KSA Bakery and Cereals Market Outlook to 2030

Region:Middle East

Author(s):Abhinav kumar

Product Code:KROD5019

December 2024

93

About the Report

KSA Bakery and Cereals Market Overview

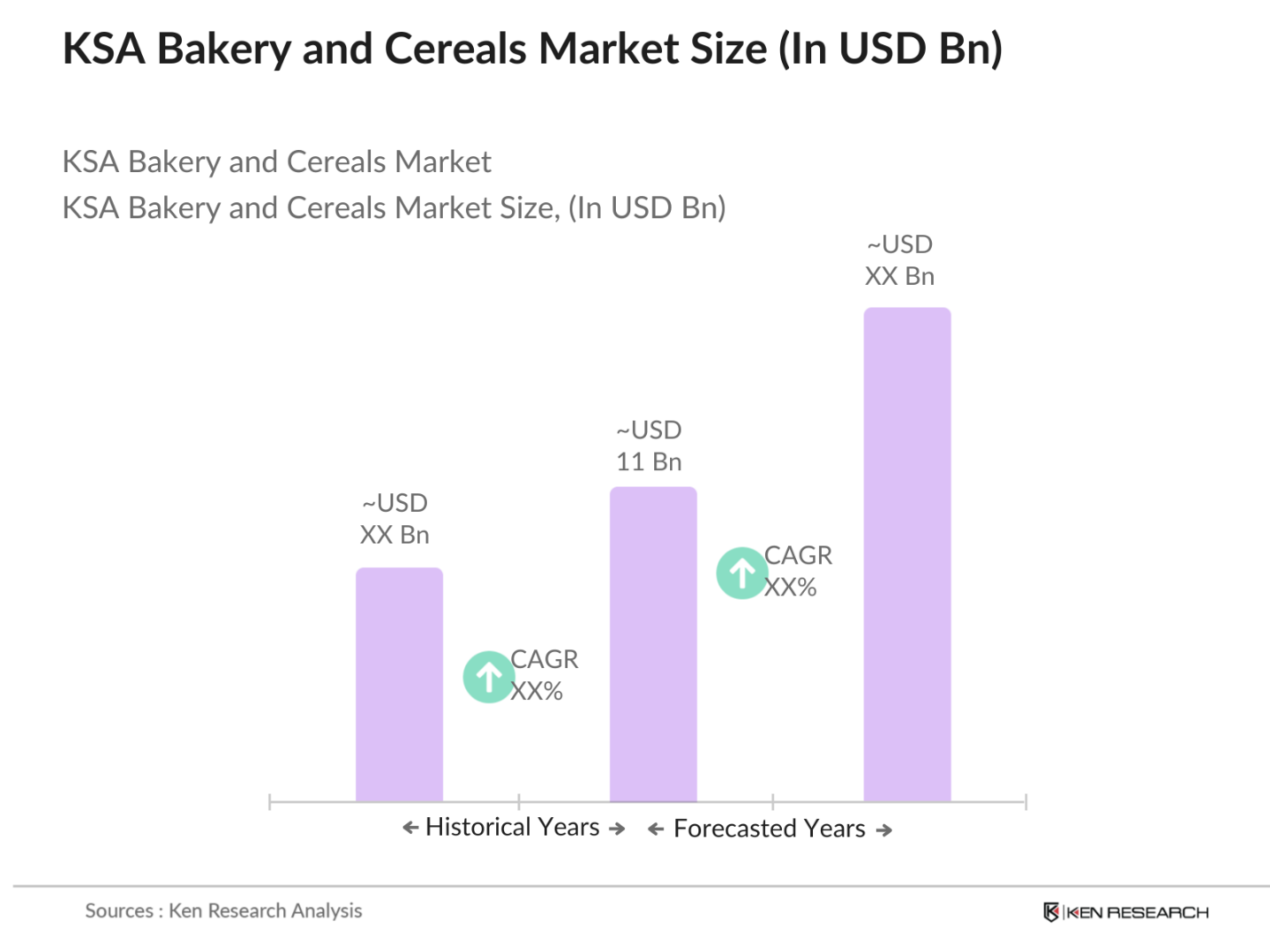

- The KSA Bakery and Cereals Market is valued at USD 11 billion, driven by rising consumer demand for convenient, ready-to-eat food products. The market's growth has been influenced by changing lifestyles, urbanization, and an increase in disposable income. As Saudi consumers increasingly seek nutritious, fortified, and on-the-go breakfast options, the demand for cereals, bread, and baked goods has surged. Furthermore, the growing health consciousness has boosted sales of organic, gluten-free, and whole grain products, which have become a key part of bakery and cereal portfolios.

- Major cities such as Riyadh, Jeddah, and Dammam dominate the market, given their large population base, modern retail infrastructure, and higher consumer purchasing power. These urban centers have the highest concentration of hypermarkets and supermarkets, driving substantial sales for bakery and cereals. Additionally, the expanding middle class and growing demand for imported premium products in these cities contribute to their dominance in the Saudi market.

- Saudi Vision 2030 has set ambitious targets for diversifying the economy, including enhancing the food manufacturing sector. As part of the initiative, the Saudi government invested $3.5 billion in the food industry in 2023, focusing on supporting local bakery and cereal production. This investment aims to reduce dependence on imports, encourage domestic manufacturing, and improve food security.

KSA Bakery and Cereals Market Segmentation

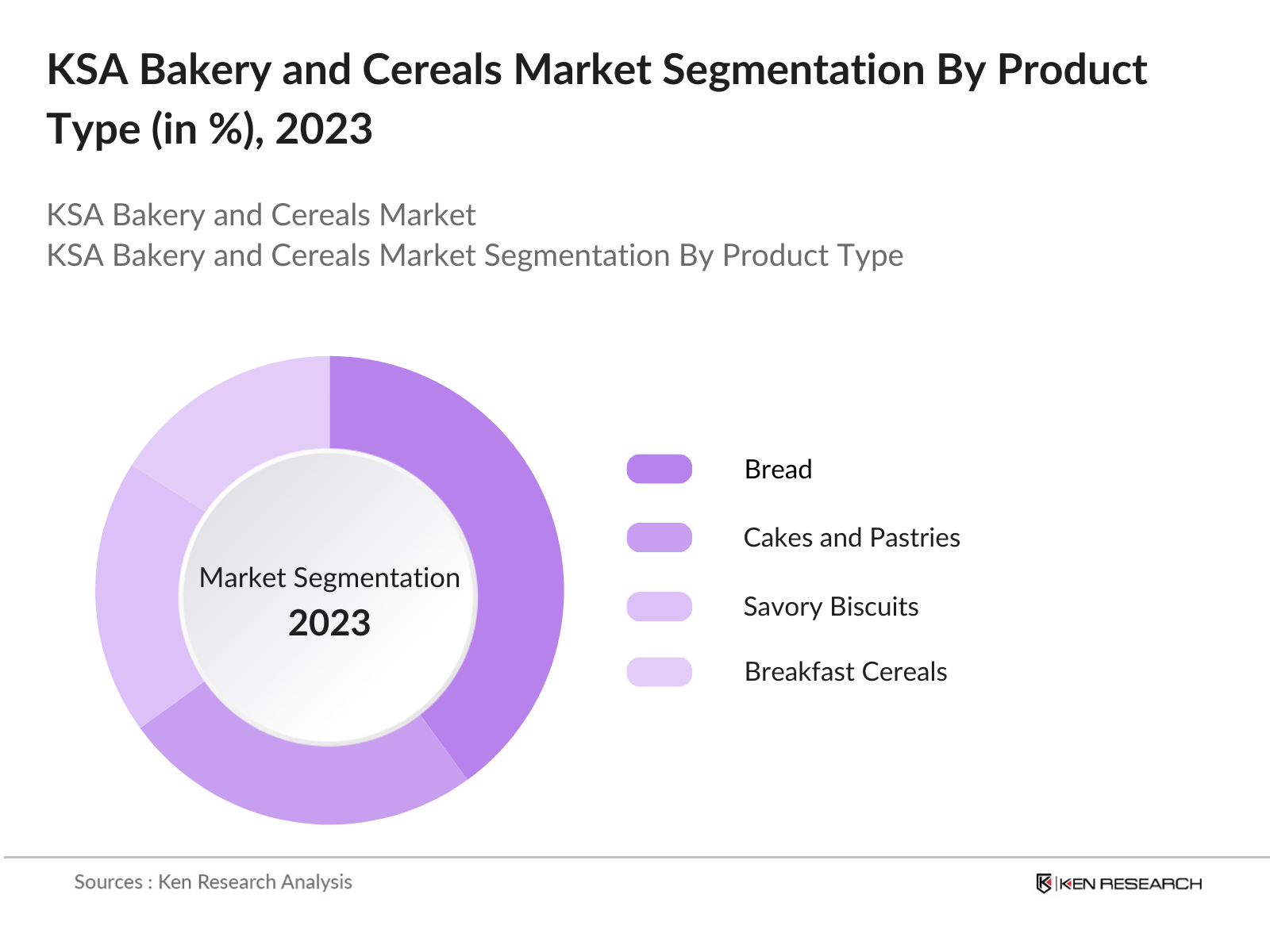

By Product Type: KSAs bakery and cereals market is segmented by product type into bread, cakes and pastries, savory biscuits, breakfast cereals, and snack bars. Recently, bread has dominated the product type segmentation due to its staple role in the Saudi diet. Local consumers favor a wide variety of bread products ranging from traditional flatbreads to Western-style loaves and rolls, making bread an essential household item. Manufacturers have introduced healthy variations, such as whole wheat and multigrain options, which have also contributed to its consistent market leadership.

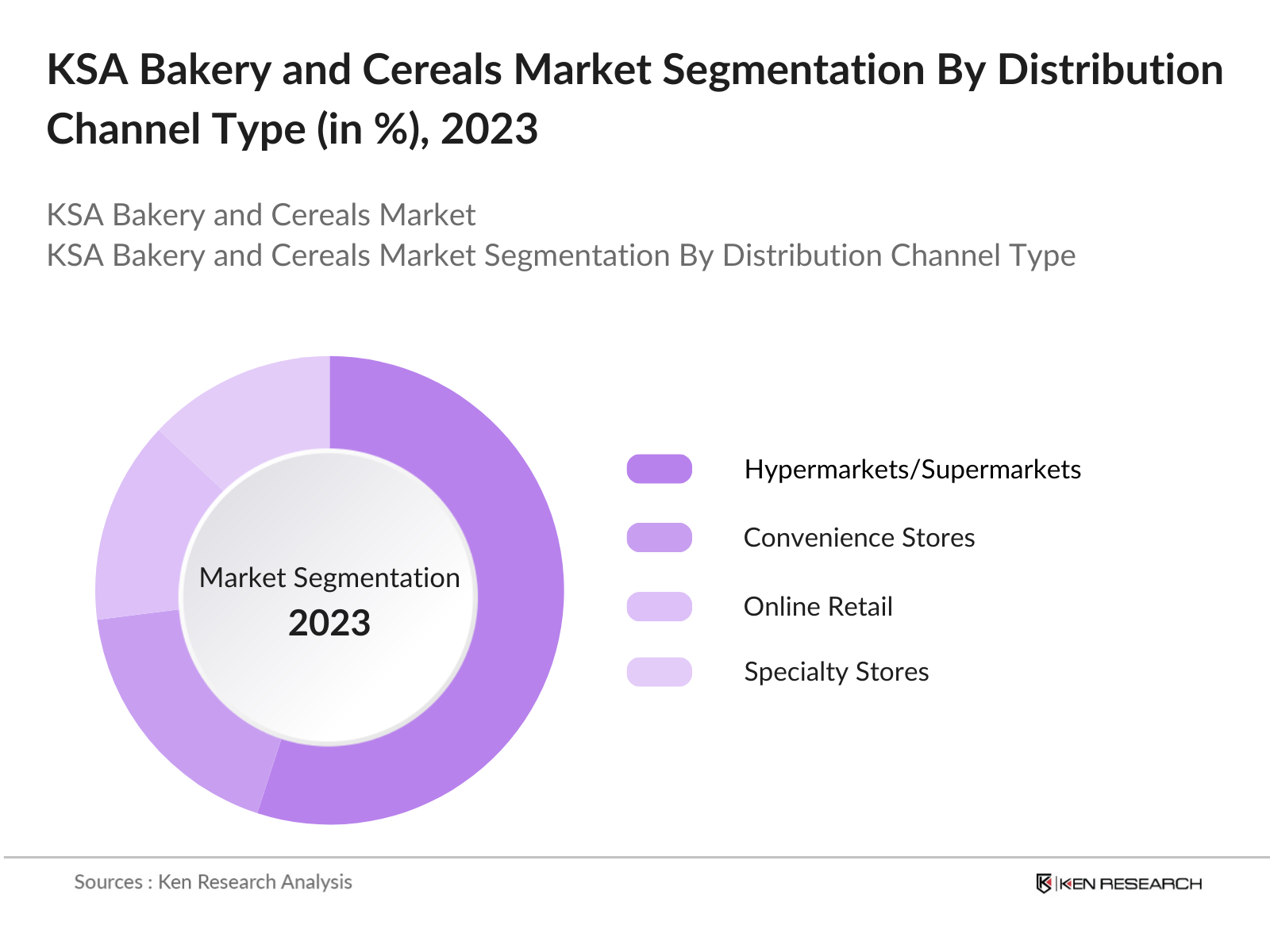

By Distribution Channel: The bakery and cereals market in KSA is segmented by distribution channels into hypermarkets/supermarkets, convenience stores, online retail, specialty stores, and others. Hypermarkets and supermarkets are the dominant distribution channel, accounting for a significant portion of total sales. These large retail outlets offer extensive product variety, bulk purchasing options, and competitive pricing, making them popular among Saudi consumers. Furthermore, the expansion of retail chains such as Carrefour and Lulu Hypermarket has bolstered this channel's position in the market.

KSA Bakery and Cereals Market Competitive Landscape

The KSA bakery and cereals market is highly competitive, with both domestic and international companies vying for market share. The market is dominated by key players with strong brand presence, distribution networks, and product innovation capabilities. Companies such as Almarai and United Food Industries Corporation have established significant footprints, offering a wide range of products tailored to local tastes.

|

Company |

Establishment Year |

Headquarters |

Revenue |

Employees |

Distribution Network |

Product Range |

Innovation |

Local Sourcing |

|

Almarai |

1977 |

Riyadh, KSA |

_ |

_ |

_ |

_ |

_ |

_ |

|

United Food Industries Corporation (Deemah) |

1977 |

Jeddah, KSA |

_ |

_ |

_ |

_ |

_ |

_ |

|

Sunbulah Group |

1980 |

Jeddah, KSA |

_ |

_ |

_ |

_ |

_ |

_ |

|

SADAFCO (Saudia Dairy & Foodstuff Co.) |

1976 |

Jeddah, KSA |

_ |

_ |

_ |

_ |

_ |

_ |

|

Mondelez International |

1923 |

Illinois, USA |

_ |

_ |

_ |

_ |

_ |

_ |

KSA Bakery and Cereals Industry Analysis

Growth Drivers

- Rising Disposable Income: The steady rise in disposable income in Saudi Arabia has driven increased consumer spending on convenience foods, including bakery and cereal products. According to the World Bank, Saudi Arabia's Gross National Income (GNI) per capita reached $23,240 in 2022, reflecting growing purchasing power among citizens. This rise in income has made premium bakery products more accessible to a larger portion of the population. Additionally, household expenditure on food in the country was estimated at $116 billion in 2022, with bakery and cereal products being a significant part of this spending.

- Increasing Urbanization: Urbanization in Saudi Arabia is occurring at an accelerated pace, contributing to higher demand for bakery and cereal products. As of 2023, around 84% of the population lives in urban areas, according to the United Nations Population Division. This urban shift is leading to lifestyle changes, where people are adopting more convenience-oriented eating habits, such as consuming more ready-made bakery and cereal products. Additionally, urban consumers are more exposed to international culinary trends, further driving demand for diverse bakery offerings.

- Changes in Dietary Habits: The shift toward convenience foods in Saudi Arabia is driven by a growing number of dual-income households and busy lifestyles. As of 2022, labor force participation reached 52.5% in Saudi Arabia, with a significant rise in female participation, according to the World Bank. This shift is pushing demand for pre-packaged, ready-to-eat bakery and cereal products that cater to on-the-go consumption. Consumers are increasingly opting for bakery products that are quick and easy to prepare, reflecting changing meal patterns and dietary habits across the country.

Market Challenges

- High Production Costs: The bakery and cereal industry in Saudi Arabia faces high production costs, driven by the increased price of raw materials such as wheat. As of 2024, Saudi Arabia imports around 80% of its wheat supply due to limited local production, leading to inflated costs. According to data from the Saudi Grains Organization (SAGO), the country imported 3.2 million metric tons of wheat in 2023, significantly increasing production expenses for manufacturers who rely on this key ingredient.

- Supply Chain Disruptions: Supply chain disruptions, exacerbated by global events and geopolitical tensions, have impacted the availability of ingredients crucial to the bakery and cereals industry in Saudi Arabia. For example, delays in wheat shipments were reported in 2022, affecting bakery production timelines. Furthermore, logistical challenges and high transportation costs within the region add to the difficulties manufacturers face in maintaining a smooth supply chain, as noted by the Saudi Ministry of Transport and Logistic Services.

KSA Bakery and Cereals Market Future Outlook

Over the next five years, the KSA bakery and cereals market is expected to experience significant growth driven by factors such as rising consumer health awareness, technological advancements in baking processes, and the ongoing demand for convenience foods. Additionally, the expanding middle class, increasing penetration of e-commerce, and the introduction of new product innovations, such as organic and gluten-free bakery items, will propel market growth. The continuous investment by local players in expanding their product range and improving supply chain efficiency is also anticipated to play a crucial role in shaping the future landscape of this market.

Opportunities

- Expansion of Organic and Gluten-Free Product Lines: There is significant potential for growth in the organic and gluten-free segments of the Saudi bakery and cereals market. As of 2023, consumer interest in organic products has surged, with the Ministry of Environment, Water, and Agriculture reporting a 35% increase in organic farming in the past two years. Gluten-free bakery products are also gaining traction, driven by rising awareness of gluten intolerance and the availability of imported gluten-free ingredients.

- Technological Advancements in Baking: Technological innovations in baking are creating new opportunities for Saudi manufacturers. Automation and the use of advanced baking machinery have enhanced production efficiency, reducing reliance on manual labor. As of 2024, several bakery firms have adopted smart technologies, such as precision ovens and ingredient optimization systems, as supported by the Saudi Industrial Development Fund (SIDF). These advancements enable local manufacturers to produce at scale, meet high demand, and reduce waste.

Scope of the Report

|

Product Type |

Bread Cakes and Pastries Savory Biscuits Breakfast Cereals Snack Bars |

|

Distribution Channel |

Hypermarkets/Supermarkets Convenience Stores Online Retail Specialty Stores Others |

|

Ingredient |

Whole Grains, Refined Wheat Flour Gluten-Free Ingredients Sugar Substitutes Dairy Alternatives |

|

Consumer Type |

Kids Adults Seniors Health-Conscious Consumers |

|

Region |

Central Saudi Arabia Western Saudi Arabia Eastern Saudi Arabia Northern Saudi Arabia Southern Saudi Arabia |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Saudi Food and Drug Authority - SFDA)

Bakery and Cereal Manufacturing Companies

Importers and Exporters Companies of Bakery and Cereal Prodoctc

E-commerce Platform Companies

Health-Conscious Consumer Industries

Packaging and Ingredient Companies

Companies

Players Mentioned in the Report

Almarai

United Food Industries Corporation (Deemah)

Sunbulah Group

SADAFCO (Saudia Dairy & Foodstuff Company)

General Mills

Kelloggs

Modern Bakery

Al Othman Agriculture Production & Processing Company (NADA)

National Biscuits & Confectionery Company

Aryzta AG

Table of Contents

1. Saudi Arabia Bakery and Cereals Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Saudi Arabia Bakery and Cereals Market Size (In SAR Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Saudi Arabia Bakery and Cereals Market Analysis

3.1. Growth Drivers

3.1.1. Rising Disposable Income

3.1.2. Increasing Urbanization

3.1.3. Changes in Dietary Habits (Shift toward Convenience Foods)

3.1.4. Health-Conscious Consumer Preferences (Demand for Healthy Bakery and Cereal Products)

3.2. Market Challenges

3.2.1. High Production Costs

3.2.2. Supply Chain Disruptions

3.2.3. Limited Local Wheat Production

3.3. Opportunities

3.3.1. Expansion of Organic and Gluten-Free Product Lines

3.3.2. Technological Advancements in Baking

3.3.3. Increasing Demand for Ready-to-Eat Cereals

3.4. Trends

3.4.1. Growth of Online Retail Channels for Bakery and Cereals

3.4.2. Use of Clean Label Ingredients

3.4.3. Adoption of Local Flavors and Ingredients in Bakery Products

3.5. Government Regulation

3.5.1. Saudi Vision 2030 Impact on Food Manufacturing

3.5.2. Saudi Food and Drug Authority (SFDA) Compliance and Certification

3.5.3. Import Regulations and Tariff Policies for Wheat and Grain Products

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.7.1. Raw Material Suppliers

3.7.2. Manufacturers

3.7.3. Retailers

3.7.4. Distributors

3.8. Porters Five Forces

3.8.1. Threat of New Entrants

3.8.2. Bargaining Power of Suppliers

3.8.3. Bargaining Power of Buyers

3.8.4. Threat of Substitutes

3.8.5. Industry Rivalry

3.9. Competition Ecosystem

4. Saudi Arabia Bakery and Cereals Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Bread

4.1.2. Cakes and Pastries

4.1.3. Savory Biscuits

4.1.4. Breakfast Cereals

4.1.5. Snack Bars

4.2. By Distribution Channel (In Value %)

4.2.1. Hypermarkets/Supermarkets

4.2.2. Convenience Stores

4.2.3. Online Retail

4.2.4. Specialty Stores

4.2.5. Others

4.3. By Ingredient (In Value %)

4.3.1. Whole Grains

4.3.2. Refined Wheat Flour

4.3.3. Gluten-Free Ingredients

4.3.4. Sugar Substitutes

4.3.5. Dairy Alternatives

4.4. By Consumer Type (In Value %)

4.4.1. Kids

4.4.2. Adults

4.4.3. Seniors

4.4.4. Health-Conscious Consumers

4.5. By Region (In Value %)

4.5.1. Central Saudi Arabia

4.5.2. Western Saudi Arabia

4.5.3. Eastern Saudi Arabia

4.5.4. Northern Saudi Arabia

4.5.5. Southern Saudi Arabia

5. Saudi Arabia Bakery and Cereals Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Almarai

5.1.2. United Food Industries Corporation (Deemah)

5.1.3. Sunbulah Group

5.1.4. Saudia Dairy & Foodstuff Company (SADAFCO)

5.1.5. General Mills

5.1.6. Kelloggs

5.1.7. Modern Bakery

5.1.8. Al Othman Agriculture Production & Processing Company (NADA)

5.1.9. National Biscuits & Confectionery Company

5.1.10. Aryzta AG

5.1.11. Mondelez International

5.1.12. Nestl Middle East

5.1.13. Al Madinah Dates Company

5.1.14. PepsiCo (Quaker Oats)

5.1.15. Danone Saudi Arabia

5.2. Cross Comparison Parameters (Market Share, Revenue, Brand Equity, Product Range, Innovation, Local Sourcing, Distribution Network, Sustainability Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Saudi Arabia Bakery and Cereals Market Regulatory Framework

6.1. Food Safety Standards and Certifications

6.2. Import-Export Regulations

6.3. Subsidies and Incentives for Local Manufacturers

6.4. SFDA Guidelines and Compliance

7. Saudi Arabia Bakery and Cereals Future Market Size (In SAR Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Saudi Arabia Bakery and Cereals Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Ingredient (In Value %)

8.4. By Consumer Type (In Value %)

8.5. By Region (In Value %)

9. Saudi Arabia Bakery and Cereals Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Consumer Behavior Analysis

9.3. Marketing Initiatives and Digital Strategies

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial step involved mapping the ecosystem of the KSA Bakery and Cereals Market, identifying key stakeholders such as manufacturers, retailers, suppliers, and regulatory bodies. Extensive desk research was conducted to gather industry data and identify the critical variables influencing market performance.

Step 2: Market Analysis and Construction

Historical data on market trends, product penetration, and revenue generation were analyzed. This included evaluating the bakery and cereals supply chain, consumer preferences, and retail distribution networks to accurately estimate the market size and growth dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were validated through interviews with industry experts, including top executives from major companies in the bakery and cereals segment. These consultations provided insights into operational and strategic challenges, which were used to refine the market analysis.

Step 4: Research Synthesis and Final Output

Finally, data from both primary and secondary research was synthesized to create a comprehensive market report. Direct engagement with key players enabled the validation of sales figures and market trends, ensuring a reliable and in-depth market outlook.

Frequently Asked Questions

1. How big is the KSA Bakery and Cereals Market?

The KSA Bakery and Cereals market is valued at USD 11 billion, driven by rising demand for convenience foods and an increase in disposable income across urban centers like Riyadh and Jeddah.

2. What are the challenges in the KSA Bakery and Cereals Market?

Key challenges include supply chain disruptions, high production costs, and limited local wheat production. Additionally, the rising cost of raw materials presents profitability concerns for manufacturers.

3. Who are the major players in the KSA Bakery and Cereals Market?

Major players include Almarai, United Food Industries Corporation (Deemah), Sunbulah Group, SADAFCO, and Mondelez International. These companies dominate the market due to their extensive product range, strong distribution networks, and innovation strategies.

4. What are the growth drivers of the KSA Bakery and Cereals Market?

Growth is propelled by increasing consumer health awareness, rising demand for gluten-free and organic products, and the expansion of retail distribution channels, including e-commerce platforms.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.