KSA Construction Market Outlook to 2030

Region:Middle East

Author(s):Shreya Garg

Product Code:KROD9334

December 2024

97

About the Report

KSA Construction Market Overview

- The construction market in the Kingdom of Saudi Arabia (KSA) is valued at USD 70.2 billion, based on a five-year historical analysis. This value is driven by the government's ambitious Vision 2030 initiative, which is focused on diversifying the economy away from oil dependence. Public investment in infrastructure, including roads, railways, airports, and megaprojects like NEOM, has been instrumental in the rapid growth of the market. This surge in construction activity is also supported by a growing population and the rising demand for housing, healthcare, and education infrastructure.

- Dominant cities like Riyadh, Jeddah, and Dammam play a huge role in the construction market's dominance. Riyadh, as the political and financial hub, attracts substantial investment in both commercial and residential projects. Jeddah, with its position as the gateway to Mecca and a major port, has witnessed extensive infrastructure development. The Eastern Province, particularly Dammam, benefits from its proximity to the oil industry, driving industrial and commercial construction projects. The strategic locations and economic significance of these cities fuel their dominance in the KSA construction market.

- The Vision 2030 strategy serves as the foundation for regulatory reform in Saudi Arabias construction sector. The government is implementing regulations aimed at enhancing transparency, efficiency, and sustainability in construction projects. As of 2024, Vision 2030 has spurred the development of mega-projects like NEOM, which require contractors to meet new regulatory standards for quality, sustainability, and workforce nationalization.

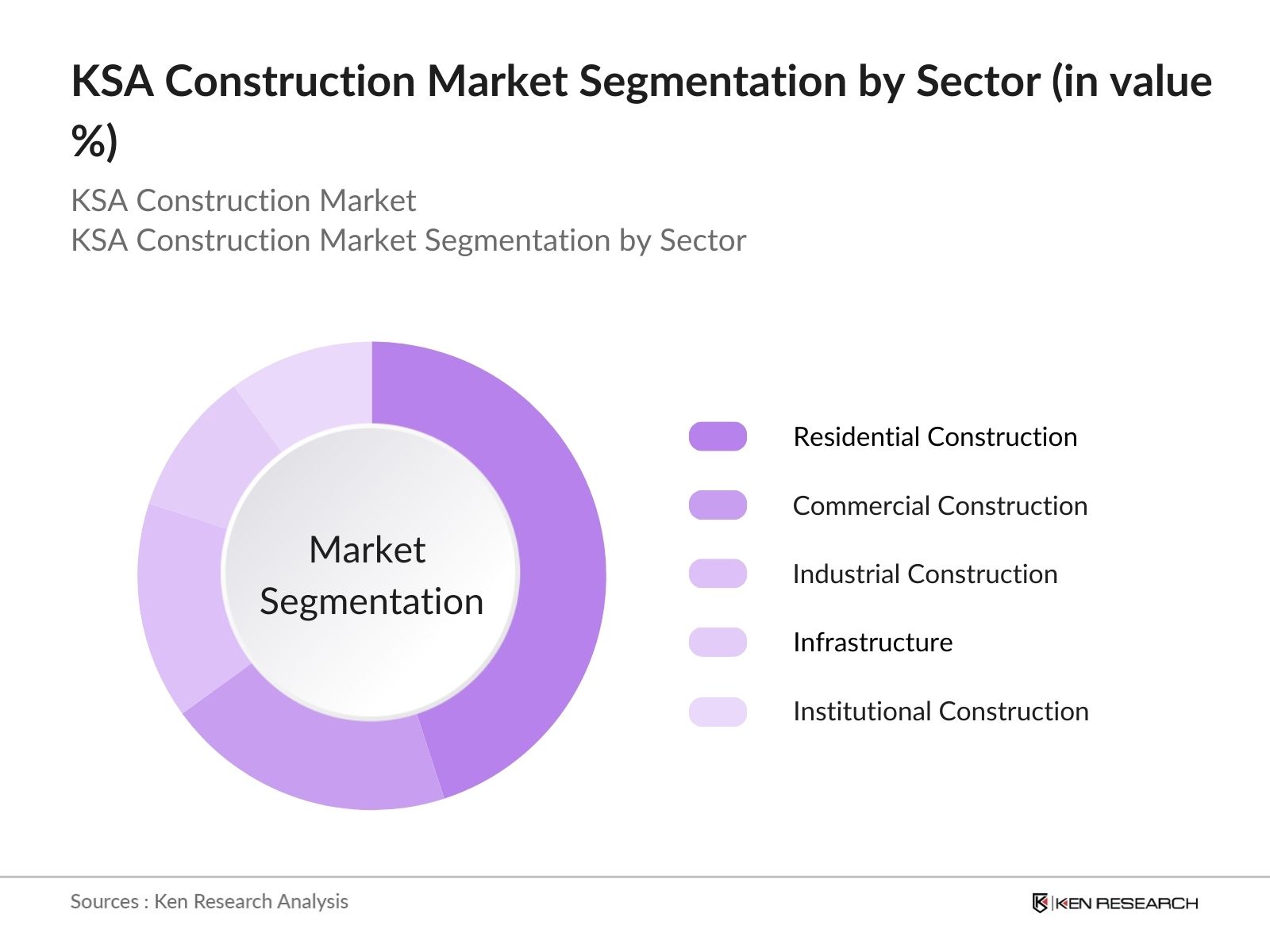

KSA Construction Market Segmentation

By Sector: The KSA construction market is segmented by sector into residential construction, commercial construction, industrial construction, infrastructure, and institutional construction. The residential construction sector holds the dominant market share due to the increasing demand for affordable housing projects and luxury developments driven by population growth and urbanization. Large-scale housing programs initiated by the government to cater to citizens under Vision 2030 further bolster this sector. Additionally, real estate developers are investing in high-end residential complexes and gated communities in cities like Riyadh and Jeddah to meet the demands of the expanding upper-middle-class population.

By Construction Type: The market is further segmented by construction type into new construction and renovation & maintenance. New construction dominates this segment due to the large-scale development of new cities, such as NEOM and The Red Sea Project, which require entirely new infrastructure and residential, commercial, and entertainment facilities. Moreover, the government's aggressive push to build smart cities and enhance public infrastructure is contributing to the predominance of new construction projects across the country.

KSA Construction Market Competitive Landscape

The KSA construction market is dominated by a combination of large local companies and international players, each playing a significant role in the execution of major projects across the Kingdom. The local firms have a strong understanding of regulatory requirements and local construction practices, while international companies bring in advanced technology and expertise for large-scale projects such as NEOM and The Red Sea Project. This balance has fostered healthy competition and collaboration in the sector.

|

Company Name |

Establishment Year |

Headquarters |

No. of Projects |

Revenue (USD) |

Key Sector Focus |

Technology Use |

Major Clients |

Sustainability Certifications |

Contract Type |

|

Saudi Binladin Group |

1931 |

Jeddah, Saudi Arabia |

|||||||

|

El Seif Engineering Contracting |

1975 |

Riyadh, Saudi Arabia |

|||||||

|

Nesma & Partners Contracting |

1981 |

Al Khobar, Saudi Arabia |

|||||||

|

Hyundai Engineering & Construction |

1947 |

Seoul, South Korea |

|||||||

|

Al-Muhaidib Contracting |

1975 |

Riyadh, Saudi Arabia |

KSA Construction Industry Analysis

Growth Drivers

- Urbanization and Population Growth: Saudi Arabias population growth and urbanization are key drivers of the construction market. By 2024, the population is expected to reach approximately 36 million people, with 83% living in urban areas. This urbanization requires extensive development in housing, infrastructure, and utilities. According to the Saudi General Authority for Statistics (GaStat), over 2.6 million new housing units are needed by 2030, putting pressure on the construction industry to expand rapidly to meet the demand. The urban expansion also increases the need for roads, transport, and public services infrastructure.

- Investment in Infrastructure: Investment in infrastructure is central to Saudi Arabia's Vision 2030. As of 2024, the government has committed over $300 billion for infrastructure projects, including transport networks and utilities like electricity and water systems. Large projects include the expansion of the Riyadh Metro and the development of airports like King Abdulaziz International. Moreover, the Saline Water Conversion Corporation plans to invest $27 billion into water infrastructure projects by 2030, aimed at boosting desalination capacity to meet the growing demand.

- Government Vision 2030 Initiatives: Vision 2030 has accelerated growth in Saudi Arabias construction sector, as it aims to diversify the economy away from oil dependency. One key initiative is the development of NEOM, a futuristic mega-city that alone requires over $500 billion in investments. The Public Investment Fund (PIF) is playing a crucial role in driving these projects, including the Red Sea Project and Qiddiya. These developments aim to boost tourism, entertainment, and urban living, providing long-term projects for contractors in the market.

Market Challenges

- Shortage of Skilled Labor: One of the key challenges in Saudi Arabia's construction market is the shortage of skilled labor. Nationalization initiatives, like the Nitaqat program, require companies to hire more Saudi nationals, but there is still heavy reliance on expatriates, who make up 75% of the construction workforce. This has created gaps in skilled labor availability, especially in technical roles, impacting project timelines and costs. The Saudi government is working on upskilling programs, but the transition remains challenging for the sector.

- Rising Material Costs: Rising material costs have affected construction projects in Saudi Arabia. As of 2024, cement prices increased by 5% year-on-year, while steel saw a rise of around 7%, driven by global supply chain disruptions and inflation. Cement production capacity in the kingdom is at 70 million tons annually, but demand continues to outpace supply, putting pressure on prices. These input cost increases directly impact project feasibility and pricing in the construction market.

KSA Construction Market Future Outlook

The KSA construction market is projected to experience significant growth, driven by the government's strategic focus on infrastructure and urban development. Large-scale initiatives like Vision 2030 and Saudi Green Initiative are expected to propel the construction industry into new domains, including sustainable and eco-friendly construction practices. The integration of technology in construction, such as Building Information Modeling (BIM) and modular construction, will further boost operational efficiency and project timelines. Additionally, ongoing foreign investment and the creation of new business hubs will likely drive increased demand for both residential and commercial construction.

Future Market Opportunities

- Expansion of Housing Projects: Saudi Arabias construction market is witnessing a significant expansion in housing projects, driven by the growing demand for affordable housing and luxury residential properties. The Sakani program, which provides housing loans and subsidies, has enabled the construction of over 280,000 housing units by 2023. Additionally, luxury developments such as those in Riyadh and Jeddah cater to the high-income segment. The governments goal to raise homeownership to 70% by 2030 further boosts opportunities for developers.

- Growth of Smart City Initiatives: The development of smart cities, such as Neom and The Red Sea Project, represents a significant opportunity in the Saudi construction market. Neom alone, with a budget of $500 billion, is designed as a technologically advanced, sustainable city, incorporating renewable energy, smart infrastructure, and artificial intelligence (AI). These projects not only offer construction opportunities but also require cutting-edge technology integration, creating new avenues for contractors specialized in smart city technologies.

Scope of the Report

|

By Sector |

Residential Commercial Industrial Infrastructure Institutional |

|

By Construction Type |

New Construction Renovation Maintenance |

|

By Building Material |

Concrete Steel Glass Plastic Others |

|

By Region |

Central West East South |

|

By Project Type |

Mega Projects Mid-sized Projects Small-scale Projects |

Products

Key Target Audience

Real Estate Developers

Government and Regulatory Bodies (Ministry of Municipal and Rural Affairs and Housing, Saudi Investment Authority)

Contractors and Builders

Infrastructure Project Developers

Venture Capital Firms

Private Equity Firms

Material Suppliers and Manufacturers

Facility Management Firms

Companies

Major Players

Saudi Binladin Group

El Seif Engineering Contracting Co.

Nesma & Partners Contracting Co. Ltd.

Al-Muhaidib Contracting Company

Almabani General Contractors

Hyundai Engineering & Construction Co.

Al Rashid Trading & Contracting Company (RTCC)

Abdullah A. M. Al-Khodari Sons Company

Shibh Al Jazira Contracting Co. Ltd.

CCE Saudi Construction Engineering

Redco Construction - Almana

Al Harbi Trading & Contracting Co. Ltd.

Al-Fouzan Trading & General Construction Co.

Al Ayuni Investment and Contracting Company

Al Jaber Trading & Contracting Co.

Table of Contents

1. KSA Construction Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate (GDP growth contribution, public vs. private sector construction)

1.4 Market Segmentation Overview

2. KSA Construction Market Size (in USD Bn)

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Market Developments and Milestones (Mega projects, government initiatives like Vision 2030)

3. KSA Construction Market Analysis

3.1 Growth Drivers

3.1.1 Urbanization and Population Growth

3.1.2 Investment in Infrastructure (transportation, utilities)

3.1.3 Government Vision 2030 initiatives

3.1.4 Foreign Direct Investment (FDI) in Construction Projects

3.2 Market Challenges

3.2.1 Shortage of Skilled Labor (nationalization initiatives, reliance on expats)

3.2.2 Rising Material Costs (cement, steel, construction inputs)

3.2.3 Complex Regulatory Requirements

3.2.4 Environmental Compliance and Sustainability (green building standards, energy efficiency)

3.3 Opportunities

3.3.1 Expansion of Housing Projects (affordable housing, luxury residential projects)

3.3.2 Growth of Smart City Initiatives (Neom, The Red Sea Project)

3.3.3 Increased Demand for Healthcare and Education Facilities

3.3.4 New Partnerships with Global Contractors

3.4 Trends

3.4.1 Integration of Smart Technologies (BIM, IoT in construction)

3.4.2 Modular and Prefabricated Construction

3.4.3 Rise of Public-Private Partnerships (PPPs)

3.4.4 Sustainable Construction Practices

3.5 Government Regulation

3.5.1 Vision 2030 Strategy

3.5.2 Building Code Standards

3.5.3 Local Content Regulations (In-Kingdom Total Value Add - IKTVA)

3.5.4 Environmental Regulations

3.6 SWOT Analysis (Strengths, Weaknesses, Opportunities, Threats)

3.7 Stakeholder Ecosystem

3.7.1 Key Contractors

3.7.2 Key Suppliers and Material Providers

3.7.3 Government Agencies and Regulatory Bodies

3.8 Porters Five Forces

3.9 Competition Ecosystem

4. KSA Construction Market Segmentation

4.1 By Sector (in Value %)

4.1.1 Residential Construction

4.1.2 Commercial Construction

4.1.3 Industrial Construction

4.1.4 Infrastructure (roads, bridges, ports, airports)

4.1.5 Institutional Construction (education, healthcare, government buildings)

4.2 By Construction Type (in Value %)

4.2.1 New Construction

4.2.2 Renovation and Maintenance

4.3 By Building Material (in Value %)

4.3.1 Concrete

4.3.2 Steel

4.3.3 Glass

4.3.4 Plastic and Composites

4.3.5 Others

4.4 By Region (in Value %)

4.4.1 Central (Riyadh, Qassim)

4.4.2 West (Jeddah, Makkah, Madinah)

4.4.3 East (Dammam, Al-Khobar)

4.4.4 South (Asir, Jazan)

4.5 By Project Type (in Value %)

4.5.1 Mega Projects (Neom, Red Sea, Qiddiya)

4.5.2 Mid-sized Projects

4.5.3 Small-scale Projects

5. KSA Construction Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Saudi Binladin Group

5.1.2 Saudi Oger Ltd.

5.1.3 El Seif Engineering Contracting Co.

5.1.4 Al-Muhaidib Contracting Company

5.1.5 Nesma & Partners Contracting Co. Ltd.

5.1.6 Almabani General Contractors

5.1.7 Al Rashid Trading & Contracting Company (RTCC)

5.1.8 Abdullah A. M. Al-Khodari Sons Company

5.1.9 Shibh Al Jazira Contracting Co. Ltd.

5.1.10 CCE Saudi Construction Engineering

5.1.11 Redco Construction - Almana

5.1.12 Hyundai Engineering & Construction Co.

5.1.13 Al Harbi Trading & Contracting Co. Ltd.

5.1.14 Al-Fouzan Trading & General Construction Co.

5.1.15 Al Ayuni Investment and Contracting Company

5.2 Cross Comparison Parameters (Number of Projects, Headquarters, Revenue, Local Workforce Percentage, Major Contracts, Use of Smart Technology, Green Certifications, Key Clients)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Public-Private Partnership Projects

5.8 Government Tenders and Contracts

6. KSA Construction Market Regulatory Framework

6.1 Building and Construction Codes

6.2 Zoning and Land-use Regulations

6.3 Local Content Requirements (IKTVA)

6.4 Certification Processes for Green Building Standards

7. KSA Construction Market Future Market Size (in USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth (Urbanization, Infrastructure, and Mega Projects)

8. KSA Construction Market Future Segmentation

8.1 By Sector (Residential, Commercial, Industrial, Infrastructure, Institutional)

8.2 By Construction Type (New Construction, Renovation and Maintenance)

8.3 By Region (Central, Western, Eastern, Southern)

8.4 By Material (Concrete, Steel, Glass, Others)

8.5 By Project Type (Mega, Mid-sized, Small-scale)

9. KSA Construction Market Analyst's Recommendations

9.1 Customer Segmentation Analysis

9.2 Strategic Market Positioning

9.3 Expansion Opportunities in Underserved Regions

9.4 Key Partnership and Joint Venture Recommendations

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This phase involved extensive desk research and data collection from government reports, proprietary databases, and industry publications. The objective was to define key variables influencing the KSA construction market, such as economic indicators, regulatory frameworks, and construction material pricing.

Step 2: Market Analysis and Construction

Data from various historical sources was aggregated to construct a comprehensive analysis of the KSA construction market. Key trends, market penetration, and revenue distribution were evaluated to ensure the reliability and accuracy of the data used in the report.

Step 3: Hypothesis Validation and Expert Consultation

Consultations with industry experts, including contractors, government officials, and real estate developers, were conducted to validate market hypotheses. These consultations provided critical insights into market dynamics and operational challenges.

Step 4: Research Synthesis and Final Output

The final step involved synthesizing all collected data and expert feedback into a cohesive report. Cross-referencing the data with the bottom-up approach ensured an accurate representation of the market.

Frequently Asked Questions

01. How big is the KSA construction market?

The KSA construction market is valued at USD 70.2 billion, driven by large-scale government investments in infrastructure and megaprojects like NEOM.

02. What are the challenges in the KSA construction market?

Challenges in the KSA construction market include high construction material costs, regulatory hurdles, and the shortage of skilled labor due to dependence on foreign workers.

03. Who are the major players in the KSA construction market?

Key players in the KSA construction market include Saudi Binladin Group, El Seif Engineering Contracting Co., Nesma & Partners Contracting, and Hyundai Engineering & Construction.

04. What are the growth drivers of the KSA construction market?

Growth in the KSA construction market is driven by Vision 2030, urbanization, increased demand for housing, and the development of mega infrastructure projects such as airports, roads, and industrial zones.

05. Which sectors dominate the KSA construction market?

Residential and infrastructure sectors dominate the KSA construction market due to government programs focused on housing and large-scale city development projects.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.