KSA Digital Advertising Market Outlook to 2030

Region:Middle East

Author(s):Naman Rohilla

Product Code:KROD3423

November 2024

95

About the Report

KSA Digital Advertising Market Overview

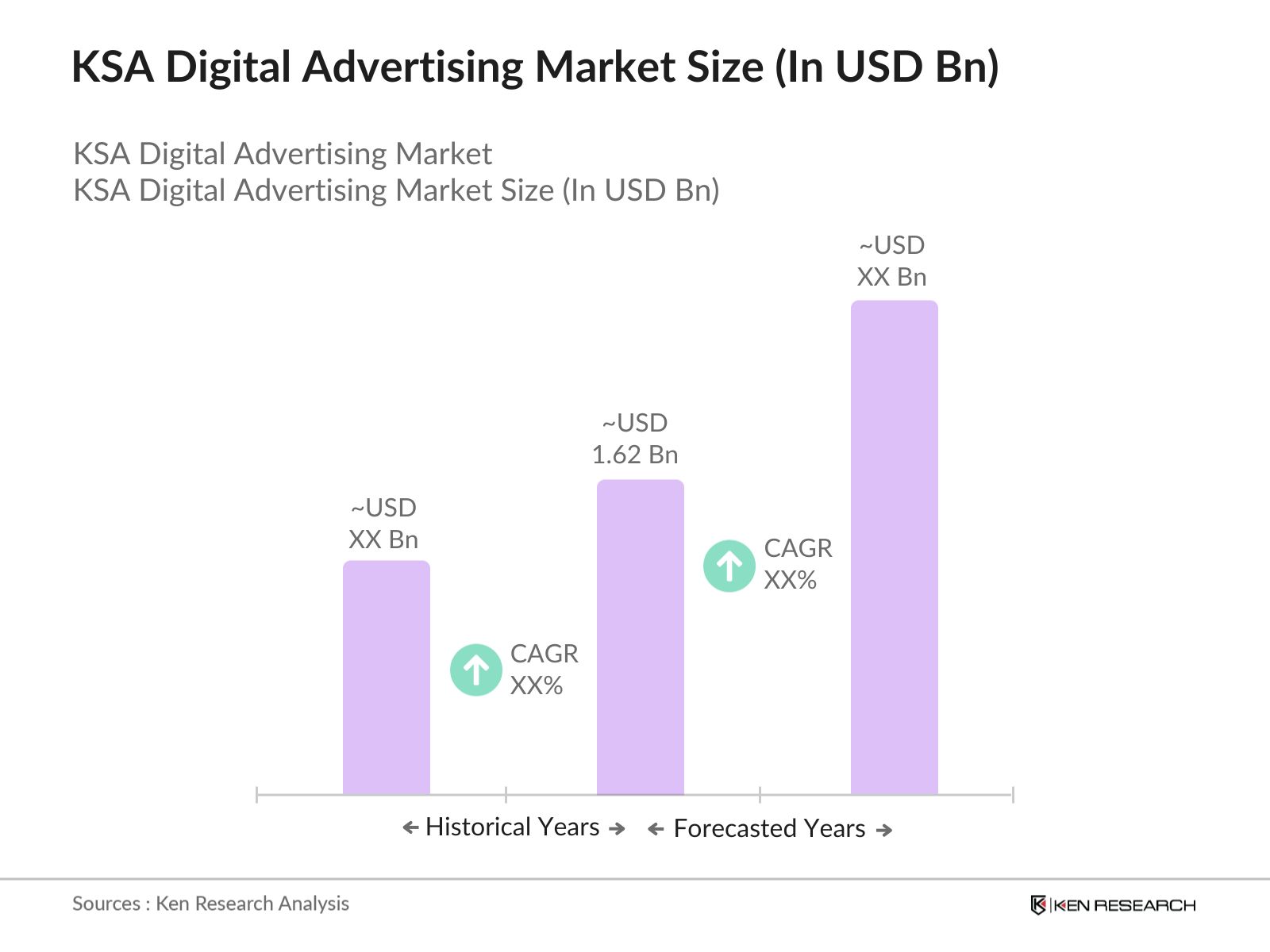

- The KSA Digital Advertising Market is valued at USD 1.62 billion, driven by increased internet penetration and widespread smartphone use among Saudi citizens. The rapid expansion of e-commerce platforms, coupled with the government's push for digital transformation as part of the Vision 2030 initiative, has boosted demand for online advertising channels. This market is primarily fueled by growing investment in sectors like retail, banking, and entertainment that increasingly rely on digital channels to engage consumers.

- Riyadh and Jeddah dominate the digital advertising landscape in Saudi Arabia, primarily due to their robust economic infrastructure and large consumer bases. These cities have a high concentration of businesses, which fuels the demand for digital marketing services. Riyadh, being the capital and a hub for multinational companies, often leads in digital ad spend. Jeddah follows closely due to its commercial importance and its role as a key e-commerce center.

- The Saudi government has introduced several policies aimed at fostering the growth of the digital economy. In 2024, the Digital Government Authority (DGA) implemented regulations that encourage digital business models, including e-commerce and digital advertising. These policies support innovation by reducing barriers to market entry and promoting competition within the digital sector. The government also offers incentives for businesses adopting digital transformation strategies, further enhancing the role of digital platforms in economic growth. These initiatives are aligned with Vision 2030s goal of increasing the contribution of the digital economy to Saudi Arabias GDP.

KSA Digital Advertising Market Segmentation

The KSA Digital Advertising Market is segmented by ad format, device type, platform type, end-user industry, and geographical region.

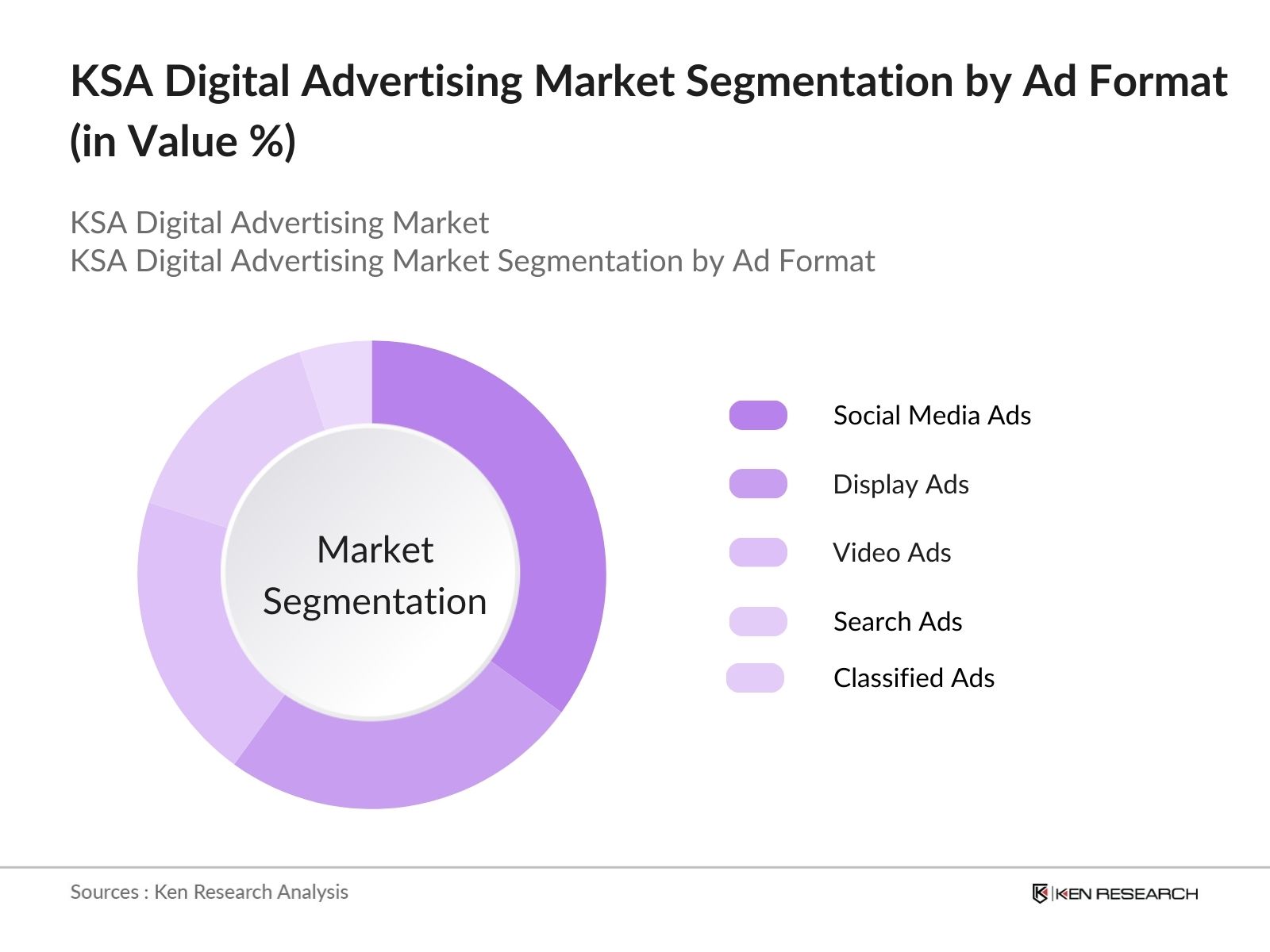

By Ad Format: The KSA Digital Advertising Market is segmented by ad format into display ads, search ads, video ads, social media ads, and classified ads. Social media ads have a dominant market share in 2023, attributed to the high penetration of platforms such as Instagram, Twitter, and Snapchat in Saudi Arabia. These platforms are increasingly used by businesses to reach younger audiences and are preferred due to their engagement tools, including influencer marketing and interactive content like polls and stories.

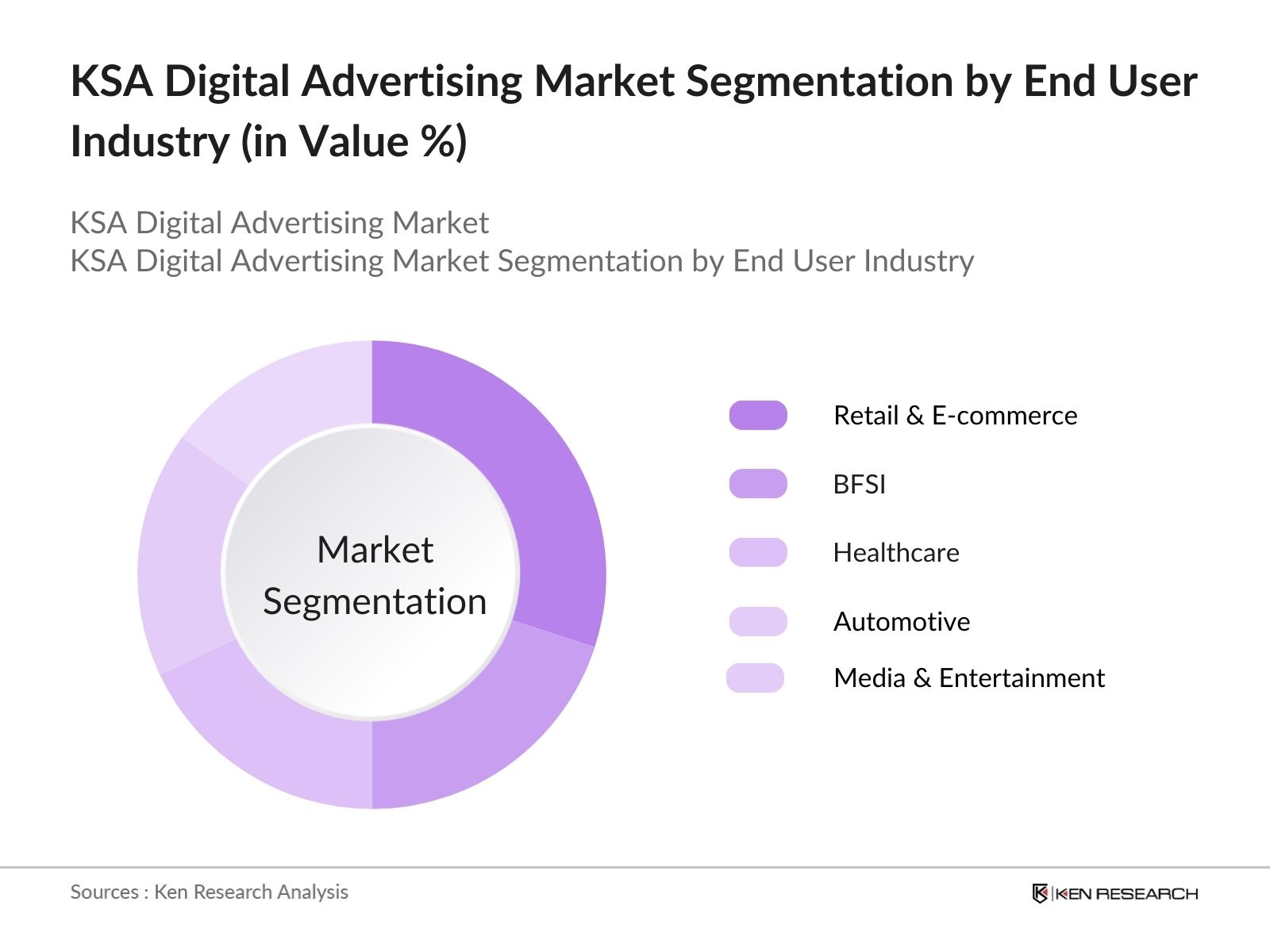

By End User Industry: The market is segmented by end user industry into retail & e-commerce, BFSI (banking, financial services, and insurance), healthcare, automotive, and media & entertainment. Retail and e-commerce dominate the digital advertising landscape in Saudi Arabia in 2023, driven by the rapid growth of online shopping and the increasing need for brands to build a strong digital presence. As consumer behavior shifts more towards online purchasing, retailers are channeling more of their budgets towards digital platforms.

KSA Digital Advertising Market Competitive Landscape

The KSA Digital Advertising Market is dominated by a combination of local companies and global giants. Leading players such as Google, Meta (Facebook), and Snapchat controls the market share, thanks to their ability to offer advanced targeting solutions. On the local front, companies like STC Media and AlArabia Outdoor have a strong presence due to their deep understanding of the regional market dynamics.

|

Company Name |

Establishment Year |

Headquarters |

Ad Platforms |

Core Services |

Local Adaptation |

Revenue |

Key Clients |

|

Google (Alphabet Inc.) |

1998 |

California, USA |

- |

- |

- |

- |

- |

|

Meta (Facebook) |

2004 |

California, USA |

- |

- |

- |

- |

- |

|

Snapchat (Snap Inc.) |

2011 |

California, USA |

- |

- |

- |

- |

- |

|

STC Media |

1998 |

Riyadh, KSA |

- |

- |

- |

- |

- |

|

AlArabia Outdoor Advertising |

1983 |

Riyadh, KSA |

- |

- |

- |

- |

- |

KSA Digital Advertising Market Analysis

KSA Digital Advertising Market Growth Drivers:

- High Internet Penetration: Saudi Arabia boasts one of the highest internet penetration rates globally, with over 34 million internet users in 2024, representing almost 95% of its population. This widespread digital connectivity is a crucial growth driver for digital advertising, as brands can reach nearly the entire population through online platforms. The Saudi governments focus on enhancing digital infrastructure, combined with the increasing use of high-speed broadband and 5G networks, further strengthens the digital ecosystem. The Kingdoms robust internet infrastructure facilitates the effective delivery of digital ads across multiple channels.

- Mobile-first Consumer Preferences: Saudi Arabia is a predominantly mobile-first nation, with 43 million mobile connections, exceeding its population due to multiple device ownership per user. Over 89% of internet users access the web through their smartphones, making mobile advertising a critical component of digital marketing strategies in the Kingdom. Mobile apps, social media, and gaming platforms are particularly popular for ad placements. With more than 28 million active social media users, platforms like Instagram, Snapchat, and TikTok are becoming prime avenues for advertisers to connect with mobile-centric consumers.

- Government Digital Transformation Initiatives (Vision 2030): Saudi Arabias Vision 2030 initiative is a catalyst for the growth of digital advertising. With a strong emphasis on digital transformation across sectors, the government aims to boost the digital economy by enhancing e-government services, digital infrastructure, and internet accessibility. In 2024, government-backed digital projects are valued at $15 billion, including initiatives to modernize public services, making digital platforms more essential for communication and advertising. These initiatives are expected to create an expanded digital landscape, providing opportunities for advertisers to engage with both consumers and businesses.

KSA Digital Advertising Market Challenges:

- Data Privacy Concerns: Data privacy has become a major concern in Saudi Arabia, especially with the rising number of cyberattacks. In 2024, Saudi Arabia witnessed over 7 million cyberattacks, affecting businesses and individuals alike. The government has responded by introducing the Personal Data Protection Law (PDPL), which restricts how companies can collect, process, and store personal data for advertising purposes. These stringent regulations pose challenges for advertisers in effectively targeting their audience, as compliance with data privacy laws requires some changes in data handling and ad targeting strategies.

- High Competition Among Platforms: The digital advertising landscape in Saudi Arabia is highly competitive, with global platforms like Google, Meta, and Snapchat dominating the market. These platforms offer advanced targeting capabilities, making it difficult for local and smaller platforms to compete. As of 2024, Google and Meta collectively control over 70% of the digital ad spend in the Kingdom, leaving limited room for smaller players. This high level of competition can drive up costs for advertisers, making it difficult to achieve high ROI without any budgets or innovative strategies.

KSA Digital Advertising Future Market Outlook

Over the next five years, the KSA Digital Advertising Market is expected to witness growth, driven by continuous investment in digital infrastructure and the widespread adoption of digital marketing strategies by businesses. The push towards online commerce and the government's focus on a digital economy under Vision 2030 will further fuel the expansion of this market. Social media advertising and video content are projected to remain at the forefront, while innovative formats such as interactive and programmatic ads will see rapid adoption.

KSA Digital Advertising Market Opportunities:

- Expansion in Social Media Advertising: Saudi Arabia is a leader in social media usage, with over 28 million active users in 2024. Platforms like Snapchat, Instagram, and TikTok have particularly strong followings among younger demographics, providing advertisers with vast opportunities for targeted marketing. In 2024, social media ad spending is expected to exceed $1.5 billion, driven by rising user engagement and the integration of e-commerce features within these platforms. Advertisers can capitalize on this trend by leveraging data-driven social media strategies to reach highly engaged audiences, particularly in sectors like fashion, retail, and entertainment.

- Increasing Video Ad Spending: Video content is becoming a dominant form of digital media consumption in Saudi Arabia, with YouTube and TikTok being the most popular platforms for watching online videos. In 2024, daily video consumption reached 115 minutes per user, up from 105 minutes in 2023. Advertisers are increasingly investing in video ads to capture audience attention, particularly through in-stream and shoppable video formats. This growing preference for video content provides a lucrative opportunity for brands to engage with their target audience through visually compelling and interactive ad formats.

Scope of the Report

|

By Ad Format |

Display Search Video Social Media Classified |

|

By Device Type |

Mobile Desktop Tablets |

|

By End User Industry |

Retail BFSI Healthcare Automotive Media |

|

By Platform |

Search Engines Social Media Video Streaming |

|

By Region |

Riyadh Jeddah Dammam Rest of KSA |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Government and Regulatory Bodies

Banks and Financial Institutes

Investors and Venture Capitalists

Digital advertising agencies

Telecommunications companies

E-commerce platforms

Retail and FMCG companies

Automotive companies

Entertainment and media companies

Companies

Players Mentioned in the Report:

Google (Alphabet Inc.)

Facebook (Meta Platforms, Inc.)

Twitter, Inc.

Snapchat (Snap Inc.)

Bytedance (TikTok)

Saudi Telecom Company (STC) Media

AlArabia Outdoor Advertising

iCubesWire

Extend The Ad Network

Publicis Groupe

WPP PLC

Omnicom Group Inc.

Dentsu KSA

Accenture Song

Havas Saudi Arabia

Table of Contents

1. KSA Digital Advertising Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. KSA Digital Advertising Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. KSA Digital Advertising Market Analysis

3.1. Growth Drivers

3.1.1. High Internet Penetration

3.1.2. Mobile-first Consumer Preferences

3.1.3. Government Digital Transformation Initiatives (Vision 2030)

3.2. Market Challenges

3.2.1. Data Privacy Concerns

3.2.2. High Competition Among Platforms

3.2.3. Limited Availability of Skilled Digital Talent

3.3. Opportunities

3.3.1. Expansion in Social Media Advertising

3.3.2. E-commerce Growth in the Kingdom

3.3.3. Increasing Video Ad Spending

3.4. Trends

3.4.1. Programmatic Advertising Adoption

3.4.2. Rise of Influencer Marketing

3.4.3. Integration of AI in Ad Targeting

3.5. Government Regulation

3.5.1. Policies Supporting Digital Economy

3.5.2. Content Moderation Guidelines for Digital Ads

3.6. SWOT Analysis

3.7. Stake Ecosystem (Agencies, Platforms, Government Bodies)

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. KSA Digital Advertising Market Segmentation

4.1. By Ad Format (In Value %)

4.1.1. Display Ads

4.1.2. Search Ads

4.1.3. Video Ads

4.1.4. Social Media Ads

4.1.5. Classified Ads

4.2. By Device Type (In Value %)

4.2.1. Mobile

4.2.2. Desktop

4.2.3. Tablets

4.3. By End User Industry (In Value %)

4.3.1. Retail and E-Commerce

4.3.2. BFSI

4.3.3. Healthcare

4.3.4. Automotive

4.3.5. Media and Entertainment

4.4. By Platform (In Value %)

4.4.1. Search Engines (Google, Bing)

4.4.2. Social Media (Instagram, Twitter, Snapchat)

4.4.3. Video Streaming (YouTube, TikTok)

4.4.4. Programmatic

4.5. By Region (In Value %)

4.5.1. Riyadh

4.5.2. Jeddah

4.5.3. Dammam

4.5.4. Rest of KSA

5. KSA Digital Advertising Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Google (Alphabet Inc.)

5.1.2. Facebook (Meta Platforms, Inc.)

5.1.3. Twitter, Inc.

5.1.4. Snapchat (Snap Inc.)

5.1.5. Bytedance (TikTok)

5.1.6. Saudi Telecom Company (STC) Media

5.1.7. AlArabia Outdoor Advertising

5.1.8. iCubesWire

5.1.9. Extend The Ad Network

5.1.10. Publicis Groupe

5.1.11. WPP PLC

5.1.12. Omnicom Group Inc.

5.1.13. Dentsu KSA

5.1.14. Accenture Song

5.1.15. Havas Saudi Arabia

5.2. Cross Comparison Parameters (Market Share, Target Audience, Ad Spend, Reach)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Venture Capital Funding in Digital Ad Startups

5.7. Private Equity Investments

6. KSA Digital Advertising Market Regulatory Framework

6.1. Ad Content Regulations

6.2. Compliance Requirements (Consumer Protection Laws)

6.3. Certification Processes for Ad Platforms

7. KSA Digital Advertising Market Future Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. KSA Digital Advertising Market Future Segmentation

8.1. By Ad Format

8.2. By Device Type

8.3. By End User Industry

8.4. By Platform

8.5. By Region

9. KSA Digital Advertising Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis (Age, Gender, Location)

9.3. Marketing Initiatives and Targeting Strategies

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

In the first phase, we constructed a market ecosystem encompassing all stakeholders within the KSA Digital Advertising market. This was done through extensive secondary research, relying on proprietary databases and industry-level information to identify critical market variables.

Step 2: Market Analysis and Construction

Historical data related to digital ad spending, market penetration, and revenue generation was compiled and analyzed. The assessment included understanding the growth of digital platforms and their impact on the advertising market in KSA.

Step 3: Hypothesis Validation and Expert Consultation

Key market hypotheses were developed and validated through consultations with industry experts. These experts, from major ad-tech companies and digital marketing firms, provided insights on operational trends, technology adoption, and advertising strategies.

Step 4: Research Synthesis and Final Output

In the final stage, we engaged with several digital advertisers to validate the findings, particularly focusing on the most impactful ad formats, platforms, and market challenges. This helped refine the analysis for accuracy and relevance.

Frequently Asked Questions

01. How big is the KSA Digital Advertising Market?

The KSA Digital Advertising market is valued at USD 1.62 billion, supported by rising smartphone penetration and the Kingdoms push toward digital transformation as part of Vision 2030.

02. What are the challenges in the KSA Digital Advertising Market?

Challenges include high competition among digital platforms, data privacy concerns, and a lack of skilled digital marketing talent. Additionally, stringent regulations around content moderation present hurdles for advertisers.

03. Who are the major players in the KSA Digital Advertising Market?

Key players include global giants like Google, Facebook, Snapchat, alongside local companies like STC Media and iCubesWire. These companies dominate due to their large user bases, data-driven advertising capabilities, and strong local presence.

04. What are the growth drivers of the KSA Digital Advertising Market?

The market is driven by high internet penetration, the rapid adoption of smartphones, government initiatives like Vision 2030, and the growing popularity of social media and video platforms for advertising.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.