KSA Data Center Market Outlook to 2030

Region:Middle East

Author(s):Pranav Krishn

Product Code:KROD281

June 2024

100

About the Report

KSA Data Center Market Overview

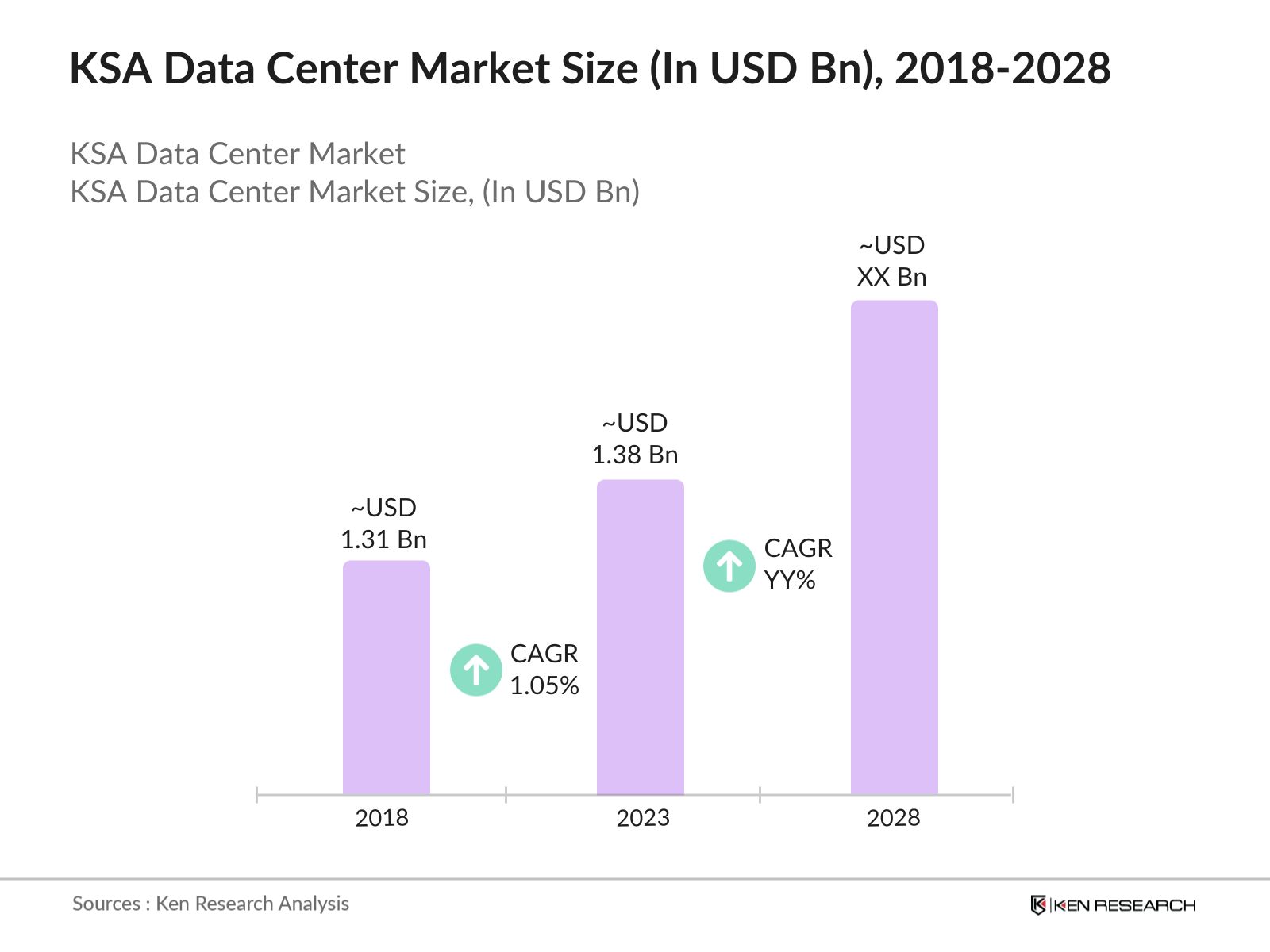

- The KSA (Kingdom of Saudi Arabia) data center market has shown substantial growth over recent years. In 2018, the market size was estimated at USD 1.31 billion, and by 2023, it reached USD 1.38 billion, reflecting a compound annual growth rate (CAGR) of around 1.05%.

- The key players in the KSA data center market include STC (Saudi Telecom Company), Mobily, Al Moammar Information Systems (MIS), Amazon Web Services (AWS), and Google Cloud. These companies have been pivotal in shaping the market through extensive investments in infrastructure, advanced technological solutions, and strategic partnerships.

- In 2023, Center3, an STC subsidiary, completed a 9.6MW expansion of its hyper-scaler-grade data center in Khurais, Riyadh. This expansion enhances Center3's hosting capacity for customers and accelerates the development of the MENA region's digital industry.

KSA Data Center Market Analysis

- The Saudi Vision 2030 program aims to diversify the economy and develop the digital infrastructure, thereby boosting the demand for data centers. Increasing adoption of cloud services by enterprises looking to reduce IT costs and improve scalability. Growing use of big data analytics and AI technologies necessitates robust data storage and processing capabilities.

- The increasing demand for data processing, storage, and management solutions has led to significant investments in data center infrastructure. Companies are leveraging advanced technologies to enhance efficiency and reduce operational costs.

- Riyadh and Jeddah are the primary hubs for data centers in Saudi Arabia. Riyadh, being the capital, hosts a majority of government offices and major corporations, making it a strategic location for data centers. Jeddah serves as a key logistical and commercial hub, further driving the demand for data center services in the region.

KSA Data Center Market Segmentation

The KSA Data Center Market be segmented based on various factors. Here are three key segmentation types with their sub-segments and estimated market share ranges:

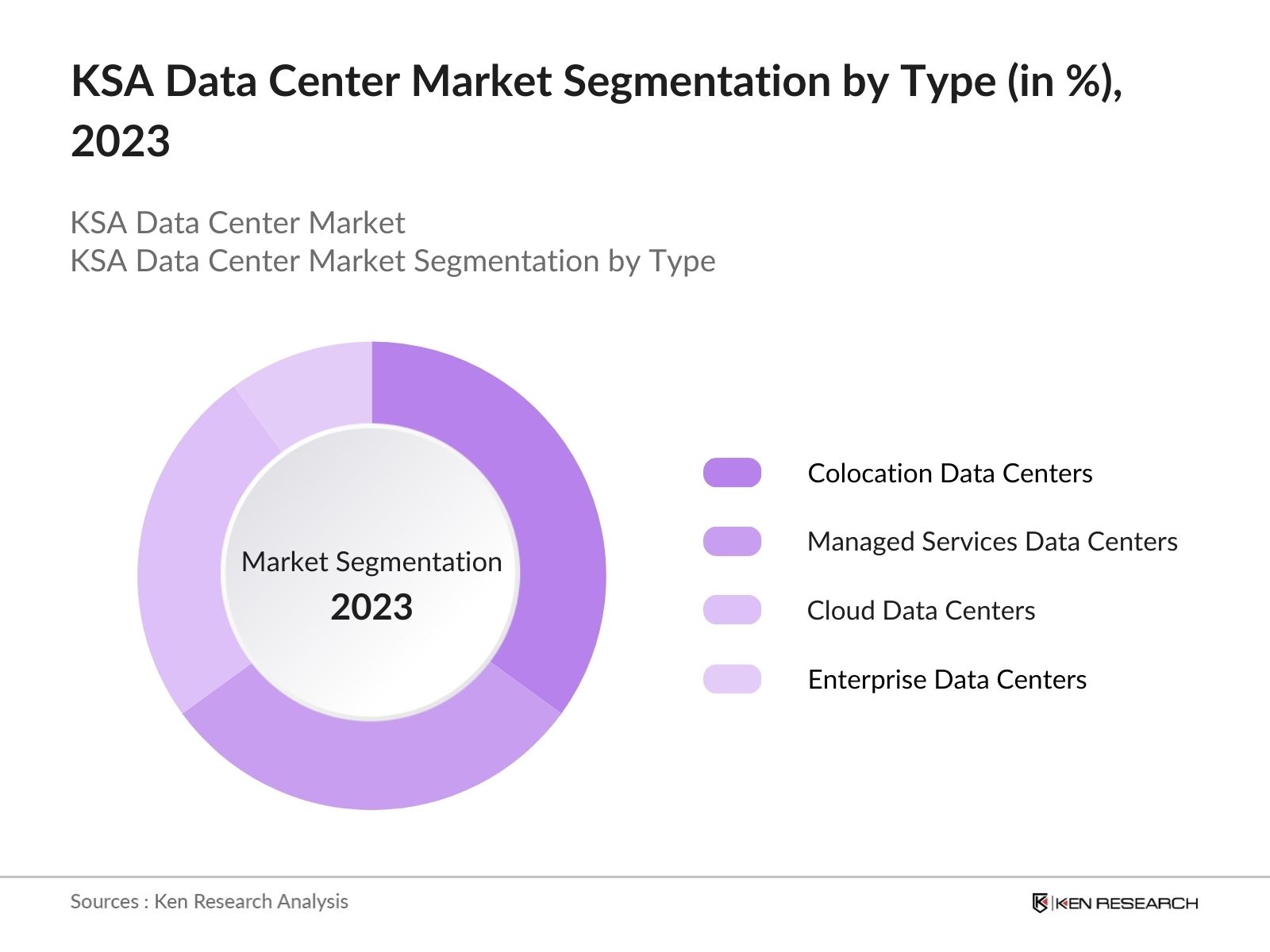

By Type: In 2023, the KSA Data Center market is segmented by type into colocation, managed services, cloud data and enterprise data centers. Colocation data centers dominate due to their cost efficiency, enhanced security measures, and reduced operational complexity. Businesses prefer colocation to leverage shared resources while maintaining control over their IT infrastructure, making it a preferred choice across industries.

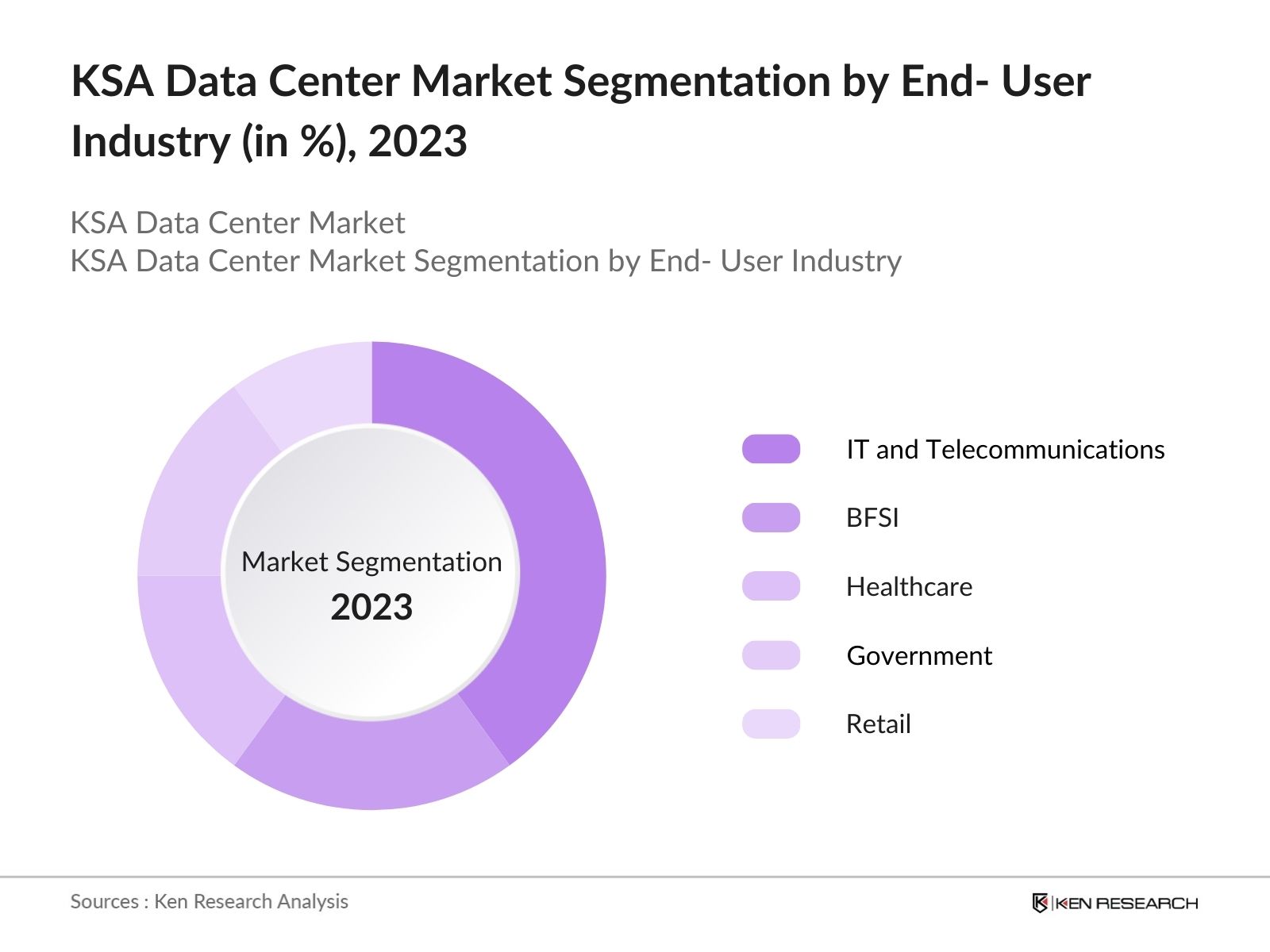

By End-User Industry: In 2023, the KSA Data Center market is segmented by end-user industry into IT and telecommunications, BFSI, healthcare, government, and retail. IT and telecommunications industry dominate due to its continuous demand for data processing and storage solutions. This sector relies heavily on data centers for network infrastructure, data management, and communication services, driving substantial growth in the data center market.

By Solution: In 2023, the KSA Data Center Market is segmented by solution into infrastructure, cooling solutions, security solutions, and power solutions. Infrastructure solutions lead due to their fundamental role in building and maintaining data center facilities. This segment encompasses the hardware and physical components necessary for data storage and processing, ensuring operational efficiency and scalability across various data center environments.

KSA Data Center Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Saudi Telecom Company (STC) |

1998 |

Riyadh |

|

Mobily |

2004 |

Riyadh |

|

Al Moammar Information Systems (MIS) |

1979 |

Riyadh |

|

Amazon Web Services (AWS) |

2006 |

Seattle, WA, USA |

|

Google Cloud |

2008 |

Mountain View, CA, USA |

- The major players in the KSA data center market are STC, Mobily, MIS, AWS, and Google Cloud. These companies dominate the market through their extensive infrastructure, advanced technologies, and comprehensive service offerings.

- These players have significantly influenced the market by driving innovation, setting high standards for service delivery, and investing heavily in expanding their data center capacities. Their presence has accelerated the adoption of advanced data center solutions across various sectors.

- AWS announced the launch of its new Middle East (Bahrain) Region, which serves as a key hub for its operations in the KSA, offering enhanced cloud services to businesses and government agencies in the region.

KSA Data Center Market Industry Analysis

KSA Data Center Market Growth Drivers

- Government Initiatives Under Vision 2030: The Saudi Vision 2030 program has been a major growth driver for the KSA data center market. For instance, the government allocated USD 15 billion for ICT infrastructure development in 2021, significantly boosting the demand for data center services.

- Increasing Adoption of Cloud Services: The adoption of cloud services has been a significant driver for the data center market in Saudi Arabia. In 2023, most enterprises in the KSA reported migrating to cloud solutions to improve operational efficiency and reduce costs. The demand for Infrastructure as a Service (IaaS) and Platform as a Service (PaaS) has seen a year-on-year increase, highlighting the growing reliance on cloud-based data centers.

KSA Data Center Market Challenges

- High Operational Costs: The high operational costs associated with running data centers pose a significant challenge. In 2022, energy consumption accounted for 30% of the total operational costs for data centers in Saudi Arabia. The rising cost of electricity, coupled with the need for continuous cooling and maintenance, impacts profitability.

- Cybersecurity Threats: The growing threat of cyberattacks poses a significant risk to data center operations. In 2022, Saudi Arabia experienced an increase in cyberattacks targeting data centers, with ransomware and DDoS attacks being the most prevalent. These threats necessitate substantial investment in cybersecurity measures, including advanced firewalls, encryption technologies, and continuous monitoring system

KSA Data Center Market Government Initiatives

- National Transformation Program (NTP): Introduced in 2016, the National Transformation Program focuses on enhancing digital capabilities and infrastructure. The NTP has allocated substantial funding for e-government services and smart city projects, driving the demand for data centers. By 2022, the NTP had facilitated over 200 digital transformation projects, significantly contributing to market growth.

- Saudi Data and Artificial Intelligence Authority (SDAIA): Established in 2019, SDAIA aims to develop the data and AI ecosystem in Saudi Arabia. The authority has launched several initiatives to promote data-driven innovation and AI adoption. In 2022, SDAIA announced a USD 5 billion investment in AI and data projects, creating new opportunities for data center expansion.

KSA Data Center Market Future Outlook

The KSA data center market is projected to grow at a robust pace, driven by ongoing digital transformation initiatives, increased cloud adoption, and government investments in digital infrastructure.

Future Market Trends

- Edge Computing: The rise of edge computing in Saudi Arabia has significantly enhanced data processing capabilities by bringing computation closer to the data source. This reduction in latency has improved performance and efficiency. For example, STC's deployment of edge data centers has reduced latency from 50 milliseconds to under 5 milliseconds, significantly boosting real-time data processing capabilities.

- Sustainability Initiatives: Sustainability initiatives are gaining traction, with major data centers in the KSA investing in green technologies. In 2024, Al Moammar Information Systems (MIS) reported that their new data center in Riyadh reduced energy consumption through the use of advanced cooling systems and renewable energy sources, cutting operational costs and carbon footprint.

Scope of the Report

|

KSA Data Center Market Segmentation |

|

|

By Type |

Colocation Data Centers Managed Services Data Centers Cloud Data Centers Enterprise Data Centers |

|

By End- User Industry |

IT and Telecommunications BFSI Healthcare Government Retail |

|

By Solution |

Infrastructure Cooling Solutions Security Solutions Power Solutions |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

IT Infrastructure Companies

Cloud Service Providers

Government IT Departments

Financial Institutions and Banks

Insurance Companies

Healthcare IT Departments

E-commerce Platforms

Retail IT Managers

Manufacturing IT Departments

Telecommunications Providers

Data Analytics Firms

Research and Development Institutions

Educational Institutions' IT Departments

Cybersecurity Firms

Smart City Planners and Developers

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

STC Solutions

Mobily

Saudi Arabian Oil Company (Saudi Aramco)

Etihad Etisalat Co.

Oracle

Microsoft

Google

IBM

Amazon Web Services (AWS)

Huawei Technologies

SAP

Dell Technologies

HPE (Hewlett Packard Enterprise)

Cisco Systems

Equinix

Digital Realty

NTT Communications

Alibaba Cloud

Tencent Cloud

Lenovo

Table of Contents

1. KSA Data Center Market Overview

1.1 KSA Data Center Market Taxonomy

2. KSA Data Center Market Size (in USD Bn), 2018-2023

3. KSA Data Center Market Analysis

3.1 KSA Data Center Market Growth Drivers

3.2 KSA Data Center Market Challenges and Issues

3.3 KSA Data Center Market Trends and Development

3.4 KSA Data Center Market Government Regulation

3.5 KSA Data Center Market SWOT Analysis

3.6 KSA Data Center Market Stake Ecosystem

3.7 KSA Data Center Market Competition Ecosystem

4. KSA Data Center Market Segmentation, 2023

4.1 KSA Data Center Market Segmentation by Type (in %), 2023

4.2 KSA Data Center Market Segmentation by End-User Industry (in %), 2023

4.3 KSA Data Center Market Segmentation by Solution (in %), 2023

5. KSA Data Center Market Competition Benchmarking

5.1 KSA Data Center Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters and advanced analytics)

6. KSA Data Center Market Future Market Size (in USD Bn), 2023-2028

7. KSA Data Center Market Future Market Segmentation, 2028

7.1 KSA Data Center Market Segmentation by Type (in %), 2028

7.2 KSA Data Center Market Segmentation by End- User Industry (in %), 2028

7.3 KSA Data Center Market Segmentation by Solution (in %), 2028

8. KSA Data Center Market Analysts’ Recommendations

8.1 KSA Data Center Market TAM/SAM/SOM Analysis

8.2 KSA Data Center Market Customer Cohort Analysis

8.3 KSA Data Center Market Marketing Initiatives

8.4 KSA Data Center Market White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.Â

Step 2 Market Building:

Collating statistics on the KSA Data Center Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for the KSA Data Center Industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.Â

Step 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.Â

Step 4 Research output:

Our team will approach multiple data center market companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from such data center industry companies.

Frequently Asked Questions

01 How big is the KSA Data Center Market?

The KSA data center market has shown substantial growth over recent years, reaching USD 1.38 billion by 2023. This growth is driven by increased digital transformation, government initiatives, and rising demand for cloud services.

02 Who are the key players of the KSA Data Center Market?

The key players in the KSA Data Center Market are STC Solutions, Mobily, Saudi Arabian Oil Company, Etihad Etisalat Co., and Oracle.

03 What factors drive the KSA Data Center Market?

Factors that drive the KSA Data Center Market include ongoing digital transformation initiatives, increased cloud adoption, and government investments in digital infrastructure.

04 What are the challenges in the KSA Data Center Market?

Challenges of the KSA Data Center Market include high operational costs, energy consumption, data security, and infrastructure limitations.

05 Which segment dominates the KSA Data Center Market?

IT and Telecommunications dominate the KSA Data Center Market by end-user industry, accounting for more than half of the market share in 2023.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.