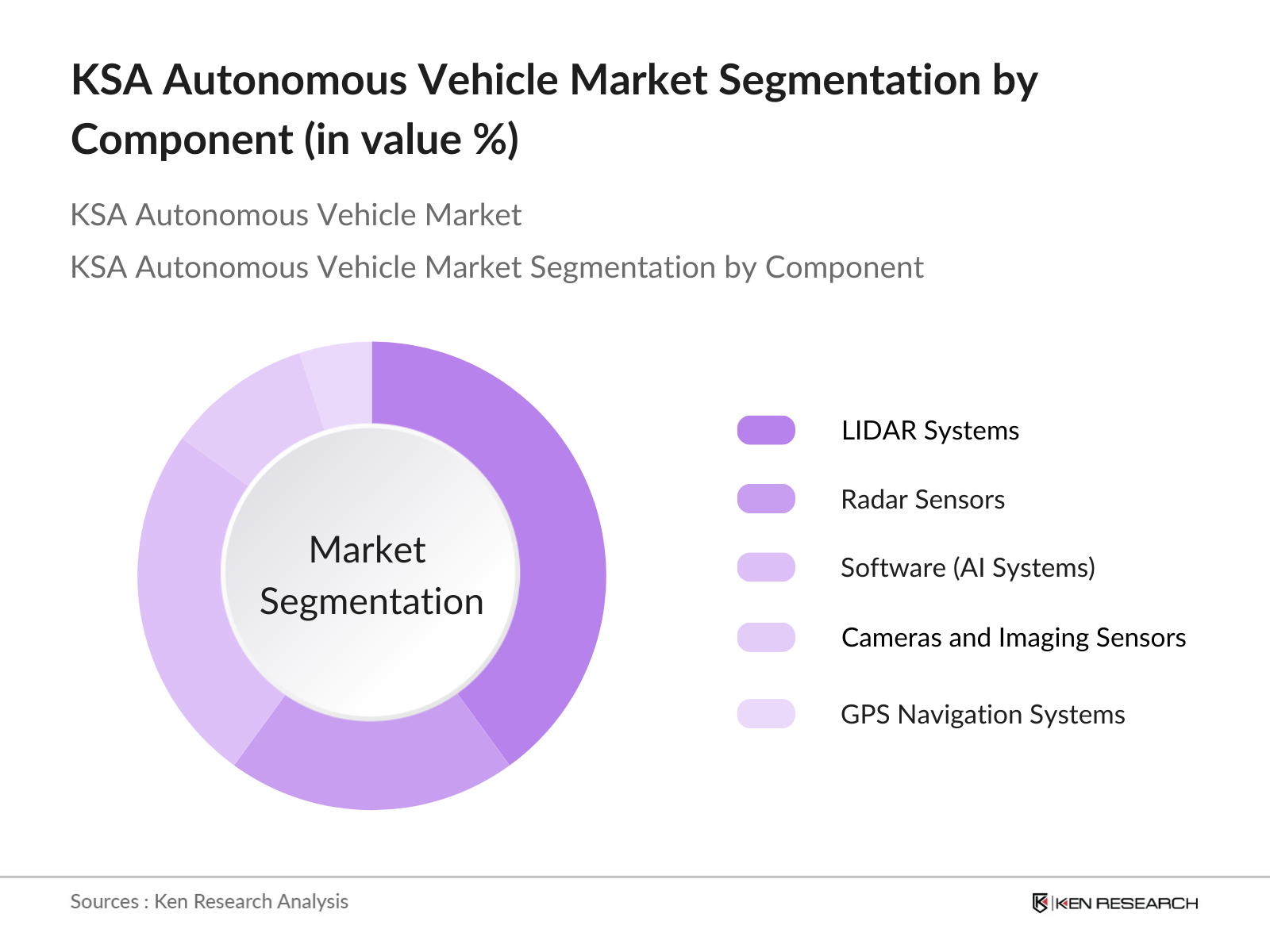

- By Component: The market is segmented into LIDAR systems, radar sensors, software, cameras and imaging sensors, and GPS navigation systems. LIDAR systems hold the largest market share due to their pivotal role in enabling real-time object detection and mapping for autonomous vehicles. As LIDAR technology improves, with reduced costs and enhanced accuracy, its adoption across vehicle platforms has surged. LIDAR systems are critical for ensuring safety in autonomous driving, making them indispensable for companies looking to scale their autonomous vehicle fleets.

KSA Autonomous Vehicle Market Competitive Landscape

The KSA autonomous vehicle market is dominated by several key players, ranging from global automakers to local tech innovators. The market consolidation highlights the competitive edge held by companies with R&D investments and strategic partnerships. Global firms such as Tesla and Waymo are expanding their operations in KSA through collaborations with local entities, leveraging the countrys favourable regulatory environment and robust investment in smart infrastructure.

KSA Autonomous Vehicle Market Analysis

KSA Autonomous Vehicle Market Growth Drivers

- Advancements in AI and Machine Learning: Saudi Arabias AI sector is growing rapidly, with $20 billion earmarked for AI development through 2030. Autonomous vehicle software benefits from these advancements, with enhanced machine learning algorithms enabling better decision-making in real-time road conditions. The Saudi Data and AI Authority (SDAIA) is spearheading AI integration across sectors, creating a robust ecosystem for AV technology. Key areas like sensor fusion and path planning are being optimized through AI, reducing response time and improving the safety of autonomous systems. These innovations support the country's aim to create smart cities with fully automated transport systems.

- Shift Towards Sustainable Transportation: Saudi Arabia is investing in electric vehicles (EVs) and sustainable transport as part of its commitment to reducing carbon emissions. In 2023, Saudi Aramco announced a goal to reduce its carbon intensity by 15%, and integrating electric autonomous vehicles is key to achieving this target. The introduction of AVs into the public transport system, combined with EV infrastructure development, is expected to lower the nation's carbon footprint, aligning with the environmental goals of Vision 2030. The Kingdoms target is to achieve net-zero emissions by 2060, and AVs will play a central role in this transition

- Urban Mobility Infrastructure: Saudi Arabia is investing heavily in smart city projects, such as NEOM, which will rely on fully autonomous, interconnected transportation networks. NEOM is expected to house more than 1 million residents, with autonomous electric shuttles and high-tech roads being integral to the citys infrastructure. These developments are also visible in projects like the King Abdullah Economic City (KAEC), which focuses on innovative mobility solutions, including AVs. The overall infrastructure development budget for Saudi Arabia reached over $300 billion by 2022, with a notable portion allocated for smart mobility solutions.

KSA Autonomous Vehicle Market Challenges

- Regulatory Barriers: Saudi Arabias regulatory framework for AVs is still under development, with guidelines currently being shaped by the Ministry of Transport and Logistic Services. The country has set up pilot zones, but nationwide deployment remains limited due to stringent approval processes. As of 2023, AV testing is primarily restricted to special economic zones like NEOM, with authorities focusing on establishing safety standards and certification processes. This regulatory inertia could slow the widespread adoption of AV technology, even as the country aims to become a regional leader in autonomous systems.

- High Capital Investment: The development and deployment of AV technology require substantial upfront investment. In 2023, Saudi Arabia invested over $500 million in R&D for AV technology, but this still represents a small portion of the total needed for nationwide integration. The cost of integrating advanced sensors, LiDAR, and AI systems into vehicles is high, with a single AV costing upwards of $100,000 to develop. Additionally, infrastructure investments for road networks and communication systems add further financial burdens, making it challenging for new players to enter the market without financial backing.

KSA Autonomous Vehicle Market Future Outlook

Over the next five years, the KSA autonomous vehicle market is expected to experience growth, driven by continuous government support, advancements in autonomous driving technology, and increasing consumer interest in AI-driven mobility solutions. The development of smart cities, particularly NEOM, is a central factor propelling the adoption of autonomous vehicles. Additionally, international players are expected to strengthen their presence through collaborations with local industries, enhancing market competitiveness.

KSA Autonomous Vehicle Market Opportunities

- Expansion in Commercial Fleets: Saudi Arabias logistics and ride-sharing sectors present growth opportunities for AV adoption. The Kingdoms logistics industry, valued at over $35 billion in 2023, is increasingly integrating AVs to improve operational efficiency. Autonomous trucks and delivery vehicles are already being piloted in projects like NEOM, where automated logistics are a key feature. In the ride-sharing sector, companies like Careem and Uber are exploring autonomous fleet options to enhance ride efficiency and reduce costs, positioning Saudi Arabia as a future leader in AV-powered logistics and public transport.

- Growing Investments from International Tech Firms: Saudi Arabias autonomous vehicle market is attracting investments from international tech firms. In 2023, leading global OEMs like Tesla and Alphabet's Waymo invested over $1 billion in AV research and development within the Kingdom. These companies are exploring partnerships with Saudi universities and research centers to localize AV technology. The countrys favorable investment environment, coupled with government incentives, is facilitating market penetration by international players, positioning Saudi Arabia as a hub for autonomous vehicle innovation in the Middle East.

Scope of the Report

By Vehicle Type | Autonomous Passenger Vehicles Autonomous Commercial Vehicles Autonomous Buses Autonomous Trucks |

By Component | LIDAR Systems Radar Sensors Software (Autonomous Driving Software) Cameras and Imaging Sensors GPS and Navigation Systems |

By Application | Autonomous Ride-Hailing Services Freight Transport and Logistics Public Transportation Last-Mile Delivery |

By Level of Automation | Level 1 Driver Assistance Level 2 Partial Automation Level 3 Conditional Automation Level 4 High Automation Level 5 Full Automation |

By Region | Riyadh Jeddah Eastern Province Mecca Medina |

Products

Key Target Audience

Automotive OEMs

Autonomous Technology Providers

Ride-Hailing and Shared Mobility Companies

Government and Regulatory Bodies (Ministry of Transport, Saudi Standards, Metrology and Quality Organization SASO)

Venture Capital Firms

Banks and Financial Institutions

Public and Private Fleet Operators

Smart City Developers (NEOM, Qiddiya)

Infrastructure Development Companies

Companies

Players Mentioned in the Report

NEOM Tech & Digital Company

Saudi Aramco

Lucid Motors

Tesla Inc.

General Motors

Aptiv

Uber ATG

Waymo

Nvidia Corporation

Mobileye

Table of Contents

1. KSA Autonomous Vehicle Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. KSA Autonomous Vehicle Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. KSA Autonomous Vehicle Market Analysis

3.1. Growth Drivers

3.1.1. Government Initiatives (e.g., Vision 2030, Public Investment Fund)

3.1.2. Advancements in AI and Machine Learning (Autonomous Vehicle Software Integration)

3.1.3. Shift Towards Sustainable Transportation (Reduced Carbon Footprint, EV Integration)

3.1.4. Urban Mobility Infrastructure (Smart Cities Development, High-Tech Roads)

3.2. Market Challenges

3.2.1. Regulatory Barriers (Approval and Testing Regulations)

3.2.2. High Capital Investment (Initial R&D and Technology Costs)

3.2.3. Public Acceptance and Safety Concerns (Perception of Autonomous Vehicles)

3.2.4. Cybersecurity Risks (Data Privacy and Autonomous System Hacking)

3.3. Opportunities

3.3.1. Expansion in Commercial Fleets (Logistics, Ride-Sharing)

3.3.2. Government-Private Partnerships (Pilot Programs, National Testing Zones)

3.3.3. Growing Investments from International Tech Firms (Market Penetration by Global OEMs)

3.3.4. Autonomous Vehicle Adoption in Mega Projects (NEOM, Qiddiya, Red Sea Project)

3.4. Trends

3.4.1. EV and Autonomous Vehicle Convergence (Integration of Electric Powertrains)

3.4.2. Use of AI-Based Decision Making (Advanced Traffic Management and Routing Systems)

3.4.3. Autonomous Public Transport (Self-Driving Buses and Shuttles in Smart Cities)

3.4.4. Rise in Shared Mobility Solutions (Autonomous Ride-Hailing Platforms)

3.5. Regulatory Framework

3.5.1. Ministry of Transport and Logistic Services Guidelines

3.5.2. Autonomous Vehicle Testing and Certification Standards (King Abdulaziz City for Science and Technology KACST Initiatives)

3.5.3. Emission Norms and Environmental Policies (Alignment with Vision 2030 Goals)

3.5.4. Data Privacy Laws and Cybersecurity Protocols

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Automotive OEMs, Tech Startups, Government Entities)

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem (Innovation Clusters, International Tech Collaborations)

4. KSA Autonomous Vehicle Market Segmentation

4.1. By Vehicle Type (In Value %)

4.1.1. Autonomous Passenger Vehicles

4.1.2. Autonomous Commercial Vehicles

4.1.3. Autonomous Buses

4.1.4. Autonomous Trucks

4.2. By Component (In Value %)

4.2.1. LIDAR Systems

4.2.2. Radar Sensors

4.2.3. Software (Autonomous Driving Software, AI Systems)

4.2.4. Cameras and Imaging Sensors

4.2.5. GPS and Navigation Systems

4.3. By Application (In Value %)

4.3.1. Autonomous Ride-Hailing Services

4.3.2. Freight Transport and Logistics

4.3.3. Public Transportation

4.3.4. Last-Mile Delivery

4.4. By Level of Automation (In Value %)

4.4.1. Level 1 Driver Assistance

4.4.2. Level 2 Partial Automation

4.4.3. Level 3 Conditional Automation

4.4.4. Level 4 High Automation

4.4.5. Level 5 Full Automation

4.5. By Region (In Value %)

4.5.1. Riyadh

4.5.2. Jeddah

4.5.3. Eastern Province

4.5.4. Mecca

4.5.5. Medina

5. KSA Autonomous Vehicle Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. NEOM Tech & Digital Company

5.1.2. Saudi Aramco

5.1.3. Lucid Motors

5.1.4. Tesla Inc.

5.1.5. General Motors

5.1.6. Aptiv

5.1.7. Uber ATG

5.1.8. Waymo

5.1.9. Nvidia Corporation

5.1.10. Mobileye

5.1.11. Baidu Apollo

5.1.12. Zoox (Amazon)

5.1.13. Intel Corporation

5.1.14. Aurora Innovation

5.1.15. Velodyne Lidar

5.2. Cross Comparison Parameters (Market-Specific)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. KSA Autonomous Vehicle Market Regulatory Framework

6.1. Autonomous Vehicle Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. KSA Autonomous Vehicle Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. KSA Autonomous Vehicle Future Market Segmentation

8.1. By Vehicle Type (In Value %)

8.2. By Component (In Value %)

8.3. By Application (In Value %)

8.4. By Level of Automation (In Value %)

8.5. By Region (In Value %)

9. KSA Autonomous Vehicle Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first step in this research involved identifying critical stakeholders, including OEMs, technology providers, and regulatory bodies. Secondary research was conducted using proprietary databases, and government reports to define key market variables affecting the KSA autonomous vehicle market, such as fleet sizes, regulatory influences, and R&D activities.

Step 2: Market Analysis and Construction

Historical data from industry reports and government sources were used to analyze market penetration and market dynamics. The evaluation focused on fleet sizes, market revenue, and the growth of autonomous vehicle services, which provided insights into market opportunities and challenges.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding market growth were validated through interviews with industry experts, including representatives from Saudi government agencies and leading autonomous vehicle manufacturers. This step ensured that the report was based on practical insights and validated market data.

Step 4: Research Synthesis and Final Output

The final phase involved synthesizing the gathered data and insights to produce a comprehensive and validated report. Additional engagement with autonomous vehicle providers ensured that the data represented current market conditions, offering a robust analysis of the KSA autonomous vehicle market.

Frequently Asked Questions

01. How big is the KSA Autonomous Vehicle Market?

The KSA autonomous vehicle market is valued at USD 812 million, driven by investments in smart city projects, government support, and international partnerships with major autonomous technology companies.

02. What are the challenges in the KSA Autonomous Vehicle Market?

Key challenges in the KSA autonomous vehicle market include regulatory approval for widespread autonomous vehicle usage, high upfront capital investment for R&D, and public concerns around safety and cybersecurity, which have slowed the pace of adoption.

03. Who are the major players in the KSA Autonomous Vehicle Market?

Major players in the KSA autonomous vehicle market include NEOM Tech & Digital, Lucid Motors, Tesla Inc., Waymo, and Uber ATG. These companies have established dominance through R&D, strategic partnerships, and government collaborations.

04. What are the growth drivers of the KSA Autonomous Vehicle Market?

Growth in the KSA autonomous vehicle market is driven by government-led initiatives, such as Vision 2030, which prioritize smart city development, sustainable transport, and tech innovation. Autonomous vehicle adoption is further supported by international investments and partnerships with global automakers.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.