KSA E-Bike Market Outlook to 2030

Region:Middle East

Author(s):Paribhasha Tiwari

Product Code:KROD1826

October 2024

99

About the Report

KSA E-Bike Market Overview

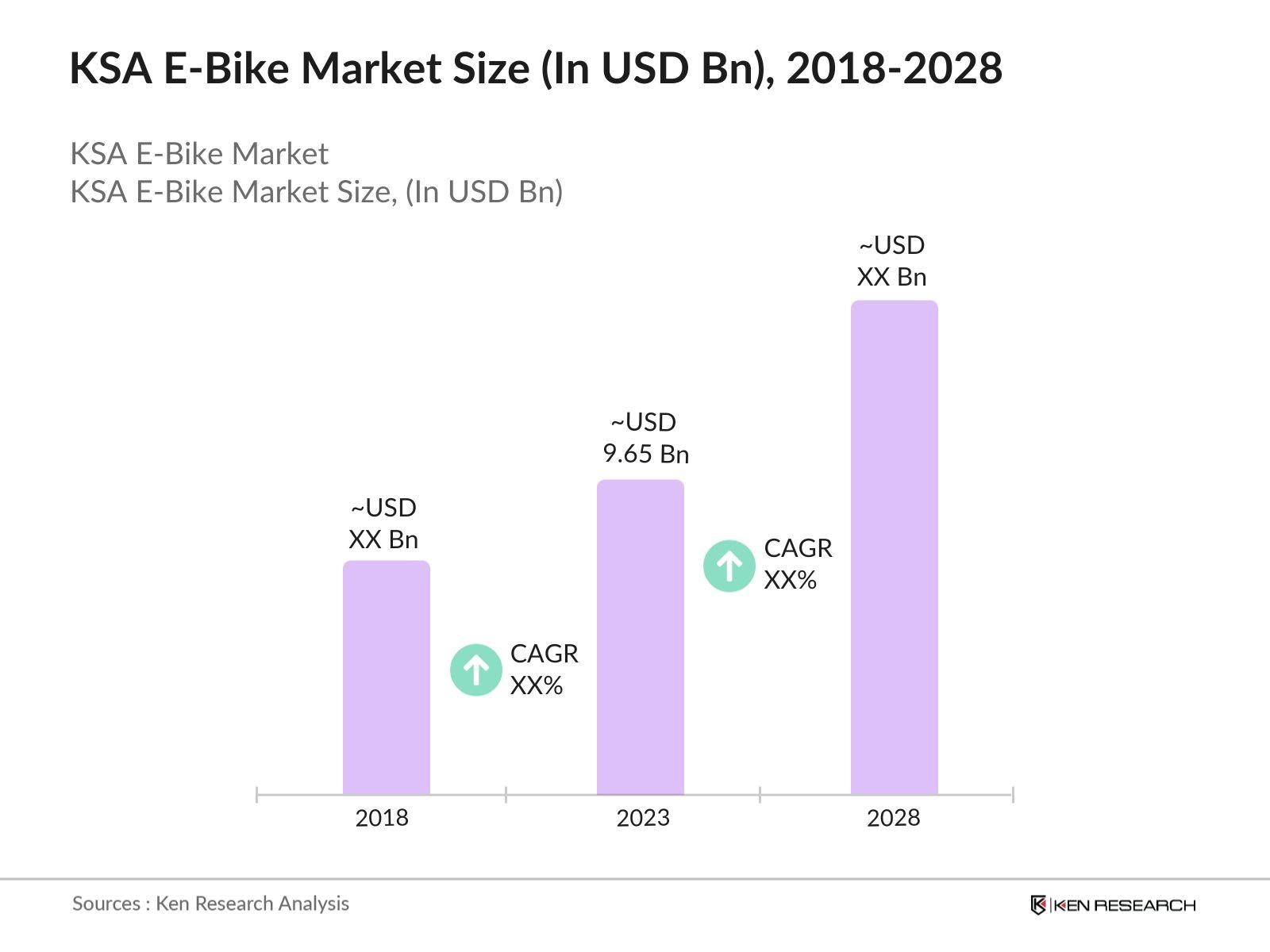

- The KSA E-Bike Market was valued at USD 9.65 billion. This growth is primarily driven by the increasing emphasis on sustainable and eco-friendly transportation alternatives. Rising fuel prices and the Saudi government's Vision 2030 initiative, which encourages green transportation solutions, have significantly boosted the demand for e-bikes.

- The KSA e-bike market is dominated by several key players, including Trek Bicycle Corporation, Giant Manufacturing Co. Ltd., Accell Group, Pedego Electric Bikes, and Yamaha Motor Co., Ltd. These companies have established a strong presence in the market through robust distribution networks and strategic partnerships with local retailers. Their competitive advantage lies in offering a wide range of e-bike models that cater to different consumer needs, from urban commuting to off-road cycling.

- In 2022, Fenix, a UAE-based micro-mobility startup, launched its e-bike sharing service in Riyadh, offering a convenient and eco-friendly transportation option for residents and tourists.

- Riyadh, Jeddah, and Dammam are the dominant cities in the KSA e-bike market. Riyadh leads due to its large population and high rate of urbanization, which creates a strong demand for alternative commuting options. Jeddah follows closely, benefiting from its relatively flat terrain and the growing popularity of cycling along the coastal areas.

KSA E-Bike Market Segmentation

The market is segmented into different factors like by product type, battery type and region.

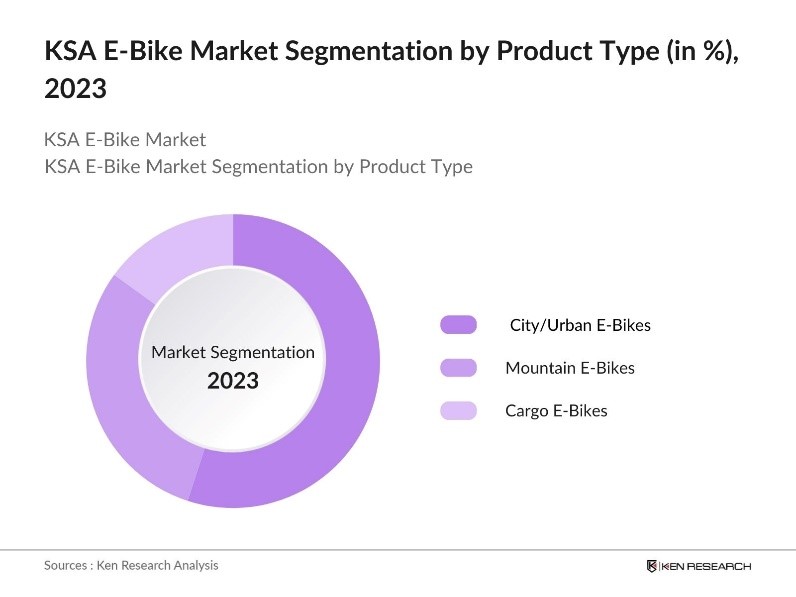

By Product Type: The market is segmented by product type into city/urban e-bikes, mountain e-bikes, and cargo e-bikes. In 2023, city/urban e-bikes held a dominant market share due to their widespread use for daily commuting and short-distance travel. The increasing congestion in major cities and the growing preference for sustainable urban mobility solutions have driven the demand for these e-bikes.

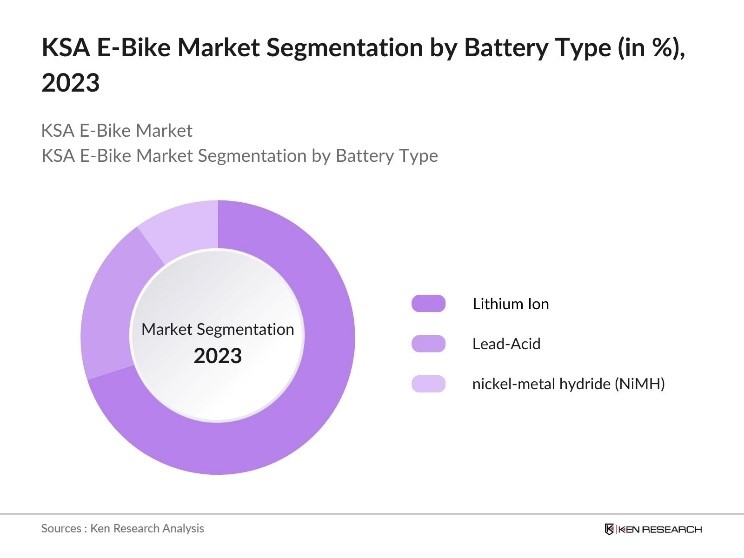

By Battery Type: The market is segmented by battery type into lithium-ion, lead-acid, and nickel-metal hydride (NiMH) batteries. In 2023, Lithium-ion batteries dominated the market due to their superior energy efficiency, lighter weight, and longer lifespan. The preference for lithium-ion batteries is driven by their rapid charging capabilities and durability, making them ideal for the urban commuting and off-road biking segments. The increasing availability of charging infrastructure in key cities also supports their dominant position in the market.

By Region: The market is segmented by region into North, South, East, and West. The Western region dominated the market in 2023. This dominance is attributed to the region's high population density and increasing tourist influx, which has boosted the demand for rental e-bikes for both recreational and commuting purposes. The region's relatively flat terrain and well-developed cycling infrastructure also contribute to its leading market position.

KSA E-Bike Market Competitive Landscape

|

Company |

Year Established |

Headquarters |

|

Trek Bicycle Corporation |

1976 |

Waterloo, USA |

|

Giant Manufacturing Co. Ltd. |

1972 |

Taichung, Taiwan |

|

Accell Group |

1998 |

Heerenveen, Netherlands |

|

Pedego Electric Bikes |

2008 |

Fountain Valley, USA |

|

Yamaha Motor Co., Ltd. |

1955 |

Iwata, Japan |

- Trek Bicycle Corporation: In 2024, Trek Bicycle Corporation expanded its distribution network in the Middle East by partnering with a major Saudi retailer, increasing its market penetration in the KSA. The company also launched a new range of city-specific e-bikes designed to cater to the growing demand for sustainable urban commuting solutions. This strategic move has enhanced Trek's market share, especially in Riyadh and Jeddah, where urban mobility is a pressing concern.

- Acell Group: Accell Group has partnered with other organizations to repurpose used e-bike batteries, aiming to significantly reduce CO2 emissions. This initiative reflects the company's focus on sustainability and environmental responsibility by giving a second life to discarded batteries, thus minimizing waste and promoting a circular economy in the e-bike sector.

KSA E-Bike Market Analysis

Growth Drivers

- Increasing Electrification and Green Financing: There is the rising demand for electric mobility in the GCC region, fueled by efforts to reduce carbon emissions and meet sustainability goals. With Qatar already achieving a 25% electrification of its public transit bus fleet and promoting EV adoption through green financing, Saudi Arabia is expected to see significant growth in e-bike adoption by 2025.

- Rising Popularity of E-Bike Sharing Programs: The KSA e-bike market growing due to the development of infrastructure supporting sustainable mobility. In April 2024, PBSC Urban Solutions launched a comprehensive bike-sharing network in Medina, featuring a fully electric fleet of 500 PBSC E-FIT e-bikes and 60 smart charging stations. This initiative promotes eco-friendly transportation and is expected to significantly boost e-bike adoption for urban commuting across Saudi Arabia.

- Increasing Health and Wellness Awareness: A surge in health and wellness awareness among the Saudi population has significantly contributed to the growing demand for e-bikes. E-bikes, which provide a balanced mix of exercise and convenience, are increasingly being adopted by individuals seeking to incorporate fitness into their daily commute. This shift is further driven by government-led campaigns promoting active lifestyles and the benefits of cycling.

Market Challenges

- ??????????????High Initial Cost of E-Bikes: The high upfront cost of e-bikes remains a significant barrier to widespread adoption in Saudi Arabia. This price point is significantly higher compared to conventional bicycles, making it less accessible to a broad consumer base. Despite government subsidies and incentives, the cost factor continues to deter potential buyers, particularly in lower-income brackets, limiting market penetration.

- Lack of Adequate Charging Infrastructure: Despite the growing popularity of e-bikes, the lack of a well-developed charging infrastructure poses a challenge. This scarcity discourages potential buyers who rely on consistent and accessible charging options, particularly those residing in suburban and rural areas. The limited infrastructure also hampers the growth of e-bike sharing programs, which require frequent charging to maintain fleet operations.

Government Initiatives

- TIER's Expansion into Saudi Arabia with Electric Micro-Mobility Solutions: In June 2022, TIER, a leading global micro-mobility service provider, expanded into the Saudi Arabian market by partnering with Sela Sport Company. This collaboration marks TIER's entry into Saudi Arabia, offering a range of electric vehicles, including e-bikes, to enhance urban mobility. This expansion builds on a strategic investment from SoftBank Investment Advisers in 2020.

- Lucid Motors Plant Launch and Nationwide EV Charging Expansion in Saudi Arabia: The development involving Lucid Motors' manufacturing plant launch and the government's plan to install EV charging stations in Saudi Arabia is set to unfold from 2023 onwards. The plant's establishment represents a significant step in the country’s push towards electric mobility, with production expected to ramp up over the next few years. Concurrently, the installation of EV charging stations across major cities is planned to accelerate through 2024 and beyond, aligning with the government’s broader sustainability initiatives.

KSA E-Bike Market Future Outlook

Market Trends

The KSA E-Bike Market is projected to grow exponentially by 2028. This growth will be driven by the increasing electrification and green financing, rising popularity of E-Bike sharing programs and increasing health and wellness awareness.

- Expansion of Smart E-Bike Technologies: By 2028, the KSA e-bike market is expected to witness a significant shift towards smart e-bike technologies, including integrated GPS, IoT connectivity, and advanced battery management systems. These innovations will enhance the user experience by providing real-time data on performance, battery life, and route optimization. The introduction of smart e-bikes is anticipated to attract tech-savvy consumers and increase market penetration, especially among younger demographics.

- Growth of E-Bike Tourism and Recreational Market: The tourism sector in Saudi Arabia is expected to contribute significantly to the e-bike market’s growth by 2028. With the government’s ongoing efforts to develop eco-friendly tourism options, e-bike tours are anticipated to become a popular recreational activity for both domestic and international tourists. Cities like Al-Ula and Jeddah, which are being developed as tourist hubs, are likely to see a surge in demand for e-bike rentals and guided tours.

Scope of the Report

|

By Product Type |

city/urban e-bikes mountain e-bikes cargo bikes |

|

By Battery Type |

lithium-ion lead-acid nickel-metal hydride (NiMH) batteries |

|

By Region |

North South East West |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

E-Bike Manufacturers and Distributors

Urban Mobility and Smart City Developers

Public and Private Transportation Agencies

Tourism and Recreational Activity Providers

Infrastructure Development Companies

Energy and Battery Technology Firms

Government and Regulatory Bodies (e.g., Ministry of Transport and Logistic Services)

- Investment and Venture Capitalist Firms

Time Period Captured in the Report:

- Historical Period: 2018-2023

- Base Year: 2023

- Forecast Period: 2023-2028

Companies

- Trek Bicycle Corporation

Giant Manufacturing Co. Ltd.

Accell Group

Pedego Electric Bikes

Yamaha Motor Co., Ltd.

Merida Industry Co. Ltd.

Riese & Müller GmbH

Specialized Bicycle Components

Bulls Bikes

Gazelle Bikes

Cannondale Bicycle Corporation

Rad Power Bikes

Aima Technology Group Co., Ltd.

Hero Cycles Ltd.

- Brompton Bicycle Ltd.

Table of Contents

1.KSA E-Bike Market Overview

1.1. Market Definition and Scope

1.2. Market Size and Growth

1.3. Key Market Drivers

1.4. Overview of Market Segmentation

2.KSA E-Bike Market Size and Analysis, 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3.KSA E-Bike Market Analysis

3.1. Growth Drivers

3.1.1. Increased Focus on Green Mobility Initiatives

3.1.2. Rising Popularity of E-Bike Sharing Programs

3.1.3. Increasing Health and Wellness Awareness

3.2. Market Challenges

3.2.1. High Initial Cost of E-Bikes

3.2.2. Lack of Adequate Charging Infrastructure

3.2.3. Regulatory and Safety Concerns

3.3. Government Initiatives

3.3.1. Subsidies and Tax Incentives for E-Bike Purchases

3.3.2. Development of Dedicated Cycling Infrastructure

3.3.3. Introduction of E-Bike-Friendly Urban Mobility Policies

3.4. Current Market Trends

3.4.1. Growth in E-Bike Retail and Service Networks

3.4.2. Partnerships for Local Assembly and Production

3.4.3. Rising Demand for High-Performance E-Bikes

4.KSA E-Bike Market Segmentation, 2023

4.1. By Product Type (Value %)

4.1.1. City/Urban E-Bikes

4.1.2. Mountain E-Bikes

4.1.3. Cargo E-Bikes

4.2. By Battery Type (Value %)

4.2.1. Lithium-Ion

4.2.2. Lead-Acid

4.2.3. Nickel-Metal Hydride (NiMH)

4.3. By Region (Value %)

4.3.1. North

4.3.2. South

4.3.3. East

4.3.4. West

5.KSA E-Bike Market Competitive Landscape

5.1. Key Players and Market Share Analysis

5.2. Strategic Initiatives and Developments

5.3. Mergers, Acquisitions, and Investments

5.4. Company Profiles

5.4.1. Trek Bicycle Corporation

5.4.2. Giant Manufacturing Co. Ltd.

5.4.3. Accell Group

5.4.4. Pedego Electric Bikes

5.4.5. Yamaha Motor Co., Ltd.

6.KSA E-Bike Market Regulatory and Legal Framework

6.1. Environmental Standards and Compliance

6.2. Certification and Regulatory Approvals

7.KSA E-Bike Market Forecast, 2023-2028

7.1. Future Market Size Projections

7.2. Factors Influencing Future Market Growth

8.Future Market Segmentation, 2028

8.1. By Product Type (Value %)

8.2. By Battery Type (Value %)

8.3. By Region (Value %)

9.Future Market Trends

9.1. Expansion of Smart E-Bike Technologies

9.2. Growth of E-Bike Tourism and Recreational Market

9.3. Rising Adoption of E-Bikes for Last-Mile Delivery Solutions

10.Analyst Recommendations and Strategic Insights

10.1. Total Addressable Market (TAM) Analysis

10.2. Customer and Market Potential Analysis

10.3. Key Strategic Initiatives for Market Penetration

11.KSA E-Bike Market Analysts’ Recommendations

11.1. TAM/SAM/SOM Analysis

11.2. Customer Cohort Analysis

11.3. Marketing Initiatives

11.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step: 2 Market Building:

Collating statistics on KSA E-Bike Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for KSA E-Bike Industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output:

Our team will approach multiple automotive companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from automotive companies.

Frequently Asked Questions

1. How big is the KSA e-bike market?

The KSA e-bike market was valued at USD 9.65 Billion in 2023, driven by the increasing demand for sustainable transportation solutions, government initiatives promoting green mobility, and rising health and fitness awareness among the population.

2. What are the challenges in the KSA e-bike market?

Challenges in the KSA e-bike market include high initial costs of e-bikes, inadequate charging infrastructure, and regulatory and safety concerns. These factors limit market penetration, especially among lower-income groups and in areas outside major urban centers.

3. Who are the major players in the KSA e-bike market?

Key players in the KSA e-bike market include Trek Bicycle Corporation, Giant Manufacturing Co. Ltd., Accell Group, Pedego Electric Bikes, and Yamaha Motor Co., Ltd. These companies have established a strong market presence through strategic partnerships, local production, and a wide range of product offerings.

4. What are the growth drivers of the KSA e-bike market?

The growth drivers of the KSA e-bike market include increased focus on green mobility initiatives, the rising popularity of e-bike sharing programs, and growing awareness of health and wellness. Government policies promoting sustainable transport and urban cycling infrastructure also contribute significantly to market expansion.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.