KSA Cybersecurity Market Outlook to 2030

Region:Middle East

Author(s):Shubham Kashyap

Product Code:KROD1658

November 2024

91

About the Report

KSA Cybersecurity Market Overview

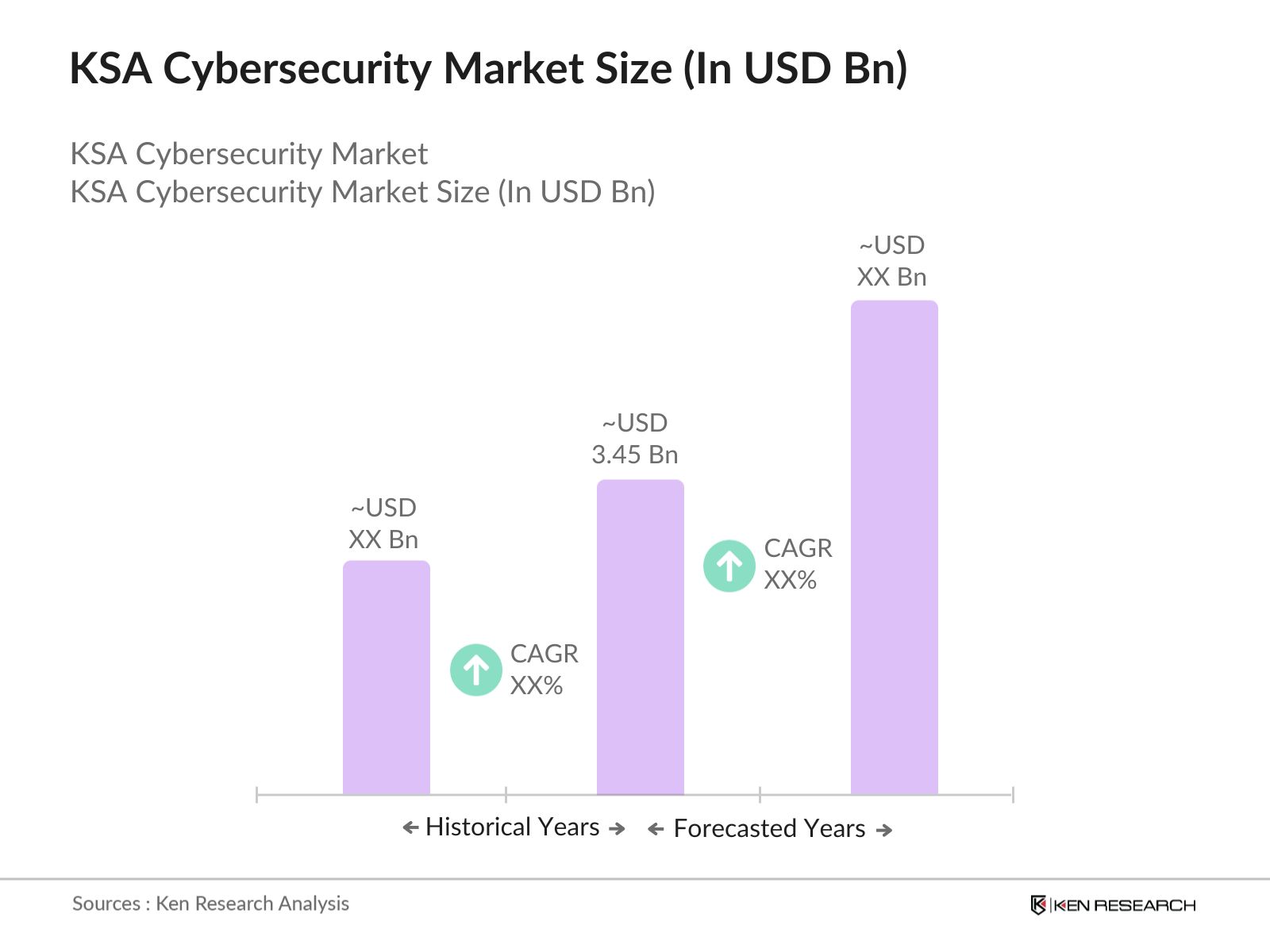

- The KSA cybersecurity market is valued at USD 3.45 billion, based on a five-year historical analysis, supported by increasing digital transformation, growing awareness of cybersecurity threats, and government-led initiatives to enhance national cybersecurity infrastructure. The market is witnessing growth driven by the rise in cyberattacks, particularly in the financial, healthcare, and energy sectors. The demand for advanced cybersecurity solutions, including network security, endpoint protection, and identity management, is surging as organizations seek to protect sensitive data from cyber threats.

- Major urban areas such as Riyadh, Jeddah, and Dhahran are leading the growth of this market due to the high concentration of large enterprises, government institutions, and financial hubs, which are more vulnerable to cyber threats. In contrast, smaller regions and rural areas are increasingly adopting cybersecurity solutions as part of broader efforts to digitalize and enhance their IT infrastructure.

- The National Cybersecurity Authority (NCA) in Saudi Arabia has implemented a comprehensive cybersecurity framework to protect critical infrastructure. In 2024, over 500 public and private organizations are subject to NCAs regulations, requiring them to adhere to strict cybersecurity standards. The NCA framework focuses on risk management, incident response, and data protection, providing a structured approach to cybersecurity across various sectors.

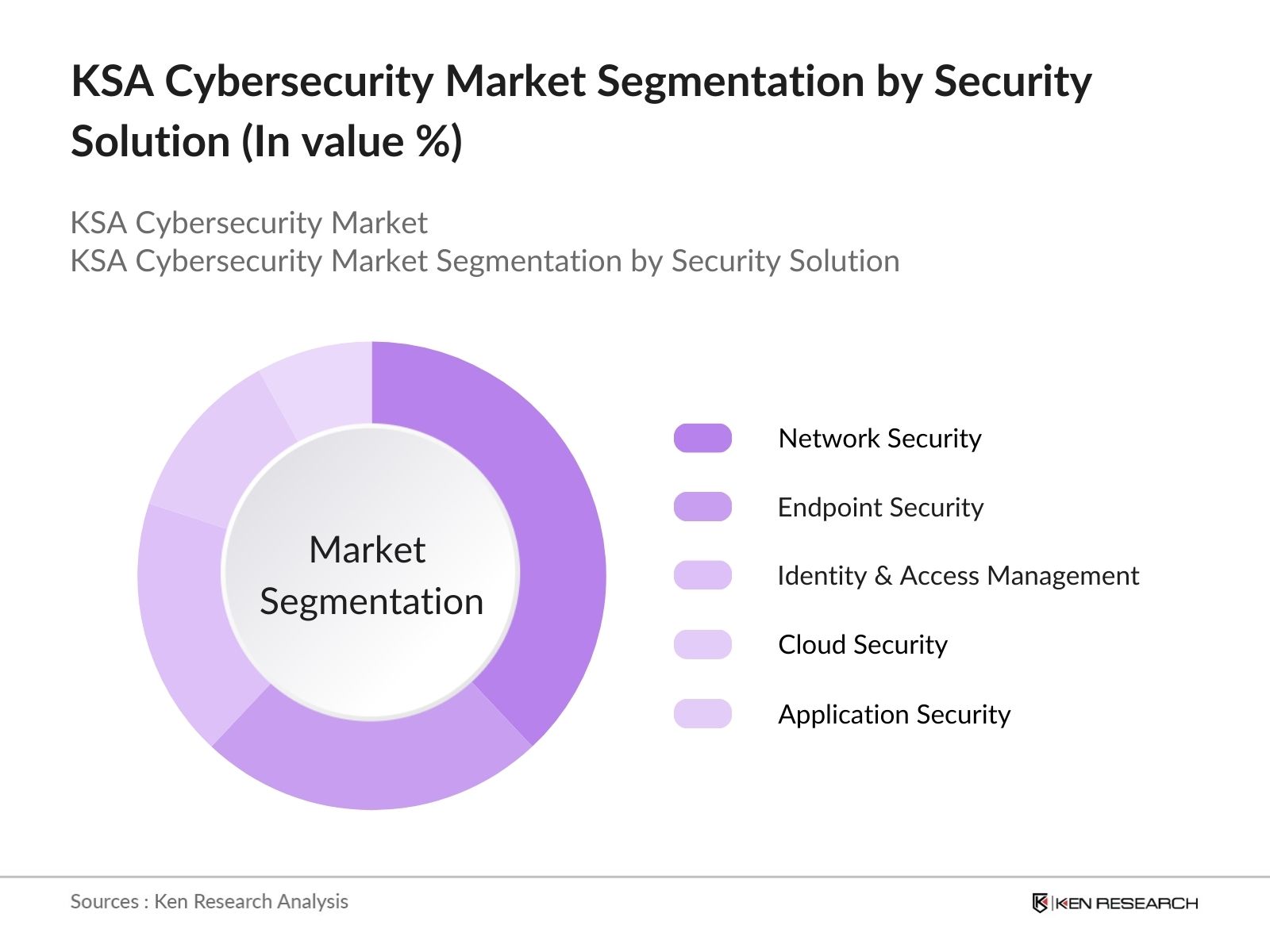

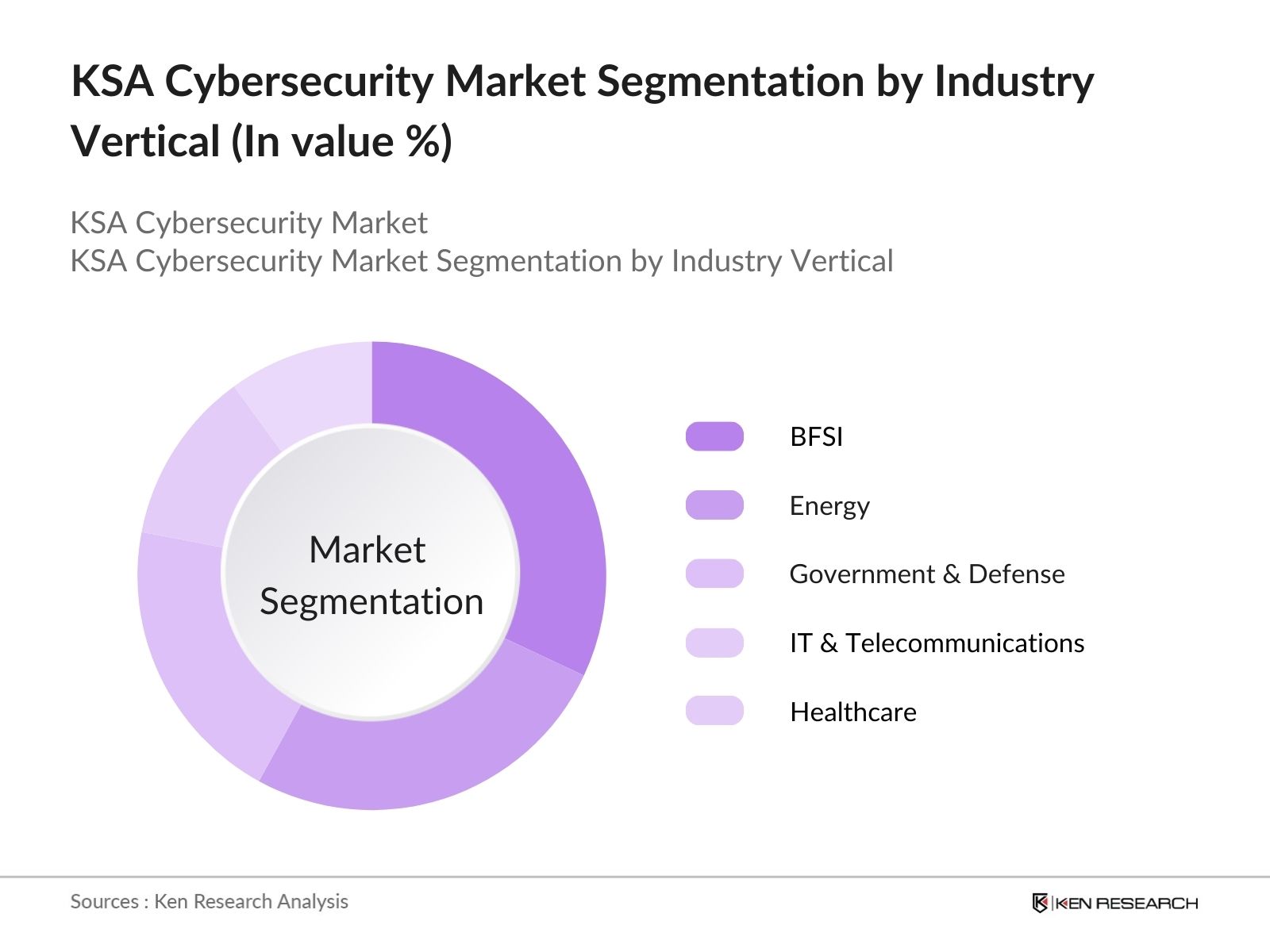

KSA Cybersecurity Market Segmentation

- By Security Solution: The market is segmented by type of security solution into network security, endpoint security, identity and access management (IAM), cloud security, and application security. Network security dominates due to the rising threat of advanced persistent threats (APTs) and ransomware targeting large enterprises and government institutions. Cloud security is also seeing rapid growth due to the increased adoption of cloud-based services, with companies seeking secure cloud environments to protect critical business data. IAM solutions are gaining traction as organizations focus on securing user identities and controlling access to sensitive information.

- By Industry Vertical: The market is segmented by industry vertical into BFSI (Banking, Financial Services, and Insurance), healthcare, energy, IT & telecommunications, and government & defense. The BFSI sector leads in cybersecurity spending, driven by stringent regulations and the need to protect financial data from fraud and cyber theft. The healthcare sector is rapidly adopting cybersecurity measures to safeguard patient data and ensure compliance with healthcare regulations. The energy sector is also a key contributor to market growth, as the risk of cyberattacks on critical infrastructure like oil and gas facilities has heightened awareness of the need for robust cybersecurity solutions.

KSA Cybersecurity Market Competitive Landscape

The KSA cybersecurity market is highly competitive, with several global and local players providing a wide range of cybersecurity solutions and services. Key players include IBM Corporation, Cisco Systems, Palo Alto Networks, and Saudi Telecom Company (STC). These companies are continuously innovating and expanding their product portfolios to address the evolving cybersecurity landscape in the Kingdom. Investments in research and development, partnerships with local companies, and the introduction of AI-driven cybersecurity solutions are common strategies employed by these players to enhance their market positions.

|

Company Name |

Establishment Year |

Headquarters |

No. of Employees |

Revenue (USD) |

Key Services |

R&D Investments |

Partnerships |

Technology Adoption |

Regional Presence |

|

IBM Corporation |

1911 |

Armonk, NY |

|||||||

|

Cisco Systems |

1984 |

San Jose, CA |

|||||||

|

Palo Alto Networks |

2005 |

Santa Clara, CA |

|||||||

|

Saudi Telecom Company (STC) |

1998 |

Riyadh, KSA |

|||||||

|

DarkMatter Group |

2014 |

Abu Dhabi, UAE |

KSA Cybersecurity Industry Analysis

Growth Drivers

- Increase in Cyber Threats Targeting Critical Sectors: In 2024, Saudi Arabia's critical sectors, including energy, BFSI (banking, financial services, and insurance), and government, faced a significant rise in cyberattacks. According to the National Cybersecurity Authority (NCA), the energy sector has been particularly targeted, with over 7,500 recorded incidents involving ransomware and phishing attempts in 2023. The BFSI sector saw a substantial increase in data breaches, highlighting the vulnerability of critical financial institutions. Government infrastructure remains at risk, with over 2,000 cyberattack attempts reported in the first quarter of 2024 alone. These increasing threats drive the demand for advanced cybersecurity measures across the nation.

- Digital Transformation in Cloud Computing and IoT Adoption: The rapid digital transformation in Saudi Arabia, driven by the adoption of cloud computing and IoT technologies, has necessitated stronger cybersecurity infrastructure. By 2024, majority of government agencies and businesses have adopted cloud services, leading to a rise in data vulnerability. The IoT market, especially in sectors like healthcare and energy, is growing at an unprecedented rate, with over 1.2 billion connected devices reported across the Kingdom. This surge in digitalization and IoT adoption increases the risk of cyberattacks, driving demand for more secure cloud and IoT cybersecurity solutions.

- Demand for Advanced Solutions: Saudi Arabia's demand for advanced cybersecurity solutions has intensified, particularly in the areas of AI-driven threat detection and Zero Trust models. In 2024, AI-powered cybersecurity systems are in place in over 500 organizations to monitor and predict potential threats. The financial sector has adopted Zero Trust models, with major banks implementing these systems in response to over 1,000 attempted data breaches in 2023 alone. These solutions, while costly, are becoming essential as the threat landscape evolves, contributing to the overall growth of the cybersecurity market in the country

Market Challenges

- Lack of Cybersecurity Professionals: Saudi Arabia faces a significant shortage of skilled cybersecurity professionals, leaving critical sectors vulnerable to cyber threats. This gap in expertise is a major challenge as businesses require qualified personnel to implement and manage sophisticated cybersecurity systems. To address this issue, the government has introduced various training initiatives under Vision 2030. However, the current shortfall continues to be a substantial barrier for market growth, as companies struggle to find the necessary expertise to protect their digital infrastructure from increasingly sophisticated attacks.

- Compliance with International and Local Regulations: Compliance with both international cybersecurity regulations, such as GDPR, and local frameworks like those set by the NCA presents a significant challenge for companies operating in Saudi Arabia. Navigating the overlap between these regulations requires substantial investment in legal and technical resources. Cross-border data exchanges and the Kingdoms global partnerships, especially in critical sectors like finance and healthcare, add complexity to regulatory adherence. This situation makes it difficult for organizations to meet all requirements, which hinders their cybersecurity readiness and stunts the overall growth of the market.

KSA Cybersecurity Market Future Outlook

The KSA cybersecurity market is expected to witness robust growth over the next five years, driven by increasing digitalization, rising cyber threats, and strong government support for cybersecurity initiatives. The integration of AI and machine learning into cybersecurity solutions will enhance threat detection and response capabilities, while the adoption of cloud-based security solutions will continue to grow.

Future Market Opportunities

- Growing Demand for Managed Security Services: Managed security services (MSS) are witnessing rising demand, particularly among SMEs, which lack in-house cybersecurity expertise. As of 2024, over 6,500 SMEs in Saudi Arabia have outsourced their cybersecurity needs to MSS providers. The MSS market is expanding rapidly, with providers offering end-to-end services that include threat monitoring, vulnerability assessments, and incident response. This growing reliance on MSS presents a significant opportunity for cybersecurity vendors to offer comprehensive solutions tailored to the needs of smaller businesses, helping them mitigate risks without the high costs of maintaining an internal cybersecurity team.

- Increased Cybersecurity Budgets in SMEs: Saudi Arabian SMEs have begun allocating larger portions of their budgets to cybersecurity, recognizing the increasing threat landscape. In 2024, the average cybersecurity budget for SMEs grew by 25% compared to 2022, with an estimated $1.5 billion in total cybersecurity spending among SMEs. Government incentives, such as tax rebates for cybersecurity investments, have encouraged this shift. This increase in spending reflects the growing awareness among SMEs of the importance of protecting their digital infrastructure and the lucrative opportunities for cybersecurity vendors targeting this segment.

Scope of the Report

|

By Security Solution |

Network Security Endpoint Security Identity & Access Management (IAM) Cloud Security Application Security |

|

By Industry Vertical |

BFSI Energy Government and Defense Healthcare IT & Telecommunications |

|

By Deployment Mode |

On-Premise Cloud-Based Hybrid |

|

By Organization Size |

Large Enterprises Small and Medium Enterprises (SMEs) |

|

Region |

Riyadh Jeddah Dammam Mecca Eastern Province |

Products

Key Target Audience

Defense Agencies (Ministry of Defense)

Financial Institutions (Banks, Insurance Companies)

Healthcare Providers

Energy Sector Companies

IT & Telecommunications Providers

Managed Security Service Providers (MSSPs)

Investments and Venture Capitalist Firms

Government & Regulatory Bodies (National Cybersecurity Authority, Ministry of Interior)

Banks and Financial Institutions

Companies

Major Players in the Report

IBM Corporation

Cisco Systems

Palo Alto Networks

Saudi Telecom Company (STC)

Trend Micro

FireEye

Fortinet

McAfee

Check Point Software Technologies

Symantec Corporation

Kaspersky Lab

DarkMatter Group

Broadcom Inc.

BAE Systems

Raytheon Technologies

Table of Contents

1. KSA Cybersecurity Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. KSA Cybersecurity Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. KSA Cybersecurity Market Analysis

3.1. Growth Drivers

3.1.1. Increase in Cyber Threats Targeting Critical Sectors (Energy, BFSI, Government)

3.1.2. Government Regulations (Vision 2030, NCA Initiatives)

3.1.3. Digital Transformation (Cloud Computing, IoT Adoption)

3.1.4. Demand for Advanced Solutions (AI in Cybersecurity, Zero Trust Models)

3.2. Market Challenges

3.2.1. Lack of Cybersecurity Professionals

3.2.2. Compliance with International and Local Regulations

3.2.3. High Cost of Advanced Cybersecurity Solutions

3.3. Opportunities

3.3.1. Growing Demand for Managed Security Services

3.3.2. Increased Cybersecurity Budgets in SMEs

3.3.3. AI-Driven Threat Detection and Response Systems

3.4. Trends

3.4.1. Increasing Use of Cloud Security Solutions

3.4.2. Integration of Blockchain in Cybersecurity

3.4.3. Rise of Identity and Access Management Solutions (IAM)

3.5. Government Regulations

3.5.1. National Cybersecurity Authority (NCA) Framework

3.5.2. Cybercrime Law Compliance

3.5.3. GDPR and Local Data Protection Laws

3.5.4. Public-Private Cybersecurity Partnerships

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. KSA Cybersecurity Market Segmentation

4.1. By Security Solution (In Value %)

4.1.1. Network Security

4.1.2. Endpoint Security

4.1.3. Identity & Access Management (IAM)

4.1.4. Cloud Security

4.1.5. Application Security

4.2. By Industry Vertical (In Value %)

4.2.1. BFSI

4.2.2. Energy

4.2.3. Government and Defense

4.2.4. Healthcare

4.2.5. IT & Telecommunications

4.3. By Deployment Mode (In Value %)

4.3.1. On-Premise

4.3.2. Cloud-Based

4.3.3. Hybrid

4.4. By Organization Size (In Value %)

4.4.1. Large Enterprises

4.4.2. Small and Medium Enterprises (SMEs)

4.5. By Service Type (In Value %)

4.5.1. Managed Security Services

4.5.2. Professional Services

4.5.3. Training & Education Services

5. KSA Cybersecurity Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. IBM Corporation

5.1.2. Cisco Systems

5.1.3. Palo Alto Networks

5.1.4. Saudi Telecom Company (STC)

5.1.5. Trend Micro

5.1.6. FireEye

5.1.7. Fortinet

5.1.8. McAfee

5.1.9. Check Point Software Technologies

5.1.10. Symantec Corporation

5.1.11. Kaspersky Lab

5.1.12. DarkMatter Group

5.1.13. Broadcom Inc.

5.1.14. BAE Systems

5.1.15. Raytheon Technologies

5.2. Cross Comparison Parameters (Headquarters, No. of Employees, Revenue, Product Offerings, Geographical Reach, Technology Focus, Security Solution Expertise, Managed Services Capability)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants and Subsidies

5.9. Private Equity Investments

6. KSA Cybersecurity Market Regulatory Framework

6.1. NCA Guidelines

6.2. Data Protection and Privacy Laws

6.3. ISO Certification for Cybersecurity

6.4. Compliance Requirements

7. KSA Cybersecurity Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. KSA Cybersecurity Future Market Segmentation

8.1. By Security Solution (In Value %)

8.2. By Industry Vertical (In Value %)

8.3. By Deployment Mode (In Value %)

8.4. By Organization Size (In Value %)

8.5. By Service Type (In Value %)

9. KSA Cybersecurity Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Go-To-Market Strategy

9.3. Partnership and M&A Opportunities

9.4. White Space Analysis

Research Methodology

Step 1: Identification of Key Variables

In the initial stage, we constructed an ecosystem map of the KSA Cybersecurity Market. This step involved secondary research using proprietary databases and industry reports to define key variables such as cyberattack trends, regulatory developments, and technological advancements.

Step 2: Market Analysis and Construction

Historical data on market penetration, the adoption of cybersecurity solutions, and the revenue growth of key players were analyzed. The analysis also considered regional variations and industry-specific cybersecurity requirements, ensuring a robust revenue estimate.

Step 3: Hypothesis Validation and Expert Consultation

Our research hypotheses were validated through interviews with cybersecurity experts and C-level executives from leading companies in the KSA. This provided real-time insights into operational challenges, market dynamics, and future trends, which were used to corroborate our findings.

Step 4: Research Synthesis and Final Output

The final step involved engaging with cybersecurity vendors and industry practitioners to gather detailed insights into product offerings, cybersecurity incidents, and the role of government initiatives. The findings were synthesized to produce a comprehensive report on the KSA Cybersecurity Market.

Frequently Asked Questions

01. How big is the KSA Cybersecurity Market?

The KSA cybersecurity market is valued at USD 3.45 billion in 2023, driven by increasing digital transformation, government regulations, and a rise in cyber threats targeting critical sectors such as finance and energy.

02. What are the challenges in the KSA Cybersecurity Market?

Challenges in the KSA cybersecurity market include the shortage of skilled cybersecurity professionals, high costs of implementing advanced cybersecurity solutions, and navigating the complex regulatory environment set by the National Cybersecurity Authority (NCA).

03. Who are the major players in the KSA Cybersecurity Market?

Key players in the KSA cybersecurity market include IBM Corporation, Cisco Systems, Palo Alto Networks, Saudi Telecom Company (STC), and DarkMatter Group. These companies dominate due to their comprehensive cybersecurity offerings and strategic partnerships with government agencies.

04. What are the growth drivers of the KSA Cybersecurity Market?

The KSA cybersecurity market is propelled by rising cyber threats, government initiatives under Vision 2030, and the increasing adoption of digital technologies across key sectors like BFSI, energy, and healthcare.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.