KSA Eyewear Market Outlook to 2030

Region:Middle East

Author(s):Abhinav kumar

Product Code:KROD6906

December 2024

85

About the Report

KSA Eyewear Market Overview

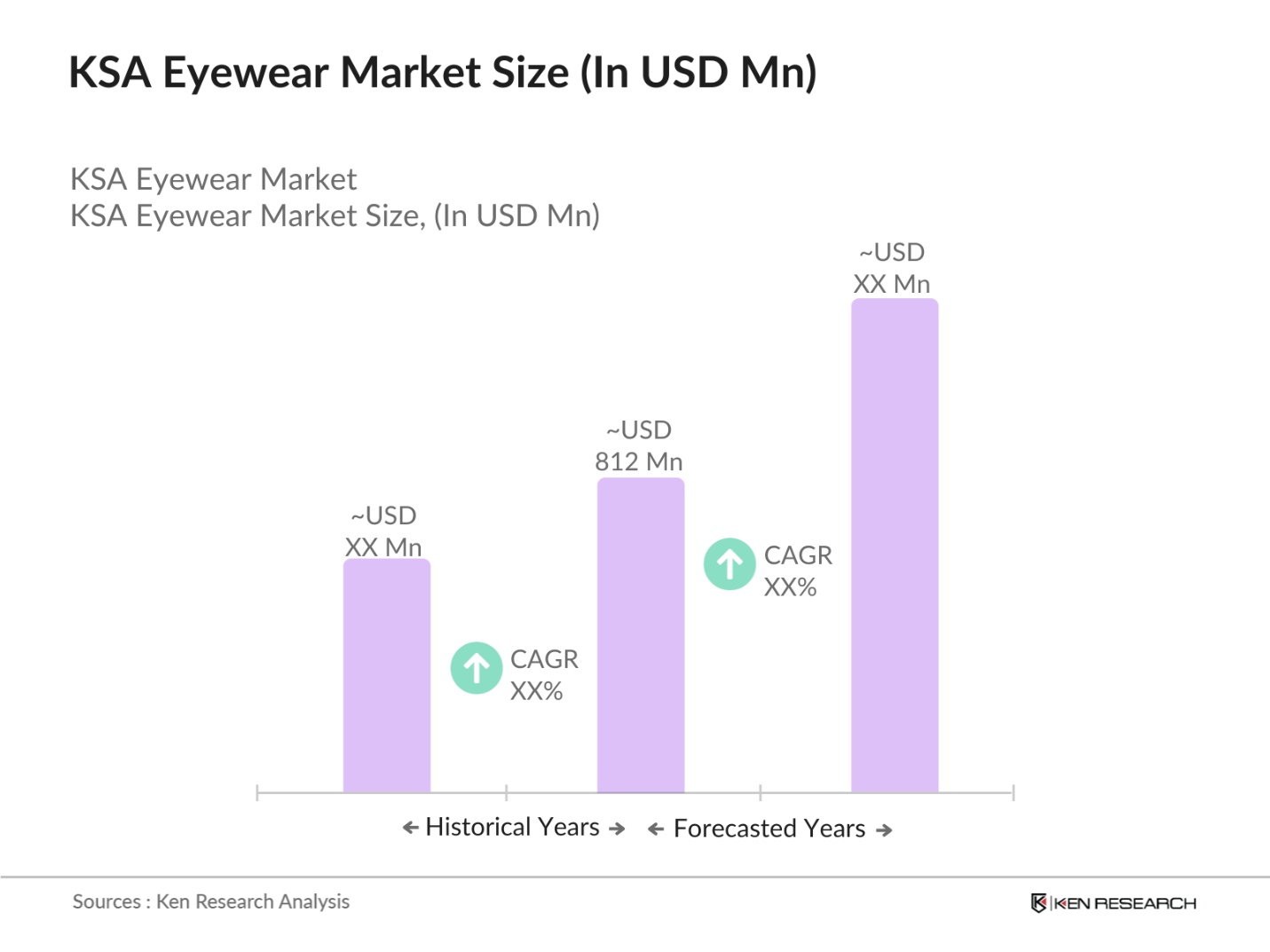

- The KSA eyewear market is valued at USD 812 million, driven by the increasing demand for prescription glasses and sunglasses due to the rise in vision-related issues and growing consumer preference for luxury eyewear. The market has experienced steady growth over the past five years, influenced by factors like higher disposable income, a shift in fashion trends, and the expansion of e-commerce platforms, which have made eyewear products more accessible to consumers across various demographics.

- Riyadh and Jeddah dominate the eyewear market in KSA due to their large urban populations, higher per capita income, and significant retail presence. The demand for premium and luxury eyewear is particularly strong in these cities, as consumers are inclined to spend on high-quality, branded products. Additionally, these cities house several international and local optical retailers, further fueling the market's growth.

- With the increasing usage of digital devices in KSA, blue-light filtering lenses have gained popularity. In 2023, over 80% of Saudi adults reported spending more than six hours a day on screens, leading to increased concerns about digital eye strain. Blue-light filtering lenses, designed to reduce eye fatigue, have become a preferred option for consumers, particularly in the working population. This trend is supported by growing awareness of the long-term effects of screen exposure on vision health.

KSA Eyewear Market Segmentation

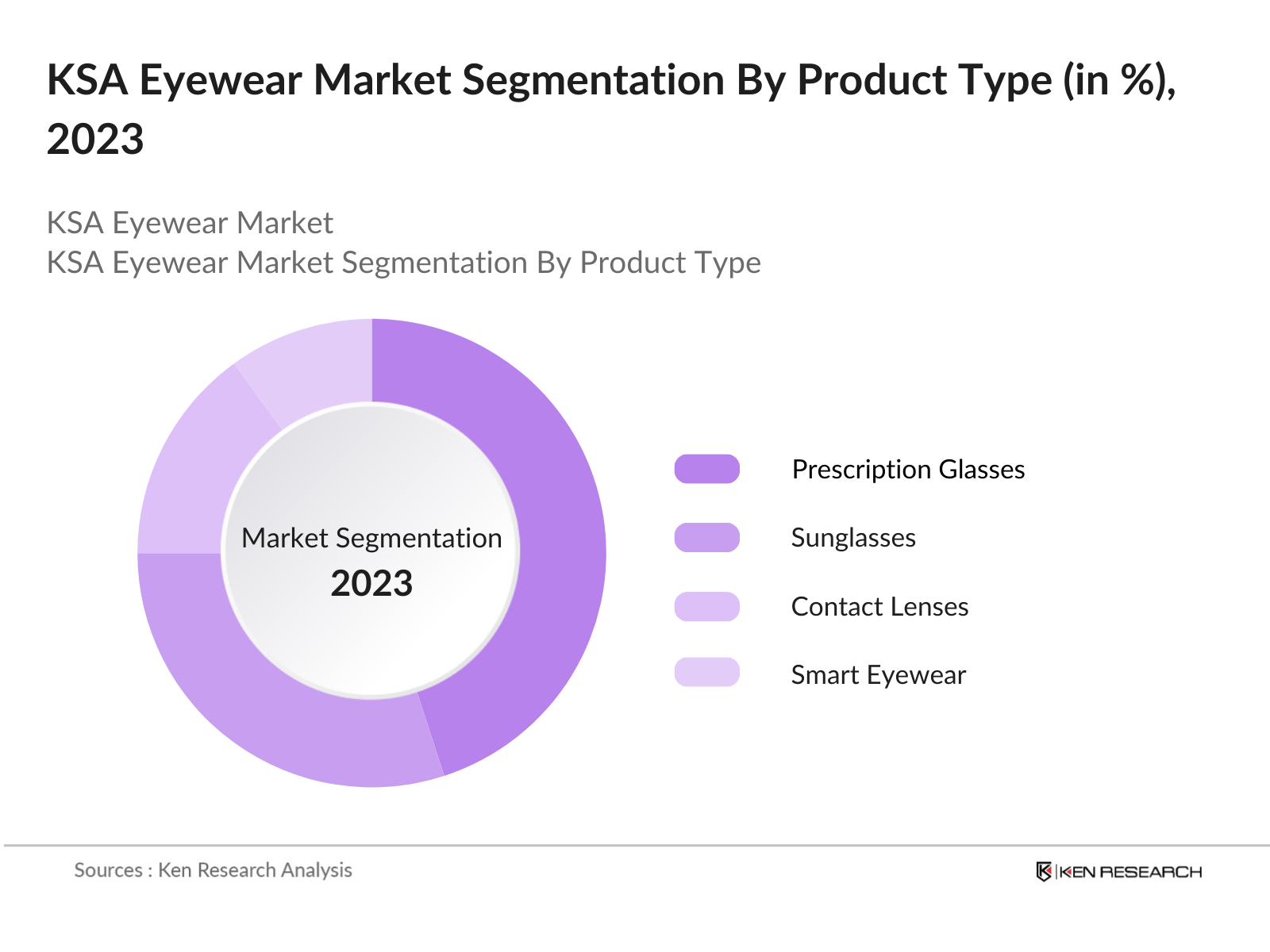

By Product Type: The KSA eyewear market is segmented by product type into prescription glasses, sunglasses, contact lenses, and smart eyewear. Recently, prescription glasses have held a dominant market share under the product type segmentation due to the rising prevalence of vision impairments, such as myopia and astigmatism. This segment's demand is further boosted by the increasing awareness of eye health and the growing elderly population who require vision correction.

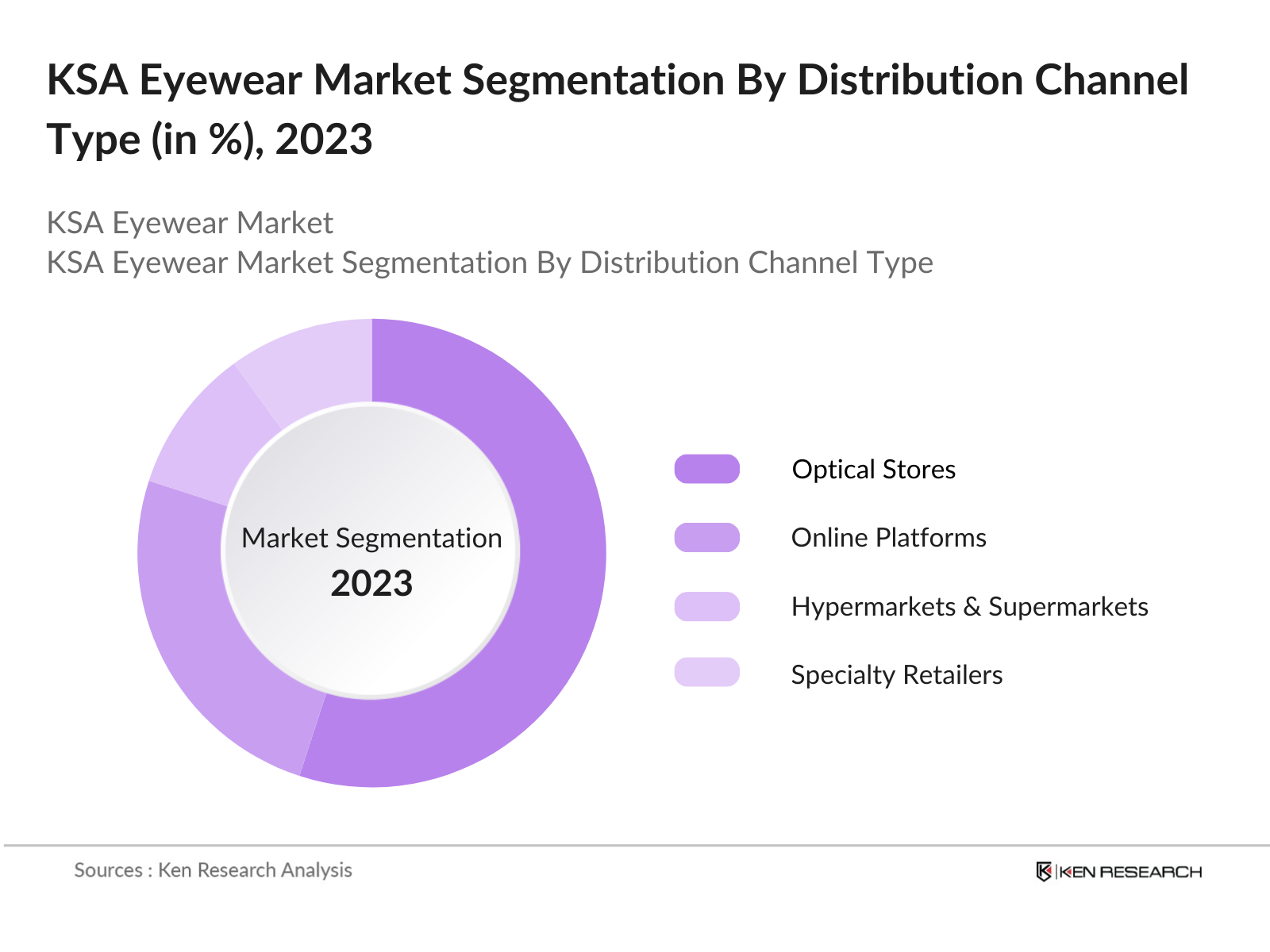

By Distribution Channel: The market is segmented by distribution channel into optical stores, online platforms, hypermarkets and supermarkets, and specialty retailers. Optical stores hold the largest market share, as consumers prefer trying on eyewear products before purchasing, and these stores offer personalized services like eye tests and fitting. Furthermore, optical stores have established trust and credibility among consumers, contributing to their strong market position.

KSA Eyewear Market Competitive Landscape

The KSA eyewear market is dominated by a few key players that hold substantial market influence through brand strength, extensive distribution networks, and innovative product offerings. The competitive landscape is characterized by both international brands and strong regional players. The markets consolidation indicates that companies with greater brand recognition, technological advancements, and customer loyalty continue to lead the market.

|

Company |

Year Established |

Headquarters |

No. of Stores |

Product Range |

Technological Innovation |

Sustainability Initiatives |

Brand Loyalty |

Market Penetration |

|

EssilorLuxottica |

1972 |

Paris, France |

_ |

_ |

_ |

_ |

_ |

_ |

|

Magrabi Optical |

1927 |

Riyadh, KSA |

_ |

_ |

_ |

_ |

_ |

_ |

|

Johnson & Johnson Vision Care |

1959 |

New Jersey, USA |

_ |

_ |

_ |

_ |

_ |

_ |

|

Al Jaber Optical |

1982 |

Abu Dhabi, UAE |

_ |

_ |

_ |

_ |

_ |

_ |

|

Safilo Group |

1934 |

Padua, Italy |

_ |

_ |

_ |

_ |

_ |

_ |

KSA Eyewear Market Industry Analysis

Growth Drivers

- Increasing Disposable Income: The rise in KSAs disposable income is directly impacting the eyewear market. In 2023, Saudi household income is projected to grow due to government initiatives aimed at diversifying the economy away from oil dependence. As of 2022, per capita income in KSA was around $23,000, with forecasts showing continued growth in 2024. This increasing income has empowered consumers to spend more on lifestyle products, including luxury eyewear. The Saudi Vision 2030 reforms are expected to boost disposable incomes further, as sectors like retail and manufacturing continue to expand.

- Shift in Consumer Preferences: KSAs population, particularly in urban areas like Riyadh and Jeddah, is showing a shift toward premium and luxury eyewear brands. By 2024, luxury retail sales in KSA, driven by the eyewear segment, are estimated to account for a significant share of the retail market. The demand for high-end products is supported by the affluent population, with an estimated 20% of households classified as high-income in 2022. This trend is influenced by a growing younger population that prioritizes fashion and status, aligning with global luxury consumption trends.

- Growing Prevalence of Vision-Related Issues: The prevalence of vision-related issues in KSA is contributing to a steady demand for prescription eyewear. In 2022, approximately 22% of the Saudi population experienced some form of vision impairment, including myopia and hyperopia. The Saudi Ministry of Health has reported a rise in eye disorders, partially attributed to increased screen time and aging demographics. As of 2023, over 70% of Saudi residents aged 35 and above required corrective lenses, further bolstering the eyewear market.

Market Challenges

- High Price Sensitivity: Despite the growth in disposable income, a significant portion of the Saudi population remains price-sensitive, particularly in the mid- to low-income segments. In 2023, roughly 50% of the population had an annual household income below $20,000, limiting their ability to purchase high-end eyewear. This creates a challenge for luxury and premium eyewear brands attempting to penetrate the broader market. Retailers are forced to balance offering premium products while addressing the needs of price-conscious consumers.

- Competition from Low-Cost Alternatives: The eyewear market in KSA faces stiff competition from low-cost alternatives, primarily imported from China and other Asian markets. In 2022, over 40% of eyewear products sold in KSA were imported from these regions, where production costs are significantly lower. The availability of budget-friendly options, including non-branded and counterfeit products, poses a challenge to established premium brands in the market. Retailers often struggle to differentiate their offerings, despite superior quality and branding.

KSA Eyewear Market Future Outlook

Over the next five years, the KSA eyewear market is expected to witness significant growth driven by technological advancements in smart eyewear, increasing health awareness, and growing demand for luxury brands. The rise of blue-light filtering lenses and eco-friendly materials is anticipated to further drive consumer interest in innovative and sustainable eyewear solutions. Additionally, expanding e-commerce platforms will make premium eyewear accessible to a larger segment of the population, especially in non-metropolitan areas.

Opportunities

Technological Advancements: KSAs rapidly growing tech-savvy population presents significant opportunities in the smart eyewear sector. In 2023, KSA ranked among the top 25 countries in terms of digital readiness. With increasing demand for wearable technology, including smart glasses with integrated health monitoring and augmented reality features, the market for tech-enhanced eyewear is poised for growth. Leading international brands have already begun exploring collaborations with local distributors, aiming to capitalize on the country's young, tech-oriented consumer base.

Expansion into Untapped Rural Markets: While urban centers dominate the eyewear market, there is a growing opportunity in rural areas, where eyewear penetration remains low. As of 2022, over 30% of KSAs population resided in rural areas, with limited access to eyewear products and optometry services. Government initiatives aimed at improving healthcare access, particularly in less developed regions, present a growth opportunity for eyewear brands that can tap into these underserved markets. The ongoing development of rural infrastructure is expected to facilitate this expansion.

Scope of the Report

|

By Product Type |

Prescription Glasses Sunglasses Contact Lenses Smart Eyewear |

|

By Distribution Channel |

Optical Stores Online Platforms Hypermarkets and Supermarkets Specialty Retailers |

|

By End-User |

Men Women Kids |

|

By Frame Material |

Metal Plastic Titanium Eco-Friendly Materials |

|

By Region |

Riyadh Jeddah Dammam Mecca Other Regions |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

Government and Regulatory Bodies (Saudi FDA)

Optical Retail Chain Industry

Eyewear Manufacturers Companies

Online Eyewear Retailer Companies

Eyewear Component Companies

Investments and Venture Capitalist Firms

Healthcare Companies

Fashion Industries

Companies

Market Players Mentioned in the Report:

EssilorLuxottica

Magrabi Optical

Johnson & Johnson Vision Care

Al Jaber Optical

Safilo Group

Ray-Ban

CooperVision

Grand Optics

Oakley

Police Eyewear

Maui Jim

Carl Zeiss AG

Silhouette International

Roberto Cavalli Eyewear

Lenskart

Table of Contents

1. KSA Eyewear Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. KSA Eyewear Market Size (In SAR Mn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. KSA Eyewear Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Disposable Income

3.1.2. Shift in Consumer Preferences (towards luxury eyewear)

3.1.3. Growing Prevalence of Vision-related Issues

3.1.4. Expansion of E-Commerce Platforms

3.2. Market Challenges

3.2.1. High Price Sensitivity

3.2.2. Competition from Low-Cost Alternatives

3.2.3. Regulatory Barriers on Importing Eyewear

3.3. Opportunities

3.3.1. Technological Advancements (Smart Eyewear)

3.3.2. Expansion into Untapped Rural Markets

3.3.3. Opportunities in Prescription Sunglasses

3.4. Trends

3.4.1. Rise of Blue-Light Filtering Lenses

3.4.2. Sustainable and Eco-Friendly Eyewear Materials

3.4.3. Customization and Personalization

3.5. Regulatory Framework (Market-Specific)

3.5.1. Saudi FDA Eyewear Product Regulations

3.5.2. Standards for UV Protection and Prescription Lenses

3.5.3. Import and Export Laws Specific to Eyewear

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. KSA Eyewear Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Prescription Glasses

4.1.2. Sunglasses

4.1.3. Contact Lenses

4.1.4. Smart Eyewear

4.2. By Distribution Channel (In Value %)

4.2.1. Optical Stores

4.2.2. Online Platforms

4.2.3. Hypermarkets and Supermarkets

4.2.4. Specialty Retailers

4.3. By End-User (In Value %)

4.3.1. Men

4.3.2. Women

4.3.3. Kids

4.4. By Frame Material (In Value %)

4.4.1. Metal

4.4.2. Plastic

4.4.3. Titanium

4.4.4. Eco-Friendly Materials

4.5. By Region (In Value %)

4.5.1. Riyadh

4.5.2. Jeddah

4.5.3. Dammam

4.5.4. Mecca

4.5.5. Other Regions

5. KSA Eyewear Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. EssilorLuxottica

5.1.2. Safilo Group

5.1.3. Al Jaber Optical

5.1.4. Magrabi Optical

5.1.5. Lenskart

5.1.6. Ray-Ban

5.1.7. Johnson & Johnson Vision Care

5.1.8. Carl Zeiss AG

5.1.9. CooperVision

5.1.10. Grand Optics

5.1.11. Police Eyewear

5.1.12. Oakley

5.1.13. Maui Jim

5.1.14. Silhouette International

5.1.15. Roberto Cavalli Eyewear

5.2. Cross Comparison Parameters (No. of Stores, Market Presence, Product Range, Customer Reach, Price Range, Sustainability Initiatives, Technological Innovation, Local Collaborations)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Joint Ventures & Collaborations

5.8. Product Launches and Innovations

6. KSA Eyewear Market Regulatory Framework

6.1. Eyewear Product Certification and Compliance

6.2. KSA Vision 2030 and Impact on Eyewear Market

6.3. Import Tariffs and Duties on Eyewear

6.4. Licensing Requirements for Eyewear Retailers

7. KSA Eyewear Market Future Size (In SAR Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. KSA Eyewear Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By End-User (In Value %)

8.4. By Frame Material (In Value %)

8.5. By Region (In Value %)

9. KSA Eyewear Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Strategies

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The research process begins with identifying the critical variables driving the KSA eyewear market, such as consumer preferences, technological advancements, and regulatory frameworks. Extensive desk research and proprietary databases were utilized to map the key stakeholders, including manufacturers, retailers, and regulatory bodies.

Step 2: Market Analysis and Construction

This phase involved analyzing historical market data to assess growth trends, the impact of key distribution channels, and revenue generation by major players. A detailed evaluation of optical stores, online platforms, and consumer preferences was conducted to create accurate market projections.

Step 3: Hypothesis Validation and Expert Consultation

Expert interviews with industry leaders and practitioners were conducted to validate key market hypotheses. These consultations offered insights into product innovation, consumer demand shifts, and distribution trends, ensuring the research findings reflect actual market dynamics.

Step 4: Research Synthesis and Final Output

The final stage of research synthesized all data from both primary and secondary sources to produce a comprehensive analysis. This step verified market statistics, such as the share of prescription glasses and sunglasses, through a bottom-up approach, ensuring the accuracy of revenue forecasts and market segmentation data.

Frequently Asked Questions

1. How big is the KSA eyewear market?

The KSA eyewear market is valued at USD 812 million, driven by increasing demand for prescription glasses and sunglasses, as well as growing consumer interest in luxury and smart eyewear.

2. What are the challenges in the KSA eyewear market?

Challenges include high price sensitivity among consumers, regulatory hurdles on importing eyewear, and competition from low-cost alternatives, particularly in the sunglasses and contact lenses segments.

3. Who are the major players in the KSA eyewear market?

Key players include EssilorLuxottica, Magrabi Optical, Johnson & Johnson Vision Care, Safilo Group, and Al Jaber Optical. These companies dominate due to their strong brand presence, technological innovation, and extensive retail networks.

4. What are the growth drivers of the KSA eyewear market?

The market is driven by increasing disposable income, the rising prevalence of vision-related issues, growing demand for luxury eyewear, and the expansion of e-commerce platforms, which make eyewear more accessible.

5. Which product segments dominate the KSA eyewear market?

Prescription glasses hold the largest market share due to the rising need for vision correction among the aging population and increased screen time, which has led to a higher prevalence of eye strain and related issues.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.