KSA Beverages Market Outlook to 2030

Region:Middle East

Author(s):Naman Rohilla

Product Code:KROD4515

October 2024

89

About the Report

KSA Beverages Market Overview

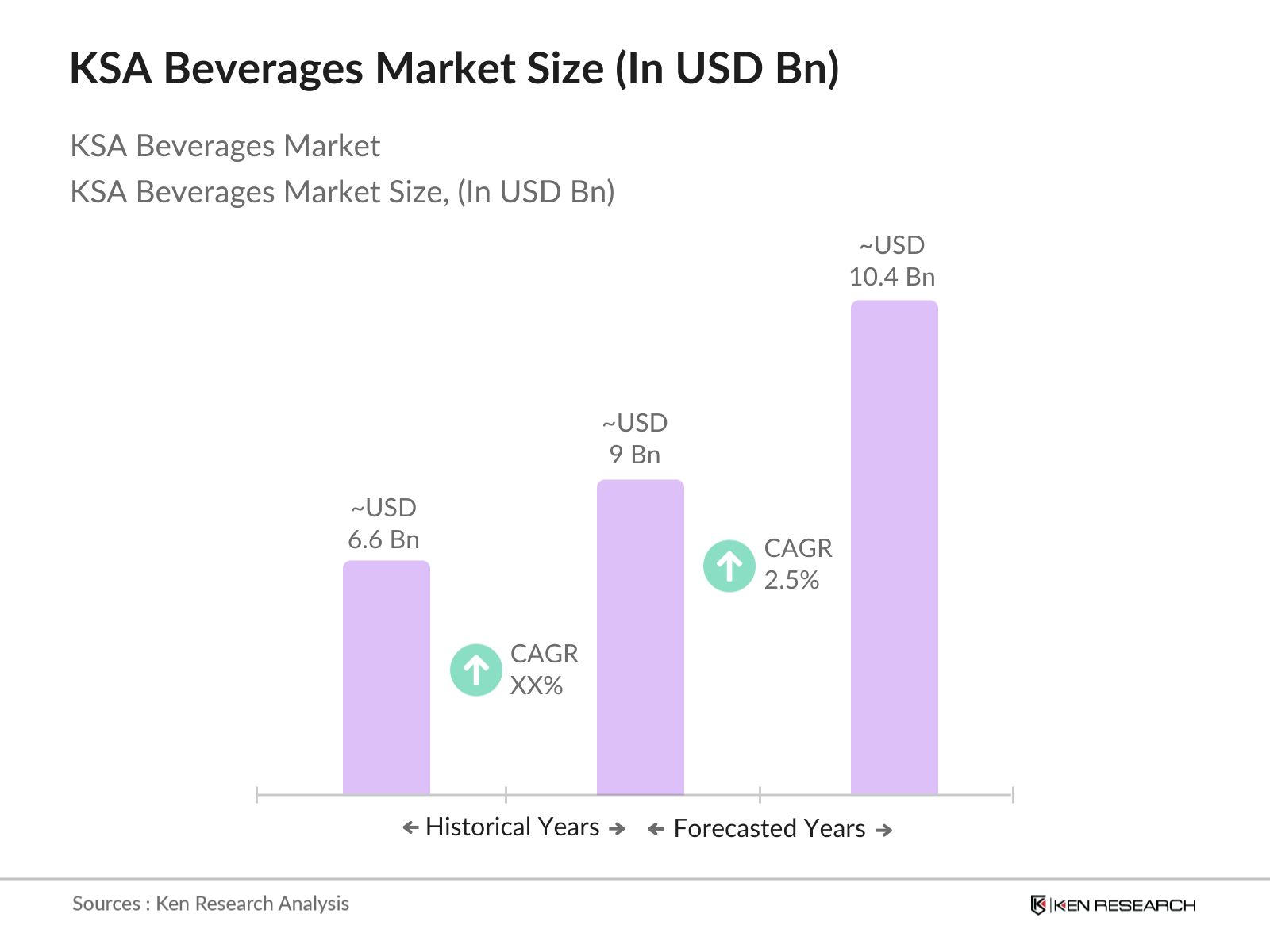

- The KSA Beverages market is valued at USD 9 billion, based on a five-year historical analysis. This market is driven by increasing consumer preferences for healthier options, government initiatives to reduce sugar consumption, and the growing demand for premium and functional beverages. The rise in disposable income and rapid urbanization are also major contributing factors to the growth of the market.

- Key cities such as Riyadh and Jeddah dominate the KSA Beverages market due to their high population density, urbanization, and increased consumer demand for beverages in the hospitality and retail sectors. These cities also have better access to advanced distribution networks, making them prime hubs for beverage consumption. Additionally, the presence of major international beverage brands in these areas further boosts market dominance.

- To curb obesity and related health issues, Saudi Arabia has imposed a 50% excise tax on sugary beverages since 2020, with notable impacts on sales patterns. According to the Saudi Food and Drug Authority (SFDA), soda sales declined by 25% in 2023. This regulation has encouraged the growth of sugar-free and low-calorie alternatives, driving innovation in product development across the beverage sector. Brands are now shifting towards formulating healthier drinks to stay compliant with regulatory standards.

KSA Beverages Market Segmentation

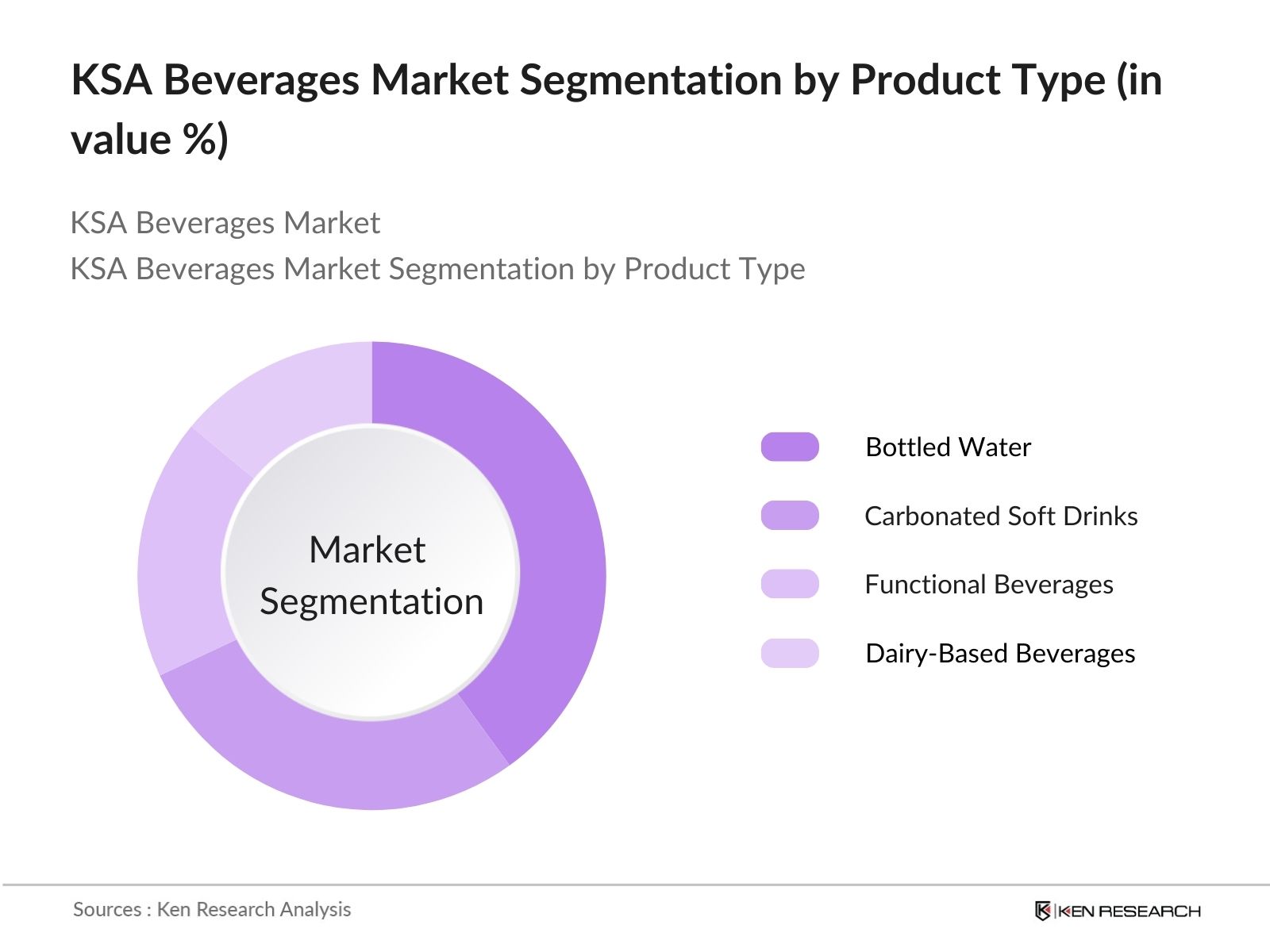

- By Product Type: The KSA Beverages market is segmented by product type into carbonated soft drinks, bottled water, functional beverages, and dairy-based beverages. Recently, bottled water has seen a dominant market share due to the rising awareness around health and hydration, particularly in arid regions like Saudi Arabia. Consumers prefer bottled water for its convenience and safety, as it provides a more accessible option compared to tap water. Key brands like Aquafina and Nestlé have cemented their place in the bottled water segment, supported by government initiatives for clean drinking water.

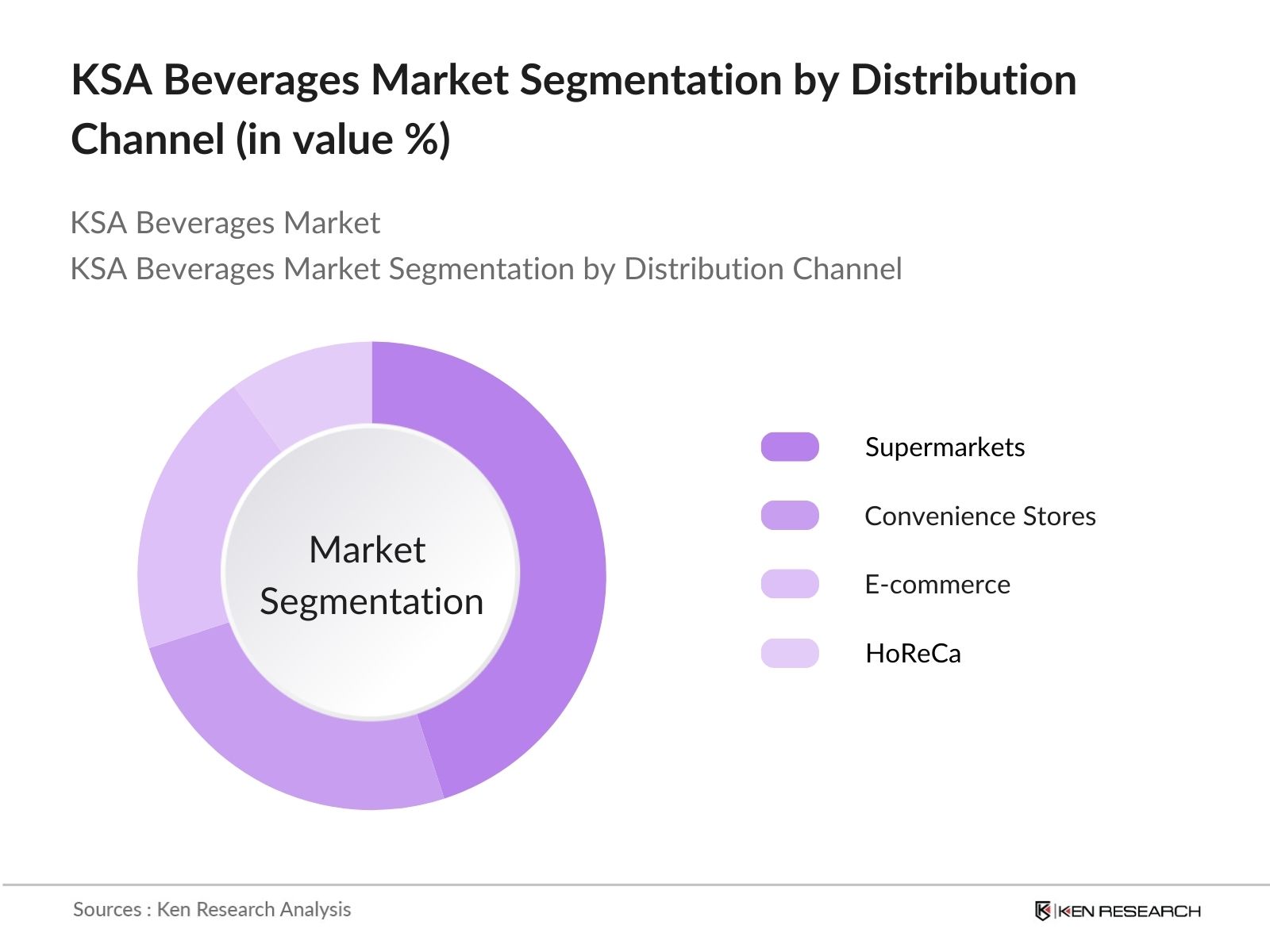

- By Distribution Channel: The KSA Beverages market is also segmented by distribution channel into supermarkets, convenience stores, e-commerce, and HoReCa (Hotels, Restaurants, and Cafés). Supermarkets have a dominant market share within this segmentation, driven by their extensive reach and the ability to cater to diverse consumer needs in one place. Consumers favour supermarkets for their promotional offers, availability of both local and international brands, and a wide variety of beverages. Retail giants such as Panda and Carrefour have established a strong presence, capitalizing on this growing demand.

KSA Beverages Market Competitive Landscape

The KSA Beverages market is dominated by a mix of local and international players. Almarai and Nadec represent strong local companies, whereas global brands like PepsiCo and Coca-Cola have maintained their foothold through strategic partnerships and widespread distribution channels. The market competition is intense, with brands vying for a larger consumer base by expanding their product lines and focusing on innovation in flavours and functional ingredients.

| Company | Year of Establishment | Headquarters | Market Share | Product Portfolio | Distribution Network | Innov ation Index |

Sustaina bility Initiatives |

Custo mer Loyalty |

Brand Penetra tion |

|---|---|---|---|---|---|---|---|---|---|

| Almarai | 1977 | Riyadh, Saudi Arabia | High | ||||||

| PepsiCo | 1965 | New York, USA | High | ||||||

| Coca-Cola | 1892 | Atlanta, USA | High | ||||||

| National Agricultural Development Company (Nadec) | 1981 | Riyadh, Saudi Arabia | Medium | ||||||

| Nestlé Middle East | 1934 | Vevey, Switzerland | Medium |

KSA Beverages Market Analysis

KSA Beverages Market Growth Drivers

- Increased Health Consciousness: The growing health consciousness in Saudi Arabia has directly influenced the beverage market, with an increasing shift towards low-sugar, natural, and functional drinks. According to the World Health Organization, Saudi Arabia has seen a 36% increase in non-communicable diseases, including diabetes and obesity, leading to greater awareness about healthier diets. This has spurred demand for beverages such as kombucha, green teas, and vitamin-enriched water. The Ministry of Health is actively promoting healthier dietary habits, further boosting this segment of the market.

- Rising Disposable Income: Saudi Arabia’s rising per capita income, driven by Vision 2030 and economic diversification efforts, has increased consumer spending on premium beverages. The World Bank estimates that per capita income in Saudi Arabia grew to USD 26,950 in 2023, reflecting increased purchasing power. This financial flexibility allows consumers to spend more on luxury and health-focused drinks, leading to robust growth in this sector. Expanding middle and upper-class segments are driving demand for organic juices, energy drinks, and plant-based beverages.

- Growing Demand for Organic Beverages: Saudi consumers are increasingly demanding organic beverages due to heightened awareness of the benefits of chemical-free products. In 2023, Saudi Arabia’s organic food and beverage market reached new heights, with over 400 organic farms certified by the Ministry of Environment, Water, and Agriculture. This increased local production capacity supports the rising demand for organic juices and beverages. Consumers are willing to pay more for products that align with their health and environmental values.

KSA Beverages Market Challenges

- High Production Costs: High production costs are a major challenge in the KSA beverages market, particularly due to ingredient sourcing. Many organic and specialized ingredients must be imported, adding to production expenses. Logistics costs in Saudi Arabia increased in 2023 due to global supply chain disruptions, raising the cost of beverage manufacturing by over 15%, as per the Saudi Logistics Hub. These factors limit small- and medium-sized local producers' ability to compete with large, established brands.

- Stringent Regulatory Environment: The Saudi beverage market faces challenges due to stringent regulatory frameworks established by the Saudi Food and Drug Authority (SFDA). Compliance with nutritional labelling, Halal certification, and excise taxes on sugary drinks requires investments. In 2023, over 5,000 beverage products were recalled or revised due to non-compliance with SFDA regulations. The stringent requirements for health-related claims and new product launches slow market entry and innovation for both local and international players.

KSA Beverages Market Future Outlook

Over the next five years, the KSA Beverages market is expected to show steady growth driven by increasing consumer interest in health-conscious products, expanding urban populations, and government regulations aimed at promoting healthier living. The demand for organic and functional beverages is set to rise as consumers become more health-aware and prefer beverages that offer additional nutritional benefits. Furthermore, the growing e-commerce sector will play a major role in reshaping distribution channels and expanding the consumer base.

KSA Beverages Market Opportunities

- Expansion of Premium and Functional Beverages: Premium and functional beverages represent a growing opportunity in the Saudi market as consumers increasingly seek products that offer health benefits, convenience, and superior quality. The demand for energy drinks, fortified water, and sports beverages grew by 12% in 2023, according to the Saudi Ministry of Commerce. Brands offering protein-enriched drinks, immunity boosters, and probiotic beverages can capitalize on this trend, particularly among younger demographics and fitness enthusiasts. This shift highlights a lucrative expansion opportunity for both domestic and international players.

- Development of Alcohol-Free Beverage Alternatives: The cultural and religious context of Saudi Arabia has created a robust market for alcohol-free beverages. This category, encompassing non-alcoholic beer and wine, saw significant growth in 2023, with sales increasing by 30% as reported by the General Authority for Statistics. Alcohol-free alternatives present an opportunity for brands to innovate and cater to consumers who seek the experience of social drinking without compromising religious obligations.

Scope of the Report

| By Product Type |

Carbonated Soft Drinks Non-Carbonated Beverages Functional Beverages Dairy-Based Beverages Coffee and Tea |

| By Distribution Channel |

Supermarkets/Hypermarkets Convenience Stores Online Channels HoReCa Specialized Retailers |

| By Packaging Type |

Bottles Cans Cartons Pouches Kegs |

| By Consumer Group |

Kids and Teenagers Adults Seniors |

| By Region |

Riyadh Jeddah Eastern Province Mecca Other Regions |

Products

Key Target Audience

Beverage Manufacturers

Investors and Venture Capitalist Firms

Banks and Financial Institutions

Government and Regulatory Bodies (Saudi Food and Drug Authority, SFDA)

Retail Chains and Supermarkets

HoReCa Industry Players

Packaging and Labeling Companies

Distributors and Wholesalers

E-commerce Platforms

Companies

Almarai

PepsiCo

Coca-Cola

National Agricultural Development Company (Nadec)

Nestlé Middle East

Red Bull GmbH

Suntory Beverage & Food Ltd.

Aujan Coca-Cola Beverages Company

Danone Saudi Arabia

Fonterra Co-operative Group

Harmless Harvest

Masafi

Juhayna Food Industries

Khalijia Water

Tetra Pak

Table of Contents

1. KSA Beverages Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. KSA Beverages Market Size (In SAR Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. KSA Beverages Market Analysis

3.1. Growth Drivers

3.1.1. Increased Health Consciousness

3.1.2. Rising Disposable Income

3.1.3. Government Health Initiatives

3.1.4. Growing Demand for Organic Beverages

3.2. Market Challenges

3.2.1. High Production Costs (Ingredient Sourcing, Logistics)

3.2.2. Stringent Regulatory Environment (Saudi FDA, SFDA)

3.2.3. Market Fragmentation (Local vs. International Brands)

3.3. Opportunities

3.3.1. Expansion of Premium and Functional Beverages

3.3.2. Development of Alcohol-Free Beverage Alternatives

3.3.3. Partnerships with Local Retailers (Market Penetration Strategies)

3.4. Trends

3.4.1. Rise in Ready-to-Drink (RTD) Beverages

3.4.2. Increasing Demand for Flavored Water and Juices

3.4.3. Growing E-commerce Sales Channel for Beverage Distribution

3.5. Government Regulations

3.5.1. Excise Taxes on Sugary Beverages

3.5.2. Halal Certification Standards (KSA-Specific Certification)

3.5.3. Nutritional Labeling Regulations

3.5.4. Environmental Policies for Sustainable Packaging

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porter’s Five Forces

3.9. Competition Ecosystem

4. KSA Beverages Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Carbonated Soft Drinks

4.1.2. Non-Carbonated Beverages (Juices, Sports Drinks, Flavored Water)

4.1.3. Functional and Health Beverages (Energy Drinks, Probiotic Drinks)

4.1.4. Dairy-Based Beverages

4.1.5. Coffee and Tea (Ready-to-Drink, Instant)

4.2. By Distribution Channel (In Value %)

4.2.1. Supermarkets and Hypermarkets

4.2.2. Convenience Stores

4.2.3. Online Channels (E-commerce Platforms)

4.2.4. HoReCa (Hotel, Restaurant, Café)

4.2.5. Specialized Retailers

4.3. By Packaging Type (In Value %)

4.3.1. Bottles (Glass, Plastic)

4.3.2. Cans (Aluminum, Metal)

4.3.3. Cartons and Tetrapaks

4.3.4. Pouches

4.3.5. Kegs (For HoReCa Use)

4.4. By Consumer Group (In Value %)

4.4.1. Kids and Teenagers

4.4.2. Adults (Health-Conscious, Working Professionals)

4.4.3. Seniors (Nutritional and Specialty Beverages)

4.5. By Region (In Value %)

4.5.1. Riyadh

4.5.2. Jeddah

4.5.3. Eastern Province

4.5.4. Mecca

4.5.5. Other Regions

5. KSA Beverages Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Almarai

5.1.2. PepsiCo

5.1.3. Coca-Cola

5.1.4. National Agricultural Development Company (Nadec)

5.1.5. Al Rabie Saudi Foods Co.

5.1.6. Aujan Coca-Cola Beverages Company

5.1.7. Nestlé Middle East

5.1.8. Suntory Beverage & Food Ltd.

5.1.9. Masafi

5.1.10. Red Bull GmbH

5.1.11. Khalijia Water

5.1.12. Juhayna Food Industries

5.1.13. Fonterra Co-operative Group

5.1.14. Danone Saudi Arabia

5.1.15. Harmless Harvest

5.2 Cross Comparison Parameters (Market Share, Brand Penetration, Product Portfolio, Distribution Strength, Sustainability Initiatives, Pricing Strategy, Innovation Index, Customer Loyalty)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Government Grants and Incentives

5.8 Private Equity Investments

6. KSA Beverages Market Regulatory Framework

6.1. Saudi Food and Drug Authority (SFDA) Standards

6.2. Compliance with Halal Certification

6.3. Excise Taxes on Sugar-Sweetened Beverages

6.4. Import Tariffs and Local Production Regulations

7. KSA Beverages Future Market Size (In SAR Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. KSA Beverages Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Consumer Group (In Value %)

8.4. By Packaging Type (In Value %)

8.5. By Region (In Value %)

9. KSA Beverages Market Analyst’s Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping key stakeholders within the KSA Beverages market. We utilize both secondary and proprietary databases to gather industry information and define variables influencing market dynamics, such as consumption patterns and product innovations.

Step 2: Market Analysis and Construction

In this stage, historical data for the KSA Beverages market is compiled and analyzed. This includes an assessment of revenue generation, market penetration, and key market milestones. We also evaluate consumer behaviour and brand preference trends to construct a reliable market model.

Step 3: Hypothesis Validation and Expert Consultation

Through interviews with industry professionals and analysts, we validate market hypotheses and refine the gathered data. These consultations are conducted using structured questionnaires to gain insights into the operational and financial aspects of major market players.

Step 4: Research Synthesis and Final Output

The final stage involves integrating insights from interviews and secondary data to produce a detailed analysis. This output is verified through a bottom-up approach to ensure an accurate reflection of the KSA Beverages market landscape.

Frequently Asked Questions

01. How big is the KSA Beverages Market?

The KSA Beverages market is valued at USD 9 billion, driven by rising health consciousness, increased urbanization, and demand for premium and functional beverages.

02. What are the challenges in the KSA Beverages Market?

Challenges in the KSA Beverages market include high production costs due to the arid climate, regulatory pressures such as sugar taxes, and competition between local and international brands.

03. Who are the major players in the KSA Beverages Market?

Key players in the KSA Beverages market include Almarai, PepsiCo, Coca-Cola, National Agricultural Development Company (Nadec), and Nestlé Middle East. These companies dominate due to their extensive product portfolios, strong distribution networks, and brand loyalty.

04. What are the growth drivers of the KSA Beverages Market?

KSA Beverages market growth drivers include increasing consumer preference for healthier options, government health initiatives, and the rapid rise in e-commerce as a distribution channel for beverages.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.