KSA Digital Transformation Market Outlook to 2030

Region:Middle East

Author(s):Shubham Kashyap

Product Code:KROD2204

November 2024

100

About the Report

KSA Digital Transformation Market Overview

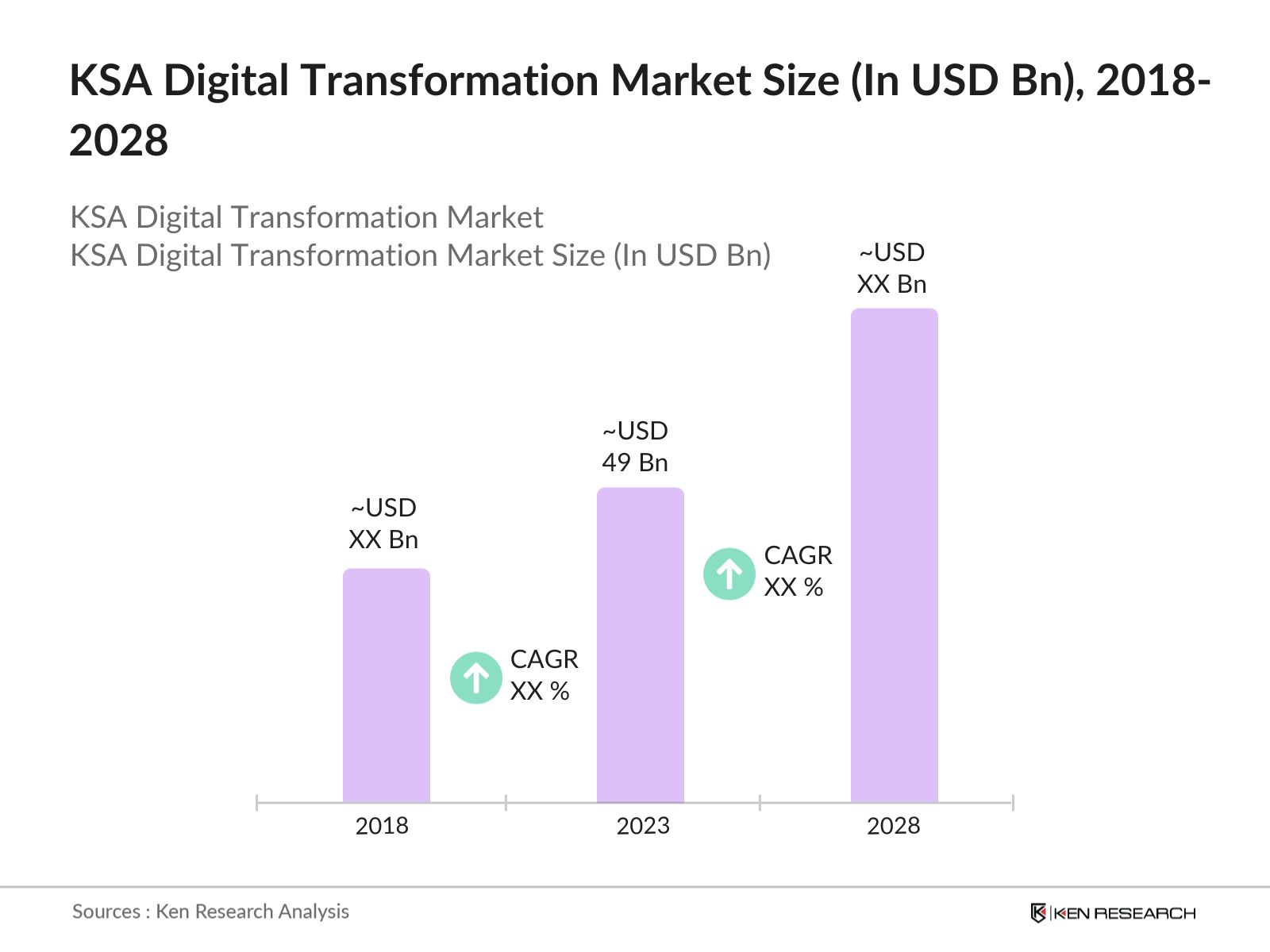

- The KSA Digital Transformation Market was valued at USD 49 billion in 2023, driven by the Kingdoms Vision 2030 initiative, which focuses on diversifying the economy through digitalization and the adoption of advanced technologies. The increasing demand for digital solutions across industries such as healthcare, education, banking, and manufacturing has accelerated market growth.

- Major players in the KSA Digital Transformation Market include Saudi Telecom Company (STC), SAP, Microsoft, Oracle, and IBM. These companies dominate the market through extensive investments in digital infrastructure, partnerships with the government, and the delivery of cloud computing, AI, and IoT-based solutions.

- Regions such as Riyadh, Jeddah, and Dammam lead the market due to high urbanization rates, substantial industrial bases, and government initiatives to promote digitalization. The adoption of 5G, AI, and cloud technologies has further strengthened the market's presence in these regions.

- In March 2024, Saudi Telecom Company (STC) partnered with the Ministry of Communications and Information Technology (MCIT) to launch a series of digital transformation projects, focusing on smart cities, cloud infrastructure, and 5G deployment across the Kingdom. The partnership aligns with the broader goals of Saudi Arabia's Vision 2030, which aims to enhance the country's digital infrastructure and promote technological advancements.

KSA Digital Transformation Market Segmentation

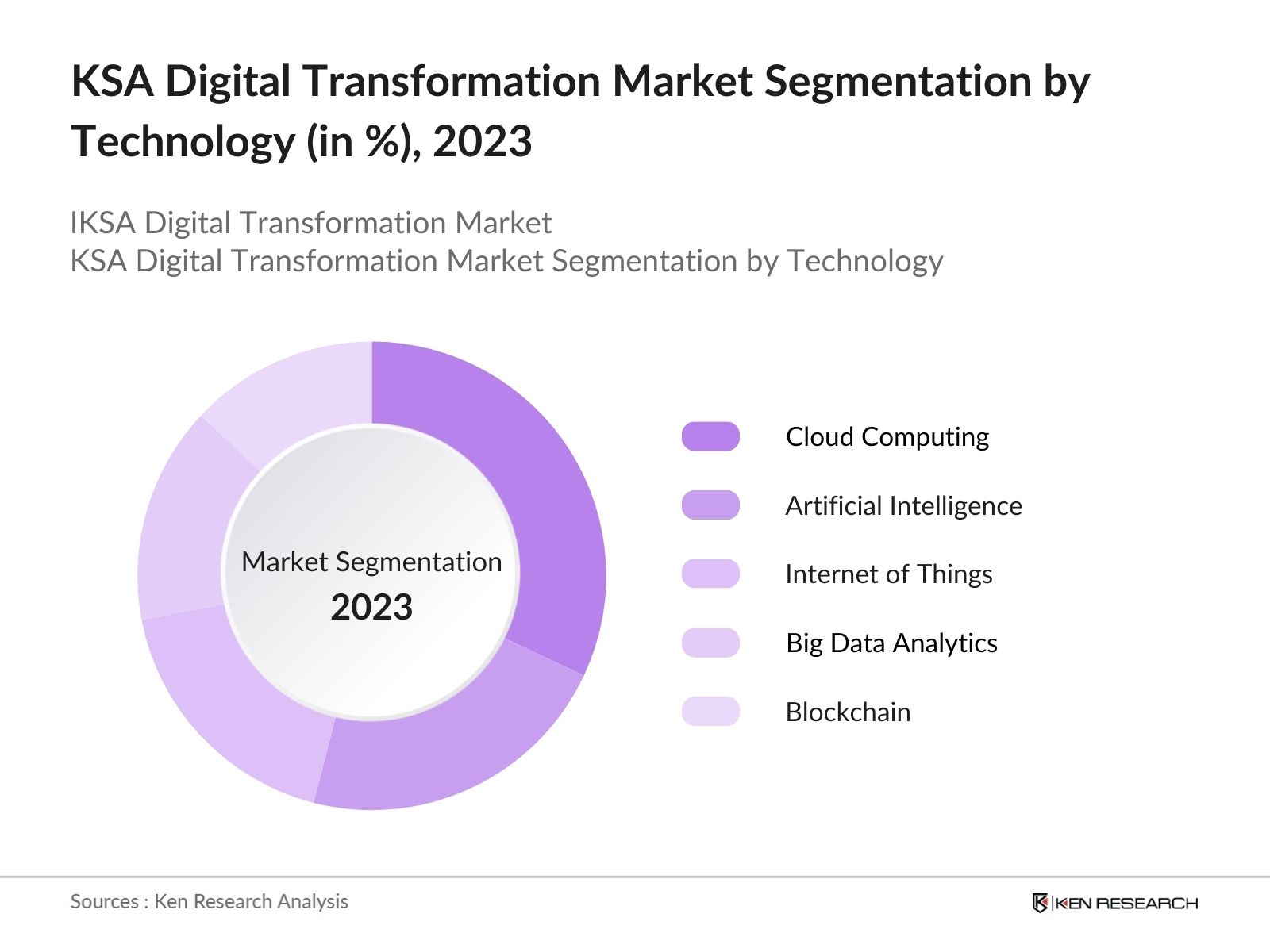

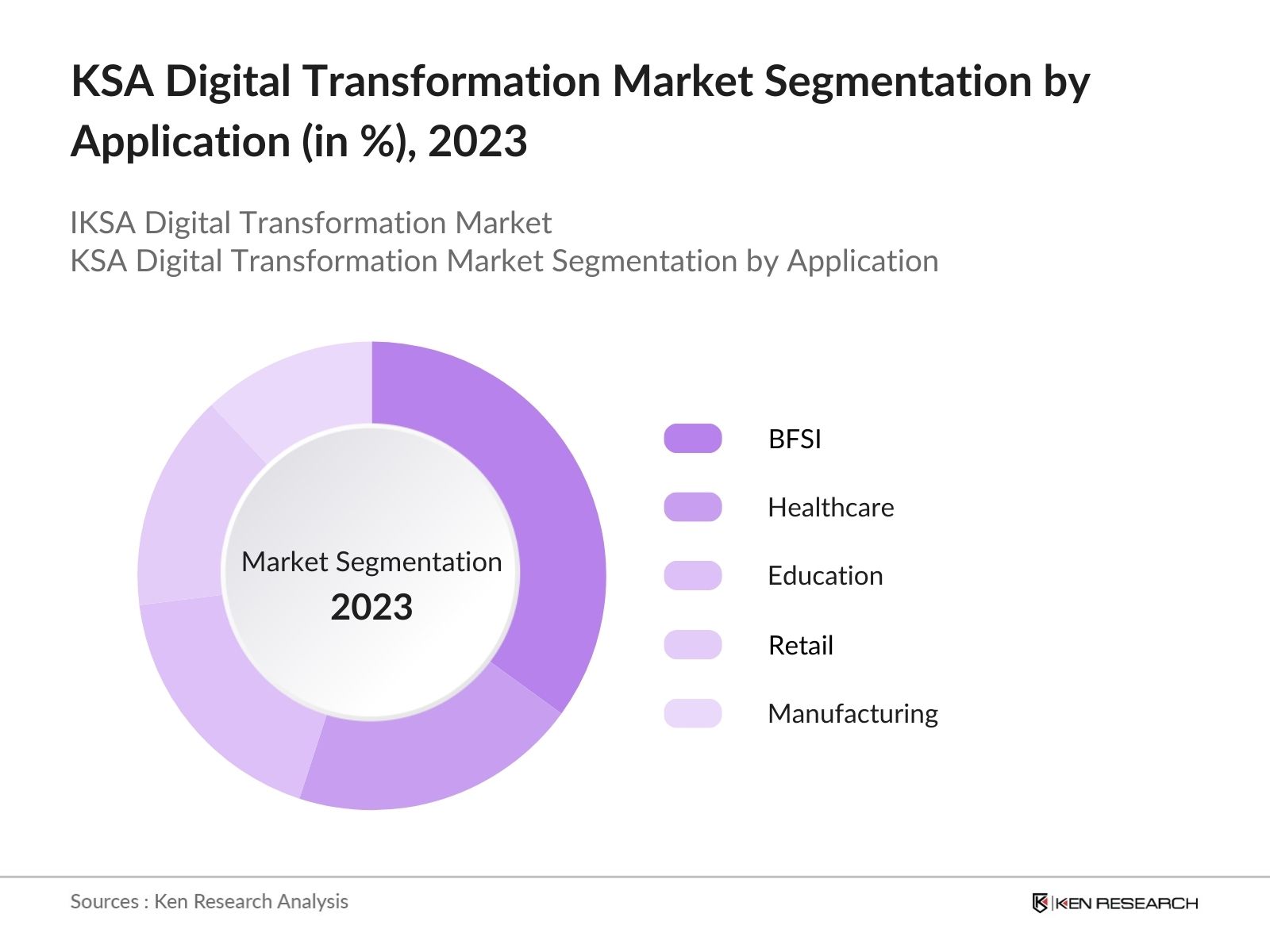

The KSA Digital Transformation Market is segmented by technology, application, and region.

- By Technology: The market is segmented into Cloud Computing, Artificial Intelligence (AI), Internet of Things (IoT), Big Data Analytics, and Blockchain. In 2023, Cloud Computing held the dominant market share due to the growing adoption of cloud services by both public and private sectors. Major players like Microsoft and Oracle lead this segment, offering cloud infrastructure solutions to various industries.

- By Application: The market is segmented by application into Healthcare, Education, BFSI (Banking, Financial Services, and Insurance), Manufacturing, and Retail. The BFSI sector led the market in 2023 due to the increasing adoption of digital banking services, fintech solutions, and blockchain technology to enhance customer experiences and operational efficiency.

- By Region: The market is segmented by region into Central, Eastern, Western, and Northern regions. The Central region dominated the market in 2023 due to strong government support, high industrialization rates, and substantial investments in digital infrastructure. This regions strategic importance and strong digitalization initiatives contribute to its leading market position.

KSA Digital Transformation Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Saudi Telecom Company (STC) |

1998 |

Riyadh, Saudi Arabia |

|

SAP |

1972 |

Walldorf, Germany |

|

Microsoft |

1975 |

Redmond, Washington, USA |

|

Oracle |

1977 |

Austin, Texas, USA |

|

IBM |

1911 |

Armonk, New York, USA |

- STC: In November 2023, Microsoft announced plans to establish a new cloud region in Saudi Arabia, investing USD 2.1 billion over the next five years. The cloud region will provide a secure and reliable infrastructure for Microsoft's cloud services, including Azure, Office 365, and Dynamics 365, enabling organizations to store data locally while benefiting from Microsoft's global network.

- SAP: In January 2024, SAP announced the launch of the SAP Cloud Hub in Saudi Arabia, investing USD 76 million over four years. This initiative aims to support the Kingdom's Vision 2030 by establishing a public cloud data center, fostering local developer platforms, and enhancing digital transformation for government and enterprise clients through industry-specific solutions and advanced technologies.

KSA Digital Transformation Market Analysis

Growth Drivers

- Increased Government Investment in National Digital Transformation Projects:

The Saudi government plans to invest over USD 20 billion in data and artificial intelligence initiatives by 2030, aiming to establish the country as a leader in this field. This funding is directed at expanding cloud infrastructure, AI-driven smart cities, and digital education platforms. One of the flagship projects includes the Smart Cities Initiative, which targets the digital transformation of cities like Riyadh, Jeddah, and NEOM. The objective is to deploy Internet of Things (IoT) solutions and big data analytics to optimize urban services, enhancing energy efficiency and reducing operational costs across sectors. - Expansion of 5G Networks and IoT Adoption: Saudi Arabia's telecommunications sector has made rapid strides in deploying 5G technology across major urban centres. STC, one of the prominent players in the market, reported that it provides 5G coverage to over 90% of its mobile site locations in major cities as of October 2023, providing ultra-fast internet speeds and low latency, which are crucial for IoT applications. This expansion has enabled industries such as healthcare, manufacturing, and logistics to adopt IoT-based solutions for real-time monitoring, predictive maintenance, and automation. The widespread availability of 5G has accelerated the growth of the digital transformation market, facilitating the integration of smart technologies across various sectors.

- Digital Banking and Fintech Growth: The rise of digital banking services and fintech solutions has contributed to the growth of the digital transformation market. In 2023, the fintech sector saw substantial increase in investment as more financial institutions adopted blockchain and AI-driven financial solutions. The fintech sector in Saudi Arabia has been experiencing noteworthy growth, with over 200 fintech firms established by August 2023, reflecting a robust ecosystem supported by government initiatives.

Challenges

- Cybersecurity Threats: The rapid digital transformation in KSA has also led to an increase in cyber threats. In 2023, the KSA government reported over 200 noteworthy cybersecurity incidents targeting critical sectors such as finance and healthcare. The need for robust cybersecurity frameworks is becoming increasingly critical as more businesses adopt digital solutions.

- Talent Shortage in Digital Skills: The digital transformation of Saudi Arabia faces hurdles due to the shortage of qualified professionals with expertise in emerging technologies like AI, big data, and cybersecurity. Although the government has launched several initiatives to upskill the workforce, the gap between demand and available talent remains significant.

Government Initiatives

- Vision 2030 and National Digital Transformation Program: Under the Vision 2030 framework, the National Digital Transformation Program was launched to enhance the Kingdoms digital infrastructure and improve the adoption of digital technologies across sectors. The program focuses on increasing internet penetration, fostering innovation in emerging technologies, and developing a digital-ready workforce.

- MCIT's AI and Data Strategy 2023-2025: The Ministry of Communications and Information Technology (MCIT) launched the AI and Data Strategy 2023-2025 to enhance Saudi Arabia's digital transformation. This initiative aims to integrate AI across sectors like education, healthcare, and energy, backed by USD 2 billion in funding. It focuses on improving AI research, establishing innovation hubs, and implementing AI solutions to drive economic growth and efficiency.

KSA Digital Transformation Market Future Outlook

The KSA Digital Transformation Market is expected to witness remarkable growth, driven by continued government support, the growing adoption of advanced technologies, and increasing demand for digital services.

Future Market Trends

- Growth of Smart Cities and IoT-Driven Infrastructure: By 2028, Saudi Arabia's major cities like Riyadh, NEOM, and Jeddah are expected to be fully integrated with IoT-driven infrastructure. The deployment of 5G networks will enable real-time data exchange, smart traffic management, and automated public services.

- Expansion of Digital Banking and Fintech Ecosystem: The fintech ecosystem in Saudi Arabia is forecasted to experience exponential growth by 2028, with AI and blockchain technologies driving innovations in the BFSI sector. With majority of financial transactions expected to be conducted digitally, AI-powered customer service and blockchain-based secure transactions will become standard practices.

Scope of the Report

|

By Technology |

Cloud Computing Artificial Intelligence (AI) Internet of Things (IoT) Big Data Analytics Blockchain |

|

By Application |

Healthcare Education BFSI Manufacturing |

|

By Region |

Central Eastern Western Northern |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report

Cloud Computing Service Providers

Artificial Intelligence Developers

Internet of Things (IoT) Solution Providers

Banking and Financial Institutions

Healthcare Technology Providers

Retail and E-commerce Companies

Telecom Operators

Cybersecurity Firms

Manufacturing Industry Players

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Communications and Information Technology)

Time Period Captured in the Report

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Major Market Players

Saudi Telecom Company (STC)

Microsoft

IBM

Oracle

Huawei Technologies

Cisco Systems

SAP

Google Cloud

Accenture

Amazon Web Services (AWS)

Honeywell

Siemens

Ericsson

Hewlett Packard Enterprise (HPE)

Dell Technologies

Table of Contents

1. KSA Digital Transformation Market Overview

1.1. Definition and Scope

1.2. Market Structure and Taxonomy (Cloud Computing, AI, IoT, Big Data Analytics, Blockchain)

1.3. Market Growth Rate Analysis (Financial and Operational Metrics)

1.4. Key Market Developments and Milestones (Government Initiatives, Technological Adoption)

1.5. Role of Vision 2030 in Market Expansion

2. KSA Digital Transformation Market Size (USD Billion)

2.1. Historical Market Size (Value and Volume)

2.2. Year-on-Year Growth Analysis (Revenue, Market Share, Key Industry Metrics)

2.3. Contribution of Key Sectors (BFSI, Healthcare, Education, Manufacturing)

2.4. Industry Revenue Breakdown by Digital Platforms (Cloud, AI, IoT, Big Data)

2.5. Breakdown of Market Value by Government and Private Sector Adoption

3. KSA Digital Transformation Market Dynamics

3.1. Growth Drivers

3.1.1. Government Investments in Digital Transformation Projects (Vision 2030)

3.1.2. Expansion of 5G Networks and IoT Integration

3.1.3. Rise in Demand for Cloud Computing and AI Solutions

3.2. Market Challenges

3.2.1. High Implementation Costs for Digital Infrastructure

3.2.2. Cybersecurity and Data Privacy Concerns

3.2.3. Shortage of Skilled Workforce in Advanced Digital Technologies

3.3. Market Opportunities

3.3.1. Increased Adoption of Digital Banking and Fintech Solutions

3.3.2. Collaboration Between Government and Tech Companies for Smart City Projects

3.3.3. Growth of E-learning and Digital Education Solutions

4. KSA Digital Transformation Market Segmentation

4.1. By Technology (Value %)

4.1.1. Cloud Computing

4.1.2. Artificial Intelligence (AI)

4.1.3. Internet of Things (IoT)

4.1.4. Big Data Analytics

4.1.5. Blockchain

4.2. By Application (Value %)

4.2.1. Banking, Financial Services, and Insurance (BFSI)

4.2.2. Healthcare

4.2.3. Retail

4.2.4. Education

4.2.5. Manufacturing

4.3. By Region (Value %)

4.3.1. Central (Riyadh)

4.3.2. Eastern (Dammam, Al Khobar)

4.3.3. Western (Jeddah, Makkah)

4.3.4. Northern (Tabuk, Al Jawf)

5. KSA Digital Transformation Competitive Landscape

5.1. Market Share Analysis (Based on Revenue, Market Penetration)

5.2. Competitive Positioning (Financial Performance, Technological Leadership)

5.3. Strategic Initiatives by Key Players (Partnerships, Investments, Product Launches)

5.4. Cross Comparison (Company Profiles Establishment Year, Headquarters, Revenue, No. of Employees)

5.5. Competitors

5.5.1. Saudi Telecom Company (STC)

5.5.2. Microsoft

5.5.3. Oracle

5.5.4. IBM

5.5.5. Huawei Technologies

5.5.6. SAP

5.5.7. Amazon Web Services (AWS)

5.5.8. Cisco Systems

5.5.9. Google Cloud

5.5.10. Accenture

5.5.11. Dell Technologies

5.5.12. Honeywell

5.5.13. Siemens

5.5.14. Ericsson

5.5.15. Hewlett Packard Enterprise (HPE)

6. KSA Digital Transformation Financial Analysis

6.1. Financial Performance of Key Players

6.1.1. Revenue Analysis by Key Companies

6.1.2. Operational Efficiency Metrics (Technology Adoption, Cost Efficiency)

6.2. Investment and Venture Capital Analysis

6.2.1. Recent Investments and Fundings (Government Grants, Private Equity)

6.2.2. Mergers and Acquisitions

6.3. Profitability and Revenue Forecasts

7. KSA Digital Transformation Regulatory Framework

7.1. Government Policies Supporting Digital Transformation (Vision 2030)

7.2. Cybersecurity Regulations and Data Protection Laws

7.3. Compliance and Certification Requirements for Digital Services Providers

7.4. Environmental Standards for Tech Companies (Sustainability Initiatives)

8. Future Outlook for KSA Digital Transformation Market

8.1. Market Growth Projections (2024-2028)

8.2. Key Trends Shaping Future Digitalization (AI, IoT, Autonomous Systems)

8.3. Expansion of Cloud and AI Services in Government and Healthcare

8.4. Sustainability in Digital Operations (Carbon Footprint Reduction, Eco-Friendly Data Centers)

9. KSA Digital Transformation Market Segmentation

9.1. By Technology (Value %)

9.2. By Application (Value %)

9.3. By Region (Value %)

10. Analyst Recommendations

9.1. TAM/SAM/SOM Analysis for KSA Digital Transformation Market

9.2. Key Strategic Recommendations for Technology Service Providers

9.3. Emerging Markets and White-Space Opportunities

9.4. Customer-Centric Approach for Enhanced Digital Service Delivery

Research Methodology

Step: 1 Identifying Key Variables

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step: 2 Market Building

Collating statistics on KSA digital transformation market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for KSA digital transformation market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output

Our team will approach multiple essential wind digital companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from wind digital companies.

Frequently Asked Questions

01. How big is the KSA Digital Transformation Market?

The KSA Digital Transformation Market was valued at USD 49 billion in 2023, driven by strong government initiatives, the expansion of 5G networks, and increasing adoption of cloud computing and AI technologies across sectors like BFSI and healthcare.

02. What are the challenges in the KSA Digital Transformation Market?

Challenges in the KSA digital transformation market include high implementation costs for digital infrastructure, cybersecurity threats, and a shortage of skilled professionals in AI, IoT, and cloud computing. Additionally, data privacy concerns continue to hinder rapid digital adoption across key industries.

03. Who are the major players in the KSA Digital Transformation Market?

Key players include Saudi Telecom Company (STC), Microsoft, Oracle, IBM, and Huawei Technologies. These companies lead the market through strong partnerships with the government and their offerings in cloud computing, AI solutions, and digital services.

04. What are the growth drivers of the KSA Digital Transformation Market?

The KSA digital transformation market is driven by government investments under Vision 2030, the expansion of 5G networks, and the rising demand for digital solutions in sectors like healthcare, education, and finance. The adoption of AI and IoT technologies is also accelerating digital transformation.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.