KSA Edible Oil Market Outlook to 2030

Region:Middle East

Author(s):Sanjna

Product Code:KROD2587

December 2024

97

About the Report

KSA Edible Oil Market Overview

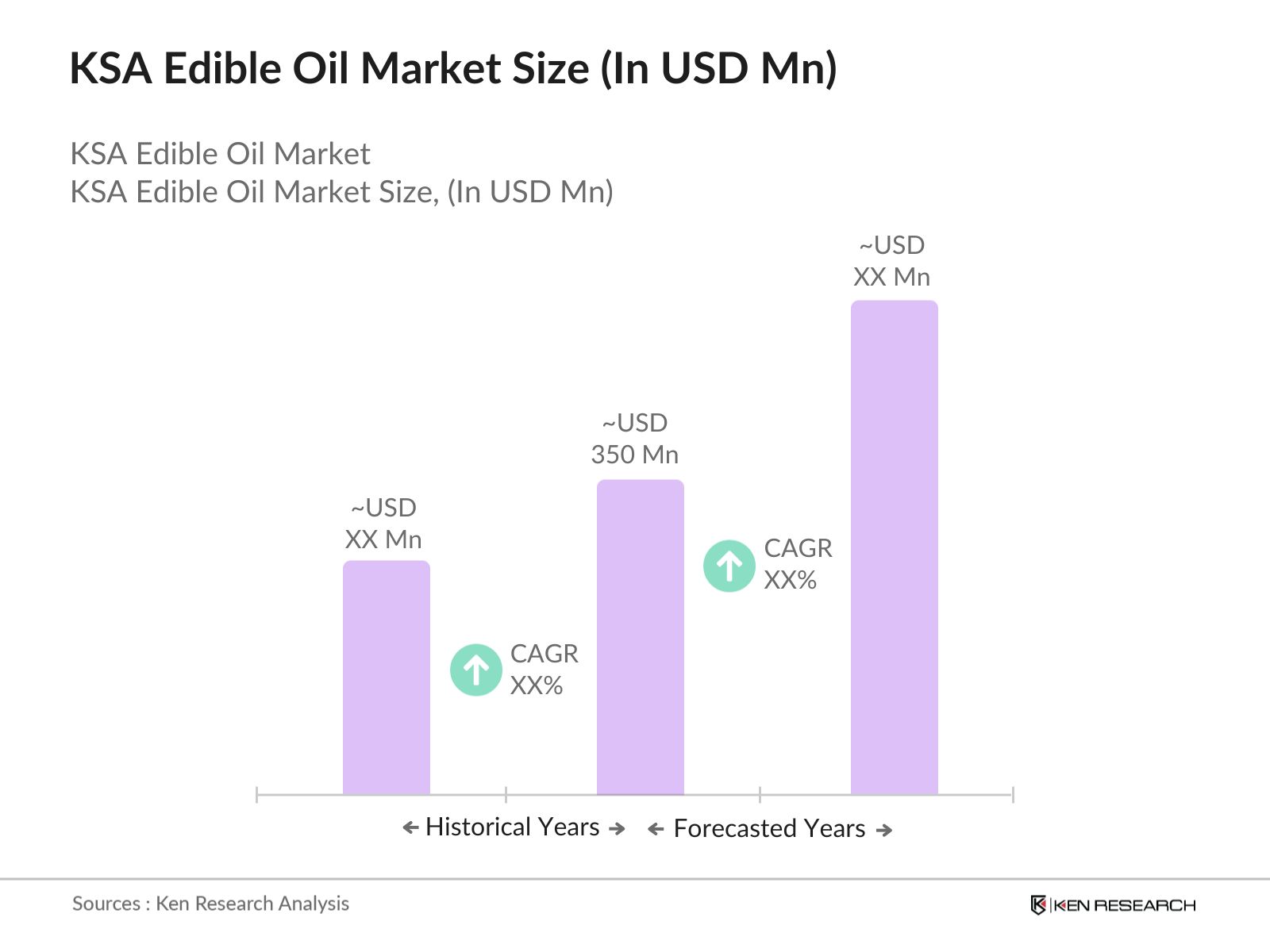

- In 2023, the KSA Edible Oil Market is valued at USD 350 million, driven by a growing population, rising disposable income, and increasing consumption of processed foods. This demand has been supported by an expanding food service sector and rising health awareness. Sunflower oil and palm oil are the dominant types in the market, driven by their widespread use in cooking and processed foods. Moreover, the increased demand for healthier oils like olive oil also contributes to market growth.

- Key players dominating the KSA edible oil industry include Savola Group, Almarai, United Foods, and Mazola. Savola Group remains the largest producer, with a diverse portfolio of cooking oils like sunflower and canola. Mazola, a significant player in the health-conscious segment, focuses on corn and olive oil. Almarai has a substantial market presence through its collaboration with international oil brands

- In 2022, Olam Group sold a 35.43% stake in Olam Agri to the Saudi Agricultural and Livestock Investment Company (SALIC) for $1.24 billion. This transaction valued Olam Agri at approximately $3.5 billion. The partnership aims to enhance Olam Agri's access to high-growth markets in the Middle East, aligning with the increasing demand for food security in the region.

- Riyadh and Jeddah dominate the KSA edible oil market. Riyadh leads due to its high population density and substantial foodservice sector, while Jeddah, being a key port city, is the entry point for imported oils like palm and soybean oil. The high concentration of retail chains, hypermarkets, and foodservice outlets in these cities ensures robust consumption patterns.

KSA Edible Oil Market Segmentation

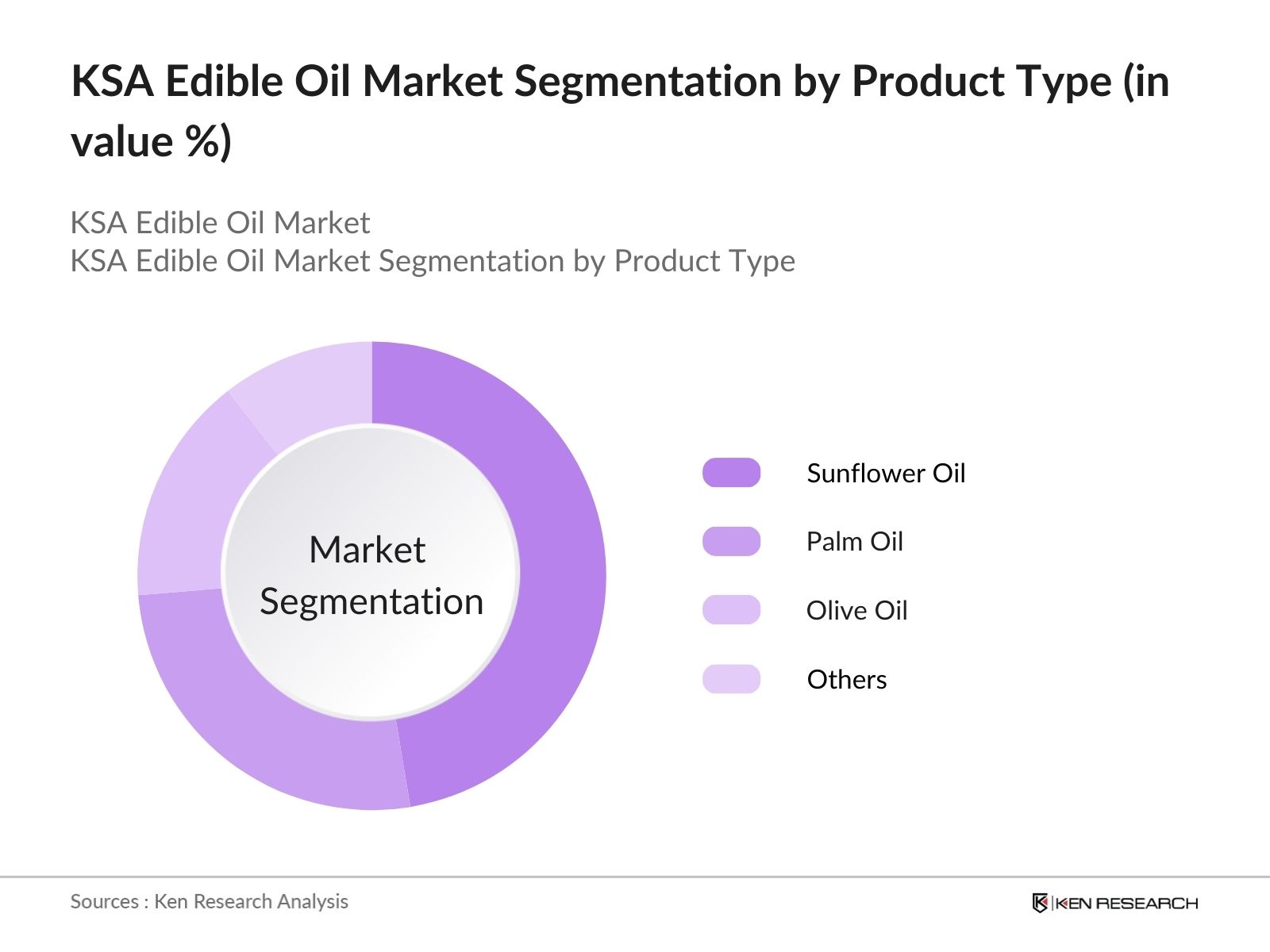

By Product Type: The market is segmented by product type into sunflower oil, palm oil, olive oil, and others (soybean oil, canola oil). In 2023, sunflower oil held the largest market share, driven by its affordability, high availability, and increasing preference for heart-healthy oils. Brands like Savola and Afia are leading suppliers in this segment. Sunflower oil's versatility for both household use and foodservice industries contributes to its dominance.

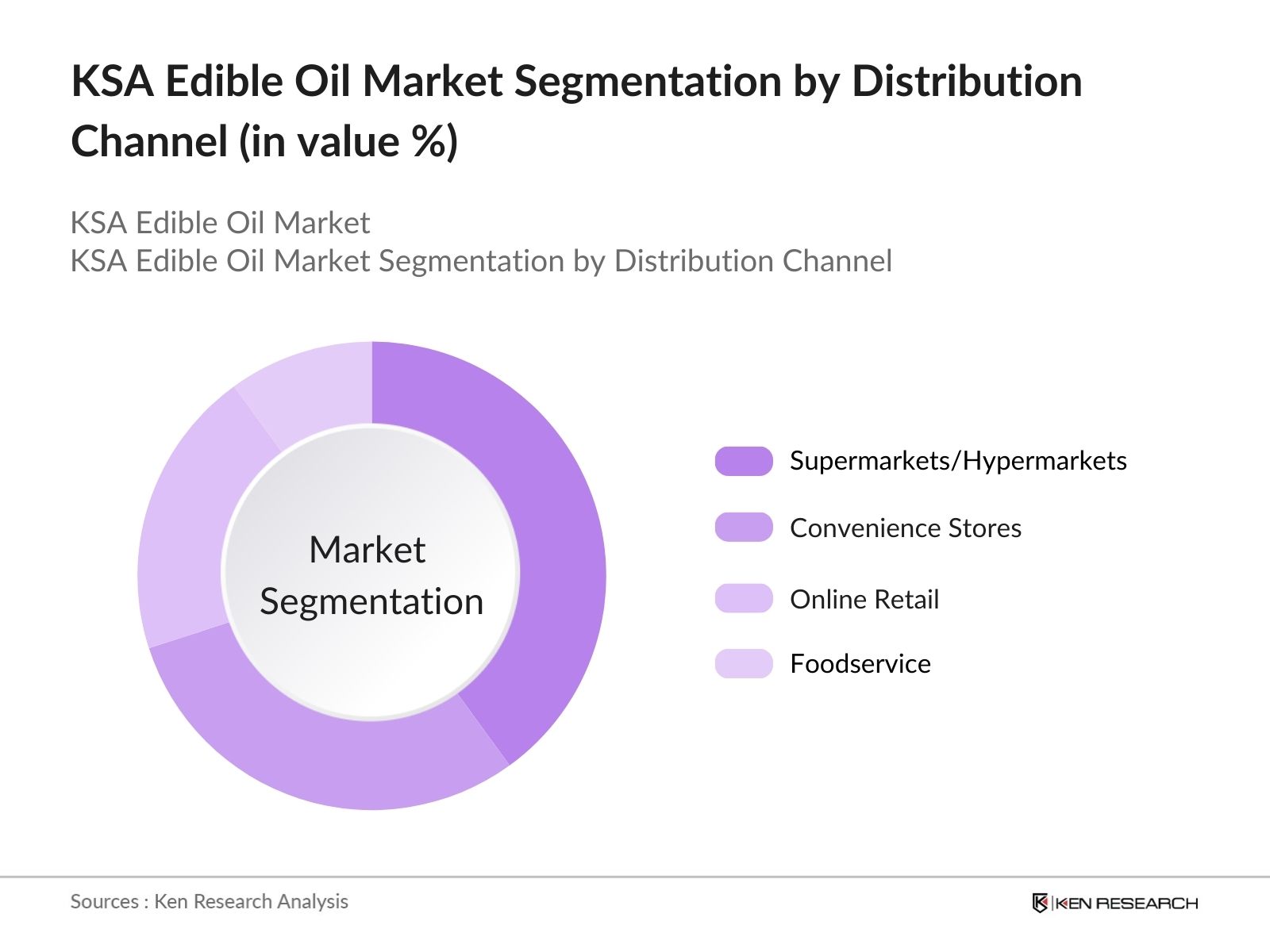

By Distribution Channel: The market is segmented into supermarkets/hypermarkets, convenience stores, online retail, and foodservice. Supermarkets and hypermarkets dominated in 2023, owing to their widespread presence and the preference for bulk buying among consumers. These channels benefit from consumer trust and the ability to offer promotions and discounts.

By Region: The market is regionally segmented into the Central, Western, Eastern, and Southern regions. The Central region, holds a dominant market share in 2023 due to its large population and high purchasing power. This region has a well-established retail network and strong demand for premium edible oils, especially among health-conscious consumers. The rising number of households and urbanization further contribute to its market share dominance.

By Region: The market is regionally segmented into the Central, Western, Eastern, and Southern regions. The Central region, holds a dominant market share in 2023 due to its large population and high purchasing power. This region has a well-established retail network and strong demand for premium edible oils, especially among health-conscious consumers. The rising number of households and urbanization further contribute to its market share dominance.

KSA Edible Oil Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Savola Group |

1979 |

Jeddah |

|

Almarai |

1977 |

Riyadh |

|

United Foods |

1976 |

Dubai, UAE |

|

Mazola |

1911 |

Chicago, USA |

|

Afia |

1990 |

Jeddah |

- United Foods: In 2024, United Petfood has signed a share purchase agreement to acquire Vital Petfood Group, located in lgod, Denmark. This acquisition will enhance United Petfood's portfolio, which already includes various pet food manufacturing facilities across Europe. Vital specializes in dry and semi-moist pet food for private labels and its own brands. In addition, the acquisition will strengthen United Petfood's market presence in the Nordic region, further solidifying its position as a leading pet food manufacturer in Europe.

- Savola Group: In 2021, Savola Foods, a subsidiary of Savola Group, completed the acquisition of Bayara Holding Limited for approximately USD 260 million. This acquisition is part of Savola's strategy to diversify its offerings in high-growth, value-added food categories, particularly targeting younger consumers. Bayara is well-known in the UAE for its range of packaged foods, including nuts and spices, and has a strong distribution network across the Middle East and Africa.

KSA Edible Oil Industry Analysis

Growth Drivers:

- Increased Consumption of Healthier Edible Oils: The demand for healthier oils like olive and sunflower oil saw a significant increase, driven by Saudi Arabias changing consumer preferences as olive oil consumption in Saudi Arabia increased by 25% between 2018 and 2022. Also, heightened awareness of cardiovascular health. Cardiovascular diseases or CVDs account for 28% of non-communicable disease (NCD) deaths in Saudi Arabia, underscoring their status as a leading health issue.

- Foodservice Sector Expansion: The growing tourism and foodservice sector in KSA, fueled by Vision 2030, has directly impacted the demand for edible oils. Saudi restaurant sales increased by 13.66% to $23.8 billion in 2023, with December sales reaching SR8 billion, reflecting a growing consumer preference despite challenges like increased competition and rising operational costs.

- Rising Demand from the Packaged Food Industry: In 2019, Saudi Arabia imported $2.7 billion worth of intermediate food items, primarily for further processing. Additionally, U.S. processed food exports to Saudi Arabia were valued at $533.8 million in 2022, reflecting a 16% increase from the prior year. This growth directly impacted the demand for edible oils, as manufacturers increasingly relied on oils like sunflower, palm, and soybean for product formulations, particularly in snacks, baked goods, and ready-made meals.

Market Challenges:

- High Dependence on Imports: Despite local efforts to increase oilseed production, Saudi Arabia still heavily relies on imported edible oils, particularly palm oil from Malaysia and Indonesia. Till recently, edible oils consumed in the Kingdom were imported, leading to price volatility due to fluctuations in global supply chains. The cost of imported oils increased compared to the previous year, putting pressure on local distributors and retailers

- Logistical Bottlenecks: The distribution of edible oils within Saudi Arabia faces logistical challenges, especially in transporting products from Jeddah port to inland cities like Riyadh and Dammam. An increase in transportation costs due to fuel price hikes and port congestion added in additional expenses to the industry. This bottleneck has been identified as a major challenge for domestic producers and importers alike.

- Environmental Sustainability Concerns: Palm oil production, a key segment of the edible oil market, has come under scrutiny due to its environmental impact. Increased regulations in key supplier countries like Indonesia caused disruptions in supply chains. Additionally, KSA's commitment to international environmental agreements has placed pressure on local companies to shift to more sustainable oil sources, which requires significant investment in sustainable supply chains.

KSA Edible Oil Future Market Outlook

As Saudi Arabia progresses with its Vision 2030 agenda, the edible oil market is expected to witness significant transformations driven by health-conscious consumer behavior, government initiatives promoting self-sufficiency, and innovations in oil production and packaging.

Future Trends

- Shift Toward Sustainable Production: This shift will be driven by rising environmental awareness and stricter regulations on palm oil imports from key supplier nations. Additionally, manufacturers will seek certification from sustainable organizations to appeal to eco-conscious consumers. Innovations in biodegradable packaging and reduced carbon footprints will also become central to brand strategies, setting new industry standards.

- Rise in Demand for Premium Oils: There will be an increasing demand for premium oils such as olive oil, particularly among the growing middle and upper-middle class. Consumers will become more health-conscious, and the market for high-end edible oils will see robust growth as a result. The shift towards healthier lifestyles will also spur demand for organic and cold-pressed oils. Furthermore, premium oil brands will expand their product lines to include infused and specialty oils, catering to gourmet cooking trends.

Scope of the Report

|

By Product Type |

Sunflower Oil Palm Oil Olive Oil Others |

|

By Distribution Channel |

Supermarkets/Hypermarkets Convenience Stores Online Retail Foodservice |

|

By Region |

Central West East South |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Hospitality Sector

FMCG Companies

Health and Nutrition Companies

Food Processing Companies

Restaurant Chains

Agriculture Cooperatives

Investment & Venture Capitalist Firms

Government and Regulatory Bodies (Saudi Food and Drug Authority)

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Major Players Mentioned in the Report:

Savola Group

Almarai

United Foods

Mazola

Afia

Cargill

GEA Group

Olam International

Wilmar International

Arabian Food Supplies

Unilever KSA

Marico

Table of Contents

1. KSA Edible Oil Market Overview

1.1. Definition and Scope

1.2. Market Growth Rate and Dynamics

1.3. Market Taxonomy

1.4. Overview of Market Trends and Drivers

2. KSA Edible Oil Market Size (in USD Bn)

2.1. Historical Market Size Analysis

2.2. Current Market Size

2.3. Future Market Size

2.4. Year-on-Year Growth Rate (CAGR)

2.5. Key Market Milestones and Developments

3. KSA Edible Oil Market Segmentation

3.1. By Product Type (Value in %)

3.1.1. Sunflower Oil

3.1.2. Palm Oil

3.1.3. Olive Oil

3.1.4. Other Oils (Soybean, Canola)

3.2. By Distribution Channel (Value in %)

3.2.1. Supermarkets/Hypermarkets

3.2.2. Convenience Stores

3.2.3. Online Retail

3.2.4. Foodservice

3.3. By Region (Value in %)

3.3.1. Central Region

3.3.2. Western Region

3.3.3. Eastern Region

3.3.4. Southern Region

3.4. By Consumer Type

3.4.1. Retail

3.4.2. Institutional

3.4.3. Industrial

4. KSA Edible Oil Market Analysis

4.1. Growth Drivers

4.1.1. Population Growth and Urbanization

4.1.2. Health-conscious Consumer Shifts

4.1.3. Foodservice Sector Expansion

4.1.4. Oilseed Cultivation Initiatives

4.2. Market Restraints

4.2.1. High Dependence on Imports

4.2.2. Logistical Challenges and Supply Chain Disruptions

4.2.3. Environmental Sustainability Concerns

4.3. Market Opportunities

4.3.1. Rise in Demand for Premium Edible Oils

4.3.2. Government Initiatives (Vision 2030)

4.3.3. Technological Innovations in Oil Production

4.4. Emerging Trends

4.4.1. Sustainable Packaging and Eco-friendly Production

4.4.2. Increasing Popularity of Organic and Cold-pressed Oils

4.4.3. Consumer Preferences for Localized Production

5. KSA Edible Oil Market Competitive Landscape

5.1. Key Market Players

5.1.1. Savola Group

5.1.2. Almarai

5.1.3. United Foods

5.1.4. Mazola

5.1.5. Afia

5.1.6. Olam Group

5.1.7. United Foods

5.1.8. Hayatna

5.1.9. Emirates Refining Company

5.1.10. Al-Rabie

5.1.11. Bunge Limited

5.1.12. Cargill

5.1.13. Al-Ghurair Foods

5.1.14. Wilmar International

5.1.15. Arabian Agricultural Services Company

5.2. Competitive Strategies

5.3. Market Share Analysis

6. KSA Edible Oil Market Cross-Comparison

6.1. Key Performance Indicators (KPIs) Comparison

6.2. Financial and Operational Parameters (Revenue, Profit Margins)

6.3. Cross-company Comparison (Market Position, Production Capabilities)

7. KSA Edible Oil Market Regulatory Framework

7.1. Government Regulations (Food Standards, Import Policies)

7.2. Compliance Requirements (Environmental Standards, Sustainability)

7.3. Certification and Accreditation Processes

8. KSA Edible Oil Market Future Outlook

8.1. Future Market Growth Projections

8.2. Key Future Trends

8.2.1. Adoption of Sustainable Practices and Technologies

8.2.2. Rising Demand for High-end Oils (Olive, Organic, Cold-pressed)

8.2.3. Expansion of Domestic Oilseed Cultivation

9. KSA Edible Oil Industry Recommendations

9.1. Business Strategies (Expansion into Emerging Segments)

9.2. Innovation and R&D Priorities

9.3. Supply Chain Optimization Recommendations

9.4. Consumer Engagement and Marketing Tactics (Social Media, Loyalty Programs)

9.5. Partnership and Collaboration Opportunities

10. Appendix

10.1. Market Definitions

10.2. List of Abbreviations

10.3. Sources and References

10.4. Contact Information

Research Methodology

Step 1: Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step 2: Market Building:

Collating statistics on KSA Edible Oil Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for KSA Edible Oil Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step 3: Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research output:

Our team will approach multiple edible oil companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from edible oil companies.

Frequently Asked Questions

01 How big is KSA Edible Oil Market?

In 2023, the KSA Edible Oil Market is valued at USD 350 million, driven by a growing population, rising disposable income, and increasing consumption of processed foods. This demand has been supported by an expanding food service sector and rising health awareness.

02 What are the growth drivers of the KSA Edible Oil market?

KSA Edible Oil Market is driven by factors such as rising demand for healthier oils, increased consumption from the growing food service sector, and government initiatives promoting local oilseed cultivation to reduce reliance on imports.

03 What are challenges in KSA Edible Oil Market?

Challenges include high dependency on imported oils, logistical bottlenecks in distribution from ports to inland cities, and the rising costs of transportation and raw materials, which impact profitability and supply chain efficiency.

04 Who are major players in the KSA Edible Oil Market?

Key players in the market include Savola Group, Almarai, Mazola, United Foods, and Afia. These companies dominate through their extensive distribution networks, strong brand recognition, and diverse portfolios of edible oil products.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.