KSA Basic Metal Market Outlook to 2030

Region:Middle East

Author(s):Abhinav kumar

Product Code:KROD2355

December 2024

99

About the Report

KSA Basic Metal Market Overview

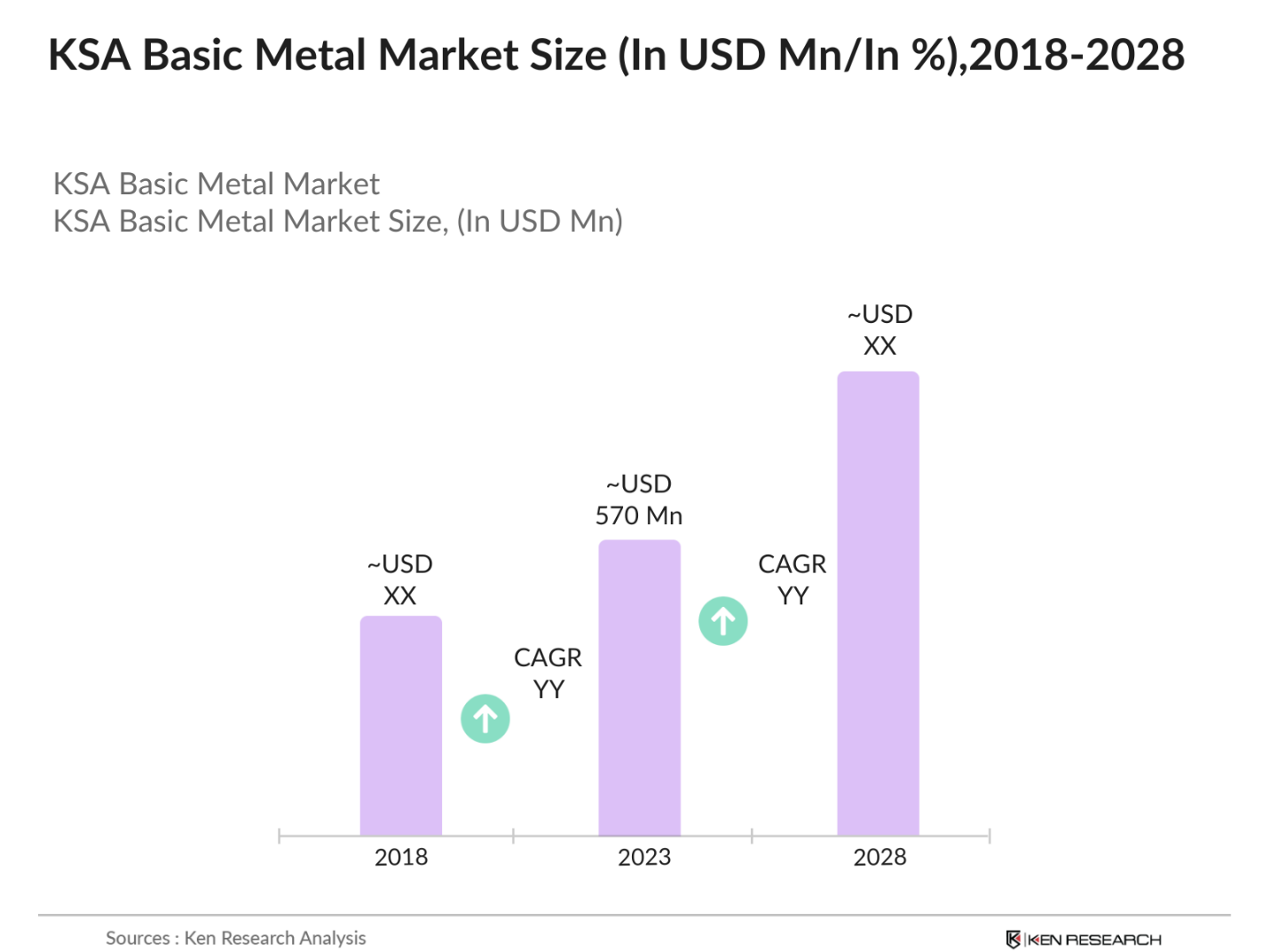

- The KSA Basic Metal Market is valued at USD 570 million, driven by strong industrial growth, construction projects, and robust demand from key sectors like infrastructure and automotive. The ongoing diversification of the economy under the Saudi Vision 2030 plan has significantly boosted local production capacities.

- Dominant players in the market include cities such as Riyadh, Jeddah, and Jubail, which host the country's largest industrial hubs and are home to several large Basic Metal production facilities. These cities dominate due to their strategic locations, established infrastructure, and access to raw materials.

- Governments are offering export incentives and tariff regulations in 2024 to support the growth of their domestic Basic Metal industries. For example, Saudi Arabia has introduced tax breaks and export incentives as part of Vision 2030 to promote local steel and aluminum producers, resulting in an export value of $8 billion in 2023. The U.S. has also introduced export incentives for sustainable Basic Metal production, providing up to $100 million in incentives for companies meeting environmental standards.

KSA Basic Metal Market Segmentation

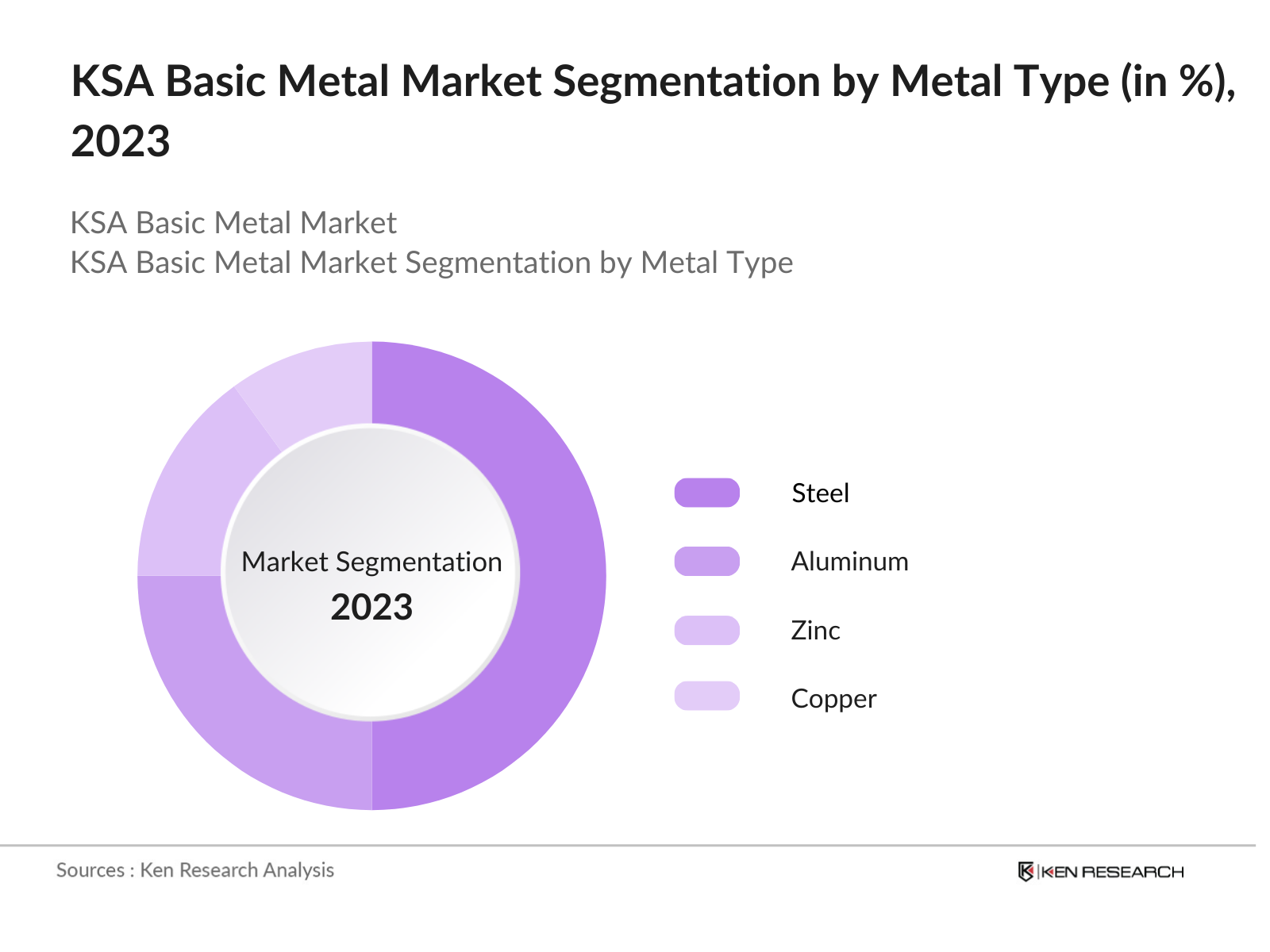

By Metal Type: The Saudi Basic Basic Metal Market is segmented by Basic Metal type into steel, aluminum, copper, zinc, and lead. Steel has a dominant market share due to its extensive use in construction and infrastructure projects. Saudi Arabia's emphasis on diversifying its economy through large-scale infrastructure projects, coupled with the demand for high-strength materials, has led to an increased demand for steel. Additionally, the establishment of local steel production facilities has reduced reliance on imports, reinforcing steel's dominant position in the market.

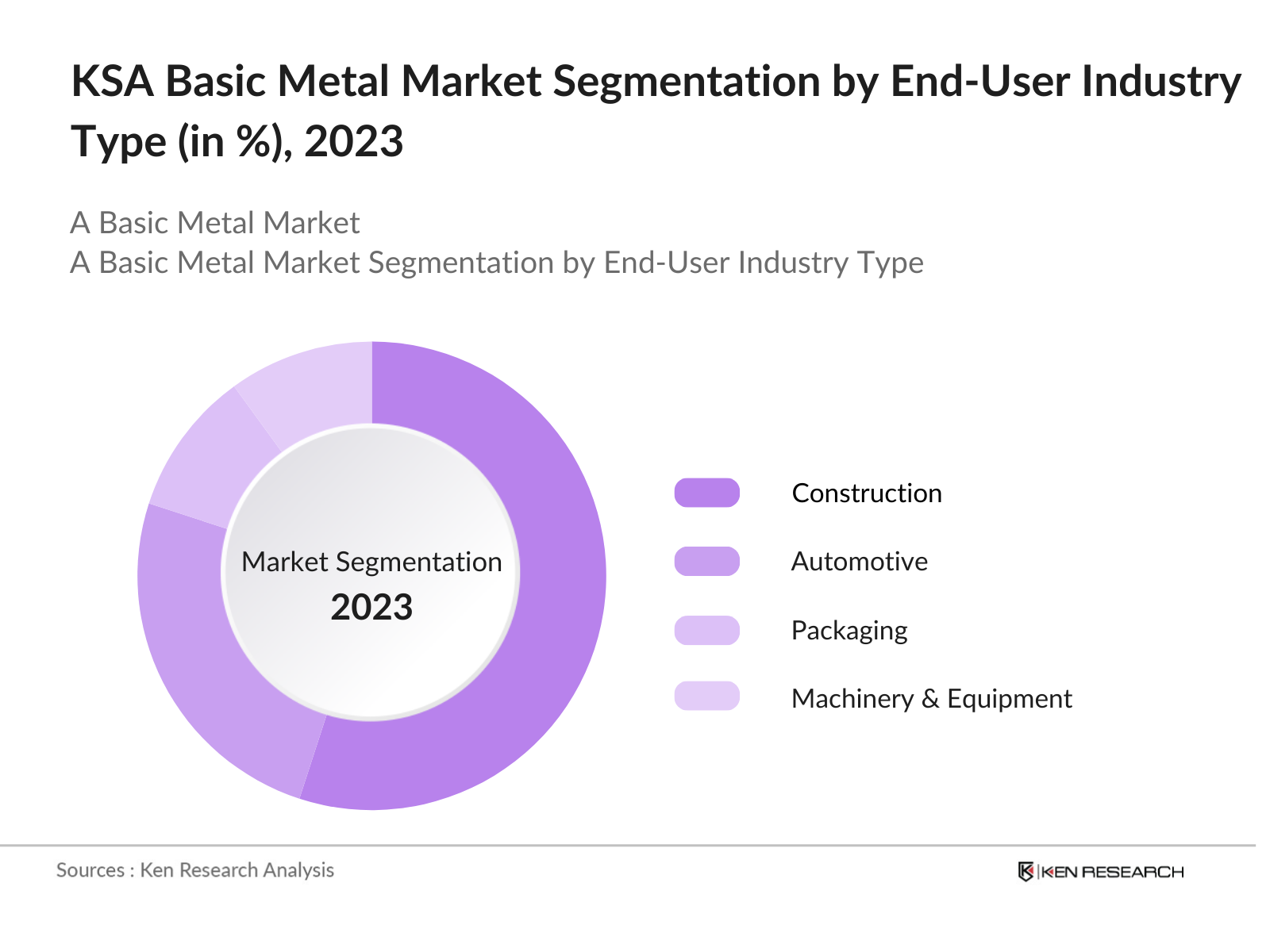

By End-User Industry: The market is also segmented by end-user industry into construction, automotive, packaging, machinery and equipment, and energy and power. The construction sector holds the largest market share, primarily driven by major infrastructure projects across the country. Saudi Arabias ongoing urbanization, combined with government-backed infrastructure projects like NEOM, has created significant demand for basic Basic Metals, particularly steel and aluminum, for use in building materials, bridges, and other large-scale structures.

KSA Basic Metal Competitive Landscape

The KSA Basic Metal Market is characterized by the dominance of a few key players, including both domestic and international companies. This consolidation is driven by the need for large-scale investments in production capabilities and infrastructure, making it difficult for smaller players to compete. Major companies such as SABIC and Ma'aden have invested heavily in expanding their local production capacities, while international firms like Alcoa and Emirates Global Aluminum (EGA) maintain a strong presence in the country through joint ventures and partnerships.

|

Company |

Established |

Headquarters |

|

Saudi Arabian Mining Company (Ma'aden) |

1997 |

Riyadh, Saudi Arabia |

|

SABIC (Saudi Basic Industries Corp) |

1976 |

Riyadh, Saudi Arabia |

|

Alcoa Saudi Arabia |

1888 |

Pittsburgh, USA (Joint Venture) |

|

Emirates Global Aluminum (EGA) |

1979 |

Dubai, UAE |

|

United Gulf Steel |

1997 |

Dammam, Saudi Arabia |

KSA Basic Metal Industry Analysis

KSA Basic Metal Market Growth Drivers

- Industrialization (Growth in Construction, Infrastructure Projects): Industrialization in 2024 continues to drive demand for Basic Metals, with governments investing heavily in infrastructure projects. For instance, Saudi Arabia's Vision 2030 initiative includes large-scale infrastructure developments such as the $500 billion NEOM project. The construction sector is expected to contribute $82 billion to the country's economy in 2024 alone. Globally, countries such as the U.S. and China are also increasing their infrastructure spending to support industrial growth.

- Automotive Industry Demand: In 2024, the automotive industry continues to be a major driver for the Basic Metals market, particularly with the rise of electric vehicles (EVs). The demand for lightweight Basic Metals, such as aluminum and magnesium, has surged as manufacturers seek to reduce vehicle weight to improve energy efficiency. In the U.S., EV production rose to 2.4 million units in 2023 and is expected to climb further due to government incentives.

- Government Vision 2030 and Localization: Saudi Arabia's Vision 2030 emphasizes increasing domestic manufacturing and reducing reliance on imports, fueling demand for localized Basic Metal production. By 2024, the countrys Basic Metal sector is receiving significant government backing through localization policies. The National Industrial Development and Logistics Program (NIDLP) aims to increase the contribution of the manufacturing sector to 20% of the GDP by 2025, creating growth in the Basic Metal industry.

KSA Basic Metal Market Challenges

- Energy Costs and Sustainability: Energy costs continue to be a significant challenge for the Basic Metal manufacturing sector in 2024,. High energy costs, particularly in Europe, where prices are more volatile, have forced manufacturers to reassess sustainability strategies. Energy-intensive processes in Basic Metal production, such as aluminum smelting, are particularly affected.

- Volatile Raw Material Prices: Raw material price volatility has become a critical challenge in 2024, with iron ore prices fluctuating between $90 and $120 per ton. Similarly, bauxite prices, essential for aluminum production, have seen significant instability due to supply chain disruptions from major exporters such as Guinea. These price fluctuations have impacted profitability for Basic Metal manufacturers, as they struggle to manage procurement costs.

KSA Basic Metal Future Market Outlook

Over the next five years, the KSA Basic Metal Market is expected to witness significant growth driven by increased infrastructure investments, energy projects, and the countrys focus on industrial self-sufficiency. The governments Vision 2030 initiative is a major driver, aiming to localize production and reduce dependency on imports by increasing domestic Basic Metal production. Additionally, advancements in technology, such as the adoption of green steel manufacturing processes, and increased demand for sustainable Basic Metal production will play a pivotal role in shaping the market.

KSA Basic Metal Market Market Opportunities

- Regional Exports Expansion: In 2024, regional Basic Metal exports are poised for expansion due to new trade agreements in Asia and the Middle East. Saudi Arabia has capitalized on its Vision 2030 initiative to increase exports of steel and aluminum, which totaled $8.3 billion in 2023. China and India have also bolstered their regional exports, particularly in aluminum, with India's Basic Metal exports reaching $15 billion in 2024.

- New Applications in Aerospace and Defense: New applications in the aerospace and defense sectors are generating opportunities for the Basic Metal market. In 2024, the global aerospace industry is projected to spend $83 billion on Basic Metal components, including titanium and aluminum, for aircraft manufacturing. Defense budgets in the U.S. and Europe, which surpassed $2.2 trillion in 2023, are also contributing to the growth in demand for specialized Basic Metals.

Scope of the Report

|

Basic Metal Type |

Steel Aluminum Copper Zinc Lead |

|

Application |

Construction Automotive Machinery & Equipment Packaging Energy & Power |

|

Production Process |

Smelting Refining Recycling |

|

End-User Industry |

Construction Manufacturing Energy Transportation |

|

Region |

Central Region Eastern Region Western Region Northern Region |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

Basic Basic Metal Manufacturers

Raw Material Companies

Automotive Industry

Construction Companies

Government and Regulatory Bodies (Saudi Ministry of Industry and Mineral Resources)

Investment and Venture Capitalist Firms

Energy and Power Companies

Environmental and Sustainability Companies

Companies

Players Mentioned in the Report:

Saudi Arabian Mining Company (Ma'aden)

SABIC (Saudi Basic Industries Corporation)

Alcoa Saudi Arabia

Emirates Global Aluminum (EGA)

United Gulf Steel

Zamil Steel

Rajhi Steel

National Basic Metal Manufacturing & Casting Co. (Maadaniyah)

Eastern Province Cement Company

Al-Tuwairqi Group

Gulf Tubing Company

Arab Steel

ArcelorMittal Saudi Arabia

Al Qaryan Group

Al-Babtain Power & Telecom Co.

Table of Contents

1. KSA Basic Metal Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Production Volume, Export and Import Data, Domestic Demand)

1.4. Market Segmentation Overview

2. KSA Basic Metal Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis (Production Output, Import-Export Balance, Market Pricing)

2.3. Key Market Developments and Milestones (Major Capacity Expansions, Government Initiatives, Infrastructure Projects)

3. KSA Basic Metal Market Analysis

3.1. Growth Drivers

3.1.1. Industrialization (Growth in Construction, Infrastructure Projects)

3.1.2. Automotive Industry Demand

3.1.3. Government Vision 2030 and Localization

3.1.4. Foreign Direct Investment in Manufacturing Sector

3.2. Market Challenges

3.2.1. Energy Costs and Sustainability

3.2.2. Volatile Raw Material Prices (Iron Ore, Bauxite)

3.2.3. Regulatory Compliance

3.3. Opportunities

3.3.1. Regional Exports Expansion

3.3.2. New Applications in Aerospace and Defense

3.3.3. Sustainable Basic Metal Production

3.4. Trends

3.4.1. Integration of Advanced Manufacturing Techniques

3.4.2. Adoption of Green Technologies

3.4.3. Lightweight Basic Metal Applications

3.5. Government Regulation

3.5.1. Export Incentives and Tariff Regulations

3.5.2. Environmental Impact Regulations (Emission Standards, Water Usage)

3.5.3. Localization Policies under Vision 2030

3.6. SWOT Analysis

3.6.1. Strengths

3.6.2. Weaknesses

3.6.3. Opportunities

3.6.4. Threats

3.7. Stake Ecosystem (Producers, Suppliers, Distributors, Industry Bodies)

3.8. Porters Five Forces

3.8.1. Bargaining Power of Suppliers

3.8.2. Bargaining Power of Buyers

3.8.3. Threat of New Entrants

3.8.4. Threat of Substitutes

3.8.5. Competitive Rivalry

3.9. Competition Ecosystem

4. KSA Basic Metal Market Segmentation

4.1. By Basic Metal Type (In Value %)

4.1.1. Steel

4.1.2. Aluminum

4.1.3. Copper

4.1.4. Zinc

4.1.5. Lead

4.2. By Application (In Value %)

4.2.1. Construction and Infrastructure

4.2.2. Automotive

4.2.3. Machinery and Equipment

4.2.4. Packaging

4.2.5. Energy and Power

4.3. By Production Process (In Value %)

4.3.1. Smelting

4.3.2. Refining

4.3.3. Recycling

4.4. By End-User Industry (In Value %)

4.4.1. Construction

4.4.2. Manufacturing

4.4.3. Energy

4.4.4. Transportation

4.5. By Region (In Value %)

4.5.1. Central Region

4.5.2. Eastern Region

4.5.3. Western Region

4.5.4. Northern Region

5. KSA Basic Metal Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Saudi Arabian Mining Company (Ma'aden)

5.1.2. SABIC (Saudi Basic Industries Corporation)

5.1.3. Alcoa Saudi Arabia

5.1.4. Emirates Global Aluminum (EGA)

5.1.5. ArcelorMittal Saudi Arabia

5.1.6. Eastern Province Cement Company

5.1.7. United Gulf Steel

5.1.8. Gulf Tubing Company

5.1.9. Al Qaryan Group

5.1.10. National Basic Metal Manufacturing & Casting Co. (Maadaniyah)

5.1.11. Rajhi Steel

5.1.12. Arab Steel

5.1.13. Saudi Iron and Steel Company (Hadeed)

5.1.14. Zamil Steel

5.1.15. Al-Tuwairqi Group

5.2. Cross Comparison Parameters (Production Capacity, Market Share, R&D Expenditure, Operational Regions, Revenue, Employee Base, Market Strategy, Export Volume)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. KSA Basic Metal Market Regulatory Framework

6.1. Production and Environmental Standards

6.2. Export-Import Regulations

6.3. Taxation Policies and Incentives

6.4. Trade Agreements Impacting Basic Metal Sector

7. KSA Basic Metal Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. KSA Basic Metal Future Market Segmentation

8.1. By Basic Metal Type (In Value %) 8.1.1. Steel

8.1.2. Aluminum

8.2. By Application (In Value %)

8.2.1. Construction

8.2.2. Automotive

8.3. By Production Process (In Value %)

8.4. By End-User Industry (In Value %)

8.5. By Region (In Value %)

9. KSA Basic Metal Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Market Positioning Strategies

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

This step involved creating a comprehensive map of stakeholders in the Saudi Basic Basic Metal Market. Utilizing both secondary research and proprietary databases, key market variables such as production capacity, raw material availability, and local consumption patterns were identified to analyze market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data on production output, market pricing, and export-import figures was gathered to establish baseline trends. The market was further segmented by Basic Metal type and end-use industries to assess growth drivers and revenue generation.

Step 3: Hypothesis Validation and Expert Consultation

Key market assumptions were validated through interviews with industry professionals, including representatives from leading Basic Metal producers and government officials. These insights provided a deeper understanding of operational challenges and strategic market shifts.

Step 4: Research Synthesis and Final Output

The final step involved synthesizing the findings from various sources to create a detailed market report. This included direct consultations with industry players to verify and refine the data, ensuring a reliable and accurate analysis.

Frequently Asked Questions

01. How big is the KSA Basic Metal Market?

The KSA Basic Metal Market is valued at USD 570 million, driven by industrial growth, demand from construction projects, and a strong focus on localizing production under Vision 2030.

02. What are the challenges in the KSA Basic Metal Market?

Key challenges include fluctuating raw material prices, high energy costs, and the need to meet stringent environmental regulations. These factors influence operational efficiency and profitability.

03. Who are the major players in the KSA Basic Metal Market?

Major players in the market include Maaden, SABIC, Alcoa Saudi Arabia, Emirates Global Aluminum, and United Gulf Steel, all of whom dominate due to their large production capacities and established supply chains.

04. What are the growth drivers of the KSA Basic Metal Market?

The market is primarily driven by infrastructure development, increasing industrialization, and government-backed initiatives such as Saudi Vision 2030, which supports local Basic Metal production and export expansion.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.