KSA Dump Truck Market Outlook to 2030

Region:Middle East

Author(s):Shambhavi Awasthi

Product Code:KROD9687

December 2024

98

About the Report

KSA Dump Truck Market Overview

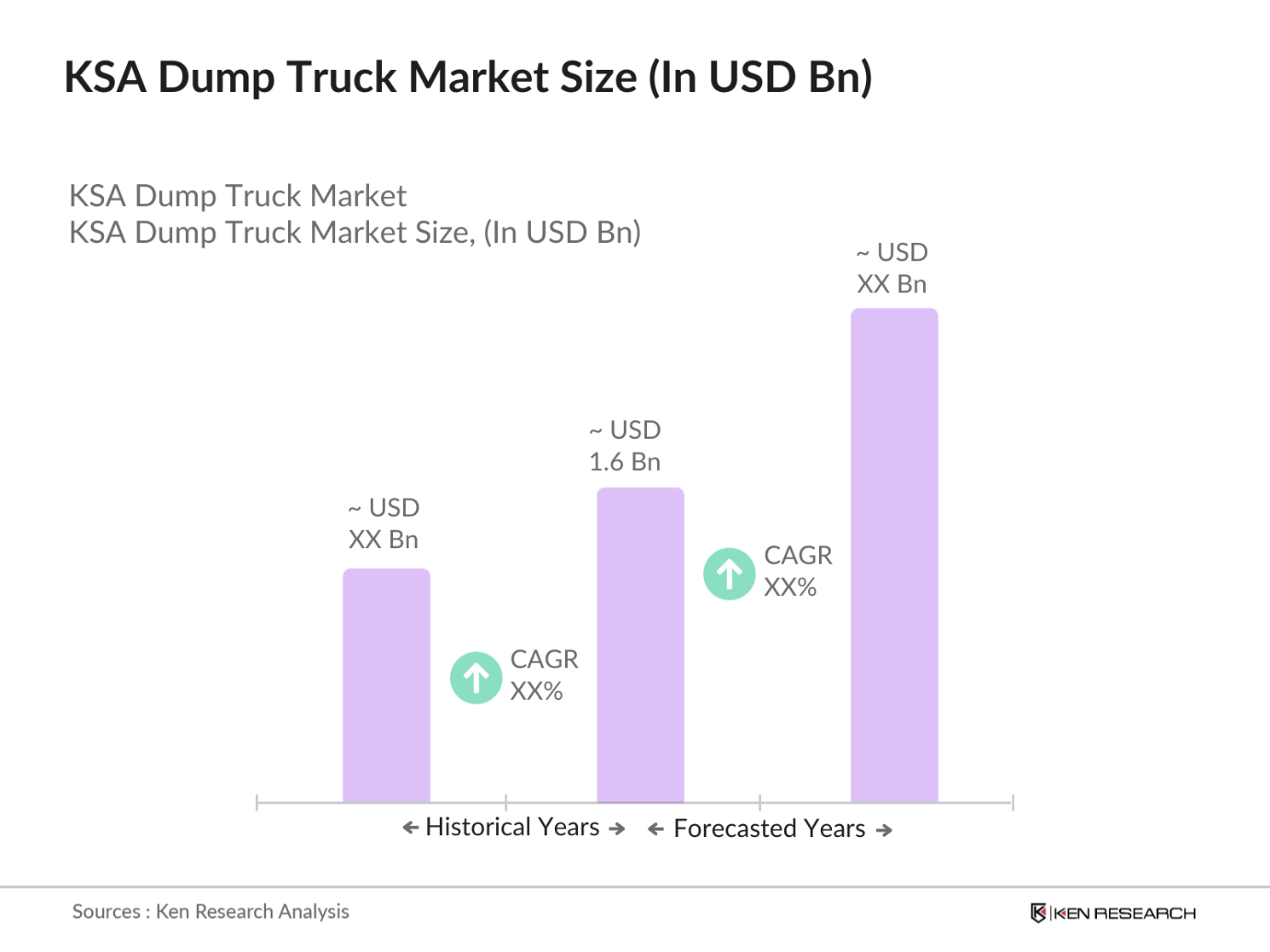

- The KSA (Kingdom of Saudi Arabia) Dump Truck market, with a valuation of USD 1.6 Bn, is driven by substantial investment in construction, mining, and infrastructure development, aligning with national projects. These sectors demand efficient material transportation, positioning dump trucks as a critical asset. Robust economic development and government-funded projects have also spurred this market's growth, facilitating urban expansion and industrial development.

- Key urban centers, such as Riyadh, Jeddah, and Dammam, dominate the KSA Dump Truck market. This is due to high infrastructure investment and rapid urbanization initiatives in these cities, alongside projects aimed at developing tourism and entertainment sectors, such as the NEOM city project. The strategic positioning of these regions as business and commercial hubs contributes to their market leadership.

- The Saudi government's Vision 2030 and the National Development Plan outline strategic objectives for economic diversification and infrastructure development. These plans include substantial investments in transportation and logistics, directly influencing the demand for dump trucks. In 2023, the government allocated SAR 10 billion to enhance road networks and transportation infrastructure, underscoring the commitment to development and the need for efficient material transport solutions.

KSA Dump Truck Market Segmentation

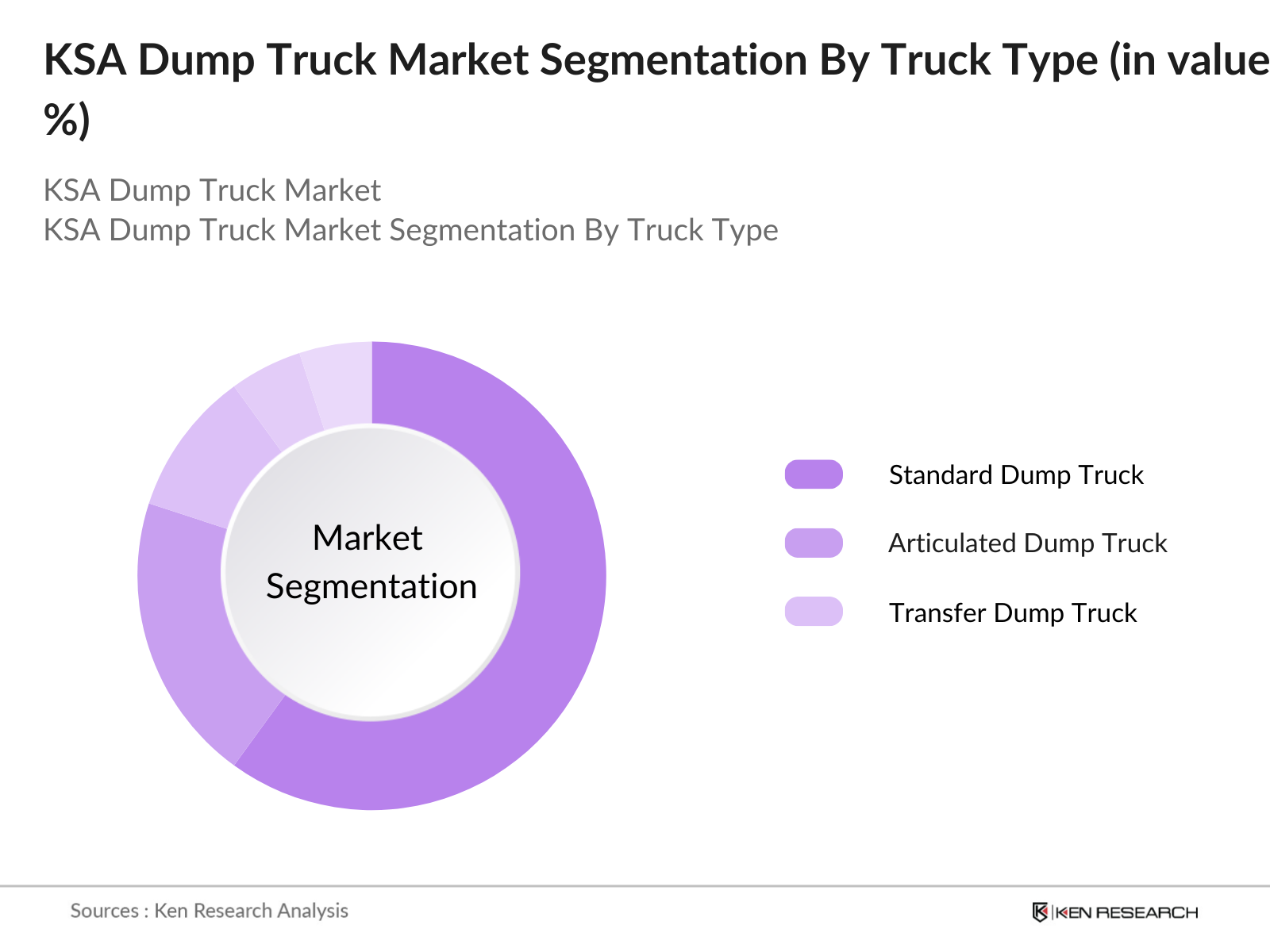

- By Truck Type: The KSA Dump Truck market is segmented into standard dump trucks, articulated dump trucks, and transfer dump trucks. The standard dump truck segment holds a dominant market share due to its wide application in construction and mining. These trucks are favored for their robustness, ability to handle heavy loads, and suitability for different terrains, essential in large-scale infrastructure projects that demand material transportation in high volumes.

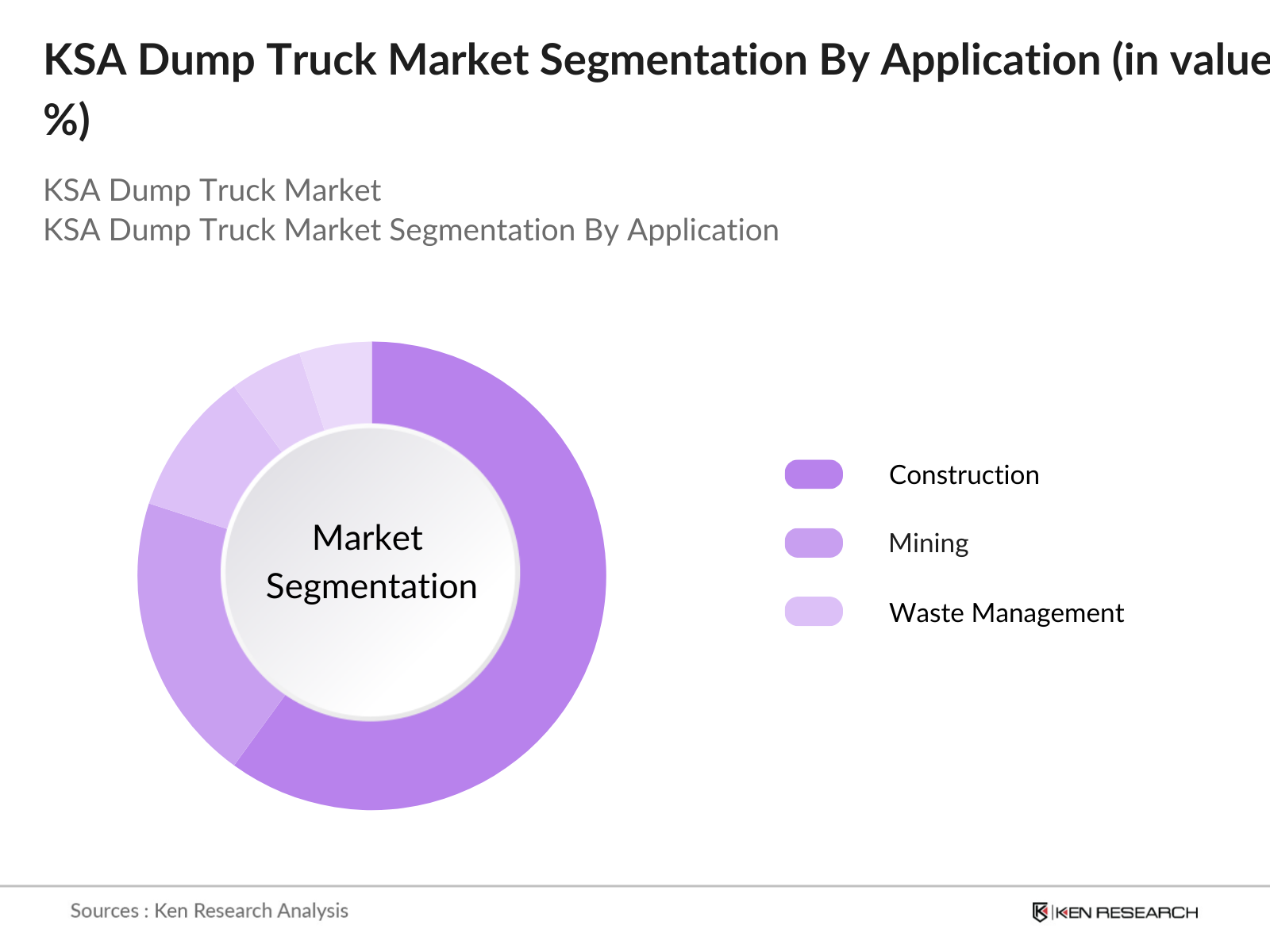

- By Application: Dump trucks are segmented by application into construction, mining, and waste management. The construction segment leads the market due to ongoing mega-projects, supported by Saudi Vision 2030. Infrastructure development and housing projects necessitate efficient transportation, making dump trucks a preferred choice for handling bulk materials, dirt, and gravel in construction zones.

KSA Dump Truck Market Competitive Landscape

The KSA Dump Truck market is characterized by the presence of both local and international players. This market is dominated by brands offering durable and efficient vehicles, addressing the demanding conditions in Saudi Arabia. Companies with established reputations for reliability, load capacity, and cost-efficiency maintain their competitive edge. Key players include well-known brands with broad distribution networks across KSA.

KSA Dump Truck Market Analysis

Growth Drivers

- Infrastructure Development: The Kingdom of Saudi Arabia is witnessing an unprecedented push in infrastructure development, with government allocations exceeding SAR 300 billion for construction projects. This includes major initiatives such as the NEOM project and expansions in the transportation sector, significantly bolstering the demand for dump trucks. By 2025, public investment in construction is projected to contribute nearly 40% of the GDP, indicating a robust market for construction equipment.

- Economic Diversification: Saudi Arabia's Vision 2030 strategy aims to diversify the economy away from oil dependency, leading to investments in non-oil sectors. In 2023, the construction sector alone saw a 6% growth rate, emphasizing the government's commitment to developing infrastructure. This has resulted in increased demand for dump trucks as more projects emerge, fostering market growth.

- Urbanization Trends: Rapid urbanization in KSA has resulted in a population growth rate of 2.6% per year, leading to increased construction activities in urban areas. This urban expansion necessitates a surge in infrastructure, with a projected requirement of approximately 50,000 new housing units annually. Such developments are expected to fuel the demand for dump trucks to support construction projects.

Market Challenges

- Fluctuating Oil Prices: The Saudi economy is highly dependent on oil revenue, with fluctuations impacting public spending and investment. In 2023, oil prices averaged around $80 per barrel; however, ongoing geopolitical tensions could lead to volatility. Such fluctuations can constrain budgets for infrastructure projects, potentially slowing down the demand for dump trucks in the market.

- Supply Chain Disruptions: The global supply chain disruptions post-COVID-19 have affected the availability of construction equipment and materials in Saudi Arabia. Factors such as increased freight costs and delays in delivery have led to project postponements. The construction sector is expected to experience delays in project completion, which could temporarily reduce the demand for dump trucks.

KSA Dump Truck Market Future Outlook

Over the next five years, the KSA Dump Truck market is expected to experience significant growth. This projection is driven by continuous infrastructure and construction projects, coupled with Saudi Arabias commitment to diversifying its economy away from oil. Increased investment in the mining sector also presents growth opportunities, fostering demand for high-capacity, reliable dump trucks. Environmental regulations encouraging efficient fuel use and low-emission vehicles will likely shape product development within this market.

Market Opportunities

- Technological Advancements: The Kingdom of Saudi Arabia is actively pursuing technological innovations to enhance its construction and mining sectors. The government's Vision 2030 initiative emphasizes the adoption of advanced technologies, including automation and electrification, to improve operational efficiency and sustainability. This strategic focus is expected to drive the demand for technologically advanced dump trucks equipped with features such as autonomous driving capabilities and electric propulsion systems. For instance, in 2023, the Saudi government allocated SAR 5 billion to support the integration of smart technologies in infrastructure projects, creating a conducive environment for the adoption of advanced dump trucks.

- Expansion in the Rental Market: The construction and mining industries in Saudi Arabia are experiencing a shift towards flexible equipment solutions, leading to a growing demand for dump truck rental services. This trend is driven by the need for cost-effective and scalable solutions to meet project-specific requirements. The government's initiatives to promote private sector participation in infrastructure development have further accelerated this shift. In 2022, the Saudi Arabian General Investment Authority reported a 15% increase in foreign direct investment in the construction sector, indicating a robust market for rental services.

Scope of the Report

|

Segments |

Sub-segments |

|---|---|

|

By Truck Type |

Rigid Dump Trucks |

|

Articulated Dump Trucks |

|

|

By Payload Capacity |

Less than 15 tons |

|

15-30 tons |

|

|

Above 30 tons |

|

|

By End-User Industry |

Construction |

|

Mining |

|

|

Agriculture |

|

|

Waste Management |

|

|

By Fuel Type |

Diesel |

|

Electric |

|

|

By Region |

Riyadh |

|

Jeddah |

|

|

Dammam |

|

|

Eastern Province |

Products

Key Target Audience

Government and regulatory bodies (Ministry of Transport, Saudi Standards, Metrology and Quality Organization)

Construction companies

Mining corporations

Waste management agencies

Logistics and transportation providers

Heavy vehicle leasing companies

Investor and venture capitalist firms

Fleet management services

Companies

Players mentioned in the report

Caterpillar Inc.

Komatsu Ltd.

MAN Truck & Bus AG

Scania AB

Hino Motors

Volvo Trucks

Mercedes-Benz Trucks

Liebherr Group

Doosan Infracore

Bell Trucks

Hyundai Construction Equipment

Ashok Leyland

Tata Motors

FAW Group

XCMG Group

Table of Contents

1. KSA Dump Truck Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. KSA Dump Truck Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. KSA Dump Truck Market Analysis

3.1. Growth Drivers

3.1.1. Infrastructure Development (Investment in Construction Projects, Government Spending)

3.1.2. Economic Diversification (Vision 2030 Initiatives)

3.1.3. Urbanization Trends (Population Growth Rates)

3.1.4. Increase in Mining Activities (Mining Sector Growth)

3.2. Market Challenges

3.2.1. Fluctuating Oil Prices (Impact on Budget Allocations)

3.2.2. Supply Chain Disruptions (Logistics Challenges)

3.2.3. Regulatory Compliance (Adherence to Environmental Standards)

3.3. Opportunities

3.3.1. Technological Advancements (Electric and Autonomous Dump Trucks)

3.3.2. Expansion in the Rental Market (Increased Demand for Flexible Solutions)

3.3.3. Public-Private Partnerships (Collaborative Projects)

3.4. Trends

3.4.1. Sustainability Initiatives (Focus on Green Construction)

3.4.2. Digital Transformation (Adoption of Fleet Management Software)

3.4.3. Resilience in Supply Chains (Local Sourcing Initiatives)

3.5. Government Regulations

3.5.1. National Development Plans (Support for Infrastructure Growth)

3.5.2. Emission Standards (Regulatory Compliance Requirements)

3.5.3. Safety Regulations (Mandatory Equipment Specifications)

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. KSA Dump Truck Market Segmentation

4.1. By Truck Type (In Value %)

4.1.1. Rigid Dump Trucks

4.1.2. Articulated Dump Trucks

4.2. By Payload Capacity (In Value %)

4.2.1. Less than 15 tons

4.2.2. 15-30 tons

4.2.3. Above 30 tons

4.3. By End-User Industry (In Value %)

4.3.1. Construction

4.3.2. Mining

4.3.3. Agriculture

4.3.4. Waste Management

4.4. By Fuel Type (In Value %)

4.4.1. Diesel

4.4.2. Electric

4.5. By Region (In Value %)

4.5.1. Riyadh

4.5.2. Jeddah

4.5.3. Dammam

4.5.4. Eastern Province

5. KSA Dump Truck Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Caterpillar Inc.

5.1.2. Volvo Group

5.1.3. Komatsu Ltd.

5.1.4. Hitachi Construction Machinery

5.1.5. Liebherr Group

5.1.6. Terex Corporation

5.1.7. Scania AB

5.1.8. MAN SE

5.1.9. Hyundai Construction Equipment

5.1.10. Doosan Infracore

5.1.11. JCB

5.1.12. Bell Equipment Company

5.1.13. XCMG Construction Machinery

5.1.14. SANY Group

5.1.15. Ahlia Heavy Equipment

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Product Portfolio, Market Share, Geographical Reach, Innovation Index)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. KSA Dump Truck Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. KSA Dump Truck Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. KSA Dump Truck Market Future Segmentation

8.1. By Truck Type (In Value %)

8.2. By Payload Capacity (In Value %)

8.3. By End-User Industry (In Value %)

8.4. By Fuel Type (In Value %)

8.5. By Region (In Value %)

9. KSA Dump Truck Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map of the KSA Dump Truck market. This step is supported by desk research, reviewing secondary and proprietary databases to gather comprehensive data. This helps identify the factors influencing the market.

Step 2: Market Analysis and Construction

Historical data compilation and analysis are central to this phase. By assessing past trends and revenue data, we establish baseline estimates. This step includes evaluating distribution and service availability.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses are validated through industry expert interviews, offering insights into financial and operational performance. These consultations are essential for refining our data and gaining market nuances.

Step 4: Research Synthesis and Final Output

Engagement with manufacturers provides details on product segments, sales, and customer preferences. This process ensures a thorough, data-backed analysis, giving a rounded view of the KSA Dump Truck market.

Frequently Asked Questions

01. How big is the KSA Dump Truck Market?

The KSA Dump Truck Market is valued at approximately USD 1.6 billion, driven by consistent infrastructure expansion and mining activities. This growth aligns with Saudi Arabias economic diversification plans.

02. What are the key challenges in the KSA Dump Truck Market?

Challenges include fluctuating fuel prices, regulatory compliance for emissions, and the need for advanced safety features. Operational efficiency and durability are also key challenges for market players.

03. Which companies dominate the KSA Dump Truck Market?

Major players include Caterpillar, Komatsu, MAN Truck & Bus, Scania, and Hino Motors, each known for robust vehicle durability and extensive service networks within Saudi Arabia.

04. What are the growth drivers of the KSA Dump Truck Market?

The market benefits from infrastructure investments, particularly within the construction and mining sectors. Increasing urbanization and government-backed mega projects further contribute to growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.