KSA Battery Market Outlook to 2030

Region:Middle East

Author(s):Samanyu

Product Code:KROD619

July 2024

100

About the Report

KSA Battery Market Overview

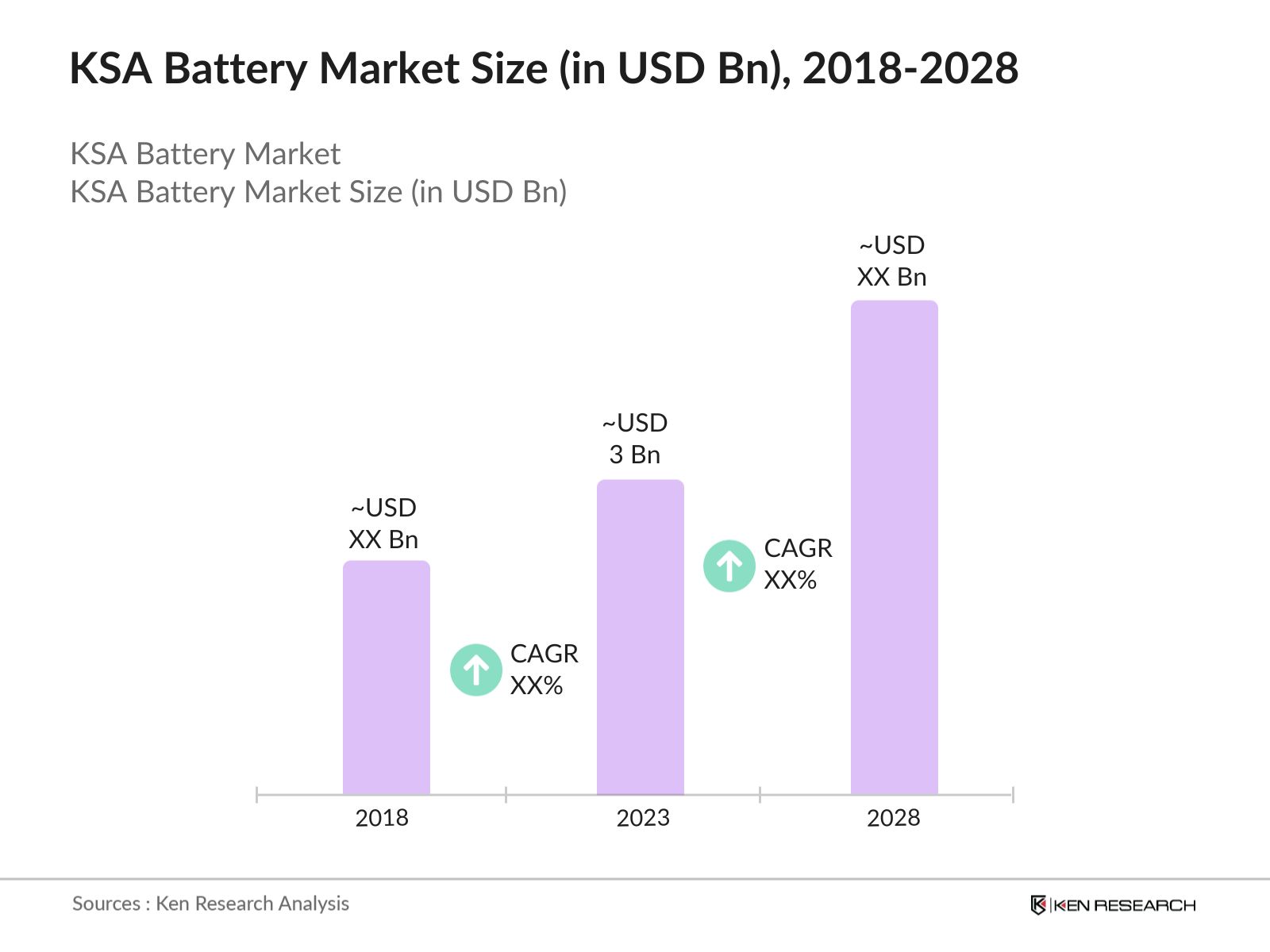

- The KSA battery market, valued at USD 3 bn in 2023, is experiencing significant growth driven by the increasing demand for energy storage solutions. This demand is primarily fueled by the expansion of renewable energy sectors, particularly solar and wind power, which require efficient storage to ensure a stable power supply.

- Key players in the KSA Battery Market include prominent names like Samsung SDI, LG Chem, Panasonic Corporation, BYD Company Ltd., and Saft Groupe S.A. These companies have established a strong presence in the market through continuous innovation and strategic partnerships.

- BYD Company Ltd. expanded its presence in the KSA battery market by entering into a strategic partnership with Al-Futtaim Electric Mobility in 2024. This partnership aims to develop and deploy large-scale battery storage solutions for renewable energy projects. The collaboration is expected to enhance BYD's market share and contribute to the growth of the KSA battery market.

- The eastern province of Saudi Arabia is particularly Riyadh, Jeddah and Dammam are dominant in the battery market due to its significant investments in renewable energy projects and the presence of major industrial players. In 2023, the eastern province accounted for major market share, driven by its strategic location and industrial base.

KSA Battery Market Segmentation

The KSA Battery Market can be segmented based on several factors:

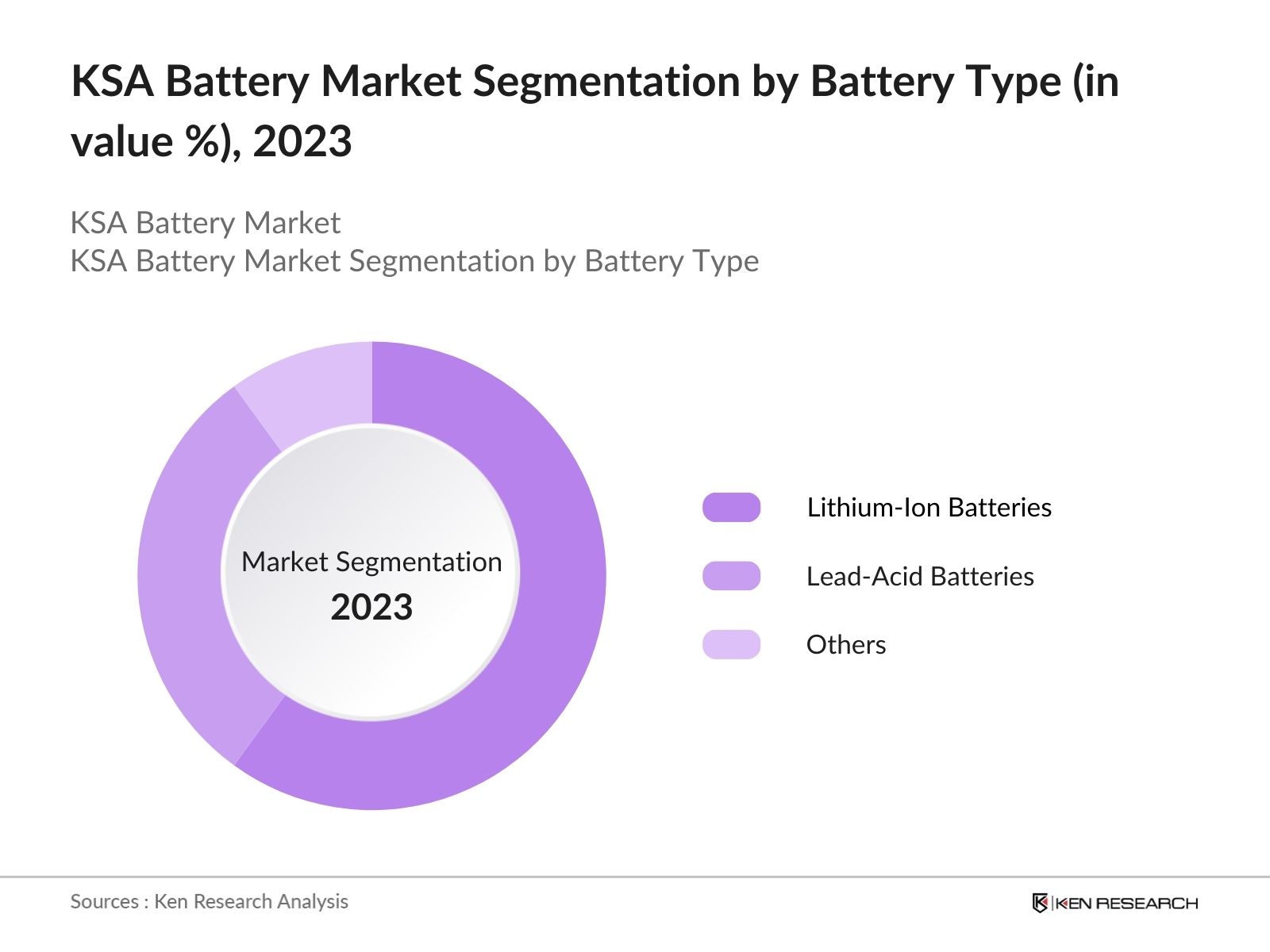

By Battery Type: KSA battery market segmentation by battery type is divided into lithium-ion, lead-acid and others battery. In 2023, lithium-ion batteries dominated the market. The high energy density, longer lifespan, and declining costs of lithium-ion batteries have made them the preferred choice for various applications.

By Application: The KSA battery market segmentation by application is divided into automotive, industrial, and consumer electronics. In 2023, automotive batteries held a dominant market share, primarily due to the rising adoption of electric vehicles (EVs) and substantial government support for EV adoption, including significant investments in EV infrastructure. This support includes policies and incentives aimed at reducing carbon emissions and promoting sustainable transportation.

By Region: KSA battery market segmentation by region is divided into north, south, east and west. In 2023, Eastern region leading due to its significant industrial activities, key energy sectors, and strategic trade location. Major market drivers include government initiatives for energy diversification, the rise of renewable energy projects, and increasing demand for electric vehicles.

KSA Battery Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Samsung SDI |

1970 |

Suwon, South Korea |

|

LG Chem |

1947 |

Seoul, South Korea |

|

Panasonic Corporation |

1918 |

Osaka, Japan |

|

BYD Company Ltd. |

1995 |

Shenzhen, China |

|

Saft Groupe S.A. |

1918 |

Levallois-Perret, France |

- Panasonic's Investment in Research and Development: In 2024, Panasonic Corporation announced an investment of USD 100 Mn in research and development to advance battery technology. The focus is on developing solid-state batteries with higher energy density and longer lifespan. This investment is expected to drive innovation and improve the performance of battery storage systems, catering to the increasing demand in the KSA market.

- LG Chem's High-Density Lithium-Ion Battery: LG Chem introduced a new high-density lithium-ion battery in 2024, capable of providing 20% more energy storage compared to previous models. This innovation has positioned LG Chem as a leader in the battery market, catering to the growing demand for efficient and reliable energy storage solutions. The new battery is expected to be widely adopted in renewable energy projects and electric vehicles.

KSA Battery Industry Analysis

KSA Battery Market Growth Drivers:

- Increased Adoption of Renewable Energy Projects: The KSA government’s Vision 2030 initiative has set ambitious targets for renewable energy, aiming to generate 58.7 gigawatts (GW) of renewable energy by 2030. In 2024, renewable energy projects under construction have a combined capacity of 5 GW, necessitating advanced battery storage systems to manage energy intermittency and improve grid reliability.

- Growing Electric Vehicle (EV) Market: The electric vehicle market in Saudi Arabia is experiencing rapid growth, with the government planning to have 100,000 electric cars on the road by 2025. This surge in EV adoption has led to an increased demand for high-performance automotive batteries. In 2024, over 20,000 electric vehicles were sold, highlighting the rising consumer interest and market potential for battery manufacturers.

- Government Investments in Infrastructure: The Saudi government has committed significant investments towards infrastructure development, including the establishment of smart cities and the expansion of the industrial sector. In 2024, the government allocated budget for infrastructure projects, with a substantial portion directed towards integrating advanced energy storage solutions. This investment is crucial for supporting the energy needs of these large-scale projects, thereby driving the demand for batteries.

KSA Battery Market Challenges:

- High Cost of Battery Storage Systems: Despite technological advancements, the cost of battery storage systems remains a significant barrier to widespread adoption. In 2024, the average cost of a lithium-ion battery storage system was USD 200 per kilowatt-hour (kWh), making it a substantial investment for businesses and consumers. This high cost limits the market's growth potential, particularly among small and medium-sized enterprises (SMEs).

- Limited Local Manufacturing Capabilities: The KSA battery market relies heavily on imports due to limited local manufacturing capabilities. In 2024, most of the batteries used in the kingdom were imported, leading to increased costs and longer lead times. Developing a robust local manufacturing ecosystem is crucial to reducing dependency on imports and enhancing market competitiveness.

KSA Battery Market Government Initiatives:

- Electric Vehicle Incentive Program: To promote the adoption of electric vehicles, the government introduced the "Electric Vehicle Incentive Program" in 2024, offering subsidies and tax incentives worth USD 100 Mn for EV buyers and manufacturers. This program is expected to boost EV sales and create a favorable environment for battery manufacturers to cater to the growing demand for automotive batteries.

- Renewable Energy Projects: The Saudi government has committed to investing in renewable energy projects by 2025. In 2024, several large-scale solar and wind projects were underway, necessitating advanced battery storage systems to manage energy intermittency and improve grid reliability. These projects are expected to drive the demand for high-capacity batteries.

KSA Battery Future Market Outlook

The KSA Battery Market is expected to show significant growth driven by continued investments in renewable energy projects and technological advancements in battery storage solutions. The government's Vision 2030 initiative is expected to further accelerate market growth by promoting sustainable energy practices.

Future Market Trends

- Advancements in Battery Recycling Technologies: The development of efficient battery recycling technologies will be a key focus in the coming years. By 2028, Saudi Arabia aims to recycle 80% of battery waste. Investments in recycling facilities and innovative recycling processes are expected to enhance the sustainability of the battery market.

- Growth of the Industrial Battery Segment: The industrial battery segment is expected to witness substantial growth, driven by the increasing adoption of energy storage solutions in the industrial and commercial sectors. By 2028, the market for industrial batteries is projected to reach USD 600 Mn, supported by investments in smart grid technologies and large-scale energy storage projects.

Scope of the Report

|

By Battery Type |

Lithium-Ion Batteries Lead-Acid Batteries Others |

|

By Application |

Automotive Batteries Industrial Batteries Consumer Electronics Batteries |

|

By Region |

North South East West |

Products

Key Target Audience – Organizations and Entities who can benefit by subscribing this report:

Renewable Energy Companies

Automotive Manufacturers

Industrial Equipment Manufacturers

Consumer Electronics Manufacturers

Battery Manufacturers

Energy Storage Solution Providers

Electric Vehicle Manufacturers

Banks and Financial Institutions

Investors and VC Firms

Government Agencies (Ministry of Energy and ECRA)

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:Â

Samsung SDI

LG Chem

Panasonic Corporation

BYD Company Ltd.

Saft Groupe S.A.

Exide Technologies

Enersys

Duracell Inc.

Johnson Controls

A123 Systems LLC

C&D Technologies Inc.

Hitachi Chemical Co. Ltd.

VARTA AG

EnerDel

Leclanché SA

Table of Contents

1. KSA Battery Market Overview

1.1 KSA Battery Market Taxonomy

2. KSA Battery Market Size (in USD Bn), 2018-2023

3. KSA Battery Market Analysis

3.1 KSA Battery Market Growth Drivers

3.2 KSA Battery Market Challenges and Issues

3.3 KSA Battery Market Trends and Development

3.4 KSA Battery Market Government Regulation

3.5 KSA Battery Market SWOT Analysis

3.6 KSA Battery Market Stake Ecosystem

3.7 KSA Battery Market Competition Ecosystem

4. KSA Battery Market Segmentation, 2023

4.1 KSA Battery Market Segmentation by Battery Type (in value %), 2023

4.2 KSA Battery Market Segmentation by Application (in value %), 2023

4.3 KSA Battery Market Segmentation by Region (in value %), 2023

5. KSA Battery Market Competition Benchmarking

5.1 KSA Battery Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters and advanced analytics)

6. KSA Battery Future Market Size (in USD Bn), 2023-2028

7. KSA Battery Future Market Segmentation, 2028

7.1 KSA Battery Market Segmentation by Battery Type (in value %), 2028

7.2 KSA Battery Market Segmentation by Application (in value %), 2028

7.3 KSA Battery Market Segmentation by Region (in value %), 2028

8. KSA Battery Market Analysts’ Recommendations

8.1 KSA Battery Market TAM/SAM/SOM Analysis

8.2 KSA Battery Market Customer Cohort Analysis

8.3 KSA Battery Market Marketing Initiatives

8.4 KSA Battery Market White Space Opportunity Analysis

Research Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.Â

Step: 2 Market Building:

Collating statistics on KSA Battery market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for KSA Battery market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.Â

Step: 4 Research Output:

Our team will approach multiple battery manufacturers and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from battery manufacturers.

Frequently Asked Questions

01 How big is KSA Battery Market?

The KSA battery market was valued at USD 3 Bn in 2023, is driven by increasing demand for energy storage solutions, particularly in renewable energy sectors such as solar and wind power.

02 What are the challenges in KSA Battery Market?

Challenges in KSA battery market include the high cost of battery storage systems, limited local manufacturing capabilities, environmental and regulatory challenges, and global supply chain disruptions affecting the availability of raw materials and components.

03 Who are the major players in KSA Battery Market?

Key players in KSA battery market include Samsung SDI, LG Chem, Panasonic Corporation, BYD Company Ltd., and Saft Groupe S.A. These companies lead the market through continuous innovation, extensive distribution networks, and strategic partnerships.

04 What are the growth drivers of KSA Battery Market?

The KSA battery market is driven by increased adoption of renewable energy projects, the growing electric vehicle market, significant government investments in infrastructure, and technological advancements in battery storage solutions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.