KSA Cardiovascular Biomarkers Market Outlook to 2030

Region:Middle East

Author(s):Vijay Kumar

Product Code:KROD5571

December 2024

96

About the Report

KSA Cardiovascular Biomarkers Market Overview

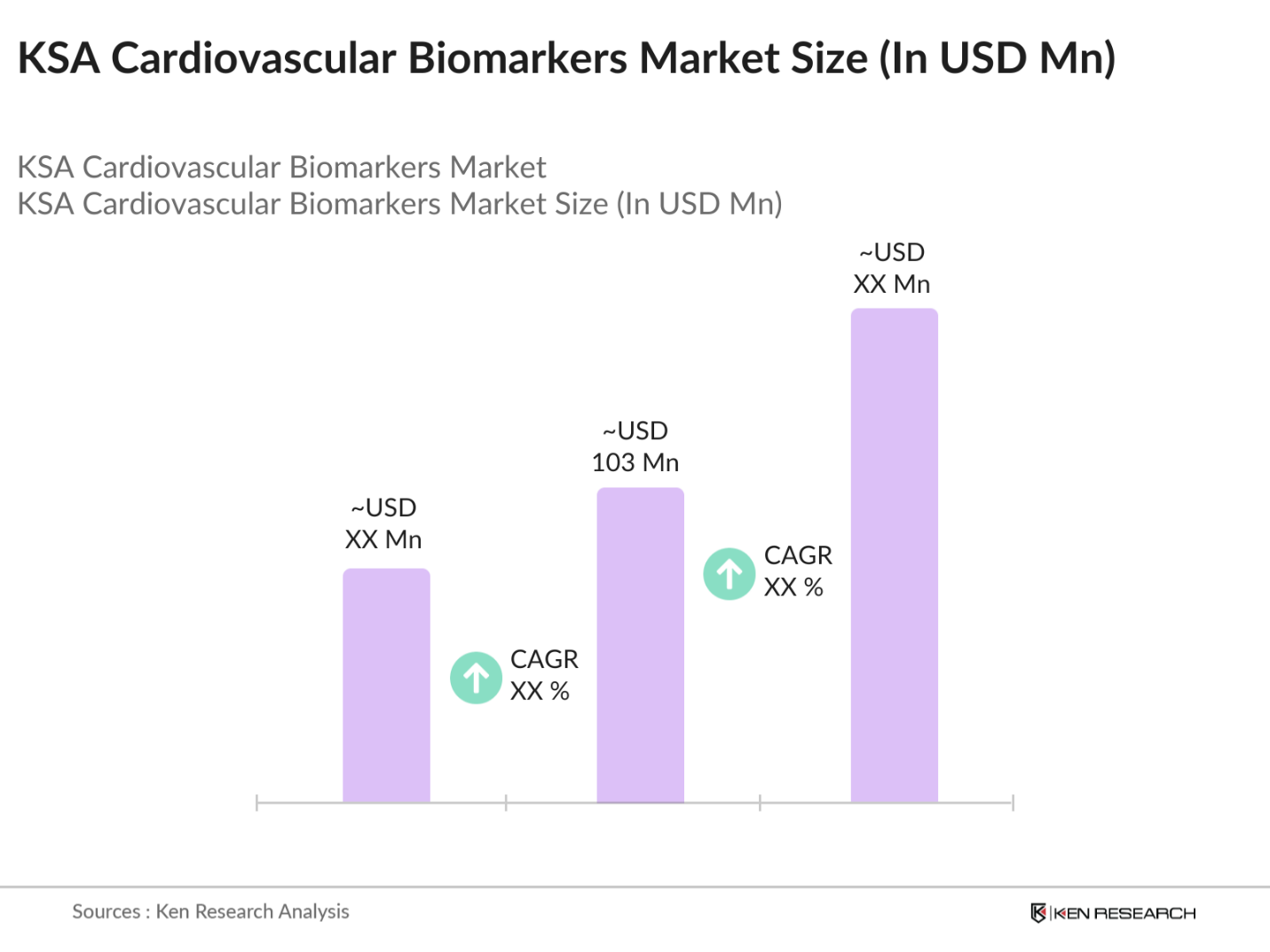

- The KSA Cardiovascular Biomarkers Market is valued at USD 103 million based on a detailed analysis of historical data from the past five years. The market is primarily driven by the increasing incidence of cardiovascular diseases (CVDs) and the rising demand for early diagnosis solutions. With Saudi Arabia's healthcare sector undergoing rapid modernization and increased government support under initiatives like Vision 2030, the demand for biomarker-based diagnostics has grown significantly, contributing to the expansion of the market.

- Key regions that dominate the KSA Cardiovascular Biomarkers Market include Riyadh, Jeddah, and Dammam. These cities lead the market due to their advanced healthcare infrastructure and higher awareness of CVDs among the population. Moreover, the concentration of leading healthcare institutions and research centers in these areas has further fueled the adoption of biomarker-based diagnostic solutions, contributing to their dominance in the overall market.

- The Saudi Food and Drug Authority (SFDA) plays a pivotal role in regulating cardiovascular biomarker diagnostics, ensuring that all products meet stringent safety and efficacy standards. The SFDAs recent guidelines on biomarker validation have streamlined the approval process for diagnostic tests, reducing the average approval time from two years to 18 months. These regulatory updates are designed to encourage innovation while maintaining high standards of patient safety.

KSA Cardiovascular Biomarkers Market Segmentation

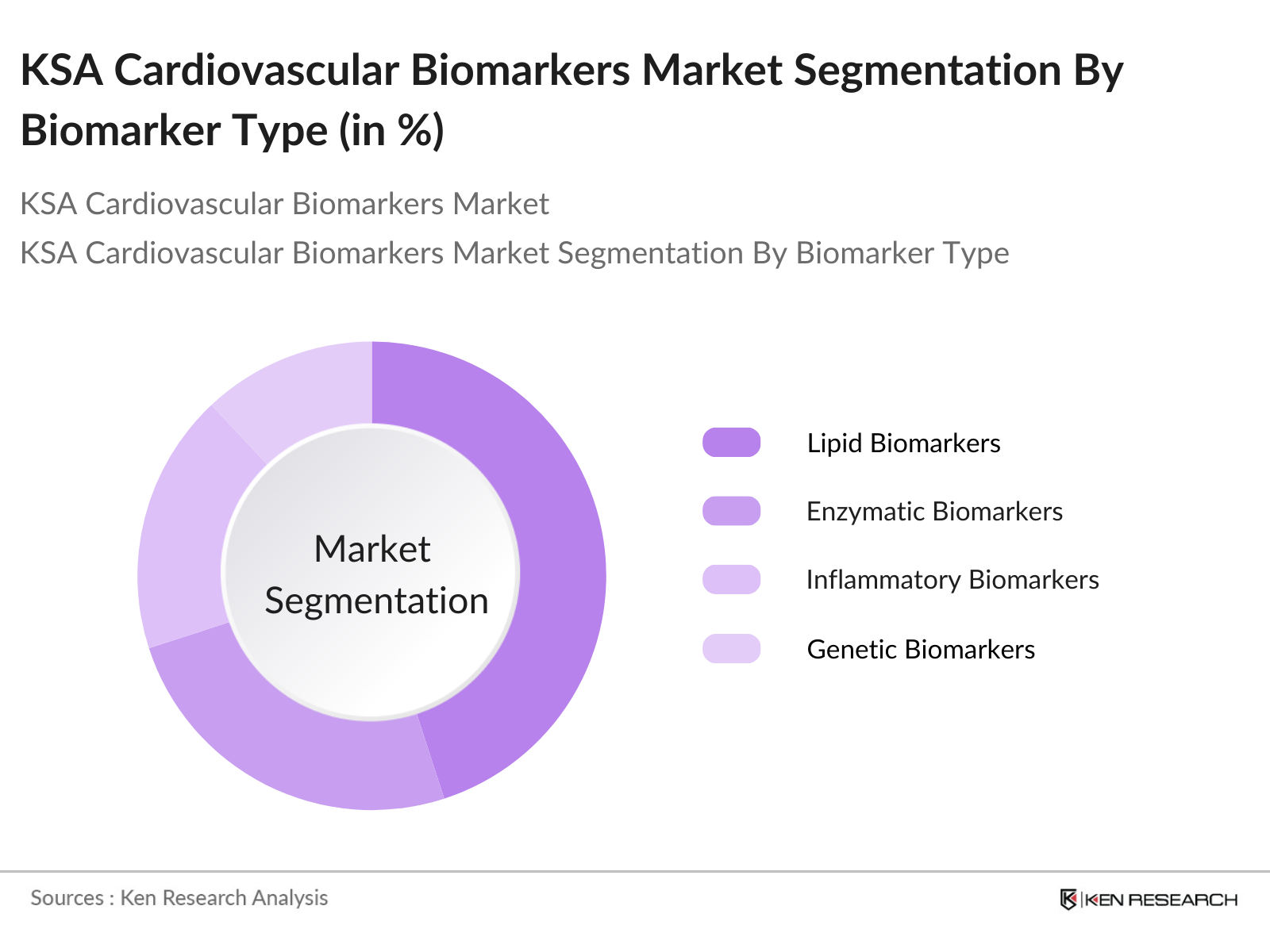

By Biomarker Type: The KSA Cardiovascular Biomarkers Market is segmented by biomarker type into enzymatic biomarkers, lipid biomarkers, inflammatory biomarkers, genetic biomarkers, and others (e.g., immune response biomarkers). Among these, lipid biomarkers hold the largest market share due to their critical role in detecting cholesterol-related issues and risk factors associated with CVDs.

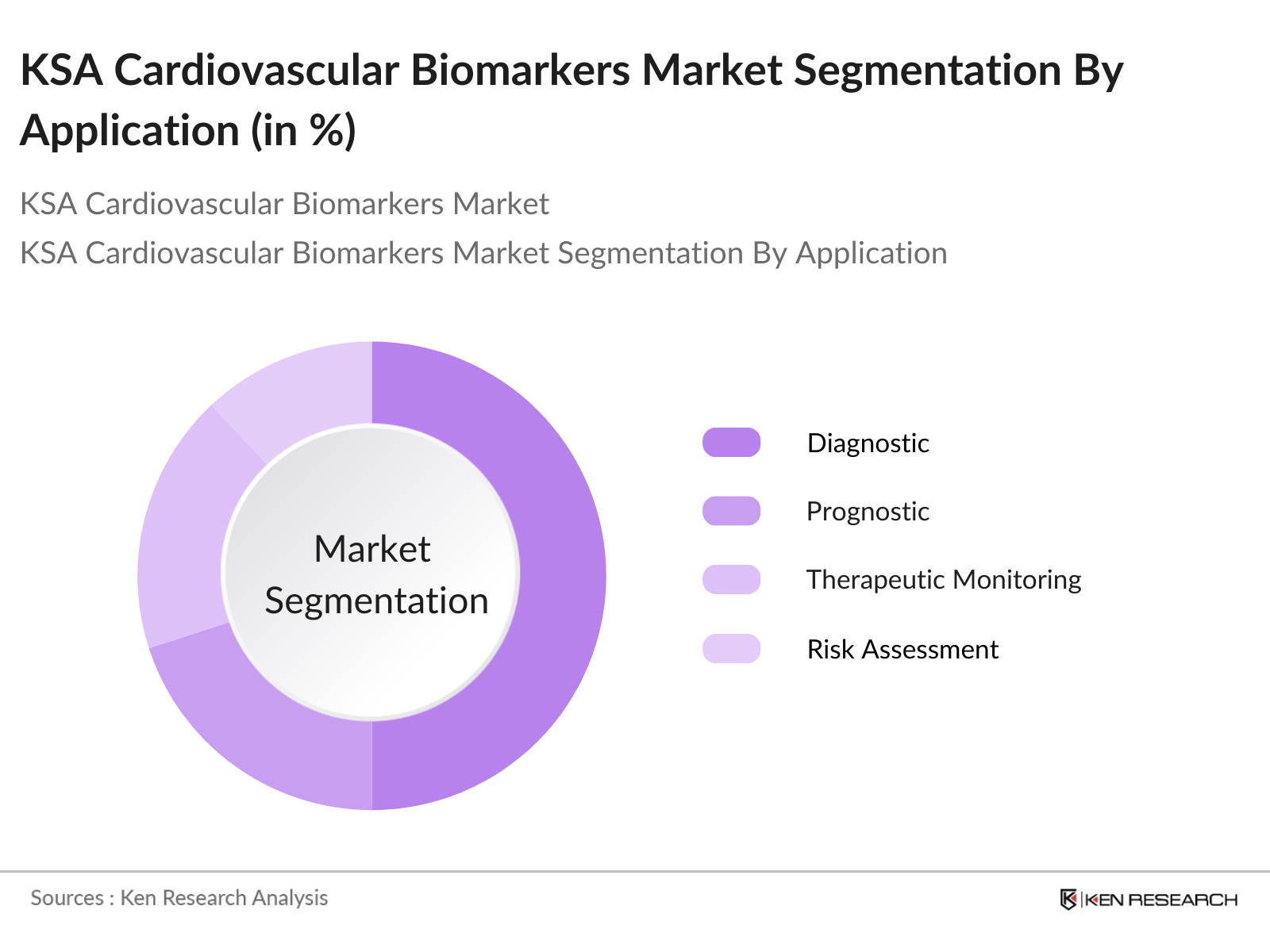

By Application: The market is also segmented by application into diagnostic, prognostic, therapeutic monitoring, and risk assessment. Diagnostic applications dominate the market, driven by the increasing demand for early detection and prevention of heart-related conditions. Saudi Arabias healthcare system has invested heavily in advanced diagnostic technologies, contributing to this sub-segments dominance.

KSA Cardiovascular Biomarkers Market Competitive Landscape

The KSA Cardiovascular Biomarkers Market is driven by several prominent players focusing on innovation, product development, and strategic partnerships to enhance their presence in the growing biomarker space. Companies like Roche Diagnostics and Siemens Healthineers lead the market, driven by strong product portfolios and continuous advancements in diagnostic tools. These companies, alongside others like Abbott Laboratories and Thermo Fisher Scientific, are investing heavily in R&D to bring new biomarker-based diagnostic solutions to the market.

KSA Cardiovascular Biomarkers Industry Analysis

Growth Drivers

- Increasing Prevalence of Cardiovascular Diseases (CVDs): Cardiovascular diseases are a leading cause of death in Saudi Arabia, with over 37,000 deaths attributed to heart conditions annually according to World Health Organization (WHO) data. The high rates of obesity, diabetes, and hypertension have exacerbated the burden of CVDs. The Ministry of Health estimates that around 40% of the adult population in the KSA is at risk of developing heart-related illnesses due to these risk factors.

- Rising Adoption of Personalized Medicine: Personalized medicine is gaining momentum in the KSA healthcare system, spurred by advancements in genomic technologies and the growing demand for individualized treatment plans. The KSA healthcare sector is projected to expand under Vision 2030, with the government increasing investment in personalized medicine. According to Saudi Vision 2030 health strategy, the government has earmarked SAR 150 billion to support healthcare innovation, which includes funding for biomarker research in cardiovascular diseases.

- Advances in Biomarker Research and Diagnostics: Technological advancements in biomarker research have led to the development of high-sensitivity diagnostic tests that can detect early-stage cardiovascular conditions. Saudi Arabias push towards adopting cutting-edge diagnostic technologies aligns with its healthcare reform efforts under Vision 2030. Recent collaborations between leading research institutions in KSA and international bodies have yielded significant advances in cardiovascular biomarker assays.

Market Challenges

- High Costs of Biomarker Validation: The validation of biomarkers for clinical use remains a major hurdle in Saudi Arabia due to the high costs associated with the regulatory approval process and clinical trials. Estimates from the Saudi Food and Drug Authority (SFDA) indicate that biomarker development costs range from SAR 5 million to SAR 25 million, depending on the complexity of the validation process.

- Regulatory Hurdles in Clinical Adoption: Despite growing interest in biomarkers, regulatory challenges continue to slow their adoption in clinical settings. The Saudi Food and Drug Authority (SFDA) has stringent guidelines for biomarker validation, requiring extensive clinical data to demonstrate safety and efficacy. These regulations add a layer of complexity to the approval process, prolonging the time it takes for new biomarkers to enter the market.

KSA Cardiovascular Biomarkers Market Future Outlook

Over the next five years, the KSA Cardiovascular Biomarkers Market is expected to experience robust growth, driven by advancements in biomarker research, the growing incidence of lifestyle-related CVDs, and government investments in healthcare infrastructure. The adoption of cutting-edge diagnostic tools and AI-driven biomarker discovery platforms will likely enhance the early detection and monitoring of heart diseases.

Market Opportunities

- Development of Novel Biomarker-Based Therapeutics: There is significant potential for the development of biomarker-based therapeutics targeting cardiovascular diseases in Saudi Arabia. The ongoing research and clinical trials sponsored by the Ministry of Health and the King Abdullah International Medical Research Center are paving the way for novel therapies. With over SAR 2 billion allocated annually for research in cardiovascular medicine, the KSA aims to position itself as a leader in biomarker-based drug development, offering promising opportunities for market players in the healthcare and pharmaceutical sectors.

- Increasing Demand for Early Diagnostic Solutions: As cardiovascular diseases continue to rise in Saudi Arabia, there is an increasing demand for early diagnostic solutions. Data from the Ministry of Health indicates that early detection of heart diseases can reduce mortality rates by 20%. The growing emphasis on preventive healthcare and the adoption of point-of-care diagnostic tools are accelerating the demand for cardiovascular biomarkers.

Scope of the Report

|

Biomarker Type |

Enzymatic Biomarkers Lipid Biomarkers Inflammatory Biomarkers Genetic Biomarkers Others |

| Application |

Diagnostic Prognostic Therapeutic Monitoring Risk Assessment |

|

Testing Location |

Hospital Laboratories Diagnostic Centers Point-of-Care Settings Research Institutes |

|

Disease Type |

Coronary Artery Disease Heart Failure Myocardial Infarction Arrhythmia Stroke |

|

Region |

Central KSA Western KSA Eastern KSA Southern KSA Northern KSA |

Products

Key Target Audience

Hospital Laboratories

Diagnostic Centers

Research Institutes

Pharmaceutical and Biotech Companies

Government Healthcare Agencies (e.g., Saudi Food and Drug Authority)

Healthcare Providers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Health)

Companies

Players Mentioned in the Report

Roche Diagnostics

Abbott Laboratories

Siemens Healthineers

Thermo Fisher Scientific

Bio-Rad Laboratories

Danaher Corporation

PerkinElmer

QIAGEN

Becton, Dickinson and Company

Randox Laboratories

Table of Contents

1. KSA Cardiovascular Biomarkers Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. KSA Cardiovascular Biomarkers Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. KSA Cardiovascular Biomarkers Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Prevalence of Cardiovascular Diseases (CVDs)

3.1.2 Rising Adoption of Personalized Medicine

3.1.3 Government Healthcare Initiatives (KSA Vision 2030)

3.1.4 Advances in Biomarker Research and Diagnostics

3.2 Market Challenges

3.2.1 High Costs of Biomarker Validation

3.2.2 Regulatory Hurdles in Clinical Adoption

3.2.3 Limited Reimbursement Policies

3.3 Opportunities

3.3.1 Development of Novel Biomarker-Based Therapeutics

3.3.2 Increasing Demand for Early Diagnostic Solutions

3.3.3 Strategic Collaborations and Partnerships

3.4 Trends

3.4.1 Integration of AI in Biomarker Discovery

3.4.2 Increasing Use of Point-of-Care Testing Devices

3.4.3 Focus on Multi-Omics and Data-Driven Insights

3.5 Government Regulation

3.5.1 KSA National Health Strategy

3.5.2 Saudi Food and Drug Authority (SFDA) Guidelines

3.5.3 Government Grants and Funding for Cardiovascular Research

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces

3.9 Competitive Landscape

4. KSA Cardiovascular Biomarkers Market Segmentation

4.1 By Biomarker Type (In Value %)

4.1.1 Enzymatic Biomarkers

4.1.2 Lipid Biomarkers

4.1.3 Inflammatory Biomarkers

4.1.4 Genetic Biomarkers

4.1.5 Others (e.g., Immune Response Biomarkers)

4.2 By Application (In Value %)

4.2.1 Diagnostic

4.2.2 Prognostic

4.2.3 Therapeutic Monitoring

4.2.4 Risk Assessment

4.3 By Testing Location (In Value %)

4.3.1 Hospital Laboratories

4.3.2 Diagnostic Centers

4.3.3 Point-of-Care Settings

4.3.4 Research Institutes

4.4 By Disease Type (In Value %)

4.4.1 Coronary Artery Disease

4.4.2 Heart Failure

4.4.3 Myocardial Infarction

4.4.4 Arrhythmia

4.4.5 Stroke

4.5 By Region (In Value %)

4.5.1 Central KSA

4.5.2 Western KSA

4.5.3 Eastern KSA

4.5.4 Southern KSA

4.5.5 Northern KSA

5. KSA Cardiovascular Biomarkers Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Roche Diagnostics

5.1.2 Siemens Healthineers

5.1.3 Abbott Laboratories

5.1.4 Thermo Fisher Scientific

5.1.5 Bio-Rad Laboratories

5.1.6 Danaher Corporation

5.1.7 Ortho Clinical Diagnostics

5.1.8 Becton, Dickinson and Company

5.1.9 Randox Laboratories

5.1.10 Merck KGaA

5.1.11 QIAGEN

5.1.12 PerkinElmer

5.1.13 Sysmex Corporation

5.1.14 Diasorin

5.1.15 Fujirebio

5.2 Cross Comparison Parameters (Revenue, Biomarker Portfolio, R&D Investment, Market Presence)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Government Grants

5.8 Private Equity Investments

6. KSA Cardiovascular Biomarkers Market Regulatory Framework

6.1 SFDA Biomarker Guidelines

6.2 Clinical Validation Requirements

6.3 Reimbursement Policies

6.4 Data Privacy and Patient Consent Regulations

7. KSA Cardiovascular Biomarkers Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. KSA Cardiovascular Biomarkers Future Market Segmentation

8.1 By Biomarker Type (In Value %)

8.2 By Application (In Value %)

8.3 By Testing Location (In Value %)

8.4 By Disease Type (In Value %)

8.5 By Region (In Value %)

9. KSA Cardiovascular Biomarkers Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Strategic Market Entry

9.3 Research and Development Recommendations

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The research began by identifying the key variables affecting the KSA Cardiovascular Biomarkers Market. This was done by reviewing historical market data and conducting an ecosystem mapping of the healthcare sector in Saudi Arabia. Desk research and proprietary databases were used to gather this information.

Step 2: Market Analysis and Construction

The next step involved analyzing historical data related to market penetration and biomarker usage trends. Various financial reports, hospital statistics, and revenue generation data from healthcare institutions were reviewed to construct the market model.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions were tested through consultations with medical professionals and industry leaders in Saudi Arabia. These discussions helped validate the data collected and provided further insights into the market's growth prospects and challenges.

Step 4: Research Synthesis and Final Output

The final phase involved synthesizing the collected data into actionable insights. This included detailed interviews with hospital administrators and regulatory bodies to ensure the accuracy of the final report.

Frequently Asked Questions

1. How big is the KSA Cardiovascular Biomarkers Market?

The KSA Cardiovascular Biomarkers Market is valued at USD 103 million based on a detailed analysis of historical data from the past five years. The market is primarily driven by the increasing incidence of cardiovascular diseases (CVDs) and the rising demand for early diagnosis solutions.

2. What are the challenges in the KSA Cardiovascular Biomarkers Market?

Key challenges include the high costs of biomarker validation, limited reimbursement policies for advanced diagnostic tests, and regulatory hurdles that slow down the adoption of new biomarker-based technologies.

3. Who are the major players in the KSA Cardiovascular Biomarkers Market?

Prominent players in the market include Roche Diagnostics, Siemens Healthineers, Abbott Laboratories, and Bio-Rad Laboratories, all of which have extensive biomarker portfolios and strong healthcare partnerships.

4. What are the growth drivers of the KSA Cardiovascular Biomarkers Market?

The market is propelled by factors such as increasing CVD prevalence, the rising adoption of personalized medicine, government healthcare initiatives, and advancements in diagnostic technologies.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.