KSA Facades Market Outlook to 2030

Region:Middle East

Author(s):Meenakshi Bisht

Product Code:KROD6196

December 2024

89

About the Report

KSA Facades Market Overview

- The KSA Facades Market is valued at USD 10.06 billion, driven by the growing demand for energy-efficient buildings and government initiatives for sustainable development. Large infrastructure projects such as NEOM and The Red Sea Project have accelerated the growth of the market. These projects focus on innovative and sustainable building designs, which include advanced facade systems that not only enhance the aesthetic appeal but also improve energy efficiency by providing insulation and reducing cooling costs.

- Riyadh and Jeddah are dominant cities in the KSA facades market. Riyadh, being the political and financial hub of the Kingdom, is witnessing extensive urban development, leading to a surge in demand for modern facade solutions. Jeddah, a key commercial port city, is seeing an increase in high-rise buildings and commercial complexes, further boosting the market for facades, particularly in the commercial and institutional sectors.

- Saudi Arabia's government initiatives for green buildings under Vision 2030 include projects like Green Riyadh, aimed at planting millions of trees to improve air quality and reduce urban temperatures. Additionally, high-profile developments like the King Abdullah Financial District and Princess Nora University emphasize sustainability through LEED certification and eco-friendly practices. These initiatives demonstrate the government's commitment to reducing environmental impacts and promoting sustainable urban growth.

KSA Facades Market Segmentation

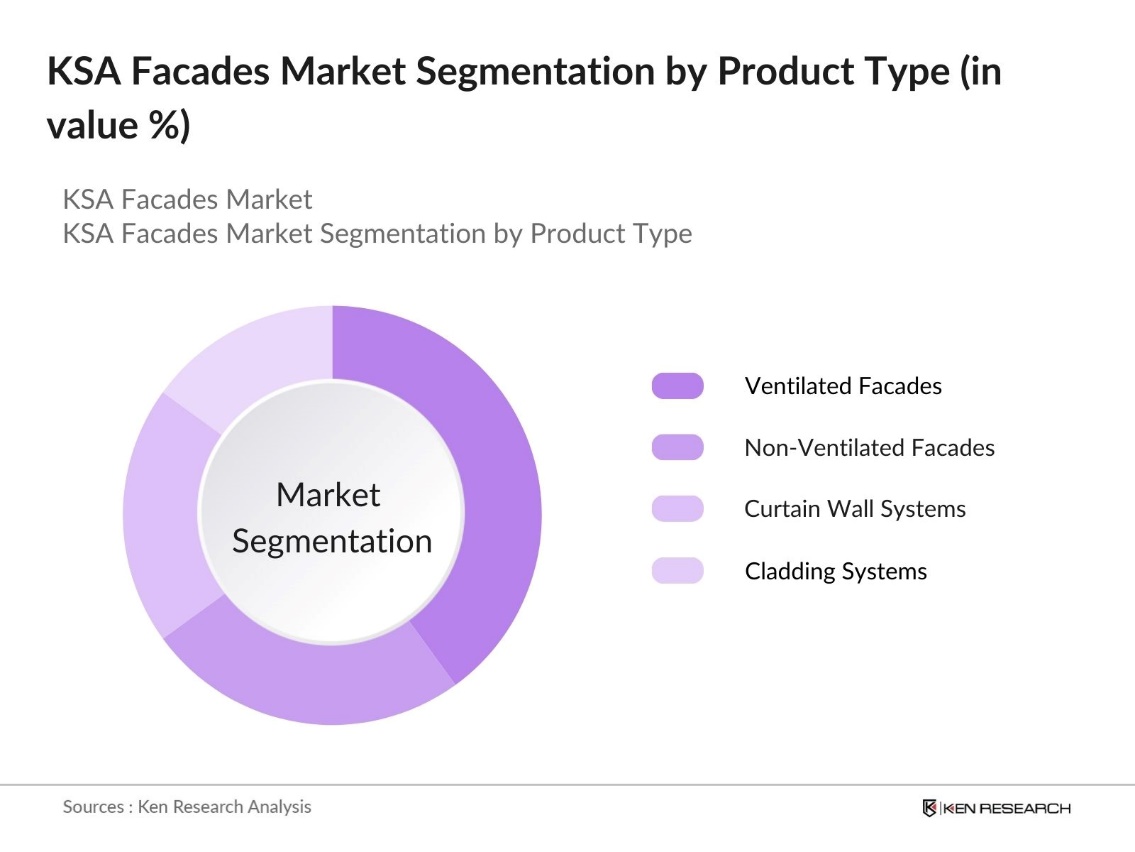

By Product Type: The KSA Facades market is segmented by product type into ventilated facades, non-ventilated facades, curtain wall systems, and cladding systems. Ventilated facades dominate the market share under the product type segmentation, largely due to their ability to enhance energy efficiency in buildings. In a climate like Saudi Arabias, where high temperatures are common, ventilated facades help maintain cooler indoor environments by reducing heat absorption. This leads to lower energy consumption for air conditioning, which is a significant factor driving the popularity of this sub-segment.

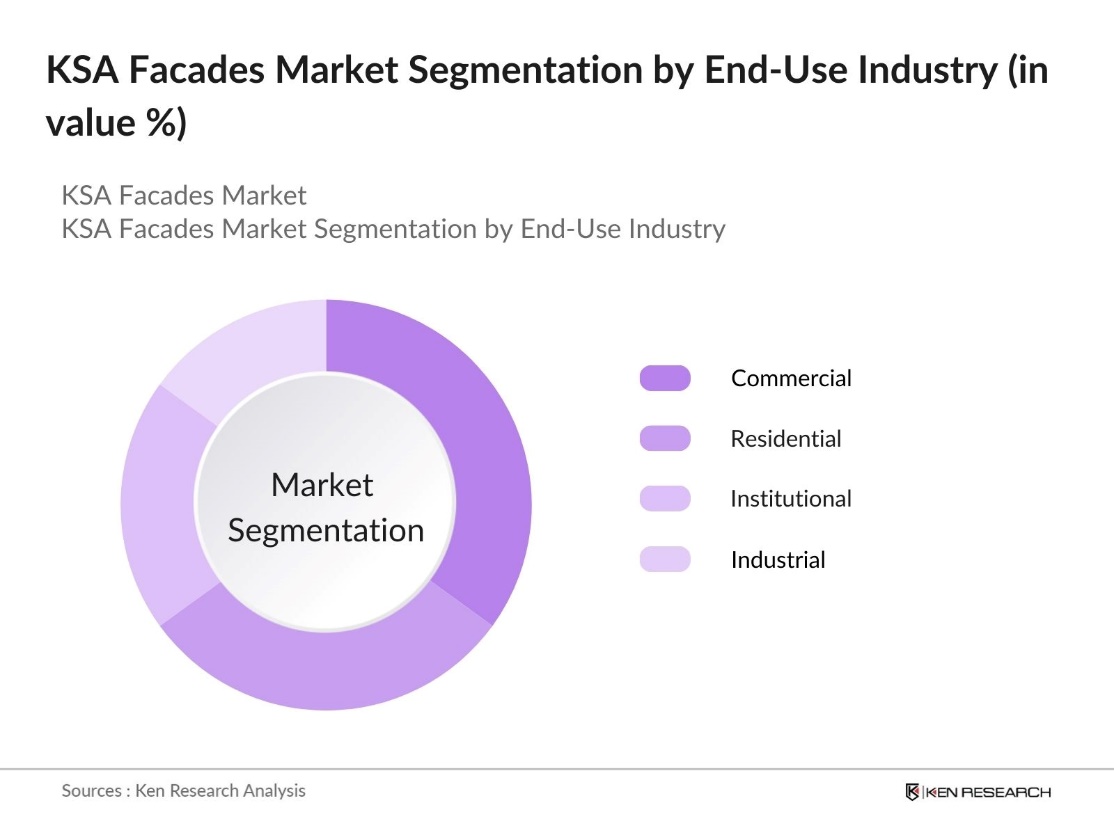

By End-Use Industry: The KSA Facades market is segmented by end-use industry into residential, commercial, institutional, and industrial sectors. Commercial buildings are the leading sub-segment in the end-use industry, driven by the rapid expansion of office spaces, shopping malls, and hotels in major cities like Riyadh and Jeddah. The commercial sectors growth is largely supported by the Vision 2030 plan, which aims to diversify the economy, reduce dependency on oil, and promote tourism.

KSA Facades Market Competitive Landscape

The KSA facades market is dominated by a mix of local and international players. The consolidation of these key companies underscores their influence in shaping the market through innovative designs, technology integration, and strategic partnerships with construction giants in KSA. The competitive landscape is highly fragmented, with companies competing to secure contracts for high-profile projects such as NEOM, King Abdullah Financial District, and The Red Sea Project.

|

Company Name |

Establishment Year |

Headquarters |

Key Products |

Revenue (2023) |

No. of Employees |

Market Share |

Recent Projects |

Green Building Certifications |

|

AluK Group |

1949 |

Dubai, UAE |

||||||

|

Schco International KG |

1951 |

Bielefeld, Germany |

||||||

|

Reynaers Middle East |

1965 |

Manama, Bahrain |

||||||

|

Saudi Building Systems |

1989 |

Riyadh, KSA |

||||||

|

Zahid Group |

1943 |

Jeddah, KSA |

KSA Facades Industry Analysis

Growth Drivers

- Growing Urbanization: Urbanization in Saudi Arabia is accelerating, with the countrys urban population expected to reach nearly 31.77 million by 2024. This urban growth is fueling demand for high-rise buildings and commercial complexes, which rely on durable, efficient facades for energy conservation and aesthetic appeal. The government's urban development plans align with this, aiming to enhance living standards and infrastructure.

- Energy Efficiency Regulations (e.g., Saudi Energy Efficiency Program): Energy efficiency is becoming a key focus in Saudi Arabia, largely due to the introduction of stringent building regulations under the Saudi Energy Efficiency Program (SEEP). As of mid-2023, SEEP has activated over 80 initiatives aimed at achieving the goals set under the Saudi Green Initiative (SGI). These initiatives include retrofitting existing public buildings and incentivizing households to replace inefficient appliances with energy-efficient models.

- Expansion in Hospitality and Commercial Sectors: The hospitality and commercial real estate sectors in Saudi Arabia are experiencing rapid growth, largely driven by government initiatives under Vision 2030 to promote tourism and diversify the economy. This expansion is leading to increased demand for hotels, resorts, and commercial buildings, all of which rely on modern facade systems to enhance visual appeal, energy efficiency, and environmental sustainability.

Market Challenges

- High Initial Investment for Smart and Sustainable Facades: Smart and sustainable facade technologies, such as dynamic solar shading and IoT-enabled designs, require a substantial initial investment. While these systems offer long-term energy savings, the high upfront costs can be a barrier, particularly for mid-sized developers. The financial burden often deters smaller projects from adopting energy-efficient solutions, limiting the wider implementation of advanced facade technologies in the market.

- Volatile Raw Material Prices: Raw material prices for facade construction, such as aluminum, steel, and glass, have been highly volatile, driven by global supply chain disruptions. This unpredictability complicates cost management for manufacturers and construction companies, often leading to project delays or revisions. For projects with tight margins, volatile raw material costs can negatively impact profitability and create financial challenges during facade installation.

KSA Facades Market Future Outlook

The KSA Facades market is expected to continue its growth trajectory, fueled by ongoing mega projects and the increasing demand for sustainable and energy-efficient building solutions. The Kingdom's Vision 2030 plan plays a crucial role in this expansion, with emphasis on developing smart cities, reducing carbon emissions, and adopting green building standards. As more projects like NEOM, The Line, and the Red Sea Development progress, the demand for advanced facade systems will increase, particularly those that incorporate smart technologies such as dynamic shading and solar panels.

Market Opportunities

- Sustainable Building Design Demand: The demand for sustainable building designs is growing in Saudi Arabia as part of the country's commitment to reducing its environmental impact under Vision 2030. There is increasing emphasis on green buildings, leading to a rising demand for facade systems that improve energy efficiency and indoor air quality. Government incentives for adopting sustainable practices are further encouraging developers to integrate environmentally friendly solutions in their projects.

- Increasing Adoption of Smart Facades: Smart facades are gaining popularity in Saudi Arabia, especially in response to the need for energy-efficient and climate-adaptive buildings. Technologies like dynamic solar shading, which adjusts to sunlight exposure, are being adopted in sectors such as commercial and hospitality. The growing trend of IoT-enabled facades is expected to continue, offering significant opportunities for manufacturers of advanced facade systems.

Scope of the Report

|

Product Type |

Ventilated Facades Non-Ventilated Facades Curtain Wall Systems Cladding Systems |

|

Material Type |

Glass Aluminum Stone Ceramic Composite Materials |

|

End-Use Industry |

Residential Commercial Institutional Industrial |

|

Technology |

Smart Facades Dynamic Solar Shading Facades Static Facades |

|

Region |

South West East North |

Products

Key Target Audience

Construction Companies

Architectural Facade Engineering Firms

Sustainable Material Manufacturers

Facade System Installation Contractors

Investors and venture capital Firms

Banks and Financial Institutions

Government and Regulatory Bodies (Saudi Energy Efficiency Program, Saudi Green Building Forum)

Companies

Players Mentioned in the Report

AluK Group

Schco International KG

Reynaers Middle East

Saudi Building Systems

Zahid Group

Juffali Technical Equipment Company

Cladtech International LLC

Al Bawani Company

EAG (Engineering Aluminum Group)

Spectrum Glass Co.

Table of Contents

1. KSA Facades Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. KSA Facades Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. KSA Facades Market Analysis

3.1. Growth Drivers

3.1.1. Infrastructure Boom (e.g., NEOM, The Line)

3.1.2. Growing Urbanization

3.1.3. Energy Efficiency Regulations (e.g., Saudi Energy Efficiency Program)

3.1.4. Expansion in Hospitality and Commercial Sectors

3.2. Market Challenges

3.2.1. High Initial Investment for Smart and Sustainable Facades

3.2.2. Volatile Raw Material Prices

3.2.3. Lack of Skilled Workforce in Advanced Facade Technologies

3.3. Opportunities

3.3.1. Sustainable Building Design Demand

3.3.2. Government Initiatives for Green Building Regulations (e.g., Saudi Green Building Forum)

3.3.3. Increasing Adoption of Smart Facades (e.g., Dynamic Solar Shading Solutions)

3.4. Trends

3.4.1. Rise in Usage of Sustainable Materials (e.g., Recycled Glass and Aluminum)

3.4.2. Integration of Smart Technologies in Facades (e.g., IoT-enabled Facades)

3.4.3. Modular and Prefabricated Facades Systems

3.5. Government Regulation

3.5.1. Saudi Building Code Compliance for Facade Safety and Design

3.5.2. Energy Efficiency Standards for Commercial Buildings (e.g., Thermal Insulation Guidelines)

3.5.3. Environmental Sustainability Regulations

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competitive Ecosystem

4. KSA Facades Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Ventilated Facades

4.1.2. Non-Ventilated Facades

4.1.3. Curtain Wall Systems

4.1.4. Cladding Systems

4.2. By Material Type (In Value %)

4.2.1. Glass

4.2.2. Aluminum

4.2.3. Stone

4.2.4. Ceramic

4.2.5. Composite Materials

4.3. By End-Use Industry (In Value %)

4.3.1. Residential

4.3.2. Commercial

4.3.3. Institutional

4.3.4. Industrial

4.4. By Technology (In Value %)

4.4.1. Smart Facades

4.4.2. Dynamic Solar Shading Facades

4.4.3. Static Facades

4.5. By Region (In Value %)

4.5.1. North

4.5.2. West

4.5.3. East

4.5.4. South

5. KSA Facades Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. AluK Group

5.1.2. Schco International KG

5.1.3. Reynaers Middle East

5.1.4. Saudi Building Systems Manufacturing Company

5.1.5. Juffali Technical Equipment Company

5.1.6. Al Fozan Group

5.1.7. Lindner Group

5.1.8. EAG (Engineering Aluminum Group)

5.1.9. Zahid Group

5.1.10. Alumil Saudi Arabia

5.1.11. Cladtech International LLC

5.1.12. Al Bawani Company

5.1.13. Spectrum Glass Co.

5.1.14. Arabian Aluminum Products Co.

5.1.15. AMCL Group

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Product Offerings, Revenue)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Partnerships, Joint Ventures, etc.)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants and Subsidies

5.9. Private Equity Investments

6. KSA Facades Market Regulatory Framework

6.1. Compliance to Saudi Building Codes

6.2. Certification Processes for Facade Systems

6.3. Energy Efficiency Standards for Building Envelopes

7. KSA Facades Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. KSA Facades Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Material Type (In Value %)

8.3. By End-Use Industry (In Value %)

8.4. By Technology (In Value %)

8.5. By Region (In Value %)

9. KSA Facades Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This stage involved mapping out key stakeholders in the KSA Facades Market. Extensive secondary research was conducted using industry reports and proprietary databases to identify critical factors such as technological advancements, raw material availability, and government regulations.

Step 2: Market Analysis and Construction

Historical data for the KSA Facades Market was compiled, focusing on construction trends, facade material preferences, and regional demand distribution. Market penetration and industry growth dynamics were studied to estimate current market size and revenue streams.

Step 3: Hypothesis Validation and Expert Consultation

We conducted telephone interviews with key industry players including facade manufacturers, contractors, and project developers. These consultations were instrumental in validating our market hypotheses and provided additional insights into market challenges and opportunities.

Step 4: Research Synthesis and Final Output

The final stage of research involved engaging with facade system manufacturers to gather detailed data on product performance, customer preferences, and key growth drivers. This was combined with bottom-up market estimations to ensure the accuracy of the final report.

Frequently Asked Questions

01. How big is the KSA Facades Market?

The KSA Facades Market is valued at USD 10.06 billion, driven by the increased demand for energy-efficient and sustainable building solutions in mega projects like NEOM and King Abdullah Financial District.

02. What are the challenges in the KSA Facades Market?

Key challenges in KSA Facades Market include the high initial investment required for advanced facade systems and fluctuating raw material prices, which can affect project budgets and timelines.

03. Who are the major players in the KSA Facades Market?

Major players in the KSA Facades Market include AluK Group, Schco International KG, Reynaers Middle East, Saudi Building Systems, and Zahid Group, dominating the market through strategic partnerships and innovative facade solutions.

04. What are the growth drivers of the KSA Facades Market?

The KSA Facades Market growth is propelled by large-scale infrastructure projects, government regulations promoting green buildings, and the increasing adoption of smart facade technologies that enhance energy efficiency.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.