KSA Diabetes Market Outlook to 2030

Region:Middle East

Author(s):Sanjeev

Product Code:KROD7056

December 2024

90

About the Report

KSA Diabetes Market Overview

- The diabetes market in the Kingdom of Saudi Arabia (KSA) is valued at USD 361 million, driven by the rising prevalence of diabetes, increasing healthcare expenditure, and government initiatives. According to data from the Saudi Ministry of Health and the International Diabetes Federation (IDF), diabetes affects 20% of the adult population in KSA. Factors contributing to the high incidence include poor dietary habits, sedentary lifestyles, and an aging population.

- Dominant cities in the KSA diabetes market include Riyadh, Jeddah, and Dammam, primarily due to their advanced healthcare infrastructure and higher prevalence of diabetes cases. Riyadh and Jeddah have the highest concentration of healthcare facilities, specialists, and medical research centers, making them pivotal in diabetes treatment and management. Additionally, the population density and urbanization in these cities drive healthcare demand, particularly in terms of diabetes care. Furthermore, these cities have a more affluent population, which leads to increased adoption of advanced treatment methods and technologies.

- Under Saudi Arabia's Vision 2030, the National Transformation Program (NTP) includes several key healthcare reforms designed to improve diabetes care, among other chronic diseases. These regulations focus on expanding the healthcare system, improving patient outcomes, and encouraging private sector participation in healthcare delivery.

KSA Diabetes Market Segmentation

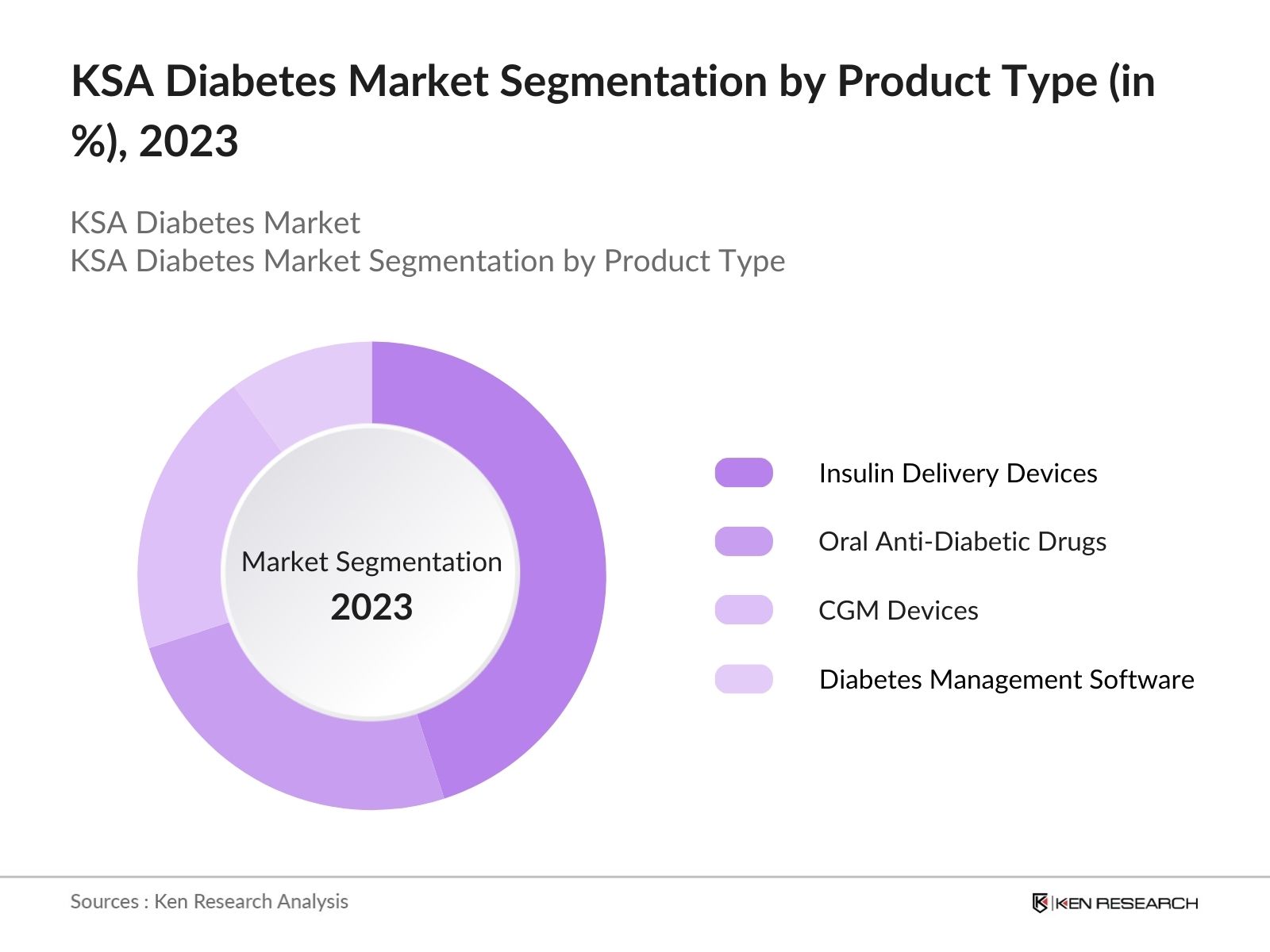

- By Product Type: The market is segmented by product type into insulin delivery devices, oral anti-diabetic drugs, continuous glucose monitoring (CGM) devices, and diabetes management software. Recently, insulin delivery devices have held a dominant market share due to their widespread use among Type 1 and advanced Type 2 diabetes patients. This sub-segment is driven by advancements in insulin pens and pumps, which offer more precise and convenient dosing options. With companies like Novo Nordisk and Eli Lilly providing state-of-the-art insulin delivery systems, their integration into daily patient care has grown. Moreover, the Saudi governments focus on modernizing healthcare has increased access to these devices, especially in major urban centers.

- By Treatment Type: The market is also segmented by treatment type into pharmacological treatments (including insulin therapy, oral anti-diabetics) and non-pharmacological treatments (such as dietary interventions, exercise plans, and behavioral support). Among these, pharmacological treatments have dominated the market due to the growing reliance on insulin and oral medications to control blood glucose levels. Oral anti-diabetic drugs, particularly metformin and sulfonylureas, remain the first-line treatment for Type 2 diabetes. Meanwhile, insulin therapies are critical for patients with Type 1 diabetes and those with advanced Type 2 diabetes. The demand for pharmacological solutions has been supported by government subsidies and insurance coverage, making these treatments accessible to a broader patient base.

KSA Diabetes Market Competitive Landscape

The KSA diabetes market is characterized by the presence of global pharmaceutical giants as well as prominent regional players. Leading companies focus on innovative product development, strategic collaborations, and partnerships with healthcare providers to expand their market share. The competition is influenced by both pricing strategies and the ability to offer a comprehensive diabetes management solution, including medication, monitoring devices, and digital health platforms.

Major players include Novo Nordisk, Sanofi, Eli Lilly, AstraZeneca, and Medtronic, all of which have established themselves as leaders in diabetes care through their extensive product portfolios and research and development activities.

Competitive Landscape Table:

|

Company Name |

Establishment Year |

Headquarters |

Revenue |

R&D Expenditure |

Product Portfolio |

|

Novo Nordisk |

1923 |

Denmark |

|||

|

Sanofi |

1973 |

France |

|||

|

Eli Lilly |

1876 |

USA |

|||

|

AstraZeneca |

1999 |

UK |

|||

|

Medtronic |

1949 |

USA |

KSA Diabetes Industry Analysis

Growth Drivers

- Increasing Prevalence of Type 2 Diabetes: Saudi Arabia has one of the highest diabetes prevalence rates globally. According to the International Diabetes Federation (IDF), 18.3% of the adult population (ages 2079) in Saudi Arabia lived with diabetes as of 2021. This is primarily attributed to rapid urbanization, sedentary lifestyles, and dietary changes, making Type 2 diabetes more widespread.

- Rising Obesity and Lifestyle Changes: Obesity is a critical driver of the increasing diabetes burden in Saudi Arabia. As of 2021, over 35% of the Saudi population was classified as obese, driven by high-calorie diets, a lack of physical activity, and increasing fast-food consumption. Obesity is a significant risk factor for Type 2 diabetes, further exacerbating the growing prevalence of the disease.

- Government Healthcare Reforms and Vision 2030: Saudi Arabia's Vision 2030 focuses on transforming the healthcare sector by increasing private sector participation, improving healthcare infrastructure, and enhancing public health. Key initiatives such as the National Transformation Program (NTP) aim to reduce the incidence of lifestyle-related diseases like diabetes by promoting preventive care and improving the accessibility of healthcare services.

Market Challenges

- Limited Access to Specialist Care: Rural and underserved areas in Saudi Arabia face challenges in accessing specialized diabetes care. Urban centers are better equipped with medical facilities and specialists, but there remains a gap in healthcare access in more remote regions, leading to delayed diagnoses and inadequate disease management.

- High Cost of Insulin and Devices: The cost of diabetes management remains a significant barrier for patients in Saudi Arabia. Insulin and advanced glucose-monitoring devices are expensive, particularly for those without adequate insurance coverage. This leads to underuse of necessary treatments, resulting in poor disease management and higher long-term healthcare costs.

KSA diabetes Market Future Outlook

Over the next five years, the KSA diabetes market is expected to witness sustained growth due to continuous government investment in healthcare infrastructure and increasing public awareness of diabetes management. The adoption of advanced technologies, such as continuous glucose monitoring systems and insulin pumps, will further accelerate growth. Additionally, the focus on early diagnosis, preventive care, and lifestyle management, in line with Vision 2030, will play a significant role in shaping the future of diabetes care in Saudi Arabia.

Future Market Opportunities

- Adoption of Digital Health Solutions and Mobile Apps: The rise of digital health solutions presents a significant opportunity to improve diabetes management in Saudi Arabia. Mobile health apps and wearable devices that monitor glucose levels, track dietary intake, and encourage physical activity can support self-management for diabetes patients. These solutions can bridge the gap between patients and healthcare providers, especially in remote areas.

- Investment in Telemedicine and Remote Patient Monitoring: Telemedicine offers an opportunity to extend the reach of diabetes care, especially in rural or underserved regions. The Saudi government and private healthcare providers have invested in telemedicine platforms to offer remote consultations, monitoring, and follow-up services for diabetic patients, allowing for more continuous and personalized care.

Scope of the Report

|

By Type of Diabetes |

Type 1 Diabetes Type 2 Diabetes Gestational Diabetes Pre-Diabetes |

|

By Product Type |

Insulin Delivery Devices Oral Anti-Diabetic Drugs Continuous Glucose Monitoring Devices Mobile Apps |

|

By Treatment Type |

Pharmacological (Insulin, Metformin, SGLT2 Inhibitors), Non-Pharmacological (Diet, Exercise) |

|

By End-User |

Hospitals Clinics Home Care Settings Retail Pharmacies |

|

By Region |

North East West South |

Products

Key Target Audience

Government and regulatory bodies (Saudi Food and Drug Authority, Ministry of Health)

Diabetes care product manufacturers

Pharmaceutical companies

Health insurance providers

Venture capital and investment firms

Banks and Financial Institutes

Healthcare professionals (endocrinologists, general practitioners)

Hospitals and clinics

Retail pharmacy chains

Companies

KSA Diabetes Market Major Players

Novo Nordisk

Sanofi

Eli Lilly

AstraZeneca

Medtronic

Roche Diabetes Care

Abbott Laboratories

Boehringer Ingelheim

Ascensia Diabetes Care

GlaxoSmithKline

Dexcom

Julphar

Nahdi Medical Company

Al-Dawaa Pharmacies

Pfizer

Table of Contents

1. KSA Diabetes Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. KSA Diabetes Market Size (In USD Billion)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. KSA Diabetes Market Analysis

3.1. Growth Drivers (Prevalence of Diabetes, Rising Healthcare Expenditure, Government Initiatives, Growing Obesity Rates)

3.1.1. Increasing Prevalence of Type 2 Diabetes

3.1.2. Rising Obesity and Lifestyle Changes

3.1.3. Government Healthcare Reforms and Vision 2030

3.1.4. Aging Population and Genetic Predisposition

3.2. Market Challenges (Lack of Awareness, Healthcare Access, High Treatment Costs)

3.2.1. Limited Access to Specialist Care

3.2.2. High Cost of Insulin and Devices

3.2.3. Low Awareness in Rural Areas

3.2.4. Fragmented Regulatory Environment

3.3. Opportunities (Technological Innovation, Market Penetration, Telemedicine, Self-Management Tools)

3.3.1. Adoption of Digital Health Solutions and Mobile Apps

3.3.2. Investment in Telemedicine and Remote Patient Monitoring

3.3.3. Expanding Healthcare Infrastructure and Accessibility

3.3.4. Personalized Treatment Protocols

3.4. Trends (Wearable Devices, Artificial Intelligence, Continuous Glucose Monitoring)

3.4.1. Increasing Adoption of Continuous Glucose Monitoring (CGM) Systems

3.4.2. Artificial Intelligence in Diabetes Management

3.4.3. Integration of Telemedicine for Diabetes Care

3.4.4. Growth of Diabetes Self-Management Education and Support (DSMES)

3.5. Government Regulations (National Diabetes Control Program, Price Regulations, Medical Device Regulations)

3.5.1. KSAs National Diabetes Control Strategy

3.5.2. Regulation of Insulin Pricing by SFDA

3.5.3. Medical Device Import and Distribution Regulations

3.5.4. Public-Private Partnerships in Diabetes Care

3.6. SWOT Analysis (Strengths, Weaknesses, Opportunities, Threats)

3.7. Stakeholder Ecosystem (Public Health Institutions, Insurance Providers, Pharma Companies, Tech Startups)

3.8. Porters Five Forces (Competitive Rivalry, Supplier Power, Buyer Power, Threat of Substitution, Threat of New Entrants)

3.9. Competition Ecosystem (Global and Local Market Players)

4. KSA Diabetes Market Segmentation

4.1. By Type of Diabetes (In Value %)

4.1.1. Type 1 Diabetes

4.1.2. Type 2 Diabetes

4.1.3. Gestational Diabetes

4.1.4. Pre-Diabetes

4.2. By Product Type (In Value %)

4.2.1. Insulin Delivery Devices

4.2.2. Oral Anti-Diabetic Drugs

4.2.3. Continuous Glucose Monitoring Devices

4.2.4. Diabetes Management Software and Mobile Apps

4.3. By Treatment Type (In Value %)

4.3.1. Pharmacological (Insulin Therapy, Metformin, SGLT2 Inhibitors, GLP-1 Receptor Agonists)

4.3.2. Non-Pharmacological (Dietary Intervention, Exercise Plans, Behavioral Support)

4.4. By End-User (In Value %)

4.4.1. Hospitals

4.4.2. Clinics

4.4.3. Home Care Settings

4.4.4. Retail Pharmacies

4.5. By Region (In Value %)

4.5.1. North

4.5.2. South

4.5.3. East

4.5.4. South

5. KSA Diabetes Market Competitive Analysis

5.1. Detailed Profiles of Major Companies (Headquarters, Employee Strength, Revenue, Market Share)

5.1.1. Novo Nordisk

5.1.2. Sanofi

5.1.3. Eli Lilly

5.1.4. AstraZeneca

5.1.5. Merck & Co.

5.1.6. Boehringer Ingelheim

5.1.7. Abbott Laboratories

5.1.8. Medtronic

5.1.9. Roche Diabetes Care

5.1.10. Ascensia Diabetes Care

5.1.11. Dexcom

5.1.12. Al-Dawaa Pharmacies

5.1.13. Nahdi Medical Company

5.1.14. GlaxoSmithKline

5.1.15. Julphar

5.2. Cross Comparison Parameters (Market Share, Revenue, R&D Expenditure, Partnerships, Geographic Presence, Therapeutic Area, Growth Strategy, Product Portfolio)

5.3. Market Share Analysis (By Product Type, By Therapy Type, By Region)

5.4. Strategic Initiatives (Partnerships, Collaborations, Product Launches)

5.5. Mergers and Acquisitions (Recent M&A Activity, Key Transactions)

5.6. Investment Analysis (Private Equity, Venture Capital, Public Funding)

5.7. Venture Capital Funding (Notable Investors, Funding Rounds)

5.8. Government Grants and Subsidies (Public Health Funding Programs)

5.9. Private Equity Investments (Significant Market Investments)

6. KSA Diabetes Market Regulatory Framework

6.1. Diabetes Care Standards (International and Local Guidelines)

6.2. Licensing and Compliance Requirements (SFDA Approvals, Import Regulations)

6.3. Certification Processes (Medical Device Certifications, Healthcare Facility Accreditation)

7. KSA Diabetes Future Market Size (In USD Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. KSA Diabetes Market Future Segmentation

8.1. By Type of Diabetes (In Value %)

8.2. By Product Type (In Value %)

8.3. By Treatment Type (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. KSA Diabetes Market Analysts Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), Serviceable Obtainable Market (SOM)

9.2. Customer Cohort Analysis (Age, Gender, Risk Factors)

9.3. Marketing Initiatives (Awareness Campaigns, Digital Marketing)

9.4. White Space Opportunity Analysis (Unmet Needs, Innovative Solutions)

DisclaimerContact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping out all key stakeholders in the KSA diabetes market. This includes manufacturers, healthcare providers, and government bodies. Extensive desk research is conducted to define and understand the variables that drive market dynamics.

Step 2: Market Analysis and Construction

Historical data is analyzed to assess the penetration of diabetes management products and services in KSA. This analysis also considers the relationship between service providers and end-users, resulting in revenue estimates for the market.

Step 3: Hypothesis Validation and Expert Consultation

Interviews are conducted with industry experts, including medical practitioners and product manufacturers, to validate market assumptions. These discussions help to refine the understanding of diabetes treatment trends and innovations in KSA.

Step 4: Research Synthesis and Final Output

The final output is synthesized by combining secondary data with inputs from direct consultations, ensuring an accurate representation of the diabetes market. This process also incorporates a bottom-up analysis to ensure data accuracy and comprehensiveness.

Frequently Asked Questions

01. How big is the KSA diabetes market?

The KSA diabetes market is valued at USD 361 million, driven by the increasing prevalence of diabetes, technological advancements, and government healthcare reforms.

02. What are the challenges in the KSA diabetes market?

KSA diabetes market Challenges include high treatment costs, lack of awareness in rural areas, and limited access to specialist care. The fragmented regulatory environment also poses difficulties for market entrants.

03. Who are the major players in the KSA diabetes market?

KSA diabetes market Key players in the market include Novo Nordisk, Sanofi, Eli Lilly, AstraZeneca, and Medtronic, all of which hold significant influence due to their comprehensive product portfolios and innovations in diabetes care.

04. What are the growth drivers of the KSA diabetes market?

Growth in KSA diabetes market is propelled by rising obesity rates, increasing healthcare expenditure, and government initiatives such as Vision 2030. The demand for continuous glucose monitoring systems and insulin delivery devices is also driving the market.

05. What are the market trends in KSA diabetes care?

Current trends in KSA diabetes market include the adoption of continuous glucose monitoring devices, the integration of artificial intelligence into diabetes management, and the expansion of telemedicine for remote patient care.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.