KSA Dog Food Market Outlook to 2030

Region:Middle East

Author(s):Shubham Kashyap

Product Code:KROD5121

December 2024

82

About the Report

KSA Dog Food Market Overview

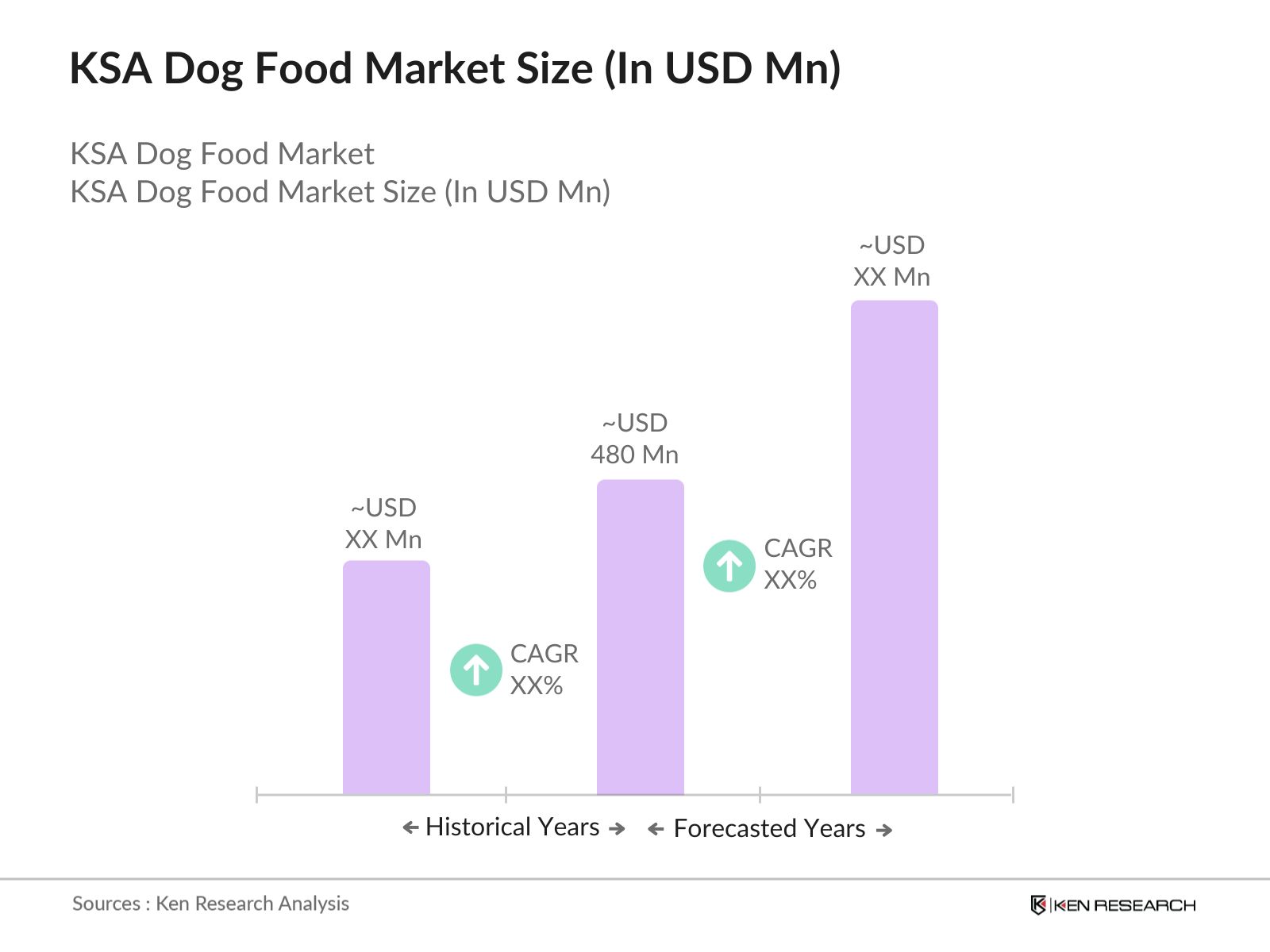

- The KSA dog food market is valued at USD 480 million, primarily driven by the growing trend of pet ownership, an increase in disposable income, and the rising awareness of pet health and nutrition. This steady growth is fueled by a demand for premium dog food products, especially among urban households, where pet owners are inclined towards high-quality and specialized dog food options. The market also benefits from the expansion of distribution networks, including supermarkets and online retail platforms, which make a wider range of products easily accessible to consumers.

- Major demand centers for dog food in KSA include Riyadh, Jeddah, and Dammam. Riyadh leads due to its urban population's preference for high-quality pet products, spurred by increasing pet ownership and awareness of pet health. Jeddah follows closely with a growing middle class and a high concentration of pet-friendly spaces. Dammam's rising disposable income and its strategic retail growth make it a prominent contributor. These cities benefit from extensive distribution channels and retail networks that cater to the specific needs of pet owners.

- The Saudi Food and Drug Authority enforces stringent import regulations on pet food, including dog food, as part of a broader initiative to ensure product safety. In 2023, nearly 45% of imported pet food shipments underwent quality inspections to meet the SFDA's safety and nutritional standards. These regulations, designed to protect pet health and consumer safety, have influenced market dynamics by limiting the influx of non-compliant products, encouraging local production, and increasing the reliability of available dog food products.

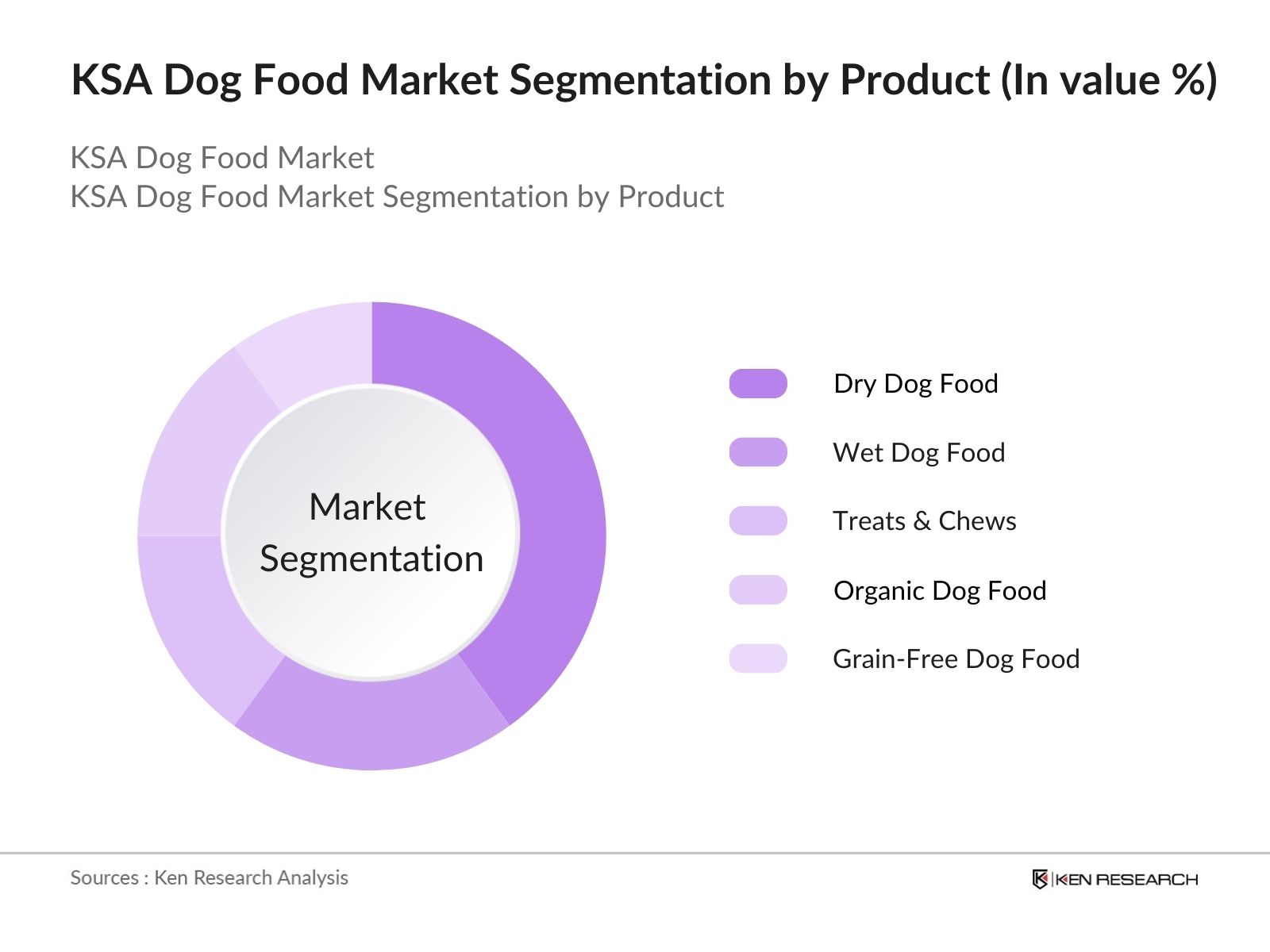

KSA Dog Food Market Segmentation

- By Product Type: The market is segmented by product type into dry dog food, wet dog food, treats & chews, organic dog food, and grain-free dog food. Dry dog food currently holds a dominant market share in KSA under this segmentation. Its popularity stems from its convenience, affordability, and longer shelf life, making it the go-to choice for pet owners. Additionally, its easy storage and feeding convenience contribute to its prevalence, especially for urban households with busy lifestyles.

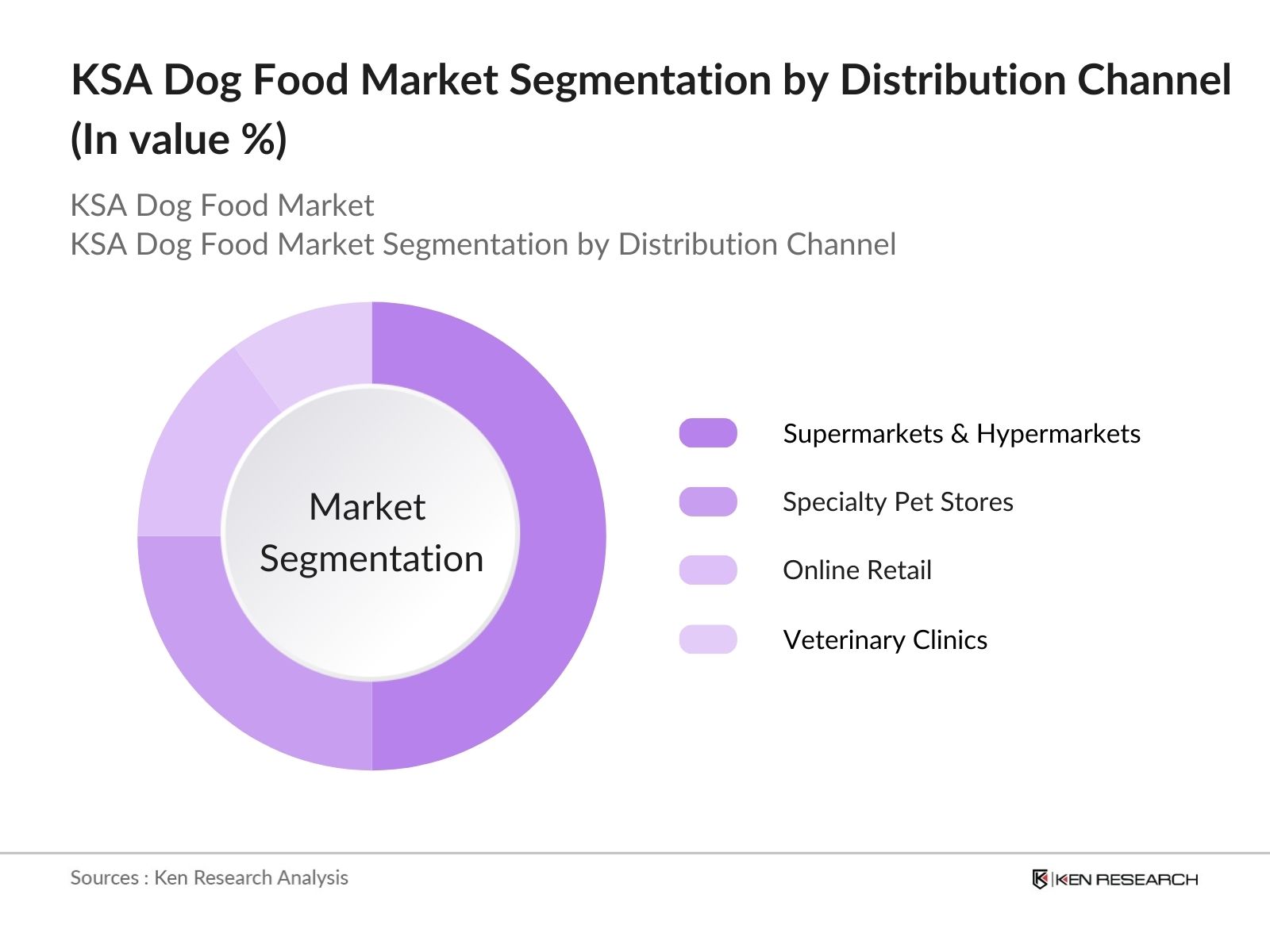

- By Distribution Channel: The market is segmented by distribution channel into supermarkets & hypermarkets, specialty pet stores, online retail, and veterinary clinics. Supermarkets and hypermarkets dominate this category due to their widespread presence and comprehensive product offerings. They are a trusted choice for pet owners who seek convenience, allowing them to access a variety of brands in a single shopping trip, thereby supporting the dominance of this segment in the distribution channel category.

KSA Dog Food Market Competitive Landscape

The KSA dog food market is dominated by a mix of global and regional players, each leveraging their extensive product ranges, strong brand recognition, and strategic distribution networks to maintain competitive advantage. Key players are investing in research and development to introduce innovative, health-focused dog food products, aligning with the rising demand for specialized diets.

KSA Dog Food Market Analysis

Growth Drivers

- Rising Pet Ownership (Urbanization): With rapid urbanization in Saudi Arabia, the number of pet-owning households has risen, supported by 2024 data from the Saudi General Authority for Statistics indicating that urbanized areas now constitute 85% of the population. This increase in urban living has contributed to more pet adoptions, as smaller household sizes and apartment living encourage individuals to seek companionship in pets, particularly dogs. Urban households account for around 10% of Saudi pet ownership, which translates to a growing demand for pet-related products, including dog food. This shift is instrumental in driving the market forward.

- Increasing Health Awareness for Pets: The heightened focus on pet health in Saudi Arabia is increasingly noticeable, with the Ministry of Environment, Water, and Agriculture reporting a substantial rise in veterinary clinic visits in 2023. This reflects a significant push towards preventive health practices, with dog owners showing a growing preference for nutrient-rich, high-quality food options to support their pets well-being. The demand for healthier dog food options is now evident across urban and suburban regions, as owners increasingly value balanced diets for their pets, paralleling global trends in pet health awareness.

- Growing Disposable Income (Affordability): Saudi Arabia has experienced an upward trend in disposable incomes, with the World Bank reporting a GDP per capita increase to USD 21,000 in 2023. This rise in financial stability is directly influencing pet owners' capacity to purchase higher-quality dog foods, with increased spending on pet welfare seen across various income levels. Households with disposable income above SAR 10,000 monthly have shown an inclination toward premium pet food options, driving the market for both specialized and premium dog food. This shift emphasizes affordability as a critical factor in market growth.

Challenges

- High Cost of Premium Products: Premium dog foods remain cost-prohibitive for many pet owners in Saudi Arabia, with the average premium dog food priced higher than standard options in 2023. Data from the Saudi Consumer Protection Association highlights that premium dog food sales primarily occur in higher-income urban areas, as these products cater to a niche market segment. The high costs restrict broader market penetration, impacting the availability and affordability of premium foods for middle-income households, where the preference often leans toward standard or locally produced brands.

- Limited Availability of Specialized Diets: The availability of specialized diets such as grain-free or hypoallergenic dog foods remains limited in Saudi Arabia, with only a few pet stores in urban centers stocking such options as of 2023. This limited availability poses a significant challenge for owners of pets with specific dietary requirements, as the demand for specialized diets is increasing due to rising awareness of canine health issues. Additionally, specialized diets are often imported, creating supply inconsistencies that limit their widespread availability and adoption in the market.

KSA Dog Food Market Future Outlook

The KSA Dog Food market is poised for significant growth, driven by the increasing trend of pet humanization and the growing demand for premium, organic, and grain-free dog food options. As pet owners continue to prioritize their pets' health, the demand for specialized and high-quality food products is expected to rise. The expansion of online retail and innovations in pet nutrition will further support market growth, positioning KSA as a promising market for the pet food industry.

Future Market Opportunities

- Rise in Demand for Organic and Natural Dog Foods: The demand for organic and natural dog foods is gaining traction in Saudi Arabia, with consumer surveys by the Ministry of Environment in 2023 indicating that a notable portion of pet owners prefer organic options over conventional products. This shift toward organic dog food aligns with the global trend of health-conscious pet ownership and reflects an emerging opportunity for brands to cater to environmentally and health-aware consumers in Saudi Arabia. Companies investing in organic dog food offerings can leverage this demand to establish a competitive edge within this evolving market.

- Expansion into Online Retail Platforms: Saudi Arabias online retail sector offers significant growth opportunities for dog food brands, as e-commerce sales have surged, with pet product sales reaching SAR 5 million in 2023. This trend, driven by increased internet penetration and consumer preference for online shopping, opens pathways for brands to reach consumers in underserved areas. Online retail not only facilitates broader access but also provides an avenue for brands to showcase a wider variety of products and engage directly with customers through promotions and loyalty programs, enhancing brand presence in the digital space.

Scope of the Report

|

By Product Type |

Dry Dog Food Wet Dog Food Treats and Chews Organic Dog Food Grain-Free Dog Food |

|

By Ingredient Type |

Animal-Based Plant-Based Synthetic Supplements |

|

By Price Range |

Premium Economy Value |

|

By Distribution Channel |

Supermarkets & Hypermarkets Online Retail Specialty Pet Stores Veterinary Clinics |

|

By Region |

Riyadh Jeddah Dammam Makkah Eastern Province |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Banks and Financial Institutions

Government and Regulatory Bodies (e.g., Ministry of Environment, Water and Agriculture)

Supermarkets and Hypermarkets

Specialty Pet Stores

Online Retail Platforms

Veterinary Clinics and Animal Hospitals

Pet Food Manufacturers and Suppliers

Companies

Players Mentioned in the Report

Mars Petcare

Nestl Purina

Hills Pet Nutrition

Royal Canin

Farmina Pet Foods

Blue Buffalo

Orijen

Pedigree

Nutro

Diamond Naturals

Taste of the Wild

Acana

Victor

Merrick

Nulo

Table of Contents

01 KSA Dog Food Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

02 KSA Dog Food Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Market Developments and Milestones

03 KSA Dog Food Market Dynamics

3.1 Growth Drivers

3.1.1 Rising Pet Ownership (Urbanization)

3.1.2 Increasing Health Awareness for Pets (Consumer Awareness)

3.1.3 Growing Disposable Income (Affordability)

3.1.4 Expansion of Distribution Channels (Availability)

3.2 Market Challenges

3.2.1 High Cost of Premium Products

3.2.2 Limited Availability of Specialized Diets

3.2.3 Supply Chain Fluctuations

3.3 Opportunities

3.3.1 Rise in Demand for Organic and Natural Dog Foods

3.3.2 Expansion into Online Retail Platforms

3.3.3 Customization of Products Based on Dog Breed and Size

3.4 Trends

3.4.1 Growth of Functional Dog Foods (Probiotics, Supplements)

3.4.2 Increasing Preference for Local Brands

3.4.3 Expansion of Subscription-Based Pet Food Services

3.5 Government Regulations

3.5.1 Import Regulations on Pet Food Products

3.5.2 Food Safety Standards for Dog Food

3.5.3 Labeling and Ingredient Disclosure Requirements

3.6 SWOT Analysis

3.7 Porters Five Forces Analysis

3.8 Competition Ecosystem

04 KSA Dog Food Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Dry Dog Food

4.1.2 Wet Dog Food

4.1.3 Treats and Chews

4.1.4 Organic Dog Food

4.1.5 Grain-Free Dog Food

4.2 By Ingredient Type (In Value %)

4.2.1 Animal-Based

4.2.2 Plant-Based

4.2.3 Synthetic Supplements

4.3 By Price Range (In Value %)

4.3.1 Premium

4.3.2 Economy

4.3.3 Value

4.4 By Distribution Channel (In Value %)

4.4.1 Supermarkets & Hypermarkets

4.4.2 Online Retail

4.4.3 Specialty Pet Stores

4.4.4 Veterinary Clinics

4.5 By Region (In Value %)

4.5.1 Riyadh

4.5.2 Jeddah

4.5.3 Dammam

4.5.4 Others

05 KSA Dog Food Market Competitive Landscape

5.1 Detailed Profiles of Major Companies

5.1.1 Mars Petcare

5.1.2 Nestl Purina

5.1.3 Hills Pet Nutrition

5.1.4 Royal Canin

5.1.5 Farmina Pet Foods

5.1.6 Blue Buffalo

5.1.7 Orijen

5.1.8 Pedigree

5.1.9 Nutro

5.1.10 Diamond Naturals

5.1.11 Taste of the Wild

5.1.12 Acana

5.1.13 Victor

5.1.14 Merrick

5.1.15 Nulo

5.2 Cross-Comparison Parameters

(Brand Recognition, Product Portfolio, Pricing Strategy, Market Share, Target Consumer Base, Geographic Reach, Innovation Rate, Sustainability Initiatives)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Government Grants

5.8 Private Equity Investments

06 KSA Dog Food Market Regulatory Framework

6.1 Food and Safety Standards Compliance

6.2 Import/Export Regulations

6.3 Ingredient Labeling and Advertising Compliance

6.4 Certification Processes

07 KSA Dog Food Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

08 KSA Dog Food Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Ingredient Type (In Value %)

8.3 By Price Range (In Value %)

8.4 By Distribution Channel (In Value %)

8.5 By Region (In Value %)

09 KSA Dog Food Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

This phase involves creating an ecosystem map that includes all significant players in the KSA Dog Food Market. Through desk research and proprietary databases, the objective is to identify and define key variables that impact the market, including consumer demographics and purchasing trends.

Step 2: Market Analysis and Construction

In this stage, historical data on the KSA Dog Food Market is compiled and analyzed. Market penetration rates, sales channels, and consumption patterns are assessed to ensure an accurate representation of revenue generation and segment performance within the market.

Step 3: Hypothesis Validation and Expert Consultation

To validate the hypotheses, interviews with industry experts are conducted, providing insights into operational challenges, demand fluctuations, and market opportunities. This step enhances data accuracy and reflects industry perspectives.

Step 4: Research Synthesis and Final Output

The final phase synthesizes insights from manufacturers and retailers, combining primary data with secondary research to deliver a comprehensive report on the KSA Dog Food Market. This synthesis ensures a validated and reliable analysis of market trends, competitive landscape, and future outlook.

Frequently Asked Questions

01. How big is the KSA Dog Food Market?

The KSA Dog Food Market is valued at USD 480 million, driven by increasing pet ownership and rising demand for premium and specialized dog food products.

02. What are the main challenges in the KSA Dog Food Market?

Challenges in the KSA Dog Food Market include high product costs, limited availability of specialty diets, and fluctuations in supply chains impacting product availability and pricing.

03. Who are the major players in the KSA Dog Food Market?

Key players in the KSA Dog Food Market include Mars Petcare, Nestl Purina, Hills Pet Nutrition, Royal Canin, and Farmina Pet Foods, known for their product range and strong consumer trust.

04. What factors are driving growth in the KSA Dog Food Market?

Growth in the KSA Dog Food Market is propelled by increased pet adoption, rising disposable income, and a growing emphasis on pet health, leading consumers to opt for premium and organic dog food options.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.