KSA Female Hygiene Products Market Outlook to 2030

Region:Middle East

Author(s):Sanjna Verma

Product Code:KROD10132

November 2024

81

About the Report

KSA Female Hygiene Products Market Overview

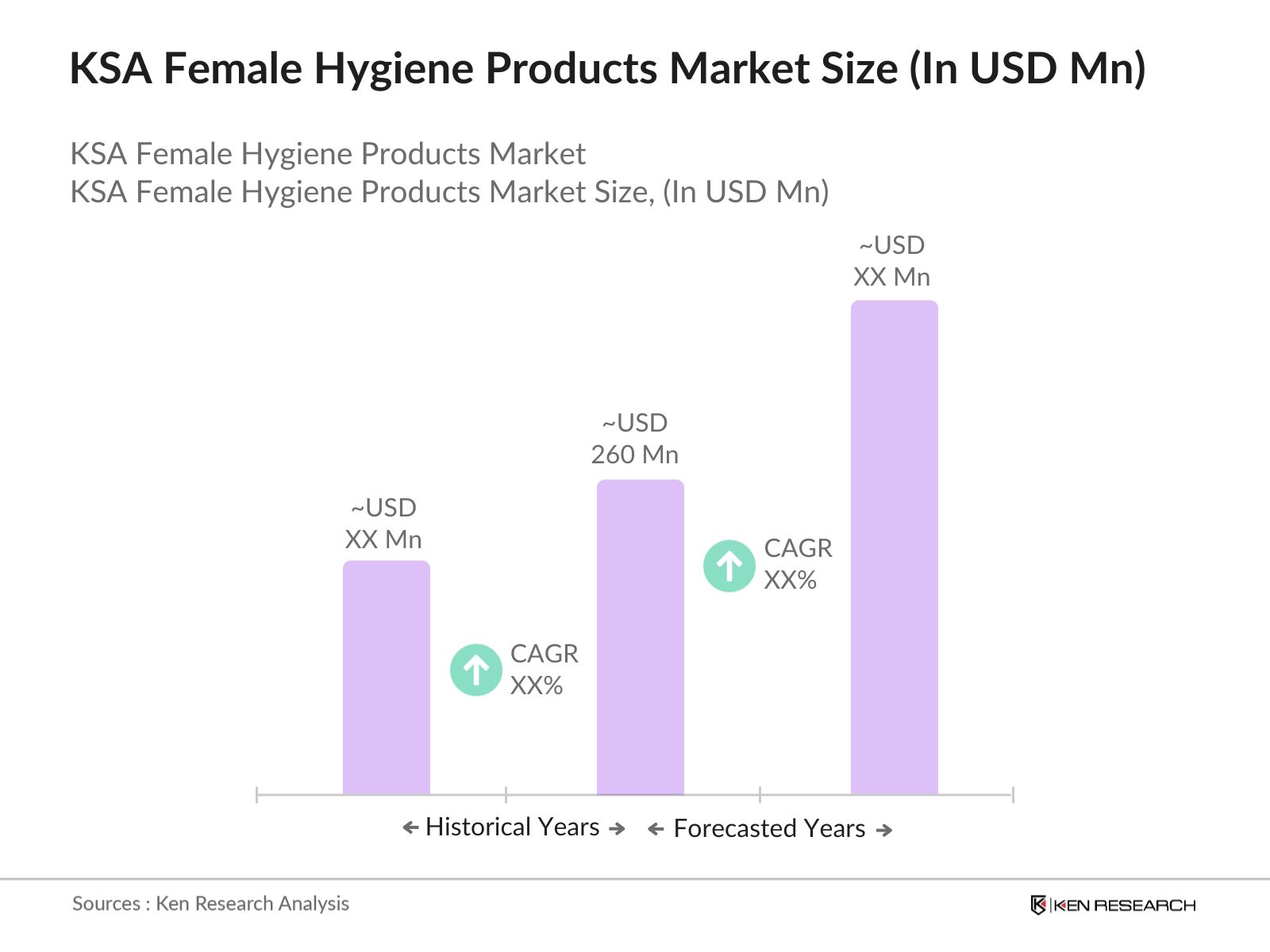

- The female hygiene products market in KSA is valued at USD 260 million, driven by increasing awareness regarding personal hygiene and health among women. Government-backed initiatives like the Saudi Vision 2030 have fueled growth by promoting women's empowerment and providing better access to hygiene products across the kingdom. Furthermore, an expanding female workforce is contributing to higher disposable incomes, enabling more women to purchase premium hygiene products, significantly impacting market dynamics.

- Riyadh and Jeddah are the leading cities in the KSA female hygiene products market. Their dominance can be attributed to their high population density, greater urbanization, and strong retail infrastructure, which ensures easier access to a wide range of products. Moreover, these cities have a more health-conscious consumer base that is better educated about female hygiene, further fueling demand for premium and organic hygiene products.

- Under Saudi Vision 2030, the government has introduced comprehensive policies aimed at improving womens health, which include expanding access to hygiene products. In 2024, the Ministry of Health launched several initiatives under this framework, ensuring that over 15 million women have access to essential health and hygiene services. These policies focus on education, awareness, and the provision of free or subsidized hygiene products in schools and healthcare facilities. The national policies aim to create equitable access to healthcare and hygiene for women across urban and rural regions.

KSA Female Hygiene Products Market Segmentation

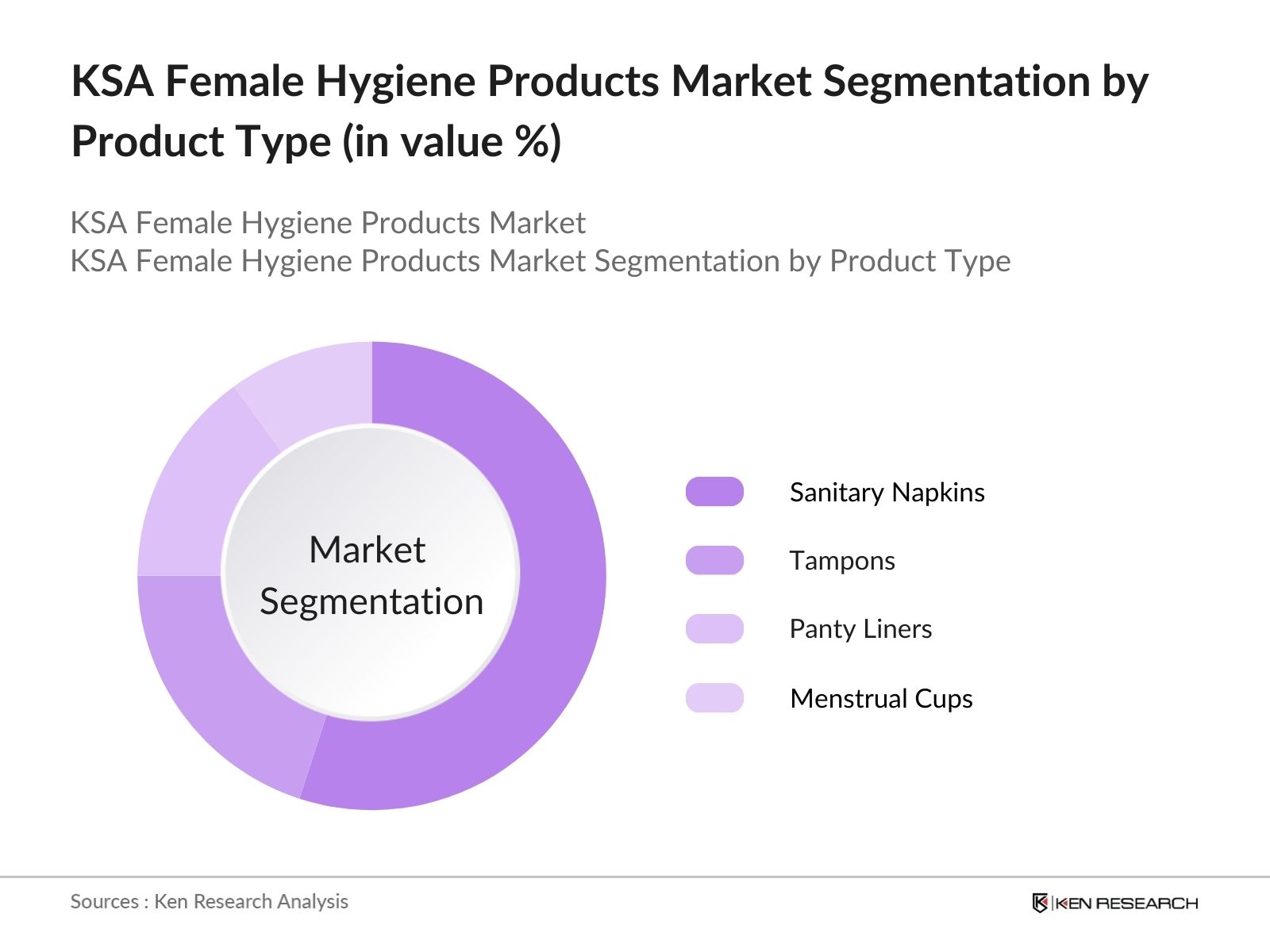

By Product Type: The KSA female hygiene market is segmented by product type into sanitary napkins, tampons, panty liners, and menstrual cups. Sanitary napkins hold a dominant market share due to their ingrained presence and widespread consumer preference. Their ease of use, availability in various price ranges, and higher comfort levels compared to alternatives like menstrual cups have contributed to their continued dominance in KSA. Brands such as Always and Kotex have established strong brand loyalty among women, significantly influencing this segment's performance.

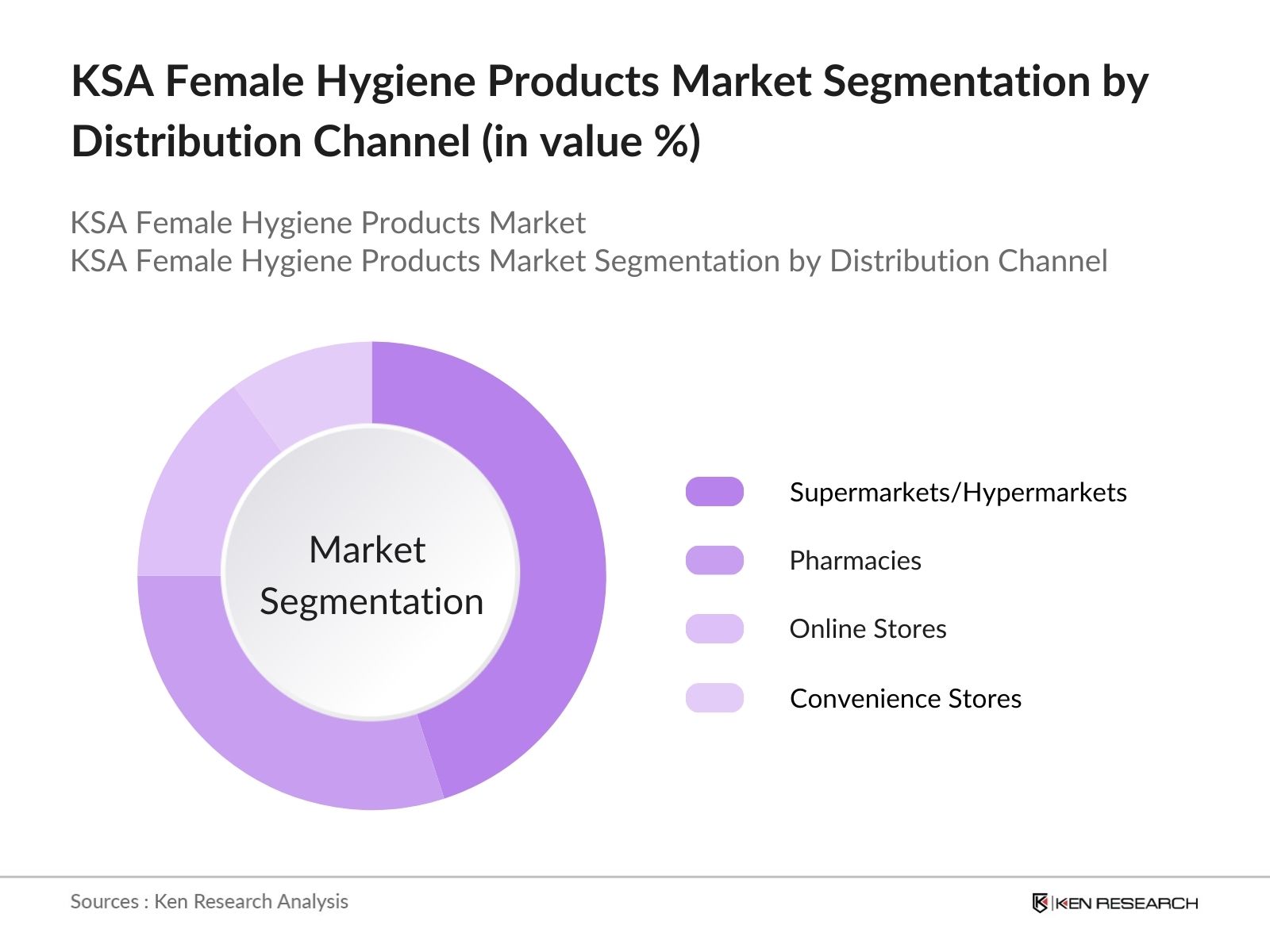

By Distribution Channel: The market is also segmented by distribution channel into supermarkets/hypermarkets, pharmacies, online stores, and convenience stores. Supermarkets and hypermarkets dominate the distribution channel segment, owing to their extensive reach and ability to offer a wide variety of products under one roof. The increasing number of women preferring to shop for hygiene products in bulk, combined with promotional discounts offered in these stores, has sustained their leading market share.

KSA Female Hygiene Products Market Competitive Landscape

The KSA female hygiene products market is consolidated, with a few major global and local players dominating the landscape. Companies like Procter & Gamble and Kimberly-Clark have established strong footholds due to their expansive product portfolios and robust distribution networks. These companies invest heavily in marketing and consumer education campaigns, further consolidating their market positions.

|

Company Name |

Year of Establishment |

Headquarters |

Product Portfolio |

Market Presence |

Distribution Network |

Sustainability Practices |

Innovation Initiatives |

Partnerships/Collaborations |

|

Procter & Gamble |

1837 |

Cincinnati, USA |

- |

- |

- |

- |

- |

- |

|

Kimberly-Clark |

1872 |

Dallas, USA |

- |

- |

- |

- |

- |

- |

|

Johnson & Johnson |

1886 |

New Brunswick, USA |

- |

- |

- |

- |

- |

- |

|

Unicharm Corporation |

1961 |

Tokyo, Japan |

- |

- |

- |

- |

- |

- |

|

Edgewell Personal Care |

2015 |

Shelton, USA |

- |

- |

- |

- |

- |

- |

KSA Female Hygiene Products Market Analysis

Growth Drivers

- Rising Female Workforce Participation: As Saudi Arabia's female workforce participation increases, there is a growing demand for female hygiene products. By 2024, female labor force participation is expected to rise to over 30%, a significant jump compared to previous years, driven by reforms under Vision 2030. This increase has boosted the demand for convenience products like sanitary napkins, tampons, and panty liners, especially among working women.

- Government Initiatives for Women's Health: Saudi Vision 2030 emphasizes women's health as a crucial pillar, driving initiatives aimed at improving access to health and hygiene products. As part of this vision, the Saudi government has allocated over $65 billion toward healthcare infrastructure improvements by 2025, particularly in maternal and reproductive health. This focus directly supports the growth of the female hygiene market, enabling better distribution and awareness of menstrual hygiene products in both urban and rural areas.

- Increasing Awareness of Personal Hygiene: The Saudi Ministry of Health, alongside private organizations, has been actively promoting awareness of personal hygiene through campaigns that reach millions of women. As part of these initiatives, in 2023, over 8 million women were educated about menstrual health, with specific focus on proper hygiene practices. These campaigns have resulted in higher adoption rates of sanitary products, with an estimated 30% increase in demand for menstrual products between 2022-2023.

Challenges

- High Cost of Premium Products: While major urban centers like Riyadh and Jeddah cater to premium brands, the average income in rural areas remains lower, leading to pricing sensitivity. In 2024, the average monthly wage in Saudi Arabia was $4,440 but rural regions saw significantly lower incomes, limiting access to higher-priced hygiene products. Consequently, premium products have seen limited penetration outside of wealthier urban areas, with consumers preferring affordable alternatives.

- Limited Access in Rural Areas: While urban areas are well-served by retail outlets and online platforms, distribution constraints still exist in rural regions. Till early 2024, 14% of Saudi Arabia's population lives in rural areas, many of which are underserved by large retail chains, leading to limited access to female hygiene products. These challenges stem from logistical constraints, with retailers and distributors finding it difficult to penetrate less populated areas due to infrastructure gaps, despite government efforts to bridge the urban-rural divide.

KSA Female Hygiene Products Market Future Outlook

KSA female hygiene products market is expected to witness significant growth, driven by increasing consumer awareness, rising disposable incomes, and the government's focus on womens health and empowerment. Moreover, the demand for organic and biodegradable hygiene products is set to increase as consumers become more conscious of sustainability. Technological advancements, such as the development of smart menstrual products and the adoption of subscription-based models, are expected to shape the markets future landscape.

Market Opportunities

- Expansion of E-commerce: The rapid growth of e-commerce in Saudi Arabia offers significant opportunities for the female hygiene market. In 2024, online retail sales for hygiene products reached $3.5 billion, accounting for 12% of total retail sales in the country. The convenience of home delivery, alongside growing digital payment adoption, has made online shopping a preferred option for consumers in urban and rural areas alike.

- Introduction of Organic and Sustainable Products: The demand for organic and sustainable hygiene products has been on the rise, driven by environmental concerns and a preference for chemical-free alternatives. In 2024, organic products accounted for 18% of total hygiene product sales in Saudi Arabia, up from just 10% in 2022. This growth reflects a broader global trend toward sustainability, with local and international brands introducing biodegradable products to meet consumer demand.

Scope of the Report

|

Segments |

Sub-Segments |

|

Product Type |

Sanitary Napkins Tampons Panty Liners Menstrual Cups Other Products |

|

Distribution Channel |

Supermarkets/Hypermarkets Pharmacies Online Stores Convenience Stores Others |

|

Age Group |

Teenagers (13-19 Years) Adults (20-40 Years) Middle-Aged Women (40+ Years) |

|

Material Type |

Organic Cotton Synthetic Materials Reusable Materials |

|

Region |

Central West East South North |

Products

Key Target Audience

Manufacturers of Female Hygiene Products

FMCG Companies

Pharmaceutical Companies

Packaging Companies

Government and Regulatory Bodies (Saudi Food and Drug Authority, Ministry of Health)

Investors and Venture Capitalist Firms

Healthcare and Wellness Companies

Non-Profit Organizations (Focusing on Womens Health)

Companies

Players Mentioned in the Report

Procter & Gamble (Always, Tampax)

Kimberly-Clark (Kotex)

Johnson & Johnson (Carefree, Stayfree)

Unicharm Corporation (Sofy)

Edgewell Personal Care (Playtex)

The Honest Company

Natracare

Corman SpA

Ontex Group

Saathi

Table of Contents

1. KSA Female Hygiene Products Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. KSA Female Hygiene Products Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. KSA Female Hygiene Products Market Analysis

3.1. Growth Drivers

3.1.1. Rising Female Workforce Participation (Impact on Demand for Hygiene Products)

3.1.2. Government Initiatives for Women's Health (Saudi Vision 2030 Initiatives)

3.1.3. Increasing Awareness of Personal Hygiene (Consumer Awareness Campaigns)

3.1.4. Urbanization and Changing Lifestyle (Shift Toward Disposable Products)

3.2. Market Challenges

3.2.1. High Cost of Premium Products (Pricing Sensitivity Among Consumers)

3.2.2. Limited Access in Rural Areas (Distribution and Logistics Constraints)

3.2.3. Cultural and Social Barriers (Stigma Around Menstrual Products)

3.2.4. Competition from Low-Cost Alternatives (Local Manufacturers and Informal Markets)

3.3. Opportunities

3.3.1. Expansion of E-commerce (Growth in Online Sales Channels)

3.3.2. Introduction of Organic and Sustainable Products (Emerging Trends in Sustainability)

3.3.3. Increasing Demand for Customized Products (Tailored Offerings for Specific Needs)

3.3.4. Growing Foreign Direct Investment (FDI in Female Hygiene Sector)

3.4. Trends

3.4.1. Preference for Organic and Biodegradable Products (Sustainability in Hygiene Market)

3.4.2. Introduction of Smart Menstrual Products (Innovative and Technologically Advanced Solutions)

3.4.3. Shift Toward Subscription-based Models (Adoption of Monthly Subscription Services)

3.4.4. Growth in Private Label Brands (Retailers Entering the Market with Own Products)

3.5. Government Regulation

3.5.1. National Health and Hygiene Policies (Women's Health Initiative Under Saudi Vision 2030)

3.5.2. Import Regulations and Tariffs (Impact on Pricing and Availability of Products)

3.5.3. Product Safety Standards (Government Guidelines for Hygiene Product Manufacturing)

3.5.4. Public Health Campaigns (Promotional Activities by Government)

4. KSA Female Hygiene Products Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Sanitary Napkins

4.1.2. Tampons

4.1.3. Panty Liners

4.1.4. Menstrual Cups

4.1.5. Other Products

4.2. By Distribution Channel (In Value %)

4.2.1. Supermarkets/Hypermarkets

4.2.2. Pharmacies

4.2.3. Online Stores

4.2.4. Convenience Stores

4.2.5. Others

4.3. By Age Group (In Value %)

4.3.1. Teenagers (13-19 Years)

4.3.2. Adults (20-40 Years)

4.3.3. Middle-Aged Women (40+ Years)

4.4. By Material Type (In Value %)

4.4.1. Organic Cotton

4.4.2. Synthetic Materials

4.4.3. Reusable Materials

4.5. By Region (In Value %)

4.5.1. Central

4.5.2. West

4.5.3. East

4.5.4. South

4.5.5. North

5. KSA Female Hygiene Products Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Procter & Gamble (Always, Tampax)

5.1.2. Kimberly-Clark (Kotex)

5.1.3. Johnson & Johnson (Stayfree, Carefree)

5.1.4. Edgewell Personal Care (Playtex)

5.1.5. Unicharm Corporation

5.1.6. The Honest Company

5.1.7. Natracare

5.1.8. Corman SpA

5.1.9. Ontex Group

5.1.10. Saathi

5.2. Cross Comparison Parameters (Brand Awareness, Product Variety, Distribution Network, Pricing Strategy, Sustainability Practices, Innovation in Product Design, Marketing Spend, Customer Loyalty)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. KSA Female Hygiene Products Market Regulatory Framework

6.1. Import/Export Regulations

6.2. Compliance Requirements

6.3. Certification Processes

6.4. Labeling and Packaging Standards

7. KSA Female Hygiene Products Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. KSA Female Hygiene Products Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Age Group (In Value %)

8.4. By Material Type (In Value %)

8.5. By Region (In Value %)

9. KSA Female Hygiene Products Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first step involves mapping the KSA female hygiene products market, identifying major stakeholders such as manufacturers, distributors, and consumers. Extensive desk research utilizing secondary databases helped pinpoint key drivers like consumer awareness and government initiatives.

Step 2: Market Analysis and Construction

In this phase, historical data on product penetration and revenue generation were gathered. A comprehensive analysis of consumer behavior and preferences for various hygiene products (such as sanitary napkins and tampons) was conducted to determine market demand and forecast future trends.

Step 3: Hypothesis Validation and Expert Consultation

Insights were obtained through telephone interviews with key stakeholders in the market, including manufacturers and distributors. These interviews validated the hypotheses regarding product demand, consumer preferences, and market challenges, ensuring the accuracy of data.

Step 4: Research Synthesis and Final Output

The final step involved synthesizing the research findings to create a comprehensive and validated analysis. Discussions with manufacturers about product development and consumer behavior enabled us to compile insights, ensuring the report provides a well-rounded view of the KSA female hygiene products market.

Frequently Asked Questions

01. How big is the KSA Female Hygiene Products Market?

The KSA female hygiene products market is valued at USD 260 million, driven by increasing awareness and government initiatives aimed at promoting womens health. The growing female workforce and rising disposable incomes also contribute to the markets expansion.

02. What are the challenges in the KSA Female Hygiene Products Market?

Key challenges in KSA female hygiene products market include the high cost of premium hygiene products, limited access to rural areas, and cultural stigmas surrounding menstruation. Competition from lower-cost alternatives is another factor that hampers the growth of premium brands.

03. Who are the major players in the KSA Female Hygiene Products Market?

Major players in KSA female hygiene products market include Procter & Gamble (Always, Tampax), Kimberly-Clark (Kotex), Johnson & Johnson (Carefree, Stayfree), and Unicharm Corporation (Sofy). These companies dominate the market due to their strong distribution networks and brand loyalty.

04. What are the growth drivers of the KSA Female Hygiene Products Market?

KSA female hygiene products market is propelled by increasing awareness of female hygiene, government support through initiatives like Saudi Vision 2030, and the rising participation of women in the workforce. The availability of premium hygiene products also plays a role in boosting market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.