KSA Enterprise Resource Planning (ERP) Market Outlook to 2030

Region:Middle East

Author(s):Abhinav kumar

Product Code:KROD8067

November 2024

96

About the Report

KSA Enterprise Resource Planning Market Overview

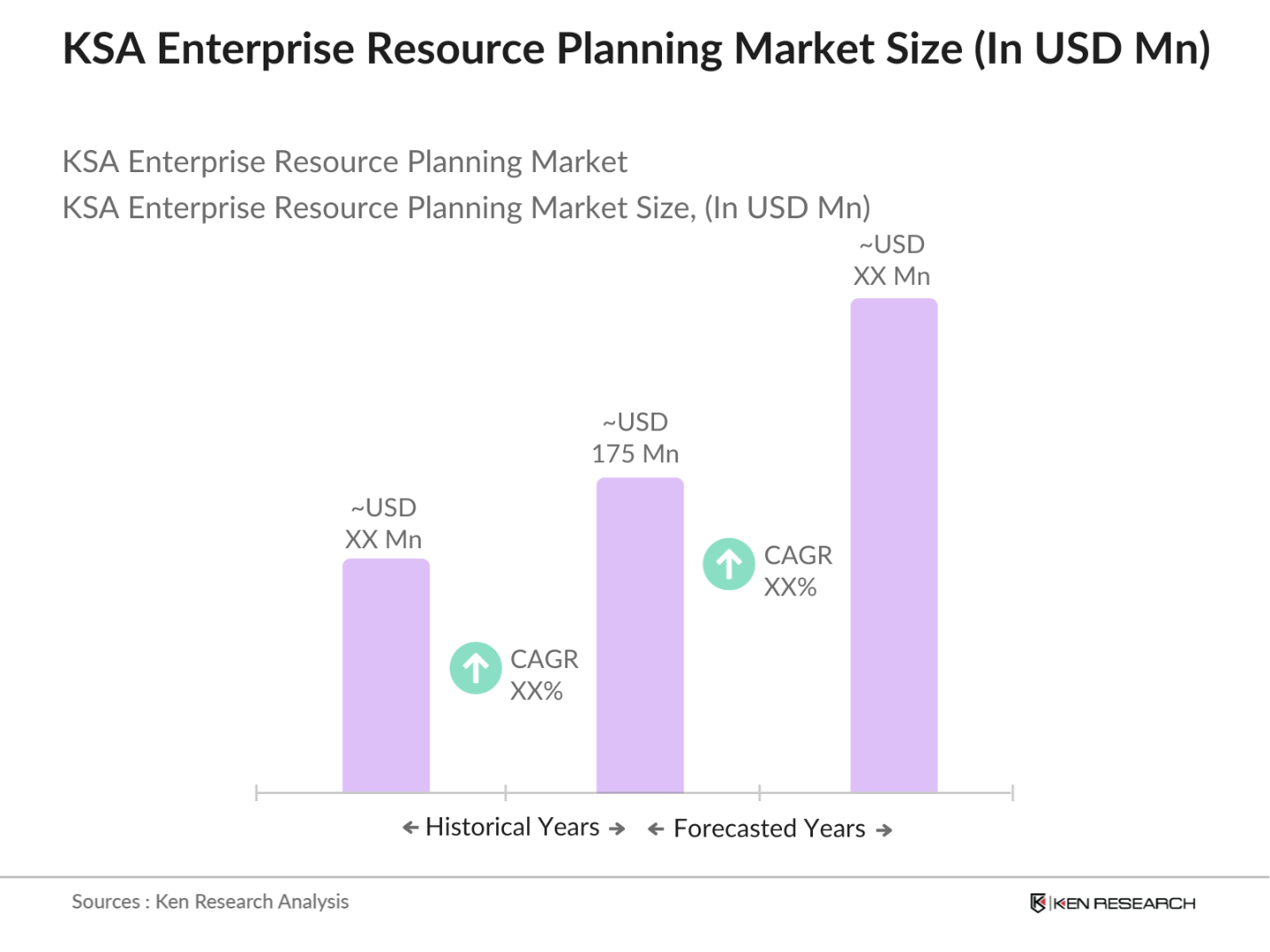

- The KSA ERP market is valued at USD 175 million driven by increasing digital transformation efforts across industries. Robust government support and initiatives aimed at enhancing IT infrastructure have significantly contributed to the markets expansion. This growth is propelled by large enterprises implementing ERP solutions to optimize operations, and SMEs increasingly adopting cloud-based ERP to enhance competitiveness.

- Riyadh and the Eastern Province are primary regions leading the KSA ERP market due to the concentration of large enterprises, government agencies, and high digital transformation activity. These areas boast a supportive business environment, investment in tech infrastructure, and high demand for ERP solutions across industries, making them central to ERP adoption.

- The inte AI and machine learning within ERP systems is a rising trend, enabling automation and predictive analysis. Saudi companies investing in AI reached $150 million in 2023, as reported by the National Center for Artificial Intelligence, and ERP systems are evolving to incorporate these technologies for smarter decision-making. This trend helps organizations optimize resource planning, maintenance, and data analytics in real-time .

KSA Enterprise Resource Planning Market Segmentation

By Deployment Type: The KSA ERP market is segmented by deployment type into On-Premises, Cloud-Based, and Hybrid ERP solutions. Cloud-based ERP solutions hold a dominant share due to their cost-effectiveness, scalability, and flexibility, which appeal to both SMEs and large organizations looking to streamline processes without investing in heavy infrastructure. Increased data security in cloud services and reduced IT management needs further contribute to their preference in the KSA market.

By Enterprise Size: Enterprise size segmentation includes Large Enterprises and Small and Medium Enterprises (SMEs). Large enterprises dominate the market due to their capability to allocate substantial budgets toward comprehensive ERP systems, which are essential for managing complex operations across multiple departments and locations. These enterprises seek ERP solutions to integrate processes, enhance productivity, and maintain competitiveness in the global market.

KSA Enterprise Resource Planning Competitive Landscape

The KSA ERP market is dominated by several major players, including both global providers and regional firms. Companies like SAP and Oracle lead due to their extensive product portfolios, expertise in large-scale deployments, and focus on localization. Local and regional players also contribute, offering tailored solutions that address specific needs within KSAs regulatory framework.

KSA Enterprise Resource Planning Industry Analysis

Growth Drivers

- Digital Transformation Initiatives: As governments and businesses worldwide emphasize digital transformation, ERP adoption has surged as a cornerstone of this shift. For instance, in 2024, digital transformation initiatives are projected to generate over $1 trillion in economic output across various sectors worldwide, fueled largely by the public sector's push for enhanced digital infrastructure, especially in emerging economies. Developing regions such as Southeast Asia and parts of Africa have allocated substantial budgets for digital infrastructure development, aiming to reduce the digital divide and strengthen economic resilience. In Indonesia, government spending on digital technology surged by 30% over two years, bolstering the demand for ERP systems that facilitate

- Adoption of Cloud-Based ERP Solutions: Cloud-based ERP systems have become a central part of enterprise operations due to their scalability and reduced infrastructure costs. In 2024, more than 70% of enterprises across the US, EU, and Asia have integrated cloud-based ERP solutions, driven by increased demand for flexibility and real-time data access. Major economies, including the United States, are seeing a strong push toward cloud adoption, evidenced by the over $100 billion allocated to cloud infrastructure improvements by the federal government alone. This trend is echoed globally, with governments investing in cloud solutions to support digital transformation and improve operational efficiency, thereby accelerating ERP adoption.

- Government Support for IT Infrastructure: Governments globally recognize the importance of IT infrastructure to economic growth and have increased investments accordingly. In 2024, the European Union allocated 3 billion specifically to digitize its public sector, with significant funding directed toward ERP systems that enhance cross-agency coordination. Similarly, in India, government initiatives under the Digital India program have facilitated the deployment of ERP systems within various public departments, strengthening Indias IT infrastructure. Such initiatives highlight a global shift toward ERP systems to support governance and foster transparency.

Market Challenges

- Data Security Concerns: With the rising adoption of ERP solutions comes heightened attention to data security. In 2024, the global cybercrime damage cost is estimated at over $8 trillion, placing significant pressure on businesses and governments to secure their ERP systems. In the United States, government regulations such as the Cybersecurity Information Sharing Act are being revised to enforce stricter security standards for enterprise solutions, including ERP platforms. Additionally, data leaks from cloud-based systems have prompted businesses to increase investments in security measures, which is essential for safeguarding their ERP deployments.

- High Implementation Costs: ERP implementation costs remain a significant barrier, especially for SMEs in emerging economies. Implementing a comprehensive ERP system often requires initial capital investments that can be prohibitive, with average ERP installation costs exceeding $1 million for mid-sized enterprises. Furthermore, ongoing maintenance and customization costs add to the burden, as 30% of businesses in the EU identified high costs as a key challenge in adopting ERP solutions, even with government incentives. This is exacerbated in regions like Africa, where limited IT budgets further constrain ERP adoption.

KSA Enterprise Resource Planning Market Future Outlook

Over the next five years, the KSA ERP market is expected to witness substantial growth, driven by sustained government support for IT and digital transformation. Additionally, the rising demand for real-time data analytics, the adoption of AI and machine learning in ERP, and the trend toward cloud ERP solutions are anticipated to bolster market expansion. This growth trajectory is also supported by initiatives to enhance the skills and knowledge of the local workforce, creating a more robust and capable ERP ecosystem.

Opportunities

- Rise of SMEs and Startup Ecosystems: The growth of SMEs, especially in Asia and Africa, presents a substantial opportunity for ERP vendors. In 2024, SMEs accounted for 80% of all enterprises in Asia, creating a fertile ground for ERP providers to tailor scalable solutions. Government-led programs in countries like Singapore, which allocated SGD 500 million to support small businesses, are facilitating ERP adoption. This growth of SMEs fosters a need for ERP solutions that are customizable and cost-effective, thus increasing ERP vendors' penetration into these markets.

- Localization of ERP Solutions: Localization of ERP solutions to meet regional language and regulatory requirements offers untapped potential, particularly in Europe and Latin America. For instance, 60% of European businesses now seek ERP solutions that comply with the EUs General Data Protection Regulation (GDPR), underscoring the need for regionally tailored products. Companies such as SAP have responded by customizing their ERP solutions to align with local legal frameworks, helping drive demand for these tailored systems. As localization efforts grow, ERP vendors are positioned to capture more regional market share.

Scope of the Report

|

Deployment Type |

On-Premises |

|

Enterprise Size |

Large Enterprises |

|

Industry Vertical |

Manufacturing |

|

Module Type |

Financial Management |

|

Region |

Riyadh |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Large Corporations seeking centralized ERP systems

Small and Medium Enterprises (SMEs)

Manufacturing Companies

Healthcare Providers Companies

Financial Companies

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Ministry of Communications and Information Technology, Saudi Authority for Data and Artificial Intelligence).

Companies

Players Mentioned in the Report

SAP SE

Oracle Corporation

Microsoft Corporation

Infor

Sage Group

Epicor Software Corporation

IFS AB

Workday, Inc.

Ramco Systems

Odoo

Table of Contents

1. KSA Enterprise Resource Planning Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Industry Adoption Rate

1.4 ERP Deployment Trends

2. KSA ERP Market Size (In USD Mn)

2.1 Historical Market Size

2.2 YoY Growth Analysis

2.3 Key Market Developments and Milestones

3. KSA ERP Market Dynamics

3.1 Growth Drivers

3.1.1 Digital Transformation Initiatives

3.1.2 Adoption of Cloud-Based ERP Solutions

3.1.3 Government Support for IT Infrastructure

3.2 Market Challenges

3.2.1 Data Security Concerns

3.2.2 High Implementation Costs

3.2.3 Skills Gap and Training Requirements

3.3 Opportunities

3.3.1 Rise of SMEs and Startup Ecosystems

3.3.2 Localization of ERP Solutions

3.3.3 Integration with Emerging Technologies

3.4 Trends

3.4.1 AI and Machine Learning in ERP

3.4.2 Mobile ERP Adoption

3.4.3 Real-Time Analytics Demand

3.5 Regulatory Impact on ERP Market

3.6 SWOT Analysis

3.7 ERP Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

4. KSA ERP Market Segmentation

4.1 By Deployment Type (in Value %)

4.1.1 On-Premises

4.1.2 Cloud-Based

4.1.3 Hybrid

4.2 By Enterprise Size (in Value %)

4.2.1 Large Enterprises

4.2.2 Small and Medium Enterprises (SMEs)

4.3 By Industry Vertical (in Value %)

4.3.1 Manufacturing

4.3.2 Retail and Distribution

4.3.3 Healthcare

4.3.4 Financial Services

4.3.5 Government

4.4 By Module Type (in Value %)

4.4.1 Financial Management

4.4.2 Human Capital Management

4.4.3 Supply Chain Management

4.4.4 Customer Relationship Management

4.4.5 Inventory and Order Management

4.5 By Region (in Value %)

4.5.1 Riyadh

4.5.2 Jeddah

4.5.3 Eastern Province

4.5.4 Other Regions

5. KSA ERP Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 SAP SE

5.1.2 Oracle Corporation

5.1.3 Microsoft Corporation

5.1.4 Infor

5.1.5 Sage Group

5.1.6 IFS AB

5.1.7 Epicor Software Corporation

5.1.8 Workday, Inc.

5.1.9 Unit4

5.1.10 Odoo

5.1.11 Ramco Systems

5.1.12 Focus Softnet

5.1.13 Syspro

5.1.14 Exact

5.1.15 Acumatica

5.2 Cross Comparison Parameters (Revenue, Market Share, Client Portfolio, Product Range, Localization Strategy, Innovation Index, Regional Presence, Customer Support Network)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Partnership and Collaboration Landscape

5.7 Investment Trends

5.8 Key Innovations in ERP Solutions

5.9 Customer Satisfaction Metrics

6. KSA ERP Market Regulatory Framework

6.1 Data Security Compliance Standards

6.2 Government Mandates on ERP Software

6.3 Certification Requirements

6.4 Licensing Procedures

7. KSA ERP Market Future Size (In USD Mn)

7.1 Projected Market Size Analysis

7.2 Key Drivers for Future Growth

8. KSA ERP Market Future Segmentation

8.1 By Deployment Type (in Value %)

8.2 By Enterprise Size (in Value %)

8.3 By Industry Vertical (in Value %)

8.4 By Module Type (in Value %)

8.5 By Region (in Value %)

9. KSA ERP Market Analyst's Recommendations

9.1 Target Addressable Market Analysis

9.2 Go-To-Market Strategies

9.3 Customer Segmentation Strategy

9.4 Market Penetration Opportunities

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This phase involves identifying the major stakeholders and defining variables that impact the ERP market in KSA, using extensive desk research and industry sources to understand the dynamics of the ERP landscape.

Step 2: Market Analysis and Construction

Historical data analysis is conducted to evaluate market growth, deployment trends, and the demand-supply gap. Industry statistics are utilized to validate revenue estimations and assess the market penetration of ERP solutions across enterprise sizes.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through direct interviews and surveys with ERP providers, industry experts, and regional partners. This step provides insights into market strategies, implementation challenges, and user adoption trends.

Step 4: Research Synthesis and Final Output

The research findings are synthesized into a comprehensive report. This final stage ensures that the analysis reflects verified data and offers a clear view of market trends, opportunities, and challenges.

Frequently Asked Questions

01. How big is the KSA Enterprise Resource Planning Market?

The KSA ERP market was valued at USD 175 million and is primarily driven by the increasing adoption of digital solutions and support from government initiatives.

02. What challenges does the KSA ERP Market face?

Key challenges include data security concerns, high implementation costs, and the shortage of skilled professionals in the ERP sector, which impacts adoption among smaller businesses.

03. Who are the major players in the KSA ERP Market?

Leading companies include SAP SE, Oracle Corporation, Microsoft Corporation, and Infor, which dominate due to comprehensive product portfolios, local partnerships, and an established presence in the KSA market.

04. What drives growth in the KSA ERP Market?

Growth drivers include the push toward digitalization, government investment in IT infrastructure, and the increasing demand for cloud ERP solutions, which offer flexibility and cost-effectiveness for businesses.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.