KSA Dairy-Free Infant Formula Market Outlook to 2030

Region:Middle East

Author(s):Ananya Singh

Product Code:KROD8840

November 2024

88

About the Report

KSA Dairy-Free Infant Formula Market Overview

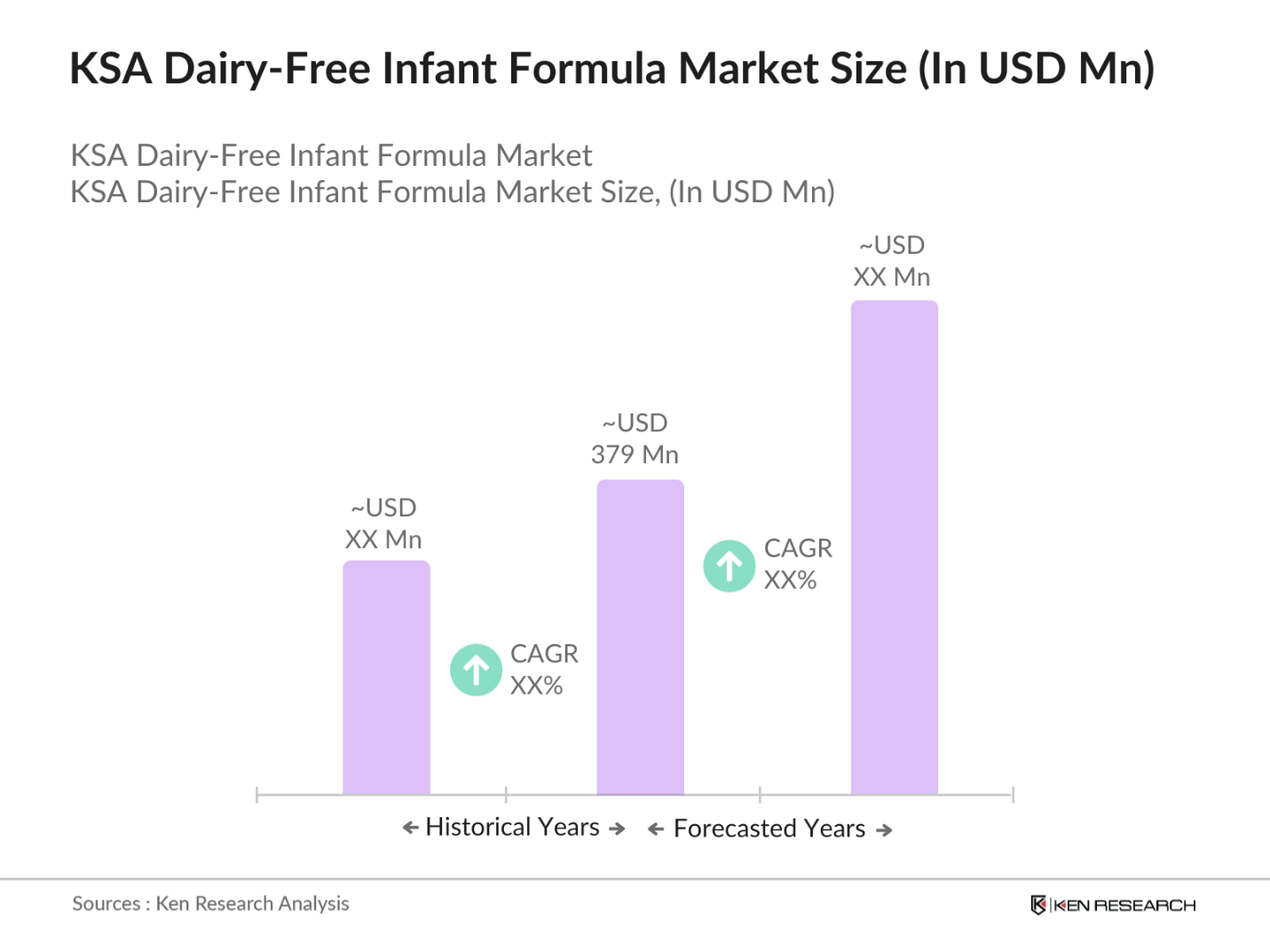

- The KSA dairy-free infant formula market is valued at USD 379 million. Driven by rising lactose intolerance among infants and an increasing demand for specialized baby nutrition options, the market reflects an accelerated shift towards plant-based formulas. Consumer awareness about the benefits of dairy-free options is rising, further spurred by recommendations from pediatric experts. This demand is substantiated by a historical analysis over five years, demonstrating a consistent preference for non-dairy alternatives that cater to specific dietary needs.

- Key regions within Saudi Arabia, including Riyadh, Jeddah, and Dammam, dominate the market for dairy-free infant formula. These cities lead due to their high population density, concentrated healthcare infrastructure, and access to premium retail outlets. The higher purchasing power in these areas, combined with a growing awareness of lactose intolerance, has led to a stronger market foothold in urbanized regions, which support the distribution and availability of specialized nutrition products.

- To boost domestic production, the Saudi government offers incentives, including tax benefits and subsidies, for companies manufacturing infant formulas locally. This initiative, part of the Kingdoms Vision 2030 plan, aims to reduce dependence on imports and encourage the production of dairy-free formulas. Recent reports indicate that local manufacturers have received USD 3 million in subsidies, which supports cost-effective production and wider availability of these products.

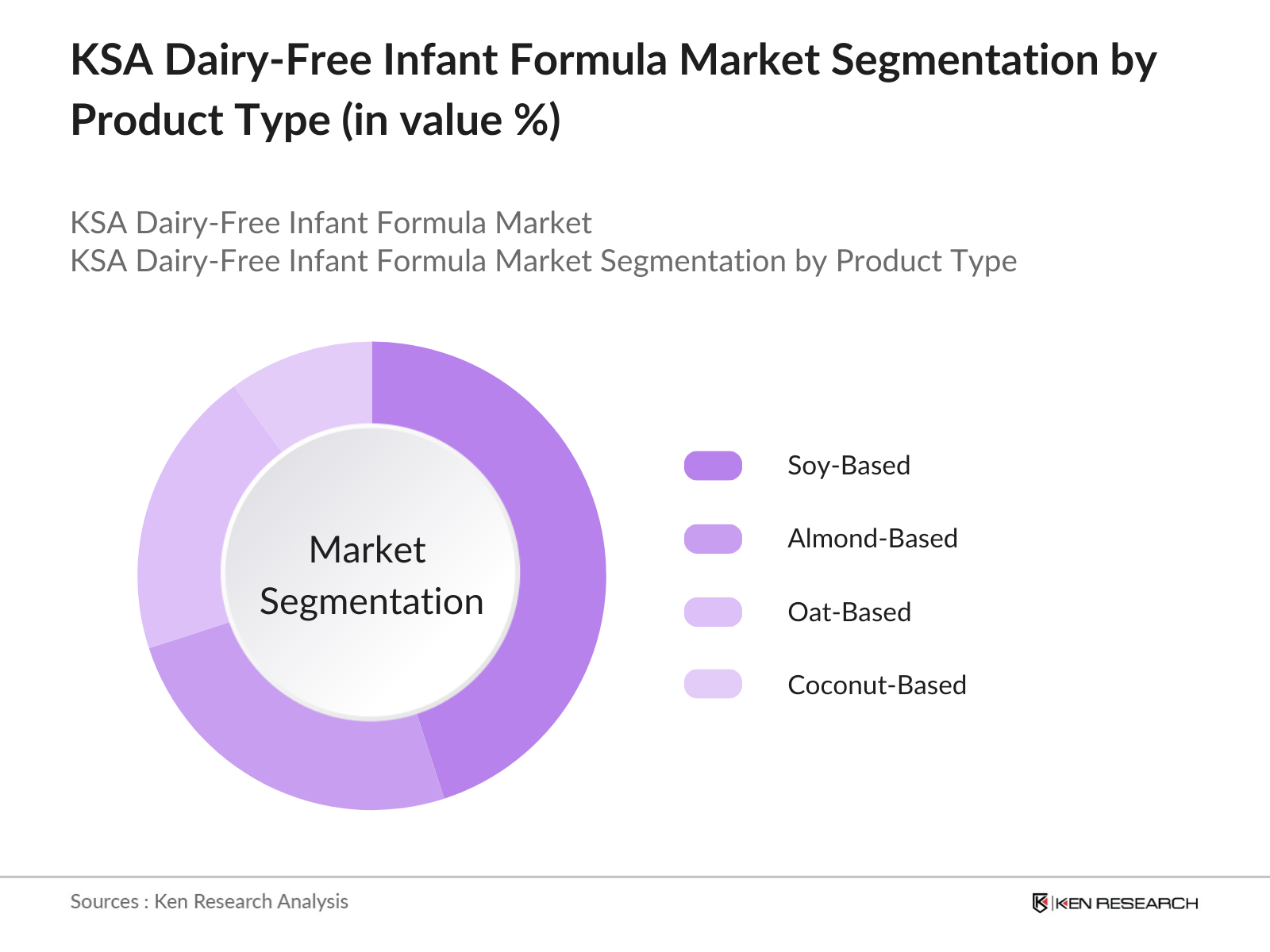

KSA Dairy-Free Infant Formula Market Segmentation

By Product Type: The KSA dairy-free infant formula market is segmented by product type into soy-based, almond-based, oat-based, and coconut-based formulas. Among these, soy-based formulas hold the dominant market share due to their well-established acceptance as a safe and nutritious dairy-free alternative. Parents often choose soy-based options as they closely mimic the nutrient profile of traditional dairy formulas, ensuring infants receive essential nutrients for growth and development. Brands providing soy-based options continue to attract demand due to the reliable protein source and affordability in comparison to other dairy-free products.

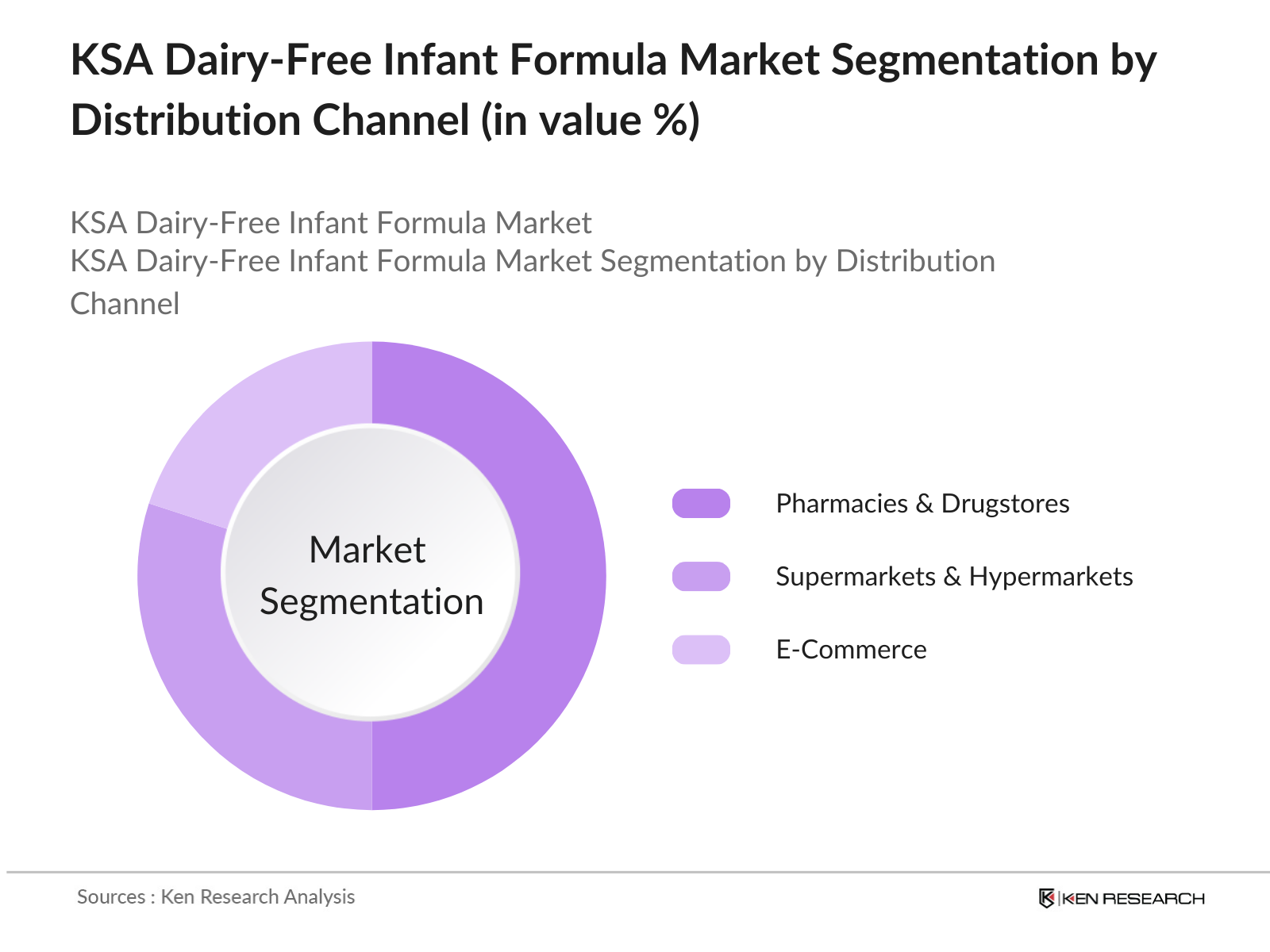

By Distribution Channel: The market is segmented by distribution channel into supermarkets & hypermarkets, pharmacies & drugstores, and e-commerce. Pharmacies and drugstores hold a dominant market share due to their strong positioning as trusted points of sale for infant nutrition products. Parents often rely on the expertise and recommendations provided by pharmacy professionals, which encourages purchases through this channel. Additionally, pharmacies provide easy access to a range of products catering to specific dietary needs, making them a preferred choice for dairy-free infant formulas.

KSA Dairy-Free Infant Formula Market Competitive Landscape

The KSA dairy-free infant formula market is characterized by the presence of several leading global and regional players. Companies such as Abbott Laboratories and Nestl S.A. maintain significant influence, while local entities are emerging with specialized plant-based offerings tailored to the Middle Eastern market. This competitive consolidation illustrates the influence of established and trusted players within the industry, where brand reputation and distribution reach are key determinants of market presence.

KSA Dairy-Free Infant Formula Market Analysis

Growth Drivers

- Increasing Infant Lactose Intolerance: In Saudi Arabia, lactose intolerance among infants is a prominent driver in the adoption of dairy-free infant formula. Studies show that over 1.5 million infants in the country experience digestive discomfort due to lactose in traditional formulas. Medical professionals increasingly recommend dairy-free options as a suitable alternative to ensure optimal nutrition for infants facing lactose intolerance. This has created a robust demand for plant-based formulas, spurring growth in the dairy-free infant formula market.

- Growing Preference for Specialized Nutrition: With a rise in parental awareness about nutrition, especially related to infant health, there has been a marked demand for specialized products such as dairy-free infant formula. An estimated 2 million parents in urban areas are actively seeking formulas that cater to specific dietary requirements, including dairy-free options. This trend aligns with a wider shift in consumer expectations toward customized nutrition for infants, further supporting the dairy-free infant formula markets expansion in the region.

- Expanding Retail Infrastructure for Specialty Products: The retail landscape in Saudi Arabia is seeing significant investments in healthcare and specialty products, particularly in urban hubs like Riyadh and Jeddah. With over 300 retail outlets now stocking dairy-free infant formula, accessibility to these products has significantly increased, leading to higher consumer adoption. Retailers report strong sales in specialized infant nutrition products, which reflects the growing inclination toward plant-based formulas across different socioeconomic demographics.

Challenges

- Higher Cost Compared to Dairy-Based Formulas: Dairy-free infant formulas are generally priced higher than traditional dairy-based products, with an average cost increase of approximately USD 2 per unit. This price differential makes dairy-free options less accessible to lower-income families, thereby limiting their adoption. Retail data shows that sales are concentrated in higher-income areas, with middle- and lower-income families often opting for more affordable alternatives due to the cost constraint.

- Limited Consumer Awareness in Rural Areas: While urban areas in Saudi Arabia show high levels of awareness and acceptance of dairy-free infant formulas, rural regions lag. Surveys indicate that nearly 60% of rural consumers are unfamiliar with dairy-free options, resulting in low adoption rates outside major cities. This lack of awareness, combined with limited distribution networks in these areas, poses a challenge to market expansion beyond urban centers.

KSA Dairy-Free Infant Formula Market Future Outlook

KSA dairy-free infant formula market is anticipated to grow as dietary preferences shift towards lactose-free alternatives. Increased urbanization, a rise in disposable income, and growing parental awareness of dairy-free nutritional benefits for infants are expected to drive this trend. The role of e-commerce is also projected to expand, with more consumers turning to online channels for a wider selection of infant formula options.

Market Opportunities

- Growth in E-Commerce Sales for Dairy-Free Infant Formula: Over the next five years, online retail is expected to play a critical role in the distribution of dairy-free infant formulas. With more than 70% of Saudi consumers indicating a preference for online shopping, e-commerce platforms are anticipated to account for nearly half of the markets sales volume. This shift is expected to be driven by the convenience of digital shopping and a wider variety of options available online.

- Increasing Preference for Organic Dairy-Free Options: Demand for organic dairy-free formulas is projected to grow, as consumers become more conscious of ingredient quality and product origin. Reports indicate that by 2029, organic variants could make up approximately 30% of the dairy-free formula market in KSA, reflecting a shift towards premium, natural products that cater to health-conscious parents.

Scope of the Report

|

By Product Type |

Soy-Based |

|

By Age Group |

0-6 Months |

|

By Ingredients |

Protein Blend |

|

By Distribution Channel |

Supermarkets & Hypermarkets Pharmacy & Drugstores |

|

By Region |

Central |

Products

Key Target Audience

Dairy-Free Formula Manufacturers

Retailers and Pharmacies

E-Commerce Platforms

Pediatric Nutritionists

Healthcare and Pediatric Clinics

Investment and Venture Capitalist Firms

Government and Regulatory Bodies (Saudi Food and Drug Authority)

Plant-Based Ingredient Suppliers

Companies

Players Mentioned in the Report

Abbott Laboratories

Nestl S.A.

Danone S.A.

Mead Johnson & Company, LLC

Else Nutrition

Holle Baby Food AG

Nature's One

Earth's Best Organic

Perrigo Company plc

Bellamy's Organic

Table of Contents

1. KSA Dairy-Free Infant Formula Market Overview

1.1. Definition and Scope (Target Consumer Group, Lactose-Free Requirement)

1.2. Market Taxonomy (Organic, Conventional)

1.3. Market Growth Rate

1.4. Market Segmentation Overview (Product Type, Distribution Channel, Ingredients)

2. KSA Dairy-Free Infant Formula Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. KSA Dairy-Free Infant Formula Market Analysis

3.1. Growth Drivers

3.1.1. Rising Lactose Intolerance in Infants

3.1.2. Increase in Health Conscious Parents

3.1.3. Expanding Retail Network for Specialty Products

3.2. Restraints

3.2.1. Higher Cost Compared to Dairy-Based Formulas

3.2.2. Limited Product Awareness

3.3. Opportunities

3.3.1. Innovation in Plant-Based Ingredients

3.3.2. Growth in E-Commerce for Baby Products

3.4. Trends

3.4.1. Organic and Non-GMO Formulations

3.4.2. Preference for Soy-Based and Almond-Based Formulas

3.5. Government Regulations

3.5.1. Import Regulations and Quality Standards

3.5.2. Labeling Requirements

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Ecosystem

4. KSA Dairy-Free Infant Formula Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Soy-Based

4.1.2. Almond-Based

4.1.3. Oat-Based

4.1.4. Coconut-Based

4.2. By Age Group (In Value %)

4.2.1. 0-6 Months

4.2.2. 6-12 Months

4.2.3. 12-24 Months

4.3. By Ingredients (In Value %)

4.3.1. Protein Blend

4.3.2. Vitamins & Minerals

4.3.3. Fats & Oils

4.4. By Distribution Channel (In Value %)

4.4.1. Supermarkets & Hypermarkets

4.4.2. Pharmacy & Drugstores

4.4.3. E-Commerce

4.5. By Region (In Value %)

4.5.1. Central

4.5.2. Eastern

4.5.3. Western

5. KSA Dairy-Free Infant Formula Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Abbott Laboratories

5.1.2. Nestle S.A.

5.1.3. Danone S.A.

5.1.4. Mead Johnson & Company, LLC

5.1.5. Else Nutrition

5.1.6. Earth's Best Organic

5.1.7. Nature's One

5.1.8. Holle Baby Food AG

5.1.9. Perrigo Company plc

5.1.10. Bellamy's Organic

5.2. Cross Comparison Parameters (Product Portfolio, Distribution Reach, Product Innovation, Key Product Certifications, Revenue, Market Share, Marketing Channels)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Expansion, Product Innovation, Marketing Campaigns)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

6. KSA Dairy-Free Infant Formula Market Regulatory Framework

6.1. Import Restrictions

6.2. Nutritional Content Requirements

6.3. Labeling and Packaging Regulations

6.4. Organic and Non-GMO Certifications

7. KSA Dairy-Free Infant Formula Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. KSA Dairy-Free Infant Formula Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Age Group (In Value %)

8.3. By Ingredients (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

9. KSA Dairy-Free Infant Formula Market Analysts Recommendations

9.1. Target Audience Segmentation

9.2. Marketing Strategies

9.3. Investment Opportunities

9.4. White Space Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

In the initial phase, an ecosystem map is constructed to include all major stakeholders in the KSA dairy-free infant formula market. Comprehensive desk research is conducted utilizing both proprietary and public data sources to outline the significant variables influencing market performance.

Step 2: Market Analysis and Construction

Historical data specific to the dairy-free infant formula market is aggregated and assessed. Analysis of market penetration by product type and distribution channel allows for accurate revenue projections. The data is cross-referenced with local dietary trends and consumer behavior in Saudi Arabia.

Step 3: Hypothesis Validation and Expert Consultation

Key hypotheses concerning consumer preference and market barriers are developed and validated through interviews with market experts and company representatives. These insights help refine the assumptions underlying the growth potential of the market.

Step 4: Research Synthesis and Final Output

The final phase synthesizes the research, providing a well-rounded analysis of the market. This includes primary insights from leading manufacturers, coupled with secondary data to present a validated, comprehensive outlook of the KSA dairy-free infant formula market.

Frequently Asked Questions

01. How big is the KSA Dairy-Free Infant Formula Market?

The KSA dairy-free infant formula market was valued at USD 379 million, driven by increasing awareness among parents about lactose intolerance and demand for specialized nutrition options.

02. What are the growth drivers of the KSA Dairy-Free Infant Formula Market?

Key growth in KSA dairy-free infant formula market drivers include rising lactose intolerance in infants, increasing consumer awareness about plant-based nutrition, and a growing preference for dairy-free dietary solutions.

03. Who are the major players in the KSA Dairy-Free Infant Formula Market?

The KSA dairy-free infant formula market includes prominent players such as Abbott Laboratories, Nestl S.A., Danone S.A., and Else Nutrition, who dominate due to their established distribution networks and trusted product lines.

04. What challenges are faced by the KSA Dairy-Free Infant Formula Market?

Challenges in KSA dairy-free infant formula market include the high cost of dairy-free formulas relative to traditional options and limited consumer awareness in certain regions, which impacts market penetration.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.