KSA Electric Bike Market Outlook to 2030

Region:Middle East

Author(s):Mukul

Product Code:KROD2369

October 2024

80

About the Report

KSA Electric Bike Market Overview

- The KSA electric bike market reached a market size of USD 1.20 million in 2023. This market is driven by growing consumer awareness regarding the environmental benefits of electric vehicles, the cost-effectiveness of e-bikes for daily commuting, and government-backed initiatives aimed at promoting clean energy. An increasing population of young, tech-savvy consumers, coupled with a focus on reducing carbon emissions, has significantly boosted the demand for electric bikes in the region.

- The key players dominating the KSA electric bike market include Hero Electric, Yamaha Motor Co., Pedego Electric Bikes, Giant Bicycles, and Trek Bicycle Corporation. These companies have been focusing on providing cost-efficient and technologically advanced products to cater to the rising demand in the Kingdom. For example, Hero Electric saw substantial growth in sales in 2023, capitalizing on the demand for affordable electric mobility solutions in the region.

- Riyadh, Jeddah, and Dammam are the dominant cities in the KSA electric bike market. Riyadhs dominance is attributed to its developed infrastructure, government support, and higher concentration of environmentally conscious consumers looking for sustainable mobility solutions.

In 2022, Hero Electric reported a significant increase in sales, achieving over 100% growth, which indicates strong demand for its products. This success in other markets could bolster its efforts in Saudi Arabia as the company seeks to replicate this growth in the region.

KSA Electric Bike Market Segmentation

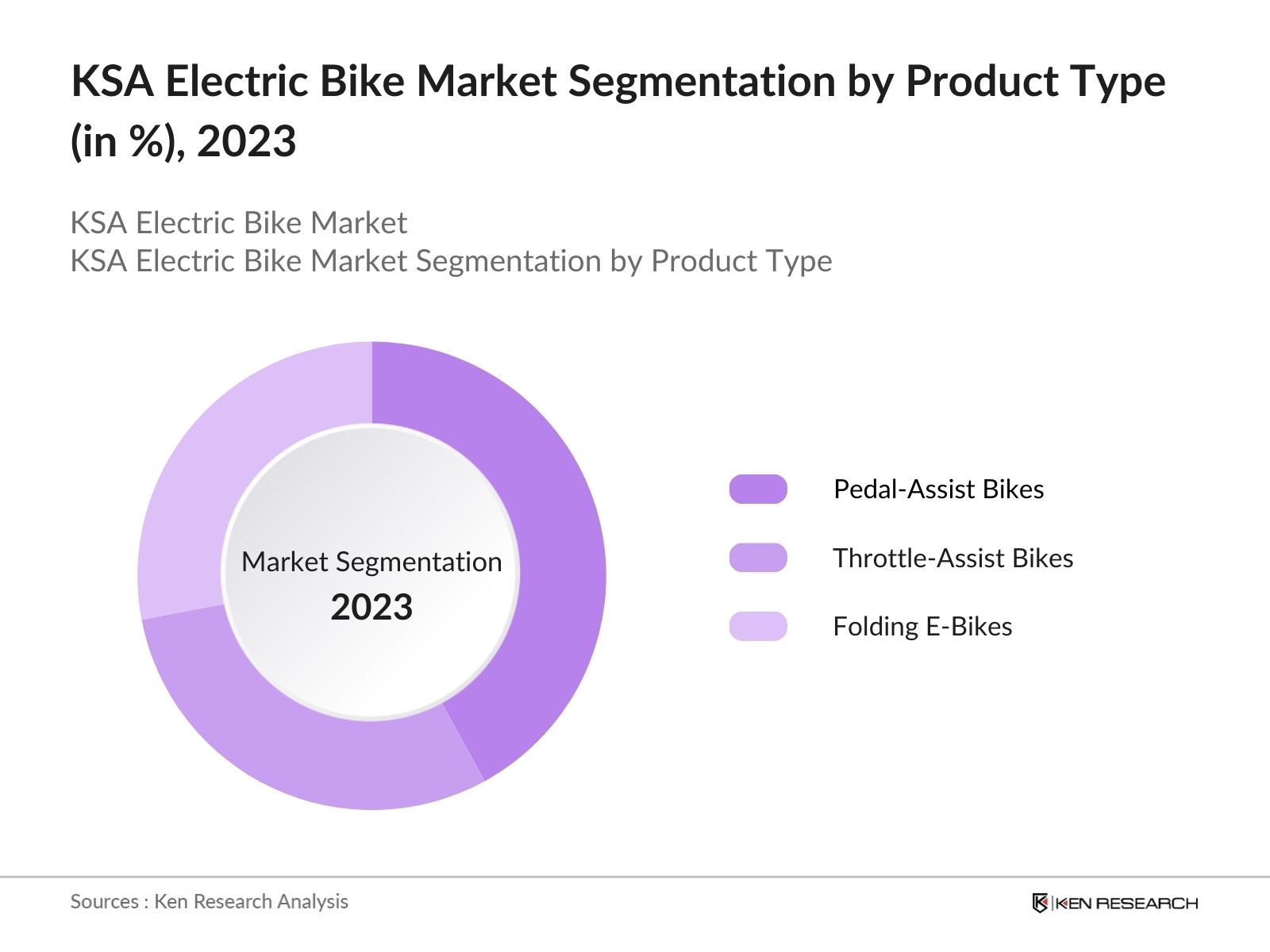

By Product Type: The KSA electric bike market is segmented by product type into pedal-assist bikes, throttle-assist bikes, and folding e-bikes. In 2023, pedal-assist bikes dominated the market, offering an efficient solution for urban commuters seeking long-range and low-maintenance transportation.

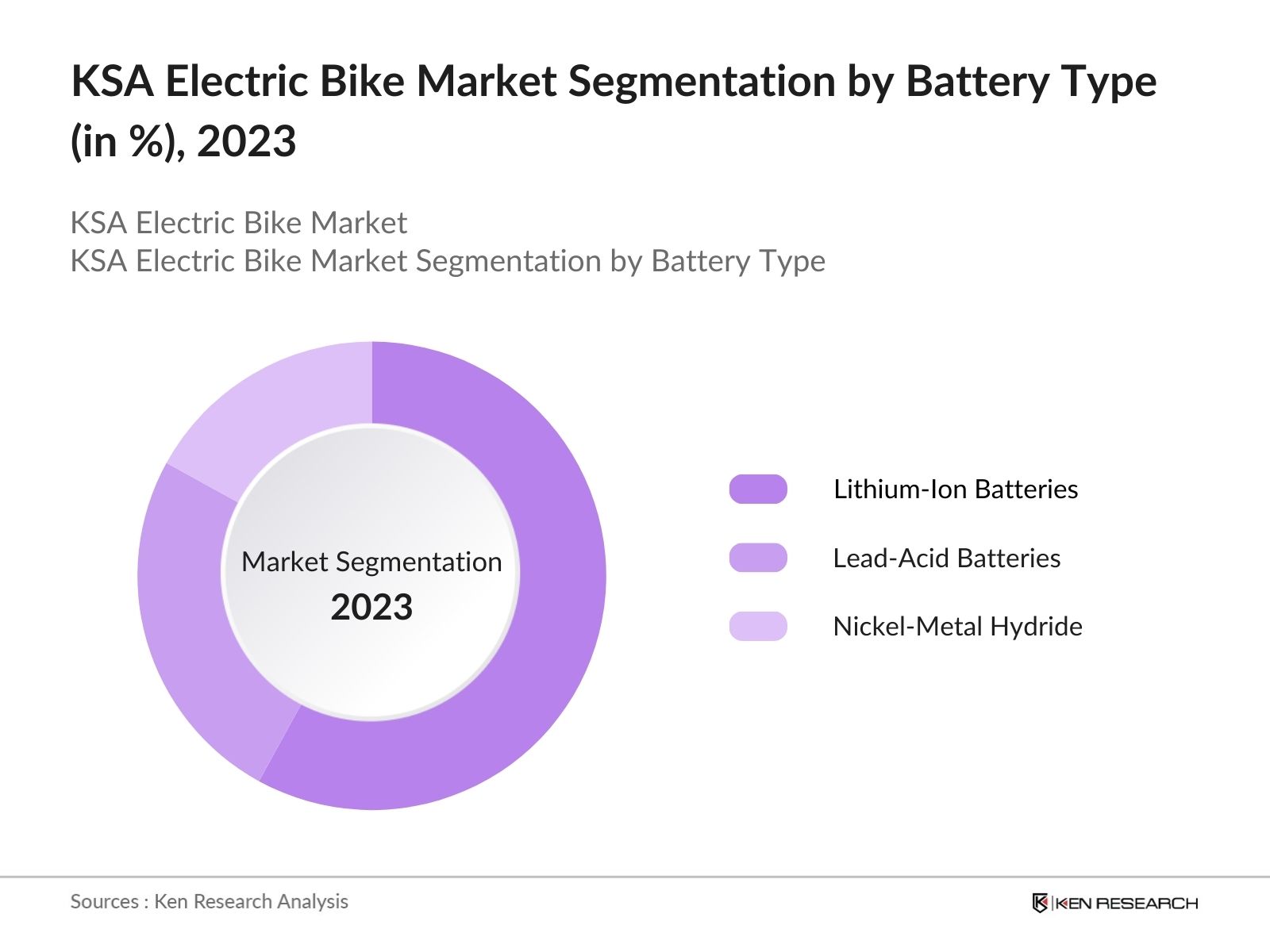

By Battery Type: The KSA electric bike market is also segmented by battery type into lithium-ion batteries, lead-acid batteries, and nickel-metal hydride batteries. Lithium-ion batteries dominated the market in 2023, due to their higher energy density and longer lifespan, making them a preferred choice for both manufacturers and consumers.

By Region: The KSA electric bike market is regionally segmented into North, South, East, and West. In 2023, the Northern region led the market due to its advanced infrastructure and higher disposable income levels, making electric bikes a practical solution for urban mobility.

KSA Electric Bike Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|

Hero Electric |

1956 |

India |

|

Yamaha Motor Co. |

1955 |

Japan |

|

Pedego Electric Bikes |

2008 |

USA |

|

Giant Bicycles |

1972 |

Taiwan |

|

Trek Bicycle Corporation |

1976 |

USA |

- Pedego Electric Bikes: In April 2024, Pedego introduced its Fat Tire Trike e-bike, featuring a low-step frame design and equipped with PEDALSENSE propulsion software, which offers various riding modes such as throttle drive, torque assist, and cruise assist. This innovation could appeal to consumers in Saudi Arabia, where comfort and ease of use are essential for navigating diverse terrains.

- Trek Bicycle Corporation:In September2023, Trek BicycleCorporation launchedtheRed BarnRefresh program, which promotessustainabilityby acceptingused Trek bicyclesfor refurbishmentand resale. Thisinitiative aimsto reduce wasteand promote cycling, aligning withthe company'scommitment tosustainabilityand reducingcarbon emissions. Such programscan resonatewell in marketslike Saudi Arabia, where thereis a growinginterest in eco-friendly transportationsolutions.

KSA Electric Bike Industry Analysis

KSA Electric Bike Market Growth Drivers

- Rising Fuel Costs: Higher fuel prices are prompting consumers to seek alternative transportation options with lower operating costs. Electric bikes, powered by rechargeable batteries, provide a cost-effective solution as they do not rely on traditional fossil fuels. For instance, oil prices are poised to hit $100 per barrel in 2023, up nearly 30% since June, driven by production cuts and increasing demand from China

- Growing Environmental Consciousness: Rising environmental concerns and stricter emissions regulations are pushing individuals towards cleaner transportation options. Electric bikes produce zero emissions during operation, making them an environmentally friendly alternative to combustion engine vehicles.

- Operating Costs Comparison: According to the analysis, the average cost of operating an electric bike is USD 0.10 per mile, compared to about USD 0.58 per mile for a gasoline-powered car. This significant difference in operating costs further encourages consumers to consider electric bikes as a viable alternative.

KSA Electric Bike Market Challenges

- Limited Charging Infrastructure: Although urban centers like Riyadh and Jeddah have developed charging networks, rural areas still lack sufficient infrastructure. This gap limits the use of electric bikes in regions outside major cities, slowing market growth.

- Weather-Related Constraints: Saudi Arabias extreme heat, particularly during the summer months, poses a challenge for electric bike usage. The high temperatures can affect battery performance and reduce the appeal of electric bikes for daily commuting during the hottest months.

KSA Electric Bike Market Government Initiatives

- Alignment with Vision 2030: The Saudi government is actively working towards sustainability goals that align with Vision 2030, which emphasizes economic diversification, technological innovation, and environmental stewardship. This includes promoting electric vehicles (EVs) and electric bikes as part of a broader strategy to enhance public transportation and reduce reliance on fossil fuels

- Promotion of Electric Vehicles: As part of its broader strategy, the Saudi government is actively promoting electric vehicles and electric bikes to enhance public transportation and reduce reliance on fossil fuels. This aligns with the Kingdom's commitment to achieving net-zero emissions by 2060 and increasing the share of renewable energy in its energy mix

KSA Electric Bike Market Future Outlook

The KSA electric bike market is projected to witness strong growth through 2028, driven by increasing government support, rising fuel prices, and growing consumer awareness of sustainable transportation. The market is expected to benefit from the ongoing expansion of urban infrastructure, which will enhance the accessibility and convenience of electric bikes for both commuting and recreational use.

Future Market Trends

- Integration of Electric Bikes into Smart City Infrastructure: By 2028, electric bikes will be integrated into Saudi Arabias smart city transportation systems, offering bike-sharing schemes and digital platforms for seamless urban commuting. These systems will enhance the convenience and efficiency of using electric bikes for short-distance travel.

- Growth in Local Manufacturing: The localization of electric bike manufacturing will reduce production costs and make electric bikes more affordable for consumers in Saudi Arabia. This shift will also create new job opportunities and contribute to the Kingdoms economic diversification efforts under Vision 2030.

Scope of the Report

|

By Product Type |

Pedal-Assist Bikes Throttle-Assist Bikes Folding E-Bikes |

|

By Battery Type |

Lithium-Ion Batteries Lead-Acid Batteries Nickel-Metal Hydride |

|

By Region |

North South East West |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Electric Vehicle Manufacturers

Local Bike Dealerships

Urban Transport Planners

Government Agencies (Ministry of Transport, Saudi Standards, Metrology and Quality Organization)

Energy Companies

Battery Manufacturers

Clean Energy Advocates

Municipalities of Major Cities

Electric Bike Importers and Distributors

Financial and Investment Firms

Time Period Captured in the Report

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report

Hero Electric

Yamaha Motor Co.

Pedego Electric Bikes

Giant Bicycles

Trek Bicycle Corporation

Specialized Bicycle Components

Riese & Mller

Rad Power Bikes

Merida Bikes

Bulls Bikes

Scott Sports

Tern Bicycles

Table of Contents

1.KSA Electric Bike Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2.KSA Electric Bike Market Size (in USD Million), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3.KSA Electric Bike Market Analysis

3.1. Growth Drivers

3.1.1. Rising Fuel Costs

3.1.2. Growing Environmental Consciousness

3.1.3. Operating Costs Comparison

3.2. Restraints

3.2.1. Limited Charging Infrastructure

3.2.2. Weather-Related Constraints

3.3. Opportunities

3.3.1. Government Initiatives

3.3.2. Expansion into Emerging Markets

3.4. Trends

3.4.1. Increasing Adoption of Electric Bikes

3.4.2. Technological Innovations in Battery Technologies

3.5. Government Initiatives

3.5.1. Alignment with Vision 2030

3.5.2. Promotion of Electric Vehicles

4.KSA Electric Bike Market Segmentation, 2023

4.1. By Product Type (in Value %)

4.1.1. Pedal-Assist Bikes

4.1.2. Throttle-Assist Bikes

4.1.3. Folding E-Bikes

4.2. By Battery Type (in Value %)

4.2.1. Lithium-Ion Batteries

4.2.2. Lead-Acid Batteries

4.2.3. Nickel-Metal Hydride

4.3. By Region (in Value %)

4.3.1. North

4.3.2. South

4.3.3. East

4.3.4. West

5.KSA Electric Bike Market Competitive Landscape

5.1. Detailed Profiles of Major Companies

5.1.1. Hero Electric

5.1.2. Yamaha Motor Co.

5.1.3. Pedego Electric Bikes

5.1.4. Giant Bicycles

5.1.5. Trek Bicycle Corporation

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6.KSA Electric Bike Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7.KSA Electric Bike Market Regulatory Framework

7.1. Environmental Standards

7.2. Compliance Requirements

7.3. Certification Processes

8.KSA Electric Bike Market Future Outlook (USD Million), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9.KSA Electric Bike Market Future Segmentation, 2028

9.1. By Product Type (in Value %)

9.2. By Battery Type (in Value %)

9.3. By Region (in Value %)

10.KSA Electric Bike Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identifying Key Variables

We began by identifying and mapping the key variables impacting the KSA Electric Bike Market, including manufacturers, suppliers, and key end-users such as urban commuters and logistics companies. We conducted extensive desk research, referring to secondary and proprietary databases to gather detailed industry information, including market size, growth drivers, and consumer trends.

Step 2: Market Building

This step involved compiling and analyzing historical and current data on the KSA Electric Bike Market, focusing on product types (pedal-assist, throttle-assist, folding e-bikes), battery technologies, and regional demand. We examined market penetration, adoption rates, and pricing trends to build a comprehensive market model.

Step 3: Validating and Finalizing

To validate our findings, we conducted Computer-Assisted Telephonic Interviews (CATIs) with industry experts, including executives from electric bike manufacturers, suppliers, and government representatives. These interviews provided insights into market conditions, operational challenges, and financial performance, helping to ensure the accuracy and reliability of our data and forecasts.

Step 4: Research Output

Our team engaged with electric bike manufacturers, industry associations, and market analysts to refine our research findings. We analyzed feedback on product segments, technological advancements, and consumer preferences. Additionally, we incorporated data from local government initiatives and infrastructure developments to finalize our market outlook.

Frequently Asked Questions

1.How big is the KSA Electric Bike Market?

In 2023, the KSA electric bike market achieved a size of USD 1.20 million. The market is fueled by increasing consumer awareness of the environmental advantages of electric vehicles, the economic benefits of e-bikes for daily commuting, and supportive government initiatives focused on advancing clean energy solutions.

2.What are the challenges in the KSA Electric Bike Market?

Challenges in the KSA electric bike market include high upfront costs, limited charging infrastructure in rural areas, and extreme weather conditions that restrict the usage of electric bikes during peak summer months.

3.Who are the major players in the KSA Electric Bike Market?

Key players in the KSA electric bike market include Hero Electric, Yamaha Motor Co., Giant Bicycles, Trek Bicycle Corporation, and Pedego Electric Bikes. These companies lead the market due to their innovative products and extensive distribution networks.

4.What are the growth drivers of the KSA Electric Bike Market?

Growth drivers include government support through initiatives like Vision 2030, increasing fuel prices, and the expansion of urban infrastructure, which has facilitated the adoption of electric bikes for daily commuting and recreational use.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.