KSA Cargo Handling Market Outlook to 2030

Region:Middle East

Author(s):Abhinav kumar

Product Code:KROD6444

November 2024

82

About the Report

KSA Cargo Handling Market Overview

- The KSA Cargo Handling Market is valued at SAR 213 million, underpinned by a comprehensive historical analysis of market trends. Major drivers include robust infrastructure projects aligned with the KSA Vision 2030, leading to increased demand for efficient cargo operations across seaports and airports. The surge in e-commerce and industrial exports further propels the market, with significant contributions from thepetrochemical and manufacturing sectors.

- Riyadh and Jeddah lead the KSA cargo handling market due to strategic locations and advanced logistical facilities. Riyadh, as the economic hub, facilitates high cargo volume through Riyadh Dry Port and the King Khalid International Airport. Meanwhile, Jeddahs proximity to major international shipping routes and the King Abdullah Port enables high trade traffic, especially from Europe and Asia.

- The KSA Vision 2030 mandates stringent regulatory standards in logistics to elevate Saudi Arabias position in global logistics. As part of this vision, the government has introduced policies incentivizing private investment in logistics hubs, port expansions, and new cargo facilities, aiming to raise the countrys logistics performance ranking. Vision 2030 compliance is now a requirement for all logistics operators, who must adhere to specific standards for operations, sustainability, and safety.

KSA Cargo Handling Market Segmentation

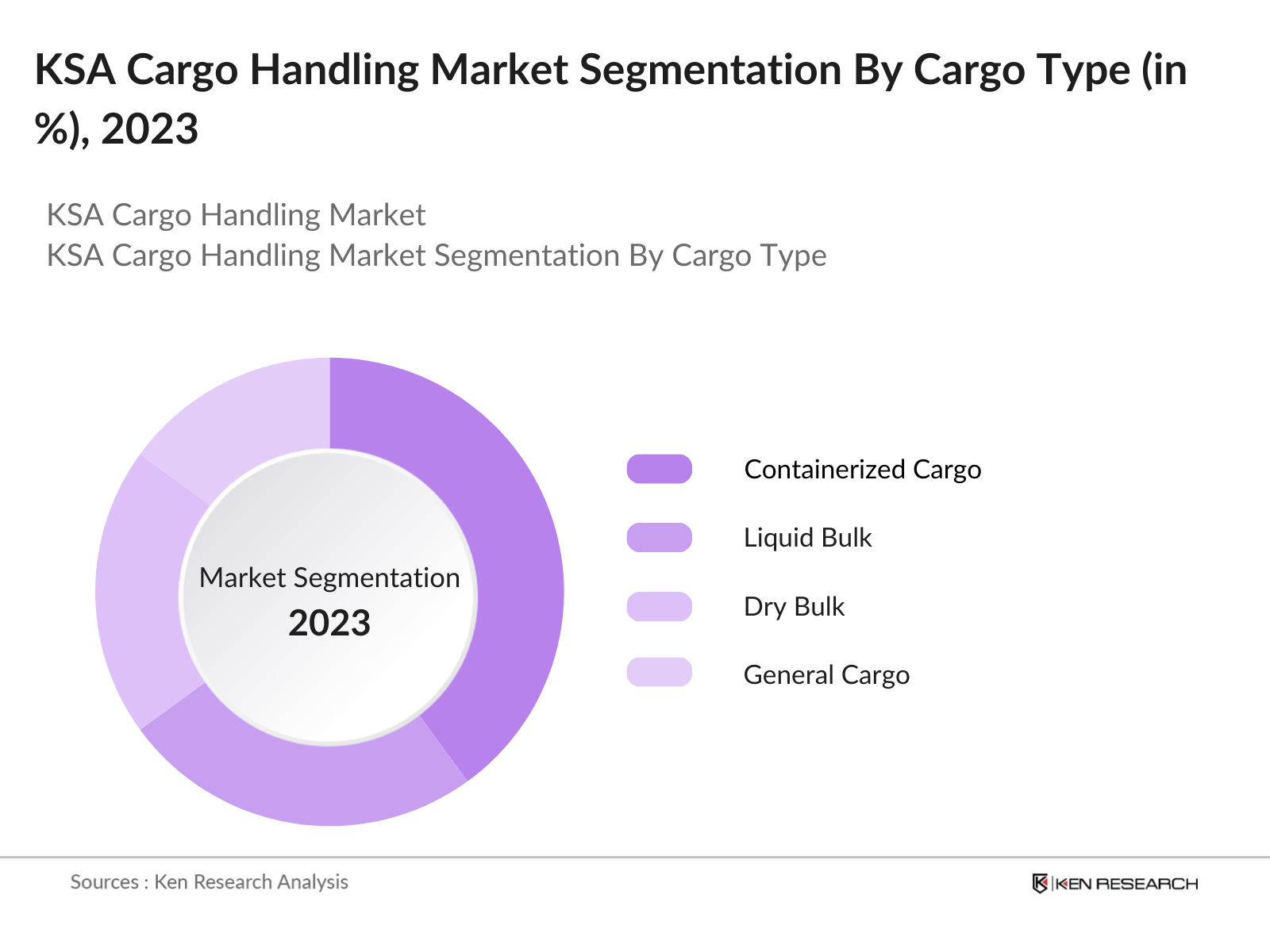

By Cargo Type: The KSA Cargo Handling Market is segmented by cargo type, including containerized cargo, liquid bulk, dry bulk, general cargo, and special cargo. Containerized cargo dominates due to its widespread use in e-commerce and industrial shipments. Leading logistics providers prioritize containerization for ease of handling and storage, which enhances throughput efficiency in major ports.

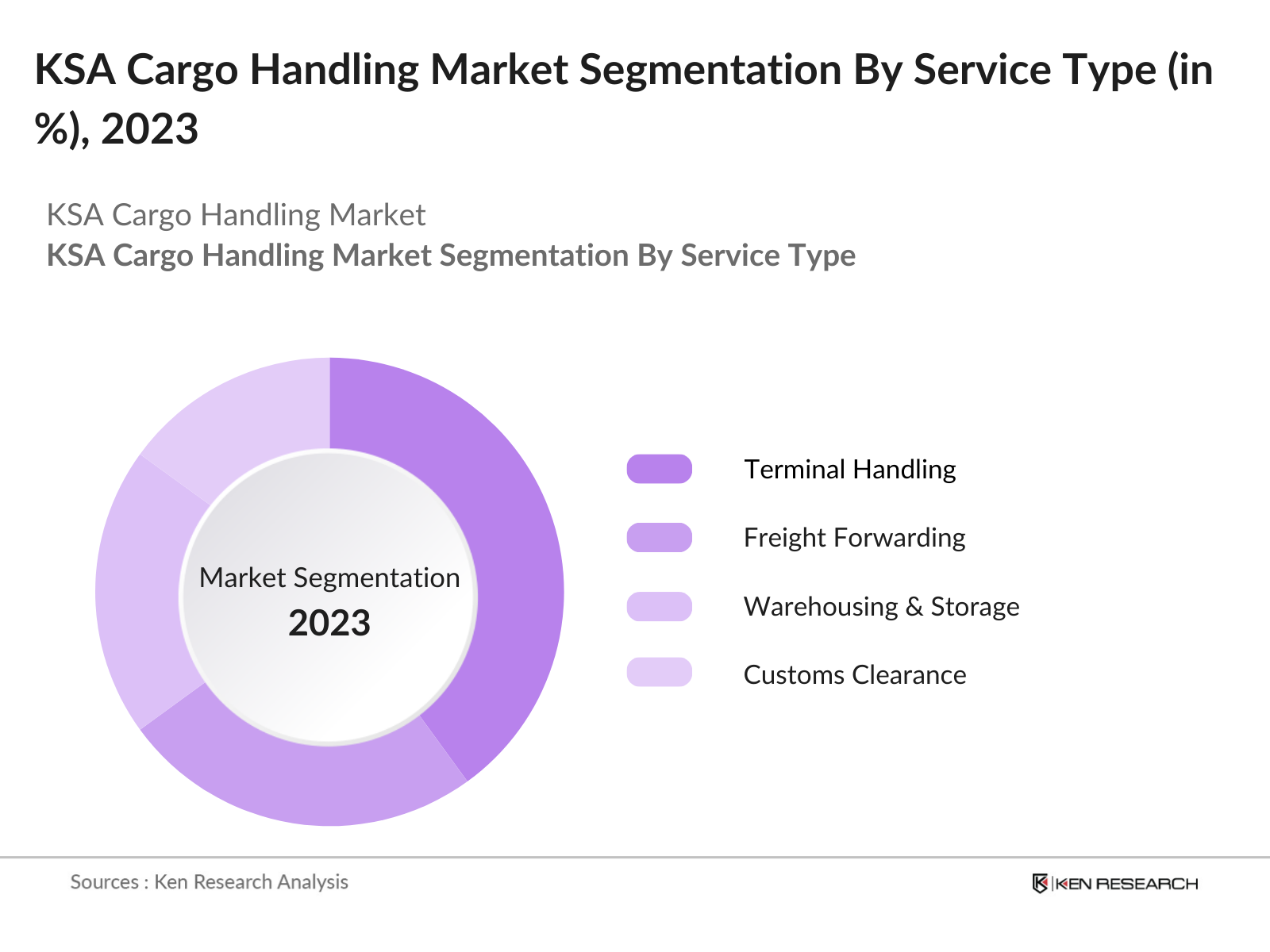

By Service Type: By service type, the KSA Cargo Handling Market includes terminal handling, freight forwarding, warehousing and storage, and customs clearance. Terminal handling holds the largest share due to its integral role in port and airport operations. This service segment benefits from government initiatives to expand terminal capacity, enhancing overall logistics performance and reducing turnaround times.

KSA Cargo Handling Market Competitive Landscape

The KSA Cargo Handling Market is dominated by both international and local players, with DP World, COSCO Shipping, and local firms like SISCO holding substantial influence. This consolidation demonstrates the role of key players who leverage advanced technologies and deep industry expertise to control a significant share of cargo operations.

KSA Cargo Handling Industry Analysis

Growth Drivers

- Trade Agreements: Saudi Arabia's participation in trade agreements has significantly boosted its cargo handling activities, with exports reaching over 1.1 billion metric tons in 2023, primarily driven by oil and petrochemical products. This trade growth has been supported by the Saudi Vision 2030 initiative, aiming to increase non-oil exports, a major component of the cargo market. The government has prioritized enhancing bilateral trade agreements with the UAE, China, and India, pushing non-oil export volumes to 300 million metric tons in 2023. These agreements directly increase demand for efficient cargo handling to support logistics at KSA ports.

- Port and Infrastructure Expansion: Saudi Arabias ports have seen major expansions, including a $30 billion investment to modernize port facilities and expand container capacities across Jeddah and Dammam ports. The Red Sea Gateway Terminal has reached an annual cargo handling capacity of 5 million TEUs, up from 3.5 million in 2022, supporting higher utilization rates. These expansions aim to meet the increased demand due to the growing industrial base and import activities. The King Abdullah Port alone has handled around 12 million tons of bulk cargo in 2023, reflecting the influence of this infrastructural development on cargo handling.

- Industrialization and Urbanization Trends: Saudi Arabias rapid urbanization, with over 84% of the population residing in urban areas, has catalyzed the need for efficient cargo handling, especially as industrial projects scale up. Industrial zones in Riyadh and Jeddah are experiencing a 10% increase in production outputs, directly driving cargo demand for transport and storage. Key industries like petrochemicals and automotive manufacturing are leveraging efficient cargo handling at ports to meet growing local and international demand. With $1 trillion in infrastructure investments, the government supports these zones, making cargo logistics an integral part of urbanization and industrial supply chains.

Market Challenges

- High Initial Investments: Cargo handling infrastructure in Saudi Arabia demands high capital investment, with initial costs for specialized equipment reaching over $5 million per terminal. This financial requirement limits market entry and impacts smaller operators. Upgrading machinery and technology infrastructure in line with global standards to handle containerized and bulk cargo further escalates investment demands. Additionally, facility expansions and maintenance contribute to financial strain, affecting the scalability of operations for logistics firms aiming to compete in the cargo handling market.

- Operational Efficiency Concerns: Despite advancements, Saudi Arabias ports face operational inefficiencies, with dwell times averaging 5-6 days per container. These extended handling times hinder efficiency, especially during high-traffic periods. Compared to global benchmarks, where average port dwell times stand at 2-3 days, KSA ports lag in optimizing operational flow. Operational issues, including labor and equipment downtime, often reduce container throughput, impacting the capacity of KSA ports to handle large cargo volumes, especially during peak seasons.

KSA Cargo Handling Market Future Outlook

Over the next five years, the KSA Cargo Handling Market is projected to witness substantial growth, driven by continuous infrastructure development, technology integration, and government-backed initiatives under Vision 2030. Increasing digitalization across logistics platforms, automation of cargo processes, and enhancements in storage facilities will accelerate the market trajectory, responding to growing trade volumes and the regions evolving logistical needs.

Opportunities

- Automation in Cargo Handling: Automation in Saudi Arabia's cargo handling sector is creating operational efficiencies. For instance, the King Abdulaziz Port in Dammam has introduced automated cranes, increasing handling speeds by 20%, directly improving cargo throughput. Automation of sorting and stacking processes is also being implemented, reducing handling times by nearly 30%, positioning KSA ports as competitive regional hubs. With the government's support, port authorities are set to further automate warehousing and tracking systems to streamline cargo management and increase capacity.

- Expanding E-commerce Demand: With the rapid expansion of e-commerce in Saudi Arabia, anticipated to reach 150 million packages handled in 2024, demand for efficient cargo handling services is growing. E-commerce giants are scaling their logistics to facilitate faster delivery, necessitating enhanced cargo handling infrastructure. Ports and logistic hubs are increasing containerized cargo facilities to handle the surge, directly benefiting from investments and technological improvements made to meet e-commerce logistics demands.

Scope of the Report

|

Cargo Type |

Containerized Cargo Liquid Bulk Dry Bulk, General Cargo Other Special Cargo |

|

Service Type |

Terminal Handling Freight Forwarding Warehousing and Storage Custom Clearance |

|

Technology |

Automated Guided Vehicles (AGVs) Robotics, Cargo Tracking Solutions Warehouse Management Systems (WMS) |

|

End-User Industry |

Oil & Gas, Retail & E-commerce Automotive Industrial Manufacturing Pharmaceuticals |

|

Region |

Western Region Central Region Eastern Region |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Logistics and Freight Forwarding Companies

Maritime and Port Authorities (Saudi Ports Authority)

Government and Regulatory Bodies (General Authority of Civil Aviation, Ministry of Transport)

Airlines and Shipping Line Industries

Investor and Venture Capitalist Firms

Warehouse and Distribution Service Providers

Automotive and Manufacturing Industries

Retail and E-commerce Companies

Companies

Players Mentioned in the Report:

DP World

COSCO Shipping

SISCO (Saudi Industrial Services Company)

Gulf Stevedoring Contracting Company

Red Sea Gateway Terminal

Saudi Global Ports

Aramex

Bahri (The National Shipping Company of Saudi Arabia)

FedEx Express

DB Schenker

Table of Contents

1. KSA Cargo Handling Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Key Performance Indicators (KPIs)

1.4 Market Segmentation Overview

2. KSA Cargo Handling Market Size (In SAR Mn)

2.1 Historical Market Size

2.2 Market Size Analysis (SAR Mn)

2.3 Year-On-Year Growth Metrics

2.4 Key Market Developments

3. KSA Cargo Handling Market Analysis

3.1 Growth Drivers

3.1.1 Trade Agreements (Import/Export Data)

3.1.2 Port and Infrastructure Expansion (Capacity Utilization Rates)

3.1.3 Industrialization and Urbanization Trends

3.1.4 Government Initiatives in Logistics Sector

3.2 Market Challenges

3.2.1 High Initial Investments (Capital Costs)

3.2.2 Operational Efficiency Concerns

3.2.3 Regulatory Compliance (Safety & Environmental Standards)

3.3 Opportunities

3.3.1 Automation in Cargo Handling (Technology Adoption)

3.3.2 Expanding E-commerce Demand

3.3.3 International Partnerships (Trade Corridors)

3.4 Trends

3.4.1 Digitalization in Logistics

3.4.2 Adoption of AI and Machine Learning (Predictive Analytics)

3.4.3 Rise of Eco-Friendly Cargo Solutions

3.5 Government Regulations

3.5.1 KSA Vision 2030 Compliance

3.5.2 Customs Procedures and Trade Laws

3.5.3 Health & Safety Regulations in Cargo Operations

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Ecosystem

4. KSA Cargo Handling Market Segmentation

4.1 By Cargo Type (In Value %)

4.1.1 Containerized Cargo

4.1.2 Liquid Bulk

4.1.3 Dry Bulk

4.1.4 General Cargo

4.1.5 Other Special Cargo

4.2 By Service Type (In Value %)

4.2.1 Terminal Handling

4.2.2 Freight Forwarding

4.2.3 Warehousing and Storage

4.2.4 Custom Clearance

4.3 By Technology (In Value %)

4.3.1 Automated Guided Vehicles (AGVs)

4.3.2 Robotics

4.3.3 Cargo Tracking Solutions

4.3.4 Warehouse Management Systems (WMS)

4.4 By End-User Industry (In Value %)

4.4.1 Oil & Gas

4.4.2 Retail & E-commerce

4.4.3 Automotive

4.4.4 Industrial Manufacturing

4.4.5 Pharmaceuticals

4.5 By Region (In Value %)

4.5.1 Western Region

4.5.2 Central Region

4.5.3 Eastern Region

5. KSA Cargo Handling Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 DP World

5.1.2 Hutchison Ports

5.1.3 COSCO Shipping

5.1.4 SISCO (Saudi Industrial Services Company)

5.1.5 Gulf Stevedoring Contracting Company

5.1.6 Red Sea Gateway Terminal

5.1.7 Saudi Global Ports

5.1.8 Agility Logistics

5.1.9 Aramex

5.1.10 Bahri (The National Shipping Company of Saudi Arabia)

5.1.11 Hellmann Worldwide Logistics

5.1.12 FedEx Express

5.1.13 DB Schenker

5.1.14 Maersk

5.1.15 Saudi Ports Authority

5.2 Cross Comparison Parameters (Employee Strength, Global Presence, Revenue, Investment in R&D, Market Share, Number of Terminals Operated, Volume Capacity, Technological Investments)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital & Private Equity Funding

5.8 Government Incentives and Grants

6. KSA Cargo Handling Market Regulatory Framework

6.1 Environmental Standards for Ports

6.2 Customs Compliance Requirements

6.3 Safety and Quality Certifications

6.4 Labor Laws in the Logistics Sector

7. KSA Cargo Handling Market Future Size (In SAR Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Growth

8. KSA Cargo Handling Future Market Segmentation

8.1 By Cargo Type

8.2 By Service Type

8.3 By Technology

8.4 By End-User Industry

8.5 By Region

9. KSA Cargo Handling Market Analysts' Recommendations

9.1 Total Addressable Market Analysis

9.2 Strategic Marketing Insights

9.3 Targeted Customer Segment Insights

9.4 White Space Analysis for Expansion

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

Our initial research phase involved constructing a comprehensive ecosystem map for the KSA Cargo Handling Market. This process included extensive desk research across reputable industry databases to identify and define key variables that influence the market.

Step 2: Market Analysis and Construction

In this stage, we compiled historical market data to analyze trends and determine revenue generation rates, assessing market penetration and the contribution of each cargo type and service.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were developed and validated through computer-assisted telephone interviews (CATI) with logistics professionals and experts across the KSA region. These insights provided operational data and grounded market estimations.

Step 4: Research Synthesis and Final Output

Our final synthesis phase included direct engagements with prominent cargo handling providers to acquire insights on service trends, technology utilization, and future growth opportunities, ensuring the analysiss accuracy.

Frequently Asked Questions

01. How big is the KSA Cargo Handling Market?

The KSA Cargo Handling Market is valued at SAR 213 million, primarily driven by the countrys infrastructure development and increased trade activities supported by Vision 2030 initiatives.

02. What are the primary challenges in the KSA Cargo Handling Market?

Key challenges include regulatory compliance, high operational costs, and the need for skilled labor to operate technologically advanced handling systems.

03. Who are the major players in the KSA Cargo Handling Market?

Leading companies include DP World, COSCO Shipping, SISCO, Saudi Global Ports, and Aramex, each holding a strong presence due to their extensive networks and technological adoption.

04. What factors drive the KSA Cargo Handling Market?

The market is driven by rising demand for efficient logistics solutions, rapid industrialization, and government policies focused on expanding KSAs position as a logistics hub.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.