KSA Digital Twin Market Outlook to 2030

Region:Middle East

Author(s):Yogita Sahu

Product Code:KROD2585

October 2024

97

About the Report

KSA Digital Twin Market Overview

- The KSA Digital Twin market is valued at USD 2 billion based on a five-year historical analysis. The market is driven by several factors, including the growing demand for digital solutions in infrastructure development and industrial automation. This technology is crucial for enhancing operational efficiency, improving decision-making, and reducing costs across various industries such as oil & gas, healthcare, and manufacturing.

- The market is dominated by cities like Riyadh and Jeddah, primarily due to their advanced infrastructure and the government's strategic focus on transforming these urban centers into smart cities. Moreover, large industrial projects and mega-cities like NEOM in the northwestern region have spurred significant demand for digital twins. These regions attract international investments and partnerships, making them leaders in digital twin adoption.

- Digital twin technology has reduced product development times by 20-50%. By 2024, industries like automotive and aerospace are using machine learning-based geometry optimization and multi-physics modeling, enabling real-time wear prediction and performance tuning, enhancing operational efficiency and reducing prototyping costs.

KSA Digital Twin Market Segmentation

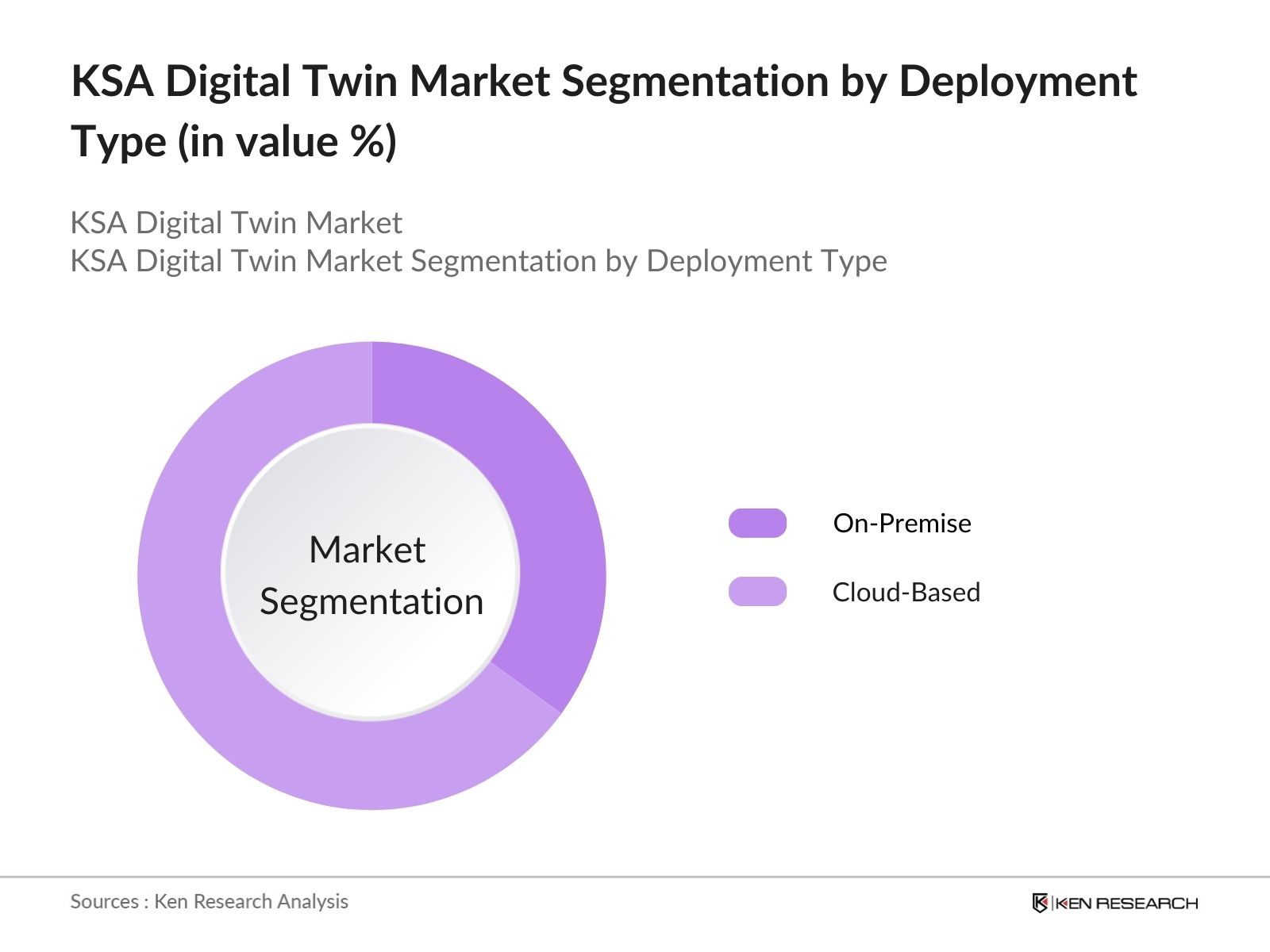

By Deployment Type: The market is segmented by deployment type into On-Premise and Cloud-Based. Cloud-based solutions have dominated the market due to the flexibility, scalability, and cost-effectiveness they offer. Cloud-based digital twins enable real-time data integration and remote monitoring, which are vital for industries like oil & gas and manufacturing, where operational efficiency is key.

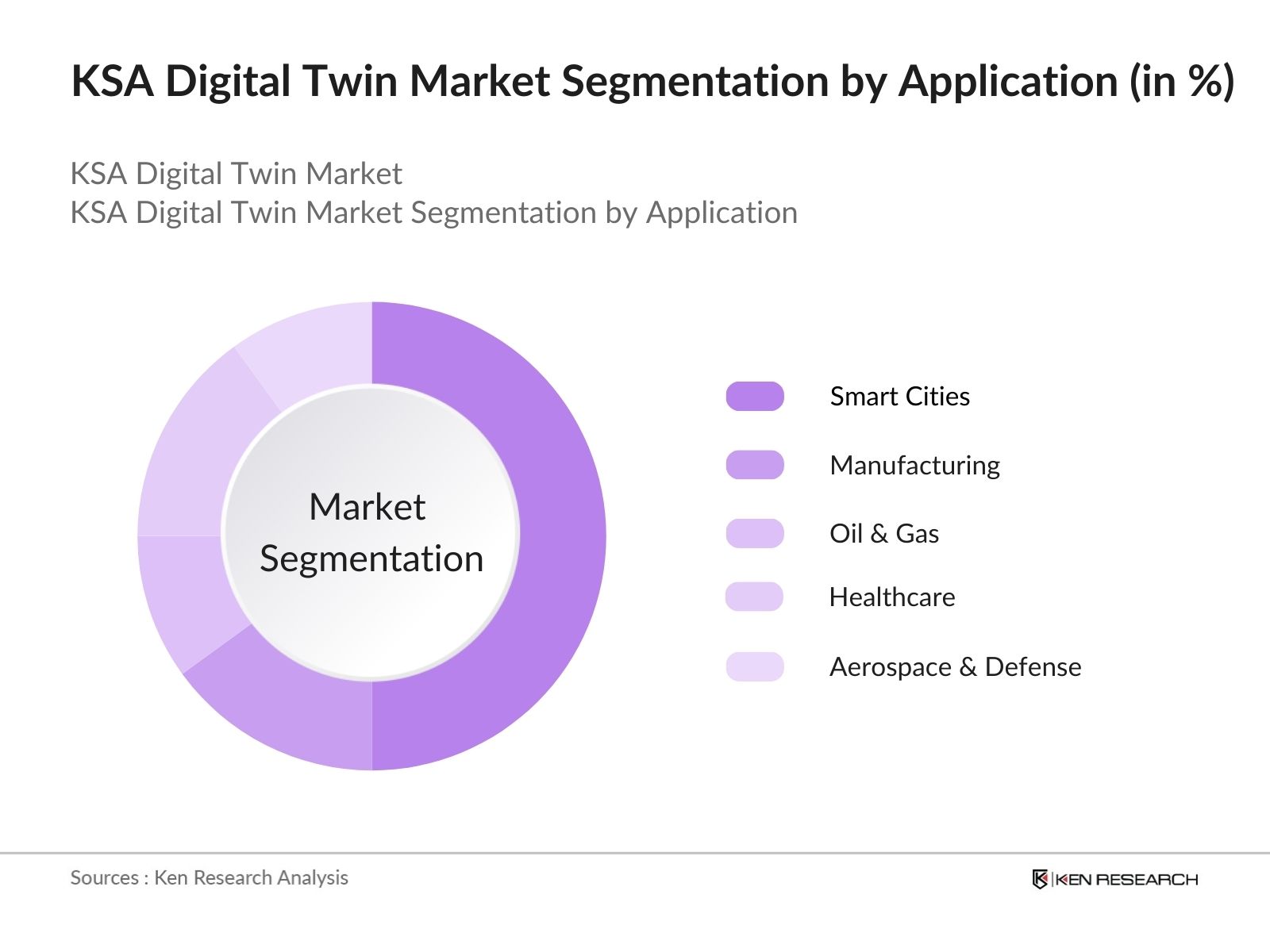

By Application: The market is also segmented by application into Smart Cities, Manufacturing, Oil & Gas, Healthcare, and Aerospace & Defense. The smart cities segment currently dominates the market due to the government's heavy investment in projects like NEOM and other urban transformation initiatives. The integration of digital twins in these smart city projects allows for real-time monitoring, predictive maintenance, and efficient energy usage, making it an essential tool in urban planning and management.

KSA Digital Twin Market Competitive Landscape

The market is dominated by a mix of international tech giants and regional players. Companies like Siemens, General Electric, and IBM have established a strong presence due to their expertise in industrial IoT and software solutions. Local players, in collaboration with global firms, are also making inroads, particularly in sectors like oil & gas and manufacturing.

|

Company Name |

Established |

Headquarters |

Revenue (2023) |

No. of Employees |

Major Industry Focus |

Partnerships |

R&D Investments |

Patent Holdings |

Regional Focus |

|

Siemens AG |

1847 |

Munich, Germany |

|||||||

|

General Electric |

1892 |

Boston, USA |

|||||||

|

IBM Corporation |

1911 |

Armonk, USA |

|||||||

|

Microsoft Corporation |

1975 |

Redmond, USA |

|||||||

|

Bentley Systems |

1984 |

Exton, USA |

KSA Digital Twin Market Analysis

Market Growth Drivers

- Infrastructure Development for Mega Projects: Digital twin technology is a key growth driver in Saudi Arabia's NEOM project, with an investment of over$500 billion. This technology enhances urban planning, resource management, and sustainability by providing real-time data integration and simulation capabilities, ensuring efficient infrastructure and optimized living conditions for future residents. These projects require advanced simulations to optimize construction and operations, positioning digital twin technology at the forefront of infrastructure development.

- Healthcare Infrastructure Investment: Saudi Arabia is investing over $65 billion in healthcare infrastructure under Vision 2030. In 2023, healthcare spending totaled $50.4 billion, making it the second-largest budgetary allocation. The governments focus includes the creation of 21 healthcare clusters and expansion of e-health services, driving digital twin adoption in healthcare for enhanced service delivery. This technology helps hospitals simulate various healthcare scenarios, leading to better patient outcomes and cost-effective management of resources.

- Transportation and Smart Mobility: Saudi Arabia's push for smart mobility is fueled by its Vision 2030 initiative, which integrates AI, IoT, and Blockchain technologies to enhance urban transportation. This strategy aims to reduce congestion, improve air quality, and stimulate economic growth, while also creating substantial employment opportunities in tech and engineering sectors.

Market Restraints

- Technical Challenges: A technical challenge is the integration of legacy systems with digital twin solutions. Many Saudi organizations, especially in the industrial and public sectors, operate with outdated infrastructure, making the integration of advanced technologies like digital twins difficult. According to the Saudi Ministry of Communications and Information Technology (MCIT), 40% of industrial operations in the Kingdom still use outdated control systems, creating obstacles in real-time data integration and predictive analysis.

- Lack of Skilled Workforce: The Kingdom faces a shortage of professionals skilled in advanced technologies such as data analytics, artificial intelligence, and digital twins. As of 2024, only about 35% of the Saudi workforce is skilled in IT-related fields, according to the World Bank. The government has launched various initiatives, including scholarships and training programs, to improve digital skills, but the gap remains, delaying widespread adoption of digital twin technologies in many sectors.

KSA Digital Twin Market Future Outlook

Over the next five years, the KSA digital twin industry is expected to witness substantial growth driven by continuous government support, advancements in digital twin technology, and increasing demand for smart city solutions. The focus on digital transformation as part of Vision 2030, along with large-scale infrastructure projects. The rise in adoption across sectors like oil & gas, healthcare, and manufacturing also points towards an expansion of the market.

Future Market Opportunities

- Technological Advancements: Advances in AI, IoT, and big data are creating new opportunities for digital twin technology in Saudi Arabia. For instance, the country's expanding 5G network, which is expected to cover most of the population by 2024, allows for faster and more efficient data exchange between physical and digital worlds. These technological advancements enable more precise simulations and analyses, fostering innovation across industries such as healthcare, real estate, and energy.

- International Collaborations: Saudi Arabia is fostering international partnerships to drive technological advancements in the digital twin sector. In 2023, the Kingdom signed collaborations with major tech players from the US, China, and Europe, focusing on enhancing digital infrastructure and technological expertise. These collaborations have led to increased foreign direct investment, much of it directed towards technology and infrastructure projects.

Scope of the Report

|

By Deployment Type |

On-Premise |

|

Cloud-Based |

|

|

By Application |

Smart Cities |

|

Manufacturing |

|

|

Oil & Gas |

|

|

Healthcare |

|

|

Aerospace & Defense |

|

|

By Technology |

IoT-Enabled Digital Twins |

|

AI and Machine Learning Integration |

|

|

Edge Computing for Twins |

|

|

Simulation Software |

|

|

By End-User |

Government |

|

Manufacturing Industries |

|

|

Healthcare Providers |

|

|

Oil & Gas Corporations |

|

|

Aerospace |

|

|

By Region |

Central Region |

|

Eastern Province |

|

|

Western Region |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Government and Regulatory Bodies (Ministry of Energy, Ministry of Investment)

Industrial Automation Companies

Investments and Venture Capitalist Firms

Oil & Gas Companies

Energy and Utility Companies

Construction and Infrastructure Companie

Artificial Intelligence (AI) Technology Firms

Transport and Logistics Companies

Facility Management Companies

Engineering and Architectural Firms

Companies

Players Mentioned in the Report:

Siemens AG

General Electric

IBM Corporation

Microsoft Corporation

Bentley Systems

Oracle Corporation

PTC Inc.

Honeywell International Inc.

Schneider Electric

AVEVA Group PLC

Dassault Systmes

Ansys Inc.

Bosch.IO

ABB Group

Hexagon AB

Table of Contents

1. KSA Digital Twin Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. KSA Digital Twin Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. KSA Digital Twin Market Analysis

3.1. Growth Drivers

3.1.1. Government Vision 2030 Initiatives

3.1.2. Increasing Adoption in Manufacturing and Infrastructure

3.1.3. Expansion of Smart Cities and IoT Ecosystem

3.1.4. Demand for Asset Optimization and Predictive Maintenance

3.2. Market Challenges

3.2.1. High Initial Deployment Costs

3.2.2. Limited Skilled Workforce in Digital Twin Implementation

3.2.3. Integration with Legacy Systems

3.3. Opportunities

3.3.1. Integration with AI and Machine Learning Models

3.3.2. Collaboration with International Tech Firms

3.3.3. Growing Adoption Across Energy, Oil & Gas Sectors

3.4. Trends

3.4.1. Rising Use of Digital Twins in Healthcare

3.4.2. Growing Focus on Sustainability and Decarbonization

3.4.3. Expansion of Edge Computing for Real-Time Twin Operations

3.5. Government Regulation

3.5.1. National Digital Transformation Program

3.5.2. Regulatory Framework for Smart Infrastructure

3.5.3. Guidelines for AI and IoT Integration

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. KSA Digital Twin Market Segmentation

4.1. By Deployment Type (In Value %)

4.1.1. On-Premise

4.1.2. Cloud-Based

4.2. By Application (In Value %)

4.2.1. Smart Cities

4.2.2. Manufacturing

4.2.3. Oil & Gas

4.2.4. Healthcare

4.2.5. Aerospace & Defense

4.3. By Technology (In Value %)

4.3.1. IoT-Enabled Digital Twins

4.3.2. AI and Machine Learning Integration

4.3.3. Edge Computing for Twins

4.3.4. Simulation Software

4.4. By End-User (In Value %)

4.4.1. Government

4.4.2. Manufacturing Industries

4.4.3. Healthcare Providers

4.4.4. Oil & Gas Corporations

4.4.5. Aerospace

4.5. By Region (In Value %)

4.5.1. Central Region

4.5.2. Eastern Province

4.5.3. Western Region

5. KSA Digital Twin Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Siemens AG

5.1.2. General Electric

5.1.3. IBM Corporation

5.1.4. Microsoft Corporation

5.1.5. Oracle Corporation

5.1.6. Dassault Systmes

5.1.7. Bentley Systems

5.1.8. ABB Group

5.1.9. Honeywell International Inc.

5.1.10. PTC Inc.

5.1.11. Ansys Inc.

5.1.12. Bosch.IO

5.1.13. Schneider Electric

5.1.14. AVEVA Group PLC

5.1.15. Hexagon AB

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Market Presence, Revenue, Industry Focus, Technology Patents, Innovation Index, Partnerships/Collaborations)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. KSA Digital Twin Market Regulatory Framework

6.1. Compliance with National Smart Infrastructure Standards

6.2. Digital Twin Integration Guidelines in Energy Sector

6.3. Data Privacy and Security in Digital Twin Deployments

7. KSA Digital Twin Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. KSA Digital Twin Future Market Segmentation

8.1. By Deployment Type (In Value %)

8.2. By Application (In Value %)

8.3. By Technology (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. KSA Digital Twin Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Go-To-Market Strategies

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first phase involves constructing a comprehensive ecosystem map of all stakeholders within the KSA Digital Twin Market. This step is based on in-depth desk research using secondary databases to identify the critical variables influencing the market, such as technological adoption, industrial demand, and government policies.

Step 2: Market Analysis and Construction

We analyzed historical data from industry reports to determine market penetration, the ratio of deployments across sectors, and revenue generation trends. This stage also included evaluating service quality metrics, ensuring the reliability and accuracy of the revenue forecasts.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were developed and validated through consultations with industry experts via computer-assisted telephone interviews (CATIs). These discussions provided vital financial and operational insights from key market players.

Step 4: Research Synthesis and Final Output

This phase involved direct engagement with industry stakeholders such as manufacturers, service providers, and government agencies to verify data. The insights gathered from these interactions were synthesized with bottom-up market estimates, ensuring a comprehensive and accurate analysis of the KSA Digital Twin Market.

Frequently Asked Questions

01. How big is the KSA Digital Twin Market?

The KSA Digital Twin market is valued at USD 2 billion, driven by the increasing adoption of smart city projects, digital transformation initiatives, and industrial automation.

02. What are the challenges in the KSA Digital Twin Market?

The KSA Digital Twin market faces challenges such as high initial implementation costs, limited local expertise in digital twin technology, and integration issues with legacy systems.

03. Who are the major players in the KSA Digital Twin Market?

Key players in the KSA digital twin market include Siemens AG, General Electric, IBM Corporation, Microsoft Corporation, and Bentley Systems. These companies dominate due to their expertise in digital solutions and strategic partnerships in Saudi Arabia.

04. What are the growth drivers of the KSA Digital Twin Market?

The KSA digital twin market is propelled by factors such as government support under Vision 2030, smart city projects like NEOM, and the adoption of digital twin technology in industries like oil & gas and manufacturing.

05. What are the opportunities in the KSA Digital Twin Market?

Opportunities in the KSA digital twin market include the growing integration of AI and machine learning, the expansion of smart cities, and the rising demand for real-time operational insights and predictive maintenance solutions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.