KSA Cashew Market Outlook to 2030

Region:Middle East

Author(s):Samanyu

Product Code:KROD304

June 2024

100

About the Report

KSA Cashew Market Overview

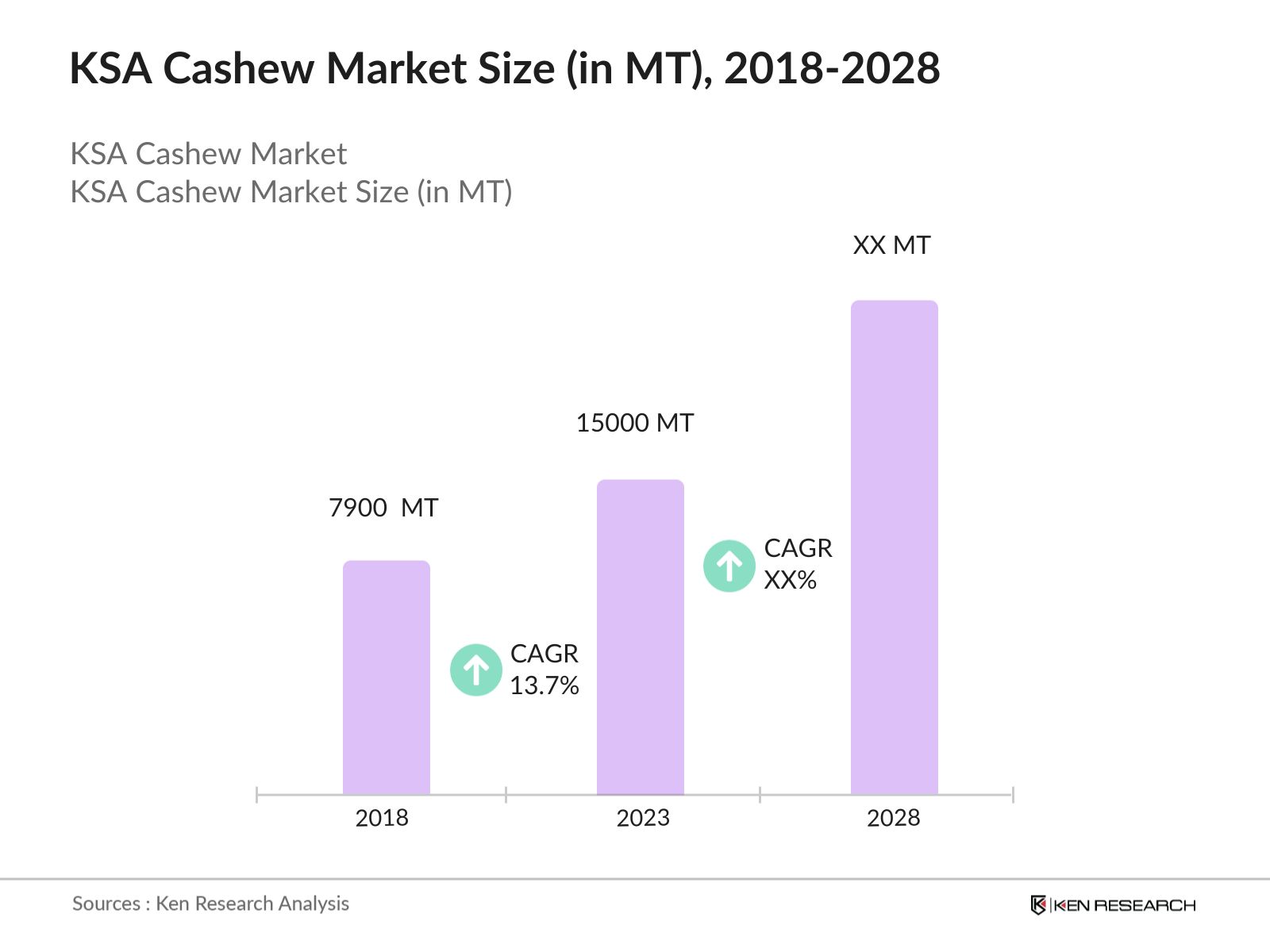

- The Saudi Arabian Cashew market has grown from 7900 MT in 2018 to 15000 MT in 2023 with a CAGR of 13.7% from 2018 to 2023, driven by increasing health awareness and demand for plant-based proteins.

- Major players such as Olam International, Haldiram’s, Kraft Foods, Tamimi Markets, and Panda Retail Company leverage strong distribution networks; growth drivers include rising disposable incomes and health consciousness, while challenges encompass price fluctuations and competition from almonds and pistachios.

- In 2021, California Gold Nutrition introduced a sustainable packaging initiative, reducing plastic usage by 30% in their nut packaging. This move has resonated with environmentally conscious consumers, boosting the company's reputation and sales.

KSA Cashew Current Market Analysis

- Health and wellness campaigns by the government and private sector are significantly influencing the cashew market. The "Live Well" initiative by the Saudi Ministry of Health, launched in 2023, promotes nut consumption as part of a balanced diet, leading to a 15% increase in nut consumption by 2024, driving demand for healthy snack options.

- The expansion of e-commerce in Saudi Arabia has significantly boosted cashew sales. A 2024 survey by the Saudi Communication and Information Technology Commission showed a 40% year-on-year growth in online grocery shopping, driven by convenience, competitive pricing, and a wider product variety, reflecting a shift in consumer purchasing behavior.

KSA Cashew Market Segmentation

The KSA Cashew Market can be segmented based on several factors:

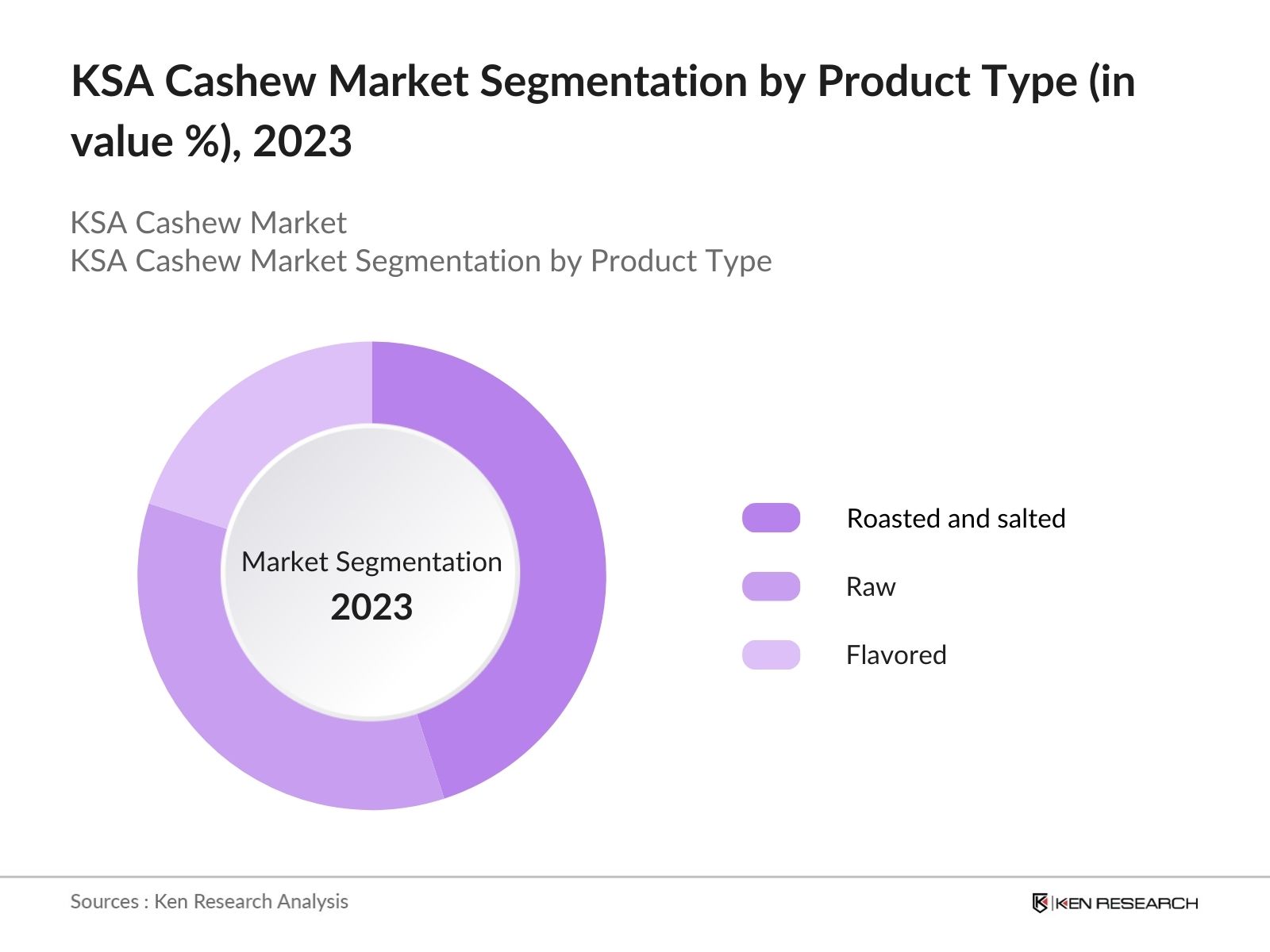

By Product Type: In 2023, the KSA cashew market segmentation by product type is divided into roasted & salted, raw and flavoured. Roasted and salted cashews are the dominant category, valued for their appealing flavour and convenient ready-to-eat nature. This segment holds a significant market share, reflecting consumer preference for savoury snacks that offer taste and nutritional benefits.

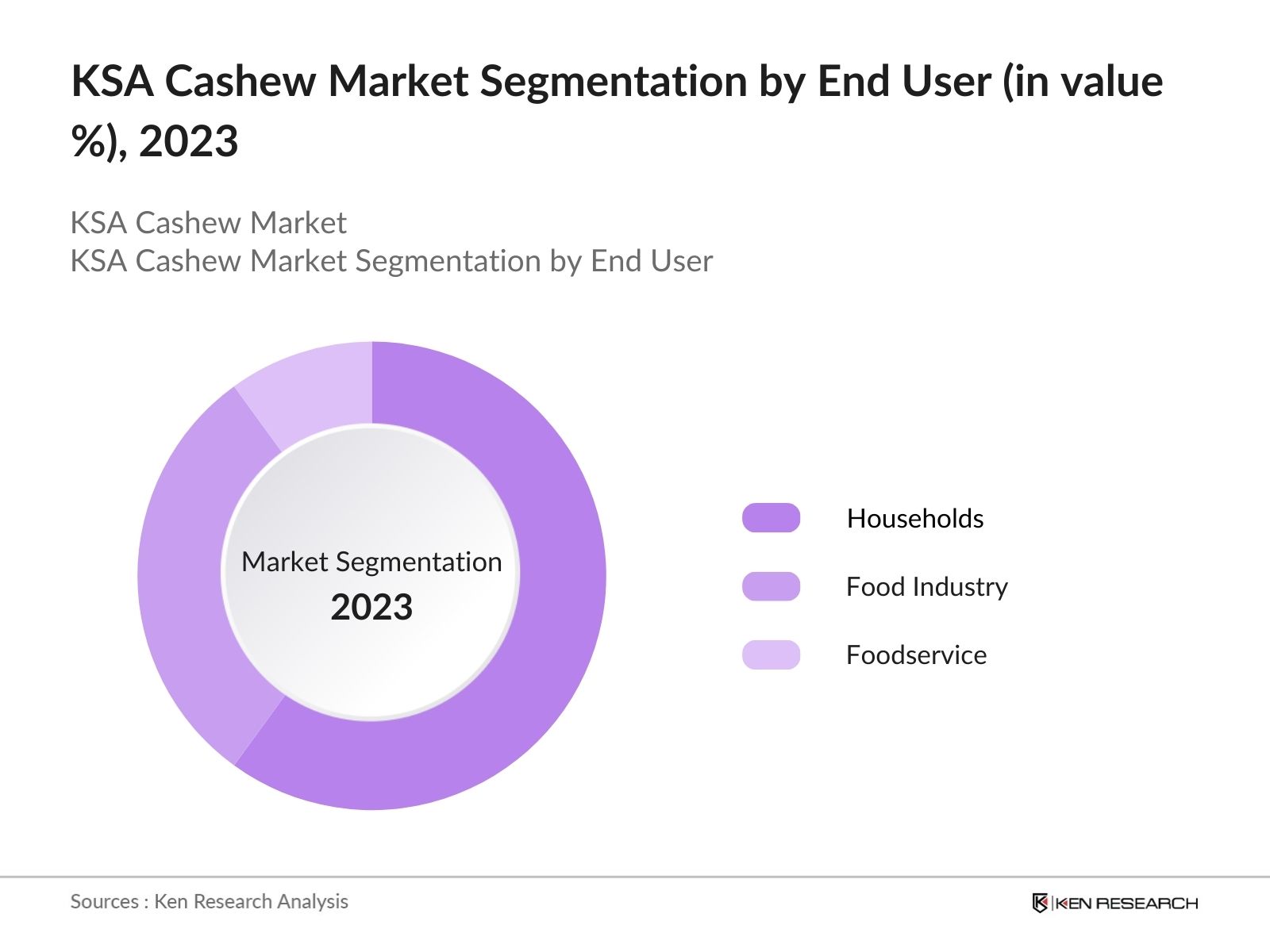

By End User: In 2023, the KSA cashew market segmentation by end-user divided into household, food industry and food service reveal households as the dominant segment, accounting for the largest share in value. This trend is driven by cashews being a primary choice among consumers for daily snacking, as well as for culinary uses such as cooking and baking.

By Distribution Channel: In 2023, the cashew market in the Kingdom of Saudi Arabia (KSA) is segmented by distribution channel into supermarkets & online retail and specialty stores, with supermarkets and hypermarkets commanding the largest share in value percentage. This is due to their widespread presence, competitive pricing, and diverse cashew product offerings.

KSA Cashew Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Olam International |

1989 |

Singapore |

|

Agrocel Industries |

1988 |

India |

|

Royal Nuts Company |

2000 |

Saudi Arabia |

|

Arabian Trading Company |

1995 |

Saudi Arabia |

|

Al-Farooj Fresh |

2005 |

Saudi Arabia |

- Olam International's Investment: In 2022, Olam International invested USD 10 million to expand its nut processing facilities in Saudi Arabia. By 2024, these expanded facilities increased the supply of high-quality cashews, stabilizing prices and ensuring consistent availability, meeting the growing demand for cashews.

- Agrocel's New Packaging Technology: In 2022, Agrocel Industries introduced innovative packaging technology that extends the shelf life of cashews and maintains their freshness. This development has set a new standard in the industry, ensuring product quality and reducing waste. By the end of 2024, this technology has been widely adopted, contributing to better consumer satisfaction and increased sales.

KSA Cashew Industry Analysis

KSA Cashew Market Growth Drivers:

- Increasing Health Awareness: The rising health consciousness among Saudi consumers is significantly boosting the cashew market. Cashews, rich in essential nutrients, support heart health and weight management. In 2024 a report by the Saudi Ministry of Health noted a 25% increase in the population opting for healthier food, driven by the government's "Healthy Food Choices" campaign launched in 2022.

- Economic Growth and Disposable Income: Saudi Arabia's robust economic growth, propelled by Vision 2030, has elevated disposable incomes and shifted consumer spending. In 2024, the World Bank reported a 3.5% increase in per capita income, enabling more consumers to afford premium food products like cashews, and enhancing their market penetration.

- Urbanization and Changing Lifestyles: Rapid urbanization in Saudi Arabia, with 84% of the population in urban areas by 2024, drives demand for convenient, healthy snacks like cashews. The expansion of supermarkets, hypermarkets, and speciality stores in urban centres has made cashews more accessible to a wider consumer base.

KSA Cashew Market Challenges:

- Regulatory and Import Restrictions: Stringent regulatory standards and import restrictions pose challenges for the cashew market. In 2024, the Saudi Food and Drug Authority tightened regulations on imported food products, increasing compliance costs for importers. These regulations, while ensuring quality and safety, can slow the market entry of new products and affect supply dynamics.

- Supply Chain Disruptions: Supply chain disruptions, exacerbated by the COVID-19 pandemic, continue to affect the cashew market. In 2024, delays in shipping and a 10% increase in logistics costs, as reported by the Saudi Ports Authority, led to inconsistent product availability and higher prices, impacting consumer trust and market reliability.

- Price Volatility: The KSA cashew market faces challenges due to raw cashew nut price volatility, influenced by global market fluctuations and supply chain disruptions. In 2024, global cashew prices fluctuated by 15%, according to the FAO, impacting local distributors' and retailers' profit margins and deterring regular consumer purchases.

KSA Cashew Market Government Initiatives:

-

-

- Saudi Vision 2030: Launched in 2016, Saudi Vision 2030 promotes healthier lifestyles, indirectly boosting demand for nutritious snacks like cashews. By end of 2024, health programs under this initiative have raised public awareness about the benefits of healthy eating, contributing to rise in the consumption of nuts and other healthy foods.

- National Nutrition Policy: Introduced in 2019, the National Nutrition Policy aims to improve the nutritional status of Saudis by reducing unhealthy food intake and increasing nutrient-rich food consumption. In 2024, the Ministry of Health reported improvement in adherence to these guidelines, positively impacting consumer behavior towards healthier options like cashews.

- Healthy Food Choices Campaign: Launched in 2022, the Healthy Food Choices campaign aims to reduce obesity and promote healthier eating habits. By 2024, this campaign had increased awareness about the health benefits of nuts, leading to rise in their consumption, contributing to the broader strategy to combat lifestyle diseases and improve public health outcomes.

-

KSA Cashew Future Market Outlook

The KSA cashew market is expected to show significant growth, driven by increasing health consciousness and higher disposable incomes.

Future Market Trends

-

-

- Rise of Organic and Sustainable Cashew Products: Consumer preference for organic and sustainably sourced cashews will continue to grow in Saudi Arabia. Future surveys by the Saudi Ministry of Environment, Water, and Agriculture are expected to show an increasing number of consumers willing to pay a premium for organic foods. This trend will likely prompt more companies to launch organic cashew lines and obtain certifications to meet the rising demand.

- Innovative Product Offerings: The Saudi cashew market will likely experience a surge in innovative products such as flavored cashews, cashew butter, and cashew milk. Major retailers are projected to report substantial increases in sales of flavored nuts, reflecting a growing consumer interest in diverse tastes. This trend will encourage manufacturers to further diversify their product portfolios.

- Increased Focus on Packaging and Branding: Enhanced packaging and branding will become increasingly crucial for improving product shelf life and consumer appeal. The Saudi Standards, Metrology and Quality Organization will continue to update packaging guidelines. Companies are expected to invest more in attractive, eco-friendly packaging solutions to protect products and attract environmentally conscious consumers, thereby boosting sales.

-

Scope of the Report

|

By Product Type |

Roasted and Salted Raw Flavored |

|

By End User |

Household Food Industry Foodservice |

|

By Distribution Channel |

Supermarkets/Hypermarkets Online Retail Specialty Stores |

Products

Key Target Audience – Organizations and Entities who can Benefit by Subscribing this Report:

Cashew Manufacturers

Cashew Exporters and Importers

Food Processing Companies

Investors and Financial Institutions

Major Cashew Retailers and Distributors

Saudi Standards, Metrology and Quality Organization (SASO)

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:Â

Olam International

Haldiram’s

Kraft Foods

Tamimi Markets

Panda Retail Company

Almarai

Americana Group

Al Othaim Markets

Carrefour

LuLu Hypermarket

Danube

Bin Dawood

Mars Inc.

Nestlé

Mondelez International

Table of Contents

1. KSA Cashew Market Overview

1.1 KSA Cashew Market Taxonomy

2. KSA Cashew Market Size (in USD Mn), 2018-2023

3. KSA Cashew Market Analysis

3.1 KSA Cashew Market Growth Drivers

3.2 KSA Cashew Market Challenges and Issues

3.3 KSA Cashew Market Trends and Development

3.4 KSA Cashew Market Government Regulation

3.5 KSA Cashew Market SWOT Analysis

3.6 KSA Cashew Market Stake Ecosystem

3.7 KSA Cashew Market Competition Ecosystem

4. KSA Cashew Market Segmentation, 2023

4.1 KSA Cashew Market Segmentation by Product Type (in value %), 2023

4.2 KSA Cashew Market Segmentation by End User (in value %), 2023

4.3 KSA Cashew Market Segmentation by Distribution Channel (in value %), 2023

5. KSA Cashew Market Competition Benchmarking

5.1 KSA Cashew Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters and advanced analytics)

6. KSA Cashew Future Market Size (in USD Mn), 2023-2028

7. KSA Cashew Future Market Segmentation, 2028

7.1 KSA Cashew Market Segmentation by Product Type (in value %), 2028

7.2 KSA Cashew Market Segmentation by End User (in value %), 2028

7.3 KSA Cashew Market Segmentation by Distribution Channel (in value %), 2028

8. KSA Cashew Market Analysts’ Recommendations

8.1 KSA Cashew Market TAM/SAM/SOM Analysis

8.2 KSA Cashew Market Customer Cohort Analysis

8.3 KSA Cashew Market Marketing Initiatives

8.4 KSA Cashew Market White Space Opportunity Analysis

Research Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.Â

Step: 2 Market Building:

Collating statistics on KSA cashew market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for KSA cashew market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.Â

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.Â

Step: 4 Research Output:

Our team will approach multiple cashew suppliers and distributors companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from cashew suppliers and distributors companies.

Frequently Asked Questions

01 How big is KSA Cashew Market?

The Saudi Arabian Cashew market has grown from 7900 MT in 2018 to 15000 MT in 2023, driven by increasing health awareness and demand for plant-based proteins.

02 What are the challenges faced in KSA Cashew Market?

The key challenges faced in KSA Cashew Market are price fluctuation and competition from consumer preferences.

03 Who the major players in the KSA Cashew Market?

Some of the major players in the KSA Cashew Market include Olam International, Haldiram’s and Kraft Foods.

04 What are the factors driving KSA cashew market?

Growth drivers include rising disposable incomes and health consciousness, while challenges include price fluctuations and competition from almonds and pistachios.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.