KSA Cold Chain Packaging Market Outlook to 2030

Region:Middle East

Author(s):Abhinav kumar

Product Code:KROD6290

November 2024

97

About the Report

KSA Cold Chain Packaging Market Overview

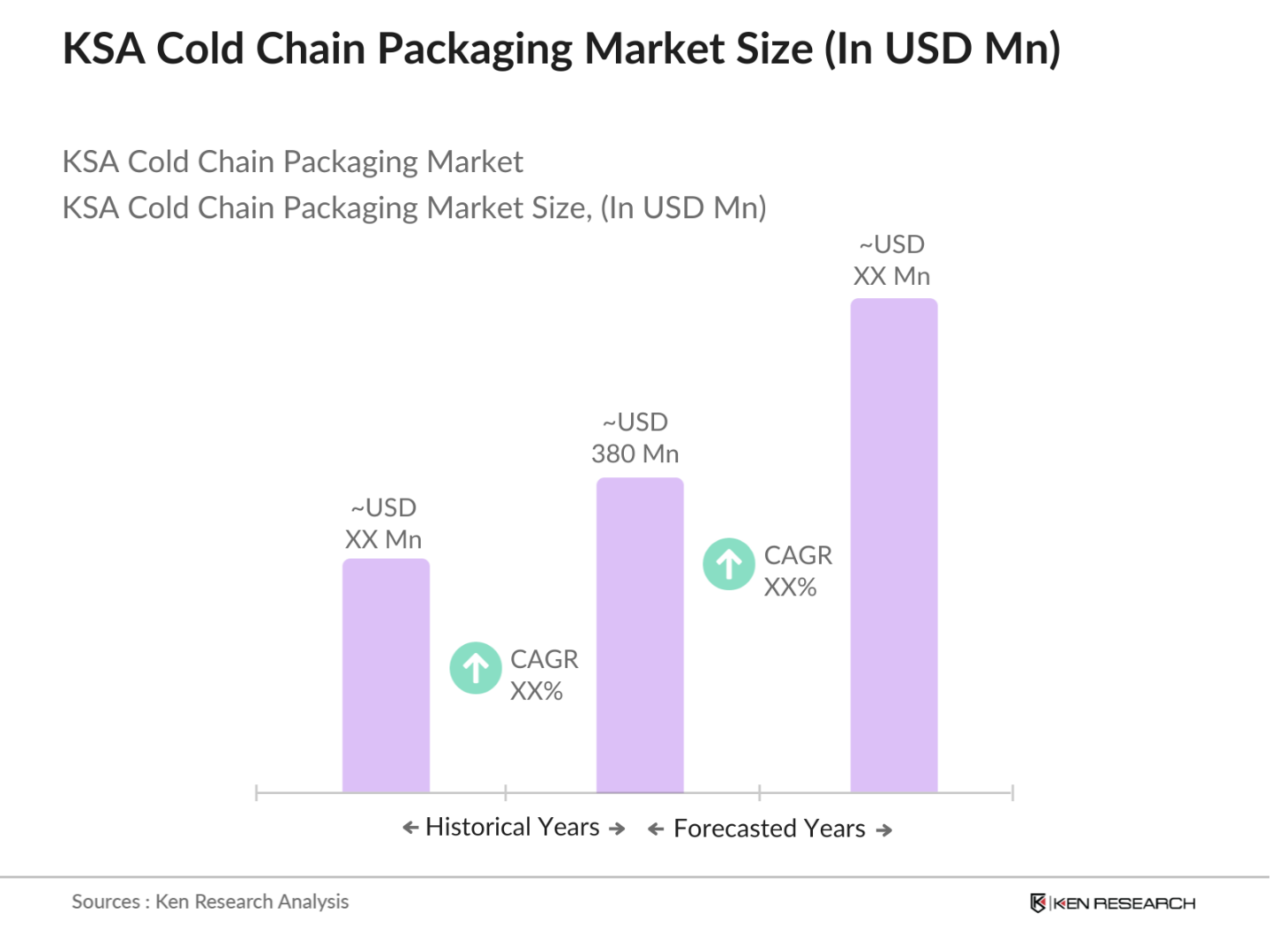

- The KSA cold chain packaging market has reached a value of USD 380 million, driven by significant growth in sectors requiring temperature-sensitive storage and transportation, such as pharmaceuticals and food & beverage. The demand for cold chain packaging has surged as Saudi Arabia continues to increase its investments in healthcare infrastructure and food safety regulations. The rising demand for vaccines and biologics, along with the expansion of the food delivery and e-commerce sectors, has contributed to the markets steady growth.

- Key cities such as Riyadh and Jeddah dominate the KSA cold chain packaging market due to their well-established logistics infrastructure and proximity to major industrial zones. These cities serve as key hubs for both domestic and international trade, which has led to increased demand for reliable and advanced cold chain solutions. Additionally, the governments focus on transforming Saudi Arabia into a logistics hub under its Vision 2030 initiative has fostered the growth of cold chain networks in these regions.

- There is a notable increase in the demand for sustainable cold chain packaging solutions in Saudi Arabia, driven by both regulatory pressures and consumer preferences. As of 2023, approximately 30% of consumers in Saudi Arabia express a preference for brands that utilize environmentally friendly packaging. The government's initiatives, including the National Waste Management Strategy, aim to reduce waste and promote recycling, leading companies to adopt sustainable practices. This growing awareness among consumers creates an imperative for businesses to invest in green cold chain packaging solutions to remain competitive.

KSA Cold Chain Packaging Market Segmentation

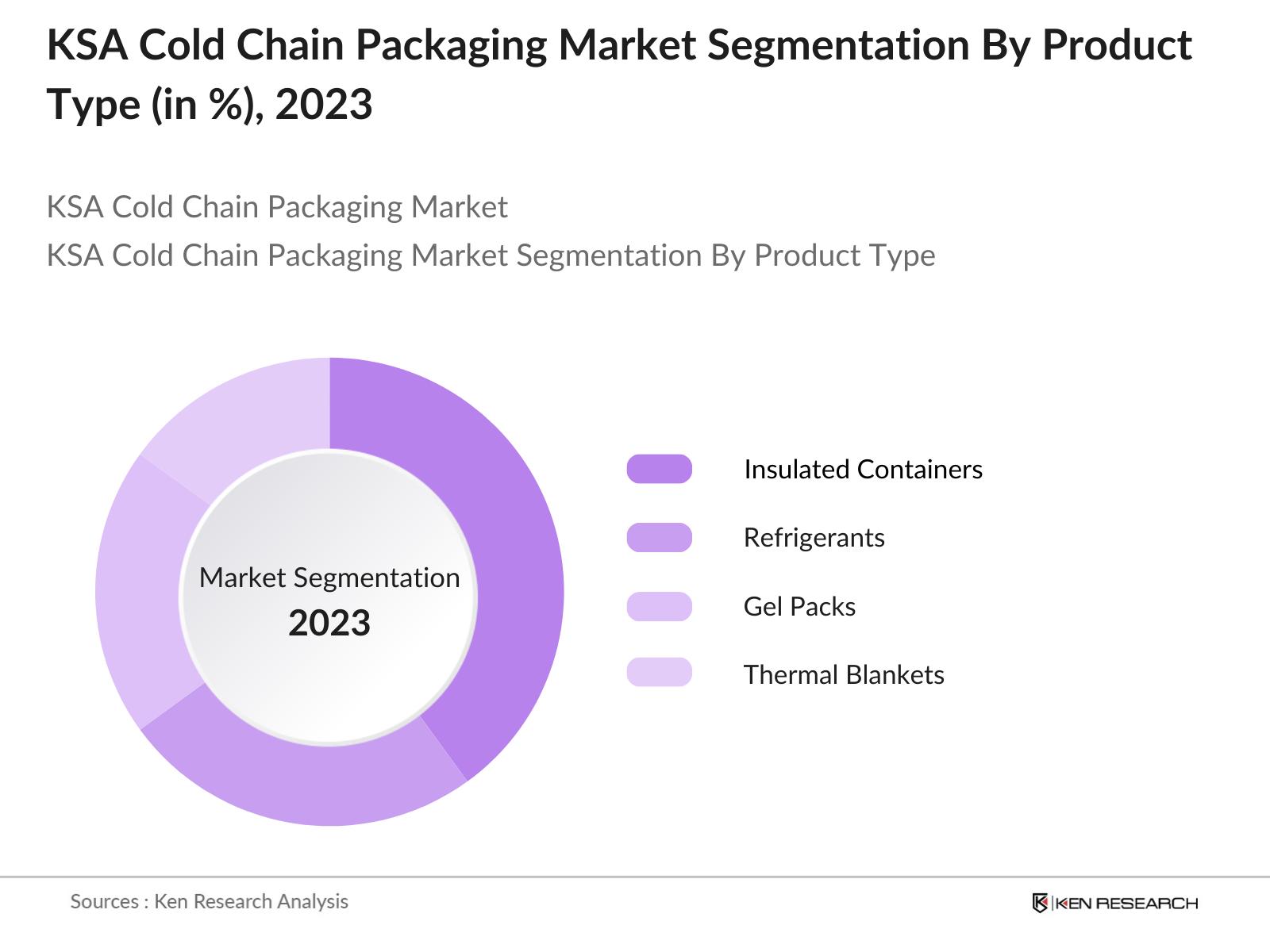

By Product Type: The KSA cold chain packaging market is segmented by product type into insulated containers, refrigerants, gel packs, thermal blankets, and phase change materials. Insulated containers hold the dominant market share due to their extensive use in transporting pharmaceutical products and perishable food items. The versatility and ability to maintain temperature control for extended periods make insulated containers a preferred choice for businesses seeking efficiency in long-haul shipments and storage solutions.

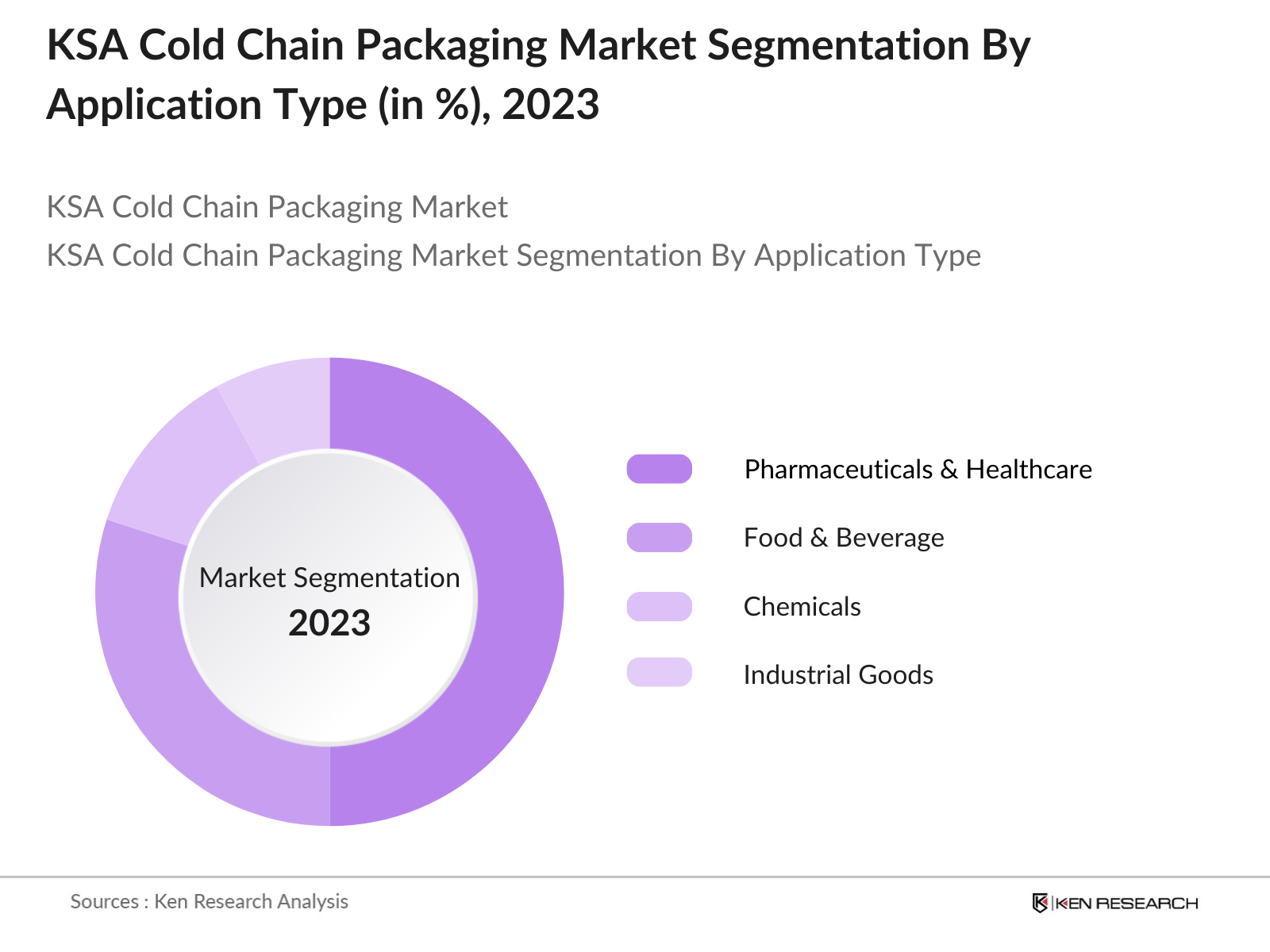

By Application: The market is also segmented by application into food and beverage, pharmaceuticals and healthcare, chemicals, industrial goods, and other specialty items. The pharmaceutical and healthcare sector dominates the application segmentation, driven by the increasing demand for vaccines, biologics, and temperature-sensitive medicines. As Saudi Arabia strengthens its healthcare system, the need for safe and reliable cold chain packaging in pharmaceuticals continues to grow, further contributing to this segments leadership in the market.

KSA Cold Chain Packaging Market Competitive Landscape

The KSA cold chain packaging market is dominated by several major players, both global and regional, who have established strong supply chains and product offerings to meet growing demands. The KSA cold chain packaging market is characterized by the presence of established players such as Sonoco ThermoSafe and Pelican BioThermal, along with emerging regional companies. These companies have consistently innovated and expanded their product portfolios to cater to the diverse needs of pharmaceuticals, food, and chemical industries. Local logistics providers are also increasing their cold storage capacities to better serve the expanding market for temperature-sensitive goods.

KSA Cold Chain Packaging Industry Analysis

Growth Drivers

- Rising Demand for Temperature-Sensitive Goods: The demand for temperature-sensitive goods in Saudi Arabia is significantly rising, with the healthcare and food sectors being primary drivers. For instance, the pharmaceutical market in Saudi Arabia is projected to reach approximately SAR 38.5 billion in 2024, up from SAR 33.1 billion in 2022. This growth is closely linked to the increasing consumption of temperature-sensitive drugs, such as vaccines and biologics, which require strict temperature control. Furthermore, the food sector is projected to grow to SAR 87 billion by 2024, necessitating robust cold chain solutions to ensure product integrity.

- Increased Healthcare Sector Investments: The Saudi government is heavily investing in the healthcare sector as part of its Vision 2030 initiative, which aims to enhance healthcare infrastructure and services. In 2023, the Ministry of Health's budget increased to SAR 167 billion, a rise from SAR 147 billion in 2022. This investment supports the expansion of healthcare facilities and the integration of advanced cold chain solutions to maintain the efficacy of sensitive medications. Additionally, the governments focus on building 80 new hospitals and expanding healthcare services contributes to the growing demand for effective cold chain packaging solutions.

- Expansion of E-commerce in Food Delivery: The e-commerce food delivery market in Saudi Arabia is projected to reach SAR 22 billion by the end of 2023, increasing the need for efficient cold chain logistics. With an annual growth rate of over 10% in the online grocery segment, there is a significant uptick in demand for refrigerated packaging solutions to ensure food safety and quality during transit. The rise of platforms like Nana and Talabat exemplifies this trend, emphasizing the need for reliable cold chain systems that adhere to temperature control standards. This burgeoning sector drives investment in innovative cold chain packaging solutions.

Market Challenges

- High Costs of Advanced Packaging Solutions: Despite the growing demand for cold chain packaging, the high costs associated with advanced solutions pose a significant challenge for market participants. The investment required for state-of-the-art insulated containers and temperature monitoring systems can exceed SAR 150,000 per unit, a substantial barrier for small to medium enterprises. Additionally, operational costs related to maintaining a temperature-controlled environment further strain budgets. This financial challenge restricts the scalability of cold chain operations, limiting market growth potential and access for emerging businesses in the sector.

- Lack of Skilled Workforce in Cold Chain Management: The cold chain packaging market in Saudi Arabia faces a significant skills gap, with only 30% of cold chain professionals possessing the necessary expertise to manage temperature-sensitive logistics effectively. This lack of skilled personnel results in operational inefficiencies and increased risks of product spoilage. According to a recent study by the Technical and Vocational Training Corporation, the need for skilled workers in logistics is projected to reach 120,000 by 2025, while current training programs

KSA Cold Chain Packaging Market Future Outlook

Over the next five years, the KSA cold chain packaging market is expected to see considerable growth. This expansion will be fueled by increasing demand for temperature-sensitive products such as pharmaceuticals, vaccines, and frozen foods. The Saudi governments ongoing investments in healthcare infrastructure and logistics development under Vision 2030 will further drive growth in this market. Additionally, advancements in packaging technologies, such as smart sensors and RFID tracking, will support the industrys evolution, enabling more efficient monitoring and management of cold chain logistics.

Opportunities

- Integration of IoT and Smart Technologies: The integration of IoT and smart technologies in cold chain logistics presents significant opportunities for market growth. Currently, about 15% of cold chain operations utilize IoT technology for real-time monitoring and tracking of temperature-sensitive goods. This figure is expected to double by 2025, driven by the increasing adoption of smart sensors and monitoring systems. Such advancements enhance operational efficiency and product safety, thereby attracting investment into the cold chain packaging sector. This shift not only optimizes logistics but also reduces waste, leading to a more sustainable approach in the industry.

- Increasing International Trade Agreements: Saudi Arabia is actively pursuing international trade agreements that enhance export opportunities for its temperature-sensitive goods. The recent Free Trade Agreement with the European Union, effective from 2023, aims to facilitate smoother trade in perishable goods, thus increasing the demand for efficient cold chain packaging solutions. The kingdom's strategic location and growing network of trade partnerships are poised to boost its role as a regional logistics hub, thereby creating substantial growth opportunities for the cold chain packaging market in the coming years.

Scope of the Report

|

By Product Type |

Insulated Containers Refrigerants Thermal Blankets Gel Packs Others |

|

By Application |

Food and Beverage Pharmaceuticals and Healthcare Chemicals, Industrial Goods Other Specialty Items |

|

By Packaging Material |

Plastic Paper and Paperboard Metal Glass |

|

By Temperature Range |

Frozen Chilled Ambient |

|

By Region |

Central Region Western Region Eastern Region Northern Region Southern Region |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Pharmaceutical Manufacturing Companies

Food and Beverage Manufacturing Companies

Chemical Manufacturing Companies

Logistics and Cold Chain Industries

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (Saudi Food and Drug Authority - SFDA, Ministry of Health - MOH)

Packaging Material Supplier Companies

Transportation and Freight Companies

Companies

Players Mentioned in the Report

Sonoco ThermoSafe

Pelican BioThermal

Cold Chain Technologies

Va-Q-Tec AG

Sofrigam SA

Cryopak Industries

Clariant AG

Softbox Systems Ltd.

Saeplast

CSafe Global

Table of Contents

1. KSA Cold Chain Packaging Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. KSA Cold Chain Packaging Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. KSA Cold Chain Packaging Market Analysis

3.1 Growth Drivers

3.1.1 Rising Demand for Temperature-Sensitive Goods

3.1.2 Increased Healthcare Sector Investments

3.1.3 Expansion of E-commerce in Food Delivery

3.1.4 Government Support for Logistics Sector Development

3.2 Market Challenges

3.2.1 High Costs of Advanced Packaging Solutions

3.2.2 Lack of Skilled Workforce in Cold Chain Management

3.2.3 Infrastructure Gaps in Cold Storage

3.3 Opportunities

3.3.1 Integration of IoT and Smart Technologies

3.3.2 Increasing International Trade Agreements

3.3.3 Adoption of Eco-Friendly Packaging Solutions

3.4 Trends

3.4.1 Growing Demand for Sustainable Cold Chain Packaging

3.4.2 Adoption of Reusable Packaging in Logistics

3.4.3 Use of RFID and Sensor-Based Monitoring Solutions

3.5 Government Regulations

3.5.1 Saudi Vision 2030s Impact on Logistics and Packaging

3.5.2 National Guidelines for Food and Pharmaceutical Transportation

3.5.3 Import/Export Compliance for Temperature-Controlled Goods

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces

3.9 Competition Ecosystem

4. KSA Cold Chain Packaging Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Insulated Containers

4.1.2 Refrigerants

4.1.3 Thermal Blankets

4.1.4 Gel Packs

4.1.5 Others (Phase Change Materials)

4.2 By Application (In Value %)

4.2.1 Food and Beverage

4.2.2 Pharmaceuticals and Healthcare

4.2.3 Chemicals

4.2.4 Industrial Goods

4.2.5 Other Specialty Items

4.3 By Packaging Material (In Value %)

4.3.1 Plastic

4.3.2 Paper and Paperboard

4.3.3 Metal

4.3.4 Glass

4.4 By Temperature Range (In Value %)

4.4.1 Frozen

4.4.2 Chilled

4.4.3 Ambient

4.5 By Region (In Value %)

4.5.1 Central Region

4.5.2 Western Region

4.5.3 Eastern Region

4.5.4 Northern Region

4.5.5 Southern Region

5. KSA Cold Chain Packaging Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Sonoco ThermoSafe

5.1.2. Cold Chain Technologies, Inc.

5.1.3. Softbox Systems Ltd.

5.1.4. Pelican BioThermal

5.1.5. Cryopak Industries

5.1.6. Saeplast

5.1.7. Intelsius (DGP Group)

5.1.8. Clariant AG

5.1.9. Envirotainer AB

5.1.10. CSafe Global

5.1.11. Va-Q-Tec AG

5.1.12. Sofrigam SA

5.1.13. CoolPac Pty Ltd.

5.1.14. Thermal Packaging Solutions

5.1.15. Topa Thermal

5.2 Cross-Comparison Parameters

5.2.1 Headquarters Location

5.2.2 Revenue (USD Mn)

5.2.3 Number of Employees

5.2.4 Year of Establishment

5.2.5 Market Share (Percentage)

5.2.6 Product Range Diversification

5.2.7 Innovation and R&D Investments

5.2.8 Geographical Reach

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital and Private Equity Funding

6. KSA Cold Chain Packaging Market Regulatory Framework

6.1 Compliance with Saudi Food and Drug Authority (SFDA) Regulations

6.2 ISO and HACCP Certifications for Cold Chain Packaging

6.3 Customs and Import Regulations for Cold Chain Packaging

6.4 Environmental and Sustainability Regulations

7. KSA Cold Chain Packaging Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. KSA Cold Chain Packaging Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Application (In Value %)

8.3 By Packaging Material (In Value %)

8.4 By Temperature Range (In Value %)

8.5 By Region (In Value %)

9. KSA Cold Chain Packaging Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Strategic Market Entry/Expansion Recommendations

9.3 Customer Segmentation and Targeting Strategies

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first phase involves constructing an ecosystem map of stakeholders within the KSA cold chain packaging market. Secondary databases and proprietary data sources are utilized to define critical variables such as market drivers, constraints, and technological innovations. This analysis helps in understanding the market dynamics.

Step 2: Market Analysis and Construction

In this step, we gather historical market data from industry reports and stakeholders in the KSA cold chain packaging market. Market penetration, volume, and revenue growth are examined, and quality statistics are evaluated to ensure accurate revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses on market trends are tested through consultations with industry experts and professionals. Insights are gathered via computer-assisted telephone interviews (CATI) with executives from packaging companies, logistics providers, and government regulators, which help to validate the market assumptions.

Step 4: Research Synthesis and Final Output

Finally, we conduct direct interviews with packaging manufacturers and logistics companies to gain detailed insights into product segments, sales data, and emerging trends. The information gathered is used to ensure that the final report offers a comprehensive and accurate analysis of the KSA cold chain packaging market.

Frequently Asked Questions

01. How big is the KSA Cold Chain Packaging Market?

The KSA cold chain packaging market is valued at USD 380 million, driven by rising demand for temperature-sensitive goods in sectors like pharmaceuticals and food & beverage.

02. What are the challenges in the KSA Cold Chain Packaging Market?

Key challenges include high costs associated with advanced packaging technologies, infrastructure gaps, and a lack of skilled workforce in cold chain management.

03. Who are the major players in the KSA Cold Chain Packaging Market?

Key players include Sonoco ThermoSafe, Pelican BioThermal, Cold Chain Technologies, Va-Q-Tec AG, and Sofrigam SA, among others.

04. What drives growth in the KSA Cold Chain Packaging Market?

The market is driven by increasing healthcare investments, demand for vaccines and biologics, and the expansion of food and beverage delivery services.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.