KSA Car Sharing, Taxi and Truck Leasing Market

Driven by Increasing tourism, need for mobility, technology integration and government initiatives to develop the economy

Region:Middle East

Author(s):Srijan and Anushi

Product Code:KR1414

February 2024

37

About the Report

Market Overview:

KSA Car Sharing, Taxi and Truck Leasing Market is expected to grow at a significant growth rate owing to different factors affecting the market. Among the three markets, the KSA taxi market is the biggest and is anticipated to develop consistently in the forecasted period as well. Al Safwa, Umrah Taxis, and Makkah Madina Taxi Service are some of the leading companies in the KSA Taxi market.

KSA Car Sharing is also growing steadily with a focus on greener mobility, offering convenience, growth in the local economy, targeting low-income segments, technology partnerships and peer-to-peer models. Sedans dominate the car-sharing market in KSA with the majority market share in terms of fleet size followed by SUVs.

The main car-sharing firms in Saudi Arabia are UDrive, IDrive, and Ekar. The Ministry of Transport, the Traffic Department, and the TGA are a few of the regulatory bodies that supervise them.

The Ministry of Transport and TGA control around 1500 companies in the KSA taxi market, the most prominent include Umrah Taxis, Makkah Madina Taxi Service, and Al Safwa. Some of the largest truck leasing companies in Saudi Arabia are Rahaal, Fraikin Dayum, Mubarrad, Amal Express, Neeran International, FWS Contracting, and AMHEC. They are subject to regulation by the TGA and various ministries.

KSA Car Sharing, Taxi and Truck Leasing Market Analysis

- The KSA Taxi Market is developing notably with a fleet size of 110,500 taxis. The market is highly fragmented with over 1500 companies actively present in the industry.

- Comparatively, the KSA Car Sharing Market is extremely consolidated with the top three companies including UDrive, Ekar and IDrive having a market share of more than 90%. The market has a fleet size of 1,150 vehicles.

- In 2018, the first car-sharing application in Saudi Arabia, IDrive, entered the market and the business started growing. Since then, the industry has expanded at an unprecedented rate as IDrive has continued to promote the idea of car sharing and compete with companies that provide rentals.

- The KSA truck leasing market is witnessing exceptional growth due to the government's initiatives to promote other industries of the economy, the rising demand for truck leasing, and the integration of technology.

- Demand for truck leasing is rising across a variety of industries in Saudi Arabia, including mining, oil, and construction, as it offers a more affordable option than buying trucks.

Key Trends by Market Segment:

By Type of Fleet: The KSA Car Sharing Market is classified into two major categories: SUV and Sedan. Because they are easily accessible and reasonably priced, Sedan cars hold an 81% market share in the KSA car sharing market. SUVs are typically the vehicle of choice for travelers since they are spacious and comfortable. Sedans are the ideal option for corporate reservations due to their lower cost and greater availability.

By Type of Vehicle: TheKSA Taxi Market is categorized into four important categories Small Taxi, Medium Taxi, Large Taxi, and Coaster. Small Taxi (1-4 Passengers) is the leading the KSA Taxi Market with a market share of 57% followed by Medium Taxi, Large Taxi, and Coaster. Sedans make up the majority of small taxis in Saudi Arabia. They are either Toyota Camries or Hyundai Sonata limos, which account for over half of all taxis in operation. These sedans offer luxurious and comfortable seating for guests to enjoy at their convenience.

By Type of Truck: The truck leasing market is classified into two categories that are Heavy Duty Trucks and Medium Duty Trucks. Medium Duty Trucks dominate the market with a market share of 70% followed by Heavy Duty Trucks. Medium Duty Trucks are preferred as Medium-duty trucks are versatile and well-suited for a range of applications. They strike a balance between the payload capacity of heavy-duty trucks and the adaptability of light-duty trucks, making them ideal for various transport needs.

Competitive Landscape:

Major Players in KSA Car Sharing, Taxi and Truck Leasing Market

In order to cater to various consumer categories, such as those seeking premium cars, family-friendly cars, out-of-town vehicles, etc., taxi firms are focusing on offering customized services. This is projected to enhance the desire for taxis in the near future.

The TGA's primary goal is to equip every taxi in Saudi Arabia with modern technology by incorporating features such as live tracking devices. Additionally, air taxis are under development and are expected to be available by 2024.

The Truck Leasing Market in KSA is moderately fragmented with Rahaal capturing more than 40% of the market and the rest being occupied by multiple players. These 5 players capture around 65% of the fleet size with Rahaal, Fraikin and Mubarrad being the leaders.

With Rahaal holding a market share of over 40% and other companies occupying the rest of the market, the truck leasing industry in Saudi Arabia is partially fragmented. The players including Rahaal, Fraikin, and Mubarrad account for almost 65% of the fleet size.

The current car-sharing firms in Saudi Arabia, including UDrive, intend to increase the number of vehicles in their fleet to 1500 by the end of this year. Such goals for growth, in addition to the arrival of new companies, will encourage market expansion to meet the growing mobility demand.

Future Outlook:

The market is expected to grow substantially during 2022-2027 owing to factors such as Increasing tourism, the need for mobility, technology integration and government initiatives to develop the economy.

Under the Saudi Vision 2030, the demand for leasing would further increase as other sectors like imported goods have to be transported by trucks which will increase the demand for them to be leased trucks in country.

The government's initiatives aimed at advancing fare practices in the taxi industry and promoting Vision 2030 would facilitate further expansion of the already extensive sector that is made up of numerous organizations. The growing adoption of digital technology will make it possible to book cabs online, thus enhancing the convenience provided.

The Saudi Arabian Vision 2030, which promotes environmentally friendly mobility, will encourage more businesses to join the flourishing car-sharing market in the future by emphasizing the sustainability of their fleet. Growth in this relatively young market in KSA is anticipated to be further enabled by the arrival of new and foreign firms.

Scope of the Report

|

KSA Car Sharing, Taxi and Truck Leasing Market |

|

|

By Type of Fleet |

SUV Sedan |

|

By Type of Taxi |

Small Taxi Medium Taxi Large Taxi Coaster |

|

By Type of Truck |

Heavy Duty Trucks Medium Duty Trucks |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

Investors

Manufacturers & Distributors

Fleet & Equipment Owners

Government Entity

Environmental Advocates

Automotive & Machinery Professionals

Time Period Captured in the Report:

Base Year: 2022

Forecast Period: 2022-2028

Companies

Major Players Mentioned in the Report:

IDrive

UDrive

Ekar

Al Safwa

Umrah Taxi Service

Makkah Madina Taxi Service

Table of Contents

1. KSA Car Sharing Market

1.1. Executive Summary: KSA Car Sharing Market

1.2. Ecosystem of KSA Car Sharing Market

1.3. KSA Car Sharing Market Sizing and Segmentation, 2019-2022

1.4. Growth Drivers

1.5. Trends and Developments

1.6. Market Shares of Major Car Sharing Companies in KSA by Fleet Size and Revenue, 2022

1.7. KSA Car Sharing Market Future Sizing, 2023P-2028F

2. KSA Taxi Market

2.1. Executive Summary: KSA Taxi Market

2.2. Ecosystem of KSA Taxi Market

2.3. KSA Taxi Market Sizing, 2018-2022

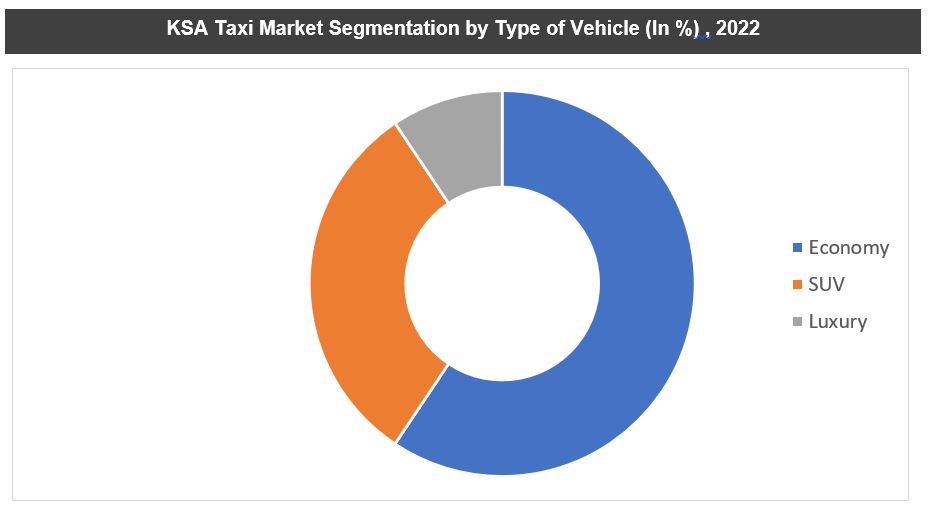

2.4. KSA Taxi Market Segmentation by Type of Taxi, 2022

2.5. Recent Developments and Government Regulations

2.6. Growth Drivers

2.7. Market Shares of Major Taxi Companies in KSA, 2022

2.8. KSA Taxi Market Future Sizing, 2023P-2028F

3. KSA Truck Leasing Market

3.1. Ecosystem of KSA Truck Leasing Market

3.2. KSA Truck Leasing Market Sizing and Segmentation, 2022-2027F

3.3. Trends and Growth Drivers

3.4. Market Shares of Major Truck Leasing Companies in KSA, 2022

4. Research Methodology

4.1. Market Definitions and Assumptions

4.2. Abbreviations Used

4.3. Market Sizing Approach

4.4. Consolidated Research Approach

4.5. Sample Size Inclusion

4.6. Research Limitations and Conclusion

Disclaimer Contact UsResearch Methodology

Step1: Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around the market to collate industry-level information.

Step2: Market Building:

Collating statistics on the Car Sharing, Taxi and Truck Leasing market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for the KSA Car Sharing, Taxi and Truck Leasing market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step3: Validating and Finalizing:

Building market hypotheses and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step4: Research output:

Our team will approach multiple Car Sharing, Taxi and Truck Leasing -providing channels and understanding the nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from Car Sharing, Taxi and Truck Leasing providers.

Frequently Asked Questions

01 How big is KSA Car Sharing, Taxi and Truck Leasing Market?

The KSA Car Sharing, Taxi and Truck Leasing Market was valued at ~ SAR 12489.6 Mn in 2022.

02 What are the Key Factors Driving the KSA Car Sharing, Taxi and Truck Leasing Market?

Increasing tourism, the need for mobility, technology integration and government initiatives to develop the economy are likely to fuel the growth in the KSA Car Sharing, Taxi and Truck Leasing Market.

03 Who are the Key Players in the KSA Car Sharing, Taxi and Truck Leasing Market?

IDrive, UDrive, Ekar, Al Safwa, Umrah Taxi Service, and Makkah Madina Taxi Service are some of the key players in the KSA car-sharing, Taxi and Truck Leasing Market.

04 What is the Future of the KSA Car Sharing, Taxi and Truck Leasing Market?

The KSA Car Sharing, Taxi and Truck Leasing Market is expected to reach ~ SAR 22445.6 Mn during the forecasted period of 2022-2028.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.