KSA Cloud Storage Market Outlook to 2030

Region:Middle East

Author(s):Sanjana

Product Code:KROD1449

October 2024

80

About the Report

KSA Cloud Storage Market Overview

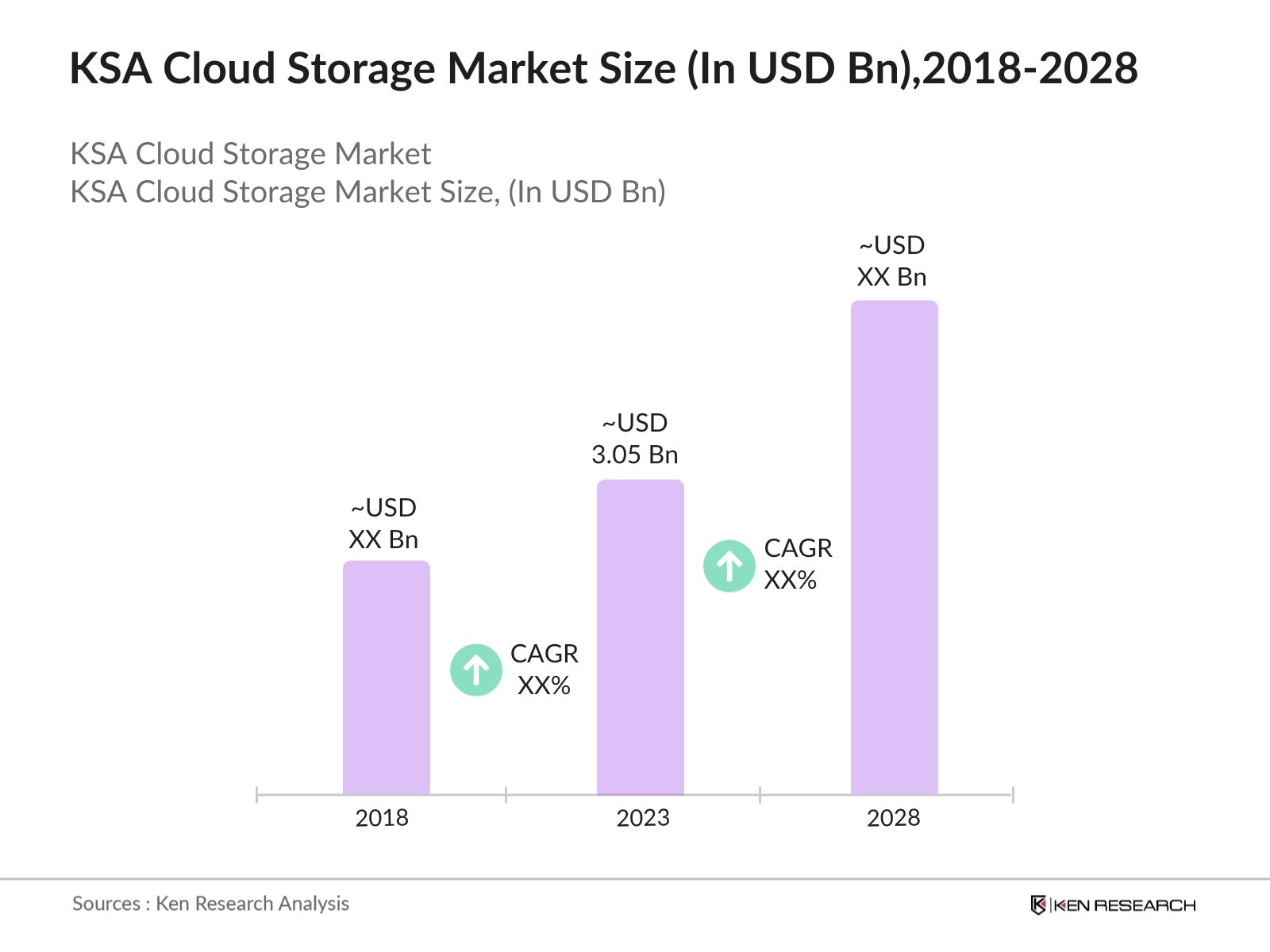

- KSA Cloud Storage Market was valued at USD 3.05 billion in 2023, driven by rapid digital transformation and increased data generation. The market's growth is fueled by rising demand for data storage solutions among businesses and government entities.

- Prominent players in the KSA Cloud Storage Market include IBM, Microsoft, Amazon Web Services (AWS), Oracle, and Google Cloud. These companies lead due to their extensive service offerings, global reach, and strong local partnerships. Their investment in local data centers and tailored solutions for KSA enterprises contribute to their market dominance.

- Riyadh and Jeddah are key cities dominating the KSA Cloud Storage Market. Riyadh's status as the capital and a major business hub drives high demand for cloud solutions among large enterprises and government agencies. Jeddah, as a significant commercial port city, also contributes substantially due to its growing tech industry and business activities.

- In January 2024, IBM inaugurated its regional headquarters in Riyadh, reinforcing its commitment to Saudi Arabia's tech sector. This move aligns with the Kingdom's Vision 2030 economic development plan and aims to enhance services in hybrid cloud and artificial intelligence.

KSA Cloud Storage Market Segmentation

The KSA Cloud Storage Market can be segmented based on several factors:

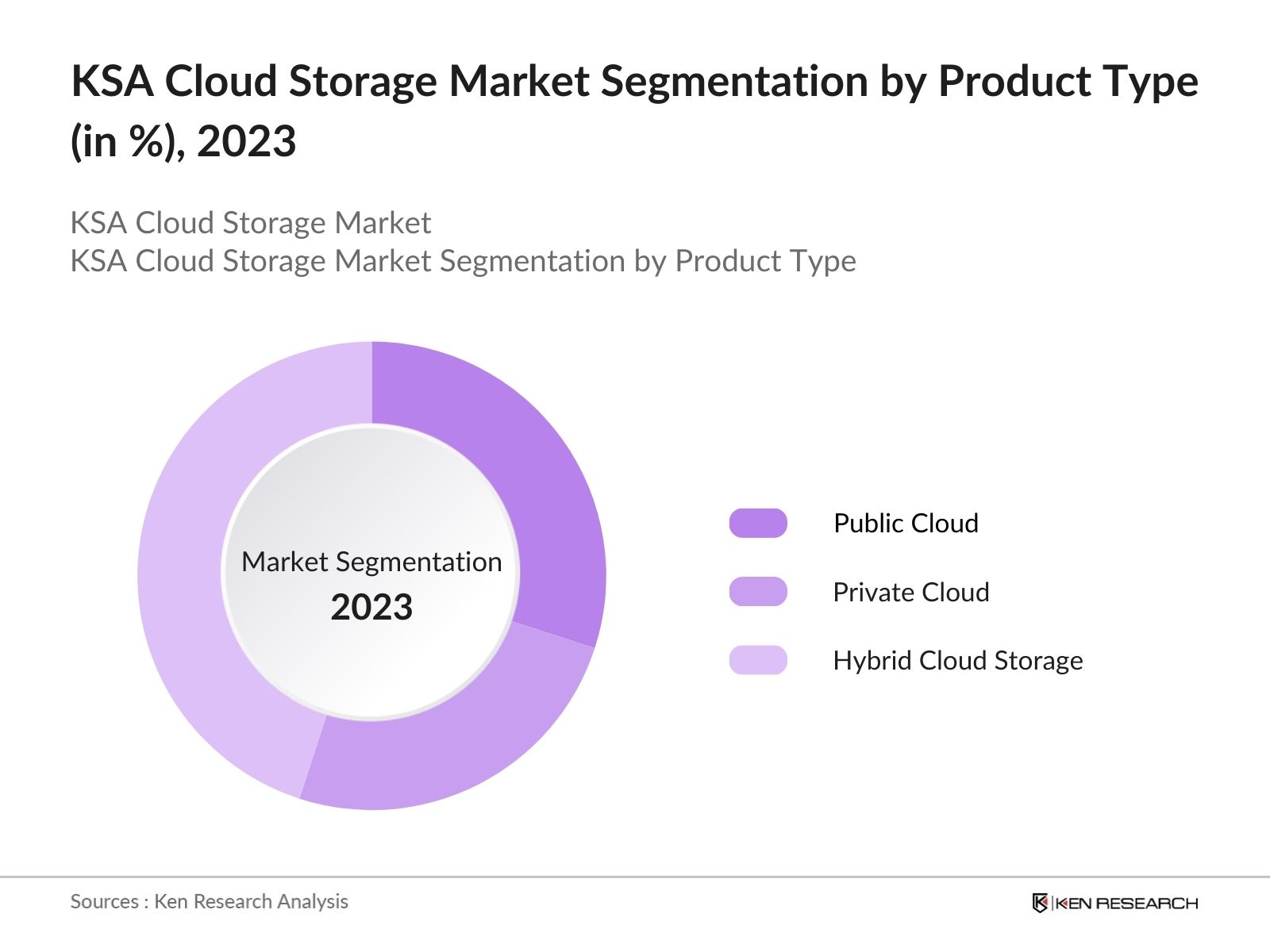

By Product Type: The market is segmented by product type into public cloud, private cloud, and hybrid cloud storage. In 2023, hybrid cloud storage led due to its flexibility in combining public and private cloud advantages, meeting varied data needs while offering cost efficiencies and security. The growing adoption of digital transformation initiatives across various industries in KSA further boosted the demand for hybrid cloud storage, as it allows businesses to scale resources dynamically while maintaining control over sensitive data.

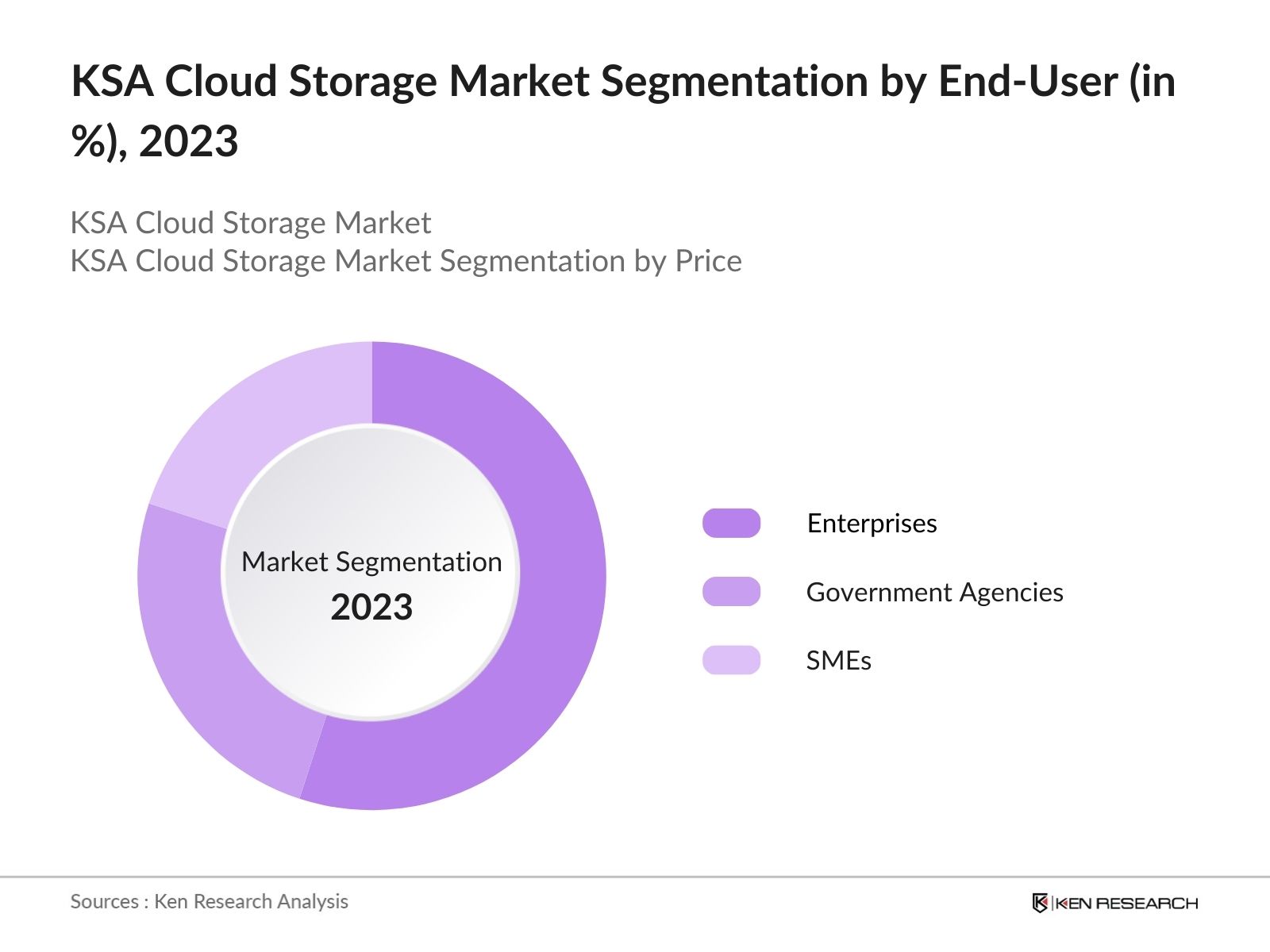

By End User: The market is categorized by end-user into enterprises, government agencies, and SMEs. In 2023, Enterprises hold the largest share due to their extensive data storage needs driven by digital operations, compliance requirements, and large-scale data management. Furthermore, the increasing use of advanced analytics and AI in enterprise operations has accelerated the adoption of cloud storage solutions, enabling faster data processing and real-time decision-making.

By Region: The market is segmented into Central Region, Western Region, Eastern Region, and Southern Region. The Central Region leads due to its concentration of corporate headquarters and governmental bodies requiring extensive cloud storage solutions. Moreover, the Central Region's focus on smart city initiatives and technological innovation further propels the demand for cloud storage, making it a hub for digital transformation in the country.

By Region: The market is segmented into Central Region, Western Region, Eastern Region, and Southern Region. The Central Region leads due to its concentration of corporate headquarters and governmental bodies requiring extensive cloud storage solutions. Moreover, the Central Region's focus on smart city initiatives and technological innovation further propels the demand for cloud storage, making it a hub for digital transformation in the country.

KSA Cloud Storage Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

IBM |

1911 |

Armonk, New York, USA |

|

Microsoft |

1975 |

Redmond, Washington, USA |

|

Amazon Web Services |

2006 |

Seattle, Washington, USA |

|

Oracle |

1977 |

Redwood City, California, USA |

|

Google Cloud |

2008 |

Mountain View, California, USA |

- Cloud Software Group and Microsoft Strategic Partnership: In 2024, Microsoft and Cloud Software Group announced an eight-year strategic partnership aimed at enhancing cloud solutions and generative AI offerings. This collaboration will leverage Citrix's applications and Microsoft Azure to provide integrated services, facilitating a more efficient cloud journey for enterprises.

- Oracle & Google Group: In 2024, Oracle and Google Cloud announced a groundbreaking partnership where Google Cloud will offer Oracle Cloud Infrastructure database services and high-speed network interconnect. Oracle will offer its Exadata Database Service and Autonomous Database Service on Google Cloud, running on Oracle Cloud Infrastructure (OCI) hardware in Google data centers.

KSA Cloud Storage Industry Analysis

Growth Drivers:

- Digital Transformation Initiatives: The KSA governments Vision 2030 outlines significant investments in digital transformation, including a major focus on cloud infrastructure. In 2023, the Kingdom allocated USD 2.5 billion to digital infrastructure projects, enhancing cloud storage capabilities for various sectors. This initiative is aimed at modernizing public and private sector operations, driving growth in cloud storage demand.

- Increase in Data Generation: The volume of data generated in Saudi Arabia exceeded 42 million terabytes in 2023. This massive data growth, driven by advancements in digital services and IoT devices, significantly fuels the demand for cloud storage solutions. As organizations and consumers generate more data, the need for scalable, secure, and cost-effective storage solutions becomes increasingly critical.

- Expansion of Local Data Centers: Major cloud service providers have significantly expanded their data center presence in Saudi Arabia. This growth is fueled by the Kingdom's Vision 2030 initiative, which emphasizes digital transformation and technological advancement. Additionally, increased investments in AI and IoT across various sectors are further boosting the demand for scalable and secure cloud solutions in the region.

KSA Cloud Storage Market Challenges:

- Data Security Concerns: Despite advancements in cloud technology, data security remains a significant challenge. KSA experienced an increase in cyber incidents, underscoring the need for enhanced security measures. Organizations are increasingly concerned about data breaches and compliance with international standards, which can impact cloud storage adoption and market growth.

- Regulatory Compliance Issues: Compliance with evolving data protection regulations can be complex. Saudi Arabia introduced new data protection regulations that require organizations to adhere to stricter data management and security practices. These regulatory changes can increase the complexity and cost of cloud storage solutions, potentially slowing market growth.

KSA Cloud Storage Market Government Initiatives:

- Digital Economy Strategy: Saudi Arabia's Digital Economy Strategy is indeed a key component of Vision 2030, which aims to diversify the economy and reduce reliance on oil revenues. The strategy emphasizes the importance of digital infrastructure and public-private partnerships to support the Kingdom's growing data needs and foster technological advancements. The goal is to enhance the digital economy's contribution to the GDP and promote non-oil sectors, thereby driving economic growth and sustainability.

- Saudi Arabias Cloud Adoption Incentives: In 2024, the Saudi government introduced incentives to promote cloud adoption among small and medium-sized enterprises (SMEs). These incentives include a reduced corporate income tax rate of 5% for up to 20 years and 0% withholding tax on profit repatriation. Additionally, the establishment of Special Economic Zones (SEZs) aims to create a favorable regulatory environment to attract investment in cloud services.

KSA Cloud Storage Future Market Outlook

The Kingdoms strategic investments in digital infrastructure and increasing data generation are expected to drive robust market expansion. By 2028, the demand for cloud storage solutions will likely be fueled by ongoing digital transformation, enhanced data security requirements, and the expansion of local data centers.

Future Trends

- Increased Adoption of Hybrid Cloud Solutions: Over the next five years, hybrid cloud storage solutions are anticipated to become increasingly popular as businesses seek to balance the benefits of public and private cloud environments. This trend will be driven by the need for flexible and scalable storage options that offer both cost efficiency and enhanced security.

- Advancements in Cloud Security Technologies: The market is expected to see significant advancements in cloud security technologies. Enhanced encryption methods, advanced threat detection systems, and comprehensive compliance tools will become standard features in cloud storage solutions, addressing growing concerns about data breaches and regulatory compliance.

Scope of the Report

|

KSA Cloud Storage Market Segmentation |

|

|

By Product Type |

Public Cloud Private Cloud Hybrid Cloud Storage |

|

By End User |

Enterprises Government Agencies SMEs |

|

By Region |

Central Western Eastern Southern |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Retail and E-Commerce Companies

Telecommunications Companies

IT and Technology Companies

Oil and Gas Companies

Health Tech Companies

Logistics Companies

Investment & Venture Capitalist Firms

Government & Regulatory Bodies (e.g., Saudi Ministry of Communications and Information Technology)

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Major Players Mentioned in the Report:

IBM

Microsoft

Amazon Web Services (AWS)

Oracle

Google Cloud

Dell Technologies

Cisco Systems

Huawei

Alibaba Cloud

NetApp

Table of Contents

1. KSA Cloud Storage Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. KSA Cloud Storage Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. KSA Cloud Storage Market Analysis

3.1. Growth Drivers

3.1.1. Digital Transformation Initiatives

3.1.2. Increasing Data Generation

3.1.3. Investments in Cloud Infrastructure

3.2. Restraints

3.2.1. High Costs of Cloud Services

3.2.2. Data Security Concerns

3.2.3. Regulatory Compliance Issues

3.3. Opportunities

3.3.1. Expansion of Local Data Centers

3.3.2. Growing Demand for Hybrid Cloud Solutions

3.3.3. Partnerships and Collaborations

3.4. Trends

3.4.1. Adoption of Multi-Cloud Strategies

3.4.2. Integration with AI and Machine Learning

3.4.3. Emphasis on Data Sovereignty

3.5. Government Regulation

3.5.1. Digital Economy Strategy

3.5.2. National Data Privacy Law

3.5.3. Vision 2030 Initiatives

3.5.4. Cybersecurity Regulations

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Competition Ecosystem

4. KSA Cloud Storage Market Segmentation, 2023

4.1. By Service Type (in Value %)

4.1.1. Infrastructure as a Service (IaaS)

4.1.2. Platform as a Service (PaaS)

4.1.3. Software as a Service (SaaS)

4.2. By Product Type (in Value %)

4.2.1. Public Cloud

4.2.2. Private Cloud

4.2.3. Hybrid Cloud

4.3. By End User (in Value %)

4.3.1. Enterprises

4.3.2. Government Agencies

4.3.3. SMEs

4.4. By Region (in Value %)

4.4.1. Central

4.4.2. Western

4.4.3. Eastern

4.4.4. Southern

5. KSA Cloud Storage Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. Amazon Web Services (AWS)

5.1.2. Microsoft Azure

5.1.3. Google Cloud

5.1.4. IBM Cloud

5.1.5. Oracle Cloud

5.1.6. Alibaba Cloud

5.1.7. SAP Cloud

5.1.8. Salesforce

5.1.9. VMware

5.1.10. Huawei Cloud

5.1.11. Rackspace

5.1.12. DigitalOcean

5.1.13. Tencent Cloud

5.1.14. Red Hat OpenShift

5.1.15. Dell Technologies

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. KSA Cloud Storage Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. KSA Cloud Storage Market Regulatory Framework

7.1. Data Privacy Regulations

7.2. Compliance Requirements

7.3. Certification Processes

8. KSA Cloud Storage Market Future Market Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. KSA Cloud Storage Market Future Market Segmentation, 2028

9.1. By Service Type (in Value %)

9.2. By Product Type (in Value %)

9.3. By End User (in Value %)

9.4. By Region (in Value %)

10. KSA Cloud Storage Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step 2: Market Building:

Collating statistics on KSA Cloud Storage Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for KSA Cloud Storage Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step 3: Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research output:

Our team will approach multiple cloud storage companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from cloud storage companies.

Frequently Asked Questions

01 How big is KSA Cloud Storage Market?

KSA Cloud Storage Market was valued at USD 3.05 billion in 2023, driven by rapid digital transformation and increased data generation. The market's growth is fueled by rising demand for data storage solutions among businesses and government entities.

02 What are the growth drivers of the KSA Cloud Storage market?

Growth drivers for the KSA Cloud Storage market include substantial investments in digital infrastructure under Vision 2030, a significant increase in data generation, and the expansion of local data centers by major cloud service providers.

03 What are challenges in KSA Cloud Storage Market?

Challenges in the KSA Cloud Storage market include data security concerns, high costs of cloud services, and regulatory compliance issues. These factors can impact adoption rates and market growth.

04 Who are major players in the KSA Cloud Storage Market?

Prominent players in the KSA Cloud Storage Market include IBM, Microsoft, Amazon Web Services (AWS), Oracle, and Google Cloud. These companies lead due to their extensive service offerings, global reach, and strong local partnerships.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.