KSA Baby Food Market Outlook to 2030

Region:Middle East

Author(s):Mukul

Product Code:KROD5039

October 2024

98

About the Report

KSA Baby Food Market Overview

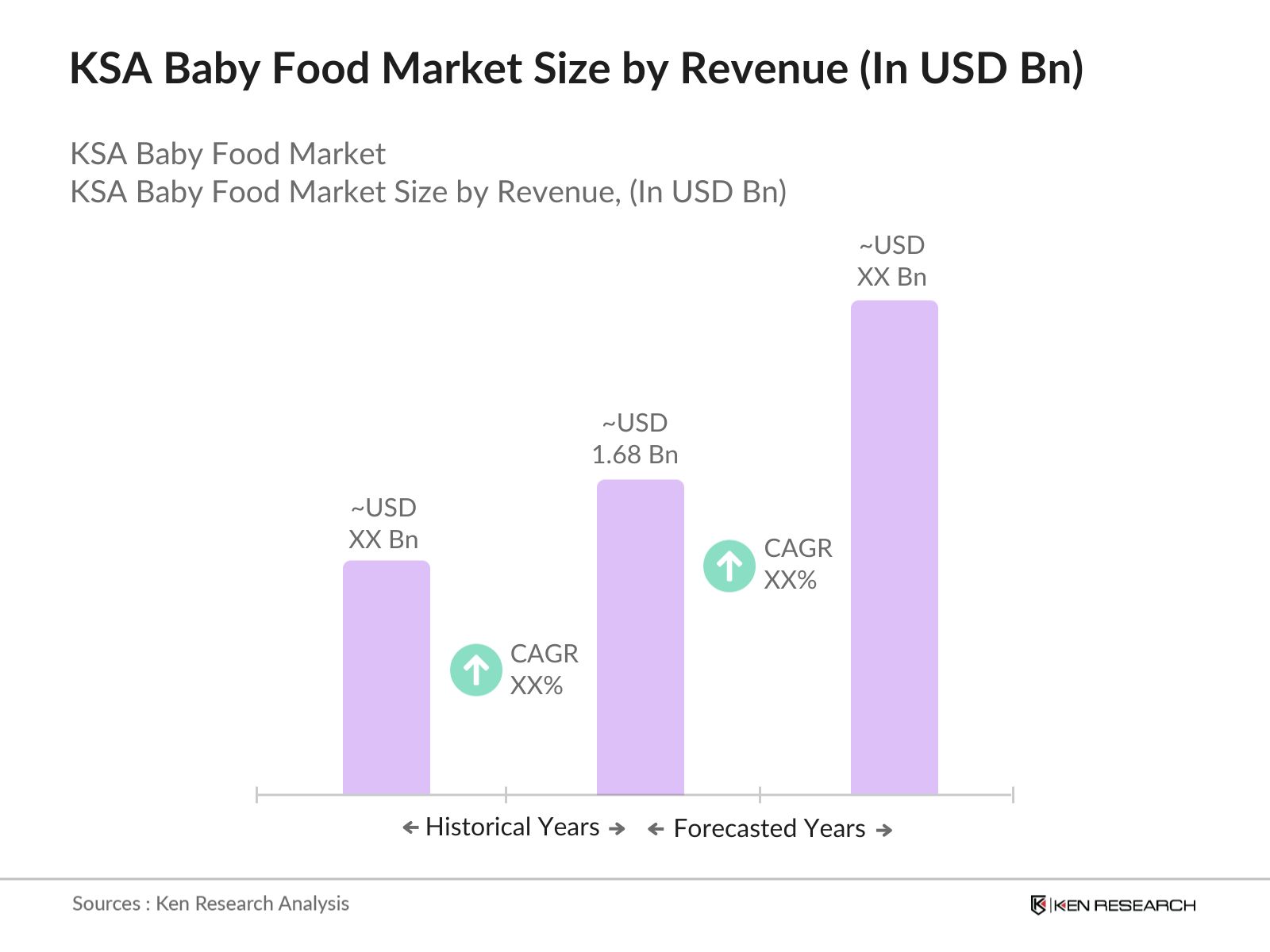

- The KSA baby food market size by revenue USD 1.68 billion, according to a comprehensive analysis of the past five years. This market is driven by an increasing birth rate, rising disposable income, and the growing awareness among parents regarding infant nutrition. Key factors also include a surge in demand for organic and halal-certified baby food products as Saudi families are increasingly prioritizing health-conscious and safe food options for their infants. The rise in e-commerce platforms has further facilitated the ease of purchasing baby food products, contributing to overall market growth.

- Riyadh and Jeddah dominate the KSA baby food market, primarily due to the larger population size, higher income levels, and more advanced retail infrastructures. These cities have well-developed distribution networks, which allow brands to introduce new products and effectively meet consumer demand. Additionally, urbanization in these regions plays a pivotal role in boosting the sales of ready-to-eat baby food, especially among working parents who seek convenience without compromising nutrition.

- In Saudi Arabia, the SFDA mandates strict guidelines for food safety and labeling, particularly for baby food. These regulations include mandatory testing for contaminants and allergens, as well as requirements for transparent ingredient labeling. In 2024, the SFDA intensified its monitoring, ensuring all baby food products adhere to stringent standards before being distributed to the market. This has led to safer products but also increased operational costs for manufacturers, who must comply with detailed inspections and certification processes.

KSA Baby Food Market Segmentation

- By Product Type: The KSA baby food market is segmented by product type into milk formula, prepared baby food, dried baby food, cereal-based baby food, and snacks. Among these, milk formula has dominated the market. This can be attributed to the preference among Saudi families for premium infant formula due to rising concerns about breastfeeding challenges and the availability of advanced, nutrition-rich formulas that cater to the specific dietary needs of babies. Moreover, milk formulas from global brands have built a reputation for safety and reliability, contributing to their strong foothold in the market.

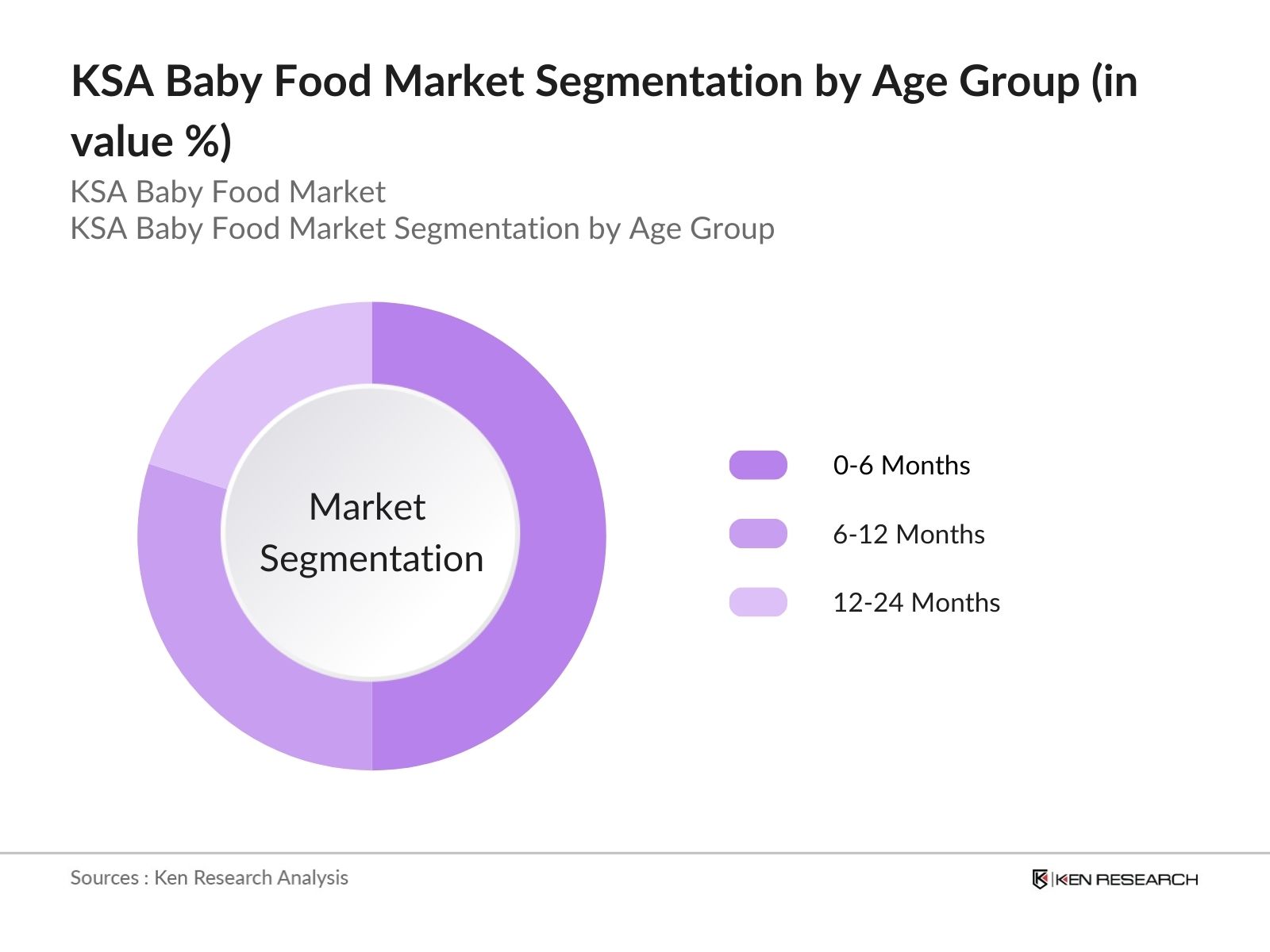

- By Age Group: The KSA Baby Food Market is segmented by age group into 0-6 months, 6-12 months, and 12-24 months. The 0-6 months age group represents the highest demand for baby food, primarily driven by the necessity of milk formula for infants unable to breastfeed. Parents in the Kingdom often opt for formula due to convenience, dietary concerns, and medical reasons. Additionally, for this age group, parents rely on baby food as the sole source of nutrition, making it a crucial segment for manufacturers to target.

KSA Baby Food Market Competitive Landscape

The KSA baby food market is dominated by both global and regional players. Multinational companies with established brand presence hold a significant share of the market, leveraging their extensive distribution networks and trust in product quality. Domestic players have started gaining traction as well, especially in the organic and halal segments, catering to local consumer preferences.

|

Company |

Establishment Year |

Headquarters |

R&D Investment |

Organic Offerings |

Number of Products |

Geographic Reach |

Halal Certification |

Strategic Partnerships |

|

Nestl S.A. |

1867 |

Vevey, Switzerland |

||||||

|

Abbott Nutrition |

1888 |

Illinois, USA |

||||||

|

Danone S.A. |

1919 |

Paris, France |

||||||

|

Hero Group |

1886 |

Lenzburg, Switzerland |

||||||

|

Almarai |

1977 |

Riyadh, Saudi Arabia |

KSA Baby Food Industry Analysis

Market Growth Drivers

- Rising birth rates: The Kingdom of Saudi Arabia has seen consistent population growth due to its rising birth rates. In 2024, the population is expected to surpass 36.5 million, with over 650,000 births recorded annually. The Saudi General Authority for Statistics reports that this increase in population is directly tied to the higher demand for baby food products as more families require nutritionally balanced food for their infants. With nearly 30% of the population under 14 years old, the market for baby food is continuously expanding, driven by demographic growth.

- Increase in dual-income households: As Saudi Arabia experiences rapid urbanization and modernization, more families are becoming dual-income households. In 2023, nearly 40% of Saudi families had both parents employed, up from 35% in 2021, according to labor force surveys from the Saudi General Authority for Statistics. This rise in disposable income has driven demand for convenient and premium baby food products as working parents seek easily accessible and healthy nutrition options for their children. The trend towards dual-income families is anticipated to continue growing due to increasing female participation in the workforce. Source.

- Government health initiatives: Saudi Vision 2030 focuses on improving public health and nutrition, leading to several health initiatives targeting infant and child nutrition. By 2023, the Ministry of Health's campaigns promoting infant health and balanced nutrition increased public awareness, especially in urban regions. Initiatives under Vision 2030 encourage breastfeeding but also stress the importance of accessible, nutritionally balanced baby food, especially for working mothers. Programs promoting child healthcare are integrated into the Saudi healthcare system, further driving the demand for fortified and specialized baby food products.

Market Restraints

- Limited shelf life of organic baby food: Organic baby food products, while popular, face challenges regarding their shelf life. In 2023, organic products had an average shelf life of around 6-9 months, significantly lower than conventional baby food. This shorter shelf life affects distribution and inventory management, especially in a vast country like Saudi Arabia, where logistics can be a challenge. Retailers must deal with frequent stock turnovers, which increases the cost and operational difficulties, leading to limited

- Stringent government regulations on food safety: The Saudi Food and Drug Authority (SFDA) and the Saudi Standards, Metrology and Quality Organization (SASO) have imposed stringent regulations on baby food safety. Manufacturers must comply with these strict standards, which include thorough testing for contaminants, nutritional content verification, and adherence to labeling laws. While these regulations ensure product safety, they also increase production costs and delay market entry for new products. Compliance with these regulations in 2024 remains a significant hurdle for both domestic and international manufacturers.

KSA Baby Food Market Future Outlook

Over the next five years, the KSA baby food market is expected to continue growing, driven by a rising awareness of the importance of infant nutrition and a preference for convenient, ready-to-eat baby food options. The market will also benefit from innovations in organic and halal-certified baby food, which align with consumer preferences for healthier, more ethically sourced products. Moreover, the expanding middle class and urbanization will sustain the demand for premium baby food products.

Market Opportunities

- Growing e-commerce penetration for baby food sales: The growth of e-commerce in Saudi Arabia presents a significant opportunity for the baby food market. As of 2024, e-commerce transactions accounted for over 25% of baby food sales, with the market expected to grow further as online retailers offer convenience and competitive pricing. Platforms like Noon and Amazon.sa have expanded their baby food categories, offering an extensive range of products, including organic, halal, and specialized formulas. Increasing internet penetration and the expansion of digital payment systems are facilitating the growth of this segment. Source.

- Increasing awareness regarding baby nutrition: Public awareness campaigns spearheaded by the Ministry of Health have significantly boosted awareness about the importance of infant nutrition. In 2023, health literacy programs reached over 70% of new parents through hospitals and pediatric clinics, educating them on the importance of balanced baby diets. This rising awareness is driving parents toward better-quality baby food products, particularly those fortified with essential vitamins and minerals. Parents are now more likely to opt for baby food products that cater to specific nutritional needs, such as lactose-free, iron-enriched, or allergen-free options.

Scope of the Report

|

By Product Type |

Milk Formula |

|

Prepared Baby Food |

|

|

Dried Baby Food |

|

|

Cereal-Based Baby Food |

|

|

Snacks |

|

|

By Age Group |

0-6 months |

|

6-12 months |

|

|

12-24 months |

|

|

By Distribution Channel |

Supermarkets and Hypermarkets |

|

Convenience Stores |

|

|

Online Retail |

|

|

Specialty Baby Stores |

|

|

By Ingredient Type |

Organic Baby Food |

|

Non-Organic Baby Food |

|

|

Halal-Certified Baby Food |

|

|

By Region |

Central Region |

|

Western Region |

|

|

Eastern Region |

|

|

Northern Region |

|

|

Southern Region |

Products

Key Target Audience

Baby Food Manufacturers

Retail Chains and Supermarkets

E-commerce Platforms

Healthcare Providers and Pediatricians

Government and Regulatory Bodies (Saudi Food and Drug Authority - SFDA)

Private Label Manufacturers

Investment and Venture Capitalist Firms

Packaging and Logistics Providers

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Nestl S.A.

Abbott Nutrition

Danone S.A.

Hero Group

Almarai

Bubs Australia

Heinz

Arla Foods

Aptamil

Humana Baby Food

Milupa

FrieslandCampina

Mead Johnson Nutrition

Bellamy's Organic

Hipp Organic

Table of Contents

1. KSA Baby Food Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Annual market growth percentage, revenue growth rate)

1.4. Market Segmentation Overview

2. KSA Baby Food Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones (New product launches, partnership agreements, regulatory updates)

3. KSA Baby Food Market Analysis

3.1. Growth Drivers

3.1.1. Rising birth rates (Saudi General Authority for Statistics)

3.1.2. Increase in dual-income households

3.1.3. Government health initiatives (Saudi Vision 2030)

3.1.4. Rising demand for organic and natural baby food 3.2. Market Challenges

3.2.1. High product pricing (Premium baby food products)

3.2.2. Limited shelf life of organic baby food

3.2.3. Stringent government regulations on food safety (SASO, SFDA compliance) 3.3. Opportunities

3.3.1. Growing e-commerce penetration for baby food sales

3.3.2. Increasing awareness regarding baby nutrition

3.3.3. Expansion of organic and halal-certified baby food segments

3.4. Trends

3.4.1. Preference for organic and non-GMO baby food products

3.4.2. Rise in subscription-based meal kits for babies

3.4.3. Growth in fortified baby food (vitamins, iron-enriched)

3.5. Government Regulations

3.5.1. Food safety and labeling regulations (SFDA guidelines)

3.5.2. Import restrictions and tariffs (Regulations impacting baby food imports)

3.5.3. Promotion of breastfeeding (World Health Organization initiatives in KSA)

3.6. SWOT Analysis

3.7. Stake Ecosystem (Suppliers, manufacturers, retailers, and distributors)

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. KSA Baby Food Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Milk Formula

4.1.2. Prepared Baby Food

4.1.3. Dried Baby Food

4.1.4. Cereal-Based Baby Food

4.1.5. Snacks 4.2. By Age Group (In Value %)

4.2.1. 0-6 months

4.2.2. 6-12 months

4.2.3. 12-24 months

4.3. By Distribution Channel (In Value %)

4.3.1. Supermarkets and Hypermarkets

4.3.2. Convenience Stores

4.3.3. Online Retail

4.3.4. Specialty Baby Stores

4.4. By Ingredient Type (In Value %)

4.4.1. Organic Baby Food

4.4.2. Non-Organic Baby Food

4.4.3. Halal-Certified Baby Food

4.5. By Region (In Value %)

4.5.1. Central Region

4.5.2. Western Region

4.5.3. Eastern Region

4.5.4. Northern Region

4.5.5. Southern Region

5. KSA Baby Food Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Nestl S.A.

5.1.2. Abbott Nutrition

5.1.3. Danone S.A.

5.1.4. Hero Group

5.1.5. Bubs Australia

5.1.6. Arla Foods

5.1.7. Heinz

5.1.8. Riri Baby Food

5.1.9. Almarai

5.1.10. Aptamil

5.1.11. Milupa

5.1.12. Humana Baby Food

5.1.13. Abbott Laboratories

5.1.14. FrieslandCampina

5.1.15. Mead Johnson Nutrition 5.2. Cross Comparison Parameters (No. of Employees, Revenue, Market Share, Product Range, R&D Spending, Geographic Reach, Organic Offerings, Partnerships) 5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. KSA Baby Food Market Regulatory Framework

6.1. Food Safety Standards (SFDA regulations)

6.2. Import Guidelines for Baby Food Products

6.3. Compliance Requirements (Labeling, nutrition facts, allergen warnings)

7. KSA Baby Food Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. KSA Baby Food Future Market Segmentation 8.1. By Product Type (In Value %)

8.2. By Age Group (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Ingredient Type (In Value %)

8.5. By Region (In Value %)

9. KSA Baby Food Market Analyst Recommendations 9.1. TAM/SAM/SOM Analysis

9.2. Marketing Initiatives

9.3. Consumer Cohort Analysis

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase focuses on identifying the core variables affecting the KSA baby food market. This includes conducting desk research and leveraging proprietary databases to examine market dynamics, regulatory policies, and consumer behavior trends.

Step 2: Market Analysis and Construction

This step involves analyzing historical data on market performance, segmentation, and sales revenue. The data is further examined for accuracy and consistency to provide reliable market forecasts.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through consultations with industry experts, pediatricians, and distributors. Their insights are instrumental in refining the market estimates and segment projections.

Step 4: Research Synthesis and Final Output

The final stage synthesizes the collected data to create a comprehensive report on the KSA baby food market. This process ensures the delivery of an accurate, data-driven analysis that reflects current market conditions.

Frequently Asked Questions

1. How big is the KSA Baby Food Market?

The KSA baby food market size by revenue USD 1.68 billion. The demand for infant nutrition, coupled with the increasing adoption of organic and halal-certified products, drives the market.

2. What are the challenges in the KSA Baby Food Market?

Challenges include strict regulatory compliance, high costs of premium products, and competition from homemade baby food options, which appeal to cost-conscious parents.

3. Who are the major players in the KSA Baby Food Market?

Key players include Nestl, Danone, Almarai, Abbott Nutrition, and Hero Group. These companies benefit from strong distribution networks, product innovation, and consumer trust.

4. What are the growth drivers of the KSA Baby Food Market?

The market is driven by rising birth rates, urbanization, and increased disposable income, along with growing awareness about the importance of early childhood nutrition.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.