KSA Cinema Market Outlook to 2030

Region:Middle East

Author(s):Naman Rohilla

Product Code:KROD8047

December 2024

83

About the Report

KSA Cinema Market Overview

- The KSA Cinema Market, valued at USD 500 million, has been driven by the governments Vision 2030 initiative, which encourages diversification of the entertainment sector and an increased focus on tourism. The market's expansion is supported by rising consumer spending on leisure activities, greater access to international films, and the rapid development of cinema infrastructure across the Kingdom. With disposable incomes growing steadily, and the demand for high-quality entertainment options on the rise, the cinema industry has seen steady growth over the past five years.

- The dominance of Riyadh and Jeddah in the KSA cinema market is primarily attributed to their population density, urbanization, and strong economic infrastructure. These cities benefit from large-scale investments in entertainment hubs and infrastructure, creating a thriving environment for the cinema industry. The presence of a cosmopolitan population with diverse tastes also supports a wide range of cinema offerings, from local films to international blockbusters, making these cities prime markets for cinema operators.

- The licensing and approval processes overseen by the General Entertainment Authority (GEA) are fundamental to the growth and regulation of the cinema sector in Saudi Arabia. The GEA has established comprehensive guidelines to streamline the licensing process for new cinema operators, reducing the time required for approvals. In 2022, it was reported that the average approval time for cinema licenses was reduced to six months, compared to over a year in previous years. This improvement in regulatory efficiency is expected to encourage more investments in the cinema market, as operators can enter the market more rapidly and capitalize on emerging opportunities. Additionally, the GEA is committed to maintaining high standards of safety and quality in cinema operations, ensuring a positive experience for audiences and fostering confidence among investors.

KSA Cinema Market Segmentation

- By Cinema Type: The KSA Cinema Market is segmented by cinema type into multiplex cinemas, single-screen cinemas, and drive-in cinemas. Multiplex cinemas dominate the market due to their ability to offer a diverse range of films, premium experiences, and larger seating capacities. Multiplex operators have been actively investing in creating entertainment destinations that go beyond just cinema, including dining and retail experiences, further enhancing consumer appeal. Additionally, these venues are strategically located in major shopping malls, making them a preferred choice for the urban population.

- By Location: The KSA Cinema Market is segmented by location into urban areas, secondary cities, and suburban regions. Urban areas, including Riyadh and Jeddah, hold the dominant share due to their high population density, superior infrastructure, and higher consumer spending capacity. The urban populations preference for premium cinema experiences and the availability of advanced technologies like IMAX and 4D enhance the demand for cinemas in these regions. Furthermore, urban locations attract foreign investments, driving the expansion of cinema chains.

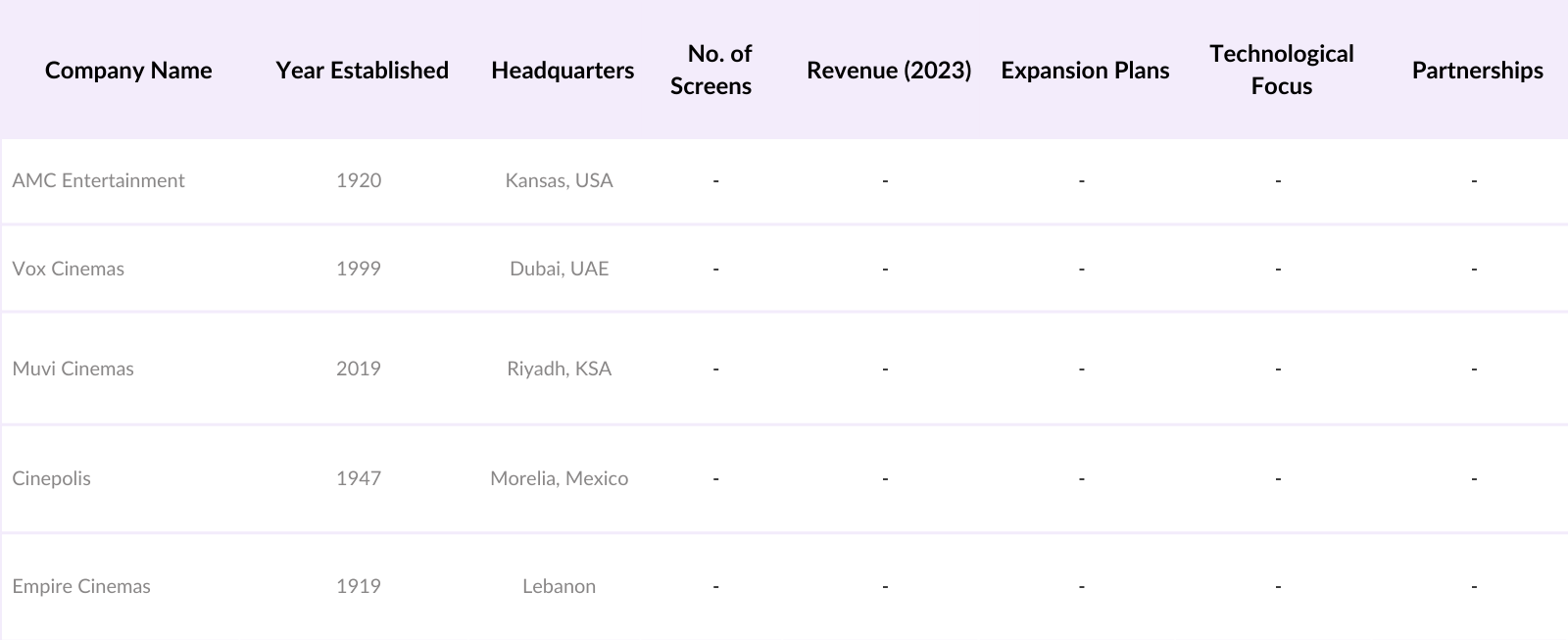

KSA Cinema Market Competitive Landscape

The KSA Cinema Market is dominated by both local and international players, each vying for market share by leveraging strategic partnerships and the introduction of cutting-edge technologies. The cinema landscape is characterized by strong brand loyalty, investments in state-of-the-art technology, and collaborations with international studios to bring exclusive content to the Saudi audience. Local companies are increasingly collaborating with international brands to expand their reach and enhance their market presence.

KSA Cinema Market Analysis

KSA Cinema Market Growth Drivers

- Expanding Entertainment Sector: The Saudi Arabian government has made strides in expanding its entertainment sector as part of its Vision 2030 initiative. With an allocated budget of SAR 64 billion ($17 billion) for cultural and entertainment projects, the country aims to enhance the quality of life for its citizens. In 2022, the General Entertainment Authority (GEA) facilitated over 350 events and concerts, attracting millions of attendees, illustrating a robust commitment to diversifying entertainment offerings. The influx of international franchises and the establishment of cinemas has resulted in a projected increase in domestic tourism, with the sector expected to contribute over SAR 50 billion to the economy by 2025. This expansion is further bolstered by strategic collaborations with international entertainment companies, enhancing local content production and audience engagement.

- Increasing Disposable Income: As Saudi Arabia experiences economic diversification, consumer disposable income has steadily increased, providing more disposable income for entertainment. The World Bank reported that Saudi Arabia's GDP per capita was around $22,300 in 2022, reflecting a positive economic trajectory. This increase in disposable income, projected to reach SAR 18,500 ($4,933) per month by 2025, supports greater spending on leisure activities, including cinema. The rise of middle-class households, expected to account for over 60% of the population by 2025, is likely to boost cinema attendance, as more consumers can afford to spend on entertainment. Furthermore, the shift towards urbanization has led to the development of entertainment complexes, increasing accessibility and attracting higher foot traffic to cinemas, ultimately driving growth in the sector.

- Changing Social Norms: The changing social dynamics in Saudi Arabia have influenced consumer behaviour regarding entertainment. The lifting of restrictions on cinemas in 2018 marked a pivotal shift in societal attitudes, with a notable increase in youth engagement in cultural activities. By 2022, reports indicated that 30% of the Saudi population, particularly among the youth demographic, actively participated in cinematic experiences. This shift is reflected in increased ticket sales and attendance figures, with cinemas reporting up to 10 million tickets sold in 2022 alone. Moreover, social media platforms have become instrumental in promoting films and cinema culture, resulting in heightened awareness and interest in local and international productions. This evolving landscape is indicative of a society increasingly open to diverse entertainment experiences, setting a positive precedent for sustained growth in the cinema market.

KSA Cinema Market Challenges

- High Operating Costs: The cinema industry in Saudi Arabia faces major challenges related to high operating costs, particularly concerning licensing and infrastructure investments. Establishing a cinema requires compliance with stringent regulations set by the GEA, which entails substantial costs for licensing and permits. For instance, initial setup costs for a multiplex cinema can range from SAR 10 million to SAR 30 million ($2.66 million to $8 million), depending on the size and location. Additionally, operational expenses, including maintenance, staffing, and technology upgrades, have been rising, with cinemas reporting an average annual operational cost increase of 15% in recent years. This financial burden can deter potential investors and limit the expansion of cinema chains, posing a challenge to achieving market growth targets.

- Limited Local Content: Despite the growing cinema market, the limited availability of local content poses a major challenge. The Saudi film industry is still in its nascent stages, with only a handful of films produced locally each year. In 2022, local films accounted for 5% of total box office revenue, underscoring the reliance on foreign films. Cultural barriers and conservative social norms have historically restricted the production and acceptance of local narratives, hindering audience engagement. The need for more culturally relevant content is crucial for driving local cinema attendance. Furthermore, the lack of established distribution networks for local films can impede their reach, resulting in an oversaturation of international films in the market.

KSA Cinema Market Future Outlook

Over the next five years, the KSA Cinema Market is expected to witness growth driven by continuous government support, the increasing number of premium cinema offerings, and the growing demand for local content. The Vision 2030 initiative, which aims to increase household spending on entertainment, is expected to further boost the cinema industry. Additionally, investments in cutting-edge cinema technologies and a focus on enhancing the customer experience are anticipated to sustain market growth. The market is also likely to see an influx of foreign players entering into strategic collaborations with local cinema operators to meet the rising demand for diverse content.

KSA Cinema Market Opportunities

- Government Support for Entertainment Hubs: The Saudi government is actively fostering growth in the cinema sector through public-private partnerships aimed at developing entertainment hubs. By 2025, the government plans to invest SAR 50 billion ($13.3 billion) into various entertainment projects, including the establishment of mega cinema complexes across major cities. This investment is expected to enhance infrastructure and attract both local and international cinema operators. Furthermore, collaborations with private companies will facilitate the development of diverse entertainment offerings beyond traditional cinema, such as theme parks and live entertainment venues. This government support is critical for creating a vibrant entertainment ecosystem, encouraging innovation, and driving long-term growth in the cinema market.

- Emerging Saudi Film Industry: The emergence of the Saudi film industry presents substantial opportunities for market growth. With an increasing number of local filmmakers and production houses, there has been a noticeable rise in the quantity and quality of locally produced films. In 2022, over 20 feature films were produced in Saudi Arabia, showcasing local talent and narratives. This burgeoning industry is expected to attract both domestic and international audiences, with local films gaining popularity in regional markets. The government's support for local film initiatives, including funding and training programs, is vital for nurturing talent and encouraging more content creation. As local productions become more prominent, they will play a crucial role in enhancing cinema attendance and fostering cultural relevance within the market.

Scope of the Report

|

Cinema Type |

Multiplex Cinemas Single-Screen Cinemas Drive-in Cinemas |

|

Location |

Urban Areas Secondary Cities Suburban Regions |

|

Ticket Type |

Standard Tickets Premium Tickets (VIP, Recliner) |

|

Content Type |

Local Films International Blockbusters |

|

Technology |

Digital Screens IMAX 4D VR Cinemas |

Products

Key Target Audience

Cinema Operators

Film Distributors

Government and Regulatory Bodies (General Entertainment Authority, Saudi Film Commission)

Real Estate Developers

Hospitality and Tourism Companies

Technology Providers (IMAX, 4D, VR companies)

Investor and Venture Capitalist Firms

Banks and Financial Institutions

Local and International Content Producers

Companies

Players Mentioned in the Report

AMC Entertainment

Vox Cinemas

Muvi Cinemas

Cinepolis

Empire Cinemas

Reel Cinemas

Novo Cinemas

CGV Cinemas

AMC Saudi Arabia

Luna Cinemas

Table of Contents

1. KSA Cinema Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. KSA Cinema Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. KSA Cinema Market Analysis

3.1 Growth Drivers

3.1.1 Expanding Entertainment Sector (Government Initiatives, Vision 2030)

3.1.2 Increasing Disposable Income (Consumer Spending Patterns)

3.1.3 Changing Social Norms (Shift in Consumer Behavior)

3.1.4 Foreign Direct Investments (FDI)

3.2 Market Challenges

3.2.1 High Operating Costs (Licensing, Infrastructure)

3.2.2 Limited Local Content (Cultural Barriers)

3.2.3 Competition from Digital Platforms (Streaming Services)

3.3 Opportunities

3.3.1 Government Support for Entertainment Hubs (Public-Private Partnerships)

3.3.2 Emerging Saudi Film Industry (Local Talent and Production)

3.3.3 Strategic International Collaborations (Co-Productions)

3.4 Trends

3.4.1 Multiplex Expansion (New Cinemas in Secondary Cities)

3.4.2 Integration of Premium Experiences (4D, IMAX)

3.4.3 Digital Transformation (Mobile Ticketing, Digital Screens)

3.5 Government Regulation

3.5.1 GEA Licensing and Approval Processes

3.5.2 Tax Incentives for Cinema Investors

3.5.3 Content Censorship Laws and Guidelines

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem (Public-Private Partnerships)

3.8 Porters Five Forces (Competitive Rivalry, Bargaining Power of Suppliers)

3.9 Competition Ecosystem

4. KSA Cinema Market Segmentation

4.1 By Cinema Type (In Value %)

4.1.1 Multiplex Cinemas

4.1.2 Single-Screen Cinemas

4.1.3 Drive-in Cinemas

4.2 By Location (In Value %)

4.2.1 Urban Areas

4.2.2 Secondary Cities

4.2.3 Suburban Regions

4.3 By Ticket Type (In Value %)

4.3.1 Standard Tickets

4.3.2 Premium Tickets (VIP, Recliner)

4.4 By Content Type (In Value %)

4.4.1 Local Films

4.4.2 International Blockbusters

4.5 By Technology (In Value %)

4.5.1 Digital Screens

4.5.2 IMAX

4.5.3 4D and VR Cinemas

5. KSA Cinema Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 AMC Entertainment

5.1.2 Vox Cinemas

5.1.3 Muvi Cinemas

5.1.4 Cinepolis

5.1.5 Empire Cinemas

5.1.6 Reel Cinemas

5.1.7 Novo Cinemas

5.1.8 CGV Cinemas

5.1.9 AMC Saudi Arabia

5.1.10 Luna Cinemas

5.1.11 Al Hokair Group Cinemas

5.1.12 Maya Cinemas

5.1.13 Cinemax

5.1.14 Cineworld Group

5.1.15 Yashraj Films (Saudi Division)

5.2 Cross Comparison Parameters (No. of Screens, Ticket Price Range, Expansion Plans, Technology Used, Market Share, Revenue, Partnerships, Content Licensing)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Government Grants and Incentives

6. KSA Cinema Market Regulatory Framework

6.1 Licensing and Certification Requirements

6.2 Compliance with GEA Standards

6.3 Cultural Sensitivity and Content Censorship

6.4 Tax and Investment Benefits for Cinemas

7. KSA Cinema Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. KSA Cinema Future Market Segmentation

8.1 By Cinema Type (In Value %)

8.2 By Location (In Value %)

8.3 By Ticket Type (In Value %)

8.4 By Content Type (In Value %)

8.5 By Technology (In Value %)

9. KSA Cinema Market Analyst Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The research began with the identification of critical factors influencing the KSA Cinema Market, including consumer spending habits, government regulations, and advancements in cinema technology. Extensive secondary research was conducted using databases, government reports, and market studies to outline key market drivers and challenges.

Step 2: Market Analysis and Construction

The research team analyzed historical data from industry reports, focusing on key market metrics such as market penetration and the ratio of premium to standard cinema offerings. This helped in estimating market revenue for different segments and understanding consumer preferences across the Kingdom.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses related to market growth and consumer demand were validated through consultations with cinema operators and industry experts. These consultations provided valuable insights into the operational and financial aspects of the cinema industry, helping to refine the market data.

Step 4: Research Synthesis and Final Output

Finally, the research team synthesized the data obtained from primary and secondary sources, validating it through cross-references and expert consultations. The outcome was a comprehensive analysis of the KSA Cinema Market, offering a detailed understanding of market trends, challenges, and opportunities.

Frequently Asked Questions

01. How big is the KSA Cinema Market?

The KSA Cinema Market is valued at USD 500 million, driven by increasing consumer spending on entertainment and strong government support for the cinema industry as part of the Vision 2030 initiative.

02. What are the challenges in the KSA Cinema Market?

The major challenges in the KSA Cinema Market include high operating costs, content censorship, and competition from digital streaming platforms that are gaining popularity in the region.

03. Who are the major players in the KSA Cinema Market?

Key players in the market include AMC Entertainment, Vox Cinemas, Muvi Cinemas, Cinepolis, and Empire Cinemas. These companies dominate the market through their partnerships, technological investments, and premium cinema offerings.

04. What are the growth drivers of the KSA Cinema Market?

The market is driven by government initiatives, rising disposable income, and the growing demand for premium cinema experiences, such as IMAX and 4D. The focus on developing entertainment hubs across the country also contributes to market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.