KSA Dairy Market Outlook to 2030

Region:Middle East

Author(s):Abhinav kumar

Product Code:KROD6136

November 2024

85

About the Report

KSA Dairy Market Overview

- The KSA Dairy Market is valued at USD 5.8 billion, based on a five-year historical analysis. This market growth is driven by the rising population, increased health consciousness, and government-backed initiatives to enhance domestic dairy production. Additionally, technological advancements in dairy farming, combined with the increased demand for both traditional dairy and dairy alternatives, have significantly contributed to the expansion of the sector.

- Dominant cities such as Riyadh and Jeddah play a pivotal role in the Saudi dairy market. The high concentration of consumers in these urban centers, along with better access to distribution networks and cold storage, solidifies their dominance. Furthermore, the urban population's rising preference for convenience foods and value-added dairy products has driven growth in these regions.

- The Saudi Food and Drug Authority (SFDA) has stringent standards for dairy product safety and quality. In 2023, the SFDA introduced new regulations that require dairy producers to adhere to specific nutritional labeling, product testing, and hygiene standards. These regulations aim to ensure that dairy products in the market meet international health and safety benchmarks, safeguarding consumer health and enhancing the market's reputation for high-quality dairy.

KSA Dairy Market Segmentation

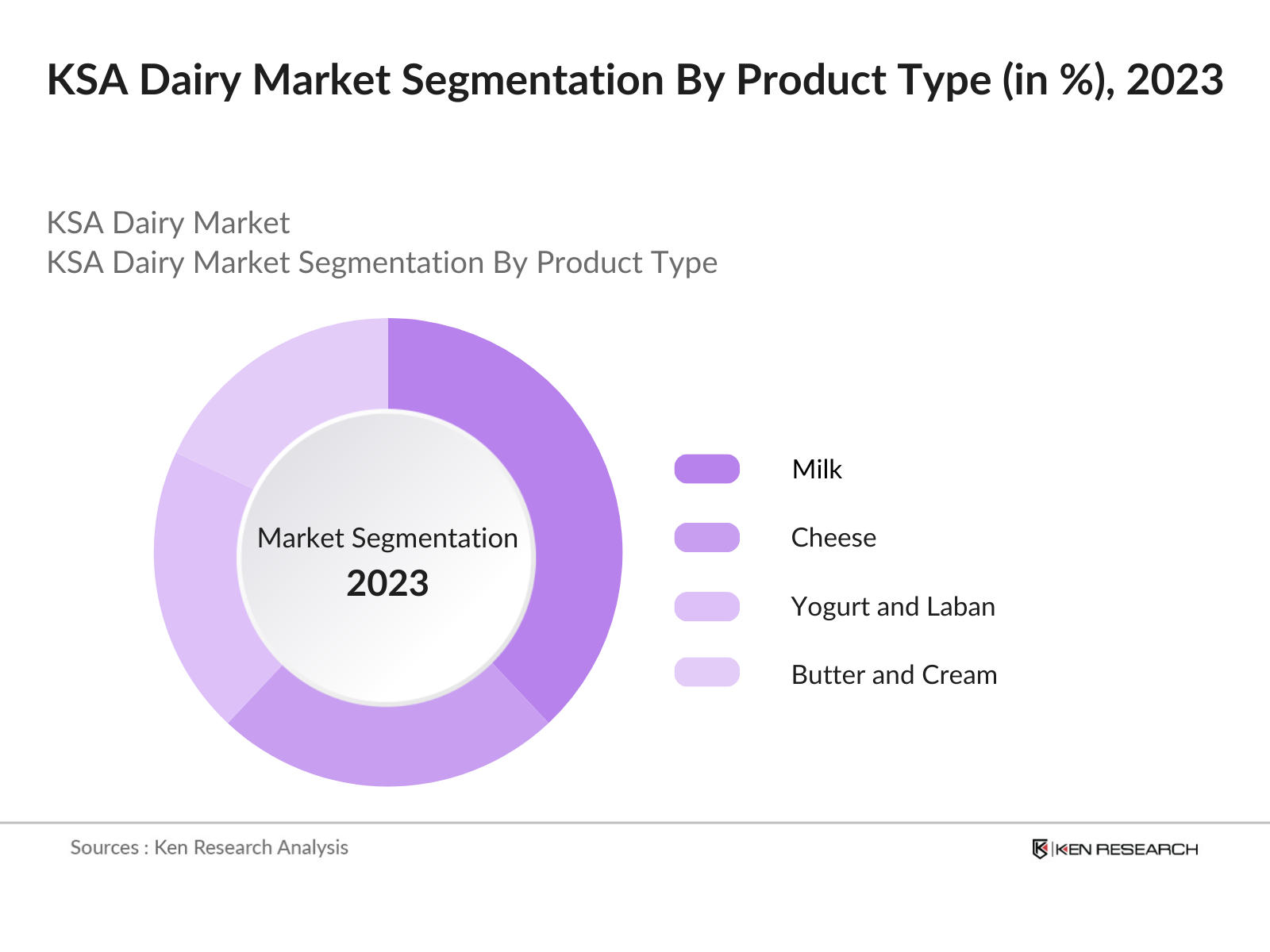

By Product Type: The KSA Dairy Market is segmented by product type into Milk, Cheese, Yogurt and Laban, Butter and Cream, and Dairy Alternatives. Among these, Milk holds the dominant market share due to its essential role in the Saudi diet, which is heavily influenced by traditional meals and the high consumption of dairy-based drinks. Moreover, the government's efforts to encourage local milk production and reduce reliance on imports have strengthened the growth of this sub-segment.

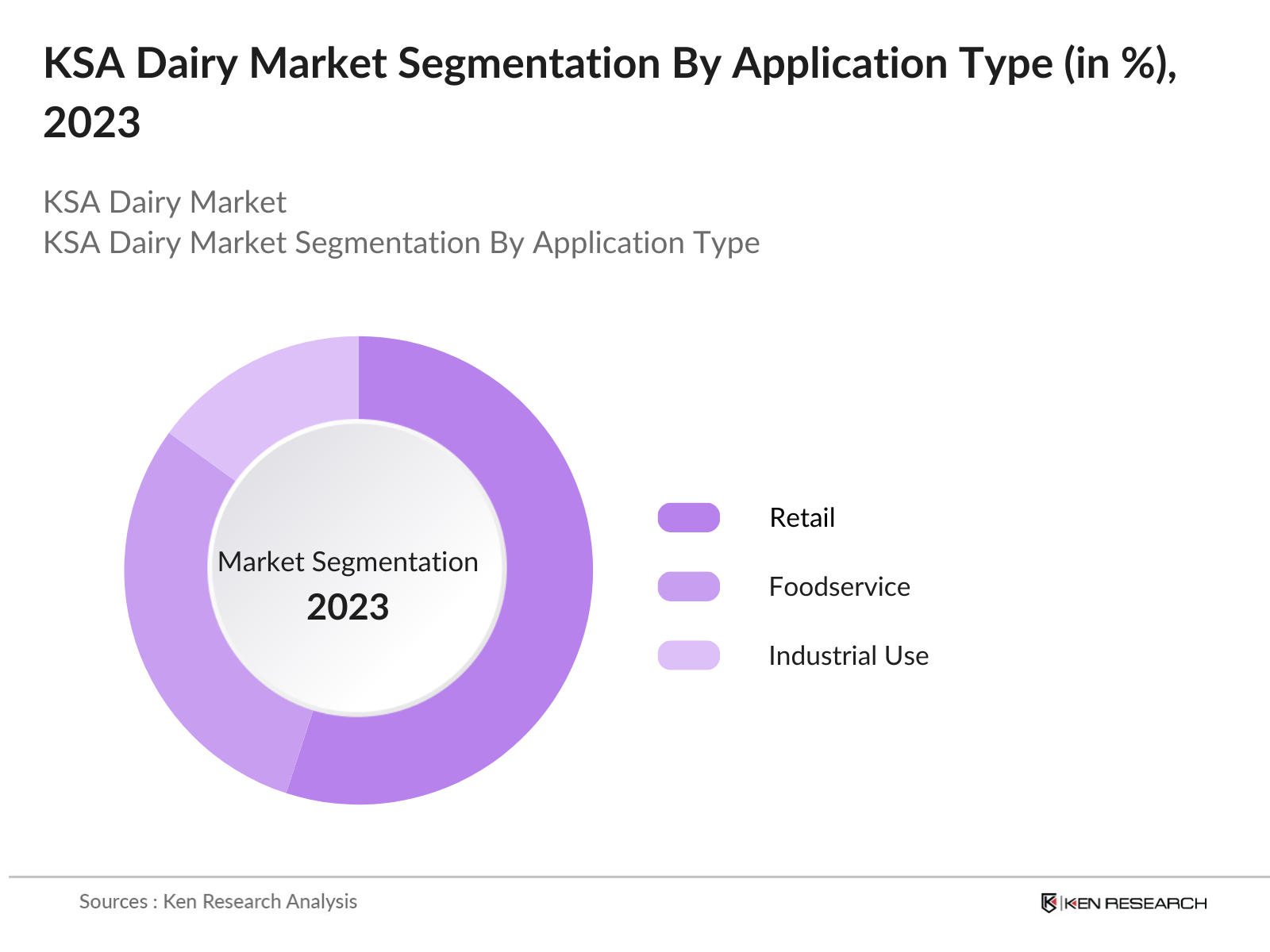

By Application: The market is segmented into Retail, Foodservice, and Industrial Use. The Retail segment dominates the market as supermarkets and hypermarkets drive the largest sales volume, bolstered by strong consumer demand for fresh dairy products. Furthermore, the expansion of organized retail channels and the increasing popularity of online grocery shopping platforms have amplified sales within the retail segment.

KSA Dairy Market Competitive Landscape

The KSA Dairy Market is highly competitive, with a mix of local giants and international players. Companies such as Almarai Co. and SADAFCO dominate the domestic market due to their extensive production capabilities and robust distribution networks. International companies like Lactalis KSA have also gained traction by offering premium dairy products tailored to local preferences. This competitive consolidation highlights the significant influence of key players, who dominate due to factors such as scale, efficiency in logistics, and a strong retail presence across the Kingdom.

KSA Dairy Industry Analysis

Growth Drivers

- Increase in Health-Conscious Consumers: The rise of health-conscious consumers in KSA is significantly driving the dairy market. As of 2023, the Kingdom has seen a marked increase in demand for healthy, high-nutrition foods. According to the Ministry of Health, KSA has a population of over 35 million, and about 40% of adults actively seek healthier food options, including dairy products like low-fat milk, yogurt, and fortified dairy items. These products are becoming essential in urban diets, driving demand for nutrient-rich dairy as consumers focus on reducing lifestyle-related health issues like obesity and diabetes.

- Growing Expat Population: KSA's large expat community, which stands at around 13 million people in 2024, contributes to a growing demand for diverse dairy products. Expats from Europe, Asia, and other regions bring varying dairy consumption preferences, increasing the demand for different types of dairy, including cheese, milk, and specialty products. This diverse consumer base helps drive demand for both traditional dairy products and international varieties, stimulating growth in the dairy sector.

- Government Initiatives to Boost Local Dairy Production: The Saudi government has actively promoted local dairy production through initiatives aimed at food security and reducing import dependency. The Ministry of Environment, Water and Agriculture has invested SAR 10 billion in programs supporting domestic livestock farming and sustainable dairy production. These initiatives are part of Vision 2030, which aims to increase the contribution of agriculture to non-oil GDP. As a result, local dairy production has surged by 12% since 2022, according to official reports.

Market Challenges

- High Dependency on Imported Raw Materials: KSA relies heavily on imported feed and other raw materials for its dairy sector, with over 80% of animal feed being imported, according to 2023 trade data from the Saudi Ports Authority. This dependency makes the dairy industry vulnerable to global supply chain disruptions, fluctuations in international feed prices, and currency exchange rates, affecting the profitability of dairy farms and processing units.

- Seasonal Fluctuations in Dairy Demand: Dairy demand in KSA experiences significant seasonal fluctuations, particularly during Ramadan and Hajj, when dairy consumption spikes due to dietary changes and an influx of pilgrims. In contrast, summer months often see reduced demand for dairy, which affects the sales cycle. The Ministry of Commerce noted that dairy consumption can increase by up to 30% during peak seasons but drop by as much as 15% in the off-season, impacting overall market stability.

KSA Dairy Market Future Outlook

Over the next five years, the KSA Dairy Market is expected to experience steady growth, driven by the continuous expansion of dairy production facilities, a rise in consumer demand for high-protein and fortified products, and technological improvements in dairy farming techniques. Additionally, the growth in demand for organic and plant-based dairy alternatives is expected to create new opportunities for market players. The increasing penetration of online retail channels is also likely to shape future trends in the dairy market.

Opportunities

- Expansion of Organic Dairy Products: The demand for organic dairy products in KSA is growing, especially among health-conscious consumers and younger populations. In 2023, the Ministry of Environment, Water and Agriculture reported a 25% increase in certified organic dairy farms. This growing niche market presents an opportunity for producers to diversify their offerings and cater to the increasing demand for clean-label, sustainably sourced dairy products.

- Rising Demand for Plant-Based Dairy Alternatives: The rise in lactose intolerance and veganism is contributing to increased demand for plant-based dairy alternatives in KSA. In 2024, the General Authority for Statistics reported a 15% increase in the consumption of plant-based milk products, such as almond and soy milk. This shift in consumer preferences represents a significant growth opportunity for dairy companies to expand their product lines and cater to changing dietary needs.

Scope of the Report

|

By Product Type |

Milk, Cheese Yogurt and Laban Butter and Cream Dairy Alternatives |

|

By Application |

Retail Foodservice Industrial Use |

|

By Distribution Channel |

Supermarkets & Hypermarkets Convenience Stores Online Channels Specialty Stores |

|

By Packaging Type |

Plastic Bottles Tetra Packs Glass Bottles Pouches |

|

By Region |

Riyadh Jeddah Dammam Mecca and Medina Other Cities |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Dairy Producer Companies

Retail and Grocery Companies

Foodservice Industries

Dairy Processing Equipment Manufacturing Comapnies

Dairy Product Industries

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Saudi Food and Drug Authority (SFDA))

Packaging and Supply Chain Service Providing Companies

Companies

Players Mentioned in the Report

Almarai Co.

Saudi Dairy and Foodstuff Co. (SADAFCO)

NADEC

Al Safi Danone

Al Rabie Saudi Foods Co.

Lactalis KSA

Baladna Qatar

Anchor Food Professionals

Arla Foods KSA

Muller Dairy

Table of Contents

1. KSA Dairy Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. KSA Dairy Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. KSA Dairy Market Analysis

3.1. Growth Drivers

3.1.1. Increase in Health-Conscious Consumers

3.1.2. Growing Expat Population

3.1.3. Government Initiatives to Boost Local Dairy Production

3.1.4. Technological Advancements in Dairy Farming

3.2. Market Challenges

3.2.1. High Dependency on Imported Raw Materials

3.2.2. Seasonal Fluctuations in Dairy Demand

3.2.3. Increasing Feed Costs for Livestock

3.3. Opportunities

3.3.1. Expansion of Organic Dairy Products

3.3.2. Rising Demand for Plant-Based Dairy Alternatives

3.3.3. Potential Export Growth to Neighboring GCC Countries

3.4. Trends

3.4.1. Adoption of Automated Dairy Farming Systems

3.4.2. Increased Consumer Preference for Value-Added Dairy Products

3.4.3. Shift Towards Sustainable Packaging

3.5. Government Regulations

3.5.1. Saudi Food and Drug Authority (SFDA) Standards

3.5.2. National Livestock Development Policies

3.5.3. Import Regulations and Tariffs on Dairy Products

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competitive Ecosystem

4. KSA Dairy Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Milk

4.1.2. Cheese

4.1.3. Yogurt and Laban

4.1.4. Butter and Cream

4.1.5. Dairy Alternatives

4.2. By Application (In Value %)

4.2.1. Retail

4.2.2. Foodservice

4.2.3. Industrial Use

4.3. By Distribution Channel (In Value %)

4.3.1. Supermarkets & Hypermarkets

4.3.2. Convenience Stores

4.3.3. Online Channels

4.3.4. Specialty Stores

4.4. By Packaging Type (In Value %)

4.4.1. Plastic Bottles

4.4.2. Tetra Packs

4.4.3. Glass Bottles

4.4.4. Pouches

4.5. By Region (In Value %)

4.5.1. Riyadh

4.5.2. Jeddah

4.5.3. Dammam

4.5.4. Mecca and Medina

4.5.5. Other Cities

5. KSA Dairy Market Competitive Analysis

5.1 Detailed Profiles of Major Competitors

5.1.1. Almarai Co.

5.1.2. Al Safi Danone

5.1.3. NADEC

5.1.4. Al Rabie Saudi Foods Co.

5.1.5. Al Othman Agri Production and Processing Co. (Nada Dairy)

5.1.6. Saudia Dairy & Foodstuff Company (SADAFCO)

5.1.7. Al Faiha for Food & Dairy Products

5.1.8. Baladna Qatar (Regional Competitor)

5.1.9. Anchor Food Professionals

5.1.10. Al Rawabi Dairy Company (UAE)

5.2. Cross Comparison Parameters

5.2.1. No. of Employees

5.2.2. Revenue

5.2.3. Geographic Reach

5.2.4. Market Share

5.2.5. Product Portfolio

5.2.6. Distribution Network

5.2.7. Research & Development Investment

5.2.8. Strategic Alliances and Joint Ventures

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Private Equity and Venture Capital Funding

5.8. Government Subsidies and Grants

6. KSA Dairy Market Regulatory Framework

6.1. Food Safety Regulations

6.2. Packaging and Labeling Standards

6.3. Trade Barriers and Import Tariffs

6.4. Dairy Farm Certification Process

7. KSA Dairy Market Future Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. KSA Dairy Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Packaging Type (In Value %)

8.5. By Region (In Value %)

9. KSA Dairy Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Consumer Behavior and Buying Patterns

9.3. Marketing Strategies for New Entrants

9.4. Innovation and Product Development Opportunities

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

In this stage, the research begins with the mapping of all critical stakeholders in the KSA Dairy Market. Extensive desk research is conducted, drawing from proprietary databases and secondary resources to capture a holistic view of the market landscape and key influencing factors.

Step 2: Market Analysis and Construction

Historical market data is compiled and analyzed to determine dairy market penetration, supply chain efficiency, and revenue generation. Detailed statistical analysis is conducted to derive reliable insights into the markets structure and performance.

Step 3: Hypothesis Validation and Expert Consultation

The data gathered is validated through consultations with industry experts. Insights obtained from these expert interviews (conducted via CATIS) provide operational, strategic, and financial insights, further corroborating market data.

Step 4: Research Synthesis and Final Output

Finally, the findings are synthesized into a comprehensive report, which includes data on dairy product segments, sales trends, consumer preferences, and technological developments in dairy production. This step ensures the accuracy and credibility of the report for decision-making.

Frequently Asked Questions

01. How big is the KSA Dairy Market?

The KSA Dairy Market was valued at USD 5.8 billion, driven by increasing health consciousness, population growth, and strong governmental support for domestic dairy production.

02. What are the challenges in the KSA Dairy Market?

Key challenges include reliance on imported feed for livestock, fluctuating milk prices, and the high cost of production. Additionally, maintaining a cold chain for dairy distribution across vast desert regions poses logistical difficulties.

03. Who are the major players in the KSA Dairy Market?

The market is dominated by companies like Almarai Co., SADAFCO, NADEC, and Lactalis KSA. Their dominance is attributed to their expansive distribution networks, established brand reputations, and extensive product portfolios.

04. What are the growth drivers of the KSA Dairy Market?

Growth in this market is driven by factors such as increased urbanization, rising health awareness among consumers, and government-backed initiatives to enhance local dairy production.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.