KSA Construction Chemicals Market Outlook to 2030

Region:Middle East

Author(s):Shreya Garg

Product Code:KROD5211

November 2024

89

About the Report

KSA Construction Chemicals Market Overview

- The KSA Construction Chemicals market is valued at USD 1.7 billion, based on a five-year historical analysis. This market is primarily driven by government-led infrastructure projects, such as Vision 2030 and the Neom City initiative, which focus on expanding residential, commercial, and industrial facilities. The growth in the construction sector has resulted in an increased demand for chemicals such as concrete admixtures, waterproofing chemicals, and sealants, essential for improving durability, efficiency, and sustainability in construction processes. Moreover, the integration of sustainable building materials has contributed to the expansion of this market.

- Riyadh, Makkah, and the Eastern Province are the dominant regions in the KSA construction chemicals market. The dominance of these regions is attributed to the rapid urbanization and industrialization efforts, as well as the substantial government investment in infrastructure development. Riyadh serves as the political and economic center, while Makkah experiences continuous expansion due to religious tourism. The Eastern Provinces dominance is fueled by its large industrial and petrochemical base, making it a focal point for construction projects.

- Vision 2030s regulatory framework is shaping the future of the construction sector in Saudi Arabia, emphasizing sustainability and innovation. In 2023, the government introduced stricter building codes that mandate the use of eco-friendly materials and energy-efficient construction practices. These regulations drive the demand for construction chemicals that align with sustainability goals, such as low-VOC coatings and green concrete admixtures. The governments push for environmental sustainability is central to achieving its long-term objectives of reducing carbon emissions and conserving energy in the built environment.

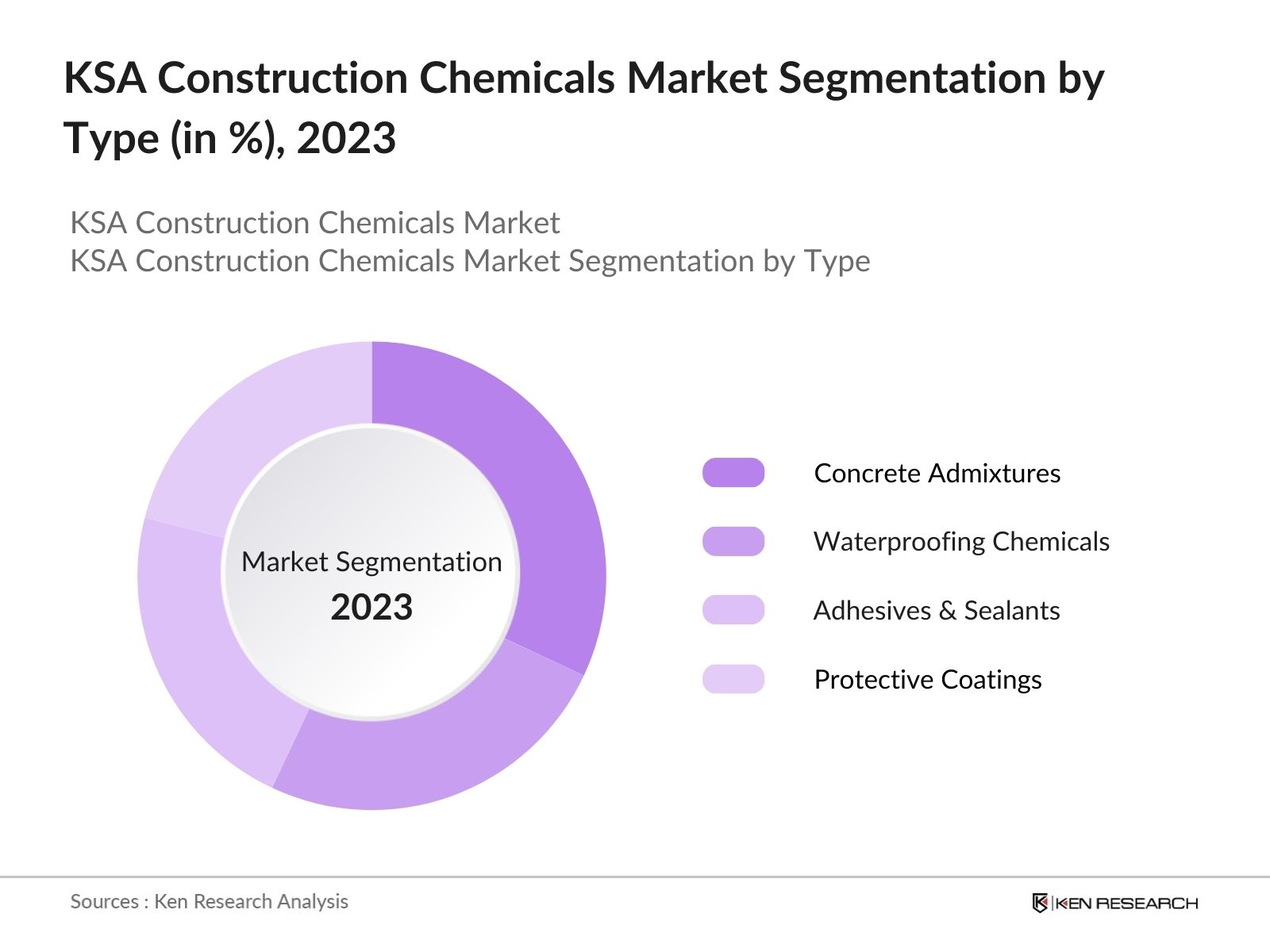

KSA Construction Chemicals Market Segmentation

By Type: The market is segmented by product type into concrete admixtures, waterproofing chemicals, adhesives & sealants, and protective coatings. Recently, concrete admixtures have dominated the market under the segmentation of product type due to their critical role in enhancing concrete properties, such as strength, durability, and workability. Large-scale infrastructure projects, such as the Red Sea Project, have spurred the demand for these admixtures, which improve the longevity of structures exposed to harsh environmental conditions.

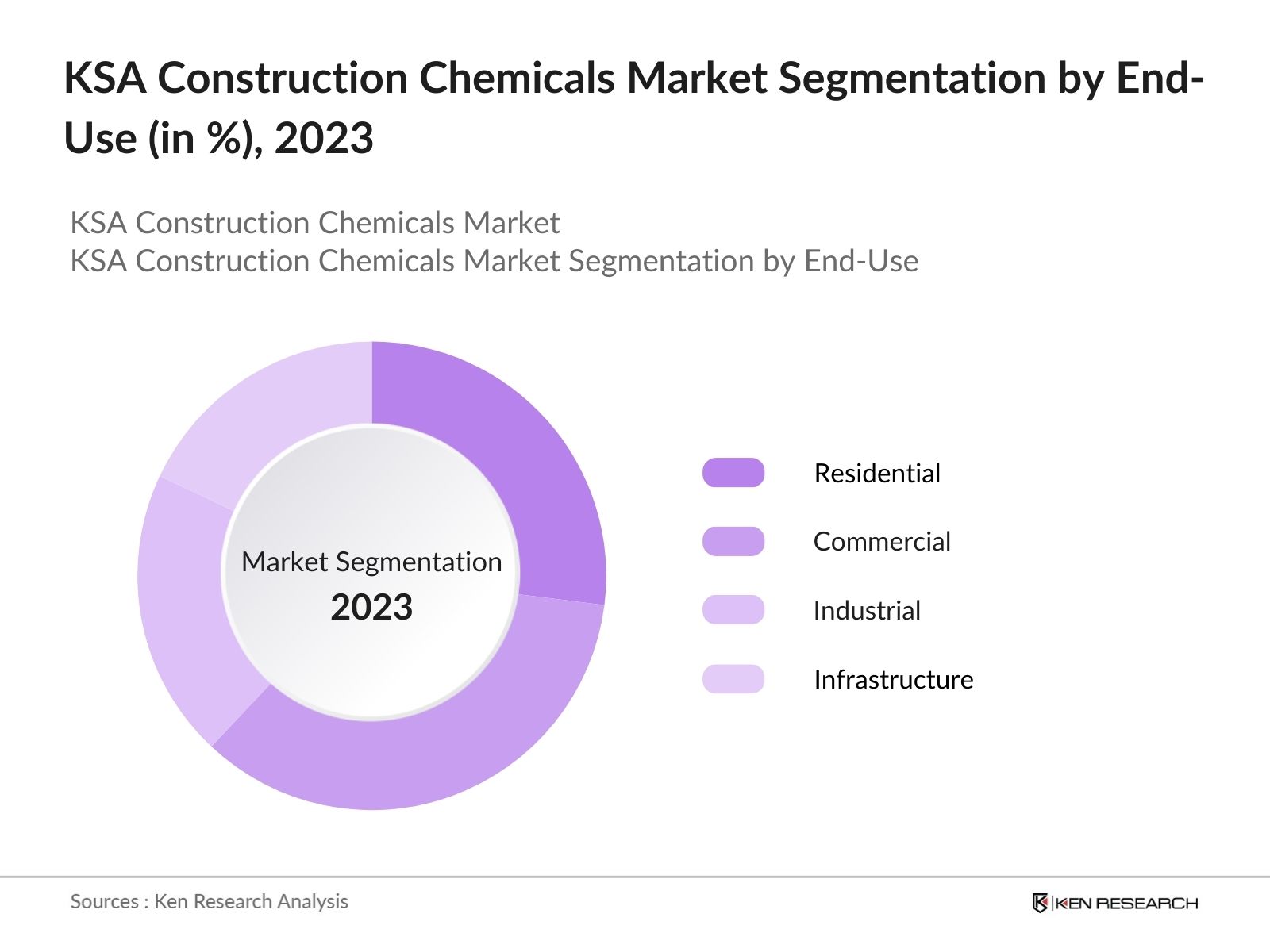

By End-Use: In terms of end-use, the market is segmented into residential, commercial, industrial, and infrastructure. The commercial segment currently holds a dominant market share, driven by the rapid development of commercial complexes and office spaces in major cities like Riyadh and Jeddah. The rise in foreign investments and the establishment of new business hubs are fueling this segments growth. Additionally, the commercial sector is more likely to adopt high-performance construction chemicals to ensure safety, longevity, and energy efficiency.

KSA Construction Chemicals Market Competitive Landscape

The KSA construction chemicals market is dominated by key players, including both global giants and local manufacturers. Major players focus on expanding their product portfolios and improving their distribution networks to capture larger market shares. Collaborations with local contractors and participation in major construction projects have allowed these companies to strengthen their foothold in the market. The competitive landscape is further intensified by new entrants who focus on niche products, such as eco-friendly chemicals, to differentiate themselves.

|

Company Name |

Establishment Year |

Headquarters |

Product Portfolio |

R&D Capabilities |

Market Presence |

Sustainability Initiatives |

Strategic Collaborations |

|

Saudi Basic Industries Corporation |

1976 |

Riyadh, Saudi Arabia |

|||||

|

BASF SE |

1865 |

Ludwigshafen, Germany |

|||||

|

Dow Chemical Company |

1897 |

Midland, USA |

|||||

|

Fosroc International |

1934 |

Dubai, UAE |

|||||

|

Sika AG |

1910 |

Baar, Switzerland |

KSA Construction Chemicals Industry Analysis

Growth Drivers

- Rapid Urbanization: The rapid urbanization in Saudi Arabia is significantly impacting the construction sector, which is expected to play a crucial role in expanding infrastructure. As of 2022, Saudi Arabia's urban population exceeded 34 million, pushing the government to invest heavily in construction chemicals to support new infrastructure projects. Construction chemicals such as concrete admixtures and waterproofing solutions are seeing increased demand as urban centers expand. In 2024, ongoing construction activities in Riyadh and Jeddah are further accelerating the need for high-performance chemicals. Saudi Arabias construction sector growth remains tied to urban expansion, with a focus on housing and commercial structures.

- Government Mega-Projects: Saudi Arabias ambitious mega-projects, such as Neom and the Red Sea Project, are driving demand for advanced construction chemicals. Neom, a $500 billion smart city, requires extensive use of innovative materials to meet high sustainability standards. In 2023, the Red Sea Project spanned over 28,000 square kilometers, demanding specialized chemicals for environmental preservation and durable infrastructure. These projects, part of Vision 2030, emphasize eco-friendly and durable solutions in construction. Government-led investments in these large-scale developments ensure sustained demand for high-performance chemicals over the coming years.

- Infrastructure Investments: Infrastructure investment is a key component of Saudi Arabias Vision 2030, with over $400 billion allocated for projects that include transport, housing, and energy. This massive spending directly boosts the demand for construction chemicals essential for building roads, bridges, and public infrastructure. In 2024, several public-private partnerships (PPPs) are advancing projects like metro systems and airports, requiring significant quantities of construction chemicals for durability and performance. The Ministry of Transports 2023 budget focused on enhancing road networks, increasing demand for concrete admixtures and coatings.

Market Challenges

- High Raw Material Costs: The cost of raw materials for construction chemicals, such as polymers and additives, has risen sharply in recent years, impacting profit margins in the KSA construction chemicals market. By 2024, fluctuations in the global prices of crude oil and its derivatives, crucial for producing chemical additives, are increasing production costs. For instance, oil prices averaged $80 per barrel in 2023, leading to higher manufacturing costs across industries reliant on petrochemical derivatives. This creates pressure on manufacturers to absorb or pass on costs, affecting profitability.

- Environmental Regulations: Saudi Arabia has introduced stricter environmental regulations that limit the use of certain chemicals in construction, posing challenges for manufacturers. By 2023, the Ministry of Environment, Water, and Agriculture enforced new compliance standards for chemical emissions, restricting the use of high VOC (volatile organic compound) materials. Companies are required to adopt safer, eco-friendly alternatives, which often come at a higher cost and necessitate technological upgrades. The push for sustainable construction practices is intensifying regulatory scrutiny, leading to increased compliance costs for chemical producers.

KSA Construction Chemicals Market Future Outlook

The KSA construction chemicals market is expected to continue its upward trajectory in the coming years, driven by ongoing mega-projects under Vision 2030, such as Neom City and the Red Sea Development. With a strong emphasis on sustainability and smart cities, the market will likely see increased demand for eco-friendly and high-performance chemicals. Furthermore, technological advancements, such as nanotechnology in construction materials, will also fuel market growth by providing more durable and cost-effective solutions for large-scale infrastructure developments.

Future Market Opportunities

- Smart Cities and Urban Development: Saudi Arabias push towards building smart cities presents significant opportunities for the construction chemicals market. Projects like Neom and the Red Sea Project, integrating IoT and AI technologies, demand specialized chemicals that enhance durability and sustainability. In 2024, the need for construction chemicals that can withstand extreme environmental conditions and support the longevity of structures in smart cities is rising. Additionally, innovative chemical solutions that integrate with digital platforms for construction management are seeing growing adoption. The smart city initiatives under Vision 2030 are key to driving future market growth.

- Adoption of Eco-Friendly Chemicals: The shift towards eco-friendly chemicals in Saudi Arabias construction sector is accelerating as part of the governments sustainability agenda. By 2024, there has been a marked increase in the demand for low-emission, water-based products, bio-based chemicals, and recyclable materials. This trend is driven by stricter environmental regulations and a growing preference for green building certifications such as LEED (Leadership in Energy and Environmental Design). Manufacturers are capitalizing on the opportunity to supply bio-based chemicals that reduce the carbon footprint of construction activities, supporting the Vision 2030 goals.

Scope of the Report

|

By Type |

Concrete Admixtures Waterproofing Chemicals Adhesives & Sealants Protective Coatings |

|

By End-Use |

Residential Commercial Industrial Infrastructure |

|

By Application |

Concrete Repair Flooring, Roofing Waterproofing |

|

By Region |

Riyadh Makkah Eastern Province Asir |

Products

Key Target Audience

Construction Contractors and Developers

Government and Regulatory Bodies (Saudi Standards, Metrology and Quality Organization - SASO)

Investors and Venture Capitalist Firms

Real Estate Companies

Infrastructure Development Agencies

Chemical Manufacturers and Suppliers

Architectural and Engineering Firms

Public-Private Partnership Stakeholders

Companies

Major Players

Saudi Basic Industries Corporation (SABIC)

BASF SE

Dow Chemical Company

Fosroc International

Sika AG

Mapei S.p.A.

Arkema Group

GCP Applied Technologies

Al-Bilad Concrete Solutions

Cemex S.A.B. de C.V.

Al Majal Al Arabi Group

Henkel AG & Co. KGaA

LafargeHolcim Ltd.

Saint-Gobain S.A.

Ashland Global Holdings Inc.

Table of Contents

1. KSA Construction Chemicals Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. KSA Construction Chemicals Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. KSA Construction Chemicals Market Analysis

3.1. Growth Drivers

3.1.1. Rapid Urbanization (Impact on construction industry)

3.1.2. Government Mega-Projects (Neom, Red Sea Project)

3.1.3. Infrastructure Investments (Vision 2030 initiatives)

3.1.4. Rise in Green Building Materials (Sustainability focus)

3.2. Market Challenges

3.2.1. High Raw Material Costs (Impact on margins)

3.2.2. Environmental Regulations (Stricter standards on chemical use)

3.2.3. Skilled Labor Shortage (Specialized labor requirement)

3.2.4. Volatility in Oil Prices (Effect on construction spending)

3.3. Opportunities

3.3.1. Smart Cities and Urban Development (Integration with new technologies)

3.3.2. Adoption of Eco-Friendly Chemicals (Increased demand for green solutions)

3.3.3. Technological Advancements (Nanotechnology in construction chemicals)

3.3.4. Public-Private Partnerships (Government incentives)

3.4. Trends

3.4.1. Use of Advanced Admixtures (Enhancing durability of structures)

3.4.2. Growth in Prefabricated Construction (Faster construction timelines)

3.4.3. Integration of Digital Platforms (Building Information Modeling - BIM)

3.4.4. Increasing Use of Self-Healing Concrete (Durability and cost-effectiveness)

3.5. Government Regulation

3.5.1. KSA Vision 2030 Regulations (Sustainable construction goals)

3.5.2. Environmental Compliance Standards (Restrictions on harmful chemicals)

3.5.3. Licensing and Permits (Requirements for chemical manufacturers)

3.5.4. Foreign Investment Laws (Impact on market entry)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Manufacturers, Distributors, Contractors, Regulatory Bodies)

3.8. Porters Five Forces (Supplier Power, Buyer Power, Threat of Substitutes, Competition)

3.9. Competition Ecosystem (Competitors, Market Share Distribution)

4. KSA Construction Chemicals Market Segmentation

4.1. By Type (In Value %)

4.1.1. Concrete Admixtures

4.1.2. Waterproofing Chemicals

4.1.3. Adhesives & Sealants

4.1.4. Protective Coatings

4.2. By End-Use (In Value %)

4.2.1. Residential

4.2.2. Commercial

4.2.3. Industrial

4.2.4. Infrastructure

4.3. By Application (In Value %)

4.3.1. Concrete Repair

4.3.2. Flooring

4.3.3. Roofing

4.3.4. Waterproofing

4.4. By Region (In Value %)

4.4.1. Riyadh

4.4.2. Makkah

4.4.3. Eastern Province

4.4.4. Asir

5. KSA Construction Chemicals Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Saudi Basic Industries Corporation (SABIC)

5.1.2. BASF SE

5.1.3. Dow Chemical Company

5.1.4. Fosroc International

5.1.5. Sika AG

5.1.6. Mapei S.p.A.

5.1.7. Arkema Group

5.1.8. GCP Applied Technologies

5.1.9. Al-Bilad Concrete Solutions

5.1.10. Cemex S.A.B. de C.V.

5.1.11. Al Majal Al Arabi Group

5.1.12. Henkel AG & Co. KGaA

5.1.13. LafargeHolcim Ltd.

5.1.14. Saint-Gobain S.A.

5.1.15. Ashland Global Holdings Inc.

5.2. Cross Comparison Parameters (Market Presence, Product Portfolio, Sustainability Initiatives, Innovation Capabilities, Revenue, Employee Strength, Global Footprint, Strategic Collaborations)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. KSA Construction Chemicals Market Regulatory Framework

6.1. Environmental Compliance Regulations (Emission control, chemical safety)

6.2. Certifications and Standards (ISO, Green Building Certifications)

6.3. Licensing and Permit Requirements

6.4. Government Subsidies for Sustainable Chemicals

7. KSA Construction Chemicals Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. KSA Construction Chemicals Future Market Segmentation

8.1. By Type (In Value %)

8.2. By End-Use (In Value %)

8.3. By Application (In Value %)

8.4. By Region (In Value %)

9. KSA Construction Chemicals Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. White Space Opportunity Analysis

9.3. Marketing Strategies

9.4. Customer Segmentation Insights

Research Methodology

Step 1: Identification of Key Variables

In the initial phase, a detailed market ecosystem map was created for the KSA Construction Chemicals Market. This included identifying the key stakeholderssuch as manufacturers, distributors, contractors, and government bodiesand mapping out their influence on market dynamics.

Step 2: Market Analysis and Construction

Historical market data was compiled from credible industry databases, focusing on key metrics such as market penetration, product demand, and infrastructure spending. An in-depth analysis of service quality statistics was also carried out to validate the reliability of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were formulated and validated through extensive interviews with industry experts, including chemical manufacturers and construction project managers. Their insights were pivotal in corroborating the gathered data and refining the market analysis.

Step 4: Research Synthesis and Final Output

This final phase involved direct engagement with top-tier chemical manufacturers and construction firms to gather detailed insights into product segments, sales performance, and consumer preferences. This ensured that the market analysis was accurate, comprehensive, and reflective of current market conditions.

Frequently Asked Questions

01 How big is the KSA Construction Chemicals Market?

The KSA construction chemicals market was valued at USD 1.7 billion, driven by large-scale infrastructure projects, including Vision 2030 initiatives and increased demand for eco-friendly chemicals.

02 What are the challenges in the KSA Construction Chemicals Market?

The primary challenges in the KSA construction chemicals market include high raw material costs, volatile oil prices impacting construction budgets, and the need to meet increasingly strict environmental regulations.

03 Who are the major players in the KSA Construction Chemicals Market?

Key players in the KSA construction chemicals market include Saudi Basic Industries Corporation (SABIC), BASF SE, Dow Chemical Company, Fosroc International, and Sika AG, which dominate through their strong product portfolios and regional presence.

04 What are the growth drivers of the KSA Construction Chemicals Market?

The KSA construction chemicals market is driven by the Kingdoms Vision 2030 infrastructure projects, increasing urbanization, and the rising adoption of sustainable building materials.

05 What are the dominant segments in the KSA Construction Chemicals Market?

Concrete admixtures dominate due to their essential role in enhancing concrete durability and strength in large-scale projects, while the commercial sector leads the end-use category due to ongoing commercial development across major cities like Riyadh in the KSA construction chemicals market.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.