KSA Camel Milk Market Outlook to 2030

Region:Middle East

Author(s):Ananya Singh

Product Code:KROD8820

November 2024

95

About the Report

KSA Camel Milk Market Overview

- The KSA camel milk market, valued at USD 269 million, is primarily driven by the rising demand for nutrient-rich alternatives to traditional cows milk. Camel milks high content of vitamins and minerals, along with its perceived health benefits such as aiding in diabetes management and boosting immunity, has pushed its popularity among both local consumers and global markets. Moreover, the Saudi government has invested in camel dairy farms, boosting production capacity and creating a favorable regulatory environment for the market.

- Major cities like Riyadh, Jeddah, and Dammam dominate the KSA camel milk market due to their higher urban populations, larger consumer base, and increased disposable incomes. These cities also serve as hubs for international trade, contributing to the export of camel milk and its derivative products. The concentration of camel farms in regions around these cities further supports their dominance in the market.

- The government, through the Ministry of Environment, Water, and Agriculture, established three new camel dairy research and development centers in 2024. These centers are focused on improving camel milk yields through genetic research, enhancing camel feed quality, and developing better processing techniques for camel milk products. The goal is to improve overall industry efficiency and productivity, ensuring that camel milk producers can meet both domestic and international demand.

KSA Camel Milk Market Segmentation

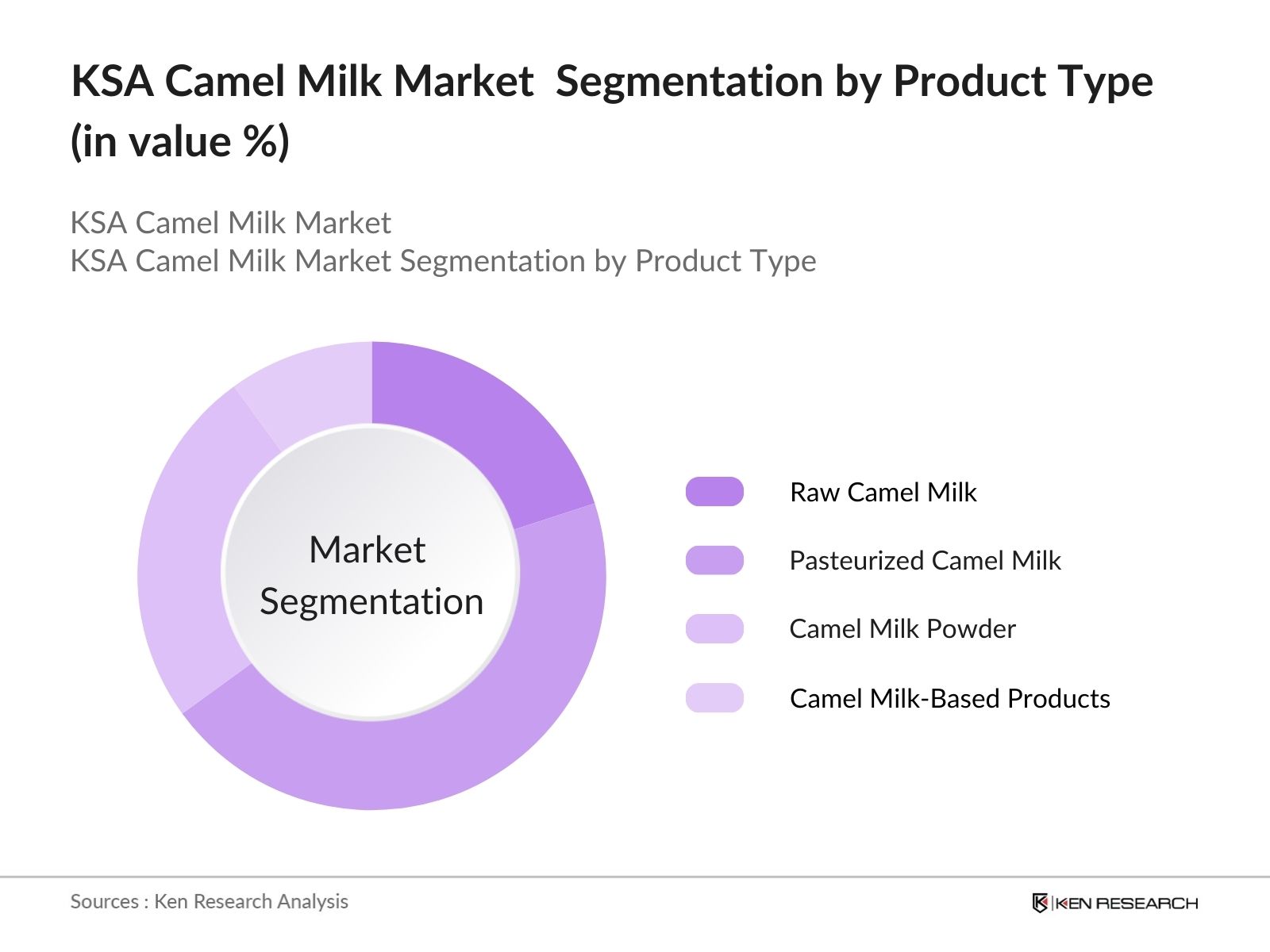

By Product Type: The KSA camel milk market is segmented by product type into Raw Camel Milk, Pasteurized Camel Milk, Camel Milk Powder, and Camel Milk-Based Products (such as cheese, yogurt, and ice cream). Pasteurized Camel Milk holds the largest share in the product type segment. The demand for pasteurized milk is fueled by consumer preference for products that offer a longer shelf life, ensuring convenience for both local and export markets. Additionally, pasteurized camel milk is favored for its lower microbial content, making it more accessible to a wider audience, including international buyers adhering to strict food safety regulations.

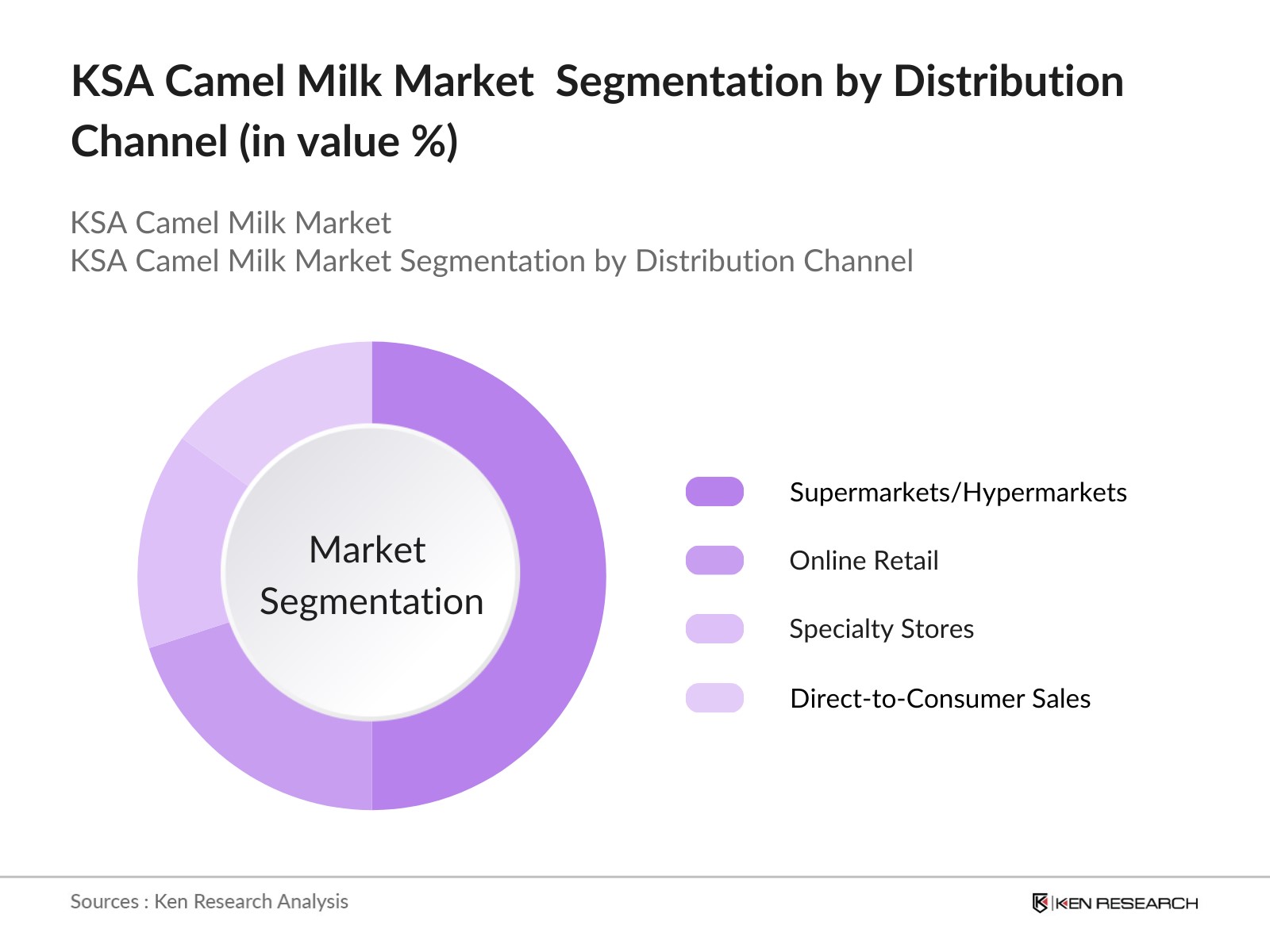

By Distribution Channel: The KSA camel milk market is segmented into Supermarkets/Hypermarkets, Online Retail, Specialty Stores, and Direct-to-Consumer Sales. Supermarkets/Hypermarkets dominate the distribution channel due to their extensive presence in major cities and their ability to provide consumers with a variety of camel milk products under one roof. Supermarkets such as Panda and Al Othaim are key players in this segment, offering both locally produced and imported camel milk products, thereby contributing to higher sales volumes.

KSA Camel Milk Market Competitive Landscape

The KSA camel milk market is characterized by several prominent players, both local and international, that have contributed to its growth and consolidation. These companies have focused on innovation, expanding product portfolios, and enhancing production capacities to meet growing consumer demand. The dominance of players such as Al Ain Farms and Emirates Industry for Camel Milk reflects the importance of large-scale production facilities and strong distribution networks in this market.

KSA Camel Milk Market Analysis

Growth Drivers

- Increased Global Demand for Camel Milk Exports: The KSA camel milk market is experiencing a surge in global demand for exports, particularly in regions like Europe and North America, where camel milk is being increasingly recognized for its nutritional benefits. In 2024, KSA exported approximately 1,200 metric tons of camel milk to international markets, driven by a growing interest in dairy alternatives. Government support for export facilities has further strengthened this driver, providing logistical and financial incentives to camel milk producers in the Kingdom to meet global demands, as stated by the Saudi Ministry of Agriculture.

- Government Support for Camel Dairy Farming: The Saudi Arabian government continues to provide substantial support to the camel dairy industry through subsidies and infrastructure development programs. In 2024, the Ministry of Environment, Water, and Agriculture allocated SAR 500 million to develop camel farming, aiming to improve camel healthcare, breeding programs, and dairy production facilities. This initiative has allowed local producers to increase their camel herd sizes and enhance their production capacity, leading to an overall increase in camel milk output, which is a critical driver for market growth.

- Health Benefits and Increasing Consumer Awareness: Consumer awareness regarding the health benefits of camel milk has contributed significantly to the market's expansion. Camel milk contains high levels of essential vitamins and minerals like vitamin C, calcium, and potassium. In 2024, studies published by the Saudi Food and Drug Authority highlighted that 70% of surveyed households in KSA are aware of camel milk's health benefits, including its potential role in controlling diabetes and aiding digestion. This awareness has led to an increased domestic demand, further boosting the growth of the camel milk market.

Market Challenges

- High Production Costs and Limited Infrastructure: Camel milk production in KSA faces challenges due to the high costs associated with camel farming, including feeding, veterinary care, and milking technology. In 2024, the average cost to maintain a single dairy camel was approximately SAR 15,000 per year, which is significantly higher compared to other dairy livestock like cows. The limited availability of specialized infrastructure for processing camel milk into diversified products also adds to production constraints, affecting the profitability and scalability of camel milk businesses in the country.

- Seasonal Variations in Camel Milk Yield

Camel milk production in KSA is subject to seasonal fluctuations, as camels naturally produce more milk during certain times of the year. In 2024, camel milk production dropped by nearly 40% during the peak summer months, as extreme temperatures impacted the milk yield. These seasonal variations disrupt supply chains, affecting both local availability and export capabilities. Producers must often rely on milk powder or stockpiled milk to meet demand during off-peak seasons, which adds operational complexity and cost.

KSA Camel Milk Market Future Outlook

Over the next five years, the KSA camel milk market is expected to experience robust growth, driven by increasing demand for healthy dairy alternatives, rising consumer awareness about the benefits of camel milk, and expanding export markets. The governments support for camel farming through subsidies and development projects will further enhance production capabilities. Innovations in product formulations, such as camel milk-based functional beverages and nutraceuticals, will likely cater to health-conscious consumers.

Market Opportunities

- Increasing Demand for Camel Milk in Functional Beverages: Over the next five years, the demand for camel milk as a key ingredient in functional beverages is expected to rise significantly. This trend will be driven by the growing global interest in health and wellness products, particularly those that cater to consumers seeking dairy alternatives. By 2029, KSA camel milk producers are anticipated to supply an additional 2,000 metric tons annually to this segment, targeting health-conscious consumers in both local and export markets.

- Technological Advancements in Camel Milk Processing: The KSA camel milk industry is likely to benefit from advancements in dairy processing technologies that improve yield and quality. By 2029, new milking and pasteurization technologies are expected to reduce production costs by SAR 50 million annually, enabling producers to scale their operations more efficiently. These technologies will also extend the shelf life of camel milk products, making them more suitable for export.

Scope of the Report

|

By Product Type |

Raw Camel Milk |

|

By Distribution Channel |

Supermarkets/Hypermarkets |

|

By End-User |

Residential Consumers |

|

By Application |

Beverages |

|

By Region |

Riyadh |

Products

Key Target Audience

Camel Milk Producers and Processors

Retail Chains and Supermarkets

Export and Trade Companies

Government and Regulatory Bodies (Saudi Food and Drug Authority, Ministry of Environment, Water and Agriculture)

Venture Capital and Investment Firms

Food and Beverage Distributors

Camel Farmers and Dairy Cooperatives

Nutraceutical and Functional Beverage Companies

Companies

Players Mentioned in the Report

Al Ain Farms

Emirates Industry for Camel Milk

Camelicious

Almarai

Al Watania Agriculture

Horizon Camel Milk

Desert Farms

Tiviski Dairy

United Dairy Company

Table of Contents

1. KSA Camel Milk Market Overview

1.1. Definition and Scope (Camel milk consumption, production techniques, market landscape)

1.2. Market Taxonomy (Products: Raw Camel Milk, Pasteurized Camel Milk, Camel Milk Powder, Camel Milk-Based Products)

1.3. Market Growth Rate (Growth rate specific to KSA's camel milk market)

1.4. Market Segmentation Overview (Product Type, Distribution Channel, End-User, Region, Application)

2. KSA Camel Milk Market Size (In USD Mn)

2.1. Historical Market Size (Market demand, production volumes, export/import data)

2.2. Year-On-Year Growth Analysis (Growth trends and developments in production, pricing, and consumption)

2.3. Key Market Developments and Milestones (Government policies, market entrants, product innovations)

3. KSA Camel Milk Market Analysis

3.1. Growth Drivers

3.1.1. Rising Consumer Demand for Camel Milk Products

3.1.2. Government Support for Camel Dairy Farming

3.1.3. Increased Awareness of Health Benefits

3.1.4. Expansion of Camel Milk Export Market

3.2. Restraints

3.2.1. High Production Costs and Limited Infrastructure

3.2.2. Competition from Other Dairy Products

3.2.3. Seasonal Variations in Camel Milk Yield

3.3. Opportunities

3.3.1. Technological Advancements in Camel Farming

3.3.2. Rising Global Demand for Dairy Alternatives

3.3.3. New Market Entrants and Innovation in Product Offerings

3.4. Trends

3.4.1. Growing Preference for Organic and Nutrient-Rich Products

3.4.2. Introduction of Camel Milk-Based Cosmetics and Pharmaceuticals

3.4.3. Collaboration with International Dairy Producers

3.5. Government Regulation

3.5.1. Camel Milk Quality Standards

3.5.2. Subsidies for Camel Farming and Dairy Development

3.5.3. Export and Trade Regulations on Camel Milk Products

3.5.4. Food Safety and Certification Standards

3.6. SWOT Analysis

3.6.1. Strengths: Local production, rising health awareness

3.6.2. Weaknesses: High cost, limited infrastructure

3.6.3. Opportunities: Global demand, innovation potential

3.6.4. Threats: Competitive dairy markets, changing consumer preferences

3.7. Stake Ecosystem (Camel farmers, processors, distributors, exporters)

3.8. Porters Five Forces (Buyer power, supplier power, competitive rivalry, threat of new entrants, threat of substitutes)

3.9. Competition Ecosystem (15 competitors, including local and international players)

4. KSA Camel Milk Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Raw Camel Milk

4.1.2. Pasteurized Camel Milk

4.1.3. Camel Milk Powder

4.1.4. Camel Milk-Based Products (Cheese, Yogurt, Ice Cream)

4.2. By Distribution Channel (In Value %)

4.2.1. Supermarkets/Hypermarkets

4.2.2. Online Retail

4.2.3. Specialty Stores

4.2.4. Direct-to-Consumer Sales

4.3. By End-User (In Value %)

4.3.1. Residential Consumers

4.3.2. Commercial Consumers (Hotels, Cafes, Restaurants)

4.3.3. Institutional Buyers (Hospitals, Schools, Military)

4.4. By Application (In Value %)

4.4.1. Beverages

4.4.2. Food Products

4.4.3. Nutraceuticals

4.4.4. Cosmetics & Pharmaceuticals

4.5. By Region (In Value %)

4.5.1. Riyadh

4.5.2. Jeddah

4.5.3. Dammam

4.5.4. Western Region

4.5.5. Eastern Region

5. KSA Camel Milk Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Al Ain Farms

5.1.2. Emirates Industry for Camel Milk and Products

5.1.3. Al-Watania Agriculture

5.1.4. Desert Farms

5.1.5. Camelicious

5.1.6. Almarai

5.1.7. Al Rawabi Dairy

5.1.8. Horizon Camel Milk

5.1.9. United Dairy Company (Kuwait)

5.1.10. Tiviski Dairy (Mauritania)

5.1.11. Mawashi Camel Dairy

5.1.12. Shubra Camel Milk

5.1.13. Nakheel Camel Farm

5.1.14. Camel Dairy Farms Dubai

5.1.15. Nabeel Camel Milk

5.2 Cross Comparison Parameters (Market Share, Camel Herd Size, Production Capacity, Product Range, Regional Presence)

5.3. Market Share Analysis (Local vs. International Players)

5.4. Strategic Initiatives (Expansion, Product Diversification, Partnerships)

5.5. Mergers and Acquisitions

5.6. Investors Analysis

5.7. Government Grants

5.8. Private Equity Investments

6. KSA Camel Milk Market Regulatory Framework

6.1. Camel Milk Industry Standards

6.2. Certification Requirements (Saudi Food & Drug Authority, Organic Certifications)

6.3. Compliance with Export Regulations (GCC Trade Standards)

7. KSA Camel Milk Market Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth (Increased health consciousness, growing export demand)

8. KSA Camel Milk Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By End-User (In Value %)

8.4. By Application (In Value %)

8.5. By Region (In Value %)

9. KSA Camel Milk Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis (Target consumers for premium products, health-focused consumers)

9.3. Marketing Initiatives (Branding, Digital Marketing, Export Promotion)

9.4. White Space Opportunity Analysis (Potential in nutraceuticals, cosmetics, and new regional markets)

Research Methodology

Step 1: Identification of Key Variables

The first phase involves the creation of an ecosystem map that captures all significant stakeholders in the KSA Camel Milk Market. This is achieved through a combination of primary and secondary research, utilizing industry-specific databases to gather comprehensive data on camel farming, production, and consumer trends.

Step 2: Market Analysis and Construction

The next phase involves a detailed analysis of historical market data related to the KSA camel milk industry. This includes evaluating production capacity, consumption patterns, and revenue streams to ensure the reliability of market size estimates and to identify key drivers.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and then validated through expert consultations, including interviews with camel milk producers, processors, and distributors. These consultations provide critical insights into industry operations and challenges, which help refine the market analysis.

Step 4: Research Synthesis and Final Output

The final stage entails synthesizing the data collected, including detailed insights on product segments, distribution channels, and market opportunities. This bottom-up approach ensures an accurate and validated understanding of the KSA camel milk market dynamics.

Frequently Asked Questions

01. How big is the KSA Camel Milk Market?

The KSA camel milk market is valued at SAR 450 million, with demand driven by increased consumer awareness of its health benefits and growing government support for the sector.

02. What are the key drivers of the KSA Camel Milk Market?

The market is primarily driven by the nutritional benefits of camel milk, rising demand for alternative dairy products, and government investment in camel dairy farming infrastructure.

03. Who are the major players in the KSA Camel Milk Market?

Key players in the market include Al Ain Farms, Emirates Industry for Camel Milk, Camelicious, Almarai, and Al Watania Agriculture, known for their extensive production capacities and export presence.

04. What challenges are faced by the KSA Camel Milk Market?

Challenges include high production costs, limited infrastructure for large-scale processing, and competition from more established dairy products such as cow's milk.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.