KSA Cryptocurrency Exchange Platform Market Outlook to 2030

Region:Middle East

Author(s):Vijay Kumar

Product Code:KROD7208

November 2024

80

About the Report

KSA Cryptocurrency Exchange Platform Market Overview

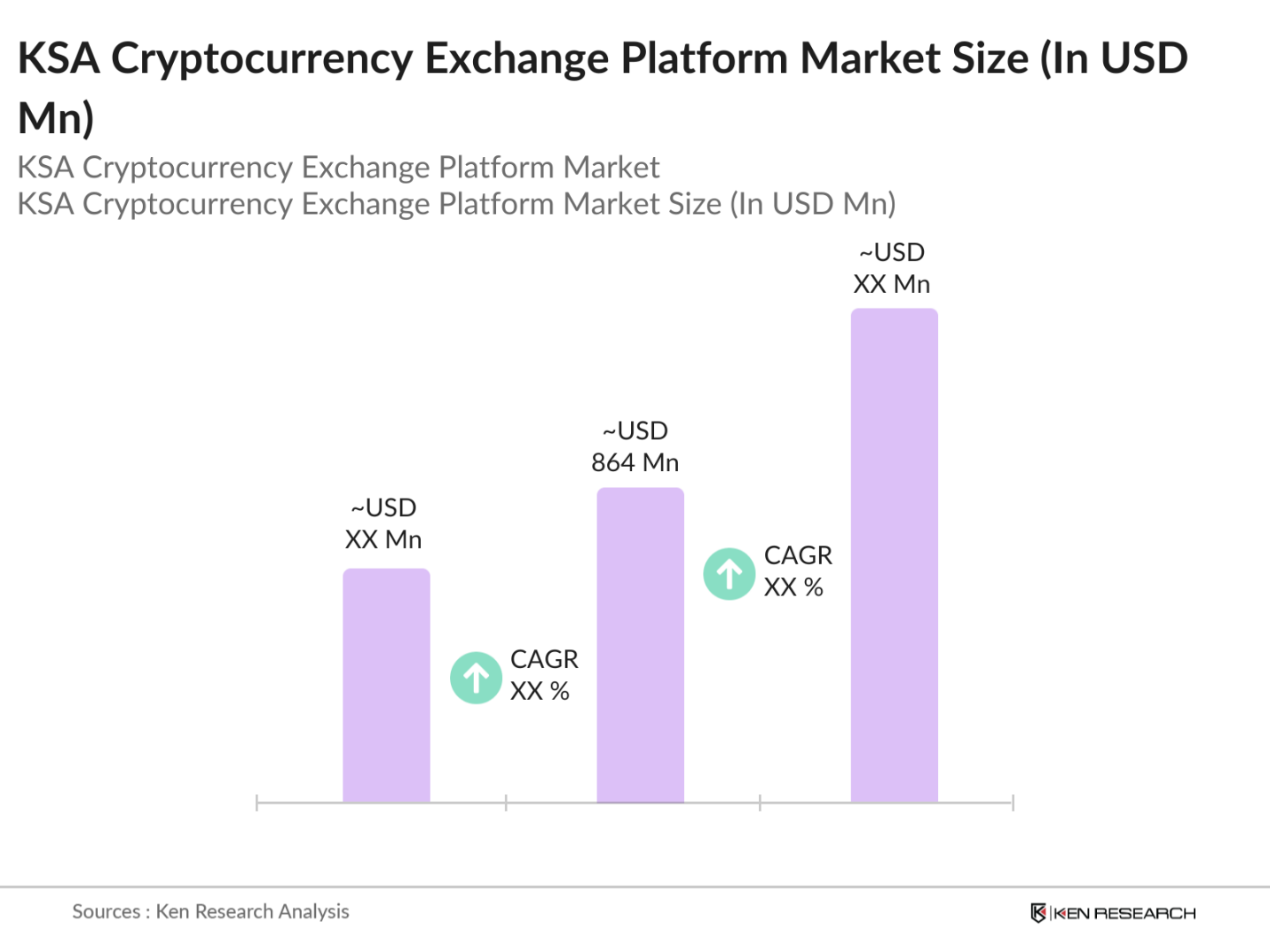

- The KSA Cryptocurrency Exchange Platform Market is valued at USD 864 million based on a five-year historical analysis, with significant growth driven by increased awareness and adoption of digital assets, regulatory advancements, and the introduction of crypto-friendly regulations by the Saudi Arabian Monetary Authority (SAMA). Major developments, such as blockchain technology integration in various sectors, and heightened interest from institutional investors, have contributed to the markets expansion. The demand for secure and user-friendly platforms continues to grow, fostering a competitive environment among exchange providers.

- In the Kingdom of Saudi Arabia, Riyadh and Jeddah dominate the cryptocurrency exchange platform market. The primary reason behind their dominance is their status as financial hubs and the increasing concentration of tech-savvy populations. Additionally, these cities benefit from superior infrastructure, higher disposable incomes, and the presence of tech start-ups and fintech innovators driving digital adoption. Government initiatives, particularly in Riyadh, are also fostering the development of blockchain and cryptocurrency technologies, making it a focal point for crypto-related activities.

- In 2023, the Saudi Arabian Monetary Authority (SAMA) released a comprehensive set of guidelines for cryptocurrency exchanges, focusing on compliance, security, and customer protection. These guidelines require exchanges to operate with full transparency, provide auditing reports, and ensure that all transactions are secure. As of 2023, over 30 exchanges have registered with SAMA, complying with these new standards.

KSA Cryptocurrency Exchange Platform Market Segmentation

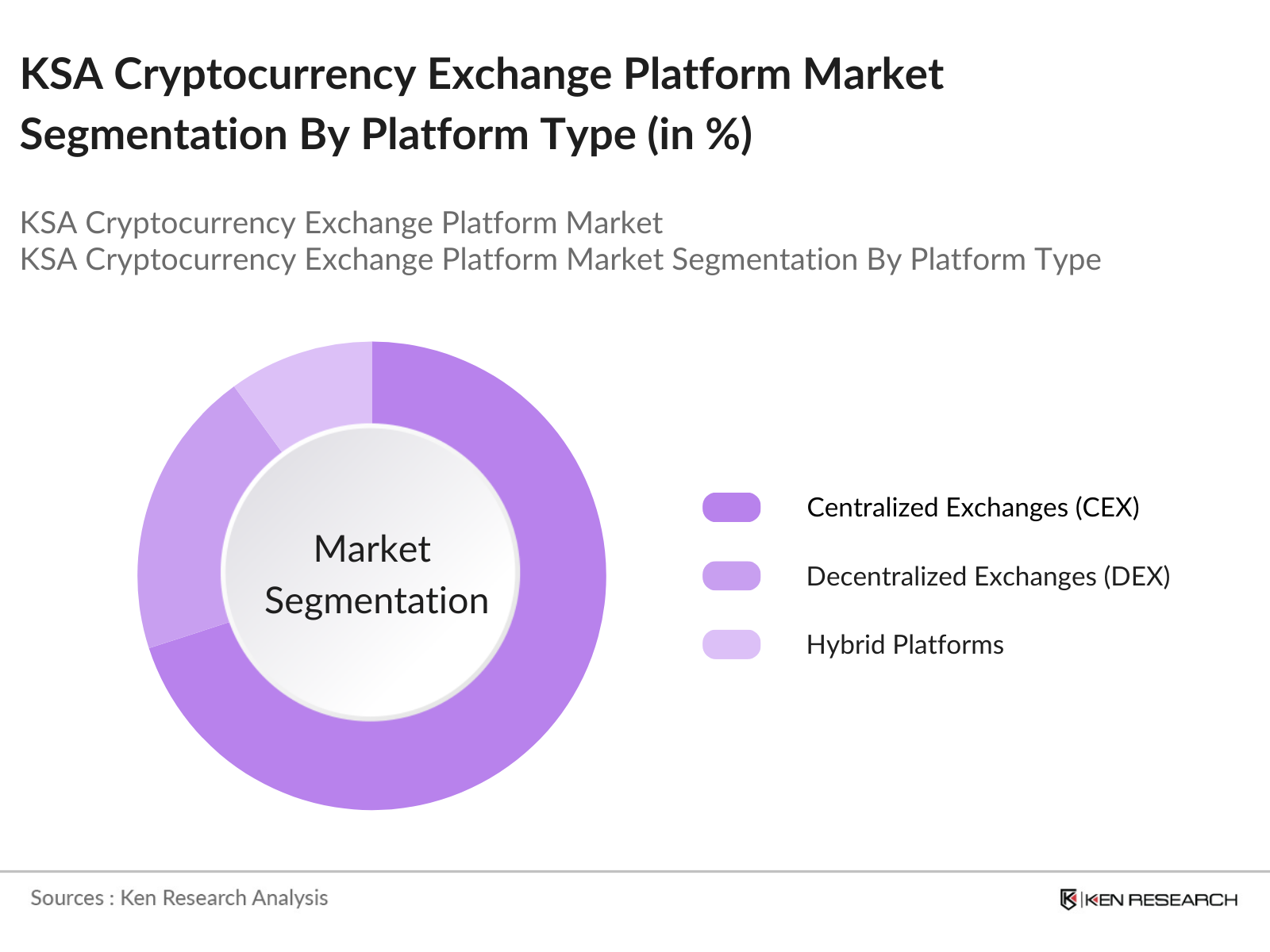

By Platform Type: The KSA cryptocurrency exchange platform market is segmented by platform type into centralized exchanges (CEX), decentralized exchanges (DEX), and hybrid platforms. Centralized exchanges have a dominant market share in Saudi Arabia under this segmentation due to their ease of use, strong security measures, and accessibility. Platforms like Binance and Coinbase have established robust operations in the region, offering seamless fiat-to-crypto conversion services that are compliant with local regulations.

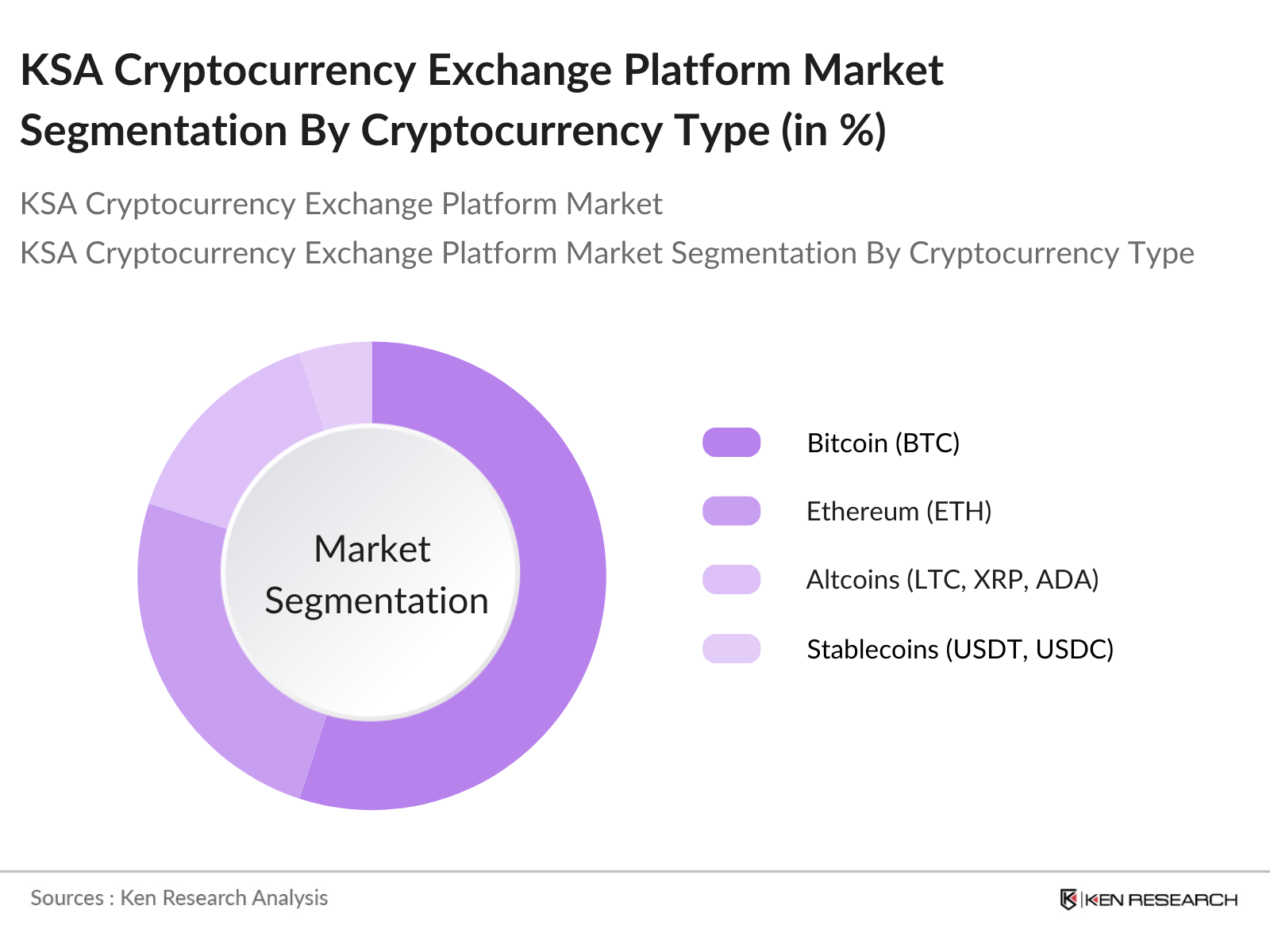

By Cryptocurrency Type: The market is also segmented by cryptocurrency type into Bitcoin (BTC), Ethereum (ETH), Altcoins (LTC, XRP, ADA), and stablecoins (USDT, USDC). Bitcoin holds a dominant market share in this segment, largely due to its first-mover advantage and widespread recognition as a store of value. In Saudi Arabia, Bitcoin is preferred by institutional investors seeking long-term gains, while retail investors appreciate its liquidity and global acceptance.

KSA Cryptocurrency Exchange Platform Market Competitive Landscape

The KSA cryptocurrency exchange platform market is dominated by a few major players, including both global and regional players. These firms have leveraged their technological expertise, regulatory compliance, and secure platforms to gain market share. The market is competitive, with these companies focusing on user experience, liquidity, and security as key differentiators.

KSA Cryptocurrency Exchange Platform Industry Analysis

Growth Drivers

- Increased Adoption of Cryptocurrencies: The cryptocurrency adoption rate in Saudi Arabia has seen a significant rise, with over 1.5 million people, representing nearly 4.5% of the population, actively using or holding cryptocurrencies in 2023. This surge is driven by the Kingdoms focus on Vision 2030, which aims to diversify the economy away from oil dependence, fostering digitalization and financial innovation. The active user base for cryptocurrencies like Bitcoin and Ethereum has grown exponentially, supported by high mobile penetration, which stands at 98.4% as of 2023.

- Rising Investments and Capital Inflows: Cryptocurrency and blockchain-related investments in Saudi Arabia reached approximately USD 500 million in 2023, driven by private capital and international crypto funds. Sovereign wealth funds, such as the Public Investment Fund (PIF), are also exploring investments in blockchain infrastructure, enhancing the sectors credibility. Capital inflows are expected to support the development of infrastructure for crypto exchanges and payment solutions.

- Technological Innovations (Blockchain Scalability, Layer 2 Solutions): Saudi Arabia is increasingly focusing on blockchain scalability and Layer 2 solutions. In 2023, the Kingdom announced the implementation of advanced blockchain technologies like Ethereum Layer 2 to enhance transaction speed and reduce fees. The move aims to address the congestion issue, with over 300,000 daily transactions processed through these technologies in major exchanges.

Market Challenges

- Volatility in Cryptocurrency Prices: The volatile nature of cryptocurrencies continues to be a significant challenge in Saudi Arabias crypto exchange platforms. In 2023, Bitcoins price ranged between USD 15,000 and USD 35,000, creating uncertainty for both traders and long-term investors. Such price swings discourage broader adoption and cause difficulties in pricing goods and services in digital currencies. This price instability, which affects daily trading volumes, impacts user confidence.

- Regulatory Uncertainty: Despite progressive developments, ambiguity in cryptocurrency regulations continues to pose challenges. As of 2023, Saudi Arabia has not yet fully implemented a comprehensive regulatory framework for all types of cryptocurrencies. Although SAMA and CMA have made advancements, concerns about unclear taxation, compliance, and licensing requirements limit the full potential of the market. Over 40% of companies involved in digital assets have delayed their operations due to these uncertainties.

KSA Cryptocurrency Exchange Platform Market Future Outlook

Over the next five years, the KSA cryptocurrency exchange platform market is expected to experience significant growth driven by favorable government regulations, advancements in blockchain infrastructure, and increasing institutional interest in cryptocurrencies. As financial technology innovations continue to rise, more individuals and businesses will adopt cryptocurrencies for trading, investment, and payment solutions.

Market Opportunities

- Expansion of Crypto Payment Gateways: Crypto payment gateways in Saudi Arabia are seeing rapid growth as businesses increasingly adopt cryptocurrencies for transactions. In 2023, over 1,000 retail outlets accepted cryptocurrencies as payment. The introduction of blockchain-based payment systems could accelerate this trend, especially as the Kingdoms digital economy continues to expand. With increasing smartphone and internet penetration, the number of transactions processed via crypto payment gateways is expected to surpass 500,000 monthly by 2025, creating opportunities for platform providers.

- Launch of New Digital Assets and Tokens: The Saudi cryptocurrency market is seeing the introduction of new digital assets and tokens. In 2023, more than 50 new digital tokens were launched, focusing on sectors like real estate and commodities. The creation of asset-backed tokens opens up new investment opportunities, as these assets provide more stable and tangible value than traditional cryptocurrencies. Government initiatives, including sandbox programs, support the development of new tokens that are compliant with Islamic finance principles, attracting a broader investor base.

Scope of the Report

|

Platform Type |

Centralized Exchanges (CEX) Decentralized Exchanges (DEX) Hybrid Platforms |

|

Cryptocurrency Type |

Bitcoin (BTC) Ethereum (ETH) Altcoins (LTC, XRP, ADA) Stablecoins (USDT, USDC) |

|

User Type |

Institutional Investors Retail Investors High-Frequency Traders (HFT) |

|

Trading Type |

Spot Trading Derivatives (Futures, Options, Perpetual Contracts) Margin Trading |

|

Region |

Riyadh Jeddah Eastern Province Makkah Province Other Regions |

Products

Key Target Audience

Institutional Investors

Retail Investors

Cryptocurrency Exchange Platforms

Payment Gateways

Technology Providers

Financial Institutions

Government and Regulatory Bodies (SAMA, CMA)

Investments and Venture Capitalist Firms

Companies

Players Mentioned in the Report

Binance

Coinbase

BitOasis

Crypto.com

KuCoin

OKX

Rain

Kraken

FTX (Post-Liquidation)

Huobi

Table of Contents

1. KSA Cryptocurrency Exchange Platform Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (CAGR, Market Dynamics)

1.4. Market Segmentation Overview

2. KSA Cryptocurrency Exchange Platform Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. KSA Cryptocurrency Exchange Platform Market Analysis

3.1. Growth Drivers

3.1.1. Increased Adoption of Cryptocurrencies

3.1.2. Regulatory Developments (SAMA, CMA Regulations)

3.1.3. Rising Investments and Capital Inflows

3.1.4. Technological Innovations (Blockchain Scalability, Layer 2 Solutions)

3.2. Market Challenges

3.2.1. Volatility in Cryptocurrency Prices

3.2.2. Regulatory Uncertainty

3.2.3. Cybersecurity Threats

3.2.4. Liquidity Constraints

3.3. Opportunities

3.3.1. Expansion of Crypto Payment Gateways

3.3.2. Launch of New Digital Assets and Tokens

3.3.3. Strategic Partnerships with Financial Institutions

3.3.4. Decentralized Finance (DeFi) Market Growth

3.4. Trends

3.4.1. Integration of AI and ML in Trading Algorithms

3.4.2. Shift Toward Decentralized Exchanges (DEX)

3.4.3. Growing Demand for Stablecoins (USDT, USDC)

3.4.4. NFT Marketplace Growth

3.5. Regulatory Framework

3.5.1. SAMA's Cryptocurrency Guidelines

3.5.2. Anti-Money Laundering (AML) and Know Your Customer (KYC) Regulations

3.5.3. Tax Implications for Crypto Transactions

3.5.4. Central Bank Digital Currency (CBDC) Initiatives

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem (Market Participants, HFT, Brokerage Firms)

4. KSA Cryptocurrency Exchange Platform Market Segmentation

4.1. By Platform Type (In Value %)

4.1.1. Centralized Exchanges (CEX)

4.1.2. Decentralized Exchanges (DEX)

4.1.3. Hybrid Platforms

4.2. By Cryptocurrency Type (In Value %)

4.2.1. Bitcoin (BTC)

4.2.2. Ethereum (ETH)

4.2.3. Altcoins (LTC, XRP, ADA)

4.2.4. Stablecoins (USDT, USDC)

4.3. By User Type (In Value %)

4.3.1. Institutional Investors

4.3.2. Retail Investors

4.3.3. High-Frequency Traders (HFT)

4.4. By Trading Type (In Value %)

4.4.1. Spot Trading

4.4.2. Derivatives (Futures, Options, Perpetual Contracts)

4.4.3. Margin Trading

4.5. By Region (In Value %)

4.5.1. Riyadh

4.5.2. Jeddah

4.5.3. Eastern Province

4.5.4. Makkah Province

4.5.5. Other Regions

5. KSA Cryptocurrency Exchange Platform Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Binance

5.1.2. Coinbase

5.1.3. BitOasis

5.1.4. Crypto.com

5.1.5. KuCoin

5.1.6. OKX

5.1.7. Rain

5.1.8. Kraken

5.1.9. FTX (Post-Liquidation Effects)

5.1.10. Huobi

5.1.11. Bittrex

5.1.12. Gemini

5.1.13. CEX.IO

5.1.14. eToro

5.1.15. ZB.com

5.2. Cross Comparison Parameters

5.2.1. Transaction Fees

5.2.2. Liquidity Levels

5.2.3. Customer Support Quality

5.2.4. Trading Volume

5.2.5. Asset Security Measures (Cold Wallet Storage, Insurance)

5.2.6. Regulatory Compliance (AML, KYC Adherence)

5.2.7. Availability of Trading Pairs

5.2.8. Mobile App Performance

5.3. Market Share Analysis

5.4. Strategic Initiatives (Partnerships, Collaborations, New Product Launches)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. KSA Cryptocurrency Exchange Platform Regulatory Framework

6.1. Cryptocurrency and Digital Asset Regulations

6.2. AML/KYC Compliance Requirements

6.3. Data Privacy and Security Standards

6.4. Certification Processes for Exchange Platforms

7. KSA Cryptocurrency Exchange Platform Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. KSA Cryptocurrency Exchange Platform Future Market Segmentation

8.1. By Platform Type (In Value %)

8.2. By Cryptocurrency Type (In Value %)

8.3. By User Type (In Value %)

8.4. By Trading Type (In Value %)

8.5. By Region (In Value %)

9. KSA Cryptocurrency Exchange Platform Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives (Brand Positioning, Community Building)

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the KSA Cryptocurrency Exchange Platform Market. This step is underpinned by extensive desk research, utilizing secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics, including regulation, adoption rates, and technology trends.

Step 2: Market Analysis and Construction

In this phase, we compiled and analyzed historical data pertaining to the KSA Cryptocurrency Exchange Platform Market. This includes assessing market penetration, the ratio of centralized to decentralized platforms, and the resultant revenue generation. Furthermore, an evaluation of the liquidity levels of major exchanges ensures the reliability and accuracy of revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were developed and subsequently validated through consultations with industry experts representing a diverse array of companies. These consultations provided valuable operational and financial insights directly from industry practitioners, which were instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involved direct engagement with multiple cryptocurrency exchanges to acquire detailed insights into platform types, daily trading volumes, and user preferences. This interaction served to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the KSA Cryptocurrency Exchange Platform Market.

Frequently Asked Questions

01. How big is the KSA Cryptocurrency Exchange Platform Market?

The KSA Cryptocurrency Exchange Platform Market is valued at USD 864 million based on a five-year historical analysis, with significant growth driven by increased awareness and adoption of digital assets, regulatory advancements, and the introduction of crypto-friendly regulations by the Saudi Arabian Monetary Authority (SAMA).

02. What are the challenges in the KSA Cryptocurrency Exchange Platform Market?

The market faces challenges such as regulatory uncertainties, concerns about the volatility of digital currencies, and cybersecurity risks. Ensuring platform security and user trust remains a priority for exchanges operating in Saudi Arabia.

03. Who are the major players in the KSA Cryptocurrency Exchange Platform Market?

Major players in the market include Binance, Coinbase, BitOasis, KuCoin, and Rain. These companies dominate the market due to their established presence, regulatory compliance, and robust security measures.

04. What are the growth drivers of the KSA Cryptocurrency Exchange Platform Market?

The market is propelled by factors such as increased institutional investments, government support for blockchain technologies, and the growing acceptance of cryptocurrencies as an investment class by the public.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.