KSA Cryogenic Equipment Market Outlook to 2030

Region:Middle East

Author(s):Shambhavi Awasthi

Product Code:KROD2358

December 2024

97

About the Report

KSA Cryogenic Equipment Market Overview

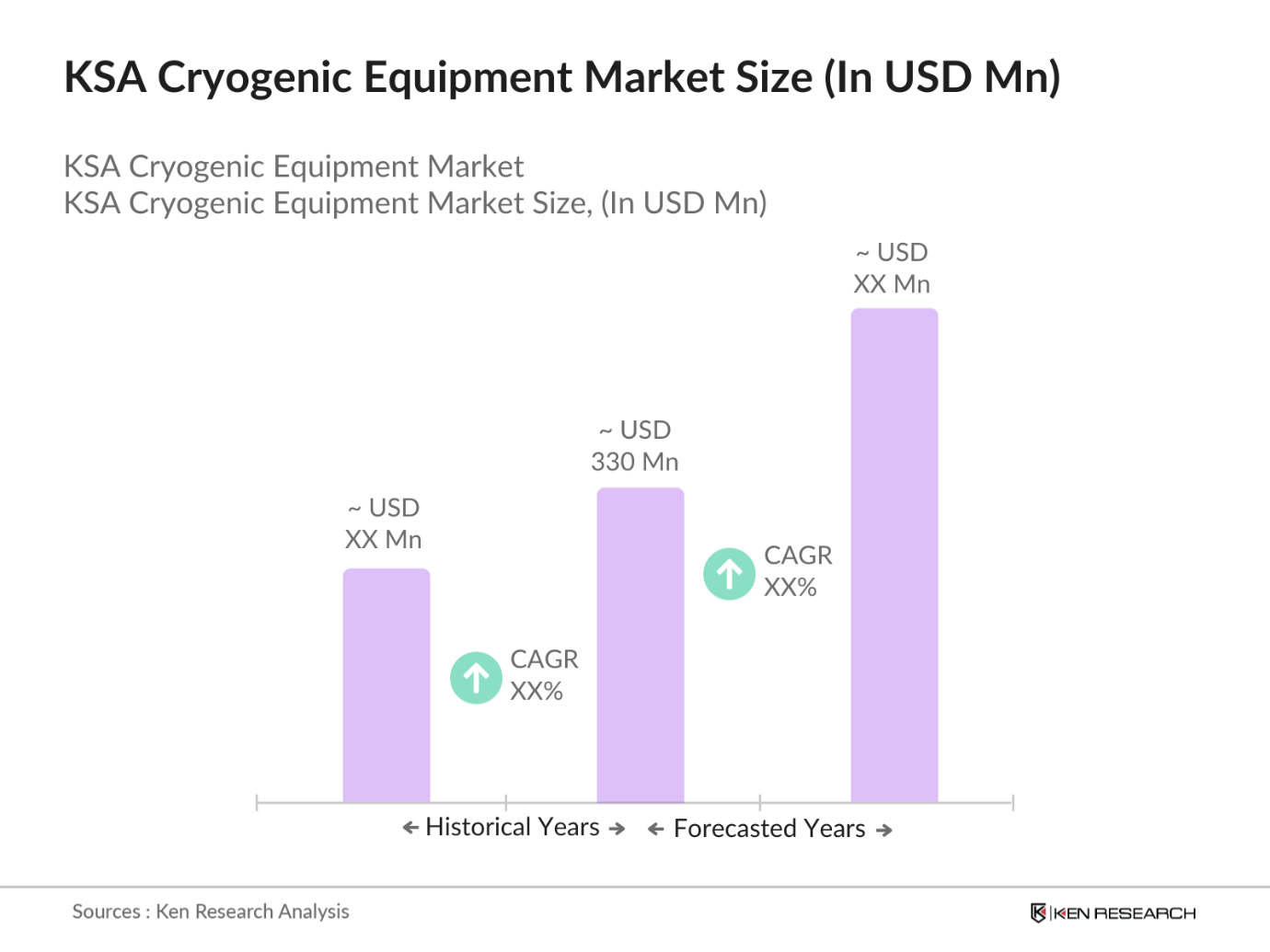

- In 2023, the KSA Cryogenic Equipment Market was valued at USD 330 million. This growth is driven by the expanding energy and oil sectors in Saudi Arabia, which rely on cryogenic equipment for the storage and transportation of liquefied natural gas (LNG) and other gases. The market is also supported by growing demand in industries such as healthcare, where cryogenic gases like liquid oxygen are essential for medical treatments. The government’s Vision 2030 plan, which aims to diversify the economy, further fuels this market.

- The KSA Cryogenic Equipment Market features major global and regional players, including Chart Industries, Air Liquide, Linde Group, and Cryofab. Local companies such as Al-Khobar-based Saudi Arabian Industrial Gas (SAGC) also play a key role. These companies dominate the market by offering a range of cryogenic solutions, including storage tanks, valves, and refrigerators, which are used in various industries like energy, healthcare, and electronics. Their expertise and innovation in developing cutting-edge cryogenic technologies strengthen their market position.

- In 2023, Saudi Arabia aims to diversify its economy away from oil dependency by increasing its share of non-oil GDP from 16% to 50% by 2030, thereby enhancing its sustainability efforts and reducing its carbon footprint. which encompasses the development of new liquefied natural gas (LNG) facilities and cryogenic infrastructure. This initiative aligns with Saudi Arabia's broader Vision 2030 strategy, which seeks to position the country as a leading hub for clean energy production and exports.

- The cities of Jubail, Yanbu, and Dammam dominate the KSA Cryogenic Equipment Market due to their strategic importance in the country’s industrial landscape. Jubail and Yanbu are home to the largest petrochemical plants and industrial cities, while Dammam is an essential hub for oil and gas activities. These cities have witnessed major industrial developments, attracting global investments and further enhancing their need for cryogenic equipment in various sectors, particularly in energy and chemicals.

KSA Cryogenic Equipment Market Segmentation

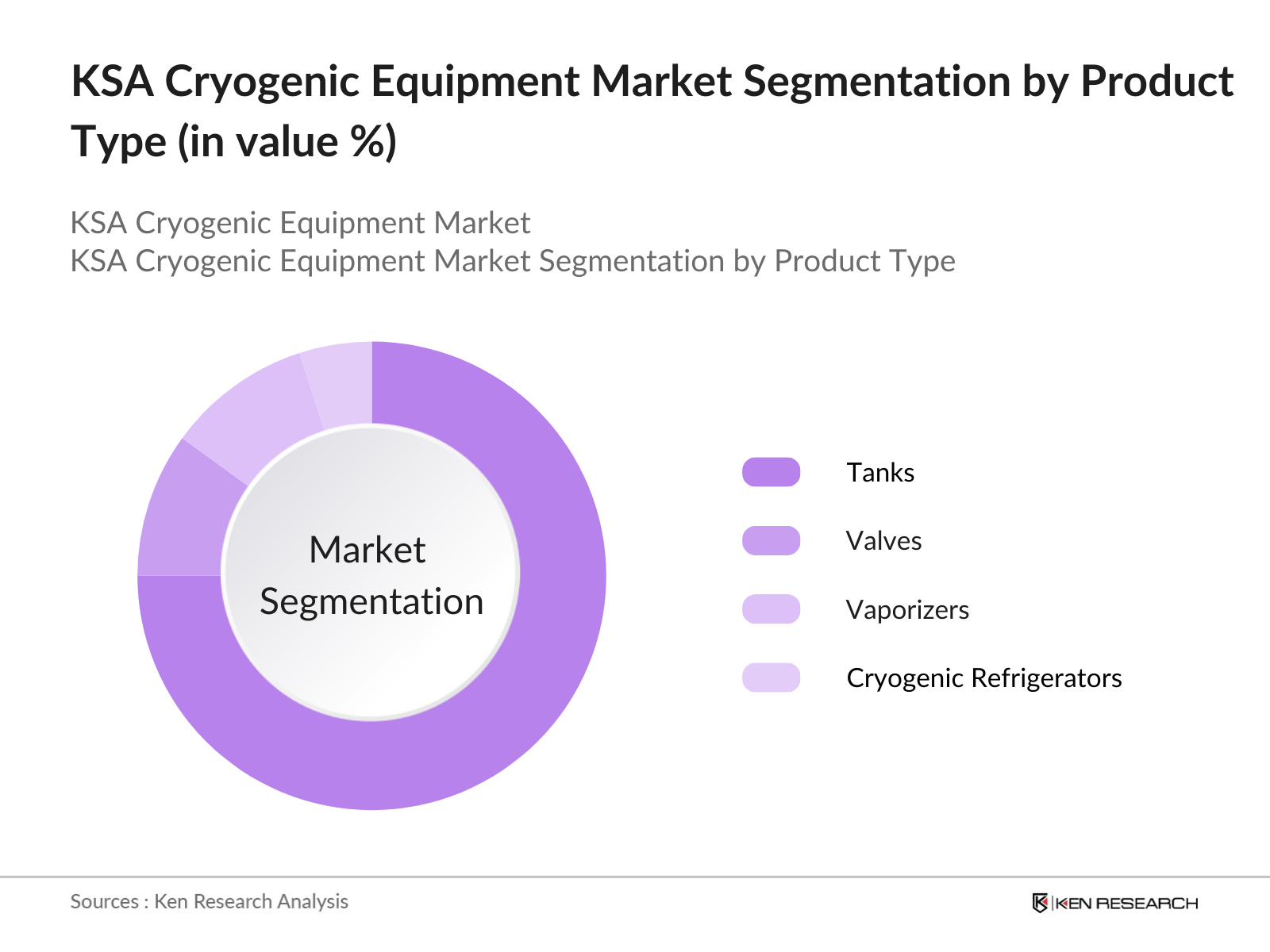

- By Product Type: The KSA Cryogenic Equipment Market is segmented by product type into tanks, valves, vaporizers, and cryogenic refrigerators. In 2023, tanks held the dominant market share. The demand for cryogenic tanks is driven by their extensive use in storing liquefied gases like LNG, oxygen, and nitrogen. Saudi Arabia's growing energy and healthcare sectors, along with its strategic initiatives to increase natural gas production, are key factors contributing to the high demand for cryogenic tanks.

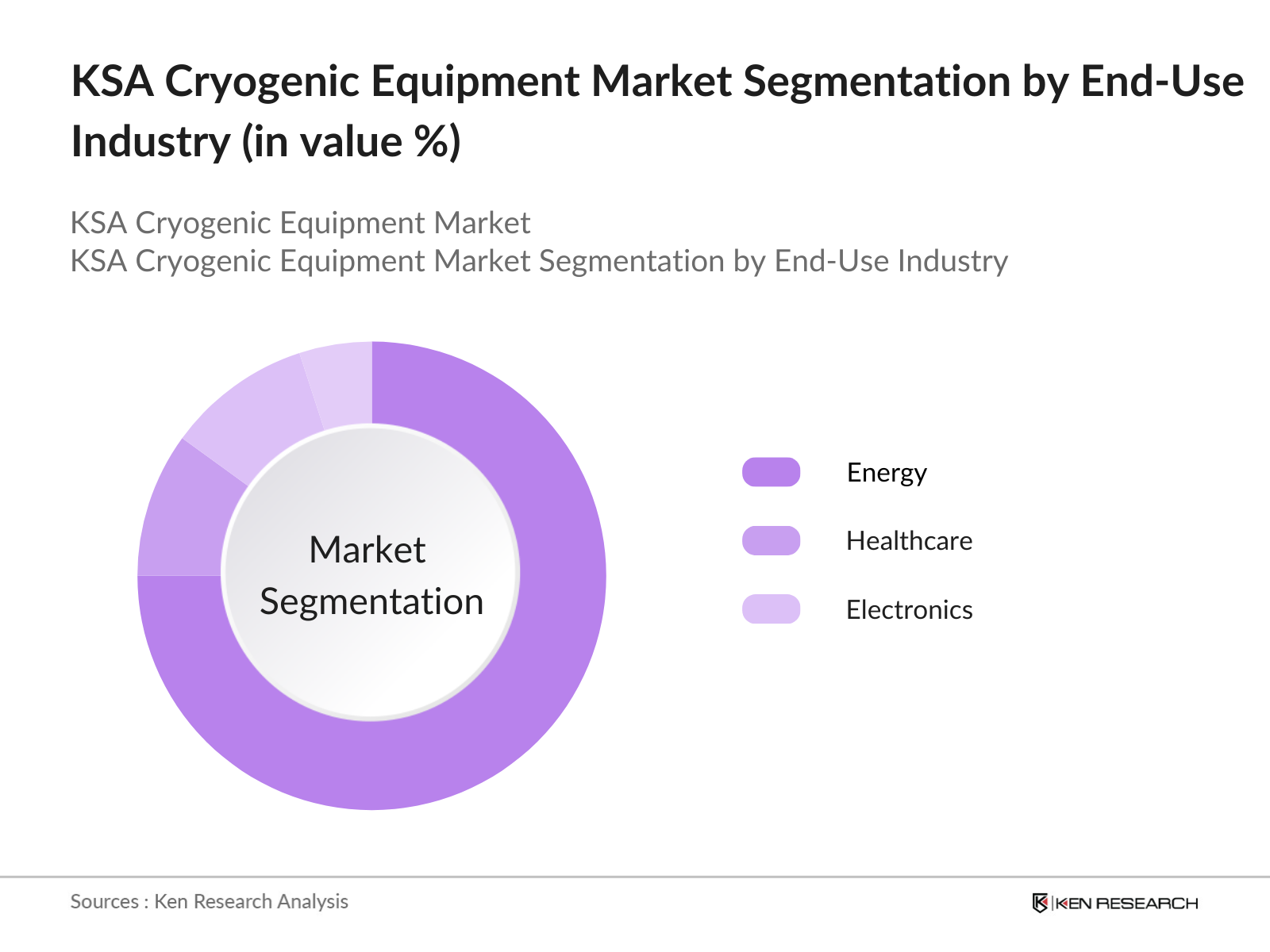

- By End-Use Industry: The market is segmented by end-use industry into energy, healthcare, and electronics. The energy sector dominated the market in 2023. This is due to Saudi Arabia’s leading position in oil and gas production, with increased investments in LNG infrastructure requiring cryogenic equipment. The healthcare sector also plays a significant role, driven by the demand for medical gases, such as liquid oxygen and nitrogen, especially after the COVID-19 pandemic.

- By Region: The KSA Cryogenic Equipment Market is segmented by region into East, Central Province, and West. In 2023, the East dominated the market. This region's dominance is primarily due to its concentration of oil and gas facilities, including some of the world’s largest industrial cities like Jubail. The region’s focus on energy production and the development of LNG infrastructure has led to a high demand for cryogenic equipment, particularly for gas storage and transportation solutions.

KSA Cryogenic Equipment Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|

Chart Industries |

1859 |

Ball Ground, USA |

|

Air Liquide |

1902 |

Paris, France |

|

Linde Group |

1879 |

Munich, Germany |

|

Cryofab |

1971 |

New Jersey, USA |

|

Saudi Arabian Industrial Gas (SAGC) |

1956 |

Al-Khobar, Saudi Arabia |

- Chart Industries: In July 2023, Chart Industries announced a strategic partnership with Saudi Aramco to supply cryogenic storage tanks for their new LNG projects in the East. This partnership is valued at USD 150 million and aims to meet Saudi Arabia's growing LNG demand as part of the National Gas Initiative. Chart Industries’ technological expertise in cryogenic equipment makes them a key supplier for Saudi Arabia’s ambitious LNG infrastructure plans.

- Air Liquide: In February 2024, Air Liquide expanded its operations in Saudi Arabia by launching a new cryogenic air separation unit in Dammam, with an investment of USD 100 million. This unit will cater to industries such as steel, chemicals, and electronics, ensuring a steady supply of oxygen and nitrogen gases. The facility aligns with the government’s Vision 2030 strategy to support industrial growth and diversify the economy beyond oil.

Growth Drivers

- Increased LNG Production and Infrastructure Expansion: Saudi Arabia’s Vision 2030 initiative is pushing for a significant boost in LNG production, and as of 2024, the country has committed USD 7.5 billion to expand its LNG infrastructure. This includes new cryogenic storage facilities, pipelines, and export terminals. According to the Saudi Ministry of Energy, this expansion is crucial as the nation moves toward becoming a global LNG exporter, leading to an increased demand for cryogenic equipment to handle and store liquefied natural gas safely.

- Rising Healthcare Needs Post-Pandemic: The demand for cryogenic gases in healthcare has risen due to an increase in critical care treatments requiring liquid oxygen and nitrogen. In 2024, Saudi Arabia’s healthcare spending reached USD 50 billion, a 15% increase from 2021 levels, according to the Saudi Ministry of Health. Cryogenic equipment plays a vital role in maintaining the supply chain for these gases, especially for hospitals and healthcare facilities that handle large volumes of medical gases for respiratory treatments, cryosurgery, and organ preservation.

- Investment in Petrochemical and Chemical Industries: The Saudi petrochemical sector, valued at USD 100 billion in 2024, is a key contributor to the cryogenic equipment market. The kingdom’s ongoing investments in expanding its petrochemical plants require advanced cryogenic equipment for gas storage and processing. For instance, the Jubail Industrial City expansion project, funded by a USD 12 billion investment from the Saudi government in 2023, has driven the demand for cryogenic valves, storage tanks, and vaporizers.

Challenges

- High Initial Investment Costs for Cryogenic Equipment: Setting up cryogenic infrastructure involves significant capital investment. In 2024, the average cost of installing a new cryogenic storage facility in Saudi Arabia ranged from USD 15 million to USD 20 million, depending on capacity and location, as reported by the Ministry of Industry and Mineral Resources. The high upfront costs make it challenging for small and medium-sized enterprises (SMEs) to enter the market, thereby limiting the market growth to major corporations with deep pockets.

- Technical and Maintenance Complexities: Cryogenic equipment is highly specialized, requiring regular maintenance and expert handling. According to a report from the Saudi Industrial Development Fund, the average annual maintenance cost of cryogenic equipment in the kingdom can reach up to USD 500,000 per plant, adding a significant operational expense to companies. This ongoing cost can be a deterrent for new market entrants or smaller firms, making the market more accessible to companies with strong technical expertise and financial stability.

Government Initiatives

- National Industrial Development and Logistics Program (NIDLP) – 2022: The Saudi government launched the NIDLP in 2022, committing over USD 400 billion to develop the country's logistics and industrial capabilities, including expanding LNG and petrochemical storage facilities that require cryogenic technology. This initiative aligns with the Vision 2030 objective of diversifying the economy and has resulted in the establishment of several new cryogenic facilities across key industrial zones such as Jubail and Yanbu.

- Saudi Green Initiative – 2023: As part of its efforts to achieve net-zero carbon emissions by 2060, Saudi Arabia launched the Saudi Green Initiative in 2023, which includes a USD 15 billion investment in clean energy and carbon capture technologies. This initiative is expected to drive the demand for cryogenic equipment, particularly in the storage and handling of carbon dioxide for industrial applications. The Ministry of Environment, Water, and Agriculture oversees this project and has been pushing for increased use of cryogenic storage solutions in carbon capture.

KSA Cryogenic Equipment Market Future Outlook

The future of the KSA Cryogenic Equipment Market is poised for robust growth, driven by Saudi Arabia’s economic diversification efforts and increasing investments in the LNG, healthcare, and industrial sectors. The National Gas Initiative and Vision 2030 will continue to play a crucial role in expanding the kingdom’s natural gas production and export capabilities, leading to higher demand for cryogenic equipment. The healthcare sector, with its growing need for liquid oxygen and nitrogen in medical applications, will also contribute to the market’s expansion.

Future Trends

- Integration of Digital Monitoring Systems

In the future, cryogenic equipment in Saudi Arabia will increasingly feature digital monitoring systems that allow for real-time data tracking and remote diagnostics. These systems will be essential for improving the efficiency and safety of cryogenic storage and transportation, particularly in the energy and healthcare sectors. Companies will focus on incorporating IoT technologies to reduce operational costs and minimize downtime due to equipment failures. - Expansion of Carbon Capture and Storage (CCS) Technologies

With Saudi Arabia’s commitment to achieving net-zero emissions by 2060, the demand for cryogenic equipment in carbon capture and storage (CCS) applications is expected to grow. The government’s focus on reducing carbon emissions will drive investments in cryogenic solutions for the safe handling and storage of CO2. This trend will be particularly significant in the petrochemical and energy sectors, where CCS is vital for reducing environmental impact.

Scope of the Report

|

By Product Type |

Tanks Valves Vaporizers Cryogenic Refrigerators |

|

By End User |

Energy Healthcare Electronics |

|

By Cryogen Type |

Liquefied Natural Gas (LNG) |

|

By Region |

North South West East |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Energy companies (Saudi Aramco, SABIC)

Healthcare providers (Saudi Ministry of Health)

Industrial gas suppliers

LNG transport companies

Cryogenic equipment manufacturers

Oil and gas firms

Electronics manufacturers

Cryogenic storage service providers

Chemical processing companies

Petrochemical companies

Government and regulatory bodies (Ministry of Energy, Vision 2030 Committee

Investors and venture capitalist firms

Companies

Players Mentioned in the Report:

Chart Industries

Air Liquide

Linde Group

Cryofab

Saudi Arabian Industrial Gas (SAGC)

Technex

INOXCVA

Air Products and Chemicals, Inc.

Taylor-Wharton

Hunan Kaimeite Gases Co., Ltd.

Cryogenmash

BOC Cryotech

Table of Contents

1. KSA Cryogenic Equipment Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy (Cryogenic Equipment Types, End-Use Industries, Geographies)

1.3. Market Growth Rate (Historical and Current)

1.4. Overview of Cryogenic Equipment Applications in Key Sectors (LNG, Healthcare, Petrochemicals, and Electronics)

1.5. Strategic Importance of Cryogenic Equipment in the Saudi Economy (Vision 2030 Alignment)

2. KSA Cryogenic Equipment Market Size (USD)

2.1. Historical Market Size (Market Data for Key Years)

2.2. Year-on-Year Growth Analysis

2.3. Market Milestones (Government Projects, Major Investments, and Industry Developments)

2.4. Market Forecast and Projections (Next 5 Years Growth Projection in USD)

3. KSA Cryogenic Equipment Market Analysis

3.1. Growth Drivers

3.1.1. LNG Production Expansion

3.1.2. Increased Healthcare Spending

3.1.3. Vision 2030 and Industrial Diversification

3.2. Market Restraints

3.2.1. High Initial Setup Costs

3.2.2. Technical and Maintenance Complexities

3.2.3. Volatility in Energy Prices

3.3. Opportunities

3.3.1. Rising Demand for Carbon Capture Storage (CCS) Solutions

3.3.2. Government Support for Clean Energy Projects

3.3.3. Expansion of Petrochemical Facilities

3.4. Trends

3.4.1. Digital Monitoring and IoT Integration

3.4.2. Focus on Sustainable Cryogenic Solutions

3.4.3. Development of LNG Export Terminals

3.5. SWOT Analysis

3.6. Competitive Ecosystem

3.7. Market Stakeholders (Government, Industrial, Healthcare, LNG Transport Companies)

4. KSA Cryogenic Equipment Market Segmentation

4.1. By Product Type (in value %) 4.1.1. Cryogenic Storage Tanks

4.1.2. Cryogenic Valves

4.1.3. Vaporizers

4.1.4. Cryogenic Refrigerators

4.2. By End-Use Industry (in value %)

4.2.1. Energy (LNG, Oil & Gas)

4.2.2. Healthcare (Medical Gases, Liquid Oxygen)

4.2.3. Petrochemical Industry

4.2.4. Electronics Industry

4.3. By Technology (in value %)

4.3.1. Continuous Monitoring Systems

4.3.2. Intermittent Monitoring Systems

4.4. By Cryogen Type (in value %)

4.4.1. Liquefied Natural Gas (LNG)

4.4.2. Liquid Oxygen (LOX)

4.4.3. Liquid Nitrogen (LN2)

4.4.4. Liquid Argon

4.5. By Region (in value %)

4.5.1. East

4.5.2. North

4.5.3. West

4.5.4 South

5. KSA Cryogenic Equipment Market Competition Analysis

5.1. Market Share Analysis (Product and Service Providers)

5.2. Strategic Initiatives (Expansion, Partnerships, and Collaborations)

5.3. Mergers and Acquisitions (Recent Activities)

5.4. Investment Analysis

5.4.1. Venture Capital Investments

5.4.2. Government Funding and Grants (Saudi Industrial Development Fund, Ministry of Energy Initiatives)

5.4.3. Private Equity Investments

5.5. Competitive Landscape – Profiles of Key Players

5.5.1. Chart Industries

5.5.2. Air Liquide

5.5.3. Linde Group

5.5.4. Cryofab

5.5.5. Saudi Arabian Industrial Gas (SAGC)

5.5.6. Technex

5.5.7. INOXCVA

5.5.8. Air Products and Chemicals, Inc.

5.5.9. Taylor-Wharton

5.5.10. Hunan Kaimeite Gases Co., Ltd.

5.5.11. Cryogenmash

5.5.12. BOC Cryotech

5.5.13. Emerson Electric

5.5.14. TSI Incorporated

5.5.15. Hunan Kaimeite Gases

6. KSA Cryogenic Equipment Market Regulatory Framework

6.1. Government Initiatives and Regulations (Vision 2030, NIDLP)

6.2. Energy and Environmental Compliance (Saudi Green Initiative, National Gas Initiative)

6.3. Industrial Standards and Certifications (ISO Standards for Cryogenic Equipment)

6.4. Safety and Handling Regulations for Cryogenic Gases

7. KSA Cryogenic Equipment Future Market Outlook

7.1. Projections for Market Growth

7.2. Impact of Future Government Policies and Initiatives

7.3. Future Demand for LNG Infrastructure and Clean Energy Solutions

7.4. Expansion into New Industrial and Healthcare Segments

7.5. Technological Innovations and Their Market Impact

8. KSA Cryogenic Equipment Market Cross-Comparison

8.1. Company Profiles and Financial Data (Revenue, Operating Margins, CapEx)

8.2. Cross-Comparison of Product Offerings (Cryogenic Tanks, Valves, Vaporizers)

8.3. Market Positioning by Region and Industry Segment

8.4. Technological Leadership Comparison (R&D Investments, Innovation Capabilities)

9. KSA Cryogenic Equipment Market Ecosystem

9.1. Supply Chain Analysis (Manufacturing, Distribution, End-User)

9.2. Key Stakeholders and Market Participants (LNG Producers, Healthcare Providers, Petrochemical Industry)

9.3. Collaboration and Partnership Opportunities (Government-Private Sector Synergies)

9.4. Investment and Funding Opportunities (Private Sector, Government, International Investors)

10. Analyst Recommendations for KSA Cryogenic Equipment Market

10.1. TAM (Total Addressable Market), SAM (Serviceable Available Market), SOM (Serviceable Obtainable Market) Analysis

10.2. Customer Cohort and Behavioral Analysis (Energy, Healthcare, and Petrochemical Sectors)

10.3. Strategic Marketing Recommendations for Penetrating Key Segments

10.4. White-Space Opportunity Analysis (Emerging Markets and Technological Gaps)

11. KSA Cryogenic Equipment Market Competitive Benchmarking

11.1. Operational Metrics (Number of Employees, Manufacturing Capabilities)

11.2. Financial Metrics (Revenue, Profitability, Capital Expenditure)

11.3. Technological Capabilities (Patents, Innovation Index, R&D Spending)

11.4. Cross-Comparison of Product Pricing (Cost vs. Value for Different Cryogenic Products)

Disclaimer

Contact US

Research Methodology

Step 1: Identifying Key Variables

Ecosystem creation for all major entities and referring to multiple secondary and proprietary databases to perform desk research around the market to collate market-level information.

Step 2: Market Building

Collating statistics on the KSA Cyrogenic Equipment Market over the years, analyzing the penetration of Cyrogenic Equipment technologies, and computing the revenue generated for the market. This step also involves reviewing technology adoption rates and application effectiveness to ensure accuracy behind the data points shared.

Step 3: Validating and Finalizing

Building market hypotheses and conducting CATIs with market experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research Output

Our team will approach multiple Cyrogenic Equipment companies to understand the nature of technology segments, consumer preferences, and other parameters. This supports validating statistics derived through a bottom-to-top approach from these Cyrogenic Equipment companies, ensuring accuracy and reliability in the report.

Frequently Asked Questions

01. How big is the KSA Cryogenic Equipment Market?

The KSA Cryogenic Equipment Market was valued at USD 330 million in 2023, driven by increased investments in LNG infrastructure, rising healthcare demand, and expanding petrochemical industries, as part of the government's Vision 2030 strategy.

02. What are the challenges in the KSA Cryogenic Equipment Market?

Challenges in the KSA Cryogenic Equipment Market include high initial investment costs for infrastructure, technical complexities in handling and maintaining cryogenic systems, and volatility in global energy prices, which can affect investment decisions in key sectors.

03. Who are the major players in the KSA Cryogenic Equipment Market?

Key players in the market include Chart Industries, Air Liquide, Linde Group, Cryofab, and Saudi Arabian Industrial Gas (SAGC). These companies dominate the market due to their advanced technology offerings and strong presence in Saudi Arabias energy and healthcare sectors.

04. What are the growth drivers of the KSA Cryogenic Equipment Market?

The market is driven by the expansion of LNG infrastructure, growing demand for cryogenic gases in healthcare, and increasing investments in petrochemical and industrial sectors. Government initiatives like Vision 2030 and the National Gas Initiative further propel market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.