KSA Child Care Services Market Outlook to 2030

Region:Middle East

Author(s):Abhinav kumar

Product Code:KROD6724

December 2024

96

About the Report

KSA Child Care Services Market Overview

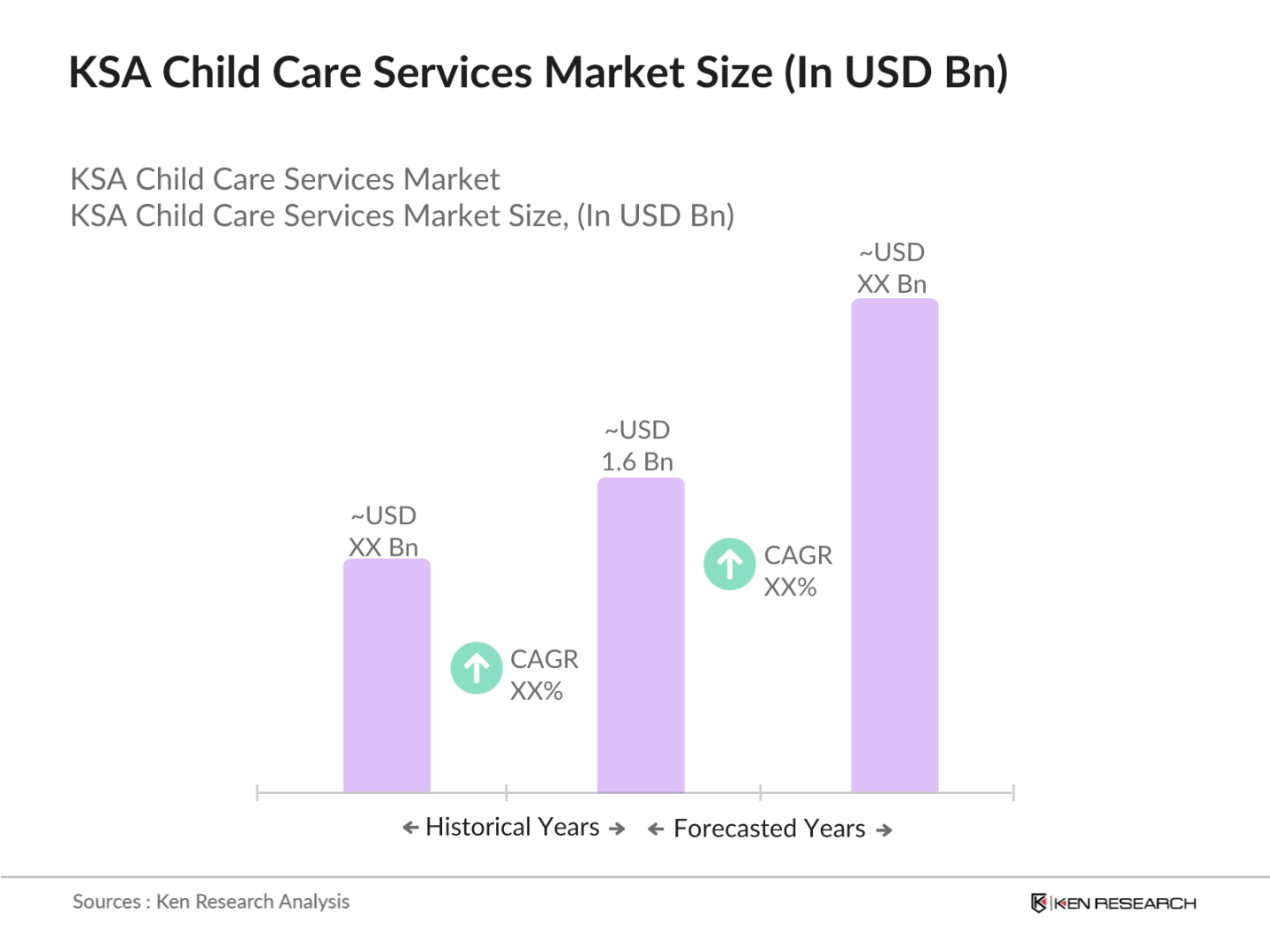

- The KSA Child Care Services market is valued at USD 1.6 billion based on a five-year historical analysis, driven by increased female workforce participation and rising dual-income households. Government initiatives under Vision 2030, which emphasize women's empowerment and early childhood education, have significantly bolstered the market. With growing urbanization and a rising population in metropolitan cities, the demand for organized childcare services has increased, providing a reliable option for working parents. Government support in terms of childcare subsidies and reforms in labor laws have further contributed to the growing market.

- Key cities in Saudi Arabia, including Riyadh, Jeddah, and Dammam, dominate the child care services market due to their large urban populations, high concentration of dual-income families, and the presence of corporate offices requiring on-site childcare services. These cities are also at the forefront of educational reforms and infrastructure development, driven by government investments, making them hubs for quality childcare facilities. The rapid economic growth in these cities has led to a shift towards professional, certified childcare services that align with global standards.

- Flexible and part-time childcare solutions are becoming increasingly popular in Saudi Arabia, catering to families who do not require full-time childcare. This trend is particularly prominent in urban areas where working parents seek part-time care options due to flexible work hours. In 2023, childcare centers in Riyadh and Jeddah began offering customized care packages that allow parents to pay for services on an hourly or part-time basis. These flexible services are designed to cater to the evolving needs of dual-income families and parents with unconventional work schedules.

KSA Child Care Services Market Segmentation

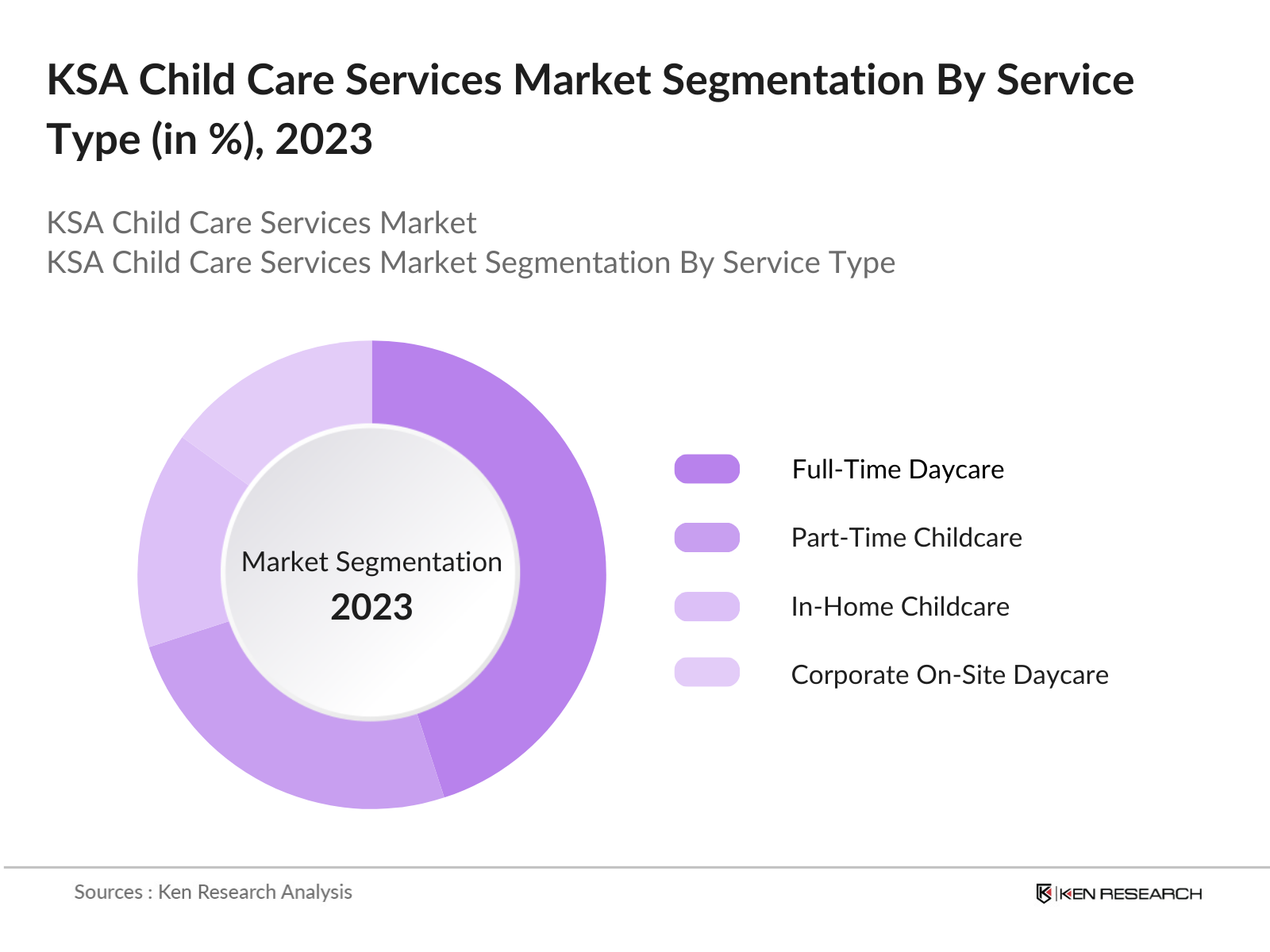

By Service Type: The KSA Child Care Services market is segmented by service type into full-time daycare, part-time childcare, in-home childcare, and corporate on-site daycare facilities. Full-time daycare services dominate the market due to the growing number of working parents who require reliable, long-term childcare solutions. The expansion of early childhood education centers and the need for structured development programs for children have led to higher demand for full-time daycare. Moreover, the increased investment in premium full-time childcare facilities by private players in major cities further fuels the growth of this segment.

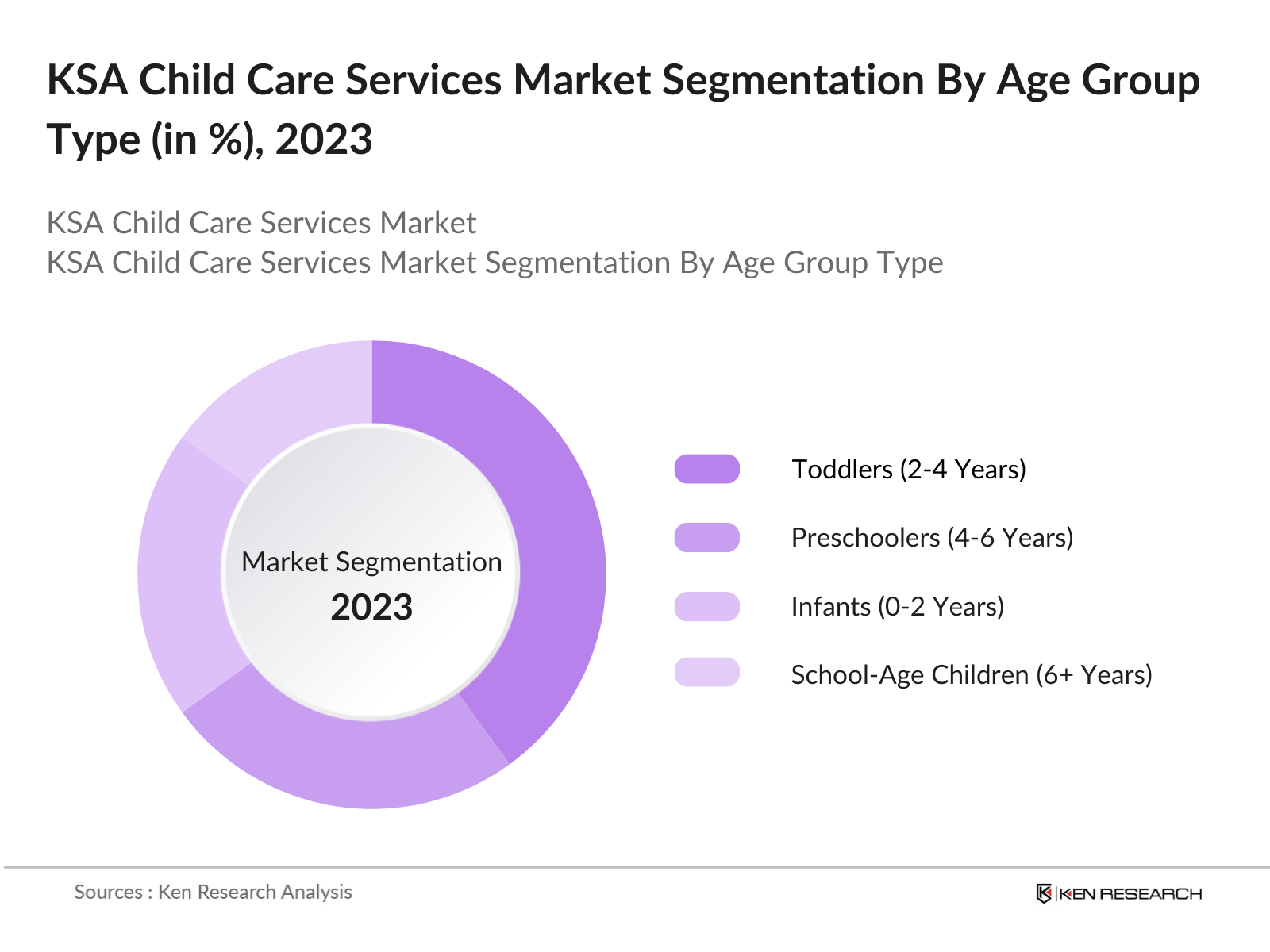

By Age Group: The market is segmented by age group into infants (0-2 years), toddlers (2-4 years), preschoolers (4-6 years), and school-age children (6+ years). The toddlers (2-4 years) segment has a dominant market share due to the increasing recognition of early childhood education as a critical phase for cognitive and social development. Parents in Saudi Arabia are increasingly enrolling their children in structured childcare programs during this age range to ensure early learning opportunities. The governments focus on early childhood development, as well as investments in advanced learning methodologies, also contributes to the dominance of this segment.

KSA Child Care Services Market Competitive Landscape

The KSA Child Care Services market is dominated by a mix of local and international players, including high-end premium service providers and government-funded centers. Many of these operators focus on offering holistic child care and early education, incorporating international curricula. The dominance of local brands is enhanced by government policies promoting the establishment of quality childcare centers to support Vision 2030. As a result, these operators play a crucial role in meeting the rising demand for professional child care services.

|

Company Name |

Establishment Year |

Headquarters |

No. of Centers |

Revenue (USD) |

Employees |

Ownership |

Key Services |

|

Childrens World Nursery |

1995 |

Riyadh |

_ |

_ |

_ |

_ |

_ |

|

Blossom Nursery |

2008 |

Jeddah |

_ |

_ |

_ |

_ |

_ |

|

Red Balloon Early Learning |

2002 |

Dammam |

_ |

_ |

_ |

_ |

_ |

|

Al Dana Nursery |

2000 |

Riyadh |

_ |

_ |

_ |

_ |

_ |

|

Tiny Town Daycare |

2010 |

Jeddah |

_ |

_ |

_ |

_ |

_ |

KSA Child Care Services Industry Analysis

Growth Drivers

- Increase in Dual-Income Families: The rise in dual-income families is driving the demand for child care services in Saudi Arabia. According to the World Bank, household income in Saudi Arabia has significantly improved, with an increasing number of families having both parents employed. In 2022, the Saudi labor force participation for both men and women increased, contributing to higher disposable income and a need for professional childcare services to accommodate working schedules. Dual-income households are especially concentrated in urban areas like Riyadh, where professional childcare centers are expanding rapidly.

- Rising Number of Women in the Workforce: Women's participation in the workforce has risen dramatically due to the Saudi Vision 2030 reforms. In 2023, women made up approximately 35% of the labor force, up from 22% in 2018, as per Saudi Arabias General Authority for Statistics. This significant rise has increased the demand for childcare services, as more women require professional facilities to care for their children while they work. The increased female workforce participation is particularly evident in sectors like healthcare, education, and retail, further contributing to the growing childcare market.

- Government Initiatives Promoting Childcare (Vision 2030): The Saudi government, under Vision 2030, has implemented various social empowerment programs aimed at supporting working families, particularly women. One key initiative is the "Qurra" program, which subsidizes childcare services for women. The government allocated nearly SAR 100 million in 2022 to assist working mothers with childcare expenses. This initiative has directly boosted the demand for licensed childcare centers, particularly in major urban centers like Jeddah and Dammam, where these services are more accessible.

Market Challenges

- Regulatory Compliance for Childcare Operators: Childcare providers in Saudi Arabia must navigate complex regulatory frameworks imposed by the Ministry of Human Resources and Social Development. These regulations include stringent licensing requirements, safety standards, and staff qualifications, which present challenges for operators, particularly new entrants. In 2022, the government introduced additional guidelines focusing on child safety, requiring an estimated SAR 200,000 investment per facility to meet compliance. Such regulatory hurdles increase operational costs, making it difficult for smaller players to enter the market.

- High Initial Setup Costs for Premium Childcare Facilities: Premium childcare centers in Saudi Arabia face high initial setup costs due to the need for advanced safety features, modern infrastructure, and highly qualified staff. The costs of establishing a high-end childcare facility, particularly in urban areas, can exceed SAR 500,000 due to the investment in technology, security systems, and facility design. This financial barrier makes it difficult for many operators to enter the premium segment, despite the growing demand from affluent families, particularly in cities like Riyadh and Jeddah.

KSA Child Care Services Market Future Outlook

The KSA Child Care Services market is expected to witness steady growth in the coming years, driven by increasing female workforce participation, the governments push for quality early childhood education, and the rising demand for professional childcare services. The expansion of corporate on-site childcare centers is anticipated to gain momentum as businesses in the country increasingly prioritize employee benefits, including family-oriented services. Moreover, advancements in digital solutions for childcare management, including safety monitoring and educational apps, will likely enhance service offerings and improve customer satisfaction.

Opportunities

- Technological Integration in Childcare Facilities: The integration of technology in childcare centers presents a significant opportunity for growth in Saudi Arabia. In 2023, many urban childcare facilities began adopting child safety technologies such as biometric entry systems, CCTV surveillance, and real-time parent monitoring apps. Additionally, digital learning platforms for early childhood education are gaining popularity, allowing centers to provide interactive and engaging learning experiences for children. The governments emphasis on digital transformation, under Vision 2030, is encouraging the adoption of such technologies, particularly in premium childcare centers in major cities.

- Increased Focus on Early Childhood Development Programs: Saudi Arabia is placing a stronger emphasis on early childhood development (ECD) programs, recognizing their importance for long-term educational outcomes. In 2023, the Ministry of Education allocated SAR 1.5 billion to ECD initiatives aimed at improving the quality of preschool education. This increased investment is creating opportunities for childcare providers to offer specialized early development programs that cater to cognitive, emotional, and physical development. The growth of ECD programs is particularly prevalent in urban centers where demand for structured learning environments is increasing.

Scope of the Report

|

By Service Type |

Full-Time Daycare Part-Time Childcare In-Home Childcare Corporate On-Site Daycare |

|

By Age Group |

Infants (0-2 Years) Toddlers (2-4 Years) Preschoolers (4-6 Years) School-Age Children (6+ Years) |

|

By End-User |

Residential Childcare Corporate Daycare Private Childcare Centers Government-Funded Centers |

|

By Ownership Type |

Private Operators Government-Owned Centers Non-Profit Organizations Franchise-Based Childcare Chains |

|

By Region |

Riyadh Jeddah Eastern Province Makkah Medina |

Products

Key Target Audience Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

Private Childcare Companies

Corporate Childcare Companies

Government and Regulatory Bodies (Ministry of Human Resources and Social Development)

Investment and Venture Capitalist Firms

International Childcare Chains Industry

Parents and Caregivers Companies

Health and Safety Regulatory Companies

Companies

Players Mentioned in the Report:

Childrens World Nursery

Blossom Nursery

Red Balloon Early Learning

Al Dana Nursery

Tiny Town Daycare

British Orchard Nursery

Future Stars Nursery

Toddler Town British Nursery

Kids Academy Nursery

Happy Hearts Nursery

Kidz World Nursery

Bright Kids Nursery

Shining Stars Academy

Early Learners Nursery

Happy Valley Daycare

Table of Contents

1. KSA Child Care Services Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Key Market Metrics (Birth Rate, Childcare Enrollment, Labor Force Participation, Household Income)

1.4. Market Growth Drivers (Urbanization, Female Workforce Participation, Early Childhood Education Emphasis)

1.5. Market Segmentation Overview

2. KSA Child Care Services Market Size (In USD Billion)

2.1. Historical Market Size (In USD Billion)

2.2. Year-On-Year Growth Analysis (In %)

2.3. Key Market Developments and Milestones

3. KSA Child Care Services Market Analysis

3.1. Growth Drivers

3.1.1. Increase in Dual-Income Families

3.1.2. Rising Number of Women in the Workforce (Workforce Participation Rate)

3.1.3. Government Initiatives Promoting Childcare (Vision 2030)

3.1.4. Growth of Urban Centers and Metropolitan Cities

3.2. Market Challenges

3.2.1. Regulatory Compliance for Childcare Operators

3.2.2. High Initial Setup Costs for Premium Childcare Facilities

3.2.3. Availability of Qualified Childcare Professionals (Employment Rate in Early Childhood Education)

3.2.4. Cultural Preferences Towards In-Home Care

3.3. Opportunities

3.3.1. Technological Integration in Childcare Facilities (Child Safety Tech, Digital Learning Platforms)

3.3.2. Increased Focus on Early Childhood Development Programs

3.3.3. Expansion of Franchise-Based Childcare Centers

3.3.4. Collaborations with Corporates for On-Site Daycare Facilities

3.4. Trends

3.4.1. Introduction of Flexible and Part-Time Childcare Solutions

3.4.2. Rise in Premium, Personalized Childcare Services

3.4.3. Growth in Demand for Early Childhood Education-Based Centers (Montessori, Reggio Emilia Approach)

3.4.4. Increased Investments in Smart Daycare Solutions (IoT, Safety Tracking Apps)

3.5. Government Regulations and Policies

3.5.1. Regulatory Framework for Licensed Childcare Providers (Ministry of Human Resources and Social Development Guidelines)

3.5.2. Vision 2030 Initiatives Impacting Childcare Sector (Social Empowerment Programs)

3.5.3. Subsidy Programs for Childcare to Support Working Mothers

3.5.4. Education Policy Changes Favoring Early Childhood Education

3.6. SWOT Analysis

3.6.1. Strengths

3.6.2. Weaknesses

3.6.3. Opportunities

3.6.4. Threats

3.7. Stakeholder Ecosystem (Government, Private Operators, Corporate Employers, Parents)

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape and Market Share Analysis (Top Competitors and Their Market Positions)

4. KSA Child Care Services Market Segmentation

4.1. By Service Type (In Value %)

4.1.1. Full-Time Daycare

4.1.2. Part-Time Childcare

4.1.3. In-Home Childcare (Nannies, Babysitters)

4.1.4. Corporate On-Site Daycare Facilities

4.2. By Age Group (In Value %)

4.2.1. Infants (0-2 Years)

4.2.2. Toddlers (2-4 Years)

4.2.3. Preschoolers (4-6 Years)

4.2.4. School-Age Children (6+ Years)

4.3. By End-User (In Value %)

4.3.1. Residential Childcare (At Home)

4.3.2. Corporate Daycare Facilities

4.3.3. Private Childcare Centers

4.3.4. Government-Funded Childcare Centers

4.4. By Ownership Type (In Value %)

4.4.1. Private Operators

4.4.2. Government-Owned Childcare Centers

4.4.3. Non-Profit Childcare Organizations

4.4.4. Franchise-Based Childcare Chains

4.5. By Region (In Value %)

4.5.1. Riyadh

4.5.2. Jeddah

4.5.3. Eastern Province (Dammam, Khobar)

4.5.4. Makkah

4.5.5. Medina

5. KSA Child Care Services Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Childrens World Nursery

5.1.2. Jumeirah International Nurseries

5.1.3. Redwood Montessori Nursery

5.1.4. Blossom Nursery

5.1.5. British Orchard Nursery

5.1.6. Little Harvard Nursery

5.1.7. Loyac Child Development Center

5.1.8. The Little Village Nursery

5.1.9. Al Dana Nursery

5.1.10. Tiny Town Daycare

5.1.11. Toddler Town British Nursery

5.1.12. Future Stars Nursery

5.1.13. Kids Academy Nursery

5.1.14. Happy Hearts Nursery

5.1.15. Kidz World Nursery

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Child Capacity, Licensing Compliance, Franchise vs. Private, Revenue, On-Site Services, Safety Measures)

5.3. Market Share Analysis (In Value %)

5.4. Strategic Initiatives (Collaborations, Expansions, Technology Upgrades)

5.5. Mergers And Acquisitions

5.6. Investment Analysis (Private Equity, Venture Capital)

5.7. Corporate Daycare Partnerships

5.8. Government Funding and Subsidies

6. KSA Child Care Services Market Regulatory Framework

6.1. Childcare Licensing and Accreditation

6.2. Labor Laws Governing Childcare Workers

6.3. Health and Safety Regulations (Health Code, Safety Protocols)

6.4. Curriculum and Educational Standards in Early Childhood Education Centers

7. KSA Child Care Services Market Analysts Recommendations

7.1. TAM/SAM/SOM Analysis

7.2. Customer Behavior Analysis

7.3. White Space Opportunity Identification

7.4. Strategic Marketing and Positioning Recommendations

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

We began by mapping the entire KSA Child Care Services ecosystem, identifying key stakeholders such as government bodies, private operators, corporate employers, and parents. Through desk research, data from proprietary databases and government publications were analyzed to determine critical factors influencing the market.

Step 2: Market Analysis and Construction

In this step, historical data was assessed for market growth, service penetration, and major revenue-generating regions. Detailed assessments of customer service quality, early childhood education frameworks, and operational efficiencies of childcare centers were conducted to ensure accurate market sizing.

Step 3: Hypothesis Validation and Expert Consultation

To validate our findings, consultations with child care service providers and industry experts were conducted via CATIS. These consultations provided key insights into market dynamics, service preferences, and operational challenges.

Step 4: Research Synthesis and Final Output

Finally, data from government agencies and private childcare operators were synthesized to create a comprehensive report. This included detailed segmentation by service type and age group, as well as competitive analysis and future outlook.

Frequently Asked Questions

1. How big is the KSA Child Care Services Market?

The KSA Child Care Services market is valued at USD 1.6 billion, driven by increasing female workforce participation and government initiatives under Vision 2030.

2. What are the challenges in the KSA Child Care Services Market?

The market faces challenges such as high operational costs for premium childcare centers, regulatory compliance issues, and a shortage of qualified childcare professionals.

3. Who are the major players in the KSA Child Care Services Market?

Key players in the market include Childrens World Nursery, Blossom Nursery, Red Balloon Early Learning, and Al Dana Nursery. These operators dominate due to their established reputations, quality services, and widespread presence in major cities.

4. What are the growth drivers of the KSA Child Care Services Market?

The market is driven by factors such as government subsidies, increasing urbanization, the rise of dual-income households, and the growing importance of early childhood education.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.