KSA Blockchain Market outlook to 2030

Region:Middle East

Author(s):Dev Chawla

Product Code:KRO004

June 2025

80

About the Report

KSA Blockchain Market Overview

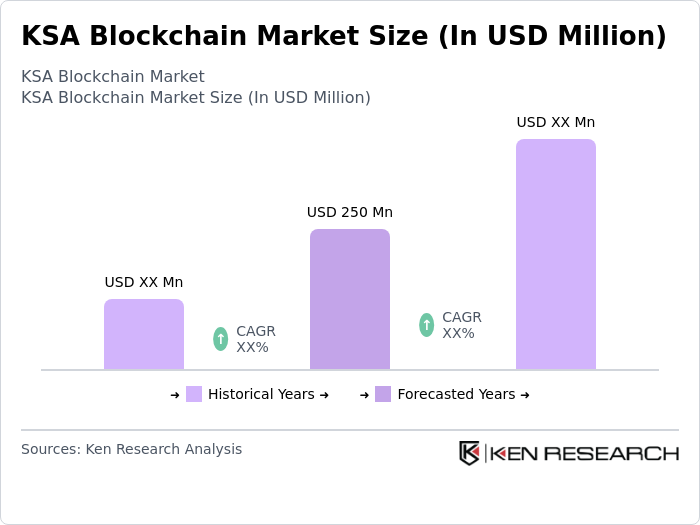

- The KSA Blockchain Market is valued at USD 250 million. This growth is primarily driven by increasing investments in digital transformation, government initiatives to promote blockchain technology, and the rising demand for secure and transparent transactions across various sectors, including finance, healthcare, and supply chain management.

- Key players in this market include Riyadh, Jeddah, and Dammam, which dominate due to their strategic locations, robust infrastructure, and the presence of major financial institutions and technology hubs. These cities are pivotal in fostering innovation and attracting investments, making them central to the blockchain ecosystem in the Kingdom.

- In 2023, the Saudi Arabian government introduced the National Blockchain Strategy, aimed at integrating blockchain technology into various sectors. This initiative includes a commitment of USD 200 million to support research and development, enhance regulatory frameworks, and promote public-private partnerships to accelerate the adoption of blockchain solutions across the nation.

KSA Blockchain Market Segmentation

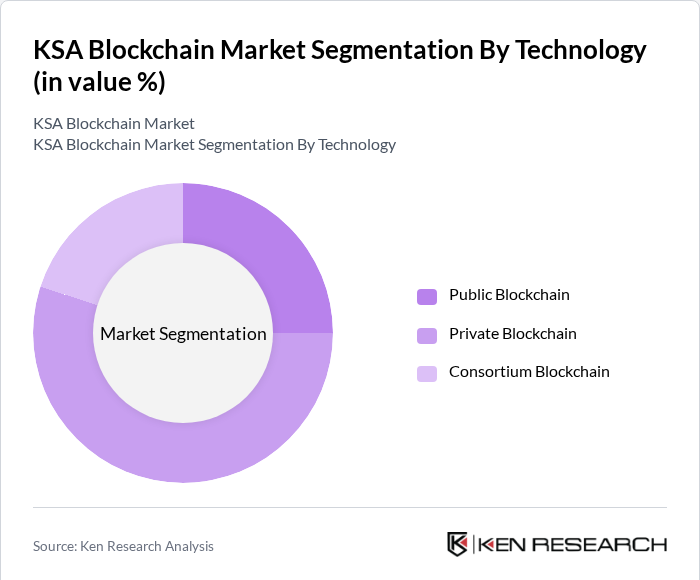

By Technology: The KSA Blockchain Market is segmented into public, private, and consortium blockchains. Among these, the private blockchain segment is dominating the market due to its enhanced security features and the ability to control access, making it particularly appealing for enterprises in sectors such as finance and healthcare. Organizations are increasingly adopting private blockchains to ensure data privacy and compliance with regulatory requirements, which is driving the growth of this segment.

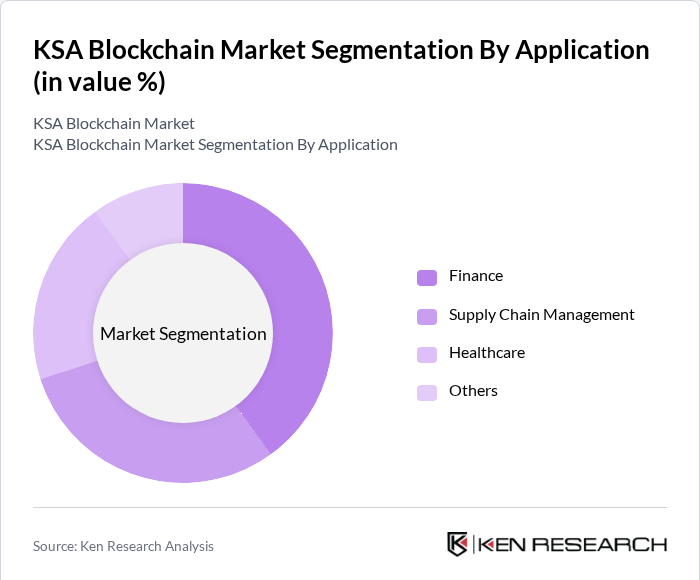

By Application: The market is further segmented into finance, supply chain management, healthcare, and others. The finance sector is leading the application segment, driven by the increasing need for secure and efficient transaction processing. Financial institutions are leveraging blockchain technology to enhance transparency, reduce fraud, and streamline operations. The growing adoption of cryptocurrencies and decentralized finance (DeFi) solutions is also contributing to the dominance of this segment.

KSA Blockchain Market Competitive Landscape

The KSA Blockchain Market is characterized by a competitive landscape featuring both local and international players. Companies such as Saudi Telecom Company, STC Pay, and IBM are at the forefront, driving innovation and adoption of blockchain solutions. The market is witnessing a mix of established firms and startups, all vying for a share in this rapidly evolving sector.

KSA Blockchain Market Industry Analysis

KSA Blockchain Market Industry Analysis

Growth Drivers

- Increasing Government Support for Blockchain Initiatives: The Saudi government has planned towards blockchain technology development as part of its Vision 2030 initiative. This funding aims to enhance digital transformation across various sectors, including finance and healthcare. The establishment of the Saudi Blockchain Association in 2023 further demonstrates the commitment to fostering innovation and collaboration among stakeholders, which is expected to drive market growth significantly in the coming years.

- Rising Demand for Transparency and Security in Transactions: With the increasing number of cyber threats, businesses in KSA are prioritizing secure transaction methods. A report from the Saudi Cybersecurity Authority indicated a 32% rise in cyber incidents in 2023. Blockchain technology offers enhanced security features, such as immutability and encryption, which are crucial for protecting sensitive data. This growing demand for secure solutions is propelling the adoption of blockchain across various industries, particularly finance and supply chain management.

- Expansion of Digital Infrastructure and Internet Penetration: KSA's internet penetration rate reached 100% in 2023, facilitating the adoption of digital technologies, including blockchain. The government's investment in digital infrastructure, amounting to $2.7 billion, aims to support smart city initiatives and e-governance. This robust digital ecosystem is creating a conducive environment for blockchain applications, enabling businesses to leverage technology for operational efficiency and improved service delivery.

Market Challenges

- Regulatory Uncertainties Surrounding Blockchain Technology: The lack of a clear regulatory framework poses significant challenges for blockchain adoption in KSA. As of 2023, only 42% of businesses reported understanding the existing regulations related to blockchain. This uncertainty can deter investment and slow down the implementation of blockchain solutions, as companies remain cautious about compliance and potential legal repercussions, hindering overall market growth.

- Limited Awareness and Understanding Among Businesses: A survey conducted in 2023 revealed that only 37% of businesses in KSA are familiar with blockchain technology and its benefits. This lack of awareness leads to hesitance in adopting blockchain solutions, as many organizations do not fully understand how it can enhance their operations. Educational initiatives and awareness campaigns are essential to bridge this knowledge gap and encourage broader adoption across sectors.

KSA Blockchain Market Future Outlook

The KSA blockchain market is poised for significant growth as the government continues to prioritize digital transformation initiatives. With increasing investments in technology and infrastructure, businesses are expected to adopt blockchain solutions to enhance operational efficiency and security. The integration of blockchain with emerging technologies, such as artificial intelligence and IoT, will further drive innovation. As regulatory frameworks evolve, the market will likely witness a surge in startups and established companies exploring blockchain applications across various sectors, including finance, healthcare, and logistics.

Market Opportunities

- Potential for Blockchain in Enhancing Supply Chain Efficiency: The supply chain sector in KSA is projected to grow by 12% annually, creating opportunities for blockchain to streamline operations. By providing real-time tracking and transparency, blockchain can reduce fraud and improve inventory management, leading to cost savings and enhanced customer satisfaction.

- Growth of Decentralized Finance (DeFi) Solutions: The DeFi market in KSA is expected to expand rapidly. This growth presents opportunities for blockchain-based financial services, enabling peer-to-peer transactions and reducing reliance on traditional banking systems, thus fostering financial inclusion and innovation.

Scope of the Report

| By Technology |

Public Private Consortium |

| By Application |

Finance Supply Chain Management Healthcare Others |

| By End-User |

Government Financial Institutions Healthcare Providers Retail Others |

| By Region |

Central Region Western Region Eastern Region Southern Region |

| By Deployment Mode |

On-Premises Cloud-Based |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Saudi Arabian Monetary Authority, Ministry of Communications and Information Technology)

Blockchain Technology Developers

Financial Institutions

Telecommunications Companies

Energy Sector Stakeholders

Logistics and Supply Chain Companies

Healthcare Providers and Organizations

Companies

Players Mentioned in the Report:

Saudi Telecom Company

STC Pay

IBM

Blockchain Solutions

Arabian Blockchain

CryptoKSA Innovations

Riyadh Ledger Technologies

DesertChain Solutions

Gulf Blockchain Ventures

Neom Digital Assets

Table of Contents

1. KSA Blockchain Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. KSA Blockchain Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. KSA Blockchain Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Government Support for Blockchain Initiatives

3.1.2. Rising Demand for Transparency and Security in Transactions

3.1.3. Expansion of Digital Infrastructure and Internet Penetration

3.2. Market Challenges

3.2.1. Regulatory Uncertainties Surrounding Blockchain Technology

3.2.2. Limited Awareness and Understanding Among Businesses

3.2.3. High Initial Investment Costs for Implementation

3.3. Opportunities

3.3.1. Potential for Blockchain in Enhancing Supply Chain Efficiency

3.3.2. Growth of Decentralized Finance (DeFi) Solutions

3.3.3. Increasing Adoption of Smart Contracts Across Industries

3.4. Trends

3.4.1. Integration of Blockchain with IoT for Enhanced Data Security

3.4.2. Rise of Non-Fungible Tokens (NFTs) in Various Sectors

3.4.3. Focus on Sustainable and Green Blockchain Solutions

3.5. Government Regulation

3.5.1. Overview of Current Regulatory Frameworks

3.5.2. Impact of Vision 2030 on Blockchain Adoption

3.5.3. Compliance Guidelines for Blockchain Startups

3.5.4. Future Regulatory Trends and Their Implications

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porter’s Five Forces

3.9. Competition Ecosystem

4. KSA Blockchain Market Segmentation

4.1. By Technology

4.1.1. Public

4.1.2. Private

4.1.3. Consortium

4.2. By Application

4.2.1. Finance

4.2.2. Supply Chain Management

4.2.3. Healthcare

4.2.4. Others

4.3. By End-User

4.3.1. Government

4.3.2. Financial Institutions

4.3.3. Healthcare Providers

4.3.4. Retail

4.3.5. Others

4.4. By Region

4.4.1. Central Region

4.4.2. Western Region

4.4.3. Eastern Region

4.4.4. Southern Region

4.5. By Deployment Mode

4.5.1. On-Premises

4.5.2. Cloud-Based

5. KSA Blockchain Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Saudi Telecom Company

5.1.2. STC Pay

5.1.3. IBM

5.1.4. Blockchain Solutions

5.1.5. Arabian Blockchain

5.1.6. CryptoKSA Innovations

5.1.7. Riyadh Ledger Technologies

5.1.8. DesertChain Solutions

5.1.9. Gulf Blockchain Ventures

5.1.10. Neom Digital Assets

5.2. Cross Comparison Parameters

5.2.1. Market Share

5.2.2. Revenue Growth Rate

5.2.3. Product Innovation

5.2.4. Customer Satisfaction Ratings

5.2.5. Geographic Presence

5.2.6. Strategic Partnerships

5.2.7. Technology Adoption Rate

5.2.8. Regulatory Compliance

6. KSA Blockchain Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. KSA Blockchain Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. KSA Blockchain Market Future Market Segmentation

8.1. By Technology

8.1.1. Public

8.1.2. Private

8.1.3. Consortium

8.2. By Application

8.2.1. Finance

8.2.2. Supply Chain Management

8.2.3. Healthcare

8.2.4. Others

8.3. By End-User

8.3.1. Government

8.3.2. Financial Institutions

8.3.3. Healthcare Providers

8.3.4. Retail

8.3.5. Others

8.4. By Region

8.4.1. Central Region

8.4.2. Western Region

8.4.3. Eastern Region

8.4.4. Southern Region

8.5. By Deployment Mode

8.5.1. On-Premises

8.5.2. Cloud-Based

9. KSA Blockchain Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the KSA Blockchain Market ecosystem, identifying key stakeholders such as government entities, private sector players, and technology providers. This step relies on extensive desk research, utilizing secondary data sources and proprietary databases to gather relevant industry insights. The primary goal is to pinpoint and define the critical variables that drive market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical and current data related to the KSA Blockchain Market. This includes evaluating market size, growth trends, and the competitive landscape. Additionally, we will assess the adoption rates of blockchain technology across various sectors to provide a comprehensive overview of market potential and challenges.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be formulated and validated through structured interviews with industry experts and stakeholders. These consultations will encompass a range of perspectives, including technology developers, regulatory bodies, and end-users. The insights gained will be crucial for refining our understanding of market trends and validating the data collected.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing the collected data and insights into a cohesive report. This will include detailed analysis of market segments, consumer behavior, and future trends. The synthesis will ensure that the findings are not only accurate but also actionable, providing stakeholders with a clear roadmap for navigating the KSA Blockchain Market through 2029.

Frequently Asked Questions

01. How big is the KSA Blockchain Market?

The KSA Blockchain Market is valued at USD 250 million, driven by factors such as increasing demand, technological advancements, and supportive government initiatives.

02. What are the key challenges in the KSA Blockchain Market?

Key challenges in the KSA Blockchain Market include intense competition, regulatory complexities, and infrastructure limitations affecting market dynamics.

03. Who are the major players in the KSA Blockchain Market?

Major players in the KSA Blockchain Market include Saudi Telecom Company, STC Pay, IBM, Blockchain Solutions, Arabian Blockchain, among others.

04. What are the growth drivers for the KSA Blockchain Market?

The primary growth drivers for the KSA Blockchain Market are increasing consumer demand, favorable policies, innovation, and substantial investment inflows.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.