KSA Doors & Windows Market Outlook to 2030

Region:Middle East

Author(s):Shivani Mehra

Product Code:KROD3383

November 2024

92

About the Report

KSA Doors & Windows Market Overview

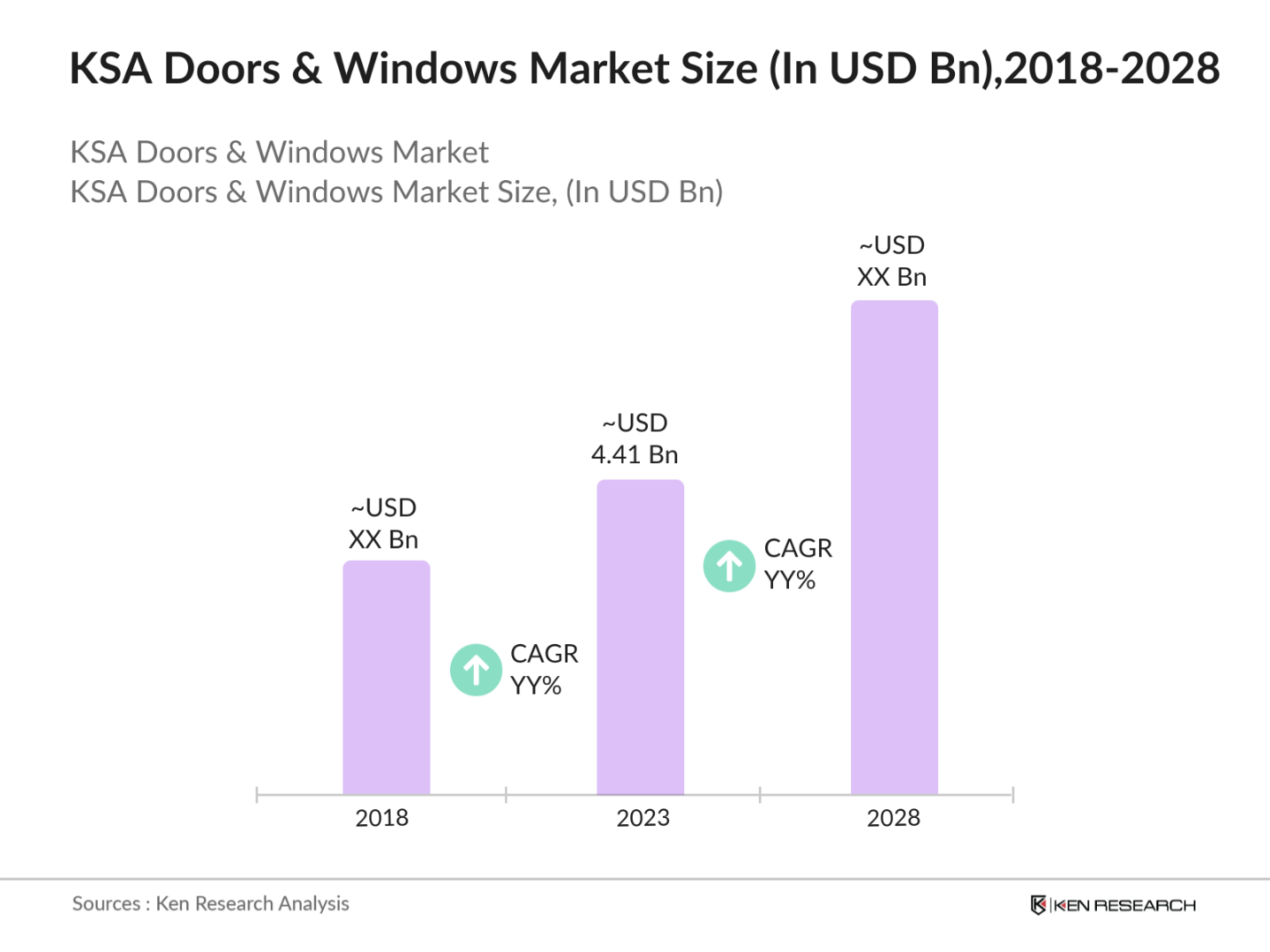

- The KSA Doors & Windows Market saw significant growth, reaching a valuation of USD 4.41 billion in 2023. This growth is primarily driven by large-scale urbanization projects such as NEOM and the Red Sea Development. Increasing demand for durable, energy-efficient products, coupled with rising consumer preferences for materials like double-glazed windows, has fueled market expansion.

- Prominent players in the KSA Doors & Windows Market include Aluplast, Reynaers Middle East, Al-Jazeera Factory for Windows, and Al-Watania Doors. These companies are at the forefront of developing and supplying advanced, energy-efficient products. Aluplast is indeed a leading manufacturer of energy-efficient windows, known for providing excellent insulation at affordable prices. Their uPVC profiles combine energy efficiency with high quality standards. Aluplast windows are suitable for passive houses, easily surpassing the 0.8 W/(m2K) requirement.

- In 2023, Reynaers Middle East launched its new line of sustainable aluminum window frames, designed to meet the rising demand for eco-friendly building solutions in Saudi Arabia is indeed focusing on sustainable construction, driven by major projects like NEOM and Qiddiya, which align with the country's strategic shift towards eco-friendly building practices. This shift is underscored by the implementation of the Saudi Green Building Code and various environmental initiatives aimed at reducing carbon emissions and promoting energy efficiency.

- Riyadh and Jeddah dominate the KSA Doors & Windows Market due to their high population density, rapid urbanization, and ongoing construction projects. Riyadh is indeed leading the market due to its expanding commercial zones and smart city initiatives. The city's growth is supported by ongoing infrastructure projects that enhance its appeal as a commercial hub. This aligns with broader trends in urban development, where Riyadh's strategic initiatives contribute to increased demand for construction materials, including doors and windows.

KSA Doors & Windows Market Segmentation

KSA Doors & Windows Market is segmented into further categories:

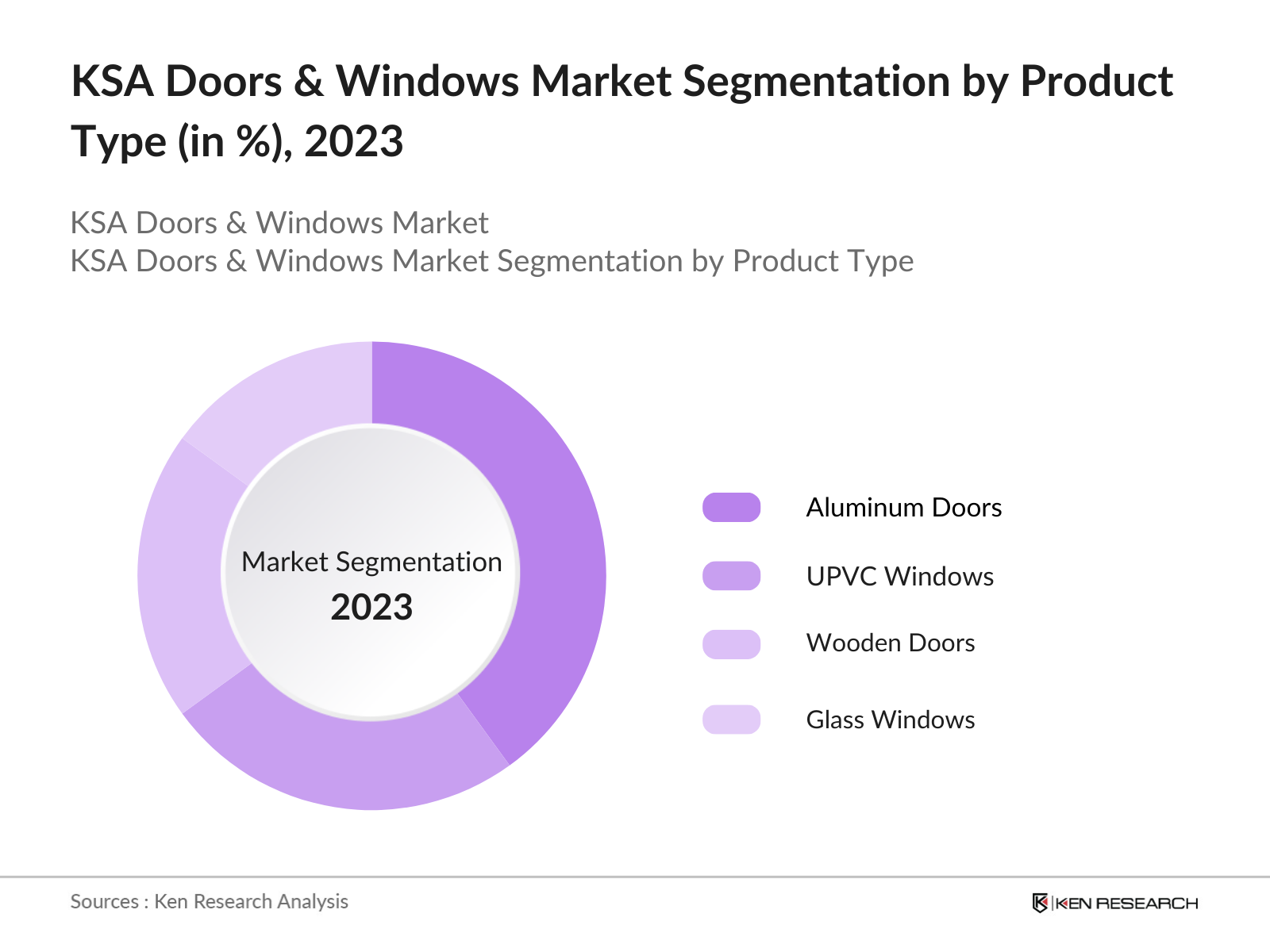

- By Product Type: The KSA Doors & Windows Market is segmented into wooden doors, aluminum doors, UPVC windows, and glass windows. In 2023, aluminum doors held the largest market share, driven by their durability, lightweight properties, and resistance to extreme weather conditions. The surge in smart city projects and sustainable infrastructure, such as in NEOM, has increased demand for aluminum doors, which are preferred due to their recyclable nature and energy efficiency. Aluminum doors also meet the high aesthetic standards required for luxury residential and commercial buildings.

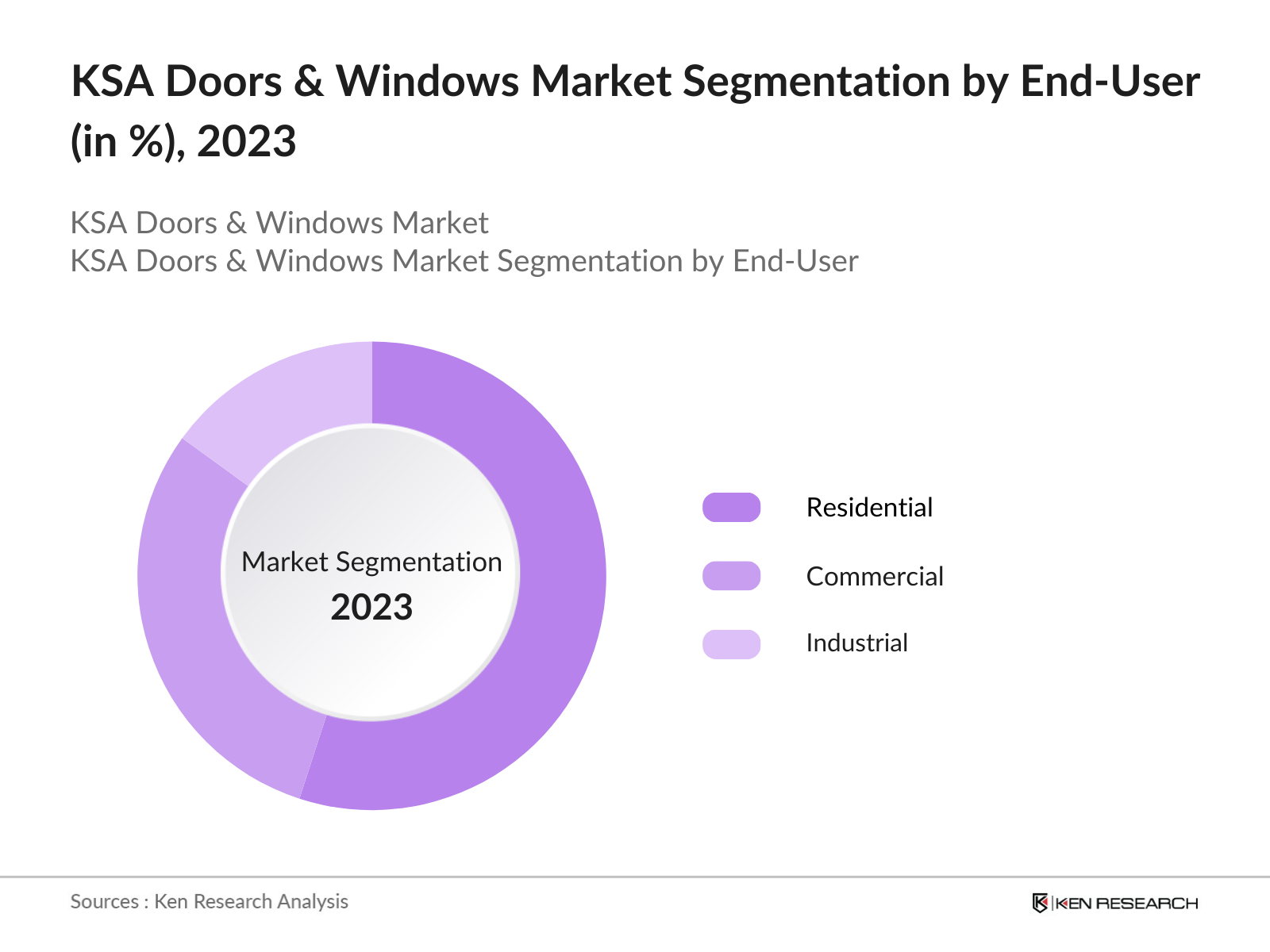

- By End-User: The KSA Doors & Windows Market is segmented by end-user into residential, commercial, and industrial. In 2023, the residential sector indeed dominated the market, largely due to the Saudi government's initiatives aimed at increasing homeownership, such as the Sakani program. This program has significantly boosted demand for residential properties. The sector also saw strong demand for eco-friendly and energy-efficient products, especially in cities like Jeddah, where luxury residential projects and affordable housing developments were on the rise, contributing to the sector's overall dominance.

By Region:The KSA Doors & Windows Market is segmented regionally into North, South, East, and West. In 2023, theWest region, which includes cities likeJeddahandMecca, indeed dominated the market. This dominance is attributed to extensiveresidential and commercial construction activities, which are driven bypopulation growthand significantgovernment investments.Projects like Jeddah Tower, which is set to be the tallest building in the world, require advanced and energy-efficient doors and windows, contributing to the region's dominance.

KSA Doors & Windows Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Aluplast |

1982 |

Riyadh, Saudi Arabia |

|

Reynaers Middle East |

1965 |

Manama, Bahrain |

|

Al-Jazeera Factory for Windows |

1975 |

Riyadh, Saudi Arabia |

|

Al-Watania Doors |

1980 |

Dammam, Saudi Arabia |

|

Technal Middle East |

1980 |

Dubai, UAE |

- Aluplast: In 2023, Aluplast launched a new range of energy-efficient UPVC windows designed specifically for the hot Saudi climate. These windows feature advanced heat-reflective technology, reducing the need for air conditioning in residential and commercial buildings. This innovation is a key response to the rising energy costs in the Kingdom, particularly in cities like Riyadh.

- Technal Middle East: In 2023, Technal Middle East introduced a new range of sustainable aluminum doors for commercial and industrial use. The product, developed with recycled materials, is in line with the governments green building initiatives. the company reported revenues of SAR 120 million from this product line, with demand primarily driven by commercial projects in Jeddah and Mecca.

KSA Doors & Windows Industry Analysis

KSA Doors & Windows Market Growth Drivers

- Energy Efficiency Regulations: The Saudi government has introduced energy efficiency standards for building materials, requiring energy-efficient doors and windows in new constructions. These regulations have increased demand for products like double-glazed windows, which help reduce energy consumption in both residential and commercial buildings, driving the market for energy-saving doors and windows.

- Massive Urban Development Projects: Projects like NEOM, the Red Sea Project, and Qiddiya are driving demand for high-quality doors and windows. NEOM alone received over SAR 500 billion in funding in 2023, focusing on creating smart, energy-efficient cities. These projects create significant opportunities for premium, sustainable materials, with ongoing construction in both residential and commercial spaces boosting market growth.

- Government Infrastructure Investments: The Saudi government has ramped up investments in infrastructure projects, driving growth in the doors and windows market. These projects, focused on both residential and commercial buildings, are part of efforts to diversify the economy. As construction progresses, the demand for doors and windows is expected to increase, supporting market expansion.

KSA Doors & Windows Market Challenges

- Fluctuating Raw Material Prices: The market is experiencing significant supply chain challenges, including disruptions in raw material availability and increased transportation costs. These factors have led to higher prices and difficulty in meeting demand, which in turn affects production costs and profitability for manufacturers, especially small and mid-sized enterprises. These rising costs have put pressure on local producers, affecting market stability and growth.

- Supply Chain Disruptions: The Saudi doors and windows market is facing challenges from global supply chain disruptions, leading to delays in raw material availability. These delays are extending project timelines and raising production costs, impacting overall market growth. If unresolved, the disruptions could continue to hinder the industry.

KSA Doors & Windows Market Government Initiatives

- Introduction of Green Building Standards: In 2023, the Saudi Ministry of Municipal, Rural Affairs, and Housing launched a Green Building Certification program aimed at promoting sustainability in construction. This initiative aims to promote sustainability in construction by mandating that all new public sector construction projects adhere to strict green building standards. These standards specifically require the use of sustainable building materials that enhance energy conservation, including energy-efficient doors and windows.

- Sustainability Regulations: The Saudi government has introduced regulations encouraging the use of eco-friendly materials in construction. These regulations are designed to promote sustainable building practices and drive demand for energy-efficient doors and windows. This focus on sustainability creates new market opportunities for manufacturers specializing in environmentally friendly products. The Kingdom aims to generate 50% of its electricity from renewable sources by 2030, up from less than 1% currently. This includes a target of 50 GW of solar and wind power capacity by 2030.

KSA Doors & Windows Market Future Outlook

The KSA Doors & Windows Market is set to witness significant growth through 2028, driven by the countrys focus on achieving energy efficiency, sustainability, and local manufacturing capabilities. The market is poised for a transformation as future trends revolve around stricter energy regulations, smart building technologies, and a push for localization in production, all of which will shape the competitive landscape during this period.

Future Trends:

- Growth Driven by Energy Efficiency Goals: By 2028, the KSA Doors & Windows Market is expected to grow, driven by the governments focus on achieving energy efficiency targets. Stricter energy regulations across public and private sectors will increase demand for energy-efficient doors and windows. This shift will be particularly noticeable in urban areas with large-scale residential and commercial projects.

- Expansion of Smart Building Technologies: By 2028, the integration of smart technologies in doors and windows is expected to become a key trend. Innovations like smart window systems, which adjust transparency to regulate indoor temperature, will align with Saudi Arabia's push towards smart cities and advanced infrastructure projects.

Scope of the Report

|

By Product Type |

Wooden Doors Aluminum Doors UPVC Windows Glass Windows |

|

By End-User |

Residential Commercial Industrial |

|

By Region |

North South East West |

Products

Key Target Audience

Government and Regulatory Bodies (e.g., Saudi Standards, Metrology and Quality Organization (SASO), Ministry of Municipal, Rural Affairs, and Housing)

Commercial Real Estate Companies

Energy Efficiency Consultants

Industrial Construction Firms

Doors & Windows Manufacturers

Suppliers of Construction Materials

Investments and Venture Capitalist Firms

Architectural Firms

Companies

Players Mentioned in the Report:

Aluplast

Reynaers Middle East

Al-Jazeera Factory for Windows

Al-Watania Doors

Technal Middle East

Sapa Building Systems

Al-Jouf Doors & Windows

Gulf Extrusions

Emirates Glass LLC

Assa Abloy

Al-Wajhat Windows

Jeld-Wen

RAK Aluminium & Glass Industries

Al Fozan Windows

AluNile

Table of Contents

1. KSA Doors & Windows Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. KSA Doors & Windows Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. KSA Doors & Windows Market Analysis

3.1. Growth Drivers

3.1.1. Energy Efficiency Regulations

3.1.2. Urban Development Projects

3.1.3. Residential Housing Boom

3.2. Challenges

3.2.1. Fluctuating Raw Material Prices

3.2.2. Limited Skilled Workforce

3.2.3. Slow Adoption of New Technologies

3.3. Opportunities

3.3.1. Localization of Production

3.3.2. Technological Innovation

3.3.3. Green Building Standards Adoption

3.4. Recent Trends

3.4.1. Demand for Sustainable Products

3.4.2. Smart Building Integration

3.4.3. Increased Localization

3.5. Government Initiatives

3.5.1. Vision 2030 Housing Goals

3.5.2. Green Building Certification

3.5.3. Customs Duty Reforms

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Competition Ecosystem

4. KSA Doors & Windows Market Segmentation, 2023

4.1. By Product Type (in Value %)

4.1.1. Wooden Doors

4.1.2. Aluminum Doors

4.1.3. UPVC Windows

4.1.4. Glass Windows

4.2. By End-User (in Value %)

4.2.1. Residential

4.2.2. Commercial

4.2.3. Industrial

4.3. By Region (in Value %)

4.3.1. North

4.3.2. South

4.3.3. East

4.3.4. West

5. KSA Doors & Windows Market Competitive Landscape

5.1. Detailed Profiles of Major Companies

5.1.1. Aluplast

5.1.2. Reynaers Middle East

5.1.3. Al-Jazeera Factory for Windows

5.1.4. Al-Watania Doors

5.1.5. Technal Middle East

5.1.6. Sapa Building Systems

5.1.7. Al-Jouf Doors & Windows

5.1.8. Gulf Extrusions

5.1.9. Emirates Glass LLC

5.1.10. Assa Abloy

5.1.11. Al-Wajhat Windows

5.1.12. Jeld-Wen

5.1.13. RAK Aluminium & Glass Industries

5.1.14. Al Fozan Windows

5.1.15. AluNile

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. KSA Doors & Windows Market Future Trends (Market Outlook 2028)

6.1. Growth Driven by Energy Efficiency Goals

6.2. Expansion of Smart Building Technologies

6.3. Increased Localization of Production

7. KSA Doors & Windows Market Regulatory Framework

7.1. Environmental Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. KSA Doors & Windows Market Future Market Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. KSA Doors & Windows Market Segmentation, 2028

9.1. By Region (in Value %)

9.2. By Product Type (in Value %)

9.3. By End Use (in Value %)

10. KSA Doors & Windows Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer Contact Us

Research Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step: 2 Market Building:

Collating statistics on the KSA Doors & Windows Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for KSA Doors & Windows Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output:

Our team will approach multiple Doors & Windows and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from Doors & Windows.

Frequently Asked Questions

01. How big is the KSA Doors & Windows Market?

The KSA Doors & Windows Market was valued at USD 4.41 billion in 2023, driven by urbanization projects, rising demand for energy-efficient products, and government-backed infrastructure development initiatives.

02. What are the challenges in the KSA Doors & Windows Market?

Challenges include fluctuating raw material prices, particularly aluminum, and a shortage of skilled labor needed for installing modern, energy-efficient products. Additionally, the slow adoption of new manufacturing technologies limits market growth potential.

03. Who are the major players in the KSA Doors & Windows Market?

Key players in the KSA Doors & Windows Market include Aluplast, Reynaers Middle East, Al-Jazeera Factory for Windows, Al-Watania Doors, and Technal Middle East. These companies dominate due to their technological advancements, local manufacturing facilities, and alignment with sustainability goals.

04. What are the growth drivers of the KSA Doors & Windows Market?

The market is propelled by government initiatives such as Vision 2030, which mandates energy-efficient construction materials. Additionally, large-scale urban development projects like NEOM and the Red Sea Project significantly boost the demand for high-performance doors and windows.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.