KSA Cold Chain Market Outlook to 2030

Driven by Increase in Demand by the End Users, Adoption of Latest Technology and Government Initiatives

Region:Middle East

Author(s):Rhythm and Nishika

Product Code:KR1455

October 2024

107

About the Report

KSA Cold Chain Market overview

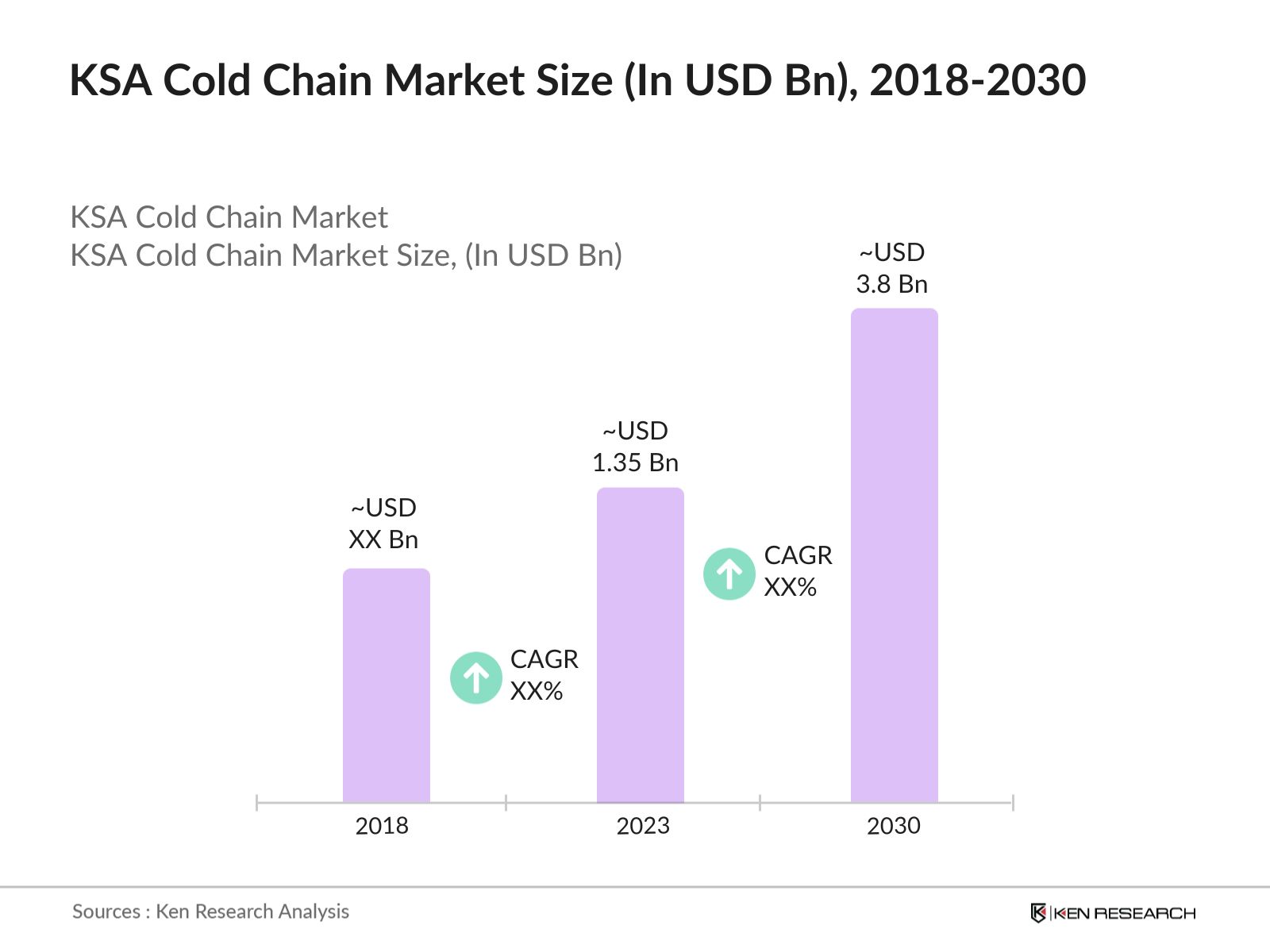

- The KSA cold chain market has witnessed significant growth in 2023, the market size was USD 1.35 billion. This robust growth is primarily driven by increasing demand for temperature-sensitive products, such as pharmaceuticals, fresh produce, and dairy, which require specialized storage and transportation solutions to maintain their quality and shelf life.

- Major players in this market include Agility Logistics, Tamer Logistics, Maersk, Mosanada Logistics, and Starlinks. These companies dominate the market by providing comprehensive cold chain logistics solutions, including storage, transportation, and value-added services like packaging and customs clearance.

- In October 2019, Agility, a leading global logistics provider, announced the opening of a new 900,000 square meter logistics park in Riyadh.This new facility, developed by Agility Logistics Parks (ALP), included 250,000 sqm of built-up, high standard warehousing and logistics facilities.The Riyadh ALP was part of a series of investments by Agility in Saudi Arabia valued at 1 billion Saudi riyals (SAR).

- Riyadh, the capital city, dominates the cold chain market in KSA due to its strategic location and robust infrastructure in 2023, hosting major players like Agility Logistics and Tamer Logistics. The city's central location makes it an ideal hub for distributing goods to other regions, thus enhancing its dominance in the market.

KSA Cold Chain Market Segmentation

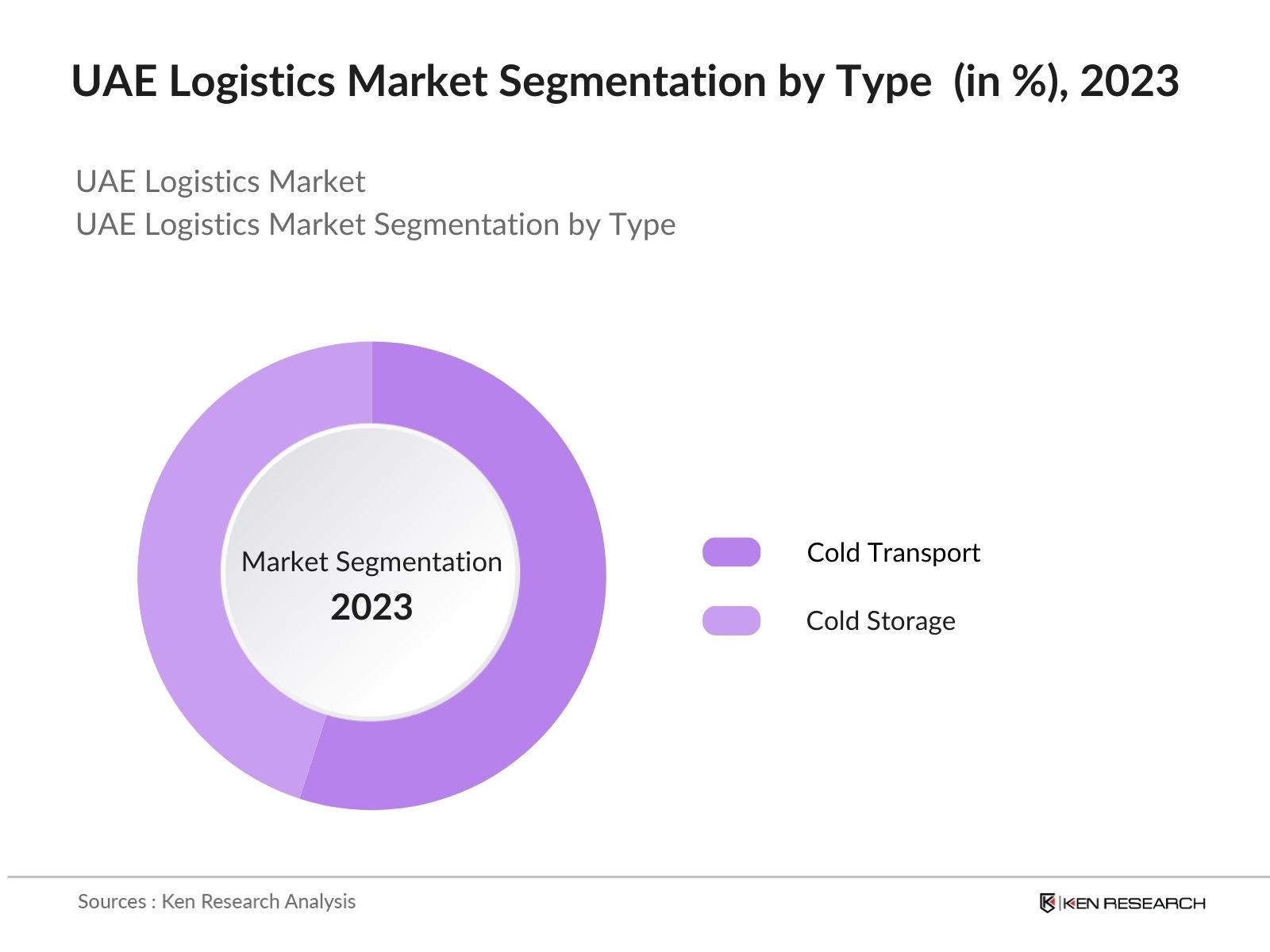

By Type: The KSA Cold Chain Market is segmented by type into cold storage and cold transport. In 2023, Cold transport dominates the market due to the country's extreme climate, which necessitates efficient temperature-controlled logistics to maintain the quality and safety of perishable goods. High demand for fresh produce, dairy, and pharmaceuticals drives the importance of cold transport in ensuring timely and safe deliveries.

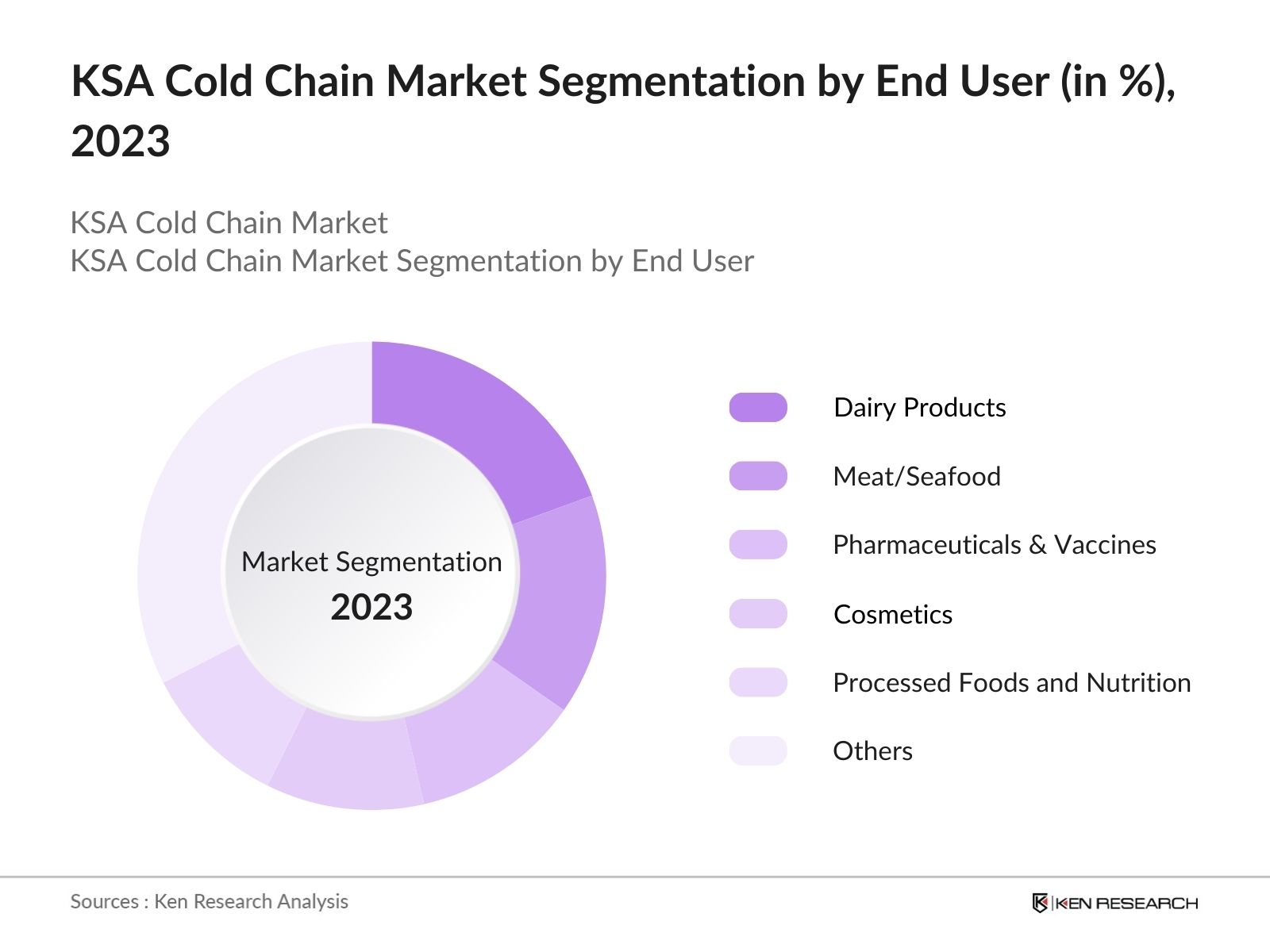

By End Users: The KSA cold chain market is also segmented by end users into dairy products, meat/seafood, pharmaceuticals, cosmetics, processed food and others. In 2023, dairy products were the leading segment. This is due to the high demand for temperature-controlled environments required for dairy storage to maintain product freshness and quality. driven by the necessity for cold storage solutions to preserve perishable products during transit.

By Region: The KSA cold chain market segmented by region into Riyadh, Jeddah, Damman, Tabuk, Madina, Makkah. In 2023, Riyadh was the leading segment. This central position drives high demand for cold storage solutions across various sectors including retail, healthcare, and logistics, reflecting its significant economic activity.

KSA Cold Chain Company Landscape

|

Company |

Establishment Year |

Headquarters |

|

Agility Logistics |

1979 |

Kuwait City, Kuwait |

|

Tamer Logistics |

1922 |

Jeddah, Saudi Arabia |

|

Maersk |

1904 |

Copenhagen, Denmark |

|

Mosanada Logistics |

2007 |

Riyadh, Saudi Arabia |

|

Starlinks |

2002 |

Jeddah, Saudi Arabia |

- TANKZEN Logistics Expansion: TANKZEN Logistics recently opened a new facility in Dubai, known as the Dubai DWC, spanning 6,000 square meters. This expansion reflects the companys strategy to strengthen its regional presence and enhance its capacity to serve key clients in the F&B, pharmaceutical, and retail sectors across the GCC countries.

- NAQEL Express Fleet Conversion Initiative: NAQEL Express has partnered with the National Transportation Solutions Company to convert its entire fleet by 2040. This partnership aims to upgrade the companys fleet for enhanced efficiency and environmental compliance, ensuring readiness to serve the expanding logistics needs of the Red Sea and Amaala regions.

KSA Cold Chain Industry Analysis

KSA Cold Chain Market Growth Drivers

- Reliance on Imports for Food Ingredients: Saudi food manufacturers heavily rely on imports for food ingredients, importing $3 billion worth of intermediate food products in 2023. This reliance drives the need for robust cold transportation solutions to maintain the quality and safety of these imported goods, supporting the growth of the cold transport market in KSA.

- Adoption of Modern Technologies: The adoption of modern technologies such as Transportation Management Systems (TMS) by companies enhances the efficiency of cold transportation. These technologies facilitate real-time tracking and optimized route planning, which has significantly contributed to the growth of the cold transport market in Saudi Arabia by improving service reliability and customer satisfaction.

- Rising Demand for Perishable Goods: The increasing demand for perishable goods, including fresh produce, dairy products, and meat, both domestically and internationally, is driving the expansion of cold chain logistics in KSA. Companies like Almarai have responded by expanding their cold chain networks, adding 1,100 refrigerated trucks and trailers to meet the growing demand for reliable cold transport solutions.

KSA Cold Chain Market Challenges

- Labor Availability: Saudi Arabia's cold chain market faces significant challenges due to a shortage of skilled and unskilled labor. This issue has been exacerbated by the implementation of dependent fees on expats in 2016, leading many foreign workers to leave the country. This labor scarcity impacts the operational capacity and service efficiency of cold chain companies.

- Limited Technology: The adoption of advanced technologies such as real-time monitoring systems, automated inventory management, and cloud-based data systems in KSA's cold chain market is limited. High costs, coupled with a lack of awareness and technical expertise, hinder the widespread implementation of these technologies, affecting the optimization of cold chain operations and overall market growth.

KSA Cold Chain Market Government Initiatives

- Infrastructure Enhancements for Cold Transportation: The Saudi government is investing in major road projects to facilitate cold transportation. This includes constructing new bridges like the King Fahd Causeway and upgrading existing road networks such as the Makkah-Jeddah highway. Additionally, the Riyadh-Qassim highway expansion, spanning 337 kilometers, significantly reduces travel times, improving the efficiency and reliability of cold chain logistics.

- Development of Specialized Sea Port Facilities: Saudi Arabia's government has enhanced its sea network with specialized equipment, including refrigerated containers at the Port of Dammam, maintaining temperatures from -25C to +25C. The Port of Jeddah features a cold storage facility with a 20,000-ton capacity, supporting temperature and humidity controls. The countrys 21 modern ports handle two million TEUs annually, accommodating around 12,000 ships and 200 berths.

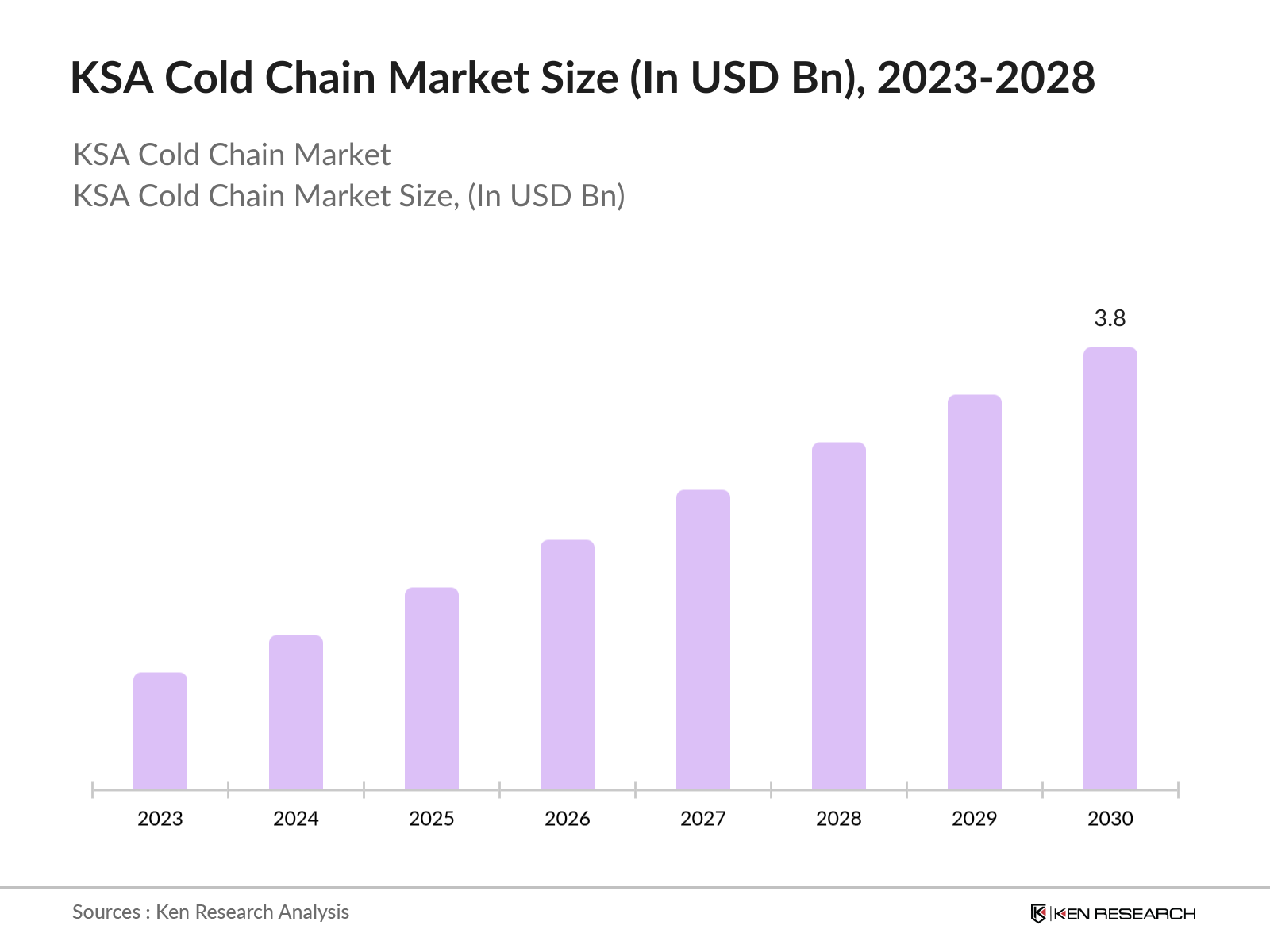

KSA Cold Chain Market Future Outlook

Looking forward to 2030, the global specialty fertilizer market is expected to continue its growth, with a projected market size of USD 3.8 Bn. The demand for specialty fertilizers will be driven by the increasing adoption of precision farming techniques, growing awareness about sustainable agriculture practices, and government initiatives aimed at boosting agricultural productivity.

Future Trends

- Robotics and Automation: The future of the KSA cold chain market will see increased adoption of robotics and automation, like robotic palletizers and conveyor systems. Companies like SADAFCO are already implementing these technologies to enhance efficiency and reduce labor costs, which is expected to become a standard across the industry, driving significant improvements in productivity and cost management.

- Blockchain Technology for Traceability: Blockchain technology will play a crucial role in the KSA cold chain market by enhancing traceability and transparency. Saudi Aramco's partnership with Circularise blockchain for tracking CO2 emissions demonstrates the potential for blockchain to ensure product quality and safety throughout the supply chain. This trend is expected to expand, improving overall supply chain integrity and compliance.

Scope of the Report

|

KSA Cold Chain Market Segmentation |

|

|

By Type |

Cold Storage Cold Transport |

|

By End User |

Dairy Products Meat/Seafood Pharmaceuticals & Vaccines Cosmetics Processed Foods and Nutrition Fruits and Vegetables Ice Cream and Frozen Desserts Lab Samples Others |

|

By Region |

Riyadh Jeddah Damman Tabuk Madina Makkah Others |

|

KSA Cold Storage Market Segmentation |

|

|

By Temperature Range |

Ambient Freezers Chillers |

|

By Automation |

Automated Pallets Non-Automated Pallets |

|

By End Users |

Dairy Products Meat/Seafood Pharmaceuticals & Vaccines Cosmetics Processed Foods and Nutrition Fruits and Vegetables Ice Cream and Frozen Desserts Lab Samples Others |

|

By Region |

Riyadh Jeddah Damman Tabuk Madina Makkah Others |

|

KSA Cold Transport Market Segmentation |

|

|

By Mode of Transport |

Land Air Sea |

|

By Location |

International Domestic |

|

By Type |

Long Haul Last Mile |

|

By End Users |

Dairy Products Meat/Seafood Pharmaceuticals & Vaccines Cosmetics Processed Foods and Nutrition Fruits and Vegetables Ice Cream and Frozen Desserts Lab Samples Others |

Products

Key Target Audience:

Cold Chain Logistics Providers

Refrigerator Equipment Manufacturers

End User associations of Cold Chain

Cold storage facility operators

Transportation service providers

Technology providers for cold chain solutions

Government agencies (Saudi Food and Drug Authority)

Investors and VC Firms

Banks and Financial Institutions

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2030

Companies

Players Mentioned in the Report:

Agility Logistics

Tamer Logistics

MAERSK

Mosanada Logistics

StarLinks

Hala

Takhzeen

NAQEL

Flow Progressive

LSC

Wared Logistics

Leha Logistics

Globus Logistics

Advanced Storage Co.

Etmam Logistics

Table of Contents

1. Executive Summary

1.1 Executive Summary of KSA Cold Chain Market

2. KSA - Country Overview, 2023

2.1 KSA Country Demographics, 2023

2.2 Cross Comparison of Quality of Infrastructure of GCC Countries

3. Infrastructural Analysis of KSA

3.1 Infrastructure Overview of KSA

3.2 Road Transport Overview

3.3 Rail Network Overview

3.4 Air Transport Overview

3.5 Sea Transport Overview

3.6 Regional Analysis of Major Cities in KSA

4. KSA Cold Chain Market Overview and Genesis

4.1 Supply Side Ecosystem of KSA Cold Chain Market

4.2 Demand Side Ecosystem of KSA Cold Chain Market

4.3 Business Cycle and Genesis of KSA Cold Chain Market

4.4 Value Chain Analysis of KSA Cold Chain Market

4.5 Existing Technologies in KSA Cold Chain Market

5. KSA Cold Chain Market Sizing and Segmentation, 2018-2023

5.1 KSA Cold Chain Market Sizing Analysis, 2018-2023

5.2 KSA Cold Chain Market Segmentation by Cold Storage and Cold Transport, 2018-2023

6. KSA Cold Storage Market

6.1 KSA Cold Storage Market Ecosystem

6.2 KSA Cold Storage Market Sizing Analysis, 2018-2023

6.3 KSA Cold Storage Market Segmentation by Temperature Range, 2023

6.4 KSA Cold Storage Market Segmentation by Automation (By Pallets), 2023

6.5 Automation in Cold Storages in KSA

6.6 KSA Cold Storage Market Segmentation by End User, 2023

6.7 KSA Cold Storage Market Segmentation by Region, 2023

7. KSA Cold Transport Market Overview

7.1 KSA Cold Storage Market Ecosystem

7.2 KSA Cold Transport Market Revenue, 2018-2023

7.3 KSA Cold Transport Market Segmentation by Mode of Transportation, 2023

7.4 KSA Cold Transport Market Segmentation by Location, 2023

7.5 KSA Cold Transport Market Segmentation by End User, 2023

8. KSA Cold Chain Industry Analysis

8.1 PESTEL Analysis

8.2 Decision Making Process for KSA Cold Chain Market

8.3 Recent Trends in KSA Cold Chain Market

8.4 Issues & Challenges in KSA Cold Chain Market

8.5 Regulatory Landscape in KSA Cold Chain Market

8.6 Government Rules and Regulations for Products in KSA

8.7 Saudi Vision 2030: Nine-Point Logistics Transformation Strategy

8.8 Emerging Technologies in KSA Cold Chain Market

9. KSA Cold Chain Market Competition Landscape

9.1 Market Share of Major Cold Chain Players in KSA

9.2 Cross Comparison of KSA Cold Chain Market Players

10. End User Analysis of KSA Cold Chain Market

10.1 Key Temperature Controlled Products with Different Shelf Lives

10.2 End-User Analysis: Pharma, Food and Nutrition, Dairy, Processed Food, Cosmetics, Ice-cream and Frozen Desserts, Fruits and Vegetables, and Lab Samples

11. Future Outlook of KSA Cold Chain Market, 2023-2030

11.1 Future Market Sizing of KSA Cold Chain Industry, 2023-2030

11.2 Future Market Segmentation of KSA Cold Chain Market by Market Type, 2030

11.3 Future Market Segmentation of KSA Cold Chain Market by End User, 2030

11.4 Future Market Sizing of Cold Storage, 2023-2030

11.5 Future Cold Storage Segmentation by Temperature, 2023-2030

11.6 Future Segmentation by Major Cities, 2030

11.7 Future Segmentation by End User, 2030

11.8 KSA Cold Transport Market Revenue, 2023-2030

11.9 Future Segmentation by Mode of Transportation, 2030

11.10 Future Market Segmentation by Location, 2030

12. Investment Opportunity in Controlled Room Temperature in KSA

12.1 Opportunity Description for Controlled Room Temperature in KSA

13. Analyst Recommendation

13.1 Ansoff's Matrix for KSA Cold Chain Market

13.2 Cluster Analysis: KSA Cold Chain Market

13.3 Policy Implications

13.4 Recommendations to Set Up a Cold Chain Unit in KSA

13.5 Market Opportunities in KSA Cold Chain Market

13.6 Inorganic Expansion Strategies in KSA Cold Chain Market

14. Research Methodology

14.1 Market Definitions and Assumptions

14.2 Abbreviations

14.3 Market Sizing Approach

14.4 Consolidated Research Approach

14.5 Sample Size Inclusion

14.6 Limitation and Future Conclusion

15. Disclaimer and Contact Us

15.1 Standard disclaimer about the report and contact information

Research Methodology

Step 1: Hypothesis Creation:

The research team first framed a hypothesis about the market through analysis of existing industry factors, obtained from company reports and from magazines, journals, online articles, ministries, government associations and data from KSA Ministry of Transport, KSA Statistics Authority, World Bank and others. We have used both public and proprietary databases to define each market and collect data points about the same.

Step 2: Hypothesis Testing:

The research team then conducted CATI (Computer Assisted Telephonic Interviews) with several industry veterans including decision makers from DSV (Agility Logistics), Mosanada Logistics, Starlinks and others in the ecosystem to get their insight on the market onboard and to seek justification to the hypothesis framed by the team.

Step 3: Interpretation and Proofreading:

The final analysis was interpreted in the research report by our expert team well versed with the cold chain industry.

Frequently Asked Questions

01 How big is the KSA Cold Chain Market?

The KSA Cold Chain Market was valued at USD 1.35 billion in 2023, driven by increasing demand for temperature-sensitive products, expansion of the pharmaceutical sector, and technological advancements in cold storage and transportation.

02 What are the challenges in the KSA Cold Chain Market?

Challenges in the KSA Cold Chain Market include high operational costs, lack of skilled workforce, infrastructure limitations, and stringent regulatory requirements that increase compliance costs for cold chain providers.

03 Who are the major players in the KSA Cold Chain Market?

Major players in the KSA Cold Chain Market include Agility Logistics, Tamer Logistics, Maersk, Mosanada Logistics, and Starlinks. These companies lead the market due to their extensive service offerings, advanced technologies, and strong distribution networks.

04 What are the growth drivers of the KSA Cold Chain Market?

Growth drivers for the KSA Cold Chain Market include the rising demand for perishable goods, increasing pharmaceutical and vaccine storage needs, government investments in cold chain infrastructure, and the adoption of advanced technologies like IoT and AI for better logistics management.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.