KSA Cloud Computing Market Outlook to 2030

Region:Middle East

Author(s):Sanjana

Product Code:KROD2366

October 2024

92

About the Report

KSA Cloud Computing Market Overview

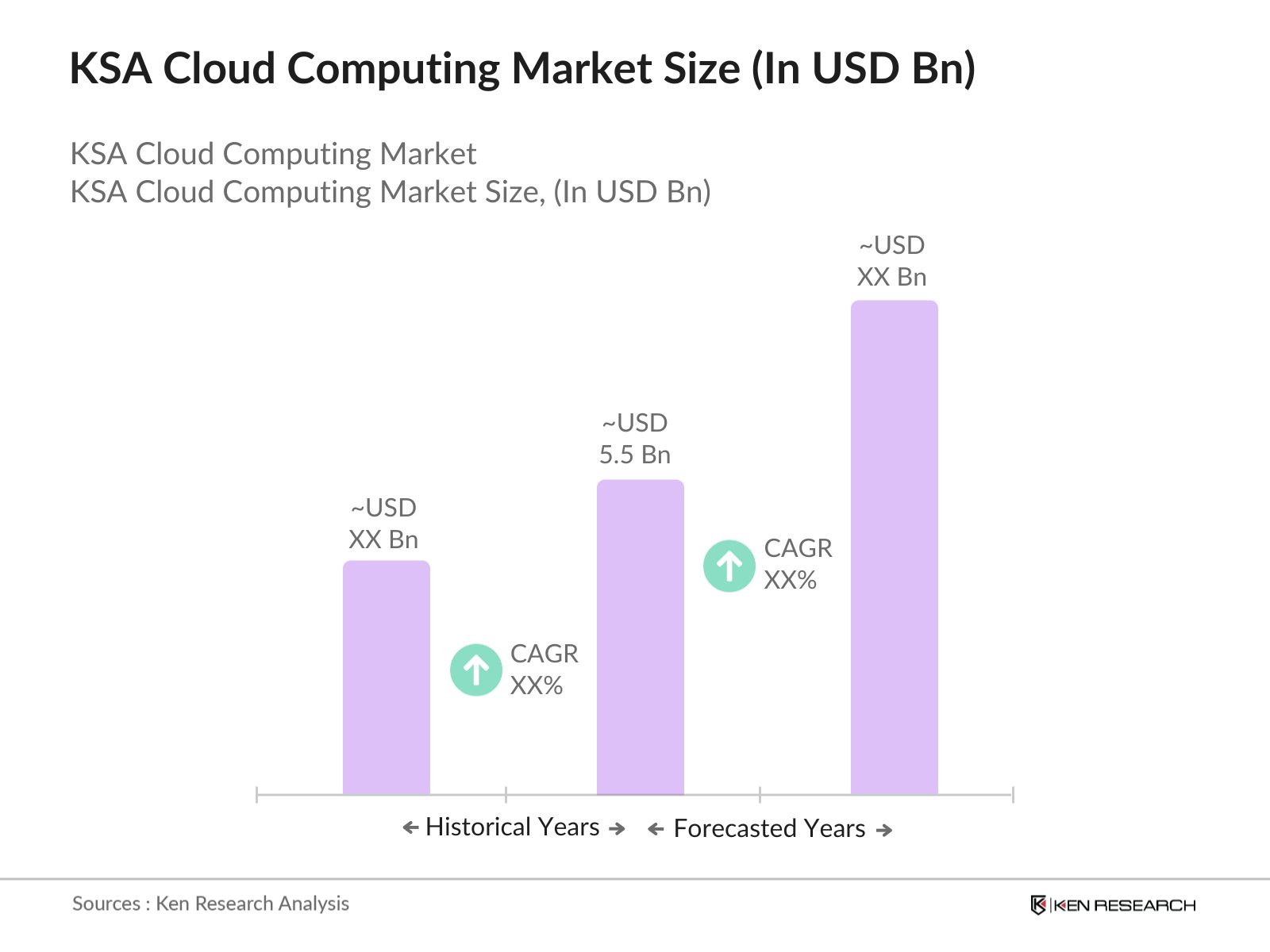

- The KSA Cloud Computing market is valued at USD 5.5 billion based on a comprehensive five-year historical analysis. This growth is primarily driven by the Kingdoms Vision 2030 initiative, which emphasizes the diversification of the economy and the acceleration of digital transformation. Increasing demand from government entities, enterprises, and startups for cloud services has further propelled market growth.

- The market is dominated by cities like Riyadh, Jeddah, and Dammam. Riyadh's dominance is attributed to the concentration of government bodies and large enterprises, which have been key drivers in cloud service adoption. Jeddah and Dammam follow closely due to their strategic importance as business and trade hubs, attracting multinational cloud providers and encouraging investments in local data centers. These cities are pivotal in the adoption of cloud computing due to their growing technological infrastructure and business ecosystems.

- The Communications and Information Technology Commission (CITC) has set stringent guidelines for cloud computing compliance in Saudi Arabia. These regulations mandate that cloud service providers must adhere to data localization laws, ensuring that sensitive data is stored within the Kingdom. The National Data Governance Policies also require that all cloud service providers meet security and privacy standards, as established by the Saudi Data and AI Authority (SDAIA).

KSA Cloud Computing Market Segmentation

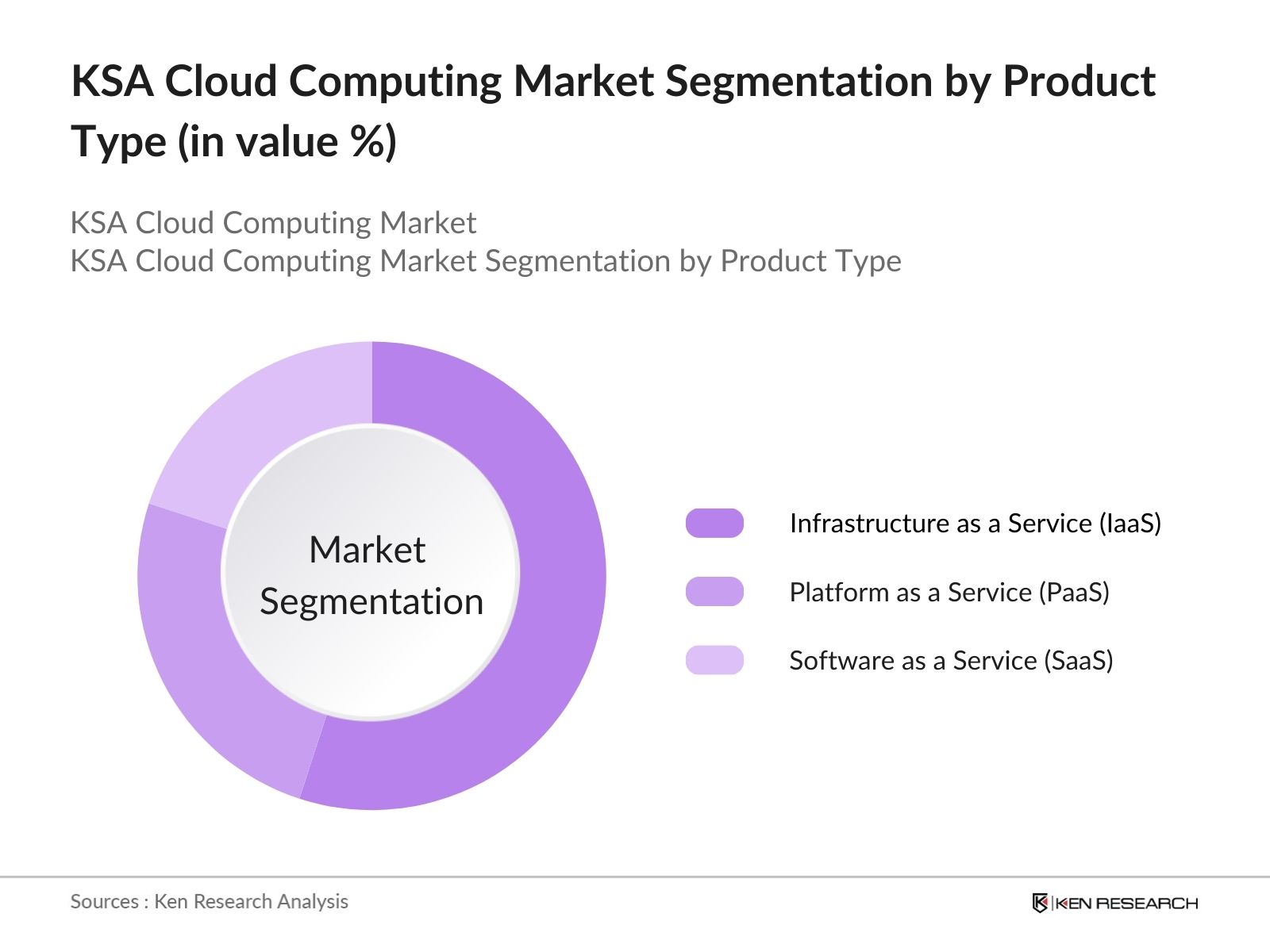

By Service Type: The KSA cloud computing market is segmented by service type into Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS). Among these, IaaS holds a dominant market share due to its flexibility and scalability, making it the go-to option for large enterprises and government sectors. IaaS solutions, such as those offered by AWS and Microsoft Azure, provide enterprises with robust computing infrastructure without the need for heavy capital expenditure on physical servers. The surge in demand for data storage and processing solutions has further consolidated IaaS as a leader in the market.

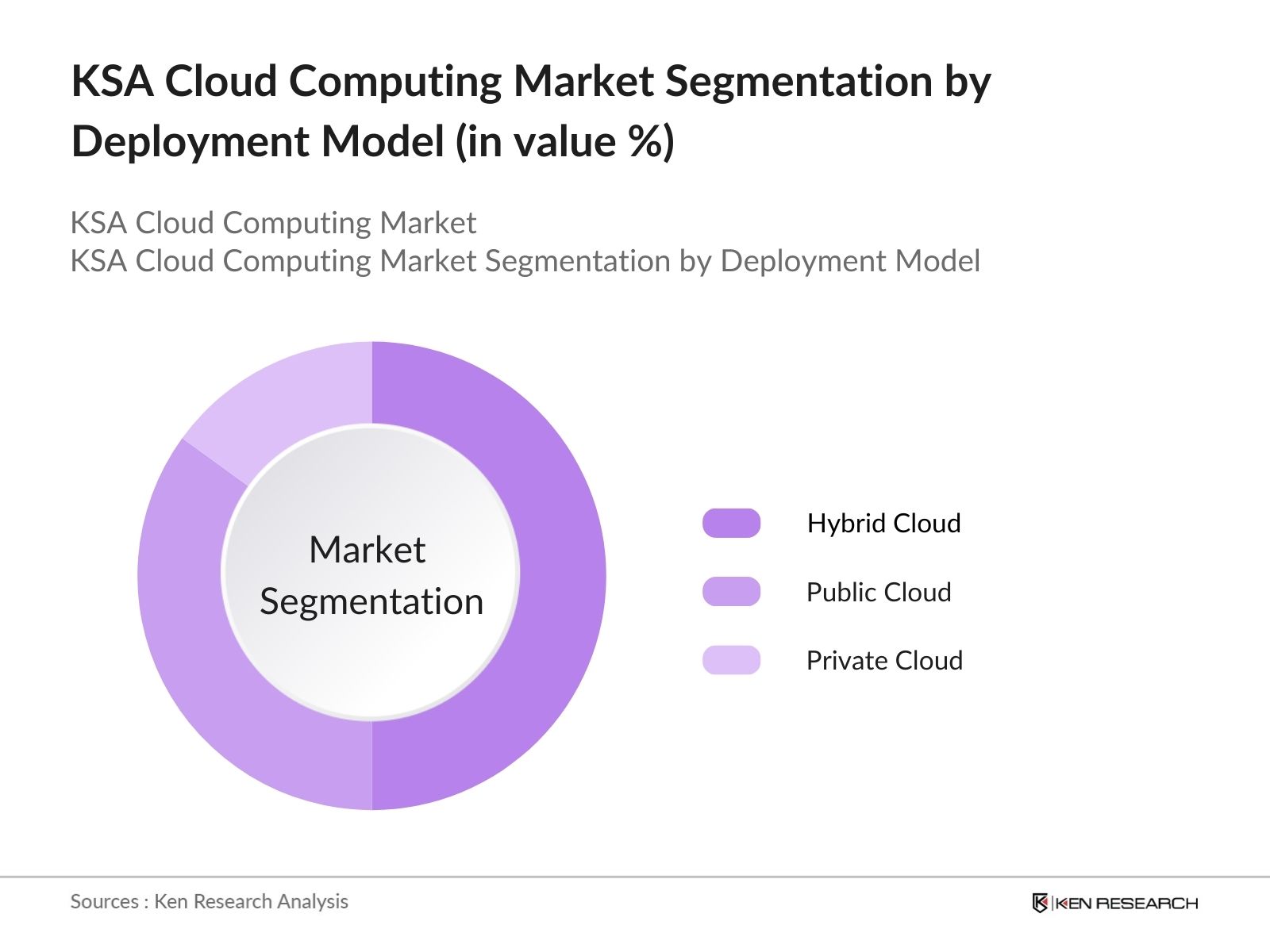

By Deployment Model: The market is also segmented by deployment model into public cloud, private cloud, and hybrid cloud. The hybrid cloud model dominates the market as it offers the best of both worldssecurity and control of private cloud solutions combined with the scalability and cost-effectiveness of public cloud offerings. This model is particularly popular among government agencies and heavily regulated industries like healthcare and finance, where data privacy and security are paramount.

KSA Cloud Computing Market Competitive Landscape

The KSA cloud computing market is dominated by both global and local players. Major global players like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud are actively investing in building local data centers and collaborating with the government to cater to local needs. Meanwhile, local providers like STC Cloud are expanding their market presence by offering tailored solutions to meet the regulatory requirements specific to the region. The competitive landscape is characterized by ongoing investments in local infrastructure, regulatory compliance, and customer-centric solutions, particularly by global players aiming to strengthen their market share in the KSA.

|

Company |

Establishment Year |

Headquarters |

No. of Data Centers |

Revenue (2023) |

Cloud Service Zones |

Security Certifications |

AI Integration |

Local Partnerships |

Global Reach |

|---|---|---|---|---|---|---|---|---|---|

|

Amazon Web Services |

2006 |

Seattle, USA |

2 |

||||||

|

Microsoft Azure |

2010 |

Redmond, USA |

2 |

||||||

|

Google Cloud |

2008 |

Mountain View, USA |

1 |

||||||

|

STC Cloud |

1998 |

Riyadh, KSA |

3 |

||||||

|

Oracle Cloud |

2012 |

Austin, USA |

1 |

KSA Cloud Computing Market Analysis

Growth Drivers

- Digital Transformation Initiatives: The Saudi government has made significant strides in advancing digital transformation through initiatives such as Vision 2030. The Vision 2030 program aims to grow the ICT sector by 50% and increase its contribution to the national GDP by $13.3 billion. The MCIT is actively working towards these goals, which include enhancing digital services and promoting a digital economy. This initiative has resulted in the increased utilization of cloud services across the Kingdom.

- Cloud-First Strategies in Public and Private Sectors: Saudi Arabia's public sector is rapidly adopting cloud-first strategies, with government agencies, healthcare, and education sectors leading the charge. Over 60 government entities in Saudi Arabia had migrated their operations to the cloud as of 2022 as part of a wider governmental initiative. The Ministry of Education has also implemented cloud-based e-learning platforms for over 7 million students across the country.

- Expansion of 5G Network: The expansion of 5G networks across Saudi Arabia is playing a pivotal role in the growth of cloud infrastructure. Zain KSA is targeting to expand its 5G network from covering 66 cities to 122 cities and governorates, which will increase the number of its 5G network sites to over 7,000. This technological expansion is enabling faster data transfer and lower latency, supporting the scalability of cloud services.

Challenges

- Data Sovereignty Regulations: Data sovereignty regulations pose a major challenge for enterprises looking to adopt cloud services in Saudi Arabia. The National Data Governance Policy, enforced by the Saudi Data and AI Authority (SDAIA), requires public and private controllers to register in the National Data Governance Platform, which will help enforce the regulations. The regulations allow for the transfer of personal data outside the Kingdom under specific conditions, as long as it does not compromise national security or the privacy of data subjects.

- High Cost of Cloud Infrastructure Implementation: Small and medium-sized businesses (SMBs) in Saudi Arabia face significant barriers due to the high costs associated with implementing cloud infrastructure. The initial setup for cloud migration can exceed $100,000 for medium-sized enterprises, which is often prohibitively expensive for SMBs in the region. This has resulted in slower cloud adoption rates among smaller firms, especially those in retail and manufacturing.

KSA Cloud Computing Future Market Outlook

The KSA cloud computing market is expected to experience continued growth over the next five years. This is largely driven by increasing cloud adoption across sectors, especially government, healthcare, and education, as part of the broader Vision 2030 initiative. The rising demand for AI, IoT, and data analytics services on the cloud is also expected to play a significant role in the market's future trajectory. Additionally, partnerships between local and global cloud service providers will further enhance market expansion, with a focus on localized solutions and compliance with regional data sovereignty regulations.

Market Opportunities

- Expansion of Hybrid Cloud Solutions: Hybrid cloud solutions are gaining traction in Saudi Arabia, especially in industries such as banking, oil and gas, and healthcare. In 2023, over 72% of enterprises adopted hybrid cloud models, combining on-premise data centers with cloud services. This allows organizations to meet data sovereignty requirements while enjoying the scalability of cloud technology. The healthcare sector is also witnessing increased adoption due to its need for secure, scalable data management solutions.

- Growth in Edge Computing: Edge computing is emerging as a key opportunity within Saudi Arabias cloud computing landscape, particularly in sectors like manufacturing and telecommunications. Globally, the adoption of 5G subscriptions continues to grow across all regions. By the end of 2029, global 5G subscriptions are projected to reach close to 5.6 billion. Major telecom providers have begun investing in edge computing infrastructure, contributing to a projected increase in local data centers focused on supporting edge applications.

Scope of the Report

|

Segment |

Sub-Segment |

|---|---|

|

Service Type |

Infrastructure as a Service (IaaS) |

|

Platform as a Service (PaaS) |

|

|

Software as a Service (SaaS) |

|

|

Deployment Model |

Public Cloud |

|

Private Cloud |

|

|

Hybrid Cloud |

|

|

Enterprise Size |

Small and Medium Enterprises (SMEs) |

|

Large Enterprises |

|

|

End-User Industry |

BFSI |

|

IT & Telecom |

|

|

Retail |

|

|

Government |

|

|

Healthcare |

|

|

Manufacturing |

|

|

Region |

Central Region (Riyadh) |

|

Eastern Province |

|

|

Western Region (Jeddah, Makkah) |

Products

Key Target Audience

Educational Technology (EdTech) Companies

Telecommunication Companies:

Cloud service providers

Cybersecurity Companies

Cloud-based Software (SaaS) Providers

Retail and E-commerce Companies

Investments and venture capital firms

Government and regulatory bodies (CITC, National Data Governance Authority)

Companies

Major Players Mentioned in the Report

Amazon Web Services (AWS)

Microsoft Azure

Google Cloud

STC Cloud

Oracle Cloud

Alibaba Cloud

Mobily Cloud

IBM Cloud

SAP Cloud

HPE Cloud

VMware Cloud

Cisco Cloud

Dell Technologies Cloud

Huawei Cloud

Equinix

Table of Contents

1. KSA Cloud Computing Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Key Market Trends and Developments

1.4. Market Segmentation Overview

2. KSA Cloud Computing Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. KSA Cloud Computing Market Analysis

3.1. Growth Drivers

3.1.1. Digital Transformation Initiatives

3.1.2. Cloud-First Strategies in Public and Private Sectors

3.1.3. Expansion of 5G Network

3.1.4. Increasing Demand for Data Centers

3.2. Market Challenges

3.2.1. Data Sovereignty Regulations

3.2.2. High Cost of Cloud Infrastructure Implementation

3.2.3. Limited Skilled Workforce

3.3. Opportunities

3.3.1. Expansion of Hybrid Cloud Solutions

3.3.2. Growth in Edge Computing

3.3.3. Collaboration with Global Cloud Service Providers

3.4. Trends

3.4.1. Rising Adoption of SaaS Solutions

3.4.2. Growth of AI and ML Services in Cloud

3.4.3. Increasing Focus on Cloud Security

3.5. Government Regulations

3.5.1. Cloud Computing Compliance Standards

3.5.2. Cybersecurity Law

3.5.3. Data Protection and Privacy Regulations

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Local Providers, International Players, Regulatory Bodies)

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. KSA Cloud Computing Market Segmentation

4.1. By Service Type (In Value %)

4.1.1. Infrastructure as a Service (IaaS)

4.1.2. Platform as a Service (PaaS)

4.1.3. Software as a Service (SaaS)

4.2. By Deployment Model (In Value %)

4.2.1. Public Cloud

4.2.2. Private Cloud

4.2.3. Hybrid Cloud

4.3. By Enterprise Size (In Value %)

4.3.1. Small and Medium Enterprises (SMEs)

4.3.2. Large Enterprises

4.4. By End-User Industry (In Value %)

4.4.1. BFSI

4.4.2. IT & Telecom

4.4.3. Retail

4.4.4. Government

4.4.5. Healthcare

4.4.6. Manufacturing

4.5. By Region (In Value %)

4.5.1. Central Region (Riyadh)

4.5.2. Eastern Province

4.5.3. Western Region (Jeddah, Makkah)

5. KSA Cloud Computing Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Amazon Web Services (AWS)

5.1.2. Microsoft Azure

5.1.3. Google Cloud

5.1.4. IBM Cloud

5.1.5. Oracle Cloud

5.1.6. Alibaba Cloud

5.1.7. STC Cloud

5.1.8. Mobily Cloud

5.1.9. Saudi Telecom Company (STC)

5.1.10. Ooredoo

5.1.11. SAP Cloud

5.1.12. HPE Cloud

5.1.13. VMWare

5.1.14. Equinix

5.1.15. Huawei Cloud

5.2. Cross Comparison Parameters (No. of Data Centers, Cloud Service Availability Zones, Service Portfolio, Industry Penetration, Security Compliance, AI/ML Integration, Cloud Migration Services, Local Partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Support for Cloud Initiatives

5.8. Cloud-related Startups and Innovation Hubs

6. KSA Cloud Computing Market Regulatory Framework

6.1. Data Residency Regulations

6.2. Cloud Certification Requirements

6.3. Local Vendor Requirements

7. KSA Cloud Computing Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. KSA Cloud Computing Future Market Segmentation

8.1. By Service Type (In Value %)

8.2. By Deployment Model (In Value %)

8.3. By Enterprise Size (In Value %)

8.4. By End-User Industry (In Value %)

8.5. By Region (In Value %)

9. KSA Cloud Computing Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Strategic Expansion Recommendations

9.3. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves creating a detailed ecosystem map that includes all stakeholders in the KSA Cloud Computing Market. This process is based on extensive desk research, utilizing a combination of proprietary databases and secondary sources to gather industry-level information. The goal is to identify and define critical variables such as service adoption rates, regulatory impacts, and market trends.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data on the KSA Cloud Computing Market, assessing market penetration rates, cloud service provider presence, and associated revenue. Additionally, service quality metrics are evaluated to ensure reliable revenue estimates and identify potential growth opportunities.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses are developed based on preliminary data and validated through expert interviews using computer-assisted telephone interviews (CATI). This consultation with cloud service providers, system integrators, and enterprise clients offers insights into operational and financial trends, enhancing the accuracy of the market analysis.

Step 4: Research Synthesis and Final Output

The final step involves direct engagement with cloud providers to acquire insights into market segments, deployment models, and user preferences. These interactions help validate the data obtained from our bottom-up approach, ensuring a comprehensive and accurate analysis of the KSA Cloud Computing Market.

Frequently Asked Questions

1. How big is the KSA Cloud Computing Market?

The KSA cloud computing market is valued at USD 5.5 billion, driven by the rapid digital transformation initiatives under Vision 2030 and increased adoption of cloud services by both public and private sectors.

2. What are the challenges in the KSA Cloud Computing Market?

The key challenges include data sovereignty regulations, the high cost of cloud infrastructure implementation, and the shortage of skilled workforce in cloud management and data security compliance.

3. Who are the major players in the KSA Cloud Computing Market?

Major players include Amazon Web Services, Microsoft Azure, Google Cloud, STC Cloud, and Oracle Cloud. These companies dominate the market due to their extensive cloud infrastructure and partnerships with local enterprises.

4. What are the growth drivers of the KSA Cloud Computing Market?

Growth drivers include government-backed digital transformation initiatives, the expansion of 5G networks, increased demand for data centers, and the growing reliance on AI and IoT services delivered via the cloud.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.